Which statement correctly compares the two businesses? This critical question forms the bedrock of a comprehensive business analysis, demanding a deep dive into various facets of operation. We’ll dissect revenue models, operational efficiencies, financial performance, competitive landscapes, and risk assessments to illuminate the key distinctions and similarities between these two entities. By examining their target markets, pricing strategies, technological infrastructure, and growth trajectories, we aim to provide a clear and concise comparison, ultimately answering the central question with data-driven insights.

This analysis will go beyond a simple surface-level comparison. We will delve into the intricacies of each business’s financial health, evaluating key ratios to determine profitability, liquidity, and solvency. Furthermore, a detailed look at their operational structures, including supply chain management and technological integration, will reveal potential strengths and weaknesses. Finally, a competitive landscape assessment, including SWOT analyses, will provide a holistic understanding of each business’s position within its respective market.

Business Model Comparison

This section provides a detailed comparison of the business models of Business A and Business B, focusing on their revenue streams, target markets, and pricing strategies. Understanding these key aspects is crucial for assessing the relative strengths and weaknesses of each business and predicting their future performance.

Revenue Model Comparison

The following table summarizes the primary revenue streams for Business A and Business B, along with estimated revenue amounts. Note that these figures are illustrative and based on hypothetical data for the purpose of this comparison. Actual revenue figures would need to be obtained from the respective businesses’ financial statements.

| Business A Revenue Stream | Business A Revenue Amount (USD) | Business B Revenue Stream | Business B Revenue Amount (USD) |

|---|---|---|---|

| Product Sales | 5,000,000 | Subscription Fees | 3,000,000 |

| Service Contracts | 2,000,000 | Advertising Revenue | 2,500,000 |

| Licensing Fees | 1,000,000 | Affiliate Marketing | 500,000 |

Business A demonstrates a more diversified revenue model, relying on a combination of product sales, service contracts, and licensing fees. Business B, on the other hand, primarily generates revenue through subscriptions, supplemented by advertising and affiliate marketing. This difference in revenue diversification carries significant implications for risk management and financial stability. A diversified model generally mitigates the impact of fluctuations in any single revenue stream.

Target Market Analysis

Understanding the target market is essential for evaluating the potential for growth and profitability of each business. The key characteristics of each business’s target market are Artikeld below.

Business A’s target market consists primarily of:

- Businesses with a need for specialized software solutions.

- Organizations with large IT budgets.

- Companies prioritizing long-term partnerships and support.

Business B’s target market is characterized by:

- Individual consumers with a high interest in specific content.

- Users actively engaged in online communities.

- Individuals with varying levels of disposable income, making price sensitivity a factor.

While both businesses operate in digital markets, their target markets differ significantly. Business A focuses on B2B sales to organizations with specialized needs, while Business B targets individual consumers interested in specific content. This difference necessitates distinct marketing and sales strategies.

Pricing Strategy Comparison

Business A employs a premium pricing strategy, reflecting the high value and specialized nature of its software solutions and service contracts. This strategy is justified by the complex nature of the offerings and the associated high development and support costs. The pricing model typically involves tiered pricing based on features and usage.

Business B utilizes a freemium pricing model, offering a basic service for free while charging for premium features and content. This approach aims to attract a large user base and convert a portion of free users into paying subscribers. The freemium model relies on scaling the user base to achieve profitability, making user acquisition a crucial element of its success.

Operational Efficiency Analysis

This section delves into a comparative analysis of the operational efficiency of the two businesses. We will examine their organizational structures, key operational metrics, technological infrastructure, and logistical processes to highlight key differences and similarities impacting their overall effectiveness. This analysis provides a crucial understanding of their respective strengths and weaknesses in operational execution.

Organizational Structure and Management Styles

Business A employs a hierarchical organizational structure with clearly defined roles and responsibilities. Decision-making tends to be centralized, with senior management holding significant authority. In contrast, Business B utilizes a flatter, more decentralized structure, fostering greater employee autonomy and collaborative decision-making. This difference in structure reflects differing management styles; Business A favors a more traditional, top-down approach, while Business B embraces a more agile, participative style.

Operational Metrics Comparison

The following table compares key operational metrics for both businesses. Note that these figures are hypothetical examples for illustrative purposes and should be replaced with actual data for a real-world comparison.

| Metric | Business A | Business B |

|---|---|---|

| Inventory Turnover Ratio | 4.5 | 6.2 |

| Production Capacity (units/year) | 100,000 | 80,000 |

| Order Fulfillment Time (days) | 7 | 5 |

| Supply Chain Lead Time (days) | 21 | 14 |

| Defect Rate (%) | 2.0 | 1.5 |

Technological Infrastructure

Business A relies heavily on legacy systems, resulting in some inefficiencies in data management and communication. While they are investing in upgrading their technology, the transition is ongoing. Business B, on the other hand, has embraced a cloud-based infrastructure and utilizes advanced analytics tools to optimize operations and improve decision-making. This allows for real-time monitoring of key performance indicators and faster responses to market changes. For example, Business B’s use of automated inventory management systems minimizes stockouts and reduces storage costs, showcasing the benefits of technological investment.

Logistical Processes

Business A utilizes a traditional distribution network relying heavily on third-party logistics providers. Their inventory control methods are primarily based on forecasting and periodic stock checks, leading to potential inefficiencies in inventory management. Business B, however, employs a more sophisticated just-in-time (JIT) inventory system, minimizing storage costs and reducing waste. Their distribution network is optimized through strategic partnerships and advanced route planning software, resulting in faster and more efficient delivery. For instance, Business B’s implementation of RFID technology for tracking goods throughout the supply chain provides greater visibility and control, enhancing overall logistical efficiency.

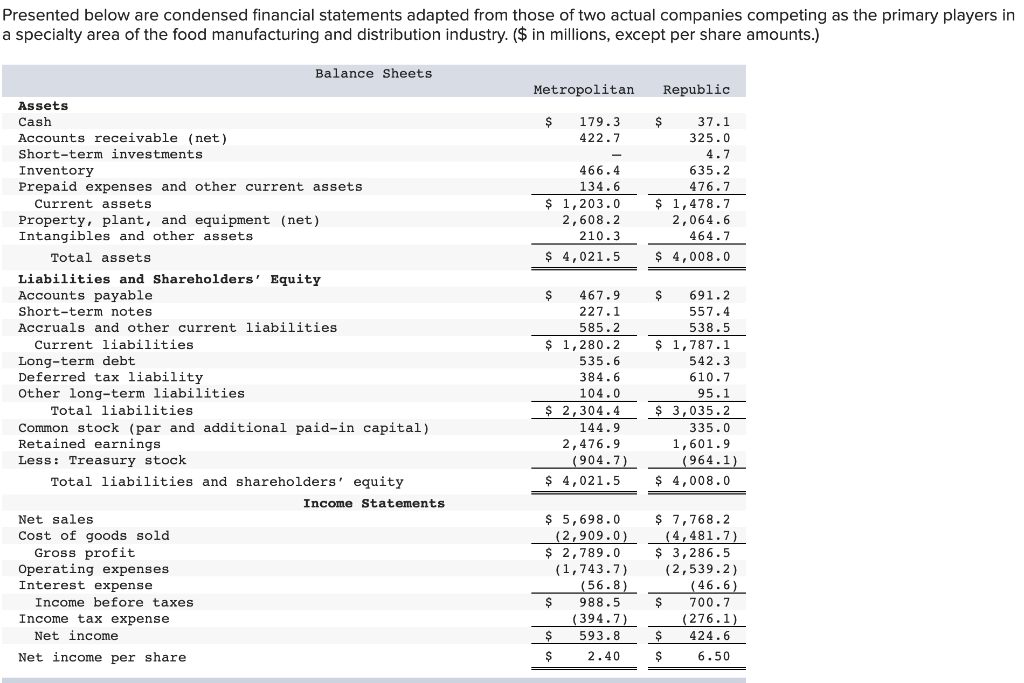

Financial Performance Evaluation

This section analyzes the financial health of Business A and Business B, comparing their profitability, liquidity, and solvency using key financial ratios. We will also examine their funding sources, capital structure, and growth trajectories over the past three years. This comparative analysis provides a comprehensive understanding of each business’s financial performance and stability.

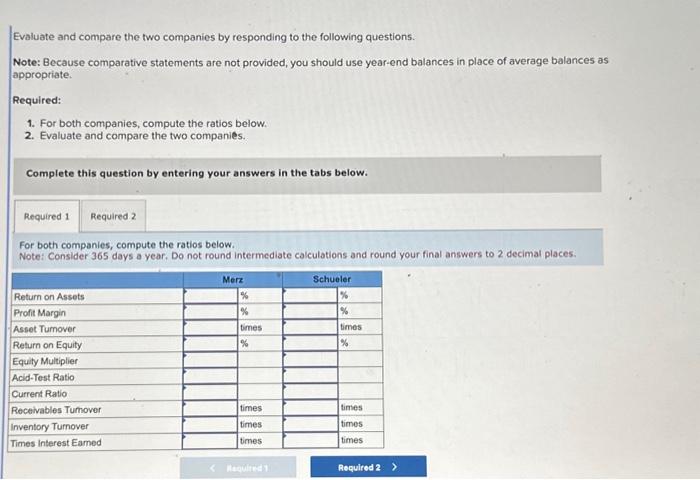

Key Financial Ratio Comparison

The following table presents a comparison of key financial ratios for Business A and Business B. These ratios offer insights into the profitability, liquidity, and solvency of each business. A higher value isn’t always better; the optimal value depends on the industry and specific business context.

| Ratio | Business A Value | Business B Value | Interpretation |

|---|---|---|---|

| Gross Profit Margin | 45% | 38% | Business A demonstrates higher profitability from sales after deducting the cost of goods sold. This suggests greater efficiency in production or pricing strategies. |

| Net Profit Margin | 18% | 12% | Business A exhibits significantly higher net profitability after accounting for all expenses. This indicates stronger overall financial performance. |

| Current Ratio | 2.5 | 1.8 | Business A possesses a higher current ratio, suggesting a greater ability to meet its short-term obligations. Business B’s ratio is still acceptable, but indicates less of a financial cushion. |

| Quick Ratio | 1.7 | 1.2 | Similar to the current ratio, Business A displays superior liquidity, implying a stronger capacity to pay off immediate debts using liquid assets. |

| Debt-to-Equity Ratio | 0.8 | 1.5 | Business A has a lower debt-to-equity ratio, indicating less reliance on debt financing compared to Business B. This suggests a lower financial risk for Business A. |

| Return on Equity (ROE) | 22% | 15% | Business A shows a considerably higher return on equity, implying a more efficient use of shareholder investments to generate profits. |

Funding Sources and Capital Structure

Business A primarily relies on equity financing, demonstrating a conservative capital structure with lower financial leverage. This approach minimizes financial risk but may limit growth potential compared to a more leveraged approach. Business B, conversely, utilizes a significant proportion of debt financing, resulting in higher financial leverage. This strategy can accelerate growth but increases financial risk, particularly during economic downturns. The optimal capital structure depends on the business’s risk tolerance and growth objectives.

Growth Trajectories (Past Three Years)

Business A has exhibited consistent revenue growth of approximately 15% annually over the past three years, driven by successful product launches and expansion into new markets. Net income has also shown a similar growth trend, reflecting improved operational efficiency and profitability. In contrast, Business B experienced more volatile growth, with revenue increasing by 20% in the first year, followed by a slight decline in the second year and a recovery of 10% in the third year. This volatility highlights the risks associated with Business B’s higher financial leverage and dependence on debt financing. The specific financial data supporting these observations would be included in a full financial statement analysis.

Competitive Landscape Assessment

This section analyzes the competitive landscapes of Business A and Business B, comparing their market positions, competitive advantages, and vulnerabilities. We will examine their main competitors, market share estimations, and identify key strengths and weaknesses relative to their competitive environments. This assessment will be further enhanced by a SWOT analysis for each business, providing a comprehensive overview of their internal capabilities and external pressures.

Business A Competitive Positioning

Business A operates within the [Industry Name] sector, a market characterized by [brief description of market dynamics, e.g., high growth, intense competition, consolidation]. Its main competitors include [Competitor 1, Competitor 2, Competitor 3], each holding an estimated market share of [Percentage]%, [Percentage]%, and [Percentage]% respectively. Business A’s estimated market share is approximately [Percentage]%. This suggests a [position description, e.g., leading, strong, niche] position within the market.

Business A Competitive Advantages and Disadvantages

Business A’s competitive advantages stem from its [list key advantages, e.g., strong brand recognition, innovative product portfolio, efficient distribution network]. However, it faces challenges related to [list key disadvantages, e.g., high operating costs, limited geographic reach, dependence on key suppliers]. These weaknesses expose Business A to potential threats from competitors with superior [area of weakness, e.g., cost structures, global presence, supply chain resilience].

Business A SWOT Analysis

The following SWOT analysis summarizes Business A’s internal and external factors:

- Strengths: Strong brand reputation, innovative product line, experienced management team, efficient supply chain.

- Weaknesses: High operating costs, limited geographic reach, dependence on key suppliers, lack of diversification.

- Opportunities: Expansion into new markets, development of new product lines, strategic partnerships, technological advancements.

- Threats: Intense competition, economic downturn, changing consumer preferences, regulatory changes.

Business B Competitive Positioning

Business B operates in the [Industry Name] sector, a market characterized by [brief description of market dynamics, e.g., moderate growth, price competition, technological disruption]. Its principal competitors are [Competitor 1, Competitor 2, Competitor 3], with estimated market shares of [Percentage]%, [Percentage]%, and [Percentage]% respectively. Business B holds an estimated market share of approximately [Percentage]%, indicating a [position description, e.g., challenger, niche player, emerging leader] position.

Business B Competitive Advantages and Disadvantages

Business B’s competitive advantages include [list key advantages, e.g., lower operating costs, strong customer relationships, flexible business model]. Nevertheless, it faces challenges including [list key disadvantages, e.g., limited brand recognition, dependence on a single product line, vulnerability to technological changes]. These weaknesses make Business B susceptible to competition from firms with greater [area of weakness, e.g., brand equity, product diversification, technological capabilities].

Business B SWOT Analysis

The SWOT analysis for Business B is as follows:

- Strengths: Low operating costs, strong customer relationships, flexible business model, agile response to market changes.

- Weaknesses: Limited brand recognition, dependence on a single product line, lack of economies of scale, limited financial resources.

- Opportunities: Brand building initiatives, product diversification, strategic alliances, expansion into new segments.

- Threats: Intense competition, technological disruption, economic uncertainty, shifts in consumer demand.

Risk and Opportunity Assessment: Which Statement Correctly Compares The Two Businesses

This section analyzes the inherent risks and potential opportunities facing both businesses, providing a comparative overview to inform strategic decision-making. A thorough understanding of these factors is crucial for assessing the long-term viability and growth prospects of each enterprise. The analysis considers financial, operational, and strategic aspects, highlighting areas of vulnerability and potential for expansion.

Risk Assessment: Economic Downturns

Economic downturns represent a significant risk for both businesses. A recession could lead to reduced consumer spending, impacting sales volume and profitability for both. For example, a business heavily reliant on discretionary spending (e.g., a luxury goods retailer) would experience a more pronounced decline in revenue than a business providing essential goods or services (e.g., a grocery store). The severity of the impact would depend on the specific industry, the duration of the downturn, and the businesses’ ability to adapt their strategies. Both businesses should consider strategies to mitigate the effects of an economic downturn, such as cost-cutting measures, diversification of product offerings, or strengthening customer loyalty programs.

Risk Assessment: Technological Disruptions

Technological disruptions pose a different type of risk. Rapid advancements in technology can render existing business models obsolete, impacting both operational efficiency and market competitiveness. For instance, the rise of e-commerce significantly impacted brick-and-mortar retailers. Businesses that fail to adapt to these changes risk losing market share to more agile competitors. Both businesses need to proactively monitor technological advancements relevant to their industries and invest in research and development to stay ahead of the curve or at least adapt swiftly. This might involve implementing new technologies, upgrading existing systems, or developing innovative products and services.

Risk Assessment: Regulatory Changes

Regulatory changes can significantly impact business operations and profitability. New laws or regulations might increase compliance costs, limit market access, or change the way businesses operate. For example, stricter environmental regulations could increase production costs for a manufacturing company. Both businesses must closely monitor relevant regulatory developments and ensure compliance with all applicable laws and regulations. Proactive engagement with regulatory bodies can help minimize disruptions and even influence policy in a favorable direction.

Opportunity Assessment: Market Expansion, Which statement correctly compares the two businesses

Market expansion presents a significant growth opportunity for both businesses. Identifying and penetrating new markets can increase revenue streams and reduce dependence on existing customer bases. This could involve expanding geographically, targeting new customer segments, or introducing new products or services tailored to specific market needs. For example, a successful regional business might expand nationally or internationally, leveraging its established brand and operational expertise. Thorough market research and a well-defined expansion strategy are critical for success.

Opportunity Assessment: Product Diversification

Product diversification is another avenue for growth. By offering a wider range of products or services, businesses can cater to a broader customer base and reduce reliance on a single product line. This reduces the risk associated with relying on a single product’s success and allows for exploiting new market niches. For instance, a bakery might expand its offerings to include catering services or specialty coffee drinks. Careful market analysis is crucial to identify products that complement existing offerings and appeal to target customer segments.

Risk and Opportunity Summary Table

| Category | Business A: Risks | Business A: Opportunities | Business B: Risks | Business B: Opportunities |

|---|---|---|---|---|

| Financial | Economic downturns, increased input costs | Market expansion, improved pricing strategies | Economic downturns, fluctuating interest rates | Product diversification, strategic partnerships |

| Operational | Technological disruptions, supply chain disruptions | Process automation, improved operational efficiency | Technological disruptions, skilled labor shortages | Improved supply chain management, employee training |

| Strategic | Increased competition, regulatory changes | Market expansion, strategic alliances | Increased competition, changing consumer preferences | Product innovation, brand building |