Can a country club membership be a business expense? The answer, surprisingly, isn’t a simple yes or no. While the lavish lifestyle associated with country clubs might seem far removed from the world of tax deductions, the IRS allows for deductions under specific circumstances. This hinges on demonstrating a clear and consistent business purpose, meticulously documenting every expense, and adhering strictly to guidelines separating personal from professional use. Understanding these rules is crucial for business owners considering this type of expenditure.

This guide navigates the complexities of claiming a country club membership as a business expense. We’ll explore IRS regulations, illustrate methods for accurate tracking of business use, and examine suitable industries where such a membership might be justified. We’ll also compare this expense to alternative networking strategies and offer practical examples of successful deductions. Ultimately, this guide aims to equip you with the knowledge to make an informed decision about the tax implications of your country club membership.

Tax Deductibility of Country Club Membership Fees

The Internal Revenue Service (IRS) allows deductions for business expenses, but these must meet specific criteria. A country club membership, often viewed as a luxury, can be a legitimate business expense if it directly contributes to the generation or collection of income. However, proving this connection is crucial for successful tax deduction. The IRS scrutinizes these deductions closely, requiring substantial documentation.

IRS Rules Regarding Deductibility of Business Expenses

To be deductible, a business expense must be both ordinary and necessary. “Ordinary” means common and accepted in your industry, while “necessary” means helpful and appropriate for your business. The expense must also be directly related to your business activities and properly documented. Personal benefits derived from the expense, such as recreational use, are not deductible. The IRS generally disallows deductions for expenses considered lavish or extravagant under the circumstances.

Examples of Legitimate Business Expense Situations

A country club membership might be considered a legitimate business expense if it’s used primarily for conducting business. For example, a real estate agent might use the club to network with potential clients or close deals. A lawyer might use the club to build relationships with other professionals. Similarly, a sales executive might entertain clients and foster relationships that directly contribute to sales revenue. The key is demonstrating a clear and consistent business purpose.

Required Documentation to Support Deduction

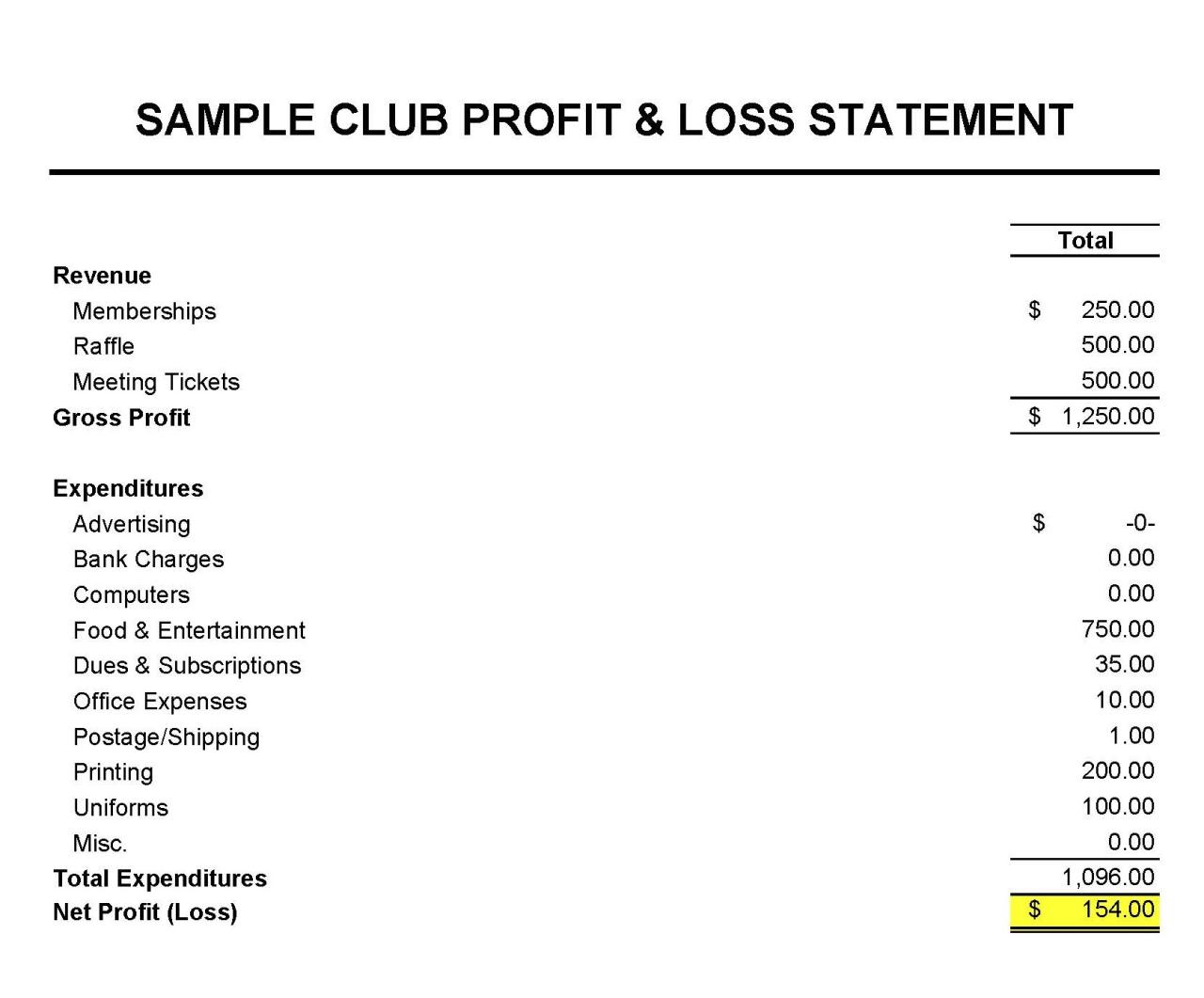

Supporting documentation is critical for justifying the deduction. This includes detailed records of all club-related expenses, such as membership fees, dining expenses, and green fees. Maintain a log detailing each business-related event at the club, including the date, attendees (with their business relationship to you), the business purpose of the meeting, and the expenses incurred. Receipts for all expenses are essential. Ideally, a detailed calendar entry or meeting minutes should also be kept. Furthermore, maintaining a separate business credit card for club expenses simplifies record-keeping and tracking.

Deductibility of Different Types of Country Club Expenses

Initiation fees are generally not deductible in the year they are paid; instead, they are amortized over a period of time. Dues, on the other hand, are generally deductible as they are incurred. Dining expenses are deductible only to the extent they are directly related to business activities. For example, a business lunch with a client is deductible, but a personal dinner with family is not. Green fees or other recreational expenses are generally not deductible unless directly related to a business purpose, such as a client golf outing specifically aimed at generating business.

Hypothetical Scenario Demonstrating Successful Deduction

Imagine Sarah, a sales representative for a software company. Sarah joins a country club, paying $5,000 in annual dues and a $10,000 initiation fee (amortized over 10 years). She consistently uses the club to host client meetings and network with potential clients, meticulously documenting each meeting with detailed notes, attendee lists, and receipts. She spends $2,000 annually on business-related meals and drinks. She can deduct her annual dues ($5,000), her amortized initiation fee ($1,000), and her business-related dining expenses ($2,000), resulting in a total deduction of $8,000. This deduction is justifiable because she maintains comprehensive records demonstrating the direct connection between the club membership and her business activities.

Business Use vs. Personal Use of Country Club Membership

The deductibility of country club membership fees hinges critically on the proportion used for business purposes. The IRS scrutinizes these expenses, requiring meticulous record-keeping to substantiate the claimed deduction. Simply stating a percentage of business use is insufficient; concrete evidence is necessary to demonstrate the legitimate business-related activities undertaken at the club.

The determination of the business versus personal use portion of a country club membership relies on a detailed analysis of how the membership was utilized throughout the year. This isn’t a simple calculation but rather a careful accounting of every instance where the membership facilitated business activities. The more substantial the business-related activities, and the more rigorously they’re documented, the stronger the case for a significant business expense deduction.

Criteria for Determining Business Use

Determining the business portion requires a thorough review of all activities conducted at the country club. Each instance of business use must be documented, providing specific details about the nature of the activity, the individuals involved, and the business purpose served. This could include client meetings, networking events, or business lunches. Simply using the club’s facilities for personal reasons, such as playing golf or attending social events, does not qualify as a business expense. The IRS expects a direct correlation between the club’s use and the generation of business income or the advancement of business interests. For example, a meeting with a potential client to discuss a significant contract would qualify, while a casual round of golf with friends would not.

Methods for Tracking Business and Personal Use

Accurate tracking is paramount. A simple method involves maintaining a detailed log or spreadsheet. This log should record the date, time, purpose of the visit, individuals involved (with their contact information), and a brief description of the business conducted. Consider using a separate log for personal use as well. This allows for easy separation of business and personal expenses and facilitates a clear audit trail. For instance, if a member spent 20% of their time at the club on business-related activities, that percentage should be reflected in the deduction. However, without meticulous records, this claim becomes difficult to substantiate.

Sample Log for Recording Business Activities

A spreadsheet or dedicated log can effectively track business use. The following columns are recommended:

| Date | Time | Purpose of Visit | Individuals Involved (with Contact Info) | Description of Business Activity | Expense Amount (if applicable) |

|---|---|---|---|---|---|

| October 26, 2024 | 12:00 PM – 2:00 PM | Client Meeting | John Smith, Acme Corp (555-123-4567) | Discussed contract details for Project X. | $75 (Lunch) |

| November 15, 2024 | 6:00 PM – 8:00 PM | Networking Event | Various business contacts | Attended industry networking event; exchanged business cards and discussed potential collaborations. | $100 (Event Fee) |

Implications of Claiming Deductions for Personal Use

Claiming business expense deductions for personal use constitutes tax fraud. The IRS takes this seriously and will penalize taxpayers who attempt to inflate their business expenses by including personal activities. Penalties can include back taxes, interest, and potential legal action. The burden of proof lies with the taxpayer to demonstrate the legitimate business purpose of each expense.

Potential Red Flags for IRS Audits

Several factors might trigger an IRS audit concerning country club membership deductions. These include:

- Inconsistent or poorly maintained records.

- A high percentage of claimed business use without substantial supporting documentation.

- Lack of specificity in describing business activities.

- Frequent use of the club for personal activities, disproportionate to business use.

- Claims exceeding industry norms or personal income.

Maintaining thorough, accurate, and contemporaneous records is crucial to avoid triggering an audit. This minimizes the risk of penalties and ensures the legitimate business expenses are appropriately recognized.

Types of Businesses Where Membership Might Be Justified: Can A Country Club Membership Be A Business Expense

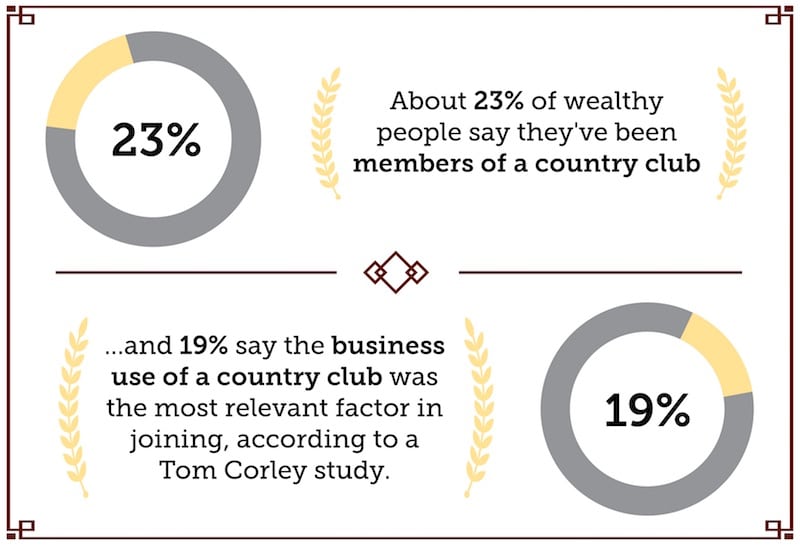

Country club memberships, while often perceived as a luxury, can serve a legitimate business purpose for certain industries. The key lies in demonstrating a direct correlation between the membership and increased business opportunities, justifying the expense as a deductible business cost. The networking opportunities, access to potential clients, and overall professional image enhancement offered by these clubs can significantly outweigh the cost for specific professions.

The justification for a country club membership as a business expense varies greatly depending on the industry. High-net-worth individuals and businesses operating in sectors with a significant reliance on relationship-building often find the investment worthwhile. However, it’s crucial to maintain meticulous records documenting business-related activities at the club to support the deduction claim during tax season.

Industries Where Country Club Memberships Are Commonly Used for Business Purposes

Several industries frequently utilize country club memberships to facilitate business development and client relations. These include real estate, finance, law, and certain sectors of consulting and sales. The common thread is the need for high-level networking and relationship building in a more exclusive and relaxed environment than a typical office or business meeting.

Comparing Business Justifications Across Industries

Real estate professionals, for example, might use a country club to cultivate relationships with high-net-worth individuals seeking luxury properties. The informal setting allows for building rapport and trust, leading to potential sales. Similarly, financial advisors may leverage memberships to connect with prospective clients and strengthen existing relationships. Law firms, especially those specializing in corporate law or mergers and acquisitions, might use the club to network with influential business leaders and secure lucrative deals. The ability to engage in informal conversations in a prestigious setting can be invaluable in these fields.

Networking Opportunities and Business Success

The networking potential of a country club is a significant factor in justifying membership costs. These clubs often host events and gatherings that provide unparalleled opportunities to meet and interact with key decision-makers in various industries. The relaxed and social atmosphere fosters genuine connections, leading to mutually beneficial business relationships. These informal settings can often lead to deals that might not have materialized through traditional business channels. The ability to build trust and rapport outside of a formal business setting can be instrumental in closing major deals and expanding business networks.

Comparison of Benefits and Drawbacks of Country Club Memberships for Different Business Types

| Business Type | Benefits | Drawbacks | Overall Justification |

|---|---|---|---|

| Real Estate | Access to high-net-worth clients, networking opportunities, enhanced professional image. | High membership fees, potential for misuse of funds for personal activities. | Strong justification if used strategically for client relationship building and lead generation. |

| Finance | Networking with potential clients and investors, building trust and rapport, facilitating deal-making. | Significant cost, requires diligent record-keeping to substantiate business use. | Justification depends on the volume of business generated directly from club activities. |

| Law | Networking with corporate leaders, securing high-profile clients, fostering strategic partnerships. | High membership fees, potential for ethical concerns if not used appropriately. | Justification is dependent on demonstrable return on investment in terms of new business secured. |

| Consulting | Building relationships with potential clients, showcasing expertise in a professional setting, securing new contracts. | Cost of membership needs to be weighed against potential revenue generated. Careful documentation is essential. | Justification depends heavily on demonstrating a clear link between membership and securing consulting contracts. |

Alternative Networking and Client Entertainment Options

Country club memberships, while offering networking opportunities, represent a significant expense. Understanding alternative, potentially more cost-effective, and equally effective methods for networking and client entertainment is crucial for businesses seeking tax-deductible strategies. This section explores viable alternatives and compares their cost-effectiveness with country club memberships.

Cost Comparison of Networking and Entertainment Options

Direct comparison between a country club membership and alternative networking methods requires considering several factors. The annual cost of a country club membership can vary widely based on location, amenities, and initiation fees. These costs often include dues, dining charges, and potential event fees. Conversely, alternative methods, such as business lunches, industry conferences, or sponsoring local events, offer greater flexibility in budgeting and expense control. A detailed budget analysis comparing the projected annual spend on a country club membership against the anticipated costs of alternative strategies is essential for a rational decision. For example, a high-end country club membership might cost $15,000 annually, while a strategic approach utilizing business lunches, industry conferences, and targeted sponsorships might achieve similar networking results for significantly less. This comparison should account for both tangible costs (e.g., meal expenses, conference registration) and intangible costs (e.g., time commitment).

Alternative Networking Strategies

Effective networking doesn’t necessitate a country club membership. A multifaceted approach incorporating several strategies often yields superior results.

- Industry Conferences and Trade Shows: These events provide concentrated access to professionals within a specific field, fostering valuable connections and knowledge sharing. The cost is usually predetermined, allowing for better budget management.

- Business Lunches and Dinners: More informal and flexible than country club settings, these meetings allow for focused client engagement and relationship building. Costs are directly related to the venue and menu chosen.

- Networking Events and Workshops: Numerous organizations and professional groups host events designed specifically for networking. These often present cost-effective opportunities for expanding professional contacts.

- Community Involvement and Sponsorships: Sponsoring local events or participating in community initiatives demonstrates corporate social responsibility and offers opportunities for building relationships with potential clients and partners. Costs are highly variable depending on the chosen sponsorship level and event.

- Online Networking Platforms: LinkedIn and other professional networking sites provide avenues for connecting with potential clients and collaborators. While the initial cost may be minimal, effective use requires time and strategic engagement.

Justifying the Choice of a Country Club Membership

While alternatives exist, a country club membership might be justified in specific situations. For example, a business operating in a highly exclusive industry where many key players are members might find the networking opportunities invaluable. However, a robust cost-benefit analysis is paramount. This analysis should clearly demonstrate that the anticipated return on investment (ROI) from the networking and client entertainment opportunities afforded by the membership significantly outweighs the associated costs. Furthermore, meticulous record-keeping of business-related activities within the club is crucial for supporting the tax deductibility of membership expenses. Failure to properly document business use could result in the IRS disallowing the deduction.

Illustrative Examples of Business Use

Country club memberships, while often associated with leisure, can serve a legitimate business purpose when used strategically for networking and client relations. The following examples illustrate scenarios where a country club membership facilitated significant business outcomes. Note that the tax deductibility of these expenses depends on the specific circumstances and adherence to IRS guidelines.

Business Meeting Leading to a Significant Deal, Can a country club membership be a business expense

Imagine Sarah, CEO of a tech startup, meeting with Mark, the head of acquisitions at a major corporation, at the prestigious Lakeside Country Club. The setting, a private dining room overlooking the golf course, provided an atmosphere conducive to relaxed yet focused discussion. The meeting, scheduled for two hours, extended to four as they delved into the specifics of a potential acquisition. Mark was impressed not only by Sarah’s presentation but also by the professional yet informal environment, which fostered trust and open communication. The relaxed setting allowed for a deeper exploration of the deal’s intricacies, leading to a successful negotiation and a multi-million dollar acquisition deal finalized within the following month. The Lakeside Country Club’s reputation and facilities played a crucial role in creating the environment that fostered this significant business outcome.

Client Entertainment Fostering a Strong Business Relationship

Consider David, a financial advisor, who hosted a client, Mr. Johnson, a high-net-worth individual, for a round of golf at the exclusive Oakwood Country Club. This wasn’t merely recreational; David used the opportunity to build rapport with Mr. Johnson, understanding his personal interests and building trust beyond the usual financial discussions. The relaxed atmosphere of the golf course, coupled with the club’s luxurious amenities, allowed for a more personal connection. This resulted in Mr. Johnson entrusting David with a significant portion of his investment portfolio, leading to increased revenue for David’s firm and the establishment of a long-term, high-value client relationship. The subsequent business generated significantly exceeded the cost of the country club membership and entertainment.

Visual Representation of a Business Meeting

The scene unfolds in a sun-drenched, oak-paneled room within the country club’s clubhouse. Large windows offer a panoramic view of a meticulously manicured golf course. Three individuals are seated around a polished mahogany table: a smartly dressed businesswoman, her counterpart, a similarly attired businessman, and their legal counsel, who sits slightly apart, reviewing documents. Soft, ambient lighting casts a warm glow, creating a comfortable yet professional atmosphere. The businesswoman is actively presenting, gesturing with a confident hand as she speaks, while the businessman leans forward, engaging in attentive listening. The legal counsel makes occasional notes, a testament to the seriousness of the discussions. The overall ambiance projects an air of professionalism, trust, and mutual respect, conducive to successful negotiations. The quiet hum of conversation, punctuated by the occasional clinking of glasses of water, further enhances the refined atmosphere.