A business form giving written acknowledgement for cash received. – A business form giving written acknowledgement for cash received is crucial for maintaining accurate financial records and mitigating potential disputes. This seemingly simple document plays a vital role in various business settings, from small retail shops to large corporations. Understanding its purpose, legal implications, and best practices for creation and storage is essential for any business handling cash transactions. This guide delves into the specifics of creating and utilizing these forms, offering practical advice and illustrative examples to ensure compliance and efficiency.

We’ll explore different formats, from simple receipts to formal invoices incorporating payment acknowledgements, highlighting the legal ramifications of issuing (or failing to issue) such documentation. We’ll also cover best practices for layout, content, and security, ensuring your records are both accurate and protected. Real-world examples will illuminate the importance of proper cash handling procedures and the potential consequences of negligence.

Defining the Business Form: A Business Form Giving Written Acknowledgement For Cash Received.

A written acknowledgment for cash received is a crucial business document providing verifiable proof of a transaction. It serves as legal protection for both the payer and the payee, ensuring transparency and minimizing disputes. This simple yet vital form safeguards against potential misunderstandings regarding payments and strengthens financial record-keeping.

A written acknowledgment for cash received Artikels the details of a cash payment, confirming its receipt. Its purpose is to provide irrefutable evidence of the transaction for both parties involved. This ensures accountability and prevents future disagreements over the payment’s occurrence and amount.

Essential Elements of a Written Acknowledgment for Cash Received

The core components of a cash receipt ensure clarity and legal validity. These essential elements minimize ambiguity and protect both the payer and the recipient. Missing even one element can weaken the document’s evidentiary value. Crucially, these elements ensure that the record is unambiguous and easily understood.

- Date of Receipt: Clearly states the date the cash was received.

- Amount Received: Specifies the exact monetary amount received in numerals and words (to avoid discrepancies).

- Payment Method: Indicates that the payment was made in cash.

- Description of Payment: Briefly describes the purpose of the payment (e.g., “payment for invoice #123,” “deposit for services rendered,” or “rent payment for July”).

- Payer Information: Includes the name and contact details of the person or entity making the payment.

- Payee Information: Includes the name, address, and any relevant identification numbers of the person or entity receiving the payment.

- Signature(s): Both the payer and payee should ideally sign the acknowledgment, providing further authentication.

Different Formats of Cash Receipt Forms

The format of a cash receipt can vary depending on the business context and level of formality required. Choosing the appropriate format enhances professionalism and legal standing. Simple receipts suffice for informal transactions, while formal invoices with payment acknowledgment suit more complex scenarios.

- Simple Receipt: A basic, handwritten or printed receipt typically includes the date, amount, and a brief description. This is suitable for small, informal transactions.

- Formal Invoice with Payment Acknowledgment: A more comprehensive document that includes an invoice detailing goods or services provided, followed by a section acknowledging the cash payment received. This is ideal for larger transactions or business-to-business interactions.

- Pre-printed Receipt Books: Many businesses use pre-printed receipt books with numbered receipts to ensure traceability and prevent fraud.

Legal Implications of Issuing a Cash Receipt

Issuing a properly completed cash receipt holds significant legal weight. It serves as irrefutable evidence in case of disputes or audits. The lack of a receipt can lead to complications and disputes. Therefore, meticulous record-keeping is crucial.

The primary legal implication is the creation of a legally binding record of the transaction. A properly completed receipt protects both parties involved. For the payee, it serves as proof of payment received. For the payer, it serves as proof of payment made. Failure to provide a receipt could lead to legal challenges if a dispute arises. The specifics of legal implications may vary based on jurisdiction and local laws, but generally, the receipt acts as strong evidence of the transaction.

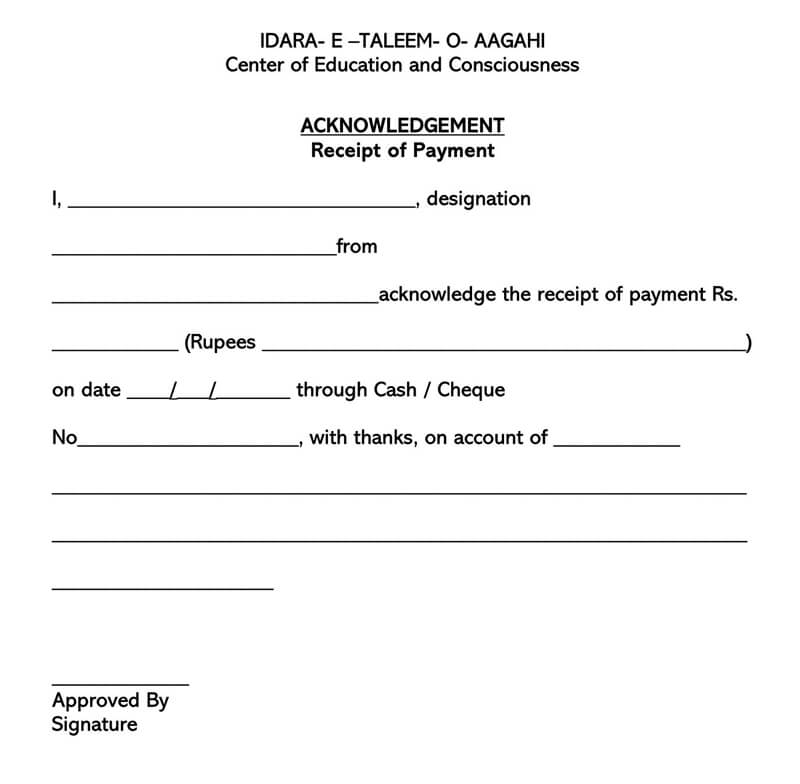

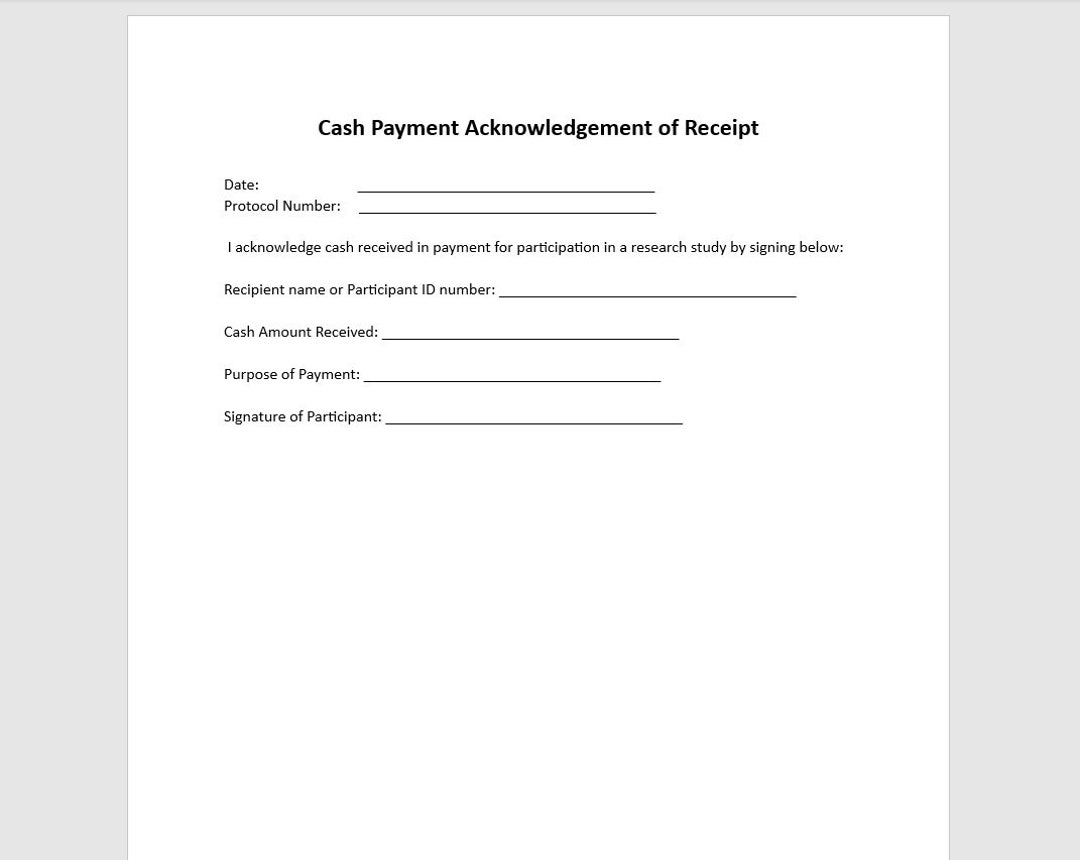

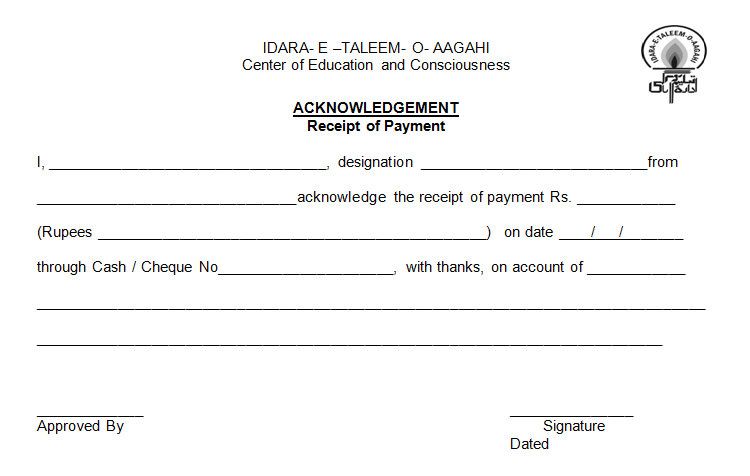

Sample Cash Receipt Form

The following HTML table provides a structured format for a cash receipt. Note that this is a simplified example and may need to be adapted based on specific business requirements. Remember to always consult legal counsel for compliance with all applicable regulations.

| Date | Amount Received | Payment Method | Description of Payment |

|---|---|---|---|

| Cash |

Purpose and Use Cases

Providing written acknowledgment for cash payments is a fundamental aspect of sound financial management for any business, regardless of size or industry. This simple act offers crucial protection against disputes, improves internal controls, and enhances overall transparency in financial transactions. A well-designed cash receipt form serves as irrefutable evidence of a transaction, safeguarding both the business and the customer.

A written record of cash received offers significant benefits, reducing the likelihood of errors, misunderstandings, and fraudulent activities. It creates a clear audit trail, simplifying reconciliation processes and improving the accuracy of financial reporting. This is particularly vital for tax compliance, where accurate records of all income are essential.

Importance in Various Industries

The importance of cash receipt forms varies across industries, with some relying on cash transactions more heavily than others. Retail businesses, for instance, frequently handle cash payments, making a standardized receipt essential for tracking sales, managing inventory, and preventing discrepancies. Similarly, service-based businesses, such as those offering repair services or freelance consulting, often rely on cash payments and need a clear record of transactions. Restaurants, particularly smaller establishments, often operate with a significant portion of their transactions in cash, highlighting the need for meticulous record-keeping. In these contexts, a well-designed cash receipt form is not just beneficial, but vital for efficient operation and compliance.

Risks of Not Issuing Cash Receipts

Failing to provide a written acknowledgment for cash payments exposes businesses to considerable risks. The most significant risk is the potential for disputes over transactions. Without a record, it can be challenging to prove that a payment was made, leading to potential losses for the business and dissatisfaction for the customer. This lack of documentation can also hinder accurate financial reporting, potentially leading to inaccurate tax filings and subsequent penalties. Furthermore, the absence of a clear audit trail can make it easier for fraudulent activities to go undetected, resulting in financial losses and reputational damage. In the worst-case scenario, the absence of receipts can lead to legal challenges and significant financial penalties.

Benefits of Standardized Cash Receipt Forms

Implementing a standardized cash receipt form offers numerous benefits. Consistency in formatting and information ensures clarity and reduces the potential for errors. A standardized form streamlines the process of recording cash payments, saving time and resources. The use of a pre-printed form ensures that all essential information—date, amount, description of goods or services, and customer details—is consistently captured, simplifying data entry and analysis. This standardization also simplifies reconciliation processes, reducing the time and effort required to match cash payments with other financial records. A well-designed form, therefore, contributes to improved efficiency and accuracy in financial management.

Content and Formatting Best Practices

A well-designed cash receipt acknowledgement form ensures clarity, professionalism, and minimizes potential disputes. Effective formatting and concise wording are crucial for efficient record-keeping and a positive client experience. The following guidelines will help create a professional and user-friendly document.

The layout should prioritize clear visual hierarchy and easy navigation. Key information needs to be readily accessible, avoiding clutter or ambiguity. Using consistent fonts, spacing, and a logical flow of information will enhance readability and overall professional appearance.

Layout and Information Organization

The form should adopt a clean, uncluttered design. A simple, professional font such as Arial or Times New Roman in a size of 10-12 points is recommended. Sufficient white space should be incorporated to separate different sections and improve readability. Information should be arranged in a logical order, typically starting with the recipient’s details followed by payment information and finally, confirmation and signatures. Consider using bold headings for each section to guide the reader’s eye. For example, sections like “Payer Information,” “Payment Details,” and “Acknowledgement” clearly delineate the form’s content.

Wording Examples for Different Scenarios

Appropriate wording depends on the specific context. Consider these examples:

Scenario 1: Full Payment

“This letter acknowledges receipt of [Amount] in full payment for invoice number [Invoice Number] dated [Date].”

Scenario 2: Partial Payment

“This letter acknowledges receipt of [Amount] as a partial payment towards invoice number [Invoice Number] dated [Date]. The outstanding balance is [Outstanding Amount].”

Scenario 3: Payment for Services Rendered

“This letter acknowledges receipt of [Amount] in payment for services rendered as per agreement dated [Date].”

Scenario 4: Payment for Goods Received

“This letter acknowledges receipt of [Amount] in payment for goods received as per order number [Order Number] dated [Date].”

Inclusion of Relevant Business Details

The form should prominently display the business’s legal name, full address, phone number, and email address. This information should be located at the top of the form, typically in the header. Including a logo can also enhance brand recognition and professionalism. For example:

[Company Name]

[Street Address]

[City, State, Zip Code]

[Phone Number]

[Email Address]

Consider adding a unique identification number to each acknowledgement form for easy tracking and retrieval. This could be a sequentially numbered receipt number or a unique transaction ID. This allows for efficient record-keeping and simplifies the process of referencing specific transactions.

Security and Record Keeping

Safeguarding cash received and maintaining meticulous records are crucial for the financial health and legal compliance of any business. Neglecting these aspects can lead to significant losses, legal repercussions, and damage to the company’s reputation. This section details best practices for securing cash transactions and archiving related documentation to ensure both immediate and long-term protection.

Proper handling of cash and related documentation minimizes the risk of theft, loss, and fraudulent activities. Effective record-keeping simplifies tax preparation, facilitates audits, and provides valuable financial insights for informed business decisions. A robust system ensures accountability and transparency in financial transactions.

Cash Handling Security Measures

Implementing stringent security protocols is paramount to protecting cash received. This includes physical security measures to deter theft and procedural safeguards to prevent errors and fraud. A comprehensive approach combines both to create a robust system.

- Use a secure cash register or designated cash box with a lock and limited access.

- Conduct regular cash counts and reconcile them with the cash receipt acknowledgements.

- Deposit cash into the bank daily or at least weekly, minimizing the amount of cash held on-site.

- Implement a two-person verification system for all cash transactions, particularly larger amounts.

- Utilize security cameras to monitor cash handling areas and record transactions.

- Train employees on proper cash handling procedures and security protocols.

- Establish clear accountability for cash received, with designated personnel responsible for specific tasks.

- Use sequentially numbered cash receipt acknowledgements to prevent duplication and loss.

- Store cash receipt acknowledgements securely in a locked filing cabinet or a fireproof safe.

Storage and Archiving of Cash Receipt Acknowledgements

Proper storage and archiving of cash receipt acknowledgements are essential for maintaining accurate financial records and complying with legal and tax regulations. These documents serve as crucial evidence of transactions and should be treated with the utmost care. Both physical and digital storage methods should consider factors such as security, accessibility, and longevity.

- Store physical copies in a secure, fireproof location, preferably in a locked cabinet or safe.

- Maintain a well-organized filing system, allowing for easy retrieval of documents when needed.

- Consider using a digital archiving system to create backups and ensure long-term preservation of records.

- Implement a retention policy that complies with relevant tax and legal requirements, specifying how long documents should be kept.

- Regularly back up digital records to an external hard drive or cloud storage.

- Employ access control measures to restrict access to sensitive financial data.

Importance of Accurate Records for Tax and Auditing Purposes

Maintaining accurate records is not merely a good business practice; it’s a legal obligation. Accurate records are crucial for tax compliance, enabling businesses to accurately report income and deductions. They also simplify audits, demonstrating transparency and accountability to tax authorities. In the event of a dispute, well-maintained records serve as strong evidence.

Accurate and complete financial records are essential for complying with tax laws and regulations, minimizing the risk of penalties and legal issues.

Illustrative Examples

Real-world scenarios highlight the importance of properly completed cash receipt forms and the potential consequences of neglecting this crucial administrative task. These examples demonstrate the practical benefits of a robust cash handling and documentation system.

Cash Receipt Form Preventing a Dispute

A small bakery, “Sweet Surrender,” received a large cash payment of $5,000 from a catering company for a wedding cake order. The bakery owner meticulously completed a cash receipt form, detailing the date, amount, purpose of payment (wedding cake order #1234), the catering company’s name and contact information, and his signature. Weeks later, the catering company claimed they hadn’t received the cake and disputed the payment. However, the detailed cash receipt form, along with the bakery’s order confirmation and delivery documentation, provided irrefutable evidence of the transaction, resolving the dispute swiftly and preventing a costly legal battle. The clear documentation proved the payment was made and the order fulfilled.

Well-Organized Filing System for Cash Receipts

Imagine a brightly lit office with a dedicated filing cabinet. The cabinet is divided into labeled drawers, each representing a specific month and year (e.g., “2024 January,” “2024 February,” etc.). Within each drawer, cash receipt forms are organized chronologically, using alpha-numeric dividers for easy retrieval. Each receipt is placed in a clear plastic sleeve to protect it from damage. A separate, smaller cabinet holds backup copies of the receipts. These copies are scanned and stored on a secure, cloud-based server, accessible only to authorized personnel. The physical and digital backups ensure data security and accessibility even in case of unforeseen circumstances like fire or theft. Regular data backups are performed to a separate external hard drive, stored offsite.

Consequences of Failing to Issue a Written Acknowledgement

A construction company, “Build Strong,” received a substantial cash payment of $100,000 from a client for a completed project. However, they failed to issue a written acknowledgement for the payment. Later, the client claimed they had never made the payment, triggering a protracted and costly legal dispute. Without a written record, the construction company struggled to prove the payment had been received, leading to significant financial losses, reputational damage, and legal fees. This scenario highlights the critical importance of providing a written receipt for all cash transactions, regardless of the amount.

Workflow of Cash Handling and Documentation, A business form giving written acknowledgement for cash received.

A visual representation would show a flowchart. The process begins with the customer handing over cash. The next step is the preparation of the cash receipt form by the designated employee, including accurate details of the transaction. The form is then signed by both parties, creating a record of the transaction. The cash is subsequently deposited into the company’s bank account, with the deposit slip referencing the cash receipt number. Finally, the completed cash receipt form is filed in the physical filing system, and a digital copy is saved to the secure server, ensuring a complete audit trail. This workflow ensures transparency, accountability, and easy access to transaction records.