A business structure that operates on a pyramid scheme is a deceptive and unsustainable model built on recruiting new members rather than selling actual products or services. These schemes often promise substantial wealth through recruitment, masking the inherent flaws that lead to the financial ruin of most participants. Understanding the mechanics of pyramid schemes is crucial to avoid becoming a victim of this predatory practice. This exploration delves into the legal definitions, identifying red flags, economic realities, and the psychological manipulation inherent in these fraudulent operations.

We will examine the typical hierarchical structure, illustrating how early investors profit at the expense of later entrants. We’ll analyze the unsustainable nature of these schemes, highlighting why they inevitably collapse, leaving a trail of financial devastation. Furthermore, we’ll explore the legal ramifications for those involved and provide insights into the psychological manipulation tactics used to lure unsuspecting individuals.

Defining Pyramid Schemes: A Business Structure That Operates On A Pyramid Scheme

Pyramid schemes are illegal business models that prioritize recruitment over the sale of goods or services. They promise participants substantial profits based primarily on recruiting new members, rather than on actual sales. This structure inherently leads to unsustainable growth and ultimately collapses, leaving most participants with significant financial losses.

Pyramid schemes are characterized by their deceptive nature and reliance on an unsustainable business model. Unlike legitimate multi-level marketing (MLM) businesses, which generate revenue from the sale of products or services, pyramid schemes focus almost exclusively on recruiting new members. This recruitment-based structure creates a system where early participants profit at the expense of later entrants, leading to a guaranteed failure for the vast majority involved. The promise of significant wealth through recruitment, often coupled with high upfront investment costs, is a hallmark of these fraudulent operations.

Pyramid Scheme Characteristics

The core difference between a pyramid scheme and a legitimate multi-level marketing business lies in the emphasis on recruitment versus product sales. In a legitimate MLM, the majority of revenue is generated from the sale of goods or services, with commissions earned through sales and team building playing a supporting role. Conversely, in a pyramid scheme, the emphasis is reversed. Profits are primarily derived from recruitment fees paid by new entrants, with the sale of products or services being secondary, if present at all. This crucial distinction makes the sustainability and ethical nature of the two business models fundamentally different. Regulatory bodies scrutinize the ratio of recruitment-based income to product-sales-based income to determine whether a structure is operating legitimately or as a pyramid scheme.

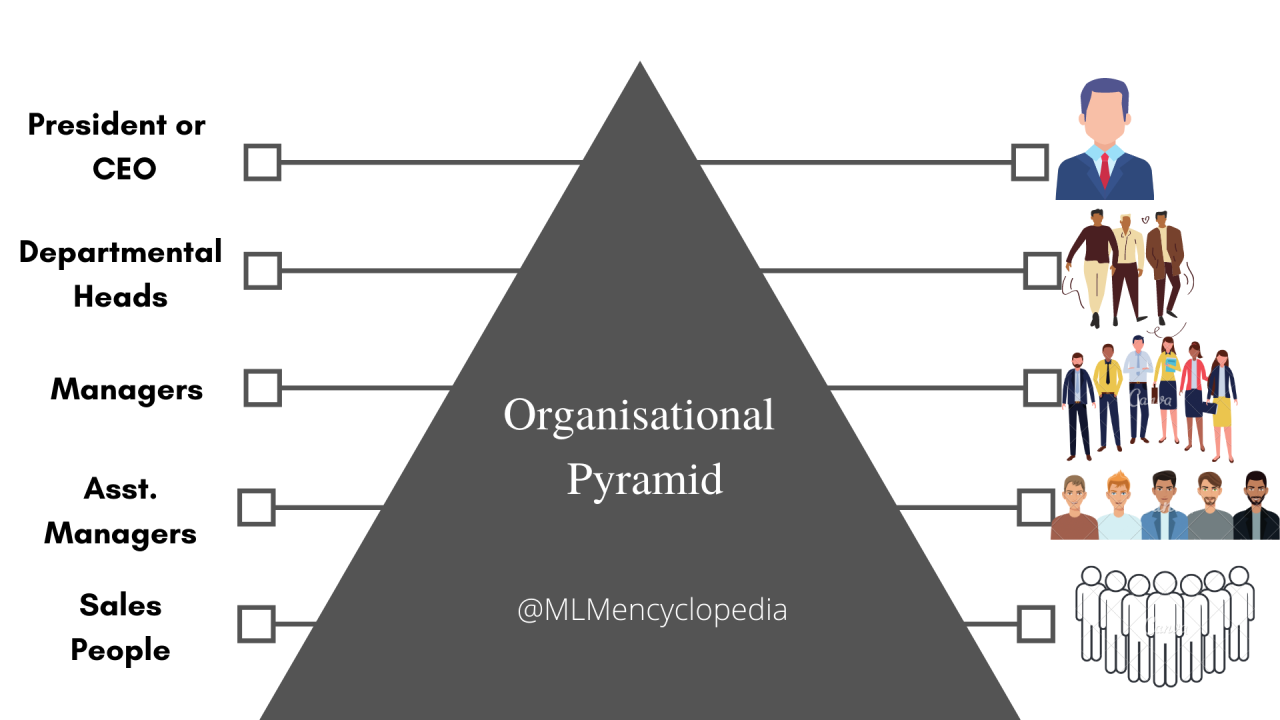

Pyramid Scheme Structure

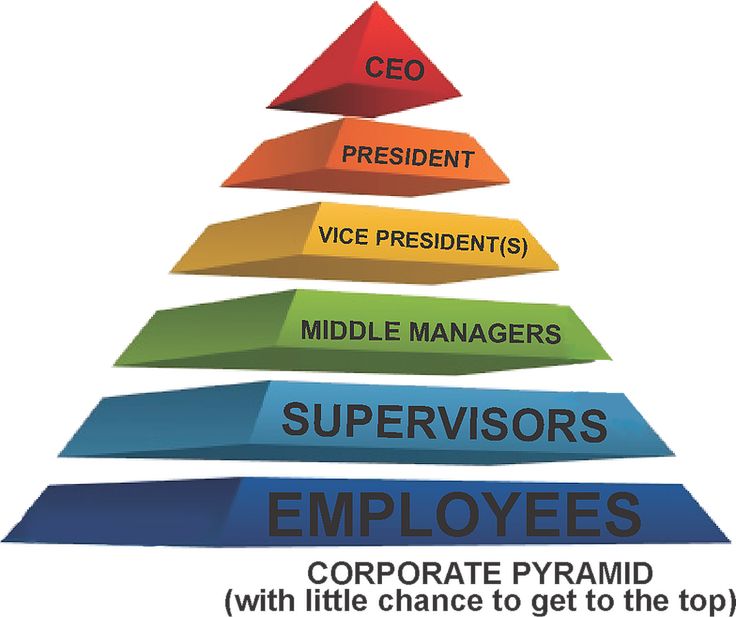

The hierarchical structure of a pyramid scheme is the key to its deceptive nature. Early participants recruit others, who in turn recruit more, creating a pyramid shape. The financial flows mirror this structure, with money flowing upwards from later entrants to earlier ones. This inherently unsustainable model ensures that only a small percentage at the top benefit significantly, while the majority at the bottom bear the financial burden.

| Level | Participants | Investment | Income |

|---|---|---|---|

| Level 1 (Top) | 1 | Minimal or None | High, primarily from recruitment fees of lower levels |

| Level 2 | 5-10 | Significant upfront investment (e.g., product purchase, training fees) | Moderate, from recruitment fees and potentially small product sales |

| Level 3 | 25-100 | Significant upfront investment (e.g., product purchase, training fees) | Low, primarily from recruitment fees, unlikely to cover investment |

| Level 4 and below | Hundreds or Thousands | Significant upfront investment (e.g., product purchase, training fees) | Minimal or None, often resulting in substantial financial losses |

Identifying Red Flags in Pyramid Schemes

Pyramid schemes, while often disguised as legitimate business opportunities, share several common characteristics that savvy individuals can learn to recognize. Understanding these red flags is crucial for protecting yourself from financial loss and disappointment. Identifying these warning signs early on can prevent significant financial hardship and wasted time.

Many pyramid schemes prey on individuals’ desires for financial independence and quick riches, often using high-pressure sales tactics and unrealistic promises of wealth. These schemes rarely, if ever, generate substantial income from the sale of actual goods or services; instead, their profitability hinges solely on recruiting new members. The focus is overwhelmingly on recruitment, not on the sale of products or services.

Common Red Flags in Pyramid Schemes

Five common red flags signal a potential pyramid scheme. These indicators, when considered collectively, offer a strong indication of a fraudulent business model. Ignoring them can lead to significant financial losses.

- Emphasis on Recruitment Over Sales: The primary focus is on recruiting new members rather than selling actual products or services. The compensation structure heavily rewards recruitment, often overshadowing any legitimate product sales.

- High Upfront Costs: Significant investment is required to join, often involving purchasing large quantities of inventory or paying hefty fees for training materials or “opportunities”. This inventory may be difficult or impossible to resell.

- Unrealistic Earnings Claims: Promises of quick riches and extraordinary returns with minimal effort are a major red flag. Schemes often cite anecdotal evidence of massive profits without providing verifiable data or realistic projections.

- Vague or Misleading Products/Services: The products or services offered are often of low value or difficult to sell. The business may focus more on marketing and recruiting than on the actual quality or marketability of its offerings.

- Pressure to Recruit Quickly: There’s intense pressure to sign up new members quickly, often employing high-pressure sales tactics and manipulative language. This urgency is a hallmark of pyramid schemes designed to maximize recruitment before the scheme collapses.

Scrutinizing Compensation Plans

A thorough examination of the compensation plan is critical in identifying hidden pyramid structures. Pyramid schemes often mask their true nature through complex compensation plans that appear legitimate at first glance. However, a closer look reveals that the majority of earnings are derived from recruiting new members, not from actual product sales.

Legitimate multi-level marketing (MLM) companies, in contrast, generate significant revenue from product sales, with recruitment playing a secondary role. The compensation plan should clearly Artikel how commissions are earned, with a strong emphasis on retail sales and a demonstrably smaller portion tied to recruiting new distributors. If the majority of income stems from recruiting, it’s a strong indicator of a pyramid scheme.

Checklist for Assessing Business Legitimacy

Using a checklist can help individuals systematically evaluate the legitimacy of a business opportunity. This systematic approach minimizes the risk of falling prey to fraudulent schemes.

- Product/Service Value: Is there a genuine demand for the product or service? Can it be independently verified?

- Compensation Plan Transparency: Is the compensation plan clearly explained, with a focus on product sales rather than recruitment?

- Independent Verification: Can you independently verify the company’s claims about its products, services, and earnings potential?

- Financial Risk Assessment: What are the financial risks involved? Is there a significant upfront investment required?

- Sales Emphasis: Is the company’s focus primarily on selling products or services, or on recruiting new members?

The Economics of Pyramid Schemes

Pyramid schemes, despite their alluring promises of quick riches, are fundamentally unsustainable economic models destined for collapse. Their inherent structure, reliant on recruiting new participants rather than selling legitimate products or services, guarantees their eventual failure. This section delves into the economic mechanics that underpin this inevitable downfall, highlighting the stark contrast in outcomes between early and late entrants.

The Unsustainable Nature of Pyramid Schemes

Pyramid schemes operate on a flawed premise: exponential growth. To sustain itself, a pyramid scheme requires a constantly expanding base of new recruits. Each new participant must, in turn, recruit multiple others to maintain the flow of money upwards. However, exponential growth is impossible to maintain indefinitely within a finite population. Eventually, the scheme reaches a point where recruiting new members becomes exponentially more difficult, leading to a sharp decline in the inflow of funds and ultimately, the scheme’s collapse. This collapse leaves the majority of participants, those who entered later, with significant financial losses. The limited pool of potential recruits is simply insufficient to support the ever-growing demands of the scheme’s structure.

Early Adopters’ Profits and Late Entrants’ Losses

The inherent unfairness of pyramid schemes is most evident in the disparity of outcomes between early and late entrants. Early adopters, often those who are at the top of the pyramid, benefit significantly from the influx of money generated by the recruitment of new members. They receive substantial payments from those below them, often accumulating significant wealth. Conversely, later entrants face a much higher risk of financial loss. As the scheme nears its inevitable collapse, these later entrants are less likely to recoup their initial investment, and may even lose significant sums of money. This is because the pool of potential recruits dwindles, and the money flows upward, leaving those at the bottom with little to no return.

A Hypothetical Pyramid Scheme Scenario

Consider a simplified pyramid scheme where each participant needs to recruit five new members. Let’s assume each participant pays $100 to join.

Level 1: One founder receives $500 (5 x $100) from five recruits.

Level 2: Five recruits each receive $500 (5 x $100) from their recruits, generating a total of $2500.

Level 3: Twenty-five recruits each receive $500 (5 x $100) from their recruits, generating a total of $12,500.

The scheme appears successful in the early stages, with the founder and early recruits profiting handsomely. However, to sustain this model, Level 4 would require 125 new recruits, Level 5 would need 625, and so on. It’s easy to see how quickly the number of required recruits becomes unsustainable. If the scheme only managed to recruit 100 people in Level 4, many would lose their initial $100 investment. The further down the pyramid one is, the higher the probability of financial loss as the number of potential recruits dwindles and the scheme collapses. This illustrates the inherently unsustainable nature of the pyramid scheme’s economic model.

Legal and Regulatory Aspects

Pyramid schemes are illegal in most jurisdictions worldwide, carrying significant legal ramifications for both operators and participants. Regulatory bodies play a crucial role in preventing their formation and prosecuting those involved. The specific legal frameworks, however, can vary considerably between countries, leading to different levels of enforcement and penalties.

The legal ramifications for individuals involved in pyramid schemes are substantial and can extend beyond financial penalties. Operating a pyramid scheme can lead to criminal charges, including fraud and conspiracy, resulting in hefty fines, imprisonment, and a damaged reputation. Participants, even those unaware of the scheme’s illegal nature, can face civil lawsuits from investors who lost money. These lawsuits can result in significant financial liabilities, including repayment of losses and legal fees. Furthermore, regulatory bodies may issue cease-and-desist orders, preventing further operation and potentially impacting future business ventures.

Legal Ramifications for Individuals

Individuals involved in pyramid schemes face a range of legal consequences depending on their level of involvement and jurisdiction. Those operating the scheme typically face the most severe penalties, often including criminal charges for fraud and conspiracy. Participants who knowingly participated in the scheme may also face civil or criminal charges. Even unwitting participants might face legal action if they are found to have benefited financially from the scheme. The severity of the penalties can vary widely depending on factors such as the amount of money involved, the number of victims, and the level of intent to defraud. For example, in the United States, penalties can range from substantial fines to lengthy prison sentences, depending on the specific charges and the scale of the operation. In other countries, similar penalties exist, though the specifics may differ.

Role of Regulatory Bodies

Regulatory bodies, such as the Federal Trade Commission (FTC) in the United States and the Competition and Markets Authority (CMA) in the United Kingdom, play a vital role in preventing and prosecuting pyramid schemes. Their responsibilities include investigating suspected schemes, issuing cease-and-desist orders, and pursuing legal action against those involved. These bodies often rely on consumer complaints and their own investigations to identify and dismantle pyramid schemes. They use various methods to gather evidence, including analyzing financial records, interviewing participants, and monitoring online activity. Successful prosecutions often lead to significant fines and other penalties imposed on the operators and, in some cases, participants. Furthermore, these bodies often engage in public education campaigns to raise awareness about the risks of pyramid schemes and help consumers identify red flags.

Legal Frameworks: United States vs. United Kingdom

The United States and the United Kingdom, while both actively combatting pyramid schemes, employ slightly different legal frameworks. In the United States, the FTC primarily uses civil enforcement actions under laws prohibiting unfair and deceptive trade practices. Criminal prosecution is also possible, often handled by state attorneys general or federal prosecutors. The focus is frequently on the deceptive nature of the scheme, targeting misleading promises of wealth and the unsustainable structure itself. In the United Kingdom, the CMA utilizes both civil and criminal enforcement powers under consumer protection legislation and competition law. The emphasis is often placed on misleading marketing practices and the restriction of unfair competition. While both countries share the common goal of protecting consumers from pyramid schemes, their approaches may differ in terms of the specific legal instruments used and the emphasis placed on different aspects of the schemes. For instance, the US might focus more on the fraudulent nature of the financial transactions, while the UK might focus on the misleading marketing and anti-competitive practices.

The Psychological Impact on Participants

Pyramid schemes prey on individuals’ psychological vulnerabilities, employing manipulative tactics to lure them into participation and maintain their involvement. The emotional consequences for victims can be devastating, often leading to financial ruin, damaged relationships, and significant emotional distress. Understanding these psychological aspects is crucial to recognizing and avoiding these destructive schemes.

Pyramid scheme operators skillfully exploit a range of psychological biases and vulnerabilities. They often leverage the desire for quick riches and financial independence, promising unrealistic returns and portraying participation as a path to effortless wealth. This taps into the human desire for financial security and the allure of easy money, especially during times of economic hardship. Furthermore, they cultivate a sense of community and belonging among participants, creating a supportive environment that discourages critical thinking and reinforces the scheme’s legitimacy. This group dynamic can make it difficult for individuals to question the scheme’s validity, even when red flags become apparent. The pressure to recruit new members further intensifies these psychological pressures, leading to feelings of guilt and obligation.

Manipulation Tactics Employed by Pyramid Scheme Operators

Pyramid scheme operators utilize a variety of manipulative tactics to recruit and retain participants. High-pressure sales techniques are frequently employed, with operators employing emotionally charged language and testimonials to create a sense of urgency and excitement. They often focus on the potential for financial gain, downplaying or ignoring the risks involved. Operators may also use social proof, highlighting the success of early participants to persuade others to join. The creation of a sense of exclusivity, suggesting that only a select few have access to this “opportunity,” further enhances the scheme’s appeal. Finally, manipulative operators often exploit pre-existing relationships, targeting friends and family members to increase recruitment rates. This tactic leverages trust and existing social bonds, making it harder for victims to recognize the manipulative nature of the scheme.

Appeal to Vulnerable Individuals and Emotional Consequences

Pyramid schemes disproportionately target vulnerable individuals, including those facing financial insecurity, unemployment, or lack of financial literacy. The promise of easy money and financial independence can be especially alluring to those struggling financially. Individuals lacking strong social support networks may also be more susceptible to the manipulative tactics employed by operators, as the sense of community and belonging offered by the scheme can fill a void in their lives. The emotional consequences of participating in a pyramid scheme can be severe. Victims often experience feelings of shame, guilt, and embarrassment, particularly if they have recruited friends and family members. Financial ruin can lead to stress, anxiety, and depression. Damaged relationships with family and friends are also common, as the scheme can strain and ultimately break interpersonal bonds. In some cases, victims may even experience feelings of hopelessness and despair, leading to significant psychological distress.

Resources for Victims of Pyramid Schemes

The emotional and financial toll of pyramid schemes can be significant, but help is available. Victims are not alone, and there are resources designed to provide support and guidance.

- The Federal Trade Commission (FTC): The FTC offers a wealth of information on pyramid schemes and provides resources for filing complaints and reporting scams. Their website offers guides and tools to help victims understand their rights and take appropriate action.

- The Better Business Bureau (BBB): The BBB provides information on businesses and allows consumers to file complaints. They can help victims research the legitimacy of businesses and potentially identify pyramid schemes before becoming involved.

- State Attorney General’s Offices: Each state has an Attorney General’s office that investigates consumer fraud, including pyramid schemes. Victims can file complaints with their state’s Attorney General’s office to initiate an investigation and potentially recover losses.

- Consumer Financial Protection Bureau (CFPB): The CFPB is another valuable resource for victims of financial fraud, including pyramid schemes. They offer information and assistance with resolving financial disputes.

- Financial counselors and therapists: Seeking professional help from a financial counselor or therapist can provide support and guidance in navigating the emotional and financial aftermath of a pyramid scheme. They can offer strategies for managing debt, rebuilding finances, and addressing psychological distress.

Case Studies of Notable Pyramid Schemes

Understanding the mechanics and consequences of pyramid schemes requires examining real-world examples. Analyzing these cases reveals common patterns and highlights the devastating impact such schemes have on individuals and economies. The following case studies illustrate the deceptive nature and eventual collapse of three notorious pyramid schemes.

The TelexFree Scheme

TelexFree, operating from 2012 to 2014, presented itself as a VoIP (Voice over Internet Protocol) company offering cheap international calls. However, its primary revenue stream wasn’t from call services; instead, it relied heavily on recruitment. Participants purchased “advertising packages” and earned commissions by recruiting new members. These packages offered little to no actual advertising value, and the vast majority of earnings came from recruiting, not from legitimate business activity. The scheme collapsed under the weight of unsustainable growth and regulatory scrutiny, leaving thousands of participants with significant financial losses.

TelexFree’s structure perfectly exemplified a pyramid scheme. Its success depended entirely on the continuous influx of new recruits, rather than the sale of a viable product or service. The promise of substantial earnings from recruiting masked the inherent unsustainability of the model. The collapse resulted in substantial legal repercussions, including criminal charges against its founders.

The BurnLounge Scheme

BurnLounge, active in the mid-2000s, marketed itself as a social networking site combined with a music-distribution platform. Participants purchased memberships and earned commissions by recruiting others. Similar to TelexFree, the real profit came from recruitment, not from music sales or legitimate network activities. The company emphasized rapid growth and high commissions, drawing in a large number of participants before its inevitable downfall. The Federal Trade Commission (FTC) eventually shut down BurnLounge, citing its fraudulent business practices.

BurnLounge’s collapse highlighted the inherent instability of pyramid schemes. The reliance on an ever-expanding base of recruits, rather than sustainable revenue from product sales, led to its rapid demise. The high-pressure recruitment tactics and misleading promises of wealth contributed to its downfall, leaving many participants financially devastated.

The ZeekRewards Scheme, A business structure that operates on a pyramid scheme

ZeekRewards, operating from 2010 to 2012, posed as an online advertising revenue-sharing program. Participants purchased advertising packages and earned commissions through recruitment. However, the promised advertising revenue was largely nonexistent; the scheme’s income stemmed almost entirely from new member recruitment. The scheme’s complexity and deceptive marketing tactics made it difficult for many participants to recognize its pyramid structure. The scheme’s collapse resulted in significant financial losses for its participants and led to legal action against its operators.

ZeekRewards’ downfall demonstrated how sophisticated marketing and obfuscation can mask the classic characteristics of a pyramid scheme. The complexity of its structure and the use of seemingly legitimate business language made it difficult for many to identify the inherent risks. The eventual collapse underscored the importance of critical evaluation and due diligence before participating in any such opportunity.

Preventing Future Pyramid Schemes

Preventing the proliferation of pyramid schemes requires a multi-pronged approach focusing on public education, enhanced financial literacy, and robust regulatory enforcement. Addressing the root causes of vulnerability to these schemes is crucial to safeguarding individuals and the economy.

Effective strategies must move beyond simply identifying the schemes and delve into understanding why people fall victim. This requires a nuanced approach that tackles both the economic pressures that make individuals susceptible and the psychological manipulation inherent in these deceptive operations.

Public Education Campaigns

Educating the public about the inherent risks of pyramid schemes is paramount. Comprehensive campaigns should utilize diverse media channels—television, radio, social media, and educational institutions—to disseminate information. These campaigns should not only highlight the warning signs of pyramid schemes but also explain the underlying economic principles that expose their unsustainable nature. For example, campaigns could use simple analogies to illustrate how a system reliant on recruiting new members rather than selling a legitimate product or service is destined to collapse. A visually appealing infographic showing the exponential growth needed to sustain a pyramid scheme, contrasting it with the limited number of participants, could be particularly effective. Furthermore, real-life case studies of individuals who lost significant sums of money due to pyramid schemes could serve as cautionary tales.

The Importance of Financial Literacy

Financial literacy plays a critical role in shielding individuals from pyramid schemes. A strong understanding of basic financial principles, such as investment diversification, risk assessment, and return on investment, empowers individuals to critically evaluate investment opportunities. Improved financial education in schools and community programs can equip individuals with the necessary skills to identify red flags and make informed decisions. This includes teaching individuals how to differentiate between legitimate multi-level marketing (MLM) businesses and pyramid schemes, focusing on the crucial distinction of product sales versus recruitment as the primary source of income. Interactive workshops and online resources that use simulations and real-world examples can make financial literacy more engaging and accessible.

Public Service Announcement (PSA)

This PSA will be broadcast on television and radio, and disseminated online.

(Scene opens with a montage of people looking excited, holding large checks, and driving fancy cars.)

Narrator: “Does it seem too good to be true? Are you promised quick riches with minimal effort? Beware! You might be looking at a pyramid scheme.”

(Scene shifts to show a person looking distressed, surrounded by debt notices.)

Narrator: “Pyramid schemes prey on your hopes and dreams. They promise wealth, but deliver only disappointment and financial ruin.”

(Scene shows a graphic illustrating a pyramid collapsing.)

Narrator: “Here’s how to protect yourself: 1. Be wary of high-pressure sales tactics and unrealistic promises of quick wealth. 2. Investigate the company thoroughly; look for independent reviews and verifiable product sales. 3. If recruitment, rather than product sales, is emphasized, it’s a major red flag. 4. Don’t invest money you can’t afford to lose. 5. If something feels wrong, it probably is. Consult a financial advisor before making any investment decisions.”

(Scene ends with a message: “Protect your future. Avoid pyramid schemes.”)