A company’s business model does not, in and of itself, guarantee success. While a well-defined model is crucial, its effectiveness hinges on numerous factors, from navigating competitive pressures and adapting to technological shifts to ensuring operational efficiency and achieving financial sustainability. This exploration delves into the common pitfalls businesses encounter, revealing how seemingly robust models can crumble under the weight of unforeseen challenges or strategic missteps. We’ll examine real-world examples of companies that failed despite having seemingly solid plans, highlighting the critical areas where businesses often falter.

From identifying weaknesses in existing structures to developing robust strategies for revenue generation, customer acquisition, and scaling operations, we’ll provide a comprehensive overview of the key elements that contribute to a thriving business model. We’ll also discuss the importance of market analysis, efficient resource allocation, and the ability to adapt to ever-changing market dynamics. Ultimately, understanding what a business model *doesn’t* guarantee is just as crucial as understanding what it *does*.

Identifying Weaknesses in a Business Model

A robust business model is the cornerstone of any successful enterprise. However, even the most meticulously crafted plans can contain flaws that, if left unaddressed, can lead to significant financial losses and even business failure. Identifying these weaknesses early is crucial for mitigating risk and ensuring long-term viability. Understanding the potential consequences of a flawed model and proactively searching for vulnerabilities are vital skills for any entrepreneur or business leader.

A flawed business model can manifest in numerous ways, leading to a cascade of negative consequences. Insufficient revenue generation, unsustainable cost structures, and a lack of competitive advantage are common outcomes. These weaknesses can erode profitability, limit growth potential, and ultimately render the business unsustainable. The consequences can range from slow growth and reduced market share to complete market failure and bankruptcy. Prolonged struggles with a flawed model can also damage brand reputation and employee morale, creating a vicious cycle that is difficult to overcome.

Examples of Companies That Failed Due to Weak Business Models

The business graveyard is littered with companies that failed despite innovative products or services, often due to fundamental flaws in their business models. Examining these failures provides valuable lessons for avoiding similar pitfalls. The following table highlights some notable examples:

| Company Name | Industry | Business Model Flaw | Outcome |

|---|---|---|---|

| Webvan | Online Grocery Delivery | High operating costs, unsustainable pricing, inadequate logistics | Bankruptcy |

| Kozmo.com | Online Delivery (books, videos, etc.) | High delivery costs, inability to achieve profitability at scale | Bankruptcy |

| Pets.com | Online Pet Supplies | Heavy reliance on venture capital, unsustainable burn rate, flawed customer acquisition strategy | Bankruptcy |

| Blockbuster | Video Rental | Failure to adapt to the rise of streaming services, clinging to a outdated business model | Bankruptcy |

Strategies for Identifying Weaknesses in a Company’s Current Business Model

Regularly assessing a business model is not a one-time event but an ongoing process. Several strategies can be employed to identify weaknesses and potential vulnerabilities. A thorough and objective analysis is crucial, often requiring external perspectives and data-driven insights.

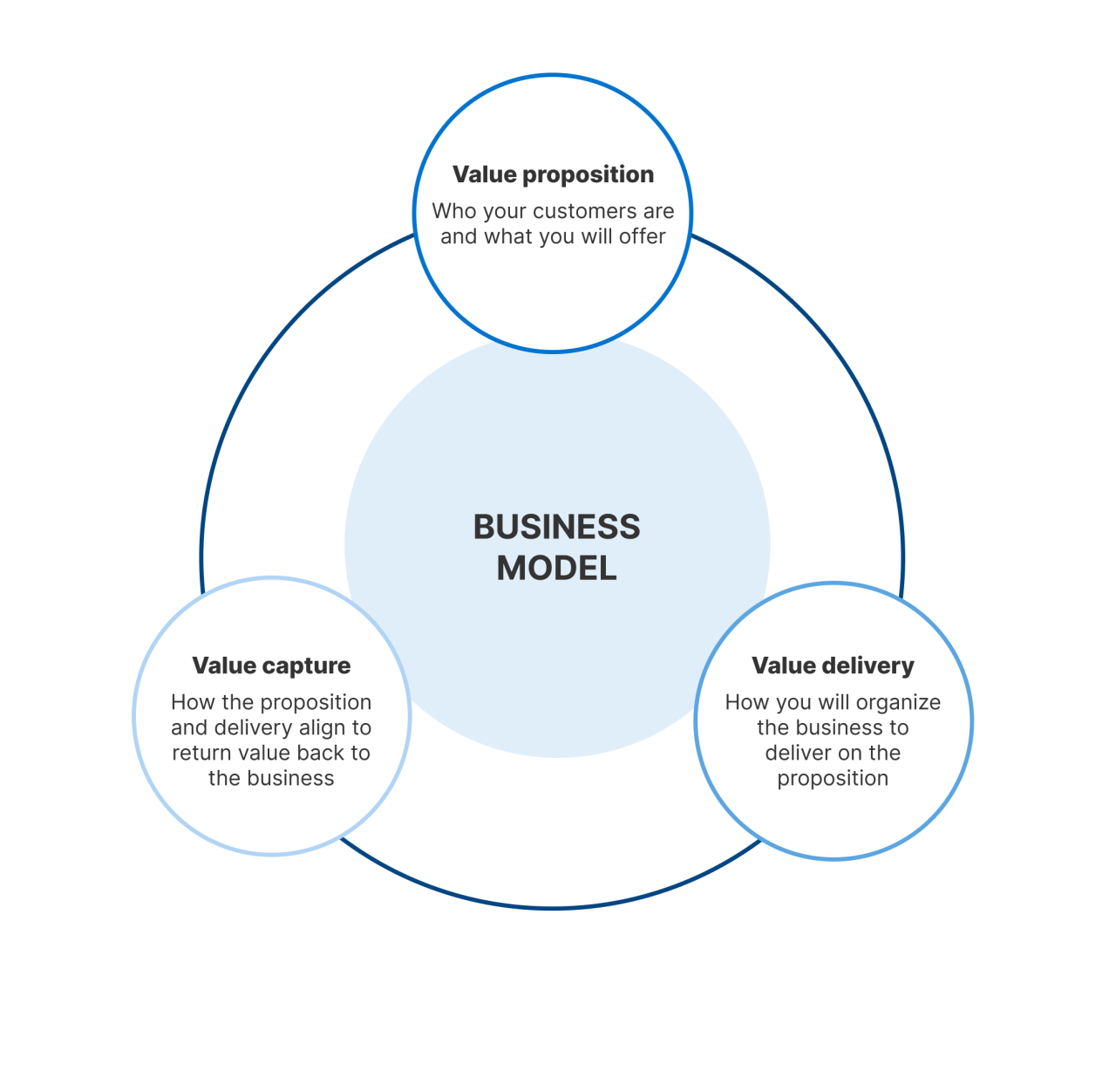

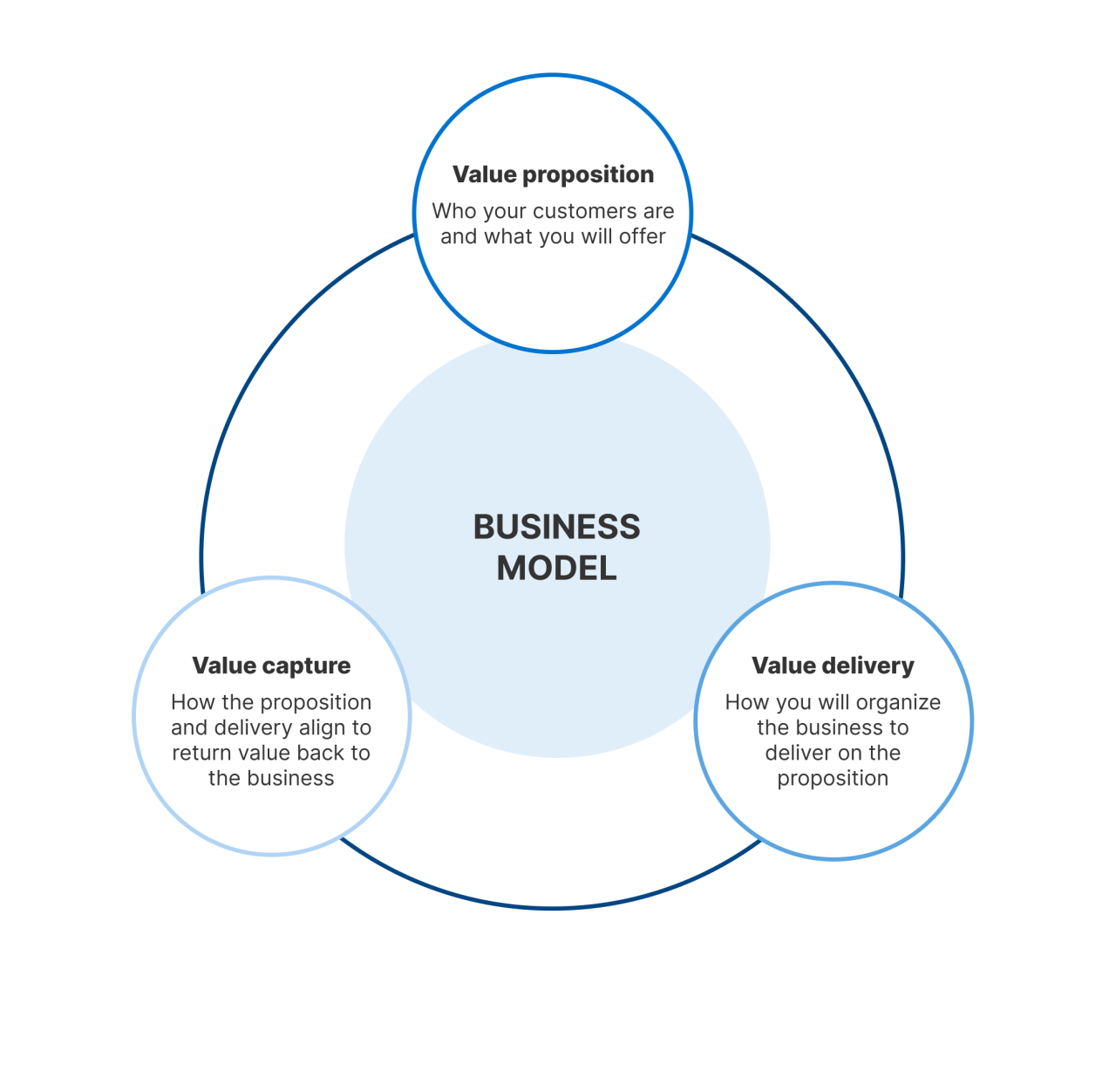

A comprehensive review should involve scrutinizing various aspects of the business model, including revenue streams, cost structures, customer segments, value propositions, and competitive landscape. Techniques such as SWOT analysis (Strengths, Weaknesses, Opportunities, Threats), competitive benchmarking, and customer feedback analysis can provide valuable insights. Analyzing key performance indicators (KPIs) related to revenue, customer acquisition cost, customer lifetime value, and profitability is essential for identifying areas requiring improvement. Furthermore, scenario planning and stress testing the model under various market conditions can help anticipate potential challenges and develop contingency plans. Finally, engaging with industry experts and seeking external advice can provide fresh perspectives and identify blind spots.

Revenue Generation Challenges

Insufficient revenue is a major hurdle for many businesses, hindering growth and potentially leading to failure. Several factors contribute to this challenge, ranging from internal operational issues to external market forces. Understanding these underlying causes is crucial for developing effective solutions.

Many companies struggle to generate sufficient revenue due to a combination of factors. Poor market analysis leading to an inaccurate understanding of customer needs and pricing sensitivity can result in low sales. Ineffective marketing and sales strategies fail to reach the target audience or persuade them to purchase. High operating costs, inefficient processes, and a lack of scalability can eat into profit margins, leaving little room for growth. Furthermore, intense competition, economic downturns, and changes in consumer behavior can significantly impact revenue generation. A lack of diversification in revenue streams also leaves a company vulnerable to fluctuations in a single market segment.

Alternative Revenue Streams for a Hypothetical Company

Let’s consider a hypothetical company, “EcoClean,” a startup offering eco-friendly cleaning products. Initially, EcoClean focused solely on direct sales through its website. However, revenue remained stagnant. To address this, EcoClean could explore several alternative revenue streams. They could establish partnerships with larger retailers, expanding their reach to a wider customer base. A subscription service offering regular deliveries of cleaning products could generate predictable recurring revenue. EcoClean could also license its eco-friendly formulations to other cleaning product manufacturers, generating income without directly managing the sales and distribution. Finally, offering workshops or educational content on sustainable cleaning practices could generate additional revenue and enhance brand awareness.

Pricing Strategies and Their Impact on Revenue

Different pricing strategies significantly impact revenue generation. A cost-plus pricing strategy, where the price is calculated by adding a markup to the cost of goods sold, is simple but may not optimize profitability if the markup is not carefully determined. Value-based pricing, which sets prices based on the perceived value to the customer, can command higher prices but requires a strong understanding of customer perception. Premium pricing, setting prices higher than competitors to signal superior quality or exclusivity, can be effective for luxury goods but risks alienating price-sensitive customers. Penetration pricing, setting initially low prices to gain market share, can attract customers but may result in lower profit margins in the short term. Finally, competitive pricing, matching or slightly undercutting competitors’ prices, is a straightforward approach but offers little differentiation. The optimal pricing strategy depends on factors such as the target market, competitive landscape, and product differentiation. For instance, a luxury brand like Rolex uses premium pricing, while a fast-food chain like McDonald’s often employs competitive pricing.

Market Position and Competition

A company’s weak market position often stems from a combination of internal and external factors. Understanding these factors is crucial for developing effective strategies to improve competitiveness and ultimately, profitability. A poorly defined value proposition, inadequate marketing and sales efforts, and a failure to adapt to changing market dynamics can all contribute to a less-than-ideal market standing. Furthermore, intense competitive pressure can significantly erode a business model’s effectiveness, even if the core concept is sound.

A company’s market position is significantly influenced by its ability to differentiate itself from competitors. Competitive pressures, such as price wars, increased marketing spend by rivals, and the emergence of disruptive technologies, can severely impact profitability and market share. These pressures force companies to constantly innovate and adapt, demanding significant investment in research and development, marketing, and potentially, operational restructuring. Failing to adequately respond to competitive threats can lead to a decline in market share, reduced profitability, and ultimately, business failure. For example, the rise of online retailers significantly impacted brick-and-mortar stores, forcing many to adapt their business models or face closure.

Factors Contributing to Weak Market Position

Several factors can contribute to a company’s weak market position. These include a lack of brand recognition, a poorly defined target market, insufficient marketing and sales efforts, inadequate product or service differentiation, high production costs leading to uncompetitive pricing, and a failure to adapt to evolving consumer preferences or technological advancements. For instance, a company with a superior product but poor marketing may struggle to gain traction in the market, while a company with a strong brand but high prices might lose customers to more affordable alternatives.

Competitive Pressures and Their Negative Effects

Intense competition can significantly damage a business model. Price wars, for example, can dramatically reduce profit margins, forcing companies to cut costs or potentially exit the market. The entry of new competitors with innovative products or services can disrupt established market dynamics, leading to a decline in market share for existing players. Similarly, increased marketing expenditure by competitors can make it more challenging for a company to reach its target audience and build brand awareness. Consider the impact of aggressive marketing campaigns by large multinational corporations on smaller, independent businesses. The smaller companies often lack the resources to compete effectively, resulting in decreased market share and potential failure.

Potential Market Niches for Improved Positioning

Identifying and exploiting market niches can significantly improve a company’s market position. This involves focusing on a specific segment of the market with unique needs or preferences that are not fully addressed by existing competitors. This could involve targeting a specific demographic, geographic area, or offering a specialized product or service. For example, a company might identify a niche market for eco-friendly products or services, catering to environmentally conscious consumers. Alternatively, a company could focus on a specific geographic region with unique cultural or economic characteristics. Successful niche marketing requires a deep understanding of the target market’s needs and preferences and a well-defined value proposition that caters specifically to those needs.

Operational Inefficiencies

Operational inefficiencies represent a significant drain on a company’s profitability. They manifest as wasted resources, increased costs, and reduced output, ultimately impacting the bottom line. Understanding and addressing these inefficiencies is crucial for sustained growth and competitive advantage. This section details how operational inefficiencies damage profitability and Artikels potential improvements.

Operational inefficiencies directly translate into reduced profitability by increasing costs and decreasing revenue. For example, inefficient inventory management can lead to excess stock holding costs, obsolescence, and lost sales due to stockouts. Similarly, poorly designed production processes can result in higher production costs, longer lead times, and reduced product quality. These issues, combined, significantly reduce profit margins and hinder overall business performance. A company might experience a 10% decrease in profitability due to inefficient supply chain management alone, for instance. This loss could be even greater if other operational areas are also inefficient.

Potential Operational Improvements

The following points highlight potential areas for operational improvement to enhance efficiency and reduce costs. Implementing these improvements can significantly boost profitability and strengthen the company’s overall competitive position.

- Streamlining Supply Chain Management: Implementing just-in-time inventory management, optimizing logistics, and establishing strong supplier relationships can significantly reduce inventory holding costs and improve delivery times. For example, a company using a just-in-time system could reduce its inventory holding costs by 15%.

- Optimizing Production Processes: Analyzing production workflows to identify bottlenecks and inefficiencies, implementing lean manufacturing principles, and investing in automation can increase productivity and reduce production costs. A company might see a 5% increase in production output with the implementation of lean manufacturing techniques.

- Improving Inventory Management: Implementing robust inventory tracking systems, forecasting demand accurately, and minimizing waste through effective stock rotation can significantly reduce inventory costs and avoid stockouts. Accurate demand forecasting can reduce stockouts by as much as 20%.

- Enhancing Employee Training and Development: Investing in employee training and development programs can improve employee skills and efficiency, leading to higher productivity and reduced error rates. A well-trained workforce can increase productivity by 10-15%.

- Automating Repetitive Tasks: Automating repetitive tasks using software and technology can free up employees to focus on higher-value activities, improving efficiency and reducing labor costs. Automating data entry, for instance, can free up employee time by 20% or more.

Plan for Streamlining Internal Processes

A comprehensive plan to streamline internal processes requires a phased approach.

- Assessment and Analysis: Conduct a thorough assessment of current processes to identify bottlenecks, inefficiencies, and areas for improvement. This might involve process mapping and data analysis to pinpoint specific problem areas.

- Prioritization: Prioritize areas for improvement based on their impact on profitability and feasibility of implementation. Focus on quick wins first to build momentum and demonstrate value.

- Implementation: Implement chosen improvements, using a phased approach to minimize disruption and allow for adjustments based on feedback. This might involve changes to workflows, technology upgrades, or employee training.

- Monitoring and Evaluation: Continuously monitor the effectiveness of implemented improvements, using key performance indicators (KPIs) to track progress and identify areas needing further attention. Regular review and adjustment are crucial for sustained improvement.

Customer Acquisition and Retention: A Company’s Business Model Does Not

Customer acquisition and retention are critical components of a sustainable business model. A successful strategy balances attracting new customers with fostering loyalty among existing ones, ultimately driving profitability and growth. Ignoring either aspect can severely limit a company’s long-term viability. This section will analyze ineffective customer acquisition strategies and Artikel effective retention methods, emphasizing the crucial role of customer feedback in refining the overall business model.

Ineffective Customer Acquisition Strategies often stem from a lack of understanding of the target audience and the broader market. Poorly targeted marketing campaigns, unrealistic expectations, and a failure to track key metrics can all lead to wasted resources and disappointing results. Focusing solely on short-term gains at the expense of long-term customer relationships is another common pitfall.

Examples of Ineffective Customer Acquisition Strategies

Generic marketing campaigns that fail to resonate with a specific target audience are a prime example of ineffective customer acquisition. Imagine a company selling high-end hiking boots launching a social media campaign using images of people wearing flip-flops on a beach. The disconnect between the product and the target audience is immediately apparent. Similarly, relying solely on expensive advertising without properly measuring its return on investment (ROI) can drain resources without generating meaningful results. Another example is neglecting to segment the market appropriately. A company attempting to sell both professional and amateur-grade photography equipment with a single marketing strategy would likely underperform. Finally, failing to understand customer motivations and purchase behaviors leads to wasted efforts and reduced conversion rates.

Strategies for Improving Customer Retention Rates

Improving customer retention involves building strong relationships, providing exceptional service, and consistently exceeding customer expectations. Proactive communication, personalized experiences, and loyalty programs are all valuable tools.

For example, implementing a loyalty program that rewards repeat customers with discounts or exclusive access to new products can significantly boost retention. Regular email marketing campaigns with personalized content can keep customers engaged and informed. Proactive customer service, such as reaching out to address potential issues before they escalate, demonstrates a commitment to customer satisfaction. Offering exceptional customer support through multiple channels, including phone, email, and live chat, ensures that customers can easily get assistance when needed. Finally, actively seeking and responding to customer feedback allows for continuous improvement and strengthens the customer-business relationship.

The Importance of Customer Feedback in Refining a Business Model

Customer feedback is invaluable in identifying areas for improvement and refining the business model. This feedback, gathered through surveys, reviews, and direct interaction, provides direct insights into customer needs, preferences, and pain points. Analyzing this data allows businesses to identify weaknesses in their offerings, improve their products or services, and tailor their marketing strategies to better resonate with their target audience. For example, consistent negative feedback about a product’s usability might indicate a need for redesign or improved instructions. Similarly, negative feedback about the customer service experience might highlight the need for additional training or improved processes. Ignoring customer feedback can lead to missed opportunities for improvement and ultimately damage the brand’s reputation and customer loyalty.

Technological Disruption and Adaptation

Technological advancements are a double-edged sword for businesses. While they offer opportunities for growth and innovation, they can also render existing business models obsolete, forcing companies to adapt or face obsolescence. The pace of technological change is accelerating, making continuous adaptation crucial for survival and success in today’s dynamic market.

Rapid technological advancements can disrupt established business models by creating new competitors, altering customer preferences, and rendering existing products or services inefficient or irrelevant. For example, the rise of e-commerce significantly impacted brick-and-mortar retailers, forcing many to adapt their strategies or face closure. Similarly, the advent of streaming services has dramatically altered the landscape of the entertainment industry, impacting traditional television broadcasting and movie rental businesses.

Strategies for Adapting to Technological Advancements

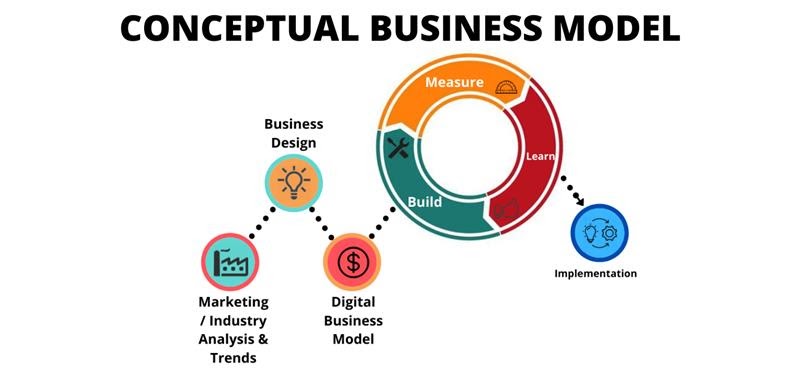

Adapting a business model to incorporate new technologies requires a proactive and strategic approach. This involves continuous monitoring of technological trends, identifying potential disruptive technologies, and developing strategies to leverage these advancements. This can involve investing in research and development, partnering with technology companies, acquiring innovative startups, or completely overhauling existing processes and products. A key aspect is fostering a culture of innovation within the organization, encouraging experimentation and risk-taking.

Impact of Technological Disruption: The Taxi Industry

Imagine a graph depicting the taxi industry’s market share over time. The pre-2010 segment shows a relatively stable market dominated by traditional taxi companies. Then, a sharp downward trend begins around 2010, coinciding with the rise of ride-hailing apps like Uber and Lyft. These apps leveraged smartphone technology and GPS to create a more efficient and convenient service, disrupting the traditional taxi model by offering better user experience, dynamic pricing, and cashless payments. The graph visually demonstrates how a disruptive technology, in this case, mobile app technology and GPS, fundamentally reshaped a well-established industry, forcing traditional taxi companies to either adapt or decline. The post-2015 segment might show a stabilization or even a slight recovery for some taxi companies that successfully integrated technology into their operations, highlighting the importance of adaptation.

Scaling and Growth Limitations

Scaling a business, while seemingly a straightforward pursuit of increased revenue and market share, presents a complex web of challenges. The transition from a small, agile operation to a larger, more complex entity often exposes vulnerabilities and limitations that hinder sustainable growth. Successfully navigating this transition requires a proactive approach, anticipating potential bottlenecks and developing strategies to mitigate them.

The challenges companies face when attempting to scale their operations are multifaceted. Simply increasing production or sales volume rarely guarantees success. Instead, scaling necessitates a holistic review of all business processes, from production and logistics to marketing and customer service. Often, systems and processes that worked effectively at a smaller scale become inefficient or break down entirely under increased pressure. This necessitates significant investment in infrastructure, technology, and human capital, all of which can strain resources and impact profitability.

Resource Constraints

Scaling requires substantial investment across multiple areas. Financial resources are crucial for expanding production capacity, hiring additional personnel, investing in new technologies, and marketing efforts. Beyond financial capital, human capital is equally vital. Finding and retaining skilled employees who can adapt to the changing dynamics of a growing company is a significant hurdle. Furthermore, access to raw materials, efficient supply chains, and suitable infrastructure can also become limiting factors, especially in industries with high demand or limited resources. For example, a rapidly growing tech startup might struggle to find enough experienced software engineers, while a food manufacturer might encounter limitations in securing sufficient quantities of high-quality ingredients.

Maintaining Quality and Consistency, A company’s business model does not

As a company scales, maintaining the quality and consistency of its products or services becomes increasingly difficult. Expanding operations often necessitates outsourcing certain functions or delegating tasks to a larger workforce, potentially leading to inconsistencies in quality control. Maintaining a consistent brand experience across multiple channels and locations also becomes more challenging. Consider a coffee chain expanding rapidly; ensuring each location maintains the same high standards of coffee preparation, customer service, and ambiance requires rigorous training, quality control measures, and ongoing monitoring.

Management and Organizational Structure

Effective management and a well-defined organizational structure are paramount for successful scaling. As a company grows, its management structure needs to adapt to accommodate the increased complexity and workload. Poorly defined roles, responsibilities, and communication channels can lead to inefficiencies, conflicts, and ultimately, hinder growth. For instance, a company might need to transition from a flat organizational structure to a more hierarchical one, introducing middle management layers to oversee various departments and ensure effective coordination. Failing to adapt the management structure appropriately can result in slow decision-making, lack of accountability, and ultimately, stifle innovation and growth.

A Plan for Overcoming Scaling Limitations

Successfully navigating the scaling process requires a well-defined strategy encompassing several key elements. Firstly, a thorough assessment of current capabilities and limitations is essential to identify potential bottlenecks. This should involve a detailed analysis of operational processes, resource availability, and market demand. Secondly, a phased approach to scaling, rather than a rapid expansion, allows for controlled growth and minimizes risks. This involves prioritizing key areas for expansion and gradually increasing capacity, ensuring that each phase is successfully completed before moving to the next. Thirdly, investing in technology and automation can significantly improve efficiency and productivity, allowing the company to handle increased volumes without proportionally increasing its workforce. Finally, building a strong and adaptable organizational culture is crucial for retaining talent and fostering collaboration across teams. This involves creating a supportive work environment, providing opportunities for professional development, and fostering open communication channels.

Financial Sustainability and Profitability

A robust business model requires not only a clear value proposition and efficient operations but also a strong foundation of financial health. Without careful financial management, even the most innovative business idea can falter and fail. Understanding the financial implications of each business decision is critical for long-term success. Poor financial management can lead to cash flow problems, inability to invest in growth, and ultimately, business failure.

Poor financial management undermines a business model in several key ways. Ignoring crucial financial metrics can lead to inaccurate forecasting, resulting in insufficient capital reserves to weather unexpected downturns or missed opportunities for expansion. Inefficient cost management can erode profit margins, making the business less competitive. A lack of proper financial controls can lead to fraud or embezzlement, severely impacting profitability and investor confidence. Furthermore, neglecting to secure appropriate funding or manage debt effectively can cripple a company’s ability to operate and grow. The cumulative effect of these issues can create a vicious cycle, pushing the business towards insolvency.

Key Financial Indicators of Business Model Health

A range of key financial indicators offer insights into the health and sustainability of a business model. Regularly monitoring these metrics provides crucial data for informed decision-making and proactive adjustments. These indicators provide a comprehensive overview of profitability, liquidity, and solvency.

- Gross Profit Margin: Indicates the profitability of sales after deducting the cost of goods sold. A higher margin suggests efficient cost management and strong pricing strategies. For example, a gross profit margin of 40% indicates that for every $1 of revenue, $0.40 is profit before operating expenses.

- Net Profit Margin: Represents the percentage of revenue remaining after all expenses are deducted. It’s a crucial indicator of overall profitability and efficiency. A consistently low net profit margin signals the need for cost-cutting or revenue-generating strategies.

- Return on Investment (ROI): Measures the profitability of an investment relative to its cost. A high ROI indicates effective resource allocation and successful business strategies.

- Cash Flow: Shows the movement of cash into and out of the business. Positive cash flow is essential for meeting short-term obligations and investing in future growth. Negative cash flow can indicate serious financial trouble.

- Debt-to-Equity Ratio: Indicates the proportion of a company’s financing that comes from debt versus equity. A high ratio suggests a higher risk of financial instability.

- Customer Lifetime Value (CLTV): Predicts the total revenue a business expects to generate from a single customer over their relationship with the company. A high CLTV is desirable and suggests strong customer loyalty and retention strategies.

Hypothetical Financial Model: Impact of Cost-Cutting Measures

Let’s consider a hypothetical scenario for “Widget Corp,” a company manufacturing widgets. Assume Widget Corp currently has annual revenue of $1 million, cost of goods sold (COGS) of $600,000, and operating expenses of $300,000, resulting in a net loss of $100,000.

| Item | Before Cost-Cutting | After Cost-Cutting |

|---|---|---|

| Revenue | $1,000,000 | $1,000,000 |

| Cost of Goods Sold (COGS) | $600,000 | $500,000 |

| Operating Expenses | $300,000 | $250,000 |

| Net Income/(Loss) | ($100,000) | $50,000 |

By implementing cost-cutting measures, such as negotiating lower prices with suppliers (reducing COGS by $100,000) and streamlining operations (reducing operating expenses by $50,000), Widget Corp transforms its $100,000 net loss into a $50,000 net profit. This hypothetical example demonstrates how targeted cost reductions can significantly impact profitability and financial sustainability. This scenario assumes that revenue remains stable despite the changes; however, in reality, cost-cutting measures may also affect revenue, either positively or negatively. A more sophisticated model would incorporate this dynamic.