A person or business to whom a liability is owed. – A person or business to whom a liability is owed, often called a creditor, plays a crucial role in the financial landscape. Understanding the creditor’s position—their rights, responsibilities, and the legal implications of owed liabilities—is essential for both individuals and businesses. This exploration delves into the multifaceted nature of creditor-debtor relationships, examining how liabilities arise, the legal recourse available to creditors, and strategies for effective liability management. We’ll analyze various creditor types, from individuals to governments, and uncover the intricacies of secured and unsecured debts, shedding light on the often-complex interplay between debtors and those to whom they owe money.

From contractual agreements to instances of negligence, the creation of liability is a complex process with far-reaching consequences. This analysis will dissect the legal mechanisms involved in assigning liability, exploring the implications of transferring debt and providing real-world examples to illustrate the various scenarios that can arise. We’ll examine the legal and financial ramifications of failing to meet obligations, exploring the potential consequences for both debtors and creditors, including the role of credit rating agencies and the legal processes involved in debt recovery.

Defining the Creditor: A Person Or Business To Whom A Liability Is Owed.

A creditor is any individual, business, or entity to whom a debt is owed. Understanding the various types of creditors and their rights is crucial in navigating financial transactions and legal obligations. This section will explore the diverse landscape of creditors, their defining characteristics, and the distinctions between secured and unsecured credit arrangements.

Types of Creditors

Creditors encompass a broad spectrum of entities. They can be categorized based on their nature and the type of debt owed to them. Examples include individuals lending money to friends or family, businesses extending credit to customers, and governments collecting taxes. Each type of creditor possesses unique characteristics and legal standing.

Characteristics of Creditors in Various Legal Contexts

The characteristics defining a creditor vary depending on the legal framework. Generally, a creditor is identified by their possession of a legally enforceable claim against a debtor. This claim stems from a contractual agreement, a court judgment, or a statutory obligation. The creditor’s rights and remedies are determined by the specific nature of the debt and the applicable laws. For instance, a secured creditor holds collateral as security for the debt, providing them with additional recourse in case of default, while an unsecured creditor relies solely on the debtor’s promise to repay.

Secured vs. Unsecured Creditors

A fundamental distinction exists between secured and unsecured creditors. Secured creditors possess a claim against specific assets of the debtor, such as a mortgage on a property or a lien on equipment. In the event of default, the secured creditor can seize and sell the collateral to recover their debt. Unsecured creditors, on the other hand, lack such collateral. Their claim is against the debtor’s general assets, and their recovery depends on the debtor’s ability and willingness to repay. Secured creditors generally enjoy a higher priority in bankruptcy proceedings than unsecured creditors.

The Role of a Creditor in Different Financial Transactions

Creditors play a vital role in various financial transactions. In lending, they provide capital to borrowers, enabling economic activity. In sales, they extend credit to customers, facilitating purchases. In government contexts, they represent the public interest in collecting taxes and ensuring compliance with financial regulations. The creditor’s role is fundamentally one of risk assessment and management, balancing the potential for return with the possibility of default.

Comparison of Creditor Rights and Responsibilities

The following table compares the rights and responsibilities of various creditor types. Note that these are general examples and specific rights and responsibilities can vary significantly based on jurisdiction and the terms of the agreement.

| Creditor Type | Rights | Responsibilities | Example |

|---|---|---|---|

| Individual Lender | Right to repayment, potential legal recourse | Due diligence in assessing borrower’s creditworthiness | Loaning money to a friend |

| Business (e.g., Bank) | Right to repayment, collateral seizure (if secured), legal action | Compliance with lending regulations, proper documentation | Providing a business loan |

| Government (Tax Authority) | Right to collect taxes, liens on assets, legal action | Fair and transparent tax collection practices | Collecting income tax |

| Credit Card Company | Right to repayment, potential fees for late payments | Compliance with consumer credit laws, clear disclosure of terms | Issuing a credit card |

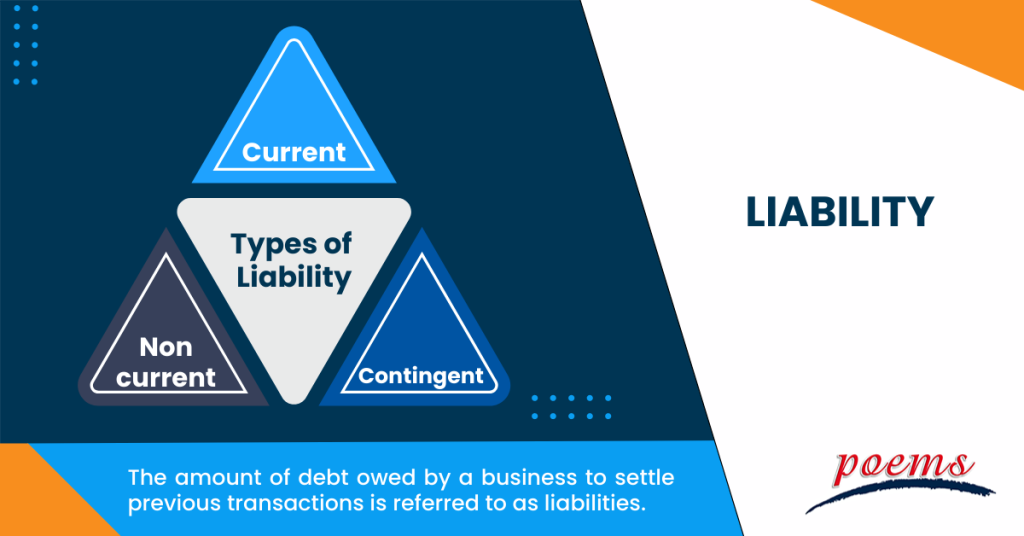

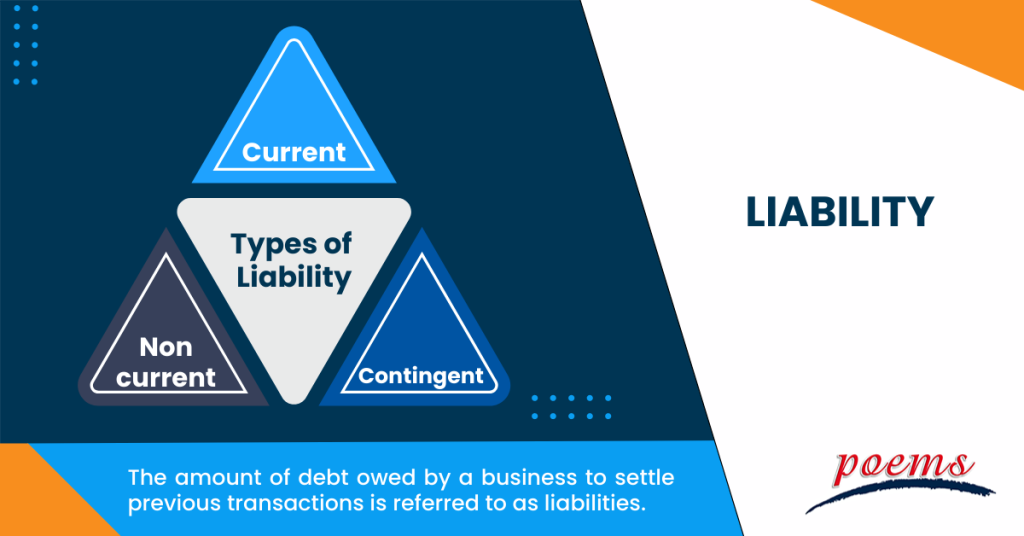

Liability Creation and Assignment

Understanding how liabilities are created and how they can be transferred is crucial for both creditors and debtors. This section details the mechanisms through which liabilities arise, focusing on contractual obligations and tortious actions, and explains the process and implications of liability assignment.

Liability creation stems primarily from contractual agreements and legal wrongs (torts). Contractual liabilities are explicitly defined within the terms of a legally binding agreement, while tortious liabilities arise from negligence or intentional harm. The assignment of liability, a separate legal process, involves transferring responsibility for a debt or obligation to a third party. This transfer, however, is subject to specific legal limitations and considerations.

Liability Creation Through Contractual Agreements

Contractual liabilities are created when parties enter into a legally binding agreement. These agreements Artikel specific obligations, and failure to meet these obligations results in liability. For example, a loan agreement creates a liability for the borrower to repay the principal and interest to the lender. Similarly, a service contract creates a liability for the service provider to perform the agreed-upon services, and a failure to do so could lead to liability for breach of contract. The specific terms of the contract dictate the nature and extent of the liability. A breach of contract, such as failing to deliver goods as agreed upon or failing to pay for services rendered, can lead to legal action and the imposition of financial penalties or other remedies. The level of liability is directly related to the specific clauses and stipulations within the contract.

Liability Arising from Torts or Negligence

Liability can also arise from torts, which are civil wrongs independent of contract. Negligence, a common form of tort, involves a failure to exercise the reasonable care that a reasonable person would exercise in similar circumstances. For example, a business owner’s failure to maintain a safe environment for customers could lead to liability if a customer is injured due to a hazardous condition. Similarly, a driver’s negligence in causing a car accident results in liability for the damages suffered by the other party involved. Intentional torts, such as assault or defamation, also create liability for the perpetrator. The injured party can sue the negligent or intentionally harmful party to recover damages. The extent of liability in tort cases is determined by the court based on factors such as the severity of the harm, the degree of negligence, and the applicable laws.

Liability Assignment to a Third Party

The process of assigning liability involves transferring the responsibility for a debt or obligation to a third party. This is often done through contractual agreements, such as novation or assignment of contracts. Novation involves replacing an existing contract with a new one, where the original debtor is released from liability and a new debtor assumes responsibility. Assignment of contracts, on the other hand, transfers the rights and obligations of one party to another. The legal implications of assigning liability depend heavily on the specific type of liability, the terms of the assignment agreement, and the relevant laws. It is important to note that not all liabilities are assignable. Some liabilities are considered personal and cannot be transferred to another party.

Legal Implications of Transferring Liability, A person or business to whom a liability is owed.

Transferring liability has significant legal implications. The original debtor may still be held liable if the assignment is not properly executed or if the third party fails to fulfill the obligation. Furthermore, the assignment may not be valid if it violates existing contracts or laws. The process often requires the consent of all parties involved, including the creditor. The legal enforceability of the assignment depends on the jurisdiction and the specifics of the agreement. Incorrectly assigning liability can lead to complex legal disputes and potential financial losses for all parties involved.

Common Scenarios Where Liability is Assigned

The following are common scenarios where liability is assigned:

- Mergers and Acquisitions: When one company acquires another, liabilities of the acquired company are often transferred to the acquiring company.

- Insurance: Insurance policies transfer liability from the insured to the insurer in the event of a covered loss.

- Guarantees: A guarantor assumes liability for another party’s debt if that party defaults.

- Indemnification Agreements: These agreements transfer liability for specific losses or damages from one party to another.

- Bankruptcy: In bankruptcy proceedings, the debtor’s assets are often used to satisfy liabilities, and some liabilities may be discharged.

Legal and Financial Implications of Owed Liabilities

Failing to meet financial obligations has significant legal and financial ramifications for both the debtor and the creditor. Understanding these implications is crucial for navigating debt-related issues effectively. This section details the legal consequences of default, the various methods creditors utilize for debt recovery, and the broader financial impacts on all parties involved. The influence of credit rating agencies is also examined.

Legal Consequences of Failing to Meet Financial Obligations

Non-payment of debts can lead to a range of legal repercussions, depending on the jurisdiction and the type of debt. These consequences escalate in severity as the debt remains unpaid. Creditors have several legal avenues to pursue recovery, ranging from formal demand letters to court action. The specific legal action depends on the amount of debt, the terms of the original agreement, and the debtor’s responsiveness. Ignoring legal notices can exacerbate the situation, leading to more severe penalties.

Legal Actions for Debt Recovery

Creditors can employ various legal actions to recover outstanding debts. These actions typically begin with a formal demand letter, outlining the outstanding debt and demanding payment. If this proves unsuccessful, further legal steps may be taken. These can include: filing a lawsuit to obtain a court judgment; garnishing wages or bank accounts; placing a lien on the debtor’s property; and, in extreme cases, initiating bankruptcy proceedings against the debtor. The choice of legal action depends on the size of the debt, the debtor’s assets, and the jurisdiction’s laws. For example, a small debt might be pursued through a simplified small claims court process, while a larger debt might necessitate a more complex civil lawsuit.

Financial Impact of Unpaid Liabilities

Unpaid liabilities have substantial financial consequences for both debtors and creditors. For debtors, the impact includes damaged credit scores, impacting future borrowing opportunities; potential legal fees and court costs; wage garnishment or asset seizure; and, in extreme cases, bankruptcy. Creditors also suffer financial losses. They face the direct loss of the principal amount owed, as well as potential losses from interest and late payment fees. The cost of pursuing legal action to recover the debt also adds to the financial burden. Furthermore, outstanding debts can tie up resources that could be used for other business operations or investments. The longer a debt remains unpaid, the higher the overall financial impact becomes.

Role of Credit Rating Agencies

Credit rating agencies play a crucial role in assessing the creditworthiness of individuals and businesses. These agencies collect and analyze financial data to generate credit scores, which influence the terms and availability of credit. A low credit score reflects a higher risk of default and can lead to higher interest rates, reduced credit limits, or even denial of credit. Creditors rely heavily on these ratings to make lending decisions, impacting the cost and accessibility of credit for debtors. The information provided by credit rating agencies therefore significantly influences creditor behavior, shaping their risk assessment and lending strategies. For example, a creditor might be more hesitant to lend to a debtor with a poor credit history, or they might offer a loan with a higher interest rate to compensate for the increased risk.

Legal Process of Debt Recovery: A Flowchart

The following describes a simplified flowchart illustrating the typical legal process of debt recovery:

[Imagine a flowchart here. The flowchart would begin with “Debt Default.” The next box would be “Demand Letter Sent.” Branches would lead to “Debt Paid” (ending the process) or “Debt Unpaid.” “Debt Unpaid” would lead to “Legal Action Initiated.” This would branch to several options: “Small Claims Court,” “Civil Lawsuit,” “Wage Garnishment,” “Asset Seizure.” Each of these would lead to a final box: “Judgment/Settlement” or “Bankruptcy.” Each box would contain a brief description of the step involved.]

Management and Mitigation of Liabilities

Effective liability management is crucial for both businesses and individuals to maintain financial stability and protect their future. Proactive strategies, risk assessment, and appropriate insurance coverage are key components of a comprehensive liability mitigation plan. Failure to adequately manage liabilities can lead to significant financial hardship, legal battles, and reputational damage.

Strategies for Business Liability Management

Businesses can employ several strategies to effectively manage and mitigate their liabilities. These strategies focus on proactive risk identification, careful contract negotiation, and robust internal controls. A strong understanding of potential liabilities is the foundation of a successful mitigation plan.

- Regular Risk Assessment: Conducting periodic reviews of potential liabilities, including operational, financial, and legal risks, allows for proactive mitigation. This involves identifying potential areas of vulnerability and developing contingency plans.

- Thorough Contract Review: Carefully reviewing and understanding all contracts before signing is essential to limit potential liability. This includes clearly defining responsibilities, limitations of liability, and dispute resolution mechanisms.

- Strong Internal Controls: Implementing robust internal controls, such as segregation of duties and regular audits, helps prevent errors and fraudulent activities that could lead to financial losses and legal repercussions.

- Compliance Programs: Establishing and maintaining comprehensive compliance programs ensures adherence to relevant laws and regulations, reducing the risk of fines and legal action.

- Insurance Coverage: Obtaining appropriate insurance coverage, such as general liability, professional liability, and product liability insurance, protects the business from financial losses arising from claims and lawsuits.

Strategies for Individual Debt Management

Individuals can prevent the accumulation of excessive debt through careful financial planning and responsible borrowing habits. Understanding personal finances and establishing realistic budgets are fundamental steps in avoiding overwhelming debt.

- Budgeting and Financial Planning: Creating and sticking to a realistic budget helps track income and expenses, ensuring that spending remains within financial means and preventing overspending that leads to debt accumulation.

- Responsible Borrowing: Borrowing money should be done judiciously, only when necessary, and with a clear understanding of the repayment terms. Comparing interest rates and loan terms from different lenders is crucial.

- Debt Consolidation: Consolidating multiple debts into a single loan with a lower interest rate can simplify repayments and potentially reduce the overall cost of borrowing.

- Financial Counseling: Seeking professional financial advice can provide personalized guidance on debt management strategies and budgeting techniques.

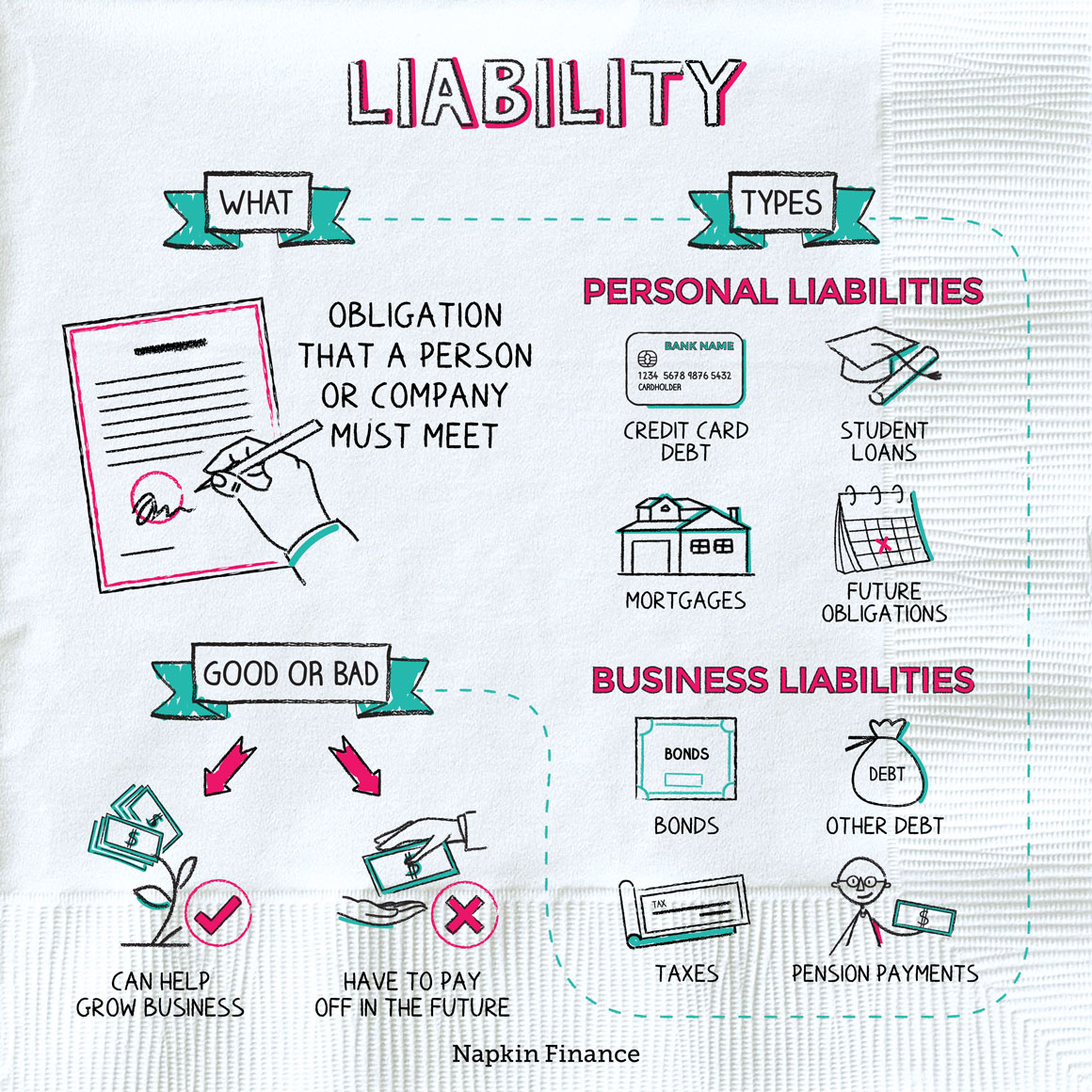

The Role of Insurance in Mitigating Liability Risks

Insurance plays a critical role in mitigating liability risks for both businesses and individuals. It provides a financial safety net in the event of unforeseen circumstances leading to legal claims or financial losses. The appropriate type and level of insurance coverage depend on individual circumstances and risk profiles.

For example, a business owner might purchase general liability insurance to protect against claims of bodily injury or property damage caused by their business operations. Similarly, an individual might purchase auto insurance to cover liability for accidents involving their vehicle. Insurance transfers the financial risk from the insured to the insurer, offering peace of mind and financial protection.

Potential Risks Associated with Different Types of Liabilities

Different types of liabilities carry varying degrees of risk. Understanding these risks is crucial for effective mitigation. Examples include contract liabilities, tort liabilities, and statutory liabilities, each requiring different management approaches.

- Contract Liabilities: Breaching a contract can lead to financial penalties and legal action. Careful contract negotiation and adherence to contract terms are crucial to mitigate this risk.

- Tort Liabilities: Negligence or intentional wrongdoing can result in lawsuits and significant financial damages. Implementing safety measures and adhering to legal standards are key to minimizing this risk.

- Statutory Liabilities: Non-compliance with laws and regulations can result in fines, penalties, and legal action. Staying informed about relevant laws and maintaining compliance programs are essential.

Designing a Risk Assessment Plan for Managing Liabilities

A comprehensive risk assessment plan involves systematically identifying, analyzing, and evaluating potential liabilities. This plan should be regularly reviewed and updated to reflect changing circumstances and emerging risks.

The process typically involves:

- Identifying Potential Liabilities: This involves brainstorming potential sources of liability, considering various scenarios and potential risks.

- Analyzing the Likelihood and Impact: Assessing the probability of each identified liability occurring and the potential financial and reputational impact.

- Evaluating Risk Levels: Prioritizing liabilities based on their likelihood and potential impact. High-risk liabilities require immediate attention and mitigation strategies.

- Developing Mitigation Strategies: Implementing strategies to reduce the likelihood or impact of identified liabilities, such as implementing safety measures, purchasing insurance, or reviewing contracts.

- Monitoring and Reviewing: Regularly monitoring the effectiveness of mitigation strategies and updating the risk assessment plan as needed.

Illustrative Scenarios of Creditor-Debtor Relationships

Understanding the dynamics of creditor-debtor relationships requires examining both successful and unsuccessful interactions. Analyzing diverse scenarios, including those involving multiple parties, helps illuminate the complexities and ethical considerations inherent in these financial agreements. The following examples illustrate a range of possibilities, highlighting best practices and potential pitfalls.

Successful Creditor-Debtor Relationship

This scenario depicts a small business, “Artisan Bread Co.”, securing a loan from a local bank, “Community First Bank,” to purchase new ovens. Artisan Bread Co. provides a detailed business plan, demonstrating strong financial projections and a clear repayment strategy. Community First Bank, impressed by the company’s viability and responsible approach, approves the loan with favorable terms. Artisan Bread Co. consistently meets its repayment schedule, even exceeding expectations at times due to strong sales. This demonstrates a mutually beneficial relationship, fostering trust and establishing a strong foundation for future collaborations. Key aspects include clear communication, realistic financial planning, and consistent adherence to the loan agreement. The bank benefits from a low-risk investment with predictable returns, while Artisan Bread Co. experiences growth and expansion.

Failed Creditor-Debtor Relationship

This scenario involves “Tech Startup X,” a fledgling company taking on significant venture capital funding from “Venture Capital Firm A.” Tech Startup X fails to deliver on promised milestones, experiencing consistent delays and underperforming financial results. Poor management decisions and a lack of transparency contribute to the downfall. Venture Capital Firm A, initially optimistic, becomes increasingly concerned and attempts to intervene, but their efforts prove futile. Ultimately, Tech Startup X defaults on its loan, leading to significant financial losses for Venture Capital Firm A and potentially legal action. Key aspects of this failure include a lack of realistic financial projections, poor management, insufficient communication, and a failure to meet agreed-upon milestones. The consequences include financial losses for the creditor, legal disputes, and reputational damage for both parties.

Complex Creditor-Debtor Relationship Involving Multiple Parties

Consider a large construction project undertaken by “Construction Co. Z.” The project involves financing from multiple sources: “Bank B,” providing a primary loan; “Investment Firm Y,” providing secondary funding; and several smaller subcontractors providing materials and services on credit. Construction Co. Z experiences unexpected cost overruns due to unforeseen circumstances. This creates a complex situation, with Bank B, Investment Firm Y, and the subcontractors all vying for repayment. The situation requires careful negotiation and potentially legal intervention to determine priorities and apportion the limited resources available. Key aspects include the complexities of multiple agreements, varying levels of risk, and the challenges of managing diverse stakeholder interests. The outcome often depends on the legal framework governing the contracts and the negotiation skills of the involved parties.

Ethical Considerations in Creditor-Debtor Relationships

Ethical considerations in creditor-debtor relationships focus on transparency, fairness, and responsible lending practices. Predatory lending, where creditors exploit vulnerable borrowers through excessively high interest rates or deceptive practices, is unethical. Conversely, responsible lending involves a thorough assessment of the borrower’s ability to repay, clear communication of terms and conditions, and fair treatment in case of financial hardship. Transparency is crucial, ensuring that both parties understand the terms of the agreement and potential risks involved. Ethical creditors prioritize the long-term well-being of their borrowers, understanding that a successful borrower is a benefit to both parties. Ethical failures can lead to significant financial and social consequences for borrowers, and reputational damage for creditors.