A small business contractor submitted a correct invoice—a seemingly simple event, yet one that underscores the crucial role of accurate invoicing in smooth business operations. This scenario highlights the importance of efficient processes, from initial contract agreement to final payment processing, and the positive impact on both contractor and client relationships. We’ll explore the steps involved in verifying invoice accuracy, processing payments, and maintaining open communication to ensure a seamless experience for all parties involved. This detailed guide covers best practices, legal considerations, and the financial implications of timely and accurate invoice handling.

This guide delves into the intricacies of handling contractor invoices, providing a comprehensive overview of the process from verification to payment. We will examine checklists for verifying invoice accuracy, different payment methods, and best practices for communication. Legal and compliance aspects, including tax regulations and record-keeping, are also discussed, along with the financial impact of timely invoice processing on cash flow and budgeting. Finally, we’ll illustrate these concepts with a detailed example of a correctly submitted invoice and its positive repercussions.

Invoice Accuracy Verification

Accurate invoice processing is crucial for maintaining healthy financial records and fostering positive relationships with contractors. Failure to verify invoices thoroughly can lead to overpayments, disputes, and ultimately, damage to your company’s bottom line. This section details a robust process for verifying the accuracy of invoices submitted by small business contractors.

Invoice Accuracy Verification Checklist

A comprehensive checklist ensures no detail is overlooked during the invoice review process. This systematic approach minimizes errors and streamlines the payment process.

The following checklist provides a structured approach to verifying invoice accuracy:

- Contractor Identification: Verify the contractor’s name and contact information match your records.

- Invoice Number and Date: Check for sequential numbering and a clear invoice date.

- Project/Contract Reference: Confirm the invoice clearly references the relevant project or contract.

- Description of Services/Goods: Ensure all items listed are clearly described and match the agreed-upon scope of work.

- Quantities and Rates: Verify the quantities of goods or services match the contract and that the rates are accurate.

- Calculations: Double-check all mathematical calculations for accuracy (extensions, subtotals, taxes, etc.).

- Payment Terms: Confirm the payment terms are consistent with the contract agreement.

- Taxes and Fees: Verify that all applicable taxes and fees are correctly calculated and included.

- Total Amount Due: Ensure the total amount due is accurately calculated.

- Supporting Documentation: Check for any required supporting documentation, such as timesheets or project milestones.

Contract Compliance Verification

Confirming invoice compliance with the contract is paramount to preventing disputes. This involves a detailed comparison of the invoice’s contents against the signed contract.

Key aspects of contract compliance to verify include:

- Scope of Work: Ensure the services or goods billed are explicitly included within the defined scope of work in the contract.

- Payment Schedule: Confirm that the invoice aligns with the agreed-upon payment schedule and milestones Artikeld in the contract.

- Pricing and Rates: Verify that the rates charged match the rates specified in the contract. Any deviations should be justified and documented.

- Contract Amendments: Account for any documented amendments or changes to the original contract that may affect the invoice.

Cross-Referencing with Timesheets or Project Milestones

For projects involving time-based billing or phased deliverables, cross-referencing the invoice with timesheets or project milestones is essential. This ensures that the billed hours or completed milestones are accurately reflected in the invoice.

The process involves:

- Timesheet Review: Compare the hours billed on the invoice to the contractor’s submitted timesheets, verifying accuracy and adherence to project requirements.

- Milestone Verification: For project-based invoices, confirm that the completed milestones match the deliverables Artikeld in the contract and are accurately reflected in the invoice.

- Discrepancy Resolution: If discrepancies are found, immediately contact the contractor to clarify and resolve the issues before processing payment.

Invoice Accuracy Verification Methods Comparison

Different methods exist for verifying invoice accuracy, each with its own advantages and disadvantages. Selecting the appropriate method depends on factors such as the complexity of the project, the contractor’s history, and available resources.

| Method | Advantages | Disadvantages | Applicability |

|---|---|---|---|

| Manual Review | Thorough, allows for detailed examination of each invoice item. | Time-consuming, prone to human error. | Suitable for small number of invoices or high-value contracts. |

| Automated Invoice Processing Software | Efficient, reduces human error, integrates with accounting systems. | Requires initial investment in software and training. | Suitable for businesses with high invoice volumes. |

| Third-Party Invoice Audit Services | Independent verification, provides an unbiased assessment. | Adds cost to the process. | Suitable for large or complex projects, or where high risk is involved. |

Payment Processing Procedures

Processing invoices accurately and efficiently is crucial for maintaining positive relationships with contractors and ensuring smooth financial operations. This section details the steps involved in processing a correct invoice from a small business contractor, from receipt to accounting entry. Understanding these procedures helps streamline payments and avoids potential delays.

Efficient invoice processing involves a series of well-defined steps to ensure timely payment to contractors while maintaining accurate financial records. This process typically includes verification, approval, payment initiation, and accounting updates.

Invoice Verification and Approval Workflow

The first step involves verifying the invoice’s accuracy against the agreed-upon contract or purchase order. This includes checking for discrepancies in quantities, rates, and descriptions of services rendered. Once verified, the invoice proceeds to the appropriate approver, often a designated manager or finance department representative, based on pre-defined authorization levels. This ensures that all invoices are reviewed and authorized before payment is processed. The approval process may involve an electronic signature or a formal approval notation on the invoice. Any discrepancies are flagged and communicated to the contractor for clarification.

Payment Methods and Processing Times

Several payment methods exist, each with its processing time. Choosing the most appropriate method depends on factors such as the contractor’s preference, the payment amount, and the company’s internal policies.

Examples of common payment methods include:

- ACH Transfer: This electronic funds transfer typically takes 1-3 business days to process. It is a cost-effective and efficient method for larger payments.

- Check: A traditional method requiring mailing; processing times vary from 3-7 business days depending on mail delivery times.

- Wire Transfer: A faster, more secure method for larger sums, usually completed within 1-2 business days. It is typically associated with higher transaction fees.

- Online Payment Platforms (e.g., PayPal, Stripe): These platforms offer faster processing, typically within 1-2 business days, with the convenience of immediate confirmation for both parties.

Generating Accounting Entries for Invoice Payments

Once the invoice is approved, an accounting entry is generated to record the transaction. This entry reflects the reduction in cash or accounts payable and the recognition of the expense incurred. The specific accounts used will depend on the company’s chart of accounts.

A typical accounting entry for an invoice payment might look like this:

Debit: Expenses (e.g., Contractor Services) – [Amount of Invoice]

Credit: Cash/Accounts Payable – [Amount of Invoice]

This entry reflects the expense incurred and the decrease in cash or accounts payable. The specific account names used will depend on the company’s chart of accounts.

Obtaining Necessary Approvals Before Payment Release

Before releasing payment, obtaining necessary approvals is crucial. This ensures compliance with internal financial policies and prevents unauthorized payments. The approval process often involves multiple levels of review, depending on the invoice amount and the company’s internal controls. For instance, invoices exceeding a certain threshold may require additional approvals from senior management. This multi-level approval process helps safeguard against fraud and ensures accountability.

Contractor Relationship Management: A Small Business Contractor Submitted A Correct Invoice

Prompt and accurate invoice processing is paramount for fostering strong, mutually beneficial relationships with contractors. Ignoring this aspect can lead to strained relationships, payment disputes, and ultimately, damage to your business reputation. A streamlined system for invoice management demonstrates professionalism and respect for the contractor’s time and effort.

Timely invoice processing significantly impacts contractor satisfaction and retention. Delayed payments can cause cash flow problems for contractors, leading to frustration and potentially impacting their ability to take on future projects. Conversely, consistent and timely payments build trust and encourage contractors to prioritize your business when selecting future opportunities. This contributes to a more reliable and predictable workflow for your company.

Importance of Timely Invoice Processing

Efficient invoice processing fosters positive contractor relationships by demonstrating respect for their time and effort. Prompt payment ensures contractors receive compensation for their services without unnecessary delays, thus maintaining their financial stability and encouraging continued collaboration. Conversely, delayed payments can damage trust, lead to disputes, and ultimately hinder future engagements. A reliable payment system showcases professionalism and builds a strong reputation, attracting and retaining high-quality contractors. For example, a consistent record of on-time payments can translate into preferential treatment from contractors, leading to faster project turnaround times and potentially lower costs.

Best Practices for Communicating Invoice Status Updates

Effective communication regarding invoice status updates is crucial for maintaining positive contractor relationships. Utilizing a combination of methods ensures transparency and keeps contractors informed throughout the payment process. This proactive approach minimizes misunderstandings and prevents potential disputes. Regular updates, delivered through a preferred communication channel, showcase professionalism and respect for the contractor’s time. For instance, sending automated email confirmations upon invoice receipt, followed by updates on processing milestones and final payment confirmations, builds trust and maintains a positive relationship.

Comparison of Communication Methods for Invoice Inquiries

Several communication methods exist for handling invoice-related inquiries. Email offers a formal record of communication, while phone calls allow for immediate clarification of concerns. Project management software platforms provide centralized communication hubs, tracking progress and facilitating efficient query resolution. The choice of method depends on the urgency and complexity of the inquiry. For routine updates, email is suitable; for urgent issues or complex questions, a phone call may be more appropriate. Utilizing a project management system offers a centralized record of all communication and updates, promoting transparency and efficiency. For example, a simple email update on invoice processing can resolve most minor queries, whereas a phone call may be needed to address a complex billing discrepancy.

Potential Communication Breakdowns and Solutions

Communication breakdowns can significantly impact contractor relationships and lead to payment delays. These breakdowns often stem from unclear communication channels, inconsistent updates, or lack of responsiveness. Implementing clear communication protocols, utilizing a centralized system for tracking invoices, and ensuring timely responses to inquiries can mitigate these risks. For example, a lack of response to invoice inquiries can be addressed by establishing a clear response time expectation (e.g., within 24-48 hours). Implementing a dedicated point of contact for invoice-related queries also improves efficiency and reduces potential confusion. Furthermore, proactively addressing potential issues before they escalate prevents payment delays and maintains positive relationships.

Legal and Compliance Aspects

Accurate and compliant invoicing is crucial for small business contractors, ensuring smooth financial operations and avoiding legal repercussions. This section Artikels key legal requirements, best practices for tax compliance, and efficient record-keeping strategies. Failure to comply can result in penalties, legal disputes, and damage to business reputation.

Common Legal Requirements for Contractor Invoices

Contractor invoices must adhere to various legal requirements, varying by jurisdiction. These typically include details such as the contractor’s legal business name and address, the client’s legal business name and address, invoice number and date, a clear description of services rendered or goods supplied, the agreed-upon payment terms, and the total amount due. Failure to include these essential elements can delay payment or lead to disputes. For instance, an invoice missing the client’s address could lead to confusion and potential non-payment. Similarly, an unclear description of services could cause disagreements over the scope of work. Additionally, invoices should clearly state applicable sales tax, if any, in accordance with local and state regulations. The inclusion of a unique invoice number aids in tracking and reconciliation.

Ensuring Compliance with Tax Regulations and Reporting Requirements, A small business contractor submitted a correct invoice

Compliance with tax regulations is paramount. Contractors must accurately report their income and remit applicable taxes according to the relevant tax laws of their jurisdiction. This involves understanding and applying sales tax, income tax, and any other relevant taxes. Accurate record-keeping is essential for preparing tax returns. Best practices include using accounting software to track income and expenses, obtaining necessary tax identification numbers (such as an Employer Identification Number (EIN) in the US), and keeping detailed records of all transactions. Failure to comply can result in significant penalties, including back taxes, interest, and potential legal action. For example, misclassifying independent contractors as employees can lead to substantial tax liabilities for both the contractor and the client.

Maintaining Accurate Invoice Records for Auditing Purposes

Maintaining accurate and organized invoice records is vital for several reasons, including tax compliance, financial reporting, and potential audits. A well-maintained system allows for easy retrieval of invoices during tax season or in response to client inquiries. It also provides a clear audit trail, demonstrating compliance with tax regulations and contractual agreements. In the event of an audit by the tax authorities, comprehensive and accurate records are crucial in demonstrating compliance and avoiding penalties. A disorganized system can significantly increase the time and effort required to respond to an audit, potentially leading to negative consequences.

System for Secure and Efficient Invoice Storage and Retrieval

A robust system for storing and retrieving contractor invoices is essential for efficient operations and legal compliance. This system should ensure secure storage, easy access, and efficient retrieval of invoices. Cloud-based accounting software offers secure storage and easy access from multiple devices. This software often includes features such as automated invoice generation, payment tracking, and reporting functionalities. Alternatively, a well-organized physical filing system can also be effective, provided it is secured appropriately. Regardless of the chosen method, regular backups are essential to protect against data loss. The system should allow for quick retrieval of invoices based on various criteria, such as invoice number, date, client name, or project name. A well-designed system will streamline administrative tasks, reduce the risk of errors, and ensure compliance with legal and regulatory requirements.

Financial Impact and Budgetary Considerations

Timely invoice processing is crucial for maintaining healthy cash flow and accurate financial forecasting within a small business. Delays in payment processing can significantly impact a company’s ability to meet its financial obligations, hindering growth and potentially leading to financial instability. Conversely, efficient invoice processing ensures a predictable inflow of funds, enabling better resource allocation and strategic decision-making.

Efficient invoice processing directly impacts a company’s cash flow. Delayed payments from clients translate to delayed payments to contractors, creating a ripple effect that can disrupt the entire financial cycle. Conversely, swift processing of contractor invoices ensures that funds are available for immediate operational needs, reducing reliance on credit lines or loans and minimizing interest expenses.

Impact of Timely Invoice Processing on Cash Flow

Prompt payment of contractor invoices directly contributes to positive cash flow. Consider a scenario where a small business has three contractors, each submitting a $5,000 invoice monthly. A delay of even one week in processing each invoice could result in a cash flow deficit of $15,000 for that week. This deficit could significantly impact the business’s ability to pay its own expenses, such as salaries, rent, and materials. Conversely, timely payment ensures that the business maintains a steady cash flow, allowing for better financial planning and investment opportunities.

Incorporating Contractor Invoice Payments into the Budget

Contractor invoice payments should be a line item in the business’s operating budget. This requires forecasting future contractor expenses based on historical data, project timelines, and anticipated workload. For example, if a business anticipates a surge in projects during the next quarter, it should allocate a larger budget for contractor payments accordingly. This proactive approach prevents unexpected financial strain and ensures sufficient funds are available to meet obligations.

Budget Projection Illustrating the Impact of Multiple Contractor Invoices

Let’s consider a simplified budget projection for a small business over a three-month period:

| Month | Contractor A ($5,000/month) | Contractor B ($3,000/month) | Contractor C ($2,000/month) | Total Contractor Expenses |

|---|---|---|---|---|

| July | $5,000 | $3,000 | $2,000 | $10,000 |

| August | $5,000 | $3,000 | $2,000 | $10,000 |

| September | $5,000 | $3,000 | $2,000 | $10,000 |

This simple projection demonstrates a consistent monthly expense of $10,000 for contractor payments. A more detailed budget would incorporate additional factors such as potential variations in project scope, additional contractors, and unexpected expenses.

Forecasting Future Contractor Invoice Expenses

Accurate forecasting of future contractor invoice expenses involves analyzing past spending patterns, reviewing current project pipelines, and considering anticipated future projects. This might involve creating a spreadsheet tracking historical contractor invoices, categorizing expenses by project, and extrapolating these figures based on projected future workload. For example, if a business has consistently spent $10,000 per month on contractor fees for the past year and anticipates a 10% increase in workload next year, it can forecast contractor expenses of approximately $11,000 per month. This type of forecasting helps in creating realistic budget projections and ensuring sufficient funds are available to cover expenses.

Illustrative Scenario: A Correct Invoice

This scenario details the process of a small business, “GreenThumb Landscaping,” receiving and processing a perfectly accurate invoice from their contractor, “Reliable Repairs,” for completed fence repair work. The scenario highlights the efficiency and positive impact of accurate invoicing on both parties.

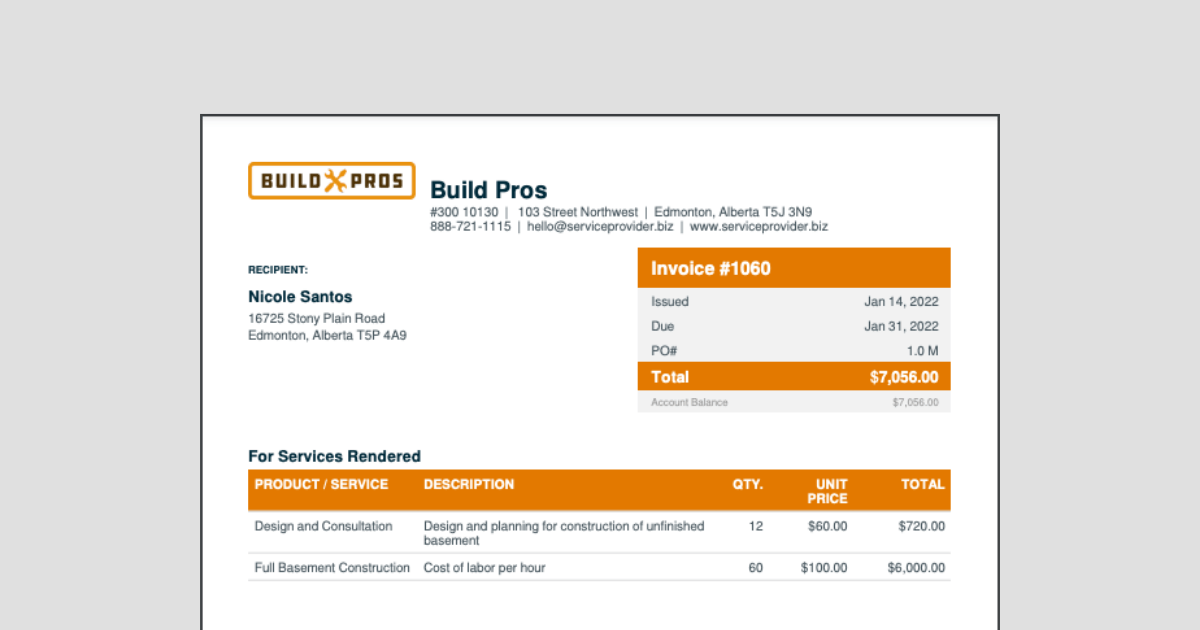

Reliable Repairs completed the repair of a damaged section of GreenThumb Landscaping’s perimeter fence on October 26th, 2024. The agreed-upon scope of work included the replacement of three damaged fence panels, the repair of a broken gate latch, and the application of a protective sealant. The contract stipulated a rate of $75 per panel, $50 for the gate latch repair, and $100 for the sealant application. Payment terms were net 30 days from the date of invoice.

Invoice Details and Verification

Reliable Repairs submitted an invoice dated October 27th, 2024, detailing the services rendered. The invoice clearly listed each service with its corresponding cost: three fence panels at $75 each ($225), gate latch repair ($50), and sealant application ($100). The total invoice amount was $375. GreenThumb Landscaping’s accounts payable department meticulously verified the invoice against the original contract and the work order. The work order, signed by both parties, confirmed the completed tasks and matched the invoice details. They also cross-referenced the invoice with their internal job costing records and found a complete match. No discrepancies were identified.

Payment Processing

Once the invoice’s accuracy was confirmed, GreenThumb Landscaping processed the payment electronically through their online banking system. They initiated the payment on November 26th, 2024, ensuring it was received by Reliable Repairs within the net 30-day payment term. A confirmation email was automatically generated and sent to both GreenThumb Landscaping and Reliable Repairs, recording the successful transaction and the payment date.

Financial Impact on GreenThumb Landscaping

The $375 payment was recorded in GreenThumb Landscaping’s accounting system as an expense under “Property Maintenance.” This transaction reduced their cash balance by $375 and was accurately reflected in their profit and loss statement for the relevant accounting period. The expense was correctly categorized, allowing for accurate financial reporting and budgeting for future maintenance projects. This accurate record-keeping ensured compliance with tax regulations and facilitated effective financial analysis.

Positive Aspects of Smooth Invoice Processing

The seamless processing of the accurate invoice fostered a positive relationship between GreenThumb Landscaping and Reliable Repairs. The prompt payment demonstrated GreenThumb Landscaping’s commitment to fair business practices, reinforcing trust and encouraging future collaborations. For Reliable Repairs, timely payment ensured efficient cash flow management, allowing them to meet their own financial obligations and invest in business growth. The entire process was straightforward and efficient, minimizing administrative overhead for both parties and promoting a mutually beneficial business relationship.