A written contract granting permission to operate a business, whether a franchise, license, or lease, forms the bedrock of many entrepreneurial ventures. Understanding the nuances of these agreements is crucial for both the grantor and the grantee, ensuring a mutually beneficial and legally sound partnership. This exploration delves into the key components of such contracts, examining their various forms, essential clauses, and the legal considerations involved in their creation and execution. We’ll also explore strategies for protecting intellectual property and resolving potential disputes.

From defining the specific rights and responsibilities of each party to navigating the complexities of intellectual property rights, this guide provides a comprehensive overview of the legal and practical aspects of securing permission to operate a business. We’ll examine real-world scenarios, highlighting the critical elements that can make or break a successful business operation. By understanding the legal framework and potential pitfalls, you can significantly reduce risks and pave the way for a thriving enterprise.

Types of Business Operating Agreements

Securing the legal right to operate a business often involves entering into a specific type of contract that Artikels the terms and conditions under which the business will function. These agreements define the relationship between the parties involved, allocating rights, responsibilities, and liabilities. Understanding the nuances of each type is crucial for mitigating risk and ensuring a successful business venture.

Franchise Agreements

Franchise agreements grant a franchisee the right to operate a business under the established brand and system of a franchisor. This involves using the franchisor’s trademarks, trade secrets, and business model in exchange for fees and adherence to specific operational standards. The franchisor typically provides training, marketing support, and ongoing assistance, while the franchisee invests capital and manages the daily operations of the franchised business. A key feature is the franchisor’s control over the franchisee’s operations to maintain brand consistency and protect the franchisor’s reputation. The legal implications include strict adherence to the franchise agreement’s terms, potential for termination based on breach of contract, and ongoing royalty payments. The franchisor retains significant control over the business’s image and operations, while the franchisee enjoys the benefits of an established brand and operational system. A common example is McDonald’s, where franchisees operate individual restaurants under the McDonald’s brand, adhering to strict quality and operational standards.

Licensing Agreements

Licensing agreements grant a licensee the right to use intellectual property, such as trademarks, patents, copyrights, or trade secrets, owned by a licensor. Unlike franchises, licensing agreements typically involve less control over the licensee’s operations. The licensor grants permission to use their intellectual property in exchange for royalties or other fees. The licensee is responsible for developing and marketing the product or service using the licensed intellectual property. Legal implications center on the scope of the license, the permitted uses of the intellectual property, and the potential for infringement if the licensee exceeds the granted rights. The licensor retains ownership of the intellectual property, while the licensee gains the right to use it for a specified purpose and duration. For instance, a company might license its patented technology to another company for manufacturing and distribution, receiving royalties on each sale.

Lease Agreements

Lease agreements grant a tenant the right to occupy and use a property owned by a landlord for a specific period and in exchange for rent. In a business context, this could involve leasing commercial space for retail, office, or manufacturing operations. The lease agreement Artikels the terms of the tenancy, including the rent amount, lease term, permitted uses of the property, and responsibilities for maintenance and repairs. Legal implications include the tenant’s obligation to pay rent and maintain the property in a certain condition, and the landlord’s responsibility to provide a habitable space. The landlord retains ownership of the property, while the tenant gains the right to use it for the duration of the lease. The lease agreement is a legally binding contract that protects both parties’ interests. A common example is a small business leasing retail space in a shopping mall.

Key Clauses in a Business Operating Agreement

A well-drafted business operating agreement is crucial for establishing a clear understanding between parties involved in a business venture. It Artikels the terms and conditions under which the business will operate, protecting the interests of all stakeholders. This section details key clauses commonly found in such agreements, emphasizing their importance and potential impact.

Term Length

The term length clause specifies the duration of the agreement. This could range from a fixed period (e.g., five years) to an indefinite period, subject to termination clauses. A clearly defined term provides certainty for all parties, allowing them to plan for the future. For instance, a franchise agreement might specify a 10-year term, renewable upon mutual agreement. A shorter term, on the other hand, may be more suitable for a licensing agreement, reflecting the limited scope of the rights granted. Ambiguity in this clause can lead to disputes and legal challenges.

Payment Terms

Payment terms detail how financial obligations will be handled. This includes specifying payment amounts, schedules, methods, and any applicable penalties for late payments. For example, a franchise agreement might Artikel royalty payments based on a percentage of sales, while a licensing agreement may involve upfront fees and ongoing royalties. Clear payment terms minimize financial misunderstandings and ensure a smooth business relationship. Failure to clearly define these terms can lead to significant financial disputes.

Termination Clauses

Termination clauses Artikel the conditions under which the agreement can be terminated by either party. These clauses often include grounds for termination, such as breach of contract, insolvency, or mutual agreement. They also specify the procedures for termination, including notice periods and potential consequences. For example, a lease agreement might allow for termination with a specific notice period, while a franchise agreement might include more stringent conditions for termination due to the significant investment involved. Well-defined termination clauses provide a framework for managing the end of the business relationship, minimizing potential conflicts and losses.

Comparison of Essential Clauses Across Agreement Types

The following table compares and contrasts three essential clauses across different agreement types: franchise, license, and lease.

| Clause | Franchise Agreement | License Agreement | Lease Agreement |

|---|---|---|---|

| Term Length | Typically longer term (e.g., 5-20 years), often renewable. | Varies widely, often shorter term, depending on the license granted. | Defined lease period, with options for renewal. |

| Payment Terms | Often includes initial franchise fee, ongoing royalties (percentage of sales), and advertising fees. | Can involve upfront fees, ongoing royalties, or a combination of both. | Typically involves monthly or quarterly rent payments. |

| Termination Clauses | Usually includes specific grounds for termination by either party, often with detailed procedures and potential penalties. | May include grounds for termination due to breach of contract, non-payment, or other specified reasons. | Often allows for termination with a specified notice period, potentially with penalties for early termination. |

Legal and Regulatory Considerations

Operating a business, regardless of size or structure, necessitates a thorough understanding of the relevant legal and regulatory frameworks. Failure to comply can lead to significant penalties, legal disputes, and even business closure. This section examines the crucial legal and regulatory aspects that influence business operating agreements and the smooth functioning of the business itself.

The legal and regulatory landscape governing business operations varies considerably depending on the jurisdiction. Factors such as the type of business, its location, and the industry it operates in all play a significant role in determining the applicable laws and regulations. Navigating this complex environment requires careful planning and adherence to all applicable rules and regulations.

Jurisdictional Variations in Business Law

Business operating agreements are subject to the laws of the jurisdiction where the business is registered and operates. For instance, a business registered in Delaware, USA, will be governed by Delaware law, while a business registered in Ontario, Canada, will be subject to Ontario law. These laws often differ significantly regarding corporate governance, contract law, and liability issues. Understanding these differences is crucial when drafting and negotiating operating agreements, ensuring compliance with all relevant legal requirements. For example, the rules surrounding shareholder agreements, the process for resolving disputes, and the legal protections afforded to business owners can vary widely across different jurisdictions. This necessitates legal counsel familiar with the specific jurisdiction in which the business operates.

Obtaining Necessary Permits and Licenses

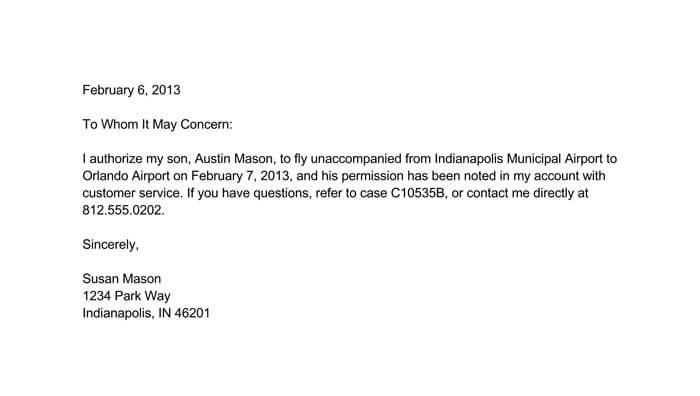

Securing the necessary permits and licenses is a fundamental step in legally operating a business. The specific permits and licenses required depend on the nature of the business, its location, and the industry. For example, a restaurant will require food handling permits and licenses to operate, while a construction company will need various construction permits and licenses. The application process typically involves submitting various documents, paying fees, and potentially undergoing inspections to ensure compliance with relevant regulations. Failure to obtain the necessary permits and licenses can result in significant fines, legal action, and potential business closure. The process of obtaining these permits and licenses varies by jurisdiction, and seeking professional guidance from a business consultant or lawyer is often beneficial.

Potential Legal Disputes from Poorly Drafted Operating Agreements

Ambiguous or poorly drafted operating agreements are a common source of legal disputes among business partners. Lack of clarity on issues such as profit and loss sharing, decision-making processes, dispute resolution mechanisms, and exit strategies can lead to significant conflicts. For example, an agreement that fails to clearly define the responsibilities of each partner can lead to disagreements over workload and compensation. Similarly, an unclear process for resolving disputes can result in costly and time-consuming litigation. A poorly drafted agreement might also fail to address the scenario of a partner’s death or incapacitation, creating further complications for the remaining partners. To mitigate these risks, it is crucial to have a well-drafted operating agreement that addresses all potential contingencies and is reviewed by legal counsel experienced in business law. Investing in legal expertise upfront can save significant costs and heartache in the long run.

Intellectual Property Rights

Protecting intellectual property (IP) is crucial for any business, and a well-drafted operating agreement should clearly Artikel ownership and usage rights to avoid future disputes. This section details methods for safeguarding various forms of IP within the context of a business operating agreement. Failure to address IP rights can lead to significant legal battles and financial losses.

A comprehensive business operating agreement should explicitly address trademarks, copyrights, and patents, defining ownership, licensing, and usage restrictions. This ensures clarity and minimizes the risk of internal conflict or external infringement claims. It’s vital to establish a clear process for managing and protecting new IP generated during the business’s operation.

Intellectual Property Ownership and Usage, A written contract granting permission to operate a business

This clause should explicitly state the ownership of all existing and future intellectual property created by or for the business. This includes, but is not limited to, trademarks, copyrights, patents, trade secrets, and know-how. The agreement should specify whether ownership resides with individual partners, the business entity itself, or a combination thereof. It should also define the permissible uses of the IP, including licensing rights, assignment possibilities, and restrictions on use outside the scope of the business.

Example Clause: “All intellectual property rights, including but not limited to trademarks, copyrights, patents, trade secrets, and know-how, created by or for the Business, whether before or after the effective date of this Agreement, shall be the exclusive property of [Business Entity Name]. Partners shall have the right to use such intellectual property solely in the course of conducting the Business, subject to the terms and conditions of this Agreement. No Partner shall have the right to license, assign, or otherwise transfer any intellectual property rights without the prior written consent of all other Partners.”

Avoiding Intellectual Property Infringement

The operating agreement should include provisions designed to prevent intellectual property infringement. This includes a commitment from all partners to respect the IP rights of others and a process for evaluating the potential infringement risk of any new products or services. Regular internal reviews and compliance procedures can help mitigate risks. The agreement should also Artikel consequences for infringement, such as financial penalties or termination of partnership.

A robust due diligence process before launching new products or services is critical. This involves searching existing IP databases to identify potential conflicts and seeking legal counsel to ensure compliance with relevant laws. Furthermore, the agreement could mandate the use of external IP counsel to advise on any significant IP-related decisions.

Trademarks, Copyrights, and Patents

Protecting these forms of IP requires specific actions within the operating agreement. For trademarks, the agreement should specify who owns and controls the use of the business’s trademarks. For copyrights, it should address the ownership of all copyrighted materials created by the business, including software, designs, and written content. Patents require a detailed clause outlining the ownership and licensing of any patented inventions developed by the business. The agreement should also clarify the process for obtaining and maintaining these protections.

Consider including a provision requiring partners to disclose any potential conflicts of interest regarding pre-existing IP that might be relevant to the business. This helps prevent future disputes and ensures transparency. For example, if a partner brings pre-existing IP into the business, the agreement should clarify the terms of its use and any associated royalties or compensation.

Dispute Resolution Mechanisms

Choosing the appropriate dispute resolution mechanism is crucial for any business operating agreement. A well-defined process can prevent costly and time-consuming litigation, preserving the working relationship between parties and ensuring business continuity. The selection should consider the nature of the business, the anticipated frequency of disputes, and the resources available to the parties involved.

Comparison of Dispute Resolution Mechanisms

Several methods exist for resolving disputes arising from a business operating agreement. Each offers unique advantages and disadvantages, impacting the cost, timeliness, and formality of the resolution process. Common mechanisms include arbitration, mediation, and litigation.

| Mechanism | Advantages | Disadvantages |

|---|---|---|

| Arbitration | Faster and less expensive than litigation; more private; can use specialized arbitrators with industry expertise; binding decision. | Less discovery than litigation; limited appeal rights; arbitrator fees can be significant; potential for bias. |

| Mediation | Preserves relationships; cost-effective; flexible; confidential; parties retain control over the outcome. | Non-binding; success depends on the willingness of parties to compromise; may not be suitable for complex disputes; no guarantee of resolution. |

| Litigation | Binding decision; extensive discovery process; clear legal framework; strong appeal rights. | Expensive; time-consuming; public record; adversarial; can damage relationships. |

Sample Dispute Resolution Clause

The following clause illustrates a potential approach to incorporating a dispute resolution mechanism into a business operating agreement. It favors arbitration as a primary method, with mediation as a precursor to potentially reduce costs and maintain a working relationship. This is just an example, and legal counsel should be sought to tailor it to specific circumstances.

All disputes arising under or relating to this Agreement shall first be submitted to mediation in accordance with the rules of [Name of Mediation Organization]. If mediation does not result in a resolution within [Number] days of the commencement of mediation, then the dispute shall be submitted to binding arbitration in accordance with the rules of [Name of Arbitration Organization]. The arbitration shall be conducted by a single arbitrator selected by mutual agreement of the parties, or if they cannot agree, appointed by [Name of Appointing Authority]. The arbitrator’s decision shall be final and binding on all parties. The prevailing party in any arbitration shall be entitled to recover its reasonable attorneys’ fees and costs. The place of arbitration shall be [Location]. The governing law shall be the law of [Jurisdiction].

Illustrative Examples of Business Operating Agreements: A Written Contract Granting Permission To Operate A Business

Business operating agreements are crucial for defining the relationships and responsibilities of parties involved in a business venture. The specific terms and conditions vary significantly depending on the type of agreement. Below are examples illustrating key aspects of franchise, licensing, and lease agreements.

Franchise Agreement Example: “The Coffee Beanery”

This example details a franchise agreement between “Brewtiful Beans Inc.” (franchisor), a successful coffee chain with a recognizable brand and established operational procedures, and “Joe’s Java Joint” (franchisee), a new business seeking to operate under the Brewtiful Beans brand. The agreement grants Joe’s Java Joint the right to operate a Brewtiful Beans franchise location in a specified geographic area. Key terms include:

* Franchise Fee: Joe’s Java Joint pays Brewtiful Beans Inc. an initial franchise fee of $50,000 for the right to use the brand, operational systems, and training.

* Royalty Fees: Joe’s Java Joint pays ongoing royalty fees (e.g., 5% of gross sales) to Brewtiful Beans Inc. for ongoing support and brand usage.

* Training and Support: Brewtiful Beans Inc. provides comprehensive training to Joe’s Java Joint’s staff on operating procedures, customer service, and product preparation. Ongoing operational support is also provided.

* Marketing and Advertising: Both parties collaborate on marketing and advertising efforts, with Joe’s Java Joint contributing to local marketing campaigns and adhering to Brewtiful Beans Inc.’s brand guidelines.

* Quality Control: Brewtiful Beans Inc. maintains quality control standards, regularly inspecting Joe’s Java Joint’s operations to ensure compliance with brand standards. This includes adherence to recipes, store appearance, and customer service protocols.

* Term and Termination: The agreement Artikels the term of the franchise (e.g., 10 years) and conditions for early termination, such as breach of contract or failure to meet performance standards.

Licensing Agreement Example: “The Widget Wizard”

This example involves a licensing agreement between “Innovative Widgets Ltd.” (licensor), the owner of a patented widget design, and “Gadget Galore Inc.” (licensee), a company seeking to manufacture and sell the widgets. The agreement grants Gadget Galore Inc. the exclusive right to manufacture and sell the patented widgets within a specified territory. Key terms include:

* License Grant: Innovative Widgets Ltd. grants Gadget Galore Inc. a non-exclusive license to manufacture and sell the patented widgets.

* Royalty Payments: Gadget Galore Inc. pays royalties to Innovative Widgets Ltd. based on the number of widgets sold (e.g., $1 per widget).

* Manufacturing Specifications: Innovative Widgets Ltd. provides Gadget Galore Inc. with detailed manufacturing specifications to ensure the widgets meet quality standards.

* Quality Control: Innovative Widgets Ltd. has the right to inspect Gadget Galore Inc.’s manufacturing processes and finished products to ensure quality and compliance.

* Term and Termination: The agreement Artikels the term of the license (e.g., 5 years) and conditions for early termination, such as breach of contract or failure to meet sales targets.

* Confidentiality: Gadget Galore Inc. agrees to maintain the confidentiality of Innovative Widgets Ltd.’s trade secrets and proprietary information.

Lease Agreement Example: “The Retail Space”

This example illustrates a lease agreement between “Property Holdings LLC” (landlord), the owner of a retail space, and “Boutique Books” (tenant), a bookstore seeking to lease the space. The agreement Artikels the terms under which Boutique Books will lease the retail space. Key terms include:

* Lease Term: The lease term is for five years, with an option to renew for an additional five years.

* Rent: Boutique Books agrees to pay monthly rent of $5,000, payable in advance on the first day of each month.

* Utilities: The agreement specifies which utilities are the responsibility of the landlord (e.g., building insurance, property taxes) and which are the responsibility of the tenant (e.g., electricity, water).

* Maintenance and Repairs: The agreement Artikels the responsibilities of both parties regarding maintenance and repairs. For example, the landlord is responsible for structural repairs, while the tenant is responsible for maintaining the interior of the space.

* Insurance: Boutique Books is required to maintain liability insurance to protect against potential risks.

* Default: The agreement Artikels the consequences of default by either party, such as failure to pay rent or breach of other terms.