Abnb personal loan – Airbnb personal loans offer a unique pathway for hosts to fuel their businesses. Securing funding for renovations, marketing, or unexpected expenses can be crucial for growth, but navigating the loan application process as an Airbnb host presents unique challenges. Understanding how lenders view Airbnb income and choosing the right loan product are vital for success. This guide explores the intricacies of obtaining a personal loan specifically tailored to your Airbnb endeavors, from eligibility criteria to effective debt management strategies.

We’ll delve into the specifics of how your Airbnb income impacts loan approval, comparing various lenders and their approaches to evaluating this unique revenue stream. We’ll also cover alternative financing options, enabling you to make informed decisions based on your individual circumstances and financial goals. Whether you’re planning a major renovation or need funds to cover unexpected repairs, this comprehensive guide provides the knowledge you need to secure the financing you deserve.

Airbnb and Personal Loan Eligibility

Securing a personal loan as an Airbnb host can be a strategic move for financing property improvements, covering operational expenses, or managing unexpected costs. However, understanding the eligibility criteria and how lenders view Airbnb income is crucial for a successful application. This section details the typical requirements, the impact of Airbnb income, and the nuances of different lenders’ approaches.

Factors Affecting Personal Loan Eligibility for Airbnb Hosts

Lenders assess several factors when evaluating personal loan applications. Traditional credit scores, debt-to-income ratios (DTI), and employment history remain significant. However, for Airbnb hosts, the consistency and volume of Airbnb income play a vital role. A strong track record of bookings, demonstrated through consistent income over several months or years, significantly strengthens an application. Conversely, inconsistent income or a history of low occupancy rates can negatively impact approval chances. Additionally, lenders consider the applicant’s overall financial stability, including assets and liabilities. This holistic assessment ensures that the applicant can comfortably repay the loan.

The Impact of Airbnb Income on Loan Approval

Airbnb income can be a powerful asset in a loan application. Lenders recognize that consistent Airbnb revenue demonstrates financial stability and earning potential. Providing detailed financial statements, including bank statements showing consistent Airbnb deposits, is essential. The length of time the applicant has been hosting on Airbnb is also a key factor; a longer history indicates a more established and reliable income stream. Conversely, relying solely on Airbnb income without a supplementary income source might present a higher risk to some lenders, potentially leading to a higher interest rate or a lower loan amount. Some lenders may even require a minimum period of consistent Airbnb income before considering an application.

Lenders’ Approaches to Evaluating Airbnb Income

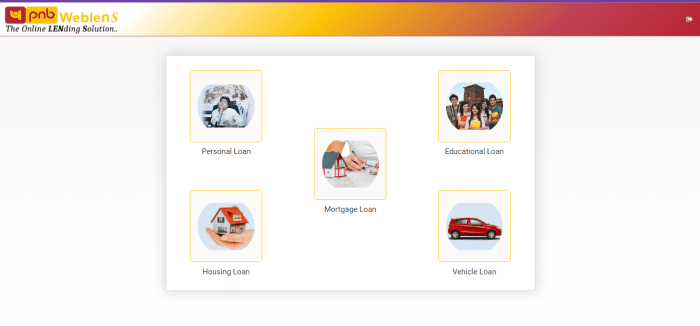

Different lenders have varying approaches to evaluating Airbnb income. Some may readily accept it as proof of income, while others might require additional documentation or verification. Some lenders may use automated systems that analyze bank statements to identify and verify Airbnb income, while others may require manual review by a loan officer. It’s advisable to research lenders who specifically cater to the needs of gig workers or those with alternative income sources, as these lenders may have more streamlined processes for evaluating Airbnb income. For example, some online lenders may be more receptive to Airbnb income than traditional brick-and-mortar banks.

Documents Required from Airbnb Hosts

Lenders typically request various documents to verify income and financial stability. These may include:

* Bank statements: Demonstrating consistent Airbnb deposits over a specific period.

* Airbnb income statements: Showing total earnings, expenses, and net income.

* Tax returns: Providing a comprehensive overview of income and expenses for tax purposes.

* Proof of identification: Such as a driver’s license or passport.

* Proof of address: Such as a utility bill or bank statement.

* Property ownership documents (if applicable): Especially relevant if the loan is secured against the Airbnb property.

Comparison of Lender Offers for Airbnb Hosts

The interest rates and loan terms offered to Airbnb hosts vary significantly across lenders. The table below provides a hypothetical comparison (actual rates and terms are subject to change and individual circumstances). It is crucial to shop around and compare offers from multiple lenders before making a decision.

| Lender | Interest Rate (APR) | Loan Term (Months) | Minimum Credit Score |

|---|---|---|---|

| Lender A | 7.5% | 36 | 680 |

| Lender B | 9.0% | 60 | 660 |

| Lender C | 8.0% | 48 | 700 |

| Lender D | 6.5% | 24 | 720 |

Using a Personal Loan for Airbnb-Related Expenses

Securing a personal loan can be a strategic financial move for Airbnb hosts looking to enhance their property, improve guest experience, or navigate unexpected costs. This approach allows for significant investments that can lead to increased bookings and higher profitability, but careful consideration of the associated costs and risks is crucial. Understanding the various scenarios where a personal loan might be beneficial, alongside its advantages and disadvantages, is key to making an informed decision.

Scenarios Requiring Airbnb-Related Personal Loans

Many Airbnb hosts find themselves needing additional capital for various improvements and operational needs. These can range from significant renovations to smaller upgrades designed to enhance the guest experience and increase booking rates. For example, a host might need funding for kitchen renovations, bathroom upgrades, the addition of smart home features, or a professional photoshoot to create more appealing listing photos. Marketing campaigns to boost visibility and occupancy rates can also require substantial upfront investment, which a personal loan can facilitate. Finally, unexpected repairs and maintenance are a common reality of property ownership, and a personal loan can provide a safety net to cover these costs.

Advantages and Disadvantages of Using Personal Loans for Airbnb Expenses

Personal loans offer several advantages for Airbnb-related expenses. The most significant is access to a substantial sum of money, enabling hosts to undertake larger projects or handle unforeseen circumstances. The repayment schedule is typically fixed and predictable, allowing for budgeting and financial planning. Furthermore, securing a loan can be faster than exploring alternative funding options, allowing hosts to act quickly on opportunities or address urgent issues. However, personal loans also come with disadvantages. Interest charges can significantly increase the overall cost, and defaulting on payments can have serious financial consequences. Moreover, the loan application process can be time-consuming and may require a good credit score. Thorough research and comparison of loan options are vital to securing the best terms and managing the repayment effectively.

Hypothetical Budget for Airbnb Renovations, Including Loan Repayment

Let’s consider a hypothetical scenario: a host needs $15,000 for kitchen and bathroom renovations. They secure a 3-year personal loan at 8% annual interest. The monthly payment would be approximately $470 (excluding any additional fees). The renovation budget could be broken down as follows:

| Expense | Amount |

|---|---|

| Kitchen Renovation (cabinets, appliances) | $8,000 |

| Bathroom Renovation (fixtures, tiling) | $5,000 |

| Professional Cleaning Post-Renovation | $500 |

| Contingency Fund | $1,500 |

| Total | $15,000 |

This budget incorporates a contingency fund to cover potential unforeseen expenses during the renovation. The monthly loan repayment of $470 would need to be factored into the host’s overall Airbnb operating budget, considering projected rental income.

Examples of Successful Airbnb Hosts Using Personal Loans Strategically

While specific examples of individual hosts using personal loans are often confidential, anecdotal evidence suggests many have leveraged loans successfully. For example, a host might use a loan to upgrade their property to a higher standard, enabling them to charge premium prices and generate higher profits despite the loan repayment. Another example might be a host using a loan to invest in professional marketing and photography, leading to a significant increase in bookings and faster loan repayment. The key is strategic planning, realistic budgeting, and a clear understanding of the return on investment.

Potential Unexpected Expenses and Loan Mitigation

Unexpected expenses are an inherent risk in Airbnb hosting. These can include plumbing issues, appliance malfunctions, pest infestations, or damage caused by guests. A personal loan can serve as a financial safety net to cover these costs, preventing financial strain and allowing for prompt repairs to maintain high occupancy rates. For example, a sudden burst pipe could cost thousands of dollars; a personal loan ensures the host can address this immediately without derailing their finances. Another example is a significant appliance failure, such as a refrigerator or washing machine, requiring immediate replacement. Having access to a personal loan minimizes disruption and ensures the property remains guest-ready.

Managing Debt from an Airbnb Personal Loan

Securing a personal loan to finance Airbnb-related expenses can significantly boost your investment, but responsible debt management is crucial for long-term success. Failing to plan for repayment can lead to financial strain and jeopardize your Airbnb venture. This section Artikels strategies for navigating the complexities of repaying a personal loan while maximizing your Airbnb’s profitability.

Realistic Repayment Plan Example

A realistic repayment plan hinges on accurately forecasting your Airbnb’s income and expenses. Let’s consider an example: Suppose you borrow $20,000 at a 7% annual interest rate, amortized over 5 years. This translates to a monthly payment of approximately $390. To ensure timely repayment, you need to project your Airbnb’s monthly net income (rental income minus expenses like mortgage, utilities, cleaning, and maintenance). If your projected net income consistently exceeds $390, you’re in a strong position to repay the loan without difficulty. However, if your net income is lower, you’ll need to adjust your budget or explore alternative repayment options. Always build a buffer into your projections to account for unexpected expenses or periods of low occupancy.

Potential Risks of Airbnb Debt

Taking on debt for Airbnb investments carries inherent risks. Fluctuations in occupancy rates, unexpected repairs, and changes in local regulations can significantly impact your income. If your Airbnb’s profitability falls short of projections, you may struggle to meet your loan repayments, leading to late payment fees, damage to your credit score, and potentially even foreclosure if the loan is secured against your property. Overestimating your Airbnb’s earning potential is a common pitfall, leading to unsustainable debt burdens. A thorough market analysis and conservative income projections are essential to mitigate these risks.

Debt Management Strategies

Effective debt management involves proactive planning and consistent monitoring. Prioritize creating a detailed budget that Artikels all income and expenses, including loan repayments. Track your Airbnb’s income and expenses meticulously using accounting software or spreadsheets. Regularly review your budget to identify areas where you can cut costs or increase revenue. Consider setting up an automatic payment system to avoid missed payments. If you anticipate difficulty meeting your repayments, communicate with your lender immediately to explore options like extending the loan term or modifying the payment schedule. Proactive communication is key to avoiding more severe financial consequences.

Comparison of Repayment Methods

Several repayment methods exist, each with its own implications. The standard method involves fixed monthly payments over the loan term. This provides predictability but may lead to higher total interest paid. Accelerated repayment, involving making larger payments or additional lump-sum payments, reduces the total interest paid and shortens the loan term. Interest-only payments, where you only pay the interest for a specified period, can provide short-term relief but ultimately lead to a larger principal balance at the end of the term. The optimal method depends on your financial situation and risk tolerance. Careful consideration of the long-term implications is crucial.

Step-by-Step Budgeting and Expense Tracking Guide

1. Detailed Income Projection: Accurately estimate your Airbnb’s monthly rental income based on market research and occupancy rates. Consider seasonal variations and potential fluctuations.

2. Comprehensive Expense Listing: List all anticipated expenses, including mortgage payments (if applicable), utilities, cleaning fees, maintenance, insurance, marketing, and loan repayments.

3. Budget Creation: Develop a monthly budget that clearly shows projected income versus expenses. Ensure that your net income comfortably covers your loan repayments and leaves a buffer for unexpected costs.

4. Expense Tracking: Maintain meticulous records of all income and expenses. Utilize accounting software or spreadsheets to simplify the process.

5. Regular Review and Adjustment: Regularly review your budget (monthly or quarterly) to compare actual figures against projections. Make adjustments as needed to ensure your budget remains accurate and realistic.

6. Emergency Fund: Establish an emergency fund to cover unexpected expenses, such as major repairs or periods of low occupancy. This will prevent you from relying on your credit card or further loans to cover shortfalls.

Alternatives to Personal Loans for Airbnb Financing

Securing funding for your Airbnb venture requires careful consideration of various financing options. While personal loans offer a straightforward approach, they might not always be the most suitable choice. Exploring alternative financing methods can lead to better terms, lower interest rates, or more flexible repayment schedules. This section examines several alternatives to personal loans, comparing their advantages and disadvantages to help you make an informed decision.

Business Loans

Business loans, offered by banks and credit unions, are specifically designed for business expenses. They often come with higher loan amounts than personal loans, making them ideal for significant Airbnb-related investments like property renovations or purchasing additional properties. The application process typically involves a detailed business plan, financial statements, and credit history review. Approval depends on your creditworthiness, business history, and the projected profitability of your Airbnb operation. A strong business plan demonstrating a clear path to profitability significantly increases your chances of approval.

Credit Cards

Credit cards provide a readily accessible source of short-term financing. They are convenient for smaller, immediate expenses such as purchasing furniture, linens, or marketing materials. However, high interest rates and potential for accumulating debt quickly make them less suitable for large-scale investments or long-term financing. Careful budgeting and prompt repayment are crucial to avoid accumulating significant interest charges. The application process is relatively straightforward, often requiring only a credit check. Using credit cards effectively requires discipline and a clear repayment plan.

Home Equity Loans and Lines of Credit (HELOC)

For homeowners with significant equity in their property, a home equity loan or HELOC can offer substantial funding at potentially lower interest rates than personal loans. These loans use your home’s equity as collateral, meaning you risk foreclosure if you fail to repay the loan. The application process involves an appraisal of your home to determine its value and the available equity. While offering larger loan amounts and potentially lower interest rates, the risk associated with using your home as collateral should be carefully weighed. This option is best suited for significant investments with a clear path to increased rental income that can comfortably cover the loan repayments.

Comparison of Financing Methods

Understanding the key differences between these financing options is vital for making the right choice. The following table summarizes the pros and cons and key considerations for each:

| Financing Method | Pros | Cons | Best Suited For |

|---|---|---|---|

| Personal Loan | Easy application, readily available | Potentially high interest rates, limited loan amounts | Smaller Airbnb-related expenses, debt consolidation |

| Business Loan | Higher loan amounts, potentially lower interest rates | Stricter application requirements, longer approval process | Significant investments, property renovations, expansion |

| Credit Cards | Easy access, convenient for small expenses | High interest rates, potential for debt accumulation | Small, immediate expenses, short-term financing |

| Home Equity Loan/HELOC | Large loan amounts, potentially lower interest rates | Risk of foreclosure, complex application process | Significant investments, large-scale renovations, property purchases |

Impact of Airbnb Income on Loan Applications: Abnb Personal Loan

Securing a personal loan can be significantly influenced by your income, particularly if that income stems from a less traditional source like Airbnb rentals. Lenders assess your ability to repay the loan, and a consistent and verifiable income stream is crucial in demonstrating this capability. Understanding how your Airbnb income is perceived by lenders is vital for a successful application.

Consistent Airbnb income strengthens a loan application by providing concrete evidence of your repayment capacity. Lenders look for stable, predictable earnings to mitigate their risk. A history of consistent bookings and rental income demonstrates a reliable revenue stream, making you a less risky borrower and increasing your chances of loan approval. This predictability allows lenders to confidently assess your debt-to-income ratio (DTI), a key factor in loan approval decisions. Conversely, fluctuating income can negatively impact your chances.

Consistent Airbnb Income and Loan Approval

A strong track record of consistent Airbnb income significantly improves the likelihood of loan approval. Lenders favor applicants with a demonstrable history of regular bookings and consistent monthly revenue. This consistency reduces the perceived risk associated with lending, leading to more favorable loan terms, including potentially lower interest rates. For instance, an applicant who has consistently earned $3,000 per month from Airbnb rentals for the past two years presents a much stronger case than someone with sporadic income fluctuating wildly between $500 and $5,000. This stability signals financial responsibility and reduces the lender’s apprehension about potential defaults.

Fluctuating Airbnb Income and Loan Approval, Abnb personal loan

In contrast to consistent income, fluctuating Airbnb income can hinder loan approval. Inconsistent rental income makes it difficult for lenders to accurately assess your repayment capacity. Seasonal fluctuations, periods of low occupancy, or unpredictable booking patterns can raise concerns about your ability to make timely loan payments. This unpredictability increases the perceived risk for the lender, potentially leading to loan denial or less favorable terms, such as higher interest rates or a smaller loan amount. For example, an applicant with inconsistent Airbnb income might be asked for a larger down payment or a higher interest rate to compensate for the increased risk.

Demonstrating Stable Airbnb Income to Lenders

Effectively demonstrating stable Airbnb income requires meticulous record-keeping and clear presentation of financial data. This involves providing comprehensive documentation to lenders that convincingly showcases the consistency and reliability of your rental income. This is crucial in mitigating any perceived risks associated with the less traditional nature of Airbnb income.

Financial Documents Supporting Airbnb Income Claims

Several financial documents can effectively support claims of Airbnb income. These documents provide concrete evidence of your rental income, strengthening your loan application significantly.

- Airbnb Account Statements: These statements provide a detailed record of your bookings, rental income, and expenses. They offer a comprehensive overview of your Airbnb activity.

- Bank Statements: Bank statements corroborate the income reported on your Airbnb statements, showing the actual deposit of rental payments into your account.

- Tax Returns: Your tax returns, particularly Schedule C (Profit or Loss from Business), provide official documentation of your Airbnb income and expenses, further bolstering your claim of consistent revenue.

- Rental Agreements (if applicable): If you have long-term rentals through Airbnb, providing copies of these agreements demonstrates a committed income stream.

Visual Representation of Airbnb Income and Loan Approval Probability

Imagine a graph with Airbnb income on the x-axis and loan approval probability on the y-axis. The line would show a positive correlation. As consistent Airbnb income increases, the probability of loan approval rises steadily. However, the line would be less steep and potentially even plateau for very high income levels, suggesting that while high income is beneficial, other factors also play a role in loan approval. For instance, a very high Airbnb income but poor credit history might still reduce the approval probability. Conversely, inconsistent or low Airbnb income would show a lower probability of approval, with the probability decreasing as the inconsistency or low income persists.

Last Recap

Successfully leveraging a personal loan for your Airbnb venture requires careful planning and a thorough understanding of your financial landscape. By strategically utilizing your Airbnb income, choosing the right lender, and implementing a robust repayment plan, you can transform your financial challenges into opportunities for growth. Remember to always compare options, understand the terms and conditions, and prioritize responsible debt management. With the right approach, an Airbnb personal loan can be a powerful tool in building a thriving and profitable hosting business.

FAQ Explained

What credit score is typically required for an Airbnb personal loan?

Lenders generally prefer applicants with good to excellent credit scores (670 or higher), although some may consider applicants with lower scores depending on other factors like income and debt-to-income ratio.

Can I use an Airbnb personal loan for purchasing property?

Typically, personal loans are not designed for property purchases. For property acquisition, you’d need a mortgage or other real estate financing options.

How long does it usually take to get approved for an Airbnb personal loan?

Approval times vary depending on the lender and the complexity of your application. It can range from a few days to several weeks.

What happens if my Airbnb income fluctuates significantly?

Fluctuating income can make loan approval more challenging. Demonstrating consistent income through tax returns, bank statements, and Airbnb booking data can help mitigate this risk.