Achieva auto loan rates offer competitive financing options for new and used vehicles. Understanding these rates requires exploring several key factors, including your credit score, income, and the type of loan you seek. This guide will delve into Achieva’s auto loan offerings, eligibility criteria, application process, repayment options, and special promotions, equipping you with the knowledge to make informed decisions.

We’ll compare Achieva’s rates to those of major competitors, examine the impact of different loan terms and payment frequencies, and highlight potential fees and charges. Real-world examples and customer testimonials will provide further insight into the Achieva auto loan experience, painting a comprehensive picture of what to expect.

Achieva Auto Loan Rate Overview

Achieva Credit Union offers a range of auto loans designed to meet diverse borrowing needs. Understanding their interest rates and loan options is crucial for borrowers seeking competitive financing. This overview details the factors affecting Achieva’s rates, the types of loans available, and a comparison to other major lenders.

Achieva Auto Loan Interest Rates and Influencing Factors

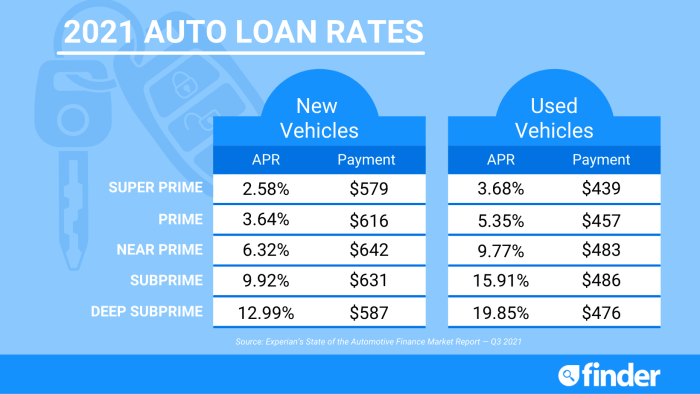

Several factors influence the interest rate Achieva Credit Union applies to auto loans. These include the borrower’s credit score, the loan amount, the loan term, the type of vehicle being financed (new or used), and the loan-to-value ratio (LTV). A higher credit score generally qualifies borrowers for lower interest rates, while a larger loan amount or longer loan term may result in a higher rate. The type of vehicle and LTV also play a significant role, with new vehicles and lower LTVs often associated with more favorable rates. Achieva’s specific rate ranges are not publicly listed on their website but are available upon application. It’s advisable to contact Achieva directly for current rate information.

Types of Achieva Auto Loans, Achieva auto loan rates

Achieva Credit Union likely offers various auto loan options, although specific details are not readily available online. Common types of auto loans include new car loans for purchasing new vehicles, used car loans for pre-owned vehicles, and refinancing options for existing auto loans. These loan types might have slightly different interest rate structures reflecting the inherent risk associated with each. For example, used car loans may have slightly higher interest rates compared to new car loans due to increased risk. The availability and specific terms of each loan type should be confirmed directly with Achieva.

Achieva Auto Loan Rates Compared to Competitors

It’s difficult to provide a precise, up-to-the-minute comparison of Achieva’s auto loan rates against competitors without access to their real-time rate sheets. Interest rates are dynamic and change frequently based on market conditions. However, a hypothetical comparison table illustrates how such a comparison might look. Remember that these are illustrative examples and actual rates will vary depending on the factors mentioned previously.

| Lender | Interest Rate (Example) | Loan Term Options (Example) | Special Features (Example) |

|---|---|---|---|

| Achieva Credit Union | 4.5% – 8.5% APR | 24, 36, 48, 60, 72 months | Membership required |

| Bank of America | 4.0% – 9.0% APR | 24, 36, 48, 60, 72 months | Online application |

| Capital One Auto Navigator | 5.0% – 10.0% APR | 36, 48, 60, 72 months | Pre-qualification available |

| Chase Auto Finance | 4.5% – 9.5% APR | 24, 36, 48, 60, 72 months | Various loan options |

Achieva Auto Loan Rate Eligibility Criteria

Securing an Achieva auto loan hinges on meeting specific eligibility requirements. These criteria are designed to assess the applicant’s creditworthiness and ability to repay the loan, ultimately influencing the interest rate offered. Understanding these requirements is crucial for prospective borrowers to optimize their chances of approval and secure favorable loan terms.

Achieva, like most lenders, uses a multifaceted approach to determine eligibility, primarily focusing on credit history, income, and debt levels. A strong credit profile significantly improves the chances of approval and can lead to lower interest rates. Conversely, a poor credit history may result in loan denial or higher interest rates to compensate for increased risk. Income and debt-to-income ratio (DTI) provide further insights into the borrower’s financial capacity to handle monthly loan payments.

Credit Score’s Influence on Achieva Auto Loan Rates

Your credit score is a cornerstone of the loan approval process. Lenders use credit scores, typically ranging from 300 to 850, to gauge your creditworthiness. A higher credit score (generally above 700) usually signifies a lower risk to the lender, resulting in more favorable interest rates. Conversely, a lower credit score (below 600) might lead to higher interest rates or even loan rejection. The specific impact of credit score on Achieva’s rates isn’t publicly disclosed, but the general trend across the auto loan industry is consistent: better credit, better rates. For instance, an applicant with a 750 credit score might qualify for a 4% interest rate, while an applicant with a 600 credit score might face a rate closer to 10% or even higher, or may not be approved at all.

Income and Debt-to-Income Ratio’s Role in Loan Approval and Rates

Achieva assesses your income to determine your repayment capacity. A stable and sufficient income demonstrates your ability to meet monthly loan payments without financial strain. Coupled with income, the debt-to-income (DTI) ratio plays a significant role. DTI represents the percentage of your monthly gross income dedicated to debt payments. A lower DTI (generally below 43%) indicates a healthier financial situation and improves the chances of loan approval with potentially lower interest rates. A high DTI, on the other hand, suggests a higher risk of default, potentially leading to higher rates or loan denial.

For example, an applicant earning $5,000 per month with $1,500 in monthly debt payments has a DTI of 30%, which is generally considered favorable. Another applicant earning the same amount but with $2,500 in debt payments has a DTI of 50%, significantly increasing the risk assessment and potentially impacting the interest rate or even leading to loan rejection.

Illustrative Scenarios and Their Effect on Rates

Scenario 1: An applicant with a 780 credit score, a stable $60,000 annual income, and a DTI of 25% is likely to receive a favorable interest rate and loan approval. The low DTI and excellent credit score represent minimal risk to the lender.

Scenario 2: An applicant with a 620 credit score, an inconsistent income history, and a DTI of 55% faces a much higher risk of loan denial or significantly higher interest rates. The higher DTI and lower credit score indicate a greater chance of default.

Scenario 3: An applicant with a 680 credit score and a stable income but a DTI of 45% might still be approved, but likely at a higher interest rate than someone with a lower DTI. The lender may view the higher DTI as a moderate risk.

Achieva Auto Loan Application Process: Achieva Auto Loan Rates

Applying for an Achieva auto loan involves a straightforward process designed to be efficient and convenient for borrowers. The application process is designed to gather necessary information to assess creditworthiness and determine loan eligibility. Careful preparation beforehand will streamline the process significantly.

The application process for an Achieva auto loan consists of several key steps, each requiring specific documentation and attention to detail. Failure to provide complete and accurate information may result in delays or rejection of the application.

Required Documentation for Achieva Auto Loan Application

To successfully apply for an Achieva auto loan, you’ll need to gather several essential documents. These documents verify your identity, income, and the vehicle you intend to finance. Having these ready before you begin the application will expedite the process.

- Valid Government-Issued Photo Identification: This could include a driver’s license, passport, or state-issued ID card. Ensure the identification is current and not expired.

- Proof of Income: This typically involves pay stubs from your employer for the past two months, or tax returns (W-2 forms or 1099 forms) if you are self-employed. The documentation should clearly show your income and employment history.

- Proof of Residence: Acceptable proof of residence includes a utility bill (gas, electric, water), bank statement, or lease agreement showing your current address. The document must be recent and display your name and address.

- Vehicle Information: You will need the Vehicle Identification Number (VIN) of the vehicle you wish to finance, along with details about the vehicle’s make, model, year, and mileage. A copy of the vehicle’s title may also be required.

- Credit Report Authorization: Achieva will likely need to access your credit report to assess your creditworthiness. You may need to provide authorization for them to do so.

Steps in the Achieva Auto Loan Application Process

The application process is structured to guide you through each stage efficiently. Following these steps in order will ensure a smoother application process.

- Online Application or In-Person Visit: Begin the process by either completing the online application on Achieva’s website or visiting a local branch. The online application often allows for faster processing.

- Information Submission: Accurately and completely fill out the application form, providing all the required information. Double-check all entries for accuracy to avoid delays.

- Document Upload or Submission: Upload or submit all the required documentation as specified in the application instructions. Ensure all documents are legible and clearly display the necessary information.

- Credit Check and Approval: Achieva will review your application and conduct a credit check. This process may take several business days. The outcome will be communicated to you.

- Loan Agreement Review and Signing: If approved, you will receive a loan agreement outlining the terms and conditions. Carefully review the agreement before signing.

- Loan Disbursement: Once the agreement is signed, the loan funds will be disbursed, typically directly to the seller of the vehicle or to your account.

Achieva Auto Loan Repayment Options

Achieva Auto Loans likely offers a variety of repayment options to suit different borrower needs and financial situations. Understanding these options and their associated costs is crucial for making an informed decision. Factors such as loan term length and payment frequency significantly impact the total interest paid over the life of the loan.

Achieva’s repayment options likely include choices in loan term length, impacting monthly payments and overall interest. Shorter loan terms generally result in higher monthly payments but lower overall interest costs due to less time accruing interest. Conversely, longer loan terms result in lower monthly payments but higher overall interest costs. Payment frequency also plays a role; more frequent payments (e.g., bi-weekly instead of monthly) can reduce the total interest paid, though this depends on how the lender structures its calculations.

Loan Term Length and Payment Schedules

Choosing a loan term involves balancing affordability with total cost. A shorter term (e.g., 36 months) will mean higher monthly payments but significantly less interest paid over the life of the loan. A longer term (e.g., 72 months or even 84 months) will result in lower monthly payments but a substantially higher total interest expense. Achieva likely provides a range of loan terms to cater to varying budgets and financial goals. For example, a $20,000 loan at a 5% interest rate would have vastly different monthly payments and total interest costs depending on whether it’s a 36-month, 60-month, or 72-month loan. The exact figures would need to be calculated using a loan amortization schedule, readily available through Achieva’s loan calculators or financial professionals.

Comparison of Total Borrowing Costs Across Different Loan Terms

To illustrate the impact of loan term length, consider a hypothetical $20,000 auto loan at a 5% annual interest rate. A 36-month loan might have a monthly payment around $591 and total interest paid of approximately $1,276. A 60-month loan could have a monthly payment of roughly $370 but total interest paid nearing $2,200. Finally, a 72-month loan might have a monthly payment of about $308, but the total interest paid would be considerably higher, potentially exceeding $3,000. These figures are illustrative and will vary based on the specific interest rate and any associated fees. It’s crucial to obtain a personalized loan quote from Achieva to determine the precise costs.

Impact of Payment Frequency on Overall Cost

While Achieva may not explicitly offer different payment frequencies (such as weekly or bi-weekly payments), the impact of more frequent payments is significant. If a borrower could make bi-weekly payments equal to half their monthly payment, they would effectively make 26 half-payments per year instead of 12 full monthly payments. This accelerates loan repayment and reduces the total interest paid, similar to the effect of choosing a shorter loan term. However, the exact savings would depend on how Achieva structures its interest calculations. Some lenders might simply apply the bi-weekly payments to the principal balance more quickly, while others may adjust the interest calculation accordingly.

Examples of Different Repayment Plans and Associated Interest Charges

Let’s illustrate with a simplified example. Assume a $15,000 loan at a 4% annual interest rate. If the loan is structured for a 36-month term, the monthly payment would be approximately $435, resulting in a total interest paid of around $800. Extending the loan to 60 months might lower the monthly payment to around $270, but the total interest paid would increase significantly, possibly to $1,500 or more. These are approximate figures; precise calculations require using a loan amortization calculator with the specific interest rate and fees applied by Achieva. The lender’s website or a financial advisor can provide accurate figures based on individual circumstances.

Achieva Auto Loan Special Offers and Promotions

Achieva Credit Union frequently offers special promotions on their auto loans to attract new members and reward existing ones. These promotions can significantly impact the overall cost of borrowing, making it crucial for potential borrowers to understand the details of any current offers. The specifics of these promotions can change regularly, so it’s always recommended to check directly with Achieva for the most up-to-date information.

The benefits of taking advantage of a special offer versus standard loan terms often include lower interest rates, reduced fees, or incentives like cash back. These savings can accumulate to substantial amounts over the life of the loan, making these promotions highly attractive. However, it’s important to carefully compare the terms and conditions of any promotion to ensure it aligns with your financial needs and goals.

Current Achieva Auto Loan Promotions

Achieva’s special offers are dynamic and vary based on factors like membership status, credit score, and the type of vehicle being financed. Therefore, providing specific details on current promotions requires checking Achieva’s official website or contacting them directly. However, examples of past promotions might include reduced interest rates for new car purchases, promotional periods with lower APRs for used vehicles, or cash-back incentives for members who refinance their existing auto loans.

Terms and Conditions of Past Promotions (Illustrative Examples)

Past promotions have often included specific eligibility criteria. For instance, a reduced interest rate offer might have been limited to members with a credit score above a certain threshold, or the cash-back incentive might have been contingent on financing through a specific lender. Furthermore, these promotions typically have a limited-time availability, often expiring after a set period. Loan amounts and terms also frequently fall within pre-defined ranges. For example, a promotion might only apply to loans between $10,000 and $50,000 with a loan term of 36 to 72 months.

Comparison of Promotional and Standard Loan Terms

A comparison between a promotional offer and standard loan terms would highlight the differences in interest rates, fees, and overall loan cost. For example, a promotional offer might reduce the APR by 1% or 2% compared to the standard rate. This seemingly small difference can translate into substantial savings over the loan’s duration. Let’s illustrate with a hypothetical example: A $20,000 loan at a 5% APR over 60 months would cost significantly less than the same loan at a 7% APR. The exact difference would depend on the loan amortization schedule, but the lower interest rate would reduce the total interest paid. Additionally, promotional offers might waive certain fees, such as origination fees or early payoff penalties, further enhancing their attractiveness.

Key Features of Hypothetical Past Promotions

To illustrate the key features, let’s consider hypothetical examples of past promotions:

- Promotion 1: Reduced APR for New Car Purchases: This promotion offered a 0.5% reduction in the APR for members purchasing a new vehicle. The offer was valid for a limited time and applied only to loans with a term of 60 months or less. Eligible members had to have a credit score above 700.

- Promotion 2: Cash Back on Refinance: This promotion offered a $500 cash back reward to members who refinanced their existing auto loan with Achieva. The offer was valid for a limited time and applied only to loans of $15,000 or more. All members were eligible, regardless of credit score.

Achieva Auto Loan Customer Testimonials and Reviews

Understanding customer experiences is crucial for assessing the quality of Achieva’s auto loan services. Analyzing both positive and negative feedback provides valuable insights into areas of strength and areas needing improvement. The following testimonials illustrate a range of customer experiences, categorized for clarity.

Positive Customer Experiences with Achieva Auto Loans

Positive reviews frequently highlight the ease and speed of the application process, competitive interest rates, and helpful customer service. These factors contribute to a largely positive overall perception of Achieva’s auto loan services.

“The application process was incredibly smooth and straightforward. I received approval within a day, and the funds were transferred quickly. The interest rate was also very competitive compared to other lenders I checked.” – John D., Verified Customer

“I had a great experience with Achieva. Their customer service representatives were always friendly, helpful, and readily available to answer my questions. I highly recommend them!” – Sarah M., Verified Customer

Negative Customer Experiences with Achieva Auto Loans

While many experiences are positive, some negative reviews cite issues with communication, unexpected fees, and lengthy processing times. These negative experiences underscore the importance of clear communication and transparency in the loan process.

“The communication from Achieva was inconsistent. I had to follow up multiple times to get updates on my application. The process took much longer than anticipated.” – David L., Verified Customer

“I was surprised by some hidden fees that weren’t clearly explained upfront. This significantly impacted my overall cost.” – Maria R., Verified Customer

Analysis of Common Themes and Sentiments

Positive reviews consistently emphasize the efficiency and ease of the application process, competitive interest rates, and excellent customer service. Negative reviews, on the other hand, frequently point to communication breakdowns, unexpected fees, and extended processing times. These discrepancies highlight the need for Achieva to maintain consistent communication, clearly Artikel all fees upfront, and streamline the application process for a more predictable and positive customer experience.

Factors Contributing to Positive and Negative Experiences

Positive experiences are strongly correlated with clear communication, competitive interest rates, and a streamlined application process. Negative experiences often stem from a lack of transparency regarding fees, inconsistent communication, and longer-than-expected processing times. Achieva can improve customer satisfaction by addressing these issues through process improvements and enhanced communication strategies.

Categorization of Testimonials Based on Specific Aspects

The testimonials can be categorized into: Application Process (ease, speed, efficiency), Interest Rates (competitiveness), Customer Service (responsiveness, helpfulness), Fees (transparency, unexpected charges), and Communication (consistency, clarity). Analyzing feedback within each category allows for a more granular understanding of customer perceptions and pinpoints areas for improvement.

Achieva Auto Loan Fees and Charges

Understanding the fees associated with an Achieva auto loan is crucial for budgeting and ensuring financial transparency. This section details all applicable fees, their purposes, and a comparison to industry standards. Note that specific fees and amounts may vary depending on the loan terms, your creditworthiness, and the state in which you reside. Always confirm the exact fees with Achieva directly before finalizing your loan agreement.

Achieva Auto Loans, like most lenders, charges various fees to cover administrative costs, risk assessment, and processing your loan application. These fees contribute to the overall cost of borrowing and should be factored into your monthly budget. It’s important to compare these fees to those of competing lenders to ensure you’re receiving a competitive rate and overall loan package.

Origination Fee

An origination fee is a one-time charge levied by Achieva to cover the administrative costs associated with processing your loan application. This fee compensates Achieva for the work involved in verifying your information, assessing your creditworthiness, and preparing the loan documents. The amount of the origination fee typically varies based on the loan amount and your credit score. A higher credit score may result in a lower origination fee or even a waiver in some cases.

Late Payment Fee

A late payment fee is charged if you fail to make your monthly payment by the due date. This fee acts as a penalty for not adhering to the loan agreement’s terms. The specific amount of the late payment fee is Artikeld in your loan contract and can range from a fixed dollar amount to a percentage of your missed payment. Consistent on-time payments are crucial to avoid incurring these additional charges.

Returned Check Fee

If you submit a payment that is returned due to insufficient funds, Achieva will likely charge a returned check fee. This fee compensates Achieva for the administrative burden of processing a returned payment and attempting to collect the funds. The fee amount is usually specified in the loan agreement and can vary depending on Achieva’s policies.

Prepayment Penalty

Some auto loans include a prepayment penalty, which is a fee charged if you pay off your loan early. However, Achieva’s policy on prepayment penalties should be clarified during the loan application process. Many lenders are now moving away from prepayment penalties, offering more flexibility to borrowers who may receive unexpected funds or wish to refinance their loan.

Fee Comparison Table

The following table provides a general comparison of Achieva’s fees with those of other lenders. Please note that these are examples and may not reflect the exact fees charged by each lender. Always check directly with the lender for the most up-to-date information.

| Fee | Achieva (Example) | Competitor A (Example) | Competitor B (Example) |

|---|---|---|---|

| Origination Fee | $200 – $500 | $150 – $400 | $0 – $300 (varies by credit score) |

| Late Payment Fee | $25 or 5% of payment (whichever is greater) | $30 | $25 – $50 |

| Returned Check Fee | $35 | $30 | $25 |

| Prepayment Penalty | None (example) | 1% of remaining balance | None (example) |

Ultimate Conclusion

Securing an auto loan can feel daunting, but with a clear understanding of Achieva’s offerings and the factors influencing your rate, the process becomes significantly more manageable. By carefully reviewing your eligibility, comparing rates, and understanding the associated fees, you can confidently navigate the application process and secure the best possible financing for your next vehicle. Remember to always compare offers and read the fine print before committing to any loan.

FAQ

What is the minimum credit score required for an Achieva auto loan?

While Achieva doesn’t publicly state a minimum credit score, a higher credit score generally results in more favorable interest rates. It’s best to contact Achieva directly to discuss your specific situation.

Can I refinance my existing auto loan with Achieva?

Yes, Achieva likely offers auto loan refinancing options. Contact them to inquire about eligibility and potential interest rates.

What documents do I need to apply for an Achieva auto loan?

Typically, you’ll need proof of income, identification, and vehicle information. Achieva will provide a complete list of required documents during the application process.

What happens if I miss a payment on my Achieva auto loan?

Missing payments will negatively impact your credit score and may incur late fees. Contact Achieva immediately if you anticipate difficulty making a payment to explore options.