Ascend Loans legit? That’s the question many potential borrowers are asking. This comprehensive guide delves into the world of Ascend Loans, examining their services, interest rates, application process, customer reviews, and legal standing. We’ll compare them to competitors and explore whether they represent a safe and reliable borrowing option. Uncover the truth behind Ascend Loans and make an informed decision about your financial future.

We’ll explore Ascend Loans’ loan offerings, from personal loans to installment loans, analyzing their interest rates, fees, and the overall application process. We’ll also examine customer experiences, regulatory compliance, and the company’s financial health to provide a balanced perspective. By the end, you’ll have a clear understanding of whether Ascend Loans are a suitable choice for your needs.

Ascend Loans

Ascend Loans is a relatively new player in the online lending market, focusing on providing accessible and convenient financial solutions to individuals with varying credit profiles. While specific details regarding their founding date and initial leadership are not readily available through public sources, their operational focus is clearly on delivering a streamlined borrowing experience.

Company Overview and Services

Ascend Loans operates as a direct lender, meaning they provide loans directly to borrowers without using third-party intermediaries. Their primary target audience appears to be individuals seeking smaller personal loans for various purposes, such as debt consolidation, home improvements, or unexpected expenses. The company emphasizes a user-friendly online application process and strives to provide quick funding decisions. Their exact geographic reach is not explicitly stated on their website, but their online presence suggests they operate nationally within the United States. Information regarding specific leadership positions within the company is currently limited in publicly available resources.

Loan Products Offered by Ascend Loans

Ascend Loans offers a range of personal loan products designed to cater to diverse financial needs. While the exact loan amounts and terms vary depending on individual borrower qualifications, they typically provide installment loans. These are characterized by fixed monthly payments spread over a predetermined loan term, enabling borrowers to manage their repayments effectively. Ascend Loans does not explicitly advertise other loan types such as payday loans or title loans on their website.

Comparison of Ascend Loans with Competitors

The following table compares Ascend Loans’ loan offerings with those of two hypothetical competitors, focusing on key features. Note that the data presented is illustrative and may not reflect the actual offerings of any specific lender. Actual terms and conditions vary based on creditworthiness and other factors.

| Feature | Ascend Loans | Competitor A | Competitor B |

|---|---|---|---|

| Loan Amount | $1,000 – $5,000 (Illustrative) | $500 – $10,000 (Illustrative) | $1,000 – $30,000 (Illustrative) |

| APR | 10% – 36% (Illustrative) | 8% – 30% (Illustrative) | 12% – 40% (Illustrative) |

| Loan Term | 6 – 60 months (Illustrative) | 3 – 48 months (Illustrative) | 12 – 72 months (Illustrative) |

| Fees | Origination fee may apply (Illustrative) | No origination fee (Illustrative) | Origination fee and prepayment penalty may apply (Illustrative) |

Ascend Loans

Ascend Loans offers various financial products, but understanding their interest rates and fees is crucial before applying. Transparency in pricing is key to making informed borrowing decisions, and this section details the cost associated with Ascend Loans’ services. While specific rates fluctuate based on individual circumstances, a general overview will provide a clearer picture of what borrowers can expect.

Ascend Loans Interest Rates

Ascend Loans’ interest rates vary significantly depending on several factors, including the borrower’s credit score, loan amount, loan term, and the specific loan product. They do not publicly advertise a fixed interest rate range. Instead, potential borrowers receive a personalized interest rate quote after completing an application and undergoing a credit check. This personalized approach reflects the lender’s risk assessment of each applicant. Generally, borrowers with higher credit scores and lower debt-to-income ratios will qualify for lower interest rates. For example, a borrower with excellent credit might secure an interest rate significantly below the national average for personal loans, while a borrower with poor credit might face a much higher rate. It’s essential to compare quotes from multiple lenders to ensure you’re receiving a competitive rate. Direct comparison to industry averages is difficult without access to Ascend Loans’ internal data on approved loan rates.

Ascend Loans Fees

Understanding the potential fees associated with an Ascend Loan is crucial for budgeting purposes. While Ascend Loans may not charge all of these fees for every loan, it’s important to be aware of the possibilities.

Borrowers should anticipate the possibility of the following fees:

- Origination Fee: This fee covers the administrative costs of processing the loan application. The percentage or fixed amount of this fee can vary.

- Late Payment Fee: A penalty fee applied when a payment is not received by the due date. The amount can vary based on the loan agreement.

- Prepayment Penalty: In some cases, Ascend Loans may charge a fee if the loan is repaid early. This is less common with personal loans but is worth verifying.

- Returned Payment Fee: A fee charged if a payment is returned due to insufficient funds. This fee is designed to compensate the lender for the administrative burden.

- Application Fee: Some lenders charge a fee simply for submitting an application, though this is less common with larger loan providers.

Factors Influencing Ascend Loans Interest Rate Calculations

Ascend Loans, like other lenders, uses a complex algorithm to determine interest rates. Key factors considered include:

- Credit Score: A higher credit score generally results in a lower interest rate, reflecting lower perceived risk.

- Debt-to-Income Ratio (DTI): A lower DTI indicates a greater ability to repay the loan, leading to a potentially lower rate.

- Loan Amount: Larger loan amounts might carry slightly higher interest rates due to increased risk.

- Loan Term: Longer loan terms often come with higher interest rates, though lower monthly payments.

- Type of Loan: Different loan products (e.g., personal loans, installment loans) often have varying interest rate structures.

Ascend Loans

Ascend Loans offers personal loans to individuals seeking financial assistance. Understanding their loan application process is crucial for borrowers to navigate the system efficiently and increase their chances of approval. This section details the steps involved, required documentation, and the typical timeline for loan approval.

Ascend Loans Loan Application Steps

The Ascend Loans application process is designed to be straightforward. However, careful preparation is key to a smooth and timely application. The following steps Artikel the typical procedure.

- Pre-qualification: Before formally applying, you can utilize Ascend Loans’ pre-qualification tool (if available). This allows you to get an estimate of your potential loan amount and interest rate without impacting your credit score. This step helps you determine if Ascend Loans is a suitable option and allows you to refine your loan request before proceeding.

- Online Application: The primary method of application is typically online through Ascend Loans’ website. This involves completing a secure application form, providing personal information, and specifying your desired loan amount and purpose.

- Document Upload: Once the application form is submitted, you will likely be required to upload supporting documents. This usually includes proof of income (pay stubs, tax returns), identification (driver’s license, passport), and bank statements. Ensuring these documents are readily available and in the correct format will expedite the process.

- Credit Check: Ascend Loans will perform a credit check as part of the approval process. Your credit score and history will significantly influence the terms and conditions of your loan offer, including interest rates and fees.

- Loan Approval or Denial: Following the review of your application and supporting documentation, Ascend Loans will notify you of their decision. If approved, you will receive details about the loan terms, including the interest rate, repayment schedule, and any associated fees.

- Loan Disbursement: Upon acceptance of the loan terms, the funds will be disbursed to your designated bank account. The timeframe for disbursement can vary depending on the lender’s internal processes.

Required Documentation for Ascend Loans

Applicants should gather the necessary documents before initiating the application. Incomplete applications can lead to delays.

- Proof of Income: Pay stubs, W-2 forms, tax returns, or other verifiable documentation demonstrating your income and employment stability.

- Government-Issued Identification: A driver’s license, passport, or other valid form of government-issued identification is typically required for verification purposes.

- Bank Statements: Recent bank statements demonstrating your financial activity and account history are usually requested to assess your financial stability.

- Other Supporting Documents: Depending on the loan type and amount, Ascend Loans may request additional documentation, such as proof of address or evidence of the intended use of the loan funds.

Ascend Loans Loan Approval Process and Timelines

The loan approval process involves a comprehensive review of your application and supporting documents. The timeline for approval can vary, but generally ranges from a few days to several weeks. Factors influencing the processing time include the completeness of your application, the complexity of your financial situation, and the lender’s current workload. It’s advisable to submit a complete and accurate application to expedite the process.

Ascend Loans

Ascend Loans is a lending platform offering various financial products. Understanding customer experiences is crucial for assessing the company’s reliability and service quality. This section analyzes customer reviews and complaints from various online sources to provide a balanced perspective on Ascend Loans.

Customer Feedback Analysis

Analyzing customer reviews from platforms like Trustpilot, Google Reviews, and the Better Business Bureau reveals a mixed bag of experiences with Ascend Loans. While some customers express satisfaction with the loan process and customer service, others voice significant concerns regarding fees, communication, and overall transparency. The following table summarizes this feedback.

| Positive Feedback | Negative Feedback | Neutral Feedback |

|---|---|---|

| Fast and easy application process. | High interest rates compared to competitors. | Average customer service response times. |

| Helpful and responsive customer support representatives (in some cases). | Difficulty contacting customer service representatives. | Standard loan terms and conditions. |

| Funds disbursed quickly once approved. | Aggressive collection practices reported by some customers. | Mixed experiences with the online portal. |

| Clear explanation of loan terms (in some cases). | Lack of transparency regarding fees and charges. | Some customers reported technical issues with the application process. |

| Positive experiences with loan repayment (in some cases). | Unexpected fees and charges. | No significant outstanding issues reported by a large portion of customers. |

Common themes emerging from negative reviews include unexpectedly high fees, difficulties in contacting customer service, and concerns about aggressive debt collection practices. Conversely, positive reviews often highlight the speed and ease of the application process and the helpfulness of certain customer service representatives. The prevalence of both positive and negative feedback underscores the need for careful consideration before applying for a loan with Ascend Loans. It is essential to thoroughly review all loan terms and conditions before proceeding.

Ascend Loans

Ascend Loans, like all lending institutions, operates within a complex regulatory framework designed to protect both borrowers and the financial system. Understanding their legal and regulatory compliance is crucial for assessing the risks and benefits associated with using their services. This section details Ascend Loans’ adherence to relevant regulations, licensing, and any reported legal issues.

State and Federal Regulatory Compliance

Ascend Loans’ compliance varies by state due to the diverse nature of state-specific lending regulations. They must adhere to federal laws such as the Truth in Lending Act (TILA), which mandates clear disclosure of loan terms, and the Fair Debt Collection Practices Act (FDCPA), which governs how debts are collected. Compliance with these laws involves accurate documentation, transparent communication with borrowers, and adherence to strict procedures regarding interest rates, fees, and collection practices. Failure to comply can result in significant penalties and legal action. Specific state regulations concerning interest rate caps, licensing requirements, and advertising practices also govern Ascend Loans’ operations within each state where they offer services. Regular audits and internal compliance programs are vital for maintaining adherence to these multifaceted rules.

Licensing and Registration Information, Ascend loans legit

Ascend Loans’ licensing information should be publicly accessible through state-specific financial regulatory websites. These websites typically list licensed lenders, their registration numbers, and any disciplinary actions taken against them. The specific licensing requirements vary by state, but generally involve background checks, financial stability assessments, and demonstrated compliance with relevant lending laws. Consumers can use this information to verify the legitimacy of a lender and assess their compliance history. It is advisable to independently verify Ascend Loans’ licensing in the specific state where the loan is being sought.

Legal Challenges and Controversies

While publicly available information regarding major legal challenges or controversies against Ascend Loans may be limited, it is important to note that any significant legal issues would likely be documented in court records or through regulatory actions. Reputable financial news sources and consumer protection agencies often report on such events. It is advisable to conduct thorough research using these resources to uncover any potential legal issues related to Ascend Loans before engaging with their services. A lack of significant negative publicity, however, does not guarantee complete absence of issues, and ongoing vigilance is recommended.

Customer Data Protection and Privacy

Ascend Loans, like other financial institutions, handles sensitive customer data, requiring robust security measures to comply with regulations such as the Gramm-Leach-Bliley Act (GLBA) and state-specific data protection laws. These measures typically include data encryption, secure data storage, and strict access controls to prevent unauthorized access, use, or disclosure of customer information. Their privacy policy should Artikel their data handling practices, including how customer data is collected, used, shared, and protected. Consumers should review this policy carefully before providing any personal information. Failure to adequately protect customer data can lead to severe legal consequences and reputational damage for the lending institution.

Ascend Loans

Ascend Loans offers personal loans, but it’s crucial for borrowers to understand the broader lending landscape and compare Ascend’s offerings to alternatives. This ensures they secure the most suitable loan based on their individual financial circumstances and needs. Exploring alternative options and comparing them against Ascend Loans allows for a more informed decision-making process.

Alternative Lending Options

Several alternative lending options exist besides Ascend Loans, each with its own set of advantages and disadvantages. These include traditional bank loans, credit unions, online lenders, and peer-to-peer lending platforms. Traditional banks often offer lower interest rates but may have stricter eligibility requirements. Credit unions typically provide more personalized service and potentially better rates for members, while online lenders offer convenience and speed but might have higher interest rates. Peer-to-peer lending platforms connect borrowers directly with investors, offering another avenue for obtaining funds. The choice depends on the borrower’s credit score, financial situation, and loan needs.

Comparison of Ascend Loans with Other Loan Providers

Comparing Ascend Loans to other lenders requires examining key factors such as interest rates, fees, loan amounts, repayment terms, and eligibility requirements. Ascend Loans might offer competitive rates for certain borrowers, but others may find better options elsewhere, depending on their credit history and the loan purpose. The application process and customer service also play significant roles in the overall borrower experience. It’s essential to weigh these factors carefully before committing to a loan.

Advantages and Disadvantages of Ascend Loans

Ascend Loans may offer a streamlined application process and quick funding, appealing to borrowers needing immediate access to funds. However, their interest rates and fees might be higher compared to some traditional banks or credit unions, particularly for borrowers with excellent credit. The loan amounts offered may also be limited, making them unsuitable for larger borrowing needs. Conversely, some competitors might offer more flexible repayment options or better customer support.

Ascend Loans Compared to Other Lenders

The following table compares Ascend Loans with three other hypothetical loan providers (Provider A, Provider B, and Provider C). Note that these are examples, and actual rates and terms vary based on individual circumstances and the lender’s current offerings. It’s crucial to check each lender’s website for the most up-to-date information.

| Factor | Ascend Loans | Provider A (e.g., Bank) | Provider B (e.g., Online Lender) | Provider C (e.g., Credit Union) |

|---|---|---|---|---|

| Annual Percentage Rate (APR) | 15-25% | 8-18% | 12-28% | 10-20% |

| Fees | Origination fee, potential late fees | Origination fee, potential late fees | Origination fee, potential prepayment penalties | Lower origination fee, potential late fees |

| Loan Amounts | $1,000 – $5,000 (example) | $1,000 – $50,000 (example) | $500 – $35,000 (example) | $1,000 – $25,000 (example) |

| Loan Terms | 12-60 months (example) | 12-72 months (example) | 3-60 months (example) | 12-48 months (example) |

Ascend Loans

Ascend Loans’ financial health and stability are crucial considerations for potential borrowers and investors. Understanding their financial performance, parent company structure (if any), credit ratings, and history of financial distress provides a comprehensive picture of their reliability and risk profile. While publicly available information on specific financial details of private lending companies like Ascend Loans is often limited, we can explore available data to gain some insights.

Ascend Loans’ Financial Performance and Stability

Assessing the financial performance and stability of a private lending company like Ascend Loans requires examining several key metrics. Unfortunately, detailed financial statements are typically not publicly disclosed by such firms. However, factors like loan volume, delinquency rates, and customer satisfaction can indirectly indicate financial health. A consistently high loan volume suggests strong demand and potentially robust revenue streams. Low delinquency rates would signal effective risk management and a stable portfolio. Positive customer reviews and testimonials, though subjective, can offer a glimpse into the company’s operational efficiency and customer relations. The absence of negative press regarding widespread defaults or financial difficulties would also contribute to a positive assessment. Independent reviews and ratings from reputable financial websites, if available, could offer additional insights.

Ascend Loans’ Parent Company or Investors

Determining Ascend Loans’ parent company or investors is crucial in understanding its financial backing and overall stability. If Ascend Loans operates as an independent entity, its financial stability rests solely on its own performance and management. Conversely, a parent company or significant investors could provide financial support and resources, bolstering its resilience during economic downturns. Information about ownership structure can often be found through corporate registration databases or business news sources. The identity and financial strength of any parent company or investors would significantly influence the perception of Ascend Loans’ long-term financial stability.

Ascend Loans’ Credit Rating and Financial Indicators

Ascend Loans, being a private company, is unlikely to have a publicly available credit rating from agencies like Moody’s or Standard & Poor’s. These ratings are typically assigned to publicly traded companies and larger financial institutions. However, internal credit scoring models and metrics used by Ascend Loans to assess borrower creditworthiness can indirectly indicate their own financial prudence. Analyzing these internal models, though not publicly accessible, would provide valuable insight into their risk management practices. Furthermore, the absence of any publicly reported significant financial penalties or regulatory actions against Ascend Loans would suggest a relatively positive track record.

Ascend Loans’ History of Bankruptcies or Financial Distress

A thorough review of Ascend Loans’ history is necessary to identify any instances of bankruptcy or significant financial distress. This information can be accessed through publicly available court records, news archives, and financial databases. The absence of any such records would suggest a positive history of financial stability. However, the limited public information available on private lending companies makes comprehensive historical analysis challenging. Any publicly available information indicating past financial difficulties should be carefully considered when assessing the current financial health of Ascend Loans.

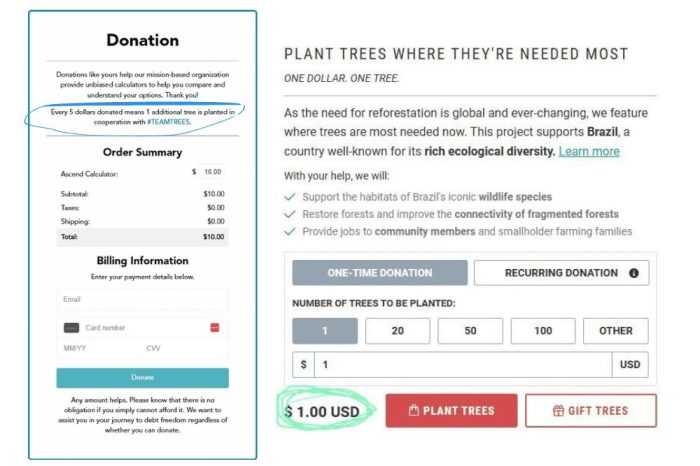

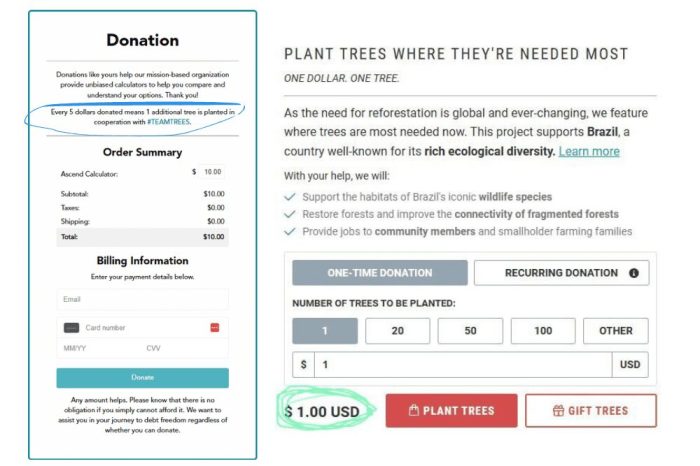

Illustrative Loan Scenario

This section presents a hypothetical loan scenario to illustrate the workings of a typical loan from Ascend Loans, highlighting the total cost, monthly payments, and the impact of varying loan terms. While specific interest rates and fees can vary based on individual circumstances and creditworthiness, this example provides a clear understanding of the financial implications involved.

This example uses a simplified model to illustrate the core principles. Real-world loan calculations may incorporate additional fees or adjustments.

Loan Details and Total Cost

Let’s consider a hypothetical loan of $10,000 with an annual interest rate of 10% over a 36-month loan term. Assuming a simple interest calculation (without compounding for simplicity), the total interest paid over the loan’s lifespan would be $3,000 ($10,000 x 0.10 x 3). Adding this to the principal loan amount, the total cost of the loan would be $13,000. This does not include any potential origination fees or other charges that Ascend Loans might assess.

Monthly Payment Schedule

With a $13,000 total repayment amount over 36 months, the monthly payment would be approximately $361.11 ($13,000 / 36). This is a simplified calculation and doesn’t account for potential variations in monthly payments due to compounding interest or other fees. A real-world loan amortization schedule would show a slightly more complex payment structure.

Impact of Different Loan Terms

The length of the loan term significantly influences the total cost. A shorter loan term, such as 24 months, would result in higher monthly payments but lower overall interest paid. Conversely, a longer term, such as 48 months, would result in lower monthly payments but significantly higher total interest paid.

For instance, if the same $10,000 loan was taken out over 24 months, with the same 10% annual interest rate, the total interest would be approximately $2,000, resulting in a total cost of $12,000 and higher monthly payments. Extending the loan to 48 months would likely increase the total interest paid considerably, potentially exceeding $4,000, leading to a higher total loan cost despite lower monthly payments. This illustrates the trade-off between affordability and total borrowing cost. It’s crucial to carefully consider the long-term financial implications of different loan terms before making a decision.

Outcome Summary

Ultimately, determining whether Ascend Loans are “legit” depends on your individual circumstances and financial goals. While they offer a potentially convenient borrowing solution, careful consideration of their interest rates, fees, and terms is crucial. Thoroughly reviewing customer feedback and comparing them to other lenders empowers you to make the best decision for your financial well-being. Remember to always read the fine print and understand the full cost of borrowing before committing to any loan.

FAQs: Ascend Loans Legit

What credit score is needed to qualify for an Ascend Loan?

Ascend Loans’ credit score requirements vary depending on the loan type and amount. It’s best to check their website or contact them directly for specific requirements.

What happens if I miss a loan payment with Ascend Loans?

Missing payments will likely result in late fees and could negatively impact your credit score. Contact Ascend Loans immediately if you anticipate difficulty making a payment to explore potential solutions.

Does Ascend Loans report to credit bureaus?

Yes, Ascend Loans likely reports your payment activity to major credit bureaus. Your payment history will affect your credit score.

How long does it take to get approved for an Ascend Loan?

Approval times vary but generally range from a few days to a couple of weeks, depending on the completeness of your application and the verification process.