Auto Loan Patelco offers a range of financing options for new and used vehicles, as well as refinancing opportunities. Understanding the specifics of Patelco’s auto loans, from interest rates and fees to the application process and loan approval, is crucial for securing the best possible financing terms. This comprehensive guide navigates you through every step, providing insights into eligibility criteria, required documentation, and the overall customer experience. We’ll also compare Patelco’s offerings to those of other major lenders, helping you make an informed decision.

Whether you’re a first-time buyer or looking to refinance your existing auto loan, this detailed exploration of Patelco Credit Union’s auto loan program will empower you to make confident financial choices. We’ll cover everything from understanding the factors influencing interest rates to navigating the loan application process and managing your loan account effectively. Our aim is to provide a clear and concise resource that equips you with the knowledge needed to secure a favorable auto loan.

Patelco Credit Union Auto Loan Overview

Patelco Credit Union offers a range of auto loan options designed to meet the diverse financial needs of its members. They provide competitive interest rates and flexible terms, making it a viable choice for individuals seeking to finance a new or used vehicle, or refinance an existing auto loan. Understanding the specifics of their offerings is crucial for making an informed decision.

Patelco Auto Loan Offerings

Patelco Credit Union provides three primary types of auto loans: new car loans, used car loans, and auto loan refinancing. New car loans are designed for the purchase of brand-new vehicles directly from dealerships. Used car loans cater to those buying pre-owned vehicles from private sellers or dealerships. Auto loan refinancing allows members to potentially lower their interest rate and monthly payments by consolidating their existing auto loan with Patelco. Each loan type comes with its own set of terms and conditions, which are subject to change. It’s always recommended to check the latest rates and terms directly with Patelco.

Patelco Auto Loan Eligibility Criteria

Eligibility for a Patelco auto loan depends on several factors. Generally, applicants must be a member of Patelco Credit Union, maintain a satisfactory credit history, and meet certain income requirements. The specific requirements may vary based on the loan type and the applicant’s individual financial situation. Providing accurate and complete information during the application process is crucial for a smooth and efficient approval process. Patelco will assess each application individually, considering factors such as credit score, debt-to-income ratio, and the vehicle’s value.

Patelco Auto Loan Terms, Rates, and Fees

The following table provides a sample of potential loan terms, interest rates, and fees. It is important to note that these are examples only and actual rates and fees may vary depending on several factors including creditworthiness, loan amount, and prevailing market conditions. It is crucial to contact Patelco directly for the most up-to-date information and a personalized quote.

| Loan Amount | APR | Loan Term (Months) | Estimated Monthly Payment |

|---|---|---|---|

| $20,000 | 4.5% | 60 | $366.88 |

| $30,000 | 5.0% | 72 | $466.05 |

| $40,000 | 5.5% | 84 | $557.64 |

| $15,000 | 4.0% | 48 | $339.34 |

Interest Rates and Fees

Patelco Credit Union’s auto loan interest rates are competitive, but the specific rate offered to an individual borrower depends on several key factors. Understanding these factors allows borrowers to optimize their application and potentially secure a lower rate. This section details the factors influencing interest rates, the calculation of monthly payments, and any additional fees associated with Patelco auto loans.

Patelco’s auto loan interest rates are determined by a complex interplay of variables reflecting both the borrower’s creditworthiness and prevailing market conditions. The credit score is a primary determinant, with higher scores generally leading to lower rates. The loan term also plays a significant role; longer loan terms typically result in higher interest rates due to increased risk for the lender. The loan-to-value ratio (LTV), which compares the loan amount to the vehicle’s value, is another critical factor. A lower LTV, indicating a larger down payment, often results in a lower interest rate. Finally, prevailing interest rates in the broader financial market influence Patelco’s rates, reflecting the overall cost of borrowing. For example, during periods of higher overall interest rates, Patelco’s auto loan rates may also increase.

Monthly Payment Calculation

Patelco calculates monthly payments using a standard amortization formula that considers the loan amount, interest rate, and loan term. This formula distributes the loan’s principal and interest over the loan’s life, resulting in consistent monthly payments. The exact calculation is complex, but it’s essentially a mathematical equation that determines the fixed payment amount required to repay the loan in full by the end of the term. For example, a $20,000 loan at 5% interest over 60 months will have a different monthly payment than a $20,000 loan at 7% interest over 48 months. Borrowers can use online calculators or contact Patelco directly to determine their estimated monthly payment based on their specific loan details.

Additional Fees

Several additional fees may be associated with a Patelco auto loan. Understanding these fees is crucial for accurately budgeting the total cost of borrowing. While Patelco strives for transparency, it’s essential to review the loan documents carefully to understand all applicable charges.

- Application Fee: Patelco may charge a fee for processing the loan application. This fee covers the administrative costs associated with reviewing the application and verifying the borrower’s information. The exact amount of the application fee, if any, should be clearly stated in the loan documents.

- Prepayment Penalty: Patelco’s loan agreement may or may not include a prepayment penalty. A prepayment penalty is a fee charged if the borrower repays the loan in full before the scheduled maturity date. This penalty compensates the lender for lost interest income. The existence and amount of any prepayment penalty will be clearly Artikeld in the loan contract.

- Late Payment Fee: Late payments may incur a fee. This fee helps compensate Patelco for the additional administrative burden of managing overdue payments. The specific amount of the late payment fee will be detailed in the loan agreement.

- Returned Check Fee: If a payment is returned due to insufficient funds, a returned check fee will likely apply. This fee covers the bank charges associated with processing the returned payment.

Application Process and Requirements: Auto Loan Patelco

Applying for a Patelco auto loan involves a straightforward process designed for efficiency and transparency. The application itself can be completed online, making it convenient for members to manage their application at their own pace. Successful applicants will need to meet certain credit and financial requirements to be approved.

- Online Application Submission: Begin by completing the online auto loan application through the Patelco Credit Union website or mobile app. This involves providing basic personal information, details about the vehicle you intend to purchase, and your desired loan amount and term.

- Document Upload: After submitting the application, you will be prompted to upload supporting documents. This typically includes proof of income (pay stubs, tax returns, or bank statements), proof of residence (utility bill or lease agreement), and the vehicle’s information (VIN number, sales contract).

- Credit Check: Patelco will conduct a credit check to assess your creditworthiness. This involves reviewing your credit history, including payment patterns, credit utilization, and any outstanding debts. The specific credit scoring model used may vary, but a higher credit score generally increases the likelihood of approval and may result in a more favorable interest rate.

- Loan Approval and Rate Determination: Based on the information provided and the credit check results, Patelco will review your application and determine loan eligibility. If approved, you will be notified of the loan terms, including the interest rate, monthly payment amount, and loan duration. The interest rate offered will depend on several factors, including your credit score, the loan amount, and the loan term.

- Loan Closing and Funding: Once you accept the loan terms, the final loan documents will be prepared. After signing the documents, the loan proceeds will be disbursed, typically directly to the car dealership or to you if you are purchasing a vehicle privately.

Required Documents

Gathering the necessary documents beforehand streamlines the application process. Having these readily available will significantly expedite the loan approval timeline. Incomplete applications may require additional time for processing.

- Proof of Income: Recent pay stubs (typically from the last two months), W-2 forms, or tax returns are usually required to demonstrate your ability to repay the loan. Self-employed individuals may need to provide additional documentation, such as profit and loss statements.

- Proof of Residence: A utility bill (gas, electric, water) or a copy of your lease agreement can verify your current address.

- Vehicle Information: The Vehicle Identification Number (VIN), make, model, year, and mileage of the vehicle are crucial for the loan appraisal process.

- Sales Contract: A copy of the sales contract from the dealership or the seller is essential to finalize the loan.

- Government-Issued Photo Identification: A valid driver’s license or passport is required for verification purposes.

Credit Check Process

Patelco utilizes a standard credit check process to assess the applicant’s creditworthiness. This involves obtaining a credit report from one or more major credit bureaus (such as Equifax, Experian, and TransUnion). The report details the applicant’s credit history, including past loans, credit card usage, and any instances of late or missed payments. This information helps determine the applicant’s credit score, which plays a significant role in determining the interest rate and loan approval. A higher credit score generally indicates lower risk to the lender and often results in more favorable loan terms. Patelco will review the credit report to assess the applicant’s repayment history and overall credit profile to make an informed lending decision. It’s important to note that a credit check is a standard procedure for most auto loans and does not necessarily impact your credit score negatively if you are only inquiring or applying for a loan.

Loan Approval and Funding

Securing an auto loan involves a multi-step process culminating in loan approval and subsequent funding. Understanding the factors influencing approval, the typical timeline, and available funding methods is crucial for a smooth and efficient experience. This section details the Patelco Credit Union auto loan approval and funding process.

Factors Influencing Loan Approval

Patelco Credit Union assesses several key factors to determine loan eligibility. These include credit score, debt-to-income ratio (DTI), income stability, employment history, and the vehicle’s condition and value. A higher credit score generally leads to more favorable interest rates and terms. A lower DTI, indicating a manageable debt load, also improves approval chances. Stable employment and a positive employment history demonstrate the applicant’s ability to repay the loan. Finally, the vehicle’s value and condition influence the loan amount and terms. Applicants with excellent credit, low DTI, stable income, and a desirable vehicle will typically experience a quicker and smoother approval process.

Loan Approval and Funding Timeline

The time it takes to receive loan approval and funding varies depending on the completeness of the application and the applicant’s financial profile. While Patelco strives for efficiency, the process generally takes between a few days to several weeks. A complete and accurate application, submitted with all necessary documentation, accelerates the process. Following application submission, Patelco reviews the application, verifies information, and assesses the applicant’s creditworthiness. Upon approval, funding is typically disbursed within a few business days. Delays may occur if additional documentation is required or if there are discrepancies in the information provided.

Funding Methods

Patelco Credit Union offers several methods for disbursing approved auto loan funds. The most common method is direct deposit into the borrower’s designated bank account. This is generally the fastest and most convenient option. In some cases, funds may be disbursed via check, mailed to the borrower’s address. The choice of funding method is often determined by the borrower’s preference and the specific circumstances of the loan. Patelco will usually Artikel the available funding options during the loan approval process.

Loan Approval Process Flowchart

The following describes a simplified visual representation of the loan approval process.

Imagine a flowchart with the following boxes and connecting arrows:

Box 1: Application Submission (Applicant submits the loan application and required documents).

Arrow 1: Leads to Box 2.

Box 2: Application Review (Patelco reviews the application for completeness and accuracy).

Arrow 2: Leads to Box 3 (if complete and accurate) or Box 4 (if incomplete or inaccurate).

Box 3: Credit and Financial Assessment (Patelco assesses the applicant’s credit score, DTI, income, and employment history).

Arrow 3: Leads to Box 5 (if approved) or Box 6 (if denied).

Box 4: Request for Additional Information (Patelco requests additional documents or clarification from the applicant).

Arrow 4: Leads back to Box 2.

Box 5: Loan Approval and Funding (Patelco approves the loan and disburses funds via the chosen method).

Arrow 5: Leads to the end of the process.

Box 6: Loan Denial (Patelco denies the loan application, potentially providing reasons for denial).

Arrow 6: Leads to the end of the process.

Customer Reviews and Experiences

Patelco Credit Union’s auto loan services receive a mixed bag of reviews, reflecting both positive and negative experiences from borrowers. Understanding these diverse perspectives offers valuable insight into the strengths and weaknesses of Patelco’s offerings. Analyzing customer feedback helps potential borrowers make informed decisions and allows Patelco to identify areas for improvement.

Customer testimonials highlight both the efficiency and the occasional frustrations encountered during the auto loan process. Positive reviews often emphasize the competitive interest rates, streamlined application process, and helpful customer service representatives. Conversely, negative feedback sometimes points to difficulties in communication, extended processing times, and challenges in resolving specific issues.

Positive Customer Testimonials

Positive customer experiences with Patelco auto loans frequently center around favorable interest rates and a generally smooth application process. Many borrowers appreciate the convenience and efficiency of online applications and the clear communication received from loan officers.

“I was very impressed with the speed and efficiency of the entire process. From application to funding, it was seamless. The interest rate was also very competitive.” – John D., San Jose, CA

“The Patelco loan officer I worked with was extremely helpful and patient, answering all my questions thoroughly. I felt well-informed throughout the entire process.” – Maria R., Sacramento, CA

Negative Customer Testimonials and Common Complaints

While many customers report positive experiences, some negative reviews highlight areas where Patelco could improve. Common complaints include delays in loan processing, difficulties reaching customer service representatives, and occasional inconsistencies in communication regarding loan terms and conditions.

“The application process took longer than I expected, and communication was inconsistent. I had to call multiple times to get updates on the status of my loan.” – David L., Oakland, CA

“I experienced some difficulty reaching a customer service representative to answer my questions. The wait times on the phone were quite long.” – Sarah M., San Francisco, CA

Patelco’s Response to Customer Concerns

Patelco acknowledges customer feedback and actively works to address concerns. They typically respond to negative reviews by attempting to resolve individual issues directly with the customer and by implementing improvements to their processes. This might involve streamlining the application process, improving communication channels, and providing additional training for customer service representatives. Patelco’s commitment to addressing customer feedback demonstrates their dedication to enhancing the overall borrowing experience. While specific instances of complaint resolution aren’t publicly available in detail, their proactive engagement with online reviews suggests a commitment to customer satisfaction.

Comparison with Other Lenders

Choosing the right auto loan lender involves careful consideration of interest rates, loan terms, fees, and overall customer service. Patelco Credit Union offers competitive auto loan options, but it’s crucial to compare its offerings with those of other major lenders to make an informed decision. This section analyzes Patelco’s auto loan features against those of prominent competitors, highlighting advantages and disadvantages.

Patelco’s competitive edge often lies in its member-centric approach and potential for lower rates for credit union members. However, other lenders may offer more flexible terms or a broader range of loan products. A direct comparison helps clarify which lender best suits individual financial needs and circumstances.

Patelco Auto Loan Compared to Other Lenders

The following table provides a comparison of Patelco’s auto loan rates and terms with those of three other major lenders. Note that these rates are subject to change and are based on average estimates as of October 26, 2023. It’s essential to check with each lender directly for the most up-to-date information specific to your creditworthiness and loan amount.

| Lender Name | APR (Approximate) | Loan Term Options (Years) | Fees (Approximate) |

|---|---|---|---|

| Patelco Credit Union | 4.5% – 12% (varies based on credit score and loan amount) | 24-72 months | $0 – $100 (varies based on loan amount and type) |

| Bank of America | 5% – 14% (varies based on credit score and loan amount) | 24-84 months | $0 – $200 (varies based on loan amount and type) |

| Capital One Auto Navigator | 6% – 18% (varies based on credit score and loan amount) | 24-72 months | $0 – $200 (varies based on loan amount and type) |

| Chase Auto | 5.5% – 15% (varies based on credit score and loan amount) | 36-72 months | $0 – $150 (varies based on loan amount and type) |

Advantages and Disadvantages of Choosing Patelco

Patelco Credit Union, as a member-owned institution, often offers advantages in terms of potentially lower interest rates and personalized service for its members. However, it may have a more limited range of loan products compared to larger national banks. The potential disadvantage is a more restricted geographic reach, meaning that only individuals within Patelco’s service area can access their services. Conversely, national banks offer broader accessibility but might not provide the same level of personalized service or potentially lower rates.

Key Differentiators of Patelco’s Auto Loan Services, Auto loan patelco

Patelco’s key differentiator often centers on its focus on member relationships and potentially lower rates for its members. They may offer personalized financial guidance and a more streamlined application process. However, the availability of these benefits hinges on membership eligibility. The absence of extensive online tools or a broad array of loan products could be perceived as disadvantages for some borrowers, compared to the larger banks that provide greater convenience and options. For example, some customers might prefer a fully digital application process, a feature that might be less developed at smaller credit unions like Patelco.

Managing Your Patelco Auto Loan

Efficiently managing your Patelco auto loan ensures timely payments, avoids late fees, and maintains a positive credit history. Understanding the various payment methods, account access options, and processes for loan modifications is crucial for a smooth loan experience.

Loan Payment Methods

Patelco offers several convenient ways to make your auto loan payments. These options provide flexibility to suit your personal preferences and schedule. You can choose the method that best fits your needs.

- Online Payments: Patelco’s online banking platform allows for quick and secure loan payments. You can schedule recurring payments or make one-time payments directly from your linked bank account or debit card. This method often provides confirmation immediately.

- In-Person Payments: Payments can be made in person at any Patelco branch during their operating hours. You’ll need to bring your payment information, such as your loan number and the amount you wish to pay.

- Mail Payments: Patelco accepts payments sent via mail. Be sure to include your loan number and account information with your check or money order. Allow sufficient time for the payment to process; mail delivery times can vary.

- Automated Clearing House (ACH) Payments: Set up automatic payments from your checking or savings account. This ensures on-time payments without manual intervention.

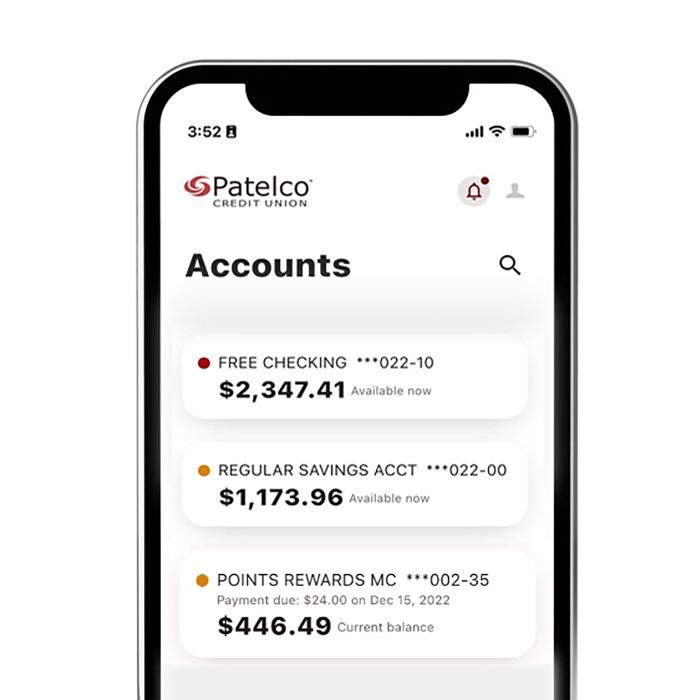

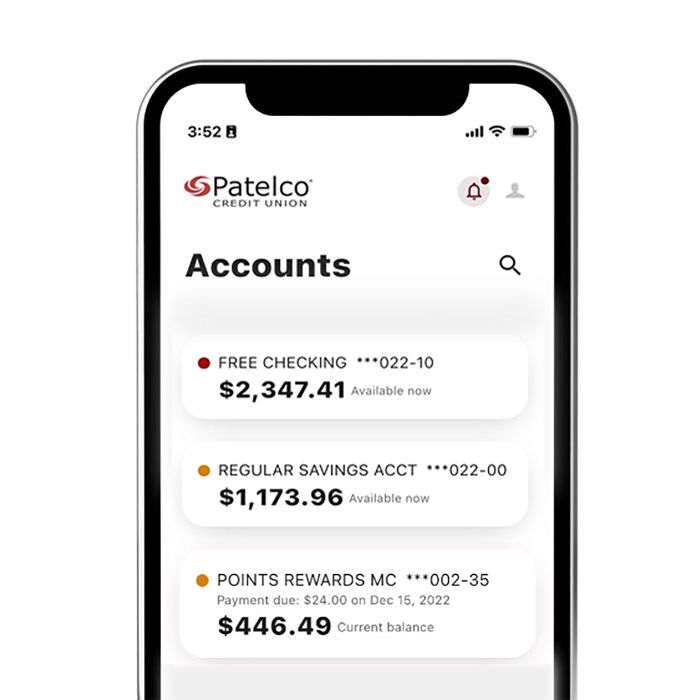

Accessing Loan Account Information Online

Patelco’s online banking portal provides convenient access to your auto loan account details. You can view your current balance, payment history, and upcoming payment due dates. This online access empowers you to monitor your loan progress actively.

To access your account information, log in to the Patelco website using your online banking credentials. Navigate to the “Loans” section of your account dashboard. Your auto loan information, including payment history and current balance, will be displayed clearly. Many users find this method more convenient than calling customer service.

Refinancing or Modifying Loan Terms

Patelco may offer options to refinance your auto loan or modify your existing loan terms. This could involve changing your loan’s interest rate, payment amount, or loan term length. Contacting Patelco directly is essential to explore these possibilities and determine eligibility.

Refinancing might be beneficial if interest rates have dropped since you initially secured your loan. Modifying loan terms could help you manage your monthly budget more effectively. Eligibility for refinancing or modification depends on factors such as your credit score and financial situation. Patelco’s loan specialists can assess your individual circumstances and advise you on the best course of action.

Contacting Patelco Customer Service

Patelco provides various channels for contacting customer service for assistance with your auto loan. Whether you have questions, need to report an issue, or require assistance with your account, these options ensure prompt support.

You can contact Patelco customer service via phone, email, or by visiting a branch in person. Their website typically provides contact information, including phone numbers and email addresses, for different departments. They also often offer online chat support for immediate assistance with common inquiries. For complex issues or those requiring detailed explanation, a phone call may be the most efficient method.

End of Discussion

Securing an auto loan can feel overwhelming, but with a thorough understanding of Patelco Credit Union’s offerings and the broader auto loan landscape, the process becomes significantly more manageable. This guide has provided a detailed overview of Patelco’s auto loan options, including interest rates, fees, application procedures, and customer experiences. By comparing Patelco to other lenders and understanding the various factors influencing loan approval, you can confidently navigate the process and secure the best financing terms to suit your needs. Remember to carefully review all terms and conditions before committing to a loan.

Query Resolution

What credit score is needed for a Patelco auto loan?

While Patelco doesn’t publicly state a minimum credit score, a higher score generally improves your chances of approval and secures better interest rates.

Can I pre-qualify for a Patelco auto loan online?

Patelco’s website may offer pre-qualification tools; check their site for the most up-to-date information.

What happens if I miss a payment on my Patelco auto loan?

Late payments can negatively impact your credit score and may incur late fees. Contact Patelco immediately if you anticipate difficulty making a payment.

How long does it take to get approved for a Patelco auto loan?

The approval process timeframe varies depending on several factors, including your creditworthiness and the completeness of your application. Contact Patelco directly for estimated timelines.