Barksdale Federal Credit Union auto loan rates offer competitive financing options for various vehicles. Understanding these rates, however, requires examining factors like credit score, loan term, and the vehicle’s value. This guide delves into the specifics of Barksdale FCU’s auto loan offerings, comparing them to competitors and helping you determine if it’s the right choice for your next vehicle purchase.

We’ll explore the application process, required documentation, available loan terms, associated fees, and eligibility criteria. By comparing Barksdale FCU’s rates and terms to other financial institutions, we aim to provide a comprehensive overview to assist you in making an informed decision. We’ll also analyze customer reviews and present illustrative loan scenarios to further clarify the process and potential costs.

Barksdale Federal Credit Union Auto Loan Overview

Barksdale Federal Credit Union (Barksdale FCU) offers a range of auto loan products designed to help members finance their vehicle purchases. These loans are competitive in terms of interest rates and terms, and the application process is designed for convenience and efficiency. Membership eligibility is required to access these services.

Barksdale FCU’s auto loan offerings provide financing for a variety of vehicles, catering to diverse member needs. The credit union strives to make the process straightforward and transparent, enabling members to make informed decisions about their vehicle financing.

Eligible Vehicles

Barksdale FCU typically finances new and used vehicles. This includes cars, trucks, SUVs, and motorcycles. Specific eligibility criteria may vary depending on the vehicle’s age, condition, and overall value. Members should contact Barksdale FCU directly to confirm eligibility for specific vehicle types.

Auto Loan Application Process

The application process for an auto loan at Barksdale FCU can be initiated online, by phone, or in person at a branch location. Applicants will need to provide personal information, employment details, and information about the vehicle being financed. A credit check will be performed as part of the application process. The approval process varies depending on individual circumstances, but Barksdale FCU aims for efficiency and transparency throughout.

Required Documentation

To complete the auto loan application, members will generally need to provide documentation such as a valid driver’s license, proof of income (pay stubs or tax returns), and proof of residence (utility bill or lease agreement). Additionally, information about the vehicle being financed will be required, including the vehicle identification number (VIN), make, model, and year. Barksdale FCU may request additional documentation depending on the specific circumstances of the application. Providing complete and accurate documentation will expedite the loan approval process.

Interest Rates and APR

Understanding Barksdale Federal Credit Union’s (BFCU) auto loan interest rates and annual percentage rates (APRs) is crucial for borrowers seeking competitive financing. This section compares BFCU’s rates to those of other financial institutions, explains the factors influencing rate determination, and provides a sample table illustrating APR variations across different loan terms.

BFCU’s auto loan interest rates are generally competitive with other credit unions and banks, but the precise rate offered depends on several individual factors. Direct comparison requires checking current rates from various lenders, as these fluctuate based on market conditions and the lender’s own lending policies. While BFCU may offer attractive rates for members with strong credit profiles, borrowers should always compare offers from multiple sources before making a decision.

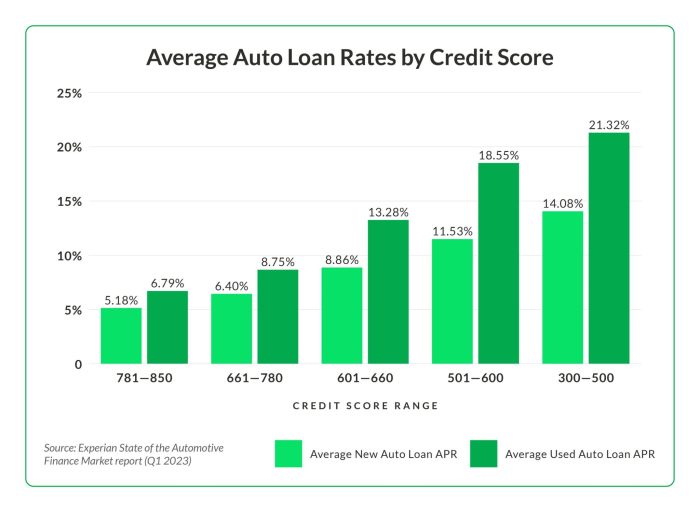

Factors Influencing Auto Loan Interest Rates

Several key factors influence the interest rate a borrower receives on an auto loan. These factors are often used in a complex algorithm by lenders to assess risk and determine the appropriate rate. A higher risk profile generally results in a higher interest rate.

| Factor | Impact on Interest Rate | Example |

|---|---|---|

| Credit Score | Higher credit scores typically result in lower interest rates, reflecting lower perceived risk. | A borrower with a credit score of 750 might qualify for a rate of 4%, while a borrower with a score of 600 might receive a rate of 8%. |

| Loan Term | Longer loan terms generally come with higher interest rates due to increased risk for the lender over a longer repayment period. | A 60-month loan might have a higher APR than a 24-month loan, even with the same credit score. |

| Vehicle Type | The type of vehicle being financed can affect the interest rate. Newer vehicles with higher resale value may result in lower rates. | A loan for a new car might have a lower rate than a loan for a used car of the same value. |

Sample APRs for Different Loan Terms

The following table presents example APRs for various loan terms. These are illustrative examples only and should not be considered as guaranteed rates from BFCU or any other lender. Actual rates will vary depending on the factors mentioned above.

| Loan Term (Months) | Example APR (Credit Score 750+) | Example APR (Credit Score 650-749) | Example APR (Credit Score Below 650) |

|---|---|---|---|

| 24 | 4.5% | 6.0% | 8.5% |

| 36 | 5.0% | 6.5% | 9.0% |

| 48 | 5.5% | 7.0% | 9.5% |

| 60 | 6.0% | 7.5% | 10.0% |

Loan Terms and Repayment Options

Choosing the right loan term and repayment option is crucial for managing your Barksdale Federal Credit Union auto loan effectively. The length of your loan significantly impacts your monthly payment amount and the total interest you pay over the life of the loan. Understanding the available options allows you to select a plan that aligns with your budget and financial goals.

Barksdale Federal Credit Union typically offers a range of loan terms for auto loans, allowing borrowers flexibility in structuring their repayments. These terms usually include options such as 24, 36, 48, and 60-month terms. Repayment options may include monthly installments, which are the most common, and potentially bi-weekly payments, offering the possibility of faster loan payoff. It’s important to note that specific terms and repayment options may vary depending on the applicant’s creditworthiness and the type of vehicle being financed. Contact Barksdale Federal Credit Union directly for the most up-to-date information on available options.

Loan Term Advantages and Disadvantages

The selection of a loan term involves a trade-off between lower monthly payments and the total interest paid. Shorter loan terms result in higher monthly payments but lower overall interest costs, while longer terms offer lower monthly payments but lead to higher total interest charges. The following bullet points Artikel these considerations:

- 24-Month Loan:

- Advantages: Lowest total interest paid, quickest payoff, builds credit rapidly.

- Disadvantages: Highest monthly payment, may strain budget.

- 36-Month Loan:

- Advantages: Moderate monthly payment, relatively quick payoff.

- Disadvantages: Higher total interest than 24-month loan.

- 48-Month Loan:

- Advantages: Lower monthly payment than shorter terms.

- Disadvantages: Higher total interest paid than shorter terms.

- 60-Month Loan:

- Advantages: Lowest monthly payment.

- Disadvantages: Highest total interest paid, longer commitment.

Repayment Option Details

While monthly payments are the standard, some lenders, including Barksdale Federal Credit Union, may offer bi-weekly payment options. This involves making half of the monthly payment every two weeks. This strategy can lead to faster loan payoff due to the equivalent of an extra monthly payment each year. However, it requires careful budgeting to ensure consistent bi-weekly payments. The credit union’s representatives can provide specific details on the availability and implications of bi-weekly payments.

Fees and Charges Associated with Barksdale FCU Auto Loans

Understanding the fees associated with your Barksdale Federal Credit Union auto loan is crucial for budgeting and ensuring financial transparency. While Barksdale FCU strives for competitive rates, additional charges can impact the overall cost of your loan. This section details the potential fees you may encounter. It’s always advisable to confirm the most up-to-date fee schedule directly with Barksdale FCU before finalizing your loan application.

Application Fees

Barksdale Federal Credit Union generally does not charge an application fee for auto loans. This means the process of submitting your application and having it reviewed does not incur an upfront cost. However, it’s important to verify this directly with the credit union as policies can change.

Origination Fees

Barksdale FCU typically does not charge origination fees for auto loans. Origination fees are administrative charges covering the costs associated with processing your loan application. The absence of this fee can significantly reduce the overall cost of borrowing. Again, confirming this directly with the credit union is recommended for the most accurate information.

Prepayment Penalties

Barksdale FCU’s policy on prepayment penalties for auto loans is generally to not charge them. This means you can pay off your loan early without incurring additional fees. This flexibility can be beneficial if your financial situation improves unexpectedly, allowing you to reduce interest payments and save money. However, it is vital to confirm this directly with Barksdale FCU as their policies may be subject to change. The absence of prepayment penalties demonstrates a commitment to member financial well-being.

Eligibility Criteria and Requirements

Securing a Barksdale Federal Credit Union auto loan hinges on meeting specific eligibility criteria. These requirements are designed to assess your creditworthiness and ensure responsible lending practices. Understanding these requirements will help you determine your eligibility and prepare a successful application.

Applicants should carefully review the following requirements to understand the process and increase their chances of approval. Failure to meet these criteria may result in loan application denial.

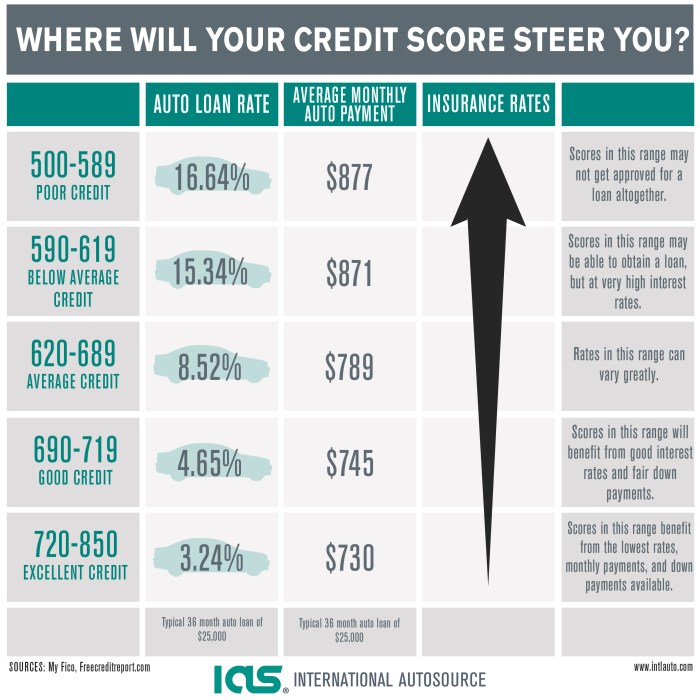

Minimum Credit Score Requirements, Barksdale federal credit union auto loan rates

While Barksdale Federal Credit Union doesn’t publicly state a minimum credit score, approval is more likely with a higher score. Generally, a credit score above 650 is considered good and significantly increases your chances of securing favorable loan terms, including a lower interest rate. Scores below 600 may make approval difficult, potentially requiring a larger down payment or a higher interest rate to compensate for the perceived higher risk. Individuals with lower credit scores may want to explore credit-building strategies before applying for an auto loan.

Income Verification Procedures and Requirements

Barksdale Federal Credit Union will verify your income to ensure you can comfortably afford the monthly loan payments. This typically involves providing documentation such as pay stubs, W-2 forms, tax returns, or bank statements showing consistent income for the past several months. Self-employed individuals may need to provide additional documentation, such as profit and loss statements or tax returns demonstrating consistent income. The goal is to demonstrate a stable income stream sufficient to cover the loan payments alongside your other financial obligations.

Process for Individuals with Less-Than-Perfect Credit History

Individuals with less-than-perfect credit histories are not automatically excluded from consideration. Barksdale Federal Credit Union may still approve loans for applicants with lower credit scores, but the terms may be less favorable. This could involve a higher interest rate, a larger down payment, or a shorter loan term. Applicants with less-than-perfect credit are encouraged to improve their credit scores before applying. Strategies to improve credit scores include paying bills on time, reducing credit utilization, and disputing any inaccurate information on credit reports. Providing additional collateral, such as a co-signer with good credit, can also strengthen an application. Applicants with less-than-perfect credit should be prepared to provide detailed financial information and demonstrate a clear plan for managing the loan responsibly.

Comparison with Other Credit Unions/Banks

Choosing the right auto loan requires careful consideration of interest rates, terms, and fees offered by various financial institutions. This section compares Barksdale FCU’s auto loan offerings with those of two other major financial institutions to help you make an informed decision. The comparison focuses on key aspects that significantly impact the overall cost and convenience of your auto loan.

Direct comparison of auto loan rates and terms across different financial institutions can be challenging due to the dynamic nature of interest rates and the varying criteria used for loan approvals. Rates are subject to change based on market conditions, creditworthiness of the borrower, and the type of vehicle being financed. Therefore, the following comparison uses hypothetical examples based on average rates and terms observed at the time of writing. It is crucial to contact the respective institutions for the most up-to-date information before making a final decision.

Auto Loan Rate and Term Comparison

The table below illustrates a hypothetical comparison of auto loan offers from Barksdale FCU, Navy Federal Credit Union, and a major national bank (e.g., Bank of America). Remember that these are illustrative examples and actual rates and terms may vary.

| Institution | APR (Example) | Loan Term (Example) | Additional Fees (Example) |

|---|---|---|---|

| Barksdale FCU | 4.5% | 60 months | $50 origination fee |

| Navy Federal Credit Union | 4.9% | 72 months | $0 origination fee |

| Bank of America | 5.5% | 48 months | $100 origination fee |

Advantages and Disadvantages of Choosing Barksdale FCU

The decision of whether to choose Barksdale FCU over its competitors depends on individual circumstances and priorities. The following points highlight potential advantages and disadvantages.

Advantages: Barksdale FCU, as a credit union, often offers competitive rates and potentially lower fees compared to national banks. Membership requirements might provide access to additional benefits and services. Furthermore, credit unions typically prioritize member satisfaction and offer personalized service. For example, a member might experience quicker loan processing and more flexible repayment options compared to a larger institution.

Disadvantages: Membership requirements may limit eligibility. Barksdale FCU’s service area might be more restricted compared to national banks, which have a wider branch network. The range of loan products and services offered by a larger bank might be more extensive.

Customer Reviews and Experiences

Understanding customer feedback is crucial for assessing the overall quality of Barksdale FCU’s auto loan services. Analyzing reviews from various online platforms provides valuable insights into customer satisfaction levels and identifies areas for potential improvement. This section summarizes both positive and negative experiences reported by Barksdale FCU auto loan customers.

Customer reviews regarding Barksdale FCU auto loans reveal a mixed bag of experiences. While many praise the credit union’s competitive interest rates and straightforward application process, others express concerns about customer service responsiveness and the clarity of loan terms. Analyzing these reviews allows for a comprehensive understanding of customer perceptions and helps identify areas where Barksdale FCU can enhance its services.

Positive Customer Feedback Examples

Positive reviews frequently highlight the competitive interest rates offered by Barksdale FCU. Customers often mention receiving lower APRs compared to other financial institutions, resulting in significant savings over the loan term. Many also commend the relatively smooth and efficient loan application and approval process, describing it as straightforward and easy to navigate. For example, one reviewer stated,

“I was approved quickly and the process was painless. The interest rate was significantly lower than what other banks offered.”

Another common positive comment centers on the helpfulness and professionalism of Barksdale FCU’s loan officers. Reviewers often describe receiving prompt responses to inquiries and feeling supported throughout the loan process.

Negative Customer Feedback Examples

Negative reviews often focus on aspects of customer service. Some customers report experiencing difficulties reaching loan officers or receiving delayed responses to their inquiries. Others express frustration with perceived inconsistencies in communication or a lack of transparency regarding certain loan terms and fees. For example, a negative review might state,

“While the interest rate was good, the communication throughout the process was poor. I had trouble getting answers to my questions.”

Another area of concern highlighted in some negative reviews is the complexity of certain loan documents or the perceived lack of clarity in explaining fees and charges associated with the loan.

Common Themes in Customer Reviews

The following points summarize common themes emerging from customer reviews:

- Competitive Interest Rates: A significant number of reviews praise Barksdale FCU’s competitive interest rates, often cited as a primary reason for choosing them.

- Efficient Application Process: Many positive reviews mention a straightforward and efficient application and approval process.

- Customer Service Responsiveness: This is a point of both praise and criticism. Some reviews highlight helpful and responsive loan officers, while others express frustration with communication delays or difficulties contacting representatives.

- Loan Term Clarity: Several negative reviews mention concerns about the clarity of loan terms and fees.

Illustrative Loan Scenarios: Barksdale Federal Credit Union Auto Loan Rates

Understanding the potential cost of an auto loan is crucial before committing. The following scenarios illustrate how different loan amounts, interest rates, and loan terms impact monthly payments and total interest paid. These are examples only and actual rates and terms may vary based on creditworthiness and other factors. Calculations assume simple interest and do not include any potential fees.

To calculate monthly payments, we’ll use the following formula:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

M = Monthly Payment

P = Principal Loan Amount

i = Monthly Interest Rate (Annual Interest Rate / 12)

n = Number of Months (Loan Term in Years * 12)

Loan Scenario Examples

| Scenario | Loan Amount | Annual Interest Rate | Loan Term (Years) | Monthly Payment | Total Interest Paid |

|---|---|---|---|---|---|

| 1 | $20,000 | 4.5% | 60 (5 years) | $366.62 | $2,000 |

| 2 | $30,000 | 6% | 72 (6 years) | $506.69 | $9,603 |

| 3 | $15,000 | 7.5% | 48 (4 years) | $362.05 | $2,338 |

Scenario 1: This scenario represents a relatively low interest rate and a common loan term. The lower interest rate results in a lower total interest paid over the life of the loan. A borrower with good credit might qualify for such a rate.

Scenario 2: This scenario reflects a higher interest rate and a longer loan term. While the monthly payment is manageable, the borrower will pay significantly more in interest over the life of the loan. This might be a scenario for someone with less-than-perfect credit or a larger loan amount.

Scenario 3: This scenario shows a shorter loan term with a higher interest rate. The shorter term results in a higher monthly payment, but significantly less interest is paid compared to Scenario 2.

Outcome Summary

Securing an auto loan can be a significant financial undertaking. By carefully considering factors like interest rates, loan terms, and fees, you can choose a loan that aligns with your financial goals. This guide has provided a detailed look at Barksdale Federal Credit Union’s auto loan offerings, enabling you to compare them to alternatives and make a well-informed decision. Remember to check your credit score and shop around for the best rates before committing to a loan.

FAQ Guide

What is the minimum loan amount offered by Barksdale FCU for auto loans?

This information isn’t consistently published online and may vary. Contact Barksdale FCU directly to confirm the minimum loan amount.

Does Barksdale FCU offer pre-approval for auto loans?

Many credit unions, including Barksdale FCU, likely offer pre-approval to give you an idea of your potential loan terms before applying formally. Check their website or contact them for confirmation.

What happens if I miss a payment on my Barksdale FCU auto loan?

Late payments will likely incur late fees and negatively impact your credit score. Contact Barksdale FCU immediately if you anticipate difficulty making a payment to explore options like deferment or forbearance.

Can I refinance my existing auto loan with Barksdale FCU?

Barksdale FCU may offer auto loan refinancing options. Contact them directly to inquire about eligibility and the refinancing process.