Brink’s Money Loan, leveraging the company’s renowned reputation for secure transportation, aims to offer a new level of trust and reliability in the lending market. This hypothetical venture would capitalize on Brink’s established brand recognition, attracting customers seeking a secure and transparent borrowing experience. Unlike some competitors, Brink’s could differentiate itself by emphasizing security measures throughout the loan process, from application to repayment.

The potential loan products would range from personal loans to small business financing, targeting individuals and entrepreneurs who value security and transparency. By focusing on a strong risk assessment and mitigation strategy, Brink’s could aim to minimize defaults and fraud, offering competitive interest rates and flexible loan terms. This strategy would build customer confidence and position Brink’s as a trustworthy alternative to traditional financial institutions.

Brink’s Money Loan Services

Brink’s, renowned for its secure transportation of valuables, could leverage its established reputation for trust and security to enter the financial services market with a new brand: Brink’s Money Loan. This hypothetical offering would focus on providing a range of accessible and reliable loan products to a specific target market.

Brink’s Money Loan Services would aim to differentiate itself from established financial institutions by focusing on a streamlined application process, transparent fees, and exceptional customer service. The brand’s inherent association with security and reliability would be a key selling point, building customer confidence and trust in a potentially vulnerable financial transaction.

Target Customer Profile

Brink’s Money Loan services would primarily target individuals and small businesses with a demonstrable need for short-term or medium-term financing. This includes individuals needing quick access to funds for unexpected expenses (medical bills, home repairs) or small business owners requiring capital for inventory purchases or operational costs. The ideal customer would value security, transparency, and a straightforward loan process, potentially those who have faced challenges securing loans through traditional channels due to credit history or other factors. This demographic often lacks access to traditional banking services and are more susceptible to predatory lending practices. Brink’s Money Loan would aim to provide a safer and more ethical alternative.

Comparison with Established Financial Institutions

Established financial institutions offer a wide variety of loan products, ranging from mortgages and auto loans to personal loans and lines of credit. However, these institutions often have stringent eligibility requirements, lengthy application processes, and potentially high interest rates. Brink’s Money Loan aims to compete by offering more accessible loan options with potentially lower interest rates for its target demographic, prioritizing a streamlined application and approval process. This would involve leveraging technology to simplify the process and reduce bureaucratic hurdles. While established banks might offer a wider array of products, Brink’s would focus on niche products tailored to its specific customer base, ensuring a more personalized and responsive service.

Hypothetical Loan Product Comparison

The following table compares three hypothetical loan products offered by Brink’s Money Loan:

| Loan Product | Interest Rate (APR) | Loan Term | Eligibility Criteria |

|---|---|---|---|

| Short-Term Personal Loan | 12-18% | 3-6 months | Minimum credit score of 550, verifiable income |

| Medium-Term Business Loan | 8-15% | 6-12 months | Established business for at least one year, verifiable revenue |

| Secured Personal Loan | 6-12% | 12-24 months | Collateral required (e.g., vehicle, savings account), verifiable income |

Brink’s Brand Reputation and Trust

Brink’s long-standing reputation for secure cash handling and valuables transportation presents a significant advantage as it expands into the financial services sector, specifically money lending. The inherent trust associated with the Brink’s brand, built over decades of reliable service, can be leveraged to foster customer confidence in its new loan offerings. This established credibility directly mitigates the inherent risk associated with lending, a sector where trust is paramount.

The established Brink’s brand image, synonymous with security and reliability, directly influences customer perception of its loan services. Customers are more likely to trust a company with a proven track record of secure handling of high-value assets to responsibly manage their financial information and loan agreements. This pre-existing trust translates into a lower barrier to entry for new customers and a higher likelihood of loan applications. The brand’s association with security implicitly communicates a level of competence and trustworthiness that competitors without such a legacy may struggle to achieve.

Leveraging Brink’s Brand Recognition for Loan Product Promotion

A successful marketing strategy would capitalize on Brink’s existing brand equity. This could involve integrating the familiar Brink’s logo and color scheme into all loan-related marketing materials, emphasizing the connection between the company’s established security expertise and the safety and security of customer funds. Targeted advertising campaigns could highlight the parallel between the secure transportation of physical valuables and the secure handling of financial information within the loan process. For example, an advertisement might depict a Brink’s armored truck transitioning into a digital representation of secure data transfer, visually linking the physical security of the brand to the digital security of its financial services.

Promotional Campaign Focusing on Security and Reliability

A promotional campaign for Brink’s money loans could center on the theme of “Secure Your Future.” This campaign could utilize various media channels, including television commercials, print advertisements, and digital marketing. The commercials could feature testimonials from satisfied customers, emphasizing their positive experiences and the peace of mind associated with borrowing from a trusted and secure institution. Print advertisements could use strong visuals of Brink’s armored vehicles alongside reassuring text emphasizing the security of the loan process and the protection of customer data. Digital marketing could involve targeted online advertising, social media campaigns, and email marketing, all reinforcing the core message of security and reliability. The overall campaign would aim to build on Brink’s established reputation for security, positioning its loan services as a safe and trustworthy option for borrowers.

Risk Assessment and Mitigation for Brink’s Loans

Offering loans under the established Brink’s brand presents unique opportunities but also introduces significant risks. The inherent association with security and trust necessitates a robust risk management framework to protect both the company’s reputation and its borrowers. Failure to adequately address these risks could lead to financial losses, reputational damage, and legal repercussions. This section details the potential risks and Artikels mitigation strategies.

Potential Risks Associated with Brink’s Loans, Brink’s money loan

The strong Brink’s brand, synonymous with security, creates high expectations for loan services. Failure to meet these expectations, particularly in areas of security and customer service, could severely damage the brand’s reputation. Specific risks include loan defaults, fraudulent applications, data breaches, and regulatory non-compliance. The high-value nature of transactions associated with Brink’s also increases the potential financial impact of any failures. Furthermore, the complexity of integrating loan services into an existing security-focused business model presents operational challenges.

Mitigation of Loan Defaults and Fraud

Mitigating the risk of loan defaults requires a comprehensive credit assessment process. This involves rigorous verification of borrower identity and financial history, utilizing both traditional credit scoring models and alternative data sources. Implementing robust fraud detection systems, including anomaly detection algorithms and real-time monitoring of application patterns, is crucial. Furthermore, establishing clear loan terms and conditions, coupled with proactive collection strategies, helps minimize defaults. For fraud mitigation, multi-factor authentication, biometric verification, and continuous monitoring of applicant behavior are essential. Regular audits of the loan application and disbursement processes can also identify and address vulnerabilities.

Borrower Identity and Creditworthiness Verification

Verifying borrower identity and creditworthiness is paramount. This involves multiple steps, starting with identity verification using government-issued identification documents and potentially including biometric authentication. Credit reports from reputable agencies provide a crucial assessment of the borrower’s credit history and repayment capacity. Further verification may involve reviewing bank statements, employment records, and tax returns to corroborate the information provided by the applicant. In cases of high-value loans, a more extensive due diligence process may be necessary, including background checks and collateral appraisal. The use of third-party verification services can enhance accuracy and efficiency.

Security Measures to Protect Sensitive Customer Data

Protecting sensitive customer data is critical. The following security measures are essential in a Brink’s loan application process:

- Data Encryption: All data transmitted and stored must be encrypted using industry-standard encryption algorithms, such as AES-256.

- Secure Data Storage: Data should be stored in secure, encrypted databases, with access strictly controlled through role-based access controls.

- Regular Security Audits: Independent security audits should be conducted regularly to identify and address vulnerabilities.

- Intrusion Detection and Prevention Systems: Implementing robust intrusion detection and prevention systems is crucial for detecting and preventing unauthorized access.

- Employee Training: Employees handling sensitive data should receive regular training on data security best practices and awareness of phishing and social engineering attacks.

- Compliance with Data Privacy Regulations: Strict adherence to relevant data privacy regulations, such as GDPR and CCPA, is essential.

Competitive Landscape and Market Analysis for Brink’s Loans

Brink’s, renowned for its secure transportation and storage of valuables, possesses a strong brand reputation synonymous with trust and security. Leveraging this established brand equity, a hypothetical Brink’s loan offering could carve a niche in the competitive financial services market. This analysis examines the competitive landscape, identifies potential USPs, and explores target market segments for a Brink’s loan product.

Comparison with Major Competitors

Several major players dominate the financial services industry, each offering diverse loan products. Direct competitors would include established banks like Wells Fargo and Bank of America, online lenders such as LendingClub and SoFi, and credit unions offering member-specific loan programs. A Brink’s loan would differentiate itself by focusing on security and potentially offering specialized loan products catering to businesses handling high-value assets or individuals with unique security needs. For example, a secured loan backed by valuable assets stored in Brink’s facilities could be a unique offering.

Unique Selling Propositions (USPs) for Brink’s Loans

The primary USP for a Brink’s loan would be the inherent security and trust associated with the Brink’s brand. This could translate into competitive advantages such as lower interest rates for secured loans, streamlined loan processing for clients with existing Brink’s security services contracts, and enhanced security measures for online loan applications and account management. Another USP could be the development of specialized loan products tailored to specific industries or high-net-worth individuals who require robust security protocols for their financial transactions. This could include features like dedicated account managers and enhanced fraud protection.

Potential Market Segments for Brink’s Loans

Brink’s could target several distinct market segments with its loan offerings. One key segment would be businesses involved in high-value transportation or storage, such as jewelry retailers, art dealers, and precious metals traders. These businesses often require secure financing solutions tailored to their specific industry needs. Another target segment would be high-net-worth individuals seeking secure and private loan options. Finally, Brink’s could target small and medium-sized enterprises (SMEs) needing financing for equipment purchases or expansion, offering competitive rates based on the security of the assets used as collateral.

Competitive Analysis of Loan Products

The following table compares key features and pricing of three hypothetical competitor loan products with a potential Brink’s loan offering. Note that these are illustrative examples and actual pricing and features may vary depending on individual circumstances and lender policies.

| Loan Product | Interest Rate (APR) | Loan Amount | Key Features |

|---|---|---|---|

| Wells Fargo Business Loan | 6.5% – 18% | $5,000 – $5,000,000 | Variable rates, various collateral options, flexible repayment terms |

| LendingClub Personal Loan | 7% – 36% | $1,000 – $40,000 | Fixed rates, online application, fast funding |

| SoFi Personal Loan | 6.99% – 20.99% | $5,000 – $100,000 | Fixed rates, autopay discounts, unemployment protection |

| Brink’s Secured Loan | 5% – 15% | $10,000 – $1,000,000 | Competitive rates for secured loans, enhanced security features, streamlined application for existing Brink’s clients |

Technological Infrastructure for Brink’s Loan Operations

A robust technological infrastructure is paramount for Brink’s to offer secure and efficient loan services. This infrastructure must encompass secure data storage and transmission, streamlined application processes, and robust risk management capabilities, all while maintaining compliance with relevant regulations. Failure to implement a comprehensive technological solution could lead to significant financial losses, reputational damage, and legal repercussions.

Necessary Technological Infrastructure for Secure and Efficient Loan Operations

Brink’s requires a multi-layered technological approach to ensure the security and efficiency of its loan operations. This includes a secure and scalable application processing system, a robust data management system with advanced encryption, and a comprehensive fraud detection and prevention system. The system should be designed for high availability and capable of handling large transaction volumes, particularly during peak periods. Integration with existing Brink’s systems, such as customer relationship management (CRM) and financial accounting systems, is crucial for seamless data flow and operational efficiency.

Security Protocols for Protecting Customer Data

Protecting customer data is critical for Brink’s. This necessitates implementing multi-factor authentication (MFA) for all user accounts, employing robust encryption protocols (e.g., AES-256) for data at rest and in transit, and regularly conducting penetration testing and vulnerability assessments to identify and address potential security weaknesses. Compliance with data privacy regulations such as GDPR and CCPA is mandatory. Data loss prevention (DLP) tools should be implemented to monitor and prevent sensitive data from leaving the controlled environment. Regular security audits and employee training on security best practices are essential to maintain a strong security posture.

Technological Solutions to Streamline Loan Processes

Several technological solutions can significantly streamline Brink’s loan processes.

- Automated Loan Application Processing: Implementing an automated system that validates applicant information, assesses creditworthiness, and pre-approves loans based on predefined criteria can significantly reduce processing time and manual intervention.

- Digital Document Management: Utilizing a secure digital document management system allows for efficient storage, retrieval, and sharing of loan documents, eliminating the need for physical storage and improving accessibility.

- AI-powered Risk Assessment: Integrating artificial intelligence (AI) into the loan application process can improve risk assessment accuracy by analyzing large datasets of applicant information and identifying potential red flags.

- Blockchain Technology for Secure Transactions: Utilizing blockchain technology can enhance transparency and security in loan transactions by providing an immutable record of all transactions.

- Robotic Process Automation (RPA): RPA can automate repetitive tasks such as data entry and document processing, freeing up human resources for more complex tasks.

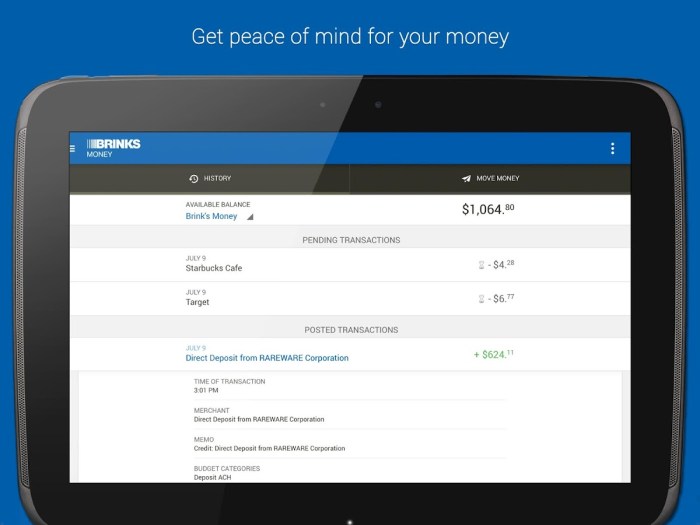

User Interface (UI) Design for Brink’s Online Loan Application Portal

The Brink’s online loan application portal should feature a clean, intuitive, and secure interface. The homepage should prominently display loan options with clear descriptions of terms and conditions. The application process should be straightforward, with a clear progression of steps. Each step should include progress indicators and helpful tips to guide users. The UI should be responsive and accessible across various devices (desktops, tablets, and smartphones). A secure messaging system should allow for direct communication between applicants and loan officers. A dedicated section for tracking application status and accessing loan documents is also essential. The design should incorporate Brink’s branding consistently throughout the portal, reinforcing trust and recognition. The use of clear and concise language, along with visual cues and progress bars, will enhance the user experience and reduce frustration. Finally, robust security measures, such as MFA and encryption, must be integrated seamlessly into the UI without compromising user-friendliness.

Regulatory Compliance for Brink’s Money Loans

Offering loan services necessitates strict adherence to a complex web of financial regulations. Brink’s, with its established reputation for security and trust, must prioritize absolute compliance to maintain its brand integrity and avoid significant legal and financial repercussions. Failure to comply can lead to substantial fines, reputational damage, and even the cessation of operations. This section details the crucial regulatory aspects and necessary compliance measures for a hypothetical Brink’s money loan operation.

Relevant Financial Regulations and Compliance Requirements

Brink’s loan operations would be subject to a variety of federal and state regulations, depending on the specific geographic locations served and the types of loans offered. Key regulations likely to apply include, but are not limited to, the Truth in Lending Act (TILA), the Fair Credit Reporting Act (FCRA), the Fair Debt Collection Practices Act (FDCPA), the Real Estate Settlement Procedures Act (RESPA) (if mortgages are offered), and state-specific usury laws which cap interest rates. Compliance necessitates thorough understanding and implementation of these regulations across all aspects of the loan lifecycle, from origination to collection. For example, TILA requires clear disclosure of all loan terms and fees, while FCRA mandates fair and accurate handling of consumer credit information. Failure to comply with these acts can result in significant penalties and legal action.

Steps to Ensure Regulatory Compliance

Ensuring compliance requires a multi-faceted approach. Brink’s must establish a robust compliance program overseen by dedicated professionals with expertise in financial regulations. This program should include comprehensive employee training on relevant laws and regulations, the development and implementation of internal policies and procedures aligned with these regulations, and regular audits to identify and address any compliance gaps. Furthermore, Brink’s needs to maintain meticulous record-keeping to demonstrate adherence to regulatory requirements and facilitate potential audits. This includes documenting all loan applications, approvals, disclosures, payments, and communications with borrowers. Regular updates to internal policies and procedures are crucial to adapt to evolving regulations and best practices. Investing in compliance technology, such as loan origination systems with built-in compliance checks, can further streamline the process and reduce the risk of errors.

Implications of Non-Compliance

Non-compliance with financial regulations carries severe consequences for Brink’s hypothetical money loan operations. Financial penalties can be substantial, ranging from thousands to millions of dollars depending on the severity and nature of the violation. Reputational damage can be equally devastating, eroding public trust and potentially impacting the company’s ability to attract customers and secure funding. Legal action from regulatory bodies and affected borrowers is a real possibility, leading to costly litigation and potentially crippling settlements. In extreme cases, non-compliance could lead to the suspension or revocation of Brink’s operating license, effectively shutting down the loan operations. The negative publicity associated with non-compliance could also severely impact Brink’s overall brand image, extending beyond the loan services division. For example, Wells Fargo’s account fraud scandal resulted in billions of dollars in fines and a significant decline in public trust.

Regulatory Compliance Checklist for Brink’s Loan Operation

A comprehensive compliance program is essential. The following checklist Artikels key steps:

- Develop a written compliance program outlining policies and procedures.

- Conduct thorough employee training on all relevant regulations.

- Implement a robust system for tracking and managing loan applications and documentation.

- Establish a process for reviewing and updating policies and procedures to reflect changes in regulations.

- Conduct regular internal audits to identify and address compliance gaps.

- Maintain accurate and complete records of all loan transactions and communications with borrowers.

- Establish a process for handling customer complaints and disputes.

- Implement a system for monitoring and reporting regulatory changes.

- Engage external legal counsel specializing in financial regulations for advice and guidance.

- Develop and implement a plan for responding to regulatory inquiries and audits.

Final Wrap-Up

Ultimately, Brink’s foray into the lending market presents a compelling opportunity to leverage its established brand equity and expertise in secure handling of valuables. By focusing on security, transparency, and customer trust, a hypothetical Brink’s Money Loan service could carve a unique niche within the competitive financial landscape. The potential for success hinges on robust risk management, compliance with financial regulations, and the development of a user-friendly, secure digital platform. The promise of a secure lending experience, backed by the Brink’s name, could attract a significant customer base.

Helpful Answers

What types of collateral might Brink’s Money Loan require?

This would depend on the loan type and amount. Options could include personal assets, business equipment, or real estate.

What is the application process like for a Brink’s Money Loan?

A streamlined online application process is envisioned, requiring basic personal and financial information. Verification of identity and creditworthiness would be crucial.

How does Brink’s protect customer data?

Brink’s would employ robust security protocols, including encryption and multi-factor authentication, to protect sensitive customer data throughout the loan process.

What happens if I miss a loan payment?

Late payment policies would be clearly Artikeld in the loan agreement. Brink’s would aim for a fair and transparent approach to handling missed payments, prioritizing communication with borrowers.