Can a business have multiple NAICS codes? This question is crucial for businesses operating across diverse sectors or offering a range of services. Understanding NAICS codes—the North American Industry Classification System—is vital for accurate business classification and access to various resources. This guide delves into the complexities of multiple NAICS code assignments, exploring eligibility criteria, the application process, and the potential impact on a business’s strategic direction.

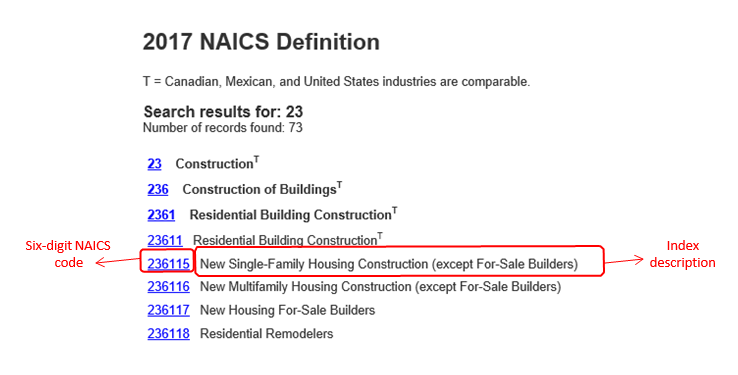

The North American Industry Classification System (NAICS) uses a six-digit code to categorize businesses based on their primary activity. While many businesses operate with a single NAICS code, others require multiple codes to accurately reflect their multifaceted operations. This decision hinges on the principal business activity and the revenue generated from different sectors. Choosing the right codes is not just a formality; it impacts access to government programs, market research effectiveness, and even the ability to target specific customer segments.

Understanding NAICS Codes and Business Activities

NAICS codes, or North American Industry Classification System codes, are a crucial element in understanding and classifying businesses across North America. They provide a standardized framework for collecting, analyzing, and publishing statistical data related to various industries, facilitating comparisons and economic analysis. Understanding these codes is essential for businesses, researchers, and government agencies alike.

NAICS codes directly reflect a business’s primary activities. The code assigned to a company indicates the type of goods or services it primarily produces or provides. A business’s activities determine its NAICS code, and conversely, the assigned NAICS code helps categorize the business’s operations within the broader economic landscape. This system allows for consistent data aggregation and analysis, enabling informed decision-making across various sectors.

Examples of Businesses with Single NAICS Codes and Their Activities

A business with a single NAICS code typically focuses on a narrow range of activities. For example, a bakery specializing solely in bread production might have a NAICS code related to bakeries, while a company exclusively involved in software development would be classified under a NAICS code specific to software publishing. The precision of these codes allows for accurate tracking of economic activity within specific sectors. Another example would be a small plumbing company performing only residential plumbing services; this would fall under a specific NAICS code dedicated to plumbing, heating, and air-conditioning contractors.

Table Comparing Business Types and Associated Primary NAICS Codes

The following table illustrates the relationship between different business types, their primary NAICS codes, the description of their activities, and a sample number of employees. Note that the number of employees is purely illustrative and can vary significantly based on the specific business.

| Business Type | Primary NAICS Code | Description of Activities | Number of Employees |

|---|---|---|---|

| Retail Bookstore | 451211 | Selling books, magazines, and other printed materials to consumers. | 10 |

| Software Development Firm | 541511 | Designing, developing, and implementing custom software applications. | 50 |

| General Contractor – Residential | 236110 | Building new residential homes and performing renovations. | 25 |

| Fast Food Restaurant | 722511 | Serving fast food and beverages to customers. | 30 |

Determining Eligibility for Multiple NAICS Codes: Can A Business Have Multiple Naics Codes

A business can use multiple North American Industry Classification System (NAICS) codes if its operations encompass activities classified under different codes. The key lies in accurately reflecting the full scope of its business activities. Understanding the criteria for eligibility and the implications of choosing the right codes is crucial for accurate data reporting and potential access to specific industry-related benefits or programs.

Determining eligibility hinges on the principle of accurately representing a business’s diverse operations. The primary criterion is whether the business engages in distinct and significant activities falling under separate NAICS codes. Simply having multiple products or services isn’t sufficient; each activity must represent a substantial and separable part of the business’s overall operations. The weighting of these activities is determined by revenue, employment, and other relevant factors.

Principal Business Activity and NAICS Code Assignment

The principal business activity is the business’s primary operation, generating the most revenue and employing the largest portion of its workforce. This activity is assigned the six-digit NAICS code that best represents it. However, a business may also report secondary or supplementary NAICS codes representing other significant business activities. These secondary codes provide a more comprehensive picture of the business’s operational diversity. For example, a company primarily selling furniture (with the principal NAICS code reflecting furniture retail) might also manufacture some of its furniture, requiring a secondary NAICS code for furniture manufacturing. The relative importance of each activity, reflected in its contribution to overall revenue and employment, dictates its inclusion as a principal or secondary code.

Examples of Businesses Requiring Multiple NAICS Codes

Several scenarios illustrate the need for multiple NAICS codes. A diversified conglomerate operating in various sectors, such as manufacturing, retail, and technology, would undoubtedly require multiple codes. Each distinct operational segment would be assigned its corresponding NAICS code. Similarly, a restaurant offering both dine-in service and catering would need separate codes reflecting food service and catering services. A consulting firm providing services in multiple areas, such as financial consulting and management consulting, would also require separate codes to accurately represent its activities. The selection of appropriate codes ensures the business is accurately categorized for statistical purposes and for potential access to industry-specific programs or funding.

Implications of Incorrect or Insufficient NAICS Codes

Using incorrect or insufficient NAICS codes can have several negative consequences. Inaccurate reporting can skew statistical data, leading to flawed economic analysis and potentially impacting government policy decisions. Furthermore, businesses may miss out on opportunities for industry-specific grants, loans, or other support programs that are often targeted based on NAICS codes. Incorrectly reporting the principal business activity can also lead to inefficiencies in business planning and resource allocation, as the business may not receive relevant industry benchmarks or competitor analysis. Finally, it can affect the accuracy of market research and competitive analysis, as the business may be grouped with incorrect industry peers. Accurate NAICS code assignment is therefore vital for effective business management and participation in the broader economic landscape.

The Process of Assigning Multiple NAICS Codes

Assigning multiple NAICS codes accurately reflects the multifaceted nature of many modern businesses. Understanding this process is crucial for accurate reporting, accessing specific government programs, and ensuring proper market categorization. This section details the procedures involved in selecting, registering, and updating NAICS codes for businesses with diverse operations.

Registering a Business with Multiple NAICS Codes

The procedure for registering a business with multiple NAICS codes varies slightly depending on the specific regulatory bodies involved (e.g., state, federal, or industry-specific agencies). However, the core principle remains consistent: identifying the most relevant codes and accurately reporting them during the registration process. Generally, businesses will select the six-digit NAICS code that best represents their primary business activity, and then list additional six-digit codes for secondary activities. The order of listing often reflects the relative contribution of each activity to the overall revenue. Specific instructions are typically found on the relevant government agency’s website, or through consultation with a business advisor. For example, a company primarily selling clothing online (454110 – Clothing Stores) but also offering alterations (811121 – Clothing Alterations) would list both codes, with 454110 likely listed first due to its greater revenue contribution.

Determining the Most Appropriate NAICS Codes

Determining the appropriate NAICS codes requires a careful analysis of a business’s activities and revenue streams. A systematic approach is essential to avoid misclassification.

- Identify all significant business activities: List every activity that generates revenue or contributes significantly to the business’s operations. Be thorough; even seemingly minor activities may require a separate NAICS code if they represent a distinct business function.

- Consult the NAICS Manual: The official NAICS manual, available online through the U.S. Census Bureau, provides detailed descriptions of each NAICS code. Carefully review these descriptions to match your business activities to the most appropriate codes. Pay close attention to the definitions and examples provided to ensure accurate selection.

- Prioritize based on revenue: Rank the identified activities by their contribution to overall revenue. The activity generating the most revenue generally receives the primary NAICS code. Secondary codes are assigned in descending order of revenue contribution.

- Consider industry-specific guidelines: Some industries have specific guidelines or regulations regarding NAICS code assignments. Check with relevant regulatory bodies or industry associations for any specific requirements.

- Seek professional assistance: If uncertainty remains, consulting with a business consultant or accountant familiar with NAICS codes can provide valuable guidance.

Updating NAICS Codes Following Business Expansion

As a business expands its operations, it may need to update its registered NAICS codes to accurately reflect the changes. This process typically involves submitting a formal amendment or update to the relevant registration authorities. The same careful analysis used for initial registration should be applied, ensuring that all significant activities are appropriately represented. For example, if a bakery (311811 – Bakeries) expands into catering (722310 – Food Service Contractors), the business should add the new code to its existing registration. Failure to update NAICS codes can lead to inaccurate reporting and potential issues with government programs or industry classifications.

Flowchart for NAICS Code Selection

A flowchart visually represents the decision-making process for selecting NAICS codes. The flowchart would begin with a box labeled “Identify all business activities and revenue streams.” This would branch to a decision diamond asking, “Is the activity significant and revenue-generating?” A “yes” response would lead to a box asking, “Consult the NAICS manual to find the most appropriate code.” A “no” response would lead back to the beginning. From the “Consult NAICS manual” box, the process would continue with boxes representing ranking activities by revenue and selecting the primary and secondary codes. The flowchart would conclude with a box labeled “Register the selected NAICS codes.” This visual representation aids in systematically determining the appropriate codes for a business’s diverse operations.

Implications of Using Multiple NAICS Codes

Employing multiple NAICS codes offers businesses a strategic advantage in navigating the complexities of government regulations, market analysis, and customer targeting. However, it also introduces complexities that need careful consideration. Understanding the implications of this choice is crucial for maximizing benefits and minimizing potential drawbacks.

Advantages and Disadvantages of Multiple NAICS Codes

Using multiple NAICS codes provides a more comprehensive representation of a business’s diverse activities. This detailed portrayal can unlock access to a wider range of government programs and funding opportunities tailored to specific business segments. Conversely, the complexity of managing multiple codes can lead to administrative burdens and potential for errors in reporting and data analysis. A streamlined approach, focusing on the primary business activity with carefully selected secondary codes, often proves most effective.

Impact on Government Programs and Funding

The selection of NAICS codes directly influences eligibility for various government programs and funding initiatives. For instance, a small business primarily involved in software development (NAICS 511210) might also offer consulting services (NAICS 541330). Listing both codes could open doors to funding opportunities specific to both the software industry and the consulting sector. Conversely, inaccurately selecting or omitting relevant codes could lead to ineligibility for crucial support. Businesses should carefully review program requirements to ensure accurate code selection.

Influence on Market Research and Competitive Analysis

Multiple NAICS codes enable more granular market research. By analyzing data segmented across different NAICS codes, businesses gain deeper insights into their competitive landscape within each specific market segment. For example, a company with both manufacturing (NAICS 311) and retail (NAICS 44-45) activities can conduct targeted market research for each sector, leading to more effective marketing strategies and improved competitive positioning. Conversely, analyzing data across multiple, unrelated NAICS codes can lead to diluted insights, making it challenging to draw meaningful conclusions.

Targeting Specific Customer Segments

The use of multiple NAICS codes facilitates the targeting of diverse customer segments. A business operating in multiple sectors can tailor its marketing efforts and sales strategies to the unique needs and preferences of each segment. Consider a company involved in both residential (NAICS 236110) and commercial construction (NAICS 236210). By utilizing both codes, they can target distinct customer groups with specialized marketing campaigns, maximizing efficiency and return on investment. However, attempting to target too many disparate segments with limited resources could lead to diluted marketing efforts and reduced effectiveness.

Illustrative Examples of Businesses with Multiple NAICS Codes

Understanding how businesses utilize multiple NAICS codes is crucial for accurate industry analysis and effective business planning. The following case studies illustrate the diverse applications and benefits of employing multiple NAICS codes, highlighting how they reflect a company’s multifaceted operations.

Case Study 1: A Multifaceted Design Firm

This case study examines a design firm that offers a range of services, encompassing graphic design, web design, and interior design. The diverse nature of their services necessitates the use of multiple NAICS codes to accurately reflect their business activities.

- Business Activities: The firm provides graphic design services for marketing materials, develops websites for businesses, and designs interiors for residential and commercial clients.

- Assigned NAICS Codes: 541420 (Graphic Design Services), 541511 (Custom Computer Programming Services), and 541330 (Architectural, Engineering, and Related Services).

- Impact: Utilizing multiple NAICS codes allowed the firm to accurately categorize its revenue streams and participate in government contracts and industry surveys specifically targeted at each service area. This improved their market analysis and business development efforts.

The firm’s use of multiple NAICS codes is strategic. It allows them to target specific marketing campaigns and to accurately report their revenue streams to various stakeholders, including investors and government agencies. The precise categorization of their diverse services allows for more effective business planning and resource allocation.

Case Study 2: A Hybrid Bookstore and Coffee Shop, Can a business have multiple naics codes

This example showcases a business model combining a retail bookstore with a coffee shop, highlighting how a single entity can effectively utilize multiple NAICS codes to represent its diverse offerings.

- Business Activities: The business operates a retail bookstore selling new and used books, and a coffee shop serving various beverages and pastries.

- Assigned NAICS Codes: 451211 (Book Stores), and 722110 (Full-Service Restaurants).

- Impact: The use of two distinct NAICS codes allows the business to track sales and profitability separately for each aspect of its operation. This granular data provides valuable insights into customer behavior and allows for optimized inventory management and marketing strategies tailored to each segment of the business.

By separating the bookstore and coffee shop operations within their NAICS coding, the owners gain a clearer understanding of each revenue stream’s performance. This data-driven approach allows for more efficient resource allocation and targeted marketing efforts, enhancing overall business profitability.

Case Study 3: A Technology Company Offering Software and Consulting Services

This case study illustrates a technology company providing both software products and related consulting services, necessitating the use of multiple NAICS codes for accurate representation.

- Business Activities: The company develops and sells custom software solutions and offers consulting services related to software implementation and integration.

- Assigned NAICS Codes: 511210 (Software Publishers), and 541511 (Custom Computer Programming Services).

- Impact: Separating the software sales and consulting services via distinct NAICS codes allows for precise financial reporting and facilitates participation in government procurement processes that often require specific industry classifications. This contributes to increased business opportunities and a more accurate portrayal of the company’s capabilities.

The use of multiple NAICS codes in this instance allows for targeted marketing towards different client segments, highlighting the company’s expertise in both software development and consulting. This precise categorization helps the company attract a wider range of clients and strengthens its competitive position in the market.