Can claims adjusters deduct business expenses? The answer, thankfully, is often yes, but navigating the complexities of IRS regulations requires careful planning and meticulous record-keeping. This guide unravels the intricacies of deductible and non-deductible expenses for claims adjusters, offering insights into maximizing tax benefits while remaining compliant. We’ll explore common deductions, from travel and home office expenses to professional development and vehicle costs, providing practical advice and examples to empower you to confidently claim what’s rightfully yours.

Understanding which business expenses are deductible can significantly impact a claims adjuster’s tax liability. This involves a thorough understanding of IRS guidelines, proper documentation, and the ability to distinguish between eligible and ineligible deductions. This guide aims to provide clarity on these aspects, equipping claims adjusters with the knowledge to optimize their tax returns legally and efficiently.

Deductibility of Common Business Expenses

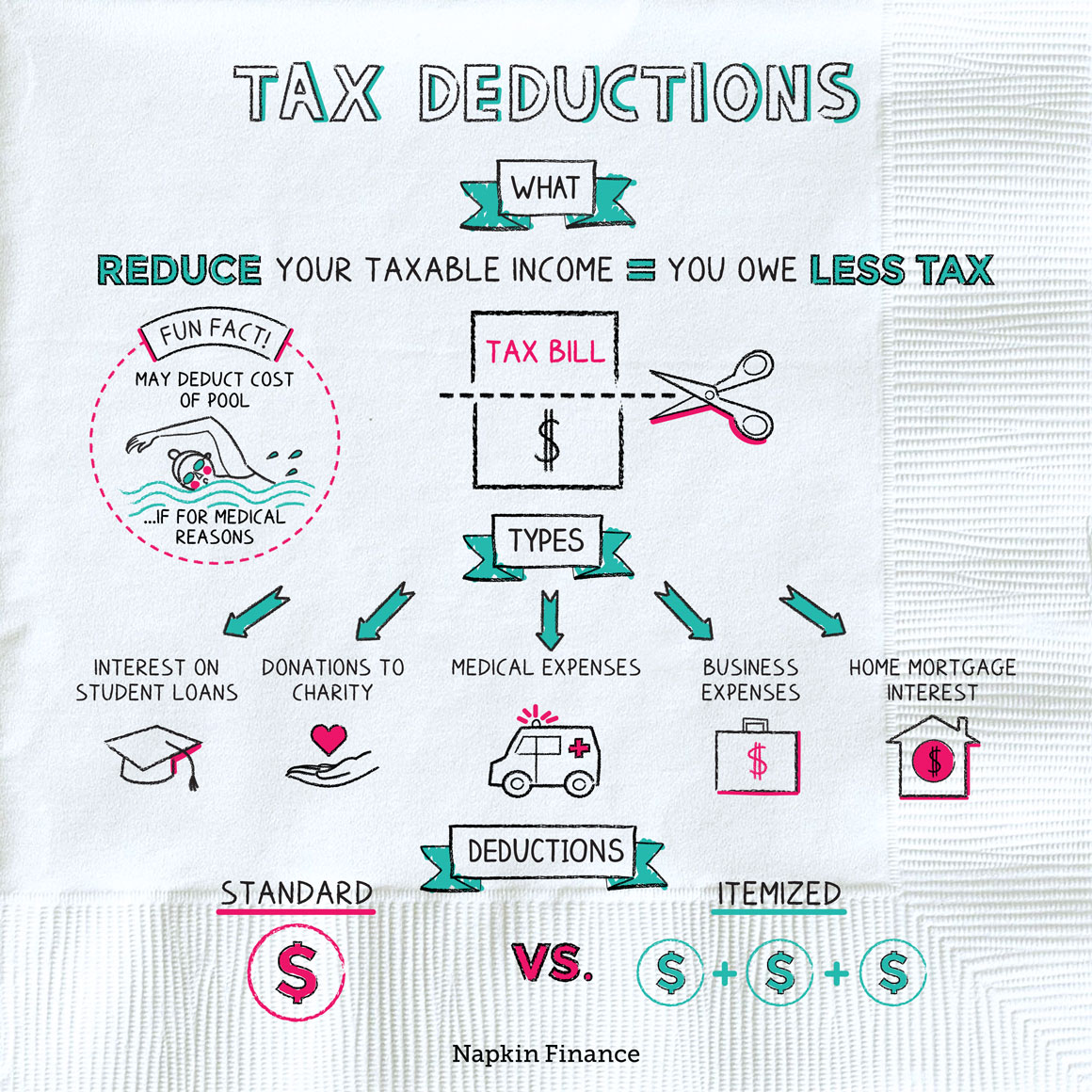

Claims adjusters, like other self-employed individuals, can deduct many ordinary and necessary business expenses from their taxable income. Understanding which expenses are deductible and how to properly document them is crucial for minimizing tax liability. The Internal Revenue Service (IRS) provides specific guidelines on what qualifies as a deductible business expense, focusing on the relationship between the expense and the generation of income from the adjuster’s business.

IRS Guidelines on Deductibility

The IRS generally allows the deduction of business expenses that are both ordinary and necessary. “Ordinary” means common and accepted in your industry, while “necessary” means helpful and appropriate for your business. Expenses must be directly related to your work as a claims adjuster and not for personal use. Furthermore, expenses must be substantiated with adequate records. The IRS scrutinizes deductions closely, so maintaining meticulous records is paramount. Improperly claimed deductions can lead to penalties and interest.

Examples of Deductible and Non-Deductible Expenses

Several common expenses for claims adjusters fall under either deductible or non-deductible categories. Accurate categorization is essential for accurate tax filing.

Travel Expenses

Travel expenses incurred directly for business purposes are generally deductible. This includes expenses such as airfare, lodging, and ground transportation when traveling to meet with clients, attend industry conferences, or inspect damage sites. However, personal portions of trips must be separated and are not deductible. For example, a weekend trip to a conference with an extra day of personal sightseeing would require the personal portion to be excluded from the deduction.

Home Office Expenses

If a dedicated and regularly used portion of your home is exclusively used for business, you may be able to deduct a portion of your home-related expenses, such as mortgage interest, rent, utilities, and depreciation. However, strict IRS guidelines apply, requiring the space to be used exclusively for business and directly related to the business’s operation. A detailed calculation based on the percentage of your home used for business is required.

Professional Development

Expenses related to professional development, such as continuing education courses, seminars, and professional memberships, are generally deductible if they maintain or improve your skills as a claims adjuster. The expense must directly relate to your professional capacity and not be for personal enrichment.

Documentation Requirements

Adequate documentation is essential for supporting any business expense deduction. The IRS requires sufficient evidence to verify the expense’s nature, amount, and business relationship. This typically includes receipts, invoices, bank statements, and a detailed log of business expenses. Maintaining organized records simplifies the tax preparation process and minimizes the risk of audit issues. For significant expenses, additional supporting documentation, such as contracts or agreements, might be necessary.

| Expense Type | Deductible? | Explanation | Supporting Documentation |

|---|---|---|---|

| Travel (airfare, lodging, car rental) to inspect a damage site | Yes | Directly related to business activity. | Airline tickets, hotel receipts, car rental agreement, mileage log |

| Business meals with a client | Partially (50%) | Only 50% of the cost is deductible under current IRS guidelines. | Restaurant receipt, description of business purpose |

| Home office expenses (portion of mortgage interest, utilities) | Potentially | Deductible if the space is exclusively used for business; requires detailed calculation. | Mortgage statement, utility bills, detailed calculation of home office percentage |

| Continuing education course for claims adjustment techniques | Yes | Improves professional skills directly related to the business. | Course registration confirmation, receipt, course description |

| Personal car insurance | No | Personal expense, not directly related to business operations. | N/A |

| New laptop for personal and business use | Partially | Only the business portion is deductible; requires allocation based on usage. | Purchase receipt, detailed explanation of business versus personal usage |

Home Office Deduction for Claims Adjusters

Claiming a home office deduction can significantly reduce a claims adjuster’s tax burden, provided they meet specific IRS requirements. This deduction allows for the deduction of expenses related to a portion of the home used exclusively and regularly for business. Understanding the eligibility criteria and calculation methods is crucial for maximizing tax savings.

Requirements for Claiming the Home Office Deduction

To claim the home office deduction, a claims adjuster must demonstrate that their home office is their principal place of business or a place used exclusively and regularly for meeting clients or customers in the course of their business. For claims adjusters, this often means proving that a significant portion of their work, such as reviewing claims, contacting clients, and preparing reports, occurs in their dedicated home office. The IRS scrutinizes these claims; therefore, maintaining meticulous records is essential. This includes documenting the percentage of time spent working from home versus other locations, as well as keeping detailed records of all home office expenses. Simply having a computer at home is insufficient; the space must be used exclusively for business purposes.

Comparison of Simplified and Regular Methods for Calculating the Home Office Deduction

Claims adjusters can choose between two methods for calculating their home office deduction: the simplified method and the regular method. The simplified method is easier to use, allowing a deduction of $5 per square foot of home office space, up to a maximum of 300 square feet. This method is straightforward and requires less record-keeping. The regular method, however, allows for the deduction of a larger percentage of home-related expenses, but necessitates a more detailed calculation based on the percentage of the home used for business. This involves calculating the percentage of home-related expenses (mortgage interest, property taxes, utilities, etc.) attributable to the home office and deducting that portion. The choice between these methods depends on the individual circumstances and the size of the home office. For a smaller home office, the simplified method might be more advantageous; for larger spaces, the regular method could result in greater savings.

Importance of Establishing a Dedicated Workspace

Establishing a dedicated workspace is paramount for successfully claiming the home office deduction. This dedicated space must be used exclusively and regularly for business purposes. It cannot be used for personal activities or other businesses. The space should be clearly identifiable as a business office, even if it is a corner of a room. This might involve having separate furniture, equipment, and supplies dedicated solely to business use. The IRS may request documentation to verify the exclusive business use, such as photographs, client invoices showing work completed in the home office, and detailed expense records. The more clearly defined the space, the stronger the claim for the deduction.

Flowchart for Claiming the Home Office Deduction

A flowchart illustrating the process would begin with the question: “Is your home office your principal place of business or is it used exclusively and regularly to meet clients?” If yes, proceed to choose between the simplified and regular method calculation. The simplified method requires calculating the square footage of the home office (up to 300 sq ft) and multiplying by $5. The regular method requires calculating the percentage of home-related expenses attributable to the home office and applying this percentage to deductible expenses. Both methods lead to the calculation of the home office deduction. Finally, the deduction is claimed on the appropriate tax form. The flowchart would visually represent these steps, making the process clear and easy to follow. Failure to meet the initial requirement of exclusive and regular business use would result in ineligibility for the deduction.

Travel Expenses and Mileage Reimbursement: Can Claims Adjusters Deduct Business Expenses

Claims adjusters often incur travel expenses while visiting accident sites, meeting with clients, or attending industry conferences. Understanding which travel expenses are deductible can significantly reduce their tax burden. Careful record-keeping is crucial for substantiating these deductions during an audit.

Travel expenses for claims adjusters are generally deductible if they are considered ordinary and necessary business expenses. This means the expenses must be common and accepted in the claims adjusting industry, and they must be directly related to your business activities. Personal trips or purely recreational activities are not deductible. The IRS scrutinizes travel expense deductions, so maintaining meticulous records is paramount.

Allowable Travel Expenses for Claims Adjusters

Allowable travel expenses typically include transportation costs (car, plane, train, bus), lodging, and meals. However, the deductibility of meals is subject to limitations. For example, if a claims adjuster travels overnight for a business trip, they can deduct the cost of lodging and a portion of their meal expenses. The IRS allows for a deduction of 50% of the cost of business meals. Other allowable expenses might include tolls, parking fees, and baggage fees directly related to business travel. It’s crucial to remember that only expenses directly related to the business trip are deductible; personal expenses incurred during the trip are not.

Tracking and Documenting Travel Expenses

Maintaining detailed records is essential for claiming travel expense deductions. This involves keeping meticulous mileage logs, preserving receipts for all expenses, and clearly documenting the business purpose of each trip. Mileage logs should include the date, starting and ending odometer readings, destination, and business purpose of the trip. Receipts should clearly show the date, vendor, amount, and a description of the goods or services purchased. A detailed travel diary or log can further support your expense claims, providing context and demonstrating the business purpose of the trip. For example, a log entry might state: “October 26, 2024: Drove from office to accident site at 123 Main Street to assess damage; mileage 50 miles, receipt for gas attached.” Digital record-keeping apps can streamline this process, automatically tracking mileage and storing digital receipts.

Common Travel Expenses and IRS Guidelines

The following table summarizes common travel expenses and their corresponding IRS guidelines:

| Expense | IRS Guideline |

|---|---|

| Mileage | Standard mileage rate (updated annually) or actual expenses. Must maintain accurate mileage log. |

| Airfare | Cost of airfare directly related to business travel. |

| Lodging | Cost of lodging while away from home overnight on business. |

| Meals | 50% of the cost of business meals. Must be directly related to business. |

| Ground Transportation (Taxi, Uber, etc.) | Cost of ground transportation directly related to business travel. |

| Tolls and Parking | Cost of tolls and parking fees incurred during business travel. |

Calculating Deductible Mileage

The IRS sets an annual standard mileage rate for business use of a vehicle. To calculate deductible mileage, multiply the total business miles driven by the standard mileage rate. For example, if the standard mileage rate is $0.58 per mile and a claims adjuster drove 5,000 miles for business purposes, the deductible mileage would be: 5,000 miles * $0.58/mile = $2,900.

Deductible Mileage = Total Business Miles × Standard Mileage Rate

Remember to always consult the latest IRS publications for the most up-to-date standard mileage rate. Keeping accurate records of business versus personal mileage is critical for accurate calculation and to avoid potential IRS scrutiny.

Professional Development and Continuing Education

Claims adjusters, like professionals in many fields, frequently engage in continuing education to maintain their licensing, enhance their skills, and stay abreast of industry changes. The Internal Revenue Service (IRS) allows for the deduction of certain expenses related to professional development, but not all. Understanding which expenses qualify is crucial for maximizing tax benefits.

Expenses incurred for professional development are generally deductible if they maintain or improve skills required in your current profession. This means the education must be directly related to your work as a claims adjuster, not for a new or different career. The key is demonstrating a direct connection between the course material and your daily responsibilities. Simply taking a course to expand your general knowledge isn’t sufficient for a deduction.

Deductibility of Professional Development Expenses

The deductibility of professional development expenses hinges on the IRS’s criteria. Expenses are generally deductible if they are directly related to your current work as a claims adjuster and are necessary to maintain or improve your existing skills. This includes courses, seminars, workshops, and conferences that provide relevant updates on claims adjusting techniques, regulations, or software. However, expenses for education leading to a new trade or business are not deductible.

Examples of Qualifying and Non-Qualifying Educational Expenses, Can claims adjusters deduct business expenses

To illustrate the difference, consider these examples. A course on advanced claims investigation techniques, a seminar on current legal updates affecting liability claims, or a conference focusing on new software used in claims processing would likely qualify as deductible expenses. Conversely, expenses for an MBA program, a real estate licensing course, or a course on a completely unrelated field would not be deductible, as they do not directly relate to the skills needed for a claims adjuster.

Limitations and Restrictions on Deducting Educational Expenses

There are several limitations to consider. First, the expenses must be ordinary and necessary for your profession. Second, you cannot deduct expenses for education that qualifies you for a new trade or business. Third, you may need to keep detailed records, including receipts and course descriptions, to substantiate your deduction. Finally, if the education leads to a credential or degree, specific rules may apply, requiring careful consideration of the IRS guidelines.

Examples of Deductible Professional Development Activities

- Attending a seminar on effective negotiation techniques for claims settlements.

- Completing a course on advanced insurance law relevant to claims handling.

- Participating in a workshop on using new claims processing software.

- Attending a conference focused on updates in claims adjusting best practices.

- Subscribing to a professional journal related to claims adjusting.

Vehicle Expenses Beyond Mileage Reimbursement

Claims adjusters often use their vehicles extensively for work, and while the standard mileage rate simplifies deductions, situations arise where additional vehicle expenses beyond the reimbursed mileage may be deductible. Understanding these circumstances and the proper documentation is crucial for maximizing tax benefits. This section details the conditions under which expenses exceeding the mileage reimbursement can be claimed, compares deduction methods, and provides examples of necessary supporting documentation.

Circumstances for Deducting Expenses Beyond Mileage Reimbursement

The Internal Revenue Service (IRS) allows deductions for vehicle expenses beyond the standard mileage rate or actual expenses method under specific circumstances. These typically involve costs not directly factored into the mileage rate, such as significant repairs exceeding normal wear and tear, or expenses related to vehicle modifications necessary for the job. For instance, a claims adjuster who requires a specialized vehicle for off-road access to accident sites might be able to deduct the cost of installing four-wheel-drive components. Similarly, repairs resulting from an accident unrelated to the adjuster’s job are generally not deductible, but repairs stemming from wear and tear incurred while performing job duties might be.

Comparison of Standard Mileage Method and Actual Expense Method

Claims adjusters can choose between two methods for deducting vehicle expenses: the standard mileage method and the actual expense method. The standard mileage method uses a predetermined rate per mile set annually by the IRS, simplifying the process. The actual expense method, conversely, allows for the deduction of all direct vehicle expenses, including depreciation, repairs, insurance, and fuel, but requires meticulous record-keeping. Choosing the most beneficial method depends on the adjuster’s specific circumstances and the total amount of vehicle expenses incurred.

Supporting Documentation for Vehicle Expense Deductions

Accurate record-keeping is paramount for successful vehicle expense deductions. For both methods, maintaining a detailed log of business miles is essential. This log should include the date, starting and ending odometer readings, purpose of the trip, and destination. For the actual expense method, additional documentation is required. This includes receipts for repairs, maintenance, insurance premiums, lease or loan payments, and any other vehicle-related expenses. Furthermore, documentation supporting the business use of the vehicle is necessary, such as client appointment schedules or work orders. Failure to provide adequate documentation can result in the IRS disallowing the deduction.

Comparison of Vehicle Expense Calculation Methods

| Method | Calculation | Advantages | Disadvantages |

|---|---|---|---|

| Standard Mileage Method | Business miles x IRS mileage rate | Simple, easy record-keeping | Less flexible, may not reflect actual expenses |

| Actual Expense Method | Sum of all allowable vehicle expenses (depreciation, repairs, insurance, etc.) | More accurate reflection of actual expenses, potentially higher deduction | Complex, requires meticulous record-keeping, potential for audit |

Self-Employment Taxes and Business Expenses

Self-employment taxes, encompassing Social Security and Medicare taxes, are a significant financial obligation for independent contractors and sole proprietors, like claims adjusters. Understanding the interplay between deductible business expenses and self-employment taxes is crucial for minimizing your tax liability and maximizing your after-tax income. Deductible business expenses directly reduce your net earnings from self-employment, which forms the basis for calculating these taxes.

Deductible business expenses directly impact the calculation of self-employment taxes. The self-employment tax is levied on your net earnings from self-employment, calculated by subtracting allowable business expenses from your gross self-employment income. This reduction in net earnings translates to a lower tax bill. Accurately reporting and documenting these expenses is paramount for achieving this tax savings.

Impact of Deductible Expenses on Self-Employment Tax Calculation

The self-employment tax rate is currently 15.3% (12.4% for Social Security and 2.9% for Medicare). However, you only pay self-employment tax on 92.35% of your net earnings from self-employment. This is because the self-employment tax is designed to mirror the employer and employee contributions in a traditional employment setting. Therefore, the actual tax rate is closer to 14.13% (15.3% * 92.35%). By deducting legitimate business expenses, you lower your net earnings from self-employment, thus directly reducing the amount subject to this 14.13% tax rate.

Examples of Deductible Expenses Reducing Self-Employment Taxes

Let’s consider a claims adjuster with gross income of $100,000. Suppose they have $30,000 in deductible business expenses, including home office expenses, professional development courses, and travel costs. Their net earnings from self-employment would be $70,000 ($100,000 – $30,000). The self-employment tax calculation would be as follows:

$70,000 (Net Earnings) * 0.9235 (Adjusted Rate) * 0.153 (Tax Rate) = $9,878.77 (Self-Employment Tax)

If no business expenses were deducted, their net earnings would be $100,000, resulting in a substantially higher self-employment tax liability:

$100,000 (Net Earnings) * 0.9235 (Adjusted Rate) * 0.153 (Tax Rate) = $14,130.00 (Self-Employment Tax)

This example illustrates a significant reduction in tax liability—a difference of $4,251.23 ($14,130.00 – $9,878.77)—solely due to the accurate deduction of business expenses.

Accurate Reporting and Overall Tax Liability

Accurate reporting of business expenses is not just about minimizing self-employment taxes; it’s about ensuring compliance with tax laws and avoiding potential penalties. The IRS scrutinizes tax returns, and underreporting or claiming ineligible expenses can lead to audits, penalties, and interest charges. Maintaining meticulous records—receipts, invoices, bank statements, and a detailed log of business activities—is essential for substantiating deductions and defending your tax position in case of an audit. Consulting with a tax professional can also provide valuable guidance in navigating the complexities of self-employment tax and expense deductions.