Can H4 EAD do business? The question itself sparks curiosity, especially for those navigating the complexities of US immigration and entrepreneurship. This guide delves into the intricacies of business ownership for H4 EAD holders, exploring the legal landscape, suitable business types, financial considerations, and tax implications. We’ll unravel the potential challenges and opportunities, providing a clear roadmap for those seeking to launch their ventures while on an H4 EAD.

Understanding the specific regulations and restrictions surrounding H4 EAD work authorization is crucial for success. This includes navigating state-specific laws, choosing the right business structure (sole proprietorship, LLC, partnership), and securing necessary licenses and permits. We’ll also examine the impact of the H4 EAD’s temporary nature on long-term business planning and growth strategies, offering practical advice to mitigate potential risks.

Eligibility for Business Ownership: Can H4 Ead Do Business

H4 EAD holders, while granted employment authorization, face specific limitations regarding business ownership. The regulations surrounding their ability to start and operate businesses are complex and vary depending on several factors, including the specific state in which they intend to operate and the nature of the business itself. Understanding these restrictions is crucial for H4 EAD holders considering entrepreneurial ventures.

Legal Restrictions on Business Ownership for H4 EAD Holders

The primary legal restriction stems from the H4 visa’s dependent status. H4 EAD holders are not considered independent immigrants and their employment authorization is tied to their spouse’s H1-B visa status. This dependent status generally prohibits them from engaging in business activities that could be considered “substantial” or “controlling” ownership. The definition of “substantial” or “controlling” is not explicitly defined in federal law but is often interpreted based on the level of ownership, management responsibilities, and overall influence exerted on the business. Activities such as forming a new corporation, acting as a primary investor, or managing a significant share of the business might be viewed as exceeding the permissible scope of an H4 EAD. Therefore, H4 EAD holders must tread carefully to avoid violating their visa status.

State-Specific Regulations Governing Business Ownership for H4 EAD Holders

There are no specific state-level regulations directly addressing business ownership for H4 EAD holders. The limitations are primarily dictated by federal immigration law. However, state-specific business registration requirements and licensing procedures will still apply. For example, an H4 EAD holder wishing to open a restaurant in California would need to comply with all California state and local regulations regarding food service licenses, health permits, and business registrations, regardless of their visa status. The key difference lies in the type and scale of the business they can operate, not the state-specific regulatory compliance.

Examples of Businesses Legally Permitted to H4 EAD Holders

H4 EAD holders can legally own and operate businesses that align with the “incidental” or “passive” investment nature of their visa status. Examples include: owning a small share in an existing established business (without significant management responsibilities), working as a contractor for a business they partially own (but not controlling it), or operating a small, sole-proprietorship business with limited scope and minimal employee involvement. For example, an H4 EAD holder could potentially own a small online store selling handmade crafts, providing freelance services, or owning a small percentage of a larger company. The key is that their involvement should not constitute “substantial” control or ownership.

Comparison of Business Ownership Restrictions for H4 EAD Holders with Other Visa Holders

Compared to other visa holders, such as those on L-1A visas (intracompany transferees) or E-2 visas (treaty investors), H4 EAD holders face significantly stricter limitations. L-1A and E-2 visa holders are explicitly allowed to engage in business ownership and management, while H4 EAD holders are restricted to activities that do not represent substantial control or ownership. This difference highlights the dependent nature of the H4 visa and its inherent limitations on entrepreneurial endeavors.

Business Ownership Rights Comparison Across States

The following table illustrates that while state-specific regulations don’t directly impact the *permissibility* of business ownership for H4 EAD holders (this is governed federally), the process of registering and operating a business will naturally vary by state due to differences in licensing and registration requirements. The table highlights this variance in procedural aspects rather than any fundamental differences in legal eligibility.

| State | Business Registration Process | Licensing Requirements (Example: Restaurant) | Other Relevant State-Specific Regulations |

|---|---|---|---|

| California | Online registration through the California Secretary of State | Health permits, food handler’s cards, business license | Compliance with California’s labor laws |

| Texas | Registration with the Texas Secretary of State | Food service permit, alcohol permit (if applicable) | Texas Department of Licensing and Regulation requirements |

| New York | Registration with the New York Department of State | Restaurant permit, fire safety inspection | Compliance with New York City’s business regulations (if applicable) |

| Florida | Registration with the Florida Department of State | Food service license, building permits | Compliance with Florida’s business tax regulations |

Types of Businesses Suitable for H4 EAD Holders

H4 EAD holders, while enjoying the privilege of work authorization, face specific limitations due to their visa status. Choosing the right business structure and type is crucial for success and compliance. This section explores suitable business models, considering potential challenges and advantages for H4 EAD holders. The key is to select a business that aligns with their skills, resources, and the inherent restrictions of their visa.

The nature of the business chosen significantly impacts an H4 EAD holder’s operational flexibility and potential for growth. Factors such as the level of investment required, the scalability of the business model, and the potential for remote work should all be carefully considered. Furthermore, understanding the legal implications and compliance requirements associated with different business structures is paramount.

Suitable Business Types for H4 EAD Holders

Several business types are generally well-suited for H4 EAD holders, offering a balance between ease of setup, scalability, and compliance with visa restrictions. These often involve businesses that can be operated remotely, require minimal capital investment, or leverage existing skills and experience. Examples include online businesses, consulting services, freelance work, and small-scale retail ventures (with appropriate licensing). However, it’s crucial to remember that engaging in any business activity should be done in full compliance with the terms and conditions of the H4 EAD.

Challenges Faced by H4 EAD Holders in Business Ownership

H4 EAD holders face unique challenges when starting and running a business. The temporary nature of the visa and the potential for changes in immigration status can create uncertainty. Access to funding might be more difficult compared to U.S. citizens or permanent residents. Additionally, some industries may have stricter regulations or licensing requirements that could pose barriers to entry. Finally, the H4 EAD holder’s primary focus remains on their spouse’s employment status, and time constraints could affect the business’s growth trajectory.

Business Structures: Sole Proprietorship, Partnership, and LLC

The choice of business structure significantly impacts liability, taxation, and administrative burden.

A sole proprietorship is the simplest structure, offering ease of setup and minimal paperwork. However, the owner’s personal assets are at risk in case of business liabilities. A partnership involves sharing responsibilities and resources with one or more partners, but it also requires a detailed partnership agreement and shares liability among partners. A Limited Liability Company (LLC) offers the advantage of limited liability, separating personal assets from business liabilities, but it involves more complex setup and administrative requirements.

For H4 EAD holders, an LLC generally provides better protection from personal liability, a crucial consideration given the temporary nature of their visa status. However, the increased administrative burden should be weighed against this protection. The best structure depends on the specific circumstances and risk tolerance of the individual.

Examples of Successful Businesses Owned by H4 EAD Holders

While specific examples are difficult to publicly document due to privacy concerns, many H4 EAD holders have successfully launched and operated businesses. These businesses often reflect the skills and experience of the individual, capitalizing on their existing expertise.

- A software engineer leveraging their skills to offer freelance programming and consulting services.

- A marketing professional starting a digital marketing agency specializing in a niche market.

- An accountant offering tax preparation and bookkeeping services to small businesses.

- An artist creating and selling handcrafted goods online through platforms like Etsy.

Financial and Legal Considerations

Starting a business, even on an H4 EAD, requires careful planning and execution across both financial and legal domains. Ignoring either aspect can lead to significant challenges and potentially jeopardize the business’s success. This section details the key financial and legal considerations for H4 EAD holders venturing into entrepreneurship.

Financial Requirements and Considerations

Securing sufficient funding is paramount for any new business. H4 EAD holders face the additional challenge of potentially limited access to traditional financing options compared to US citizens or permanent residents. Personal savings are often the primary source of initial capital. Exploring alternative funding avenues such as small business loans (if eligible), crowdfunding platforms, or angel investors should be considered. A detailed business plan demonstrating financial projections, market analysis, and management expertise is crucial for attracting investors or securing loans. Careful budgeting and financial forecasting are essential to manage cash flow and ensure the business’s long-term viability. Understanding potential tax implications for both business income and personal income is vital, requiring consultation with a tax professional experienced in immigration and business taxation. For example, accurately predicting operating costs and revenue streams is crucial for creating a realistic budget and securing necessary funding. A comprehensive financial model should account for all expenses, including rent, utilities, salaries, marketing, and potential unforeseen costs.

Legal Procedures for Business Registration and Operation, Can h4 ead do business

Registering and operating a business in the US involves several legal steps, regardless of immigration status. H4 EAD holders must comply with all applicable federal, state, and local regulations. The specific requirements vary depending on the business structure (sole proprietorship, LLC, corporation, etc.) and location. Choosing the right business structure is a crucial first step, as it impacts liability, taxation, and administrative burden. For instance, an LLC offers limited liability protection, shielding personal assets from business debts. After choosing a structure, registering the business with the relevant state authorities is necessary. This typically involves filing articles of incorporation or organization and obtaining an Employer Identification Number (EIN) from the IRS if the business will have employees or operates as a corporation or partnership. Compliance with state and local regulations, including obtaining necessary business licenses and permits, is also crucial. Failure to comply with these regulations can result in penalties and legal repercussions.

Obtaining Necessary Licenses and Permits

The specific licenses and permits required vary significantly depending on the business type, location, and industry. For example, a restaurant will need food service permits, while a retail store might require a sales tax permit. A step-by-step process typically involves researching the relevant licensing requirements at the federal, state, and local levels. This often involves checking websites of the Small Business Administration (SBA), the state’s business licensing agency, and the local municipality. Applications for licenses and permits usually involve completing forms, providing supporting documentation, and paying associated fees. Some permits may require inspections to ensure compliance with safety and health regulations. Maintaining accurate records of all licenses and permits is crucial for ensuring ongoing compliance and avoiding potential legal issues. Regularly reviewing and renewing licenses as needed is essential to avoid penalties or business disruptions.

Checklist of Essential Legal and Financial Documents

A comprehensive checklist of essential documents is crucial for a smooth and legal business launch. This checklist is not exhaustive and may vary based on specific business needs and location.

- Business Plan: A detailed plan outlining the business concept, market analysis, financial projections, and management team.

- Articles of Incorporation/Organization: Legal documents establishing the business entity.

- Employer Identification Number (EIN): Tax identification number from the IRS.

- Business Licenses and Permits: All necessary licenses and permits from federal, state, and local authorities.

- Lease Agreement (if applicable): Contract for renting business premises.

- Insurance Policies: Liability insurance, property insurance, etc.

- Financial Statements: Bank statements, cash flow projections, profit and loss statements.

- Contracts with Suppliers and Vendors: Agreements with businesses providing goods or services.

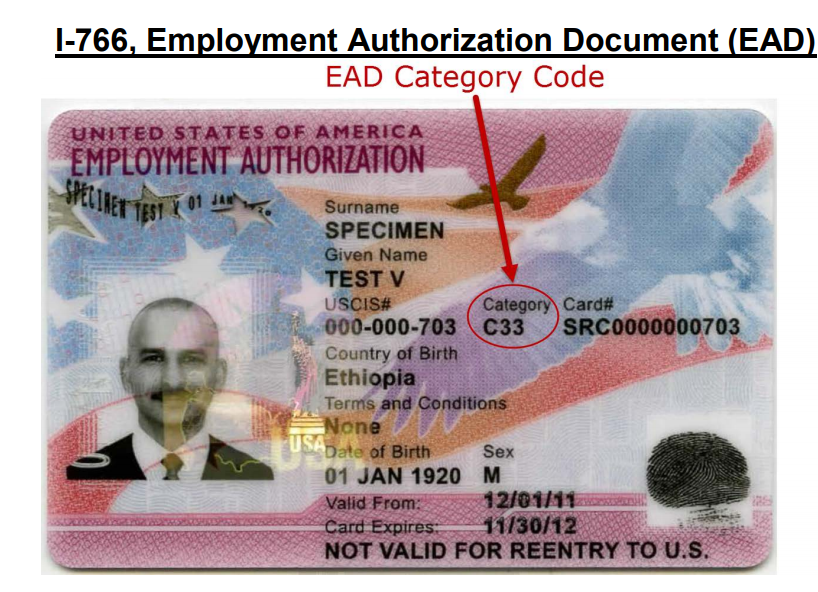

- H4 EAD Card: Proof of authorization to work in the US.

- Legal Counsel Documentation: Records of consultation with a business attorney.

Tax Implications for H4 EAD Business Owners

H4 EAD holders who establish and operate businesses in the United States face unique tax obligations stemming from their immigration status and business structure. Understanding these implications is crucial for compliance and minimizing potential tax liabilities. This section Artikels the key tax considerations for H4 EAD business owners, including tax forms, filing requirements, and potential deductions.

Tax Obligations and Responsibilities

H4 EAD holders are subject to the same federal and state tax laws as U.S. citizens and permanent residents. This means they must file income tax returns, pay estimated taxes (if applicable), and comply with all relevant tax regulations. The specific taxes owed will depend on the type of business structure chosen, the business’s revenue, and other factors. Failure to comply with these obligations can result in penalties and interest charges. Accurate record-keeping is essential for successful tax compliance. This includes maintaining meticulous records of income, expenses, and other relevant financial transactions.

Required Tax Forms and Filings

The specific tax forms required will vary based on the business structure and the nature of income. Sole proprietors typically file Schedule C (Profit or Loss from Business) with Form 1040, their individual income tax return. Partnerships use Form 1065 (U.S. Return of Partnership Income), while S corporations use Form 1120-S (U.S. Income Tax Return for an S Corporation) and C corporations use Form 1120 (U.S. Corporation Income Tax Return). Additionally, all businesses must comply with state tax regulations, which can include sales tax, state income tax, and other levies. Quarterly estimated tax payments may be required for self-employed individuals and business owners to avoid penalties at the end of the tax year.

Tax Implications of Different Business Structures

The choice of business structure (sole proprietorship, partnership, LLC, S corporation, or C corporation) significantly impacts tax implications. A sole proprietorship’s income is directly taxed on the owner’s individual income tax return, while partnerships and LLCs (typically taxed as partnerships) report income to partners who then report their share on their individual returns. S corporations and C corporations have separate tax obligations. S corporations pass income through to shareholders, avoiding double taxation, while C corporations pay corporate income tax, and shareholders pay taxes on dividends received. Each structure presents different advantages and disadvantages regarding tax liability, administrative burden, and liability protection. The optimal structure depends on individual circumstances and financial goals.

Common Tax Deductions for H4 EAD Business Owners

Properly utilizing tax deductions can significantly reduce taxable income. H4 EAD business owners are eligible for many of the same deductions available to other business owners. Accurate record-keeping is vital to substantiate these deductions.

- Home Office Deduction: If a portion of the home is used exclusively and regularly for business, expenses related to that space (a percentage of mortgage interest, rent, utilities, etc.) may be deductible.

- Business Expenses: Costs directly related to running the business, such as supplies, marketing, professional fees (accountants, lawyers), and travel expenses, are generally deductible.

- Depreciation: The cost of business assets (equipment, vehicles) can be depreciated over their useful life, reducing taxable income.

- Health Insurance Deduction: Self-employed individuals can often deduct the cost of health insurance premiums.

- Qualified Business Income (QBI) Deduction: This deduction, available to eligible pass-through entities, can significantly reduce taxable income.

Impact of H4 EAD on Business Growth and Scalability

The H4 EAD, while offering a pathway to entrepreneurship for spouses of H1-B visa holders, presents unique challenges to business growth and scalability due to its inherent temporary nature. The uncertainty surrounding renewal and potential expiration significantly impacts long-term strategic planning and investment decisions. This necessitates a more agile and adaptable approach to business development compared to businesses owned by individuals with permanent residency or citizenship.

The temporary nature of the H4 EAD directly affects a business’s ability to secure long-term funding and attract key talent. Investors and lenders are often hesitant to commit significant resources to a venture with an uncertain future, potentially limiting access to capital crucial for expansion. Similarly, recruiting and retaining employees can be difficult when the business owner’s status is temporary, potentially affecting morale and long-term project planning.

Challenges in Scaling a Business with an H4 EAD

Scaling a business while holding an H4 EAD involves navigating several significant hurdles. Securing significant investment becomes more challenging due to the inherent uncertainty surrounding the visa’s renewal. Long-term contracts with clients or partners might be difficult to negotiate given the potential for the business owner’s departure. Furthermore, attracting and retaining high-quality employees can be difficult, as prospective employees may be hesitant to commit to a company with an uncertain future. This uncertainty can also impact the business owner’s ability to make significant long-term investments in infrastructure or technology, hindering growth. For instance, a business owner might hesitate to lease a larger office space or invest in new equipment if they anticipate needing to close the business within a few years.

Strategies for Mitigating Risks Associated with H4 EAD Expiration

Several strategies can help mitigate the risks associated with the potential expiration of the H4 EAD. Developing a flexible business model that can adapt to changes in ownership or scale is crucial. This might involve creating a franchise model or focusing on a business that can be easily managed remotely. Building strong relationships with key partners and investors is also important to secure ongoing support. Proactive planning for business succession, including identifying potential successors or developing a plan for transferring ownership, is essential. This includes establishing clear legal structures and agreements to facilitate a smooth transition. Furthermore, carefully tracking the H4 EAD expiration date and proactively engaging in the renewal process well in advance can help minimize disruption. Finally, seeking legal counsel specializing in immigration law and business planning can provide valuable guidance and support throughout the process.

Transferring Business Ownership Upon H4 EAD Expiration

Transferring business ownership upon H4 EAD expiration requires careful legal and financial planning. The chosen method of transfer depends on several factors, including the type of business structure, the value of the business, and the desired outcome for the business owner. Options include selling the business, transferring ownership to a family member or partner, or dissolving the business. Each option requires specific legal and financial considerations, and professional advice is strongly recommended. For example, selling the business might involve negotiating a sale agreement, while transferring ownership to a family member requires careful consideration of tax implications and legal compliance. Dissolving the business requires winding down operations, settling outstanding debts, and complying with all relevant regulations. In all scenarios, seeking professional advice from legal and financial experts is crucial to ensure a smooth and legally compliant transition.

Illustrative Scenarios

Understanding the realities of starting a business on an H4 EAD requires examining both successful and potentially challenging scenarios. This section provides illustrative examples to clarify the practical aspects of business ownership for H4 EAD holders.

Successful Small Business Scenario: Priya’s Online Boutique

Priya, an H4 EAD holder with a background in fashion design, leveraged her skills and the flexibility of her visa status to launch an online boutique specializing in handcrafted jewelry. Initially, she faced challenges securing funding due to her visa status, but she overcame this by bootstrapping her business, using personal savings and reinvesting early profits. She utilized social media marketing effectively, building a strong online presence and cultivating a loyal customer base. Her meticulous attention to detail and commitment to quality resulted in positive customer reviews and word-of-mouth referrals, fueling her business growth. While managing inventory, fulfilling orders, and handling customer service presented ongoing operational challenges, Priya’s dedication and adaptability enabled her to navigate these obstacles and establish a profitable and sustainable business. Her success highlights the potential for H4 EAD holders to thrive in entrepreneurial ventures with careful planning and execution.

Hypothetical Business Plan: “GreenThumb Gardening Services”

This hypothetical business plan Artikels a potential venture for an H4 EAD holder with a passion for gardening.

Market Analysis

GreenThumb Gardening Services will cater to the growing demand for eco-friendly landscaping and gardening services in a suburban area with a high concentration of homeowners. Market research indicates a strong preference for organic gardening practices and a willingness to pay a premium for sustainable services. Competitor analysis reveals a limited number of businesses offering comprehensive organic gardening solutions, creating a niche market opportunity. The target market includes environmentally conscious homeowners aged 35-65 with disposable income and limited time for gardening.

Financial Projections

Start-up costs are estimated at $5,000, covering equipment purchases (wheelbarrow, gardening tools, etc.), initial marketing materials, and business licensing fees. Projected revenue for the first year is $25,000, based on an average service charge of $75 per client and an estimated 333 clients. This projection assumes a 20% profit margin after accounting for operational expenses (e.g., fertilizer, transportation, marketing). A detailed financial model, including projected income statements, cash flow statements, and balance sheets, will be developed to guide financial decision-making and secure potential funding. The financial model will also incorporate contingency plans to address potential fluctuations in demand and unexpected expenses. Similar businesses in the area have demonstrated profitability with comparable service offerings and pricing structures, supporting the viability of this projection.

Operational Strategies

GreenThumb Gardening Services will initially operate as a sole proprietorship, leveraging the owner’s existing gardening expertise. Services will include lawn maintenance, organic gardening consultations, and seasonal planting. The business will utilize online platforms and local networking to acquire clients. Customer relationship management will be a key focus, aiming to foster long-term relationships and generate repeat business through exceptional service and personalized attention. To ensure scalability, the business plan includes strategies for potential future expansion, such as hiring additional staff and outsourcing certain tasks as the business grows. A detailed operational plan will Artikel specific procedures for service delivery, client communication, and inventory management. This will be regularly reviewed and updated to ensure efficiency and effectiveness.