Can I get an LLC without a business? This question, surprisingly common, unveils a world of strategic asset protection and future business planning. Forming a Limited Liability Company (LLC) isn’t solely for established businesses; it offers significant advantages even before you launch your venture. This guide explores the legal requirements, tax implications, and financial considerations of establishing an LLC without immediate business operations, empowering you to make informed decisions about your financial future.

From understanding the fundamental legal requirements in various jurisdictions to navigating the intricacies of tax structures and operating agreements, we’ll demystify the process. We’ll examine the potential uses of an LLC as a holding company or for asset protection, and discuss how to plan for a smooth transition to active business operations when the time is right. This isn’t just about legal compliance; it’s about strategic positioning for long-term financial success.

Legal Requirements for LLC Formation

Forming a Limited Liability Company (LLC) involves navigating a series of legal requirements that vary significantly depending on the state or jurisdiction. Understanding these requirements is crucial for ensuring the LLC is properly established and enjoys the intended legal protections. Failure to comply can lead to significant legal and financial repercussions.

State-Specific Requirements for LLC Formation

Each U.S. state has its own unique set of rules governing LLC formation. These requirements typically include the submission of articles of organization, a document outlining the basic information about the LLC, such as its name, registered agent, and purpose. Some states may also require the filing of an operating agreement, an internal document outlining the management structure and operational guidelines of the LLC. The fees associated with filing these documents also vary by state. For example, Delaware, known for its LLC-friendly laws, may have higher filing fees than other states, but offers greater legal protection and established precedent. Conversely, Wyoming boasts lower fees but might have less robust legal infrastructure for complex LLC structures. Researching the specific requirements of the chosen state is paramount.

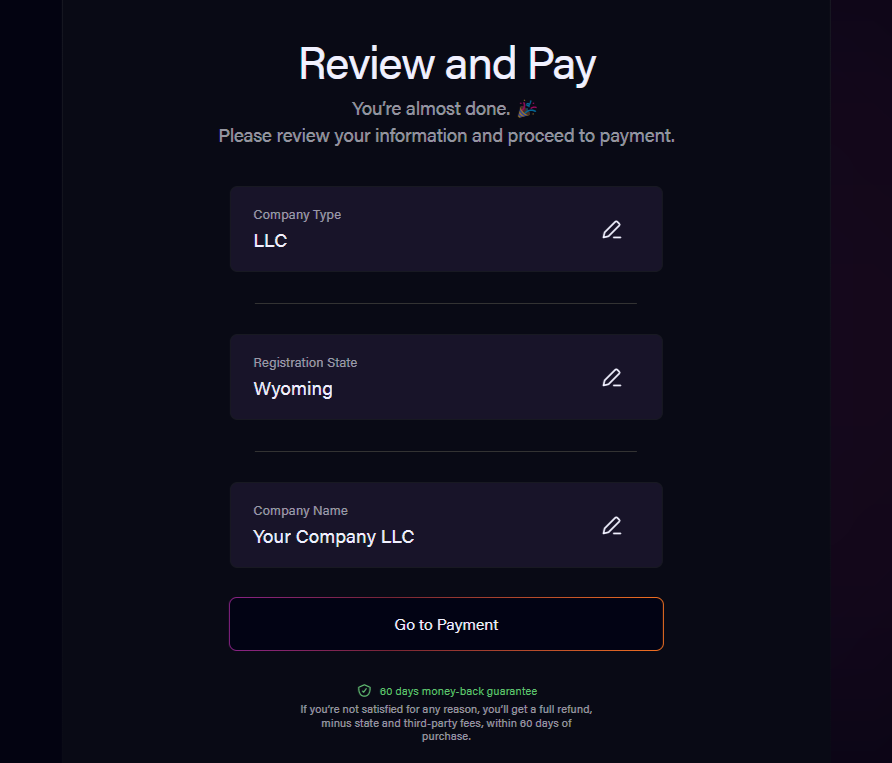

Steps Involved in LLC Formation

The LLC formation process generally involves several key steps. First, choosing a name that complies with state regulations is crucial. This often involves ensuring the name is unique and includes the LLC designation. Next, appointing a registered agent, an individual or business entity authorized to receive legal and official documents on behalf of the LLC, is mandatory. The registered agent must have a physical address within the state of formation. Then, drafting and filing the articles of organization with the relevant state agency is necessary. This often involves paying a filing fee. Finally, creating an operating agreement, though not always legally required, is highly recommended to Artikel the LLC’s internal governance and member responsibilities. This provides a clear framework for managing the LLC and resolving potential disputes.

LLC Formation: With and Without a Pre-Existing Business

The fundamental legal requirements for forming an LLC are largely the same whether or not a pre-existing business exists. However, the process might be slightly simpler if the LLC is formed to house an already operating business. In such cases, the business assets and liabilities can be transferred to the newly formed LLC. Forming an LLC without a pre-existing business involves creating the business structure and then operating within it. This requires a more comprehensive business plan, encompassing market research, financial projections, and operational strategies. Regardless of the presence of a pre-existing business, compliance with state-specific filing requirements and the appointment of a registered agent remain essential.

Flowchart Illustrating the LLC Formation Process

A flowchart depicting the LLC formation process would begin with the “Start” node. This would branch into two main paths: “Existing Business” and “New Business.” Both paths would then lead to the decision point of “Choose State of Formation.” Following this, both paths converge at “Choose LLC Name,” “Appoint Registered Agent,” “Draft Articles of Organization,” and “File Articles of Organization.” After filing, the “Existing Business” path would include a step for “Transferring Assets and Liabilities,” while the “New Business” path would branch to “Develop Business Plan” and “Secure Funding.” Both paths ultimately lead to the “LLC Formation Complete” node. Key decision points within the flowchart would emphasize the need to comply with state-specific regulations and the importance of seeking professional legal advice when necessary.

Purpose and Activities of an LLC Without a Business

Forming a Limited Liability Company (LLC) doesn’t necessitate immediate business operations. Many individuals and entities establish LLCs for strategic reasons unrelated to current commercial activity, leveraging the structure’s benefits for future planning or asset protection. These proactive measures can offer significant advantages in the long run.

The primary reasons for creating an LLC without an immediate business often revolve around asset protection, future business ventures, or acting as a holding company for existing assets. Understanding these applications is crucial for anyone considering this approach.

LLC as a Holding Company

An LLC can serve as a holding company, owning and managing assets like real estate, intellectual property, or investments without actively engaging in business operations. This structure provides liability protection for these assets, separating them from personal liabilities. For instance, an individual might form an LLC to hold several rental properties. If a tenant sues over an issue with one property, the lawsuit’s impact is limited to the LLC’s assets, protecting the individual’s personal assets from potential seizure. This separation offers a crucial layer of financial security.

Asset Protection Using an LLC

Beyond holding companies, LLCs offer significant asset protection. This is particularly valuable for individuals with substantial personal assets, such as real estate, investments, or intellectual property. By transferring these assets into an LLC, individuals create a legal barrier between their personal assets and potential liabilities arising from lawsuits, accidents, or business dealings. This protection extends to both personal and business-related risks. For example, a doctor might form an LLC to shield their personal assets from potential malpractice lawsuits.

Planning for Future Business Ventures

Establishing an LLC before launching a business provides a framework for future expansion and reduces the administrative burden when the business eventually begins operations. This proactive approach allows entrepreneurs to focus on developing their business idea rather than dealing with the complexities of LLC formation once the business is underway. This streamlined approach is particularly advantageous for startups that anticipate rapid growth and require a scalable legal structure. For example, an individual with a promising software idea could form an LLC, securing the name and legal entity, while simultaneously developing the product. Once ready to launch, the existing LLC simplifies the transition to full-fledged operations.

Advantages and Disadvantages of Forming an LLC Before Starting a Business

| Advantage | Disadvantage | Advantage | Disadvantage |

|---|---|---|---|

| Liability Protection: Shields personal assets from business debts and lawsuits. | Ongoing Costs: Annual fees and compliance requirements add to the overall expense. | Simplified Future Expansion: Easy transition to active business operations when ready. | Potential Complexity: Understanding LLC regulations and compliance can be challenging. |

| Asset Protection: Safeguards personal assets even without active business operations. | Administrative Burden: Requires filing paperwork and maintaining records, even without immediate business activity. | Credibility and Professionalism: Presents a more established image to potential investors or partners. | Limited Tax Benefits: May not offer significant tax advantages without active business income. |

Tax Implications of an LLC Without a Business: Can I Get An Llc Without A Business

Forming a Limited Liability Company (LLC) without immediate business activity might seem unusual, but it’s a choice some make for future planning or asset protection. Understanding the tax implications in this scenario is crucial, as an inactive LLC still has tax obligations, albeit different from an active one. These obligations depend heavily on the chosen tax structure and the state’s regulations.

An LLC without active business income generally doesn’t generate income subject to business taxes like corporate income tax. However, the LLC itself remains a separate legal entity, and its tax treatment depends on the election made with the IRS. Failing to make a proper election can result in unintended tax consequences.

LLC Tax Structures and Suitability for Inactive LLCs

The IRS allows LLCs to choose between several tax structures. The most common are disregarded entities, partnerships, and S corporations. The optimal choice for an inactive LLC often depends on individual circumstances and long-term plans.

A disregarded entity is treated as a sole proprietorship or partnership for tax purposes, meaning the LLC’s income and losses are reported on the owner’s personal income tax return (Form 1040, Schedule C or Form 1065). This simplifies tax filing significantly, but offers no tax advantages over a sole proprietorship or partnership structure. This structure is often the simplest and most common for inactive LLCs.

If the LLC has multiple members, it might be classified as a partnership, meaning the income and losses are passed through to the partners and reported on their individual tax returns (Form 1065 and Schedule K-1). This is similar to a disregarded entity but accommodates multiple owners.

An S corporation election offers potential tax advantages for active businesses, allowing for lower self-employment taxes. However, for an inactive LLC, the administrative burden of maintaining an S corporation structure likely outweighs any potential benefits. The added compliance requirements often make this choice impractical for an LLC without business activity.

Tax Implications Compared to Other Structures

Comparing an inactive LLC to other business structures reveals similarities and differences in tax treatment. An inactive LLC structured as a disregarded entity is essentially tax-equivalent to a sole proprietorship or partnership with respect to income taxes. The primary advantage of the LLC remains its liability protection, which is not present in a sole proprietorship or partnership. In essence, the LLC provides a shield of liability protection without necessarily incurring additional tax burdens in the absence of active business operations.

Potential Tax Deductions and Credits, Can i get an llc without a business

Even without active business income, an inactive LLC might still be eligible for certain tax deductions or credits. These are typically related to expenses incurred in maintaining the LLC’s legal structure or preparing for future operations.

The following are potential deductions or credits, depending on the specific circumstances and supporting documentation:

- Legal and professional fees: Expenses related to forming the LLC, registering with the state, and obtaining an EIN can be deductible.

- Accounting and bookkeeping fees: Costs associated with maintaining the LLC’s financial records, even if there’s no business activity, can be deductible.

- Office supplies and other administrative expenses: These expenses, if directly related to LLC administration, may be deductible. However, it is crucial that they are directly tied to LLC administration, not personal use.

It is important to consult with a tax professional to determine eligibility for specific deductions and credits. The availability and amount of deductions will vary greatly depending on the individual circumstances. Thorough record-keeping is essential to substantiate any claimed deductions.

Operating Agreements and Governance

Even without immediate business activities, establishing a comprehensive operating agreement is crucial for any LLC. This document serves as the internal constitution of your LLC, outlining the rules and regulations governing its operations and the relationships between its members. A well-drafted operating agreement protects members’ interests, prevents future disputes, and provides a framework for managing the LLC’s affairs, even in the absence of current business operations.

An operating agreement, even for an LLC without a current business, should be considered a proactive measure to prepare for future growth and expansion. It establishes a foundation for how the LLC will function once business activities commence. This foundational document is vital for maintaining order and clarity, especially when the LLC begins operating and new complexities arise.

Essential Elements of an LLC Operating Agreement

The core elements of an LLC operating agreement, regardless of current business activity, should include provisions addressing membership interests, management structure, profit and loss allocation, member contributions, and dispute resolution. Specifically, the agreement should clearly define each member’s ownership percentage, their voting rights, and their responsibilities within the LLC. It should also Artikel how profits and losses will be distributed among the members, which can be proportionate to ownership or based on other agreed-upon factors. Furthermore, the operating agreement should specify the process for admitting new members, withdrawing from the LLC, and resolving disputes among members. Finally, provisions addressing the transfer of membership interests should be included. These provisions prevent future conflict and maintain the LLC’s stability.

Defining Member Roles and Responsibilities

Clearly defining member roles and responsibilities within the operating agreement is paramount, even if the LLC is currently inactive. This prevents misunderstandings and potential conflicts later on. For example, the agreement should specify who is responsible for maintaining the LLC’s legal compliance, who will manage finances, and who will handle administrative tasks. Assigning specific responsibilities helps ensure that all necessary tasks are addressed and that each member understands their role in the LLC’s operations. This proactive approach reduces the risk of disputes arising from unclear expectations and responsibilities. Consider using a table to Artikel these roles and responsibilities, providing clarity and a formal record of each member’s contribution.

Structuring an Operating Agreement for Future Business Ventures

An effectively drafted operating agreement anticipates future growth and changes in the LLC’s operations. This involves incorporating clauses that address potential future business activities and expansion plans. The agreement should provide a flexible framework that allows the LLC to adapt to changing circumstances without requiring significant amendments later. This includes clearly outlining the process for adding new business ventures, defining how profits and losses from new ventures will be allocated, and specifying the decision-making process for expanding the LLC’s scope of operations. A well-structured agreement ensures that the LLC can evolve and grow without internal conflicts.

Sample Operating Agreement Clause Addressing Potential Future Business Activities

The Members acknowledge that the LLC may, in the future, engage in business activities beyond those currently contemplated. Any new business venture undertaken by the LLC shall require the approval of at least [Percentage]% of the Members, as determined by their respective ownership interests. The allocation of profits and losses from any new business venture shall be determined by the Members in a separate addendum to this Operating Agreement, which shall be approved by at least [Percentage]% of the Members. Any disputes arising from the initiation or operation of a new business venture shall be resolved in accordance with the dispute resolution provisions Artikeld in Section [Section Number] of this Operating Agreement.

Financial Considerations

Forming and maintaining a Limited Liability Company (LLC), even without active business operations, involves various financial commitments. Understanding these costs is crucial for responsible financial planning and managing expectations. These costs can vary significantly depending on the state of registration, the level of professional assistance sought, and the complexity of the LLC’s structure.

Initial costs associated with LLC formation primarily involve state filing fees, which can range from a few hundred dollars to well over a thousand depending on the state. These fees cover the processing and registration of the LLC’s formation documents. Additional initial costs might include the expense of a registered agent service (a necessity in most states), the cost of creating an operating agreement, and any legal fees incurred during the formation process.

Initial LLC Formation Costs

The initial cost of establishing an LLC varies greatly depending on whether you choose to do it yourself or hire professionals. DIY formation, using online services or state-provided forms, can cost as little as $50-$200, primarily covering state filing fees and potentially a registered agent service. However, using legal professionals, such as attorneys specializing in business formation, will significantly increase the initial costs, potentially ranging from $500 to $2000 or more, depending on the complexity of the situation and the attorney’s fees. This added cost provides legal expertise, ensuring compliance with all regulations and offering personalized guidance throughout the process. For example, a complex LLC structure requiring specific provisions in the operating agreement will inevitably increase legal fees.

Recurring Costs of LLC Maintenance

Beyond the initial setup, ongoing costs are essential to consider. Annual fees, often called franchise taxes or annual reports, are common in many states and typically range from $50 to $500 annually, varying by state and the LLC’s revenue. These fees are required to maintain the LLC’s good standing with the state. Compliance requirements, such as filing annual reports or updating the registered agent information, can also incur additional costs. Failure to comply can result in penalties and potential dissolution of the LLC. For instance, neglecting to file an annual report can result in late fees and, eventually, administrative dissolution of the LLC.

Cost Comparison: DIY vs. Legal Professionals

The decision to form an LLC independently or with professional assistance significantly impacts overall costs. While DIY methods are significantly cheaper upfront, they carry a higher risk of errors and non-compliance, potentially leading to costly legal battles and penalties in the future. Legal professionals ensure compliance, minimize the risk of costly mistakes, and offer valuable guidance throughout the LLC’s lifecycle. The long-term cost-effectiveness of hiring legal professionals depends on the individual’s comfort level with legal complexities and the potential risks associated with self-formation.

Three-Year LLC Budget (Without Active Business)

The following budget Artikels projected costs for an LLC over three years, assuming no active business operations:

| Year | Item | Cost (Estimate) |

|---|---|---|

| 1 | State Filing Fees | $150 |

| 1 | Registered Agent | $150 |

| 1 | Legal Fees (Formation) | $0 (DIY) or $1000 (Professional) |

| 1-3 | Annual Fees/Reports | $150/year |

| 1-3 | Registered Agent Fee | $150/year |

| Total (DIY) | $600 (Year 1), $450 (Years 2 & 3) | |

| Total (Professional) | $1650 (Year 1), $450 (Years 2 & 3) |

Note: These are estimates, and actual costs may vary depending on the state, chosen services, and the complexity of the LLC’s structure.

Future Business Planning

Establishing an LLC without immediate business activity often serves as a strategic move for future endeavors. This approach allows entrepreneurs to secure legal protection and plan for future growth without the immediate pressures of active operations. However, transitioning from a dormant to an active state requires careful planning and execution.

Successfully transitioning a dormant LLC to an active business involves a multi-faceted approach encompassing operational, legal, and financial considerations. This section details strategies for activating a dormant LLC, expanding its scope, and navigating potential challenges. It also provides examples of successful companies that leveraged this strategy.

Transitioning from Dormant to Active Operations

The transition from a dormant to an active LLC requires a systematic approach. First, review and update the LLC’s operating agreement to reflect the intended business activities. This ensures legal compliance and clarifies the roles and responsibilities of members. Next, secure any necessary licenses and permits required for the planned business operations. The specific licenses will vary depending on the nature of the business and its location. Finally, establish the necessary business infrastructure, including a business bank account, accounting systems, and potentially a physical or virtual office space. Failing to complete these steps can lead to legal and operational difficulties.

Expanding the Scope of LLC Activities

Expanding an LLC’s activities requires careful consideration of legal and operational implications. Amendments to the operating agreement may be necessary to reflect the expanded scope. This process often involves legal consultation to ensure compliance with all applicable regulations. Additional licenses or permits might be required depending on the nature of the expansion. Thorough market research and a well-defined business plan are crucial for a successful expansion. Without these elements, the expansion could be costly and ultimately unsuccessful.

Challenges in Transitioning from a Dormant LLC to an Active Business

Several challenges can arise when activating a dormant LLC. One common issue is the potential for administrative and legal complexities, especially if the LLC has been inactive for an extended period. Another challenge involves securing funding. Lenders may be hesitant to provide financing to a business with a history of inactivity. Furthermore, establishing brand recognition and attracting customers can be more difficult for a previously dormant business. Addressing these challenges requires proactive planning and potentially seeking expert advice from legal and financial professionals.

Examples of Successful Businesses that Started as Dormant LLCs

Many successful businesses began as dormant LLCs, using the initial period to plan, strategize, and secure necessary resources. While specific details are often proprietary, the general strategy often involves a period of intense research and development, followed by a targeted marketing campaign leveraging early adopter interest. For example, imagine a technology startup that used its dormant period to perfect its software and secure seed funding. This period allowed them to refine their product and develop a robust marketing strategy before launching publicly. Similarly, a small retail business might use this time to secure favorable lease terms and build up inventory before opening its doors to the public. This measured approach significantly increases the chances of success.