Can I pay my nanny through my business? This question sparks a complex web of legal, financial, and logistical considerations for parents employing childcare help. Navigating the intricacies of payroll, taxes, insurance, and employment contracts is crucial to ensure both compliance and a smooth working relationship. This guide unravels the complexities, offering a clear path toward responsible nanny employment within a business structure.

Employing a nanny through your business offers potential tax advantages, but it also necessitates understanding the legal obligations and administrative responsibilities involved. From registering your nanny as a business employee to complying with labor laws and ensuring adequate insurance coverage, the process demands careful planning and execution. This comprehensive guide will help you understand the process, weigh the pros and cons, and make informed decisions to protect both yourself and your nanny.

Legal and Tax Implications

Employing a nanny through your business introduces significant legal and tax considerations that differ substantially from paying a nanny personally. Understanding these implications is crucial to ensure compliance with the law and optimize your tax position. Failure to do so can result in penalties and legal repercussions.

Legal Requirements for Employing a Nanny Through a Business

Employing a nanny through your business means you’re treating them as an employee, not an independent contractor. This necessitates adherence to various federal and state labor laws. These laws govern aspects like minimum wage, overtime pay, workers’ compensation insurance, and unemployment insurance. You’ll also need to comply with tax withholding and reporting obligations, as discussed in the following section. Furthermore, you must comply with all relevant child labor laws, if applicable. The specific regulations vary by state, so consulting with an employment lawyer or your state’s labor department is highly recommended.

Tax Implications of Paying a Nanny as a Business Expense

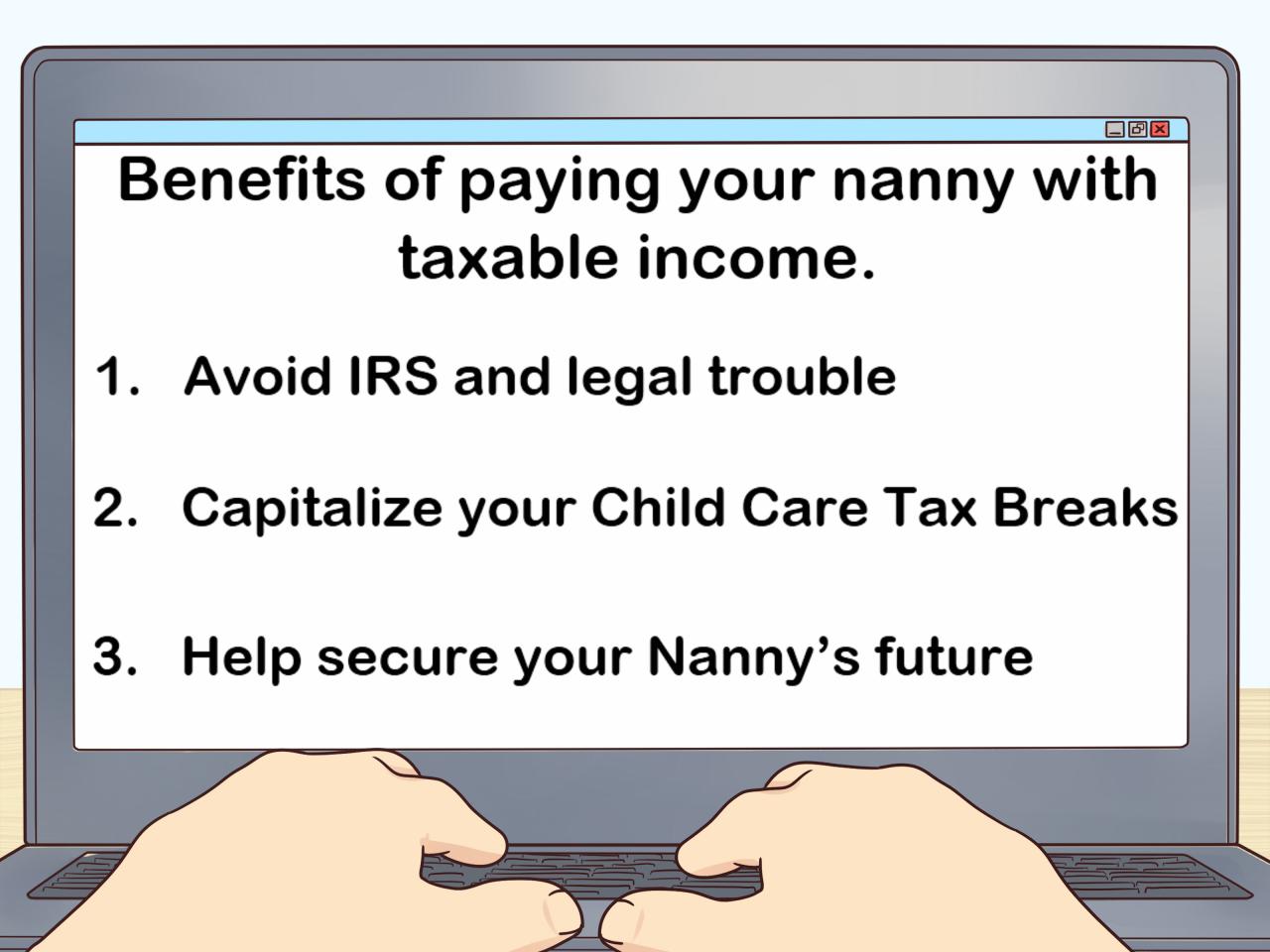

Paying a nanny as a business expense allows you to deduct their wages and related employment taxes from your business income, potentially reducing your overall tax liability. However, accurate record-keeping is paramount. You must maintain meticulous records of all nanny-related expenses, including wages, payroll taxes (Social Security and Medicare taxes), and any other employment-related costs. These records will be essential during tax audits. Failure to accurately report these expenses can lead to significant penalties. You will also need to file appropriate payroll tax returns with the IRS and your state’s taxing authority. The specific forms and deadlines will depend on your business structure and location.

Tax Burdens: Employee vs. Independent Contractor

Classifying your nanny as an employee versus an independent contractor significantly impacts tax obligations. As an employee, you are responsible for withholding income taxes, Social Security and Medicare taxes (FICA), and potentially state and local taxes from their wages. You’ll also pay the employer’s share of FICA taxes. As an independent contractor, the nanny is responsible for paying their own self-employment taxes (which are equivalent to both the employer and employee portions of FICA). Incorrect classification can lead to significant penalties from the IRS. The IRS provides guidelines to help determine proper classification. Misclassifying an employee as an independent contractor is a common error with serious consequences.

Registering a Nanny as a Business Employee

Registering your nanny as a business employee involves several steps. First, obtain an Employer Identification Number (EIN) from the IRS if your business doesn’t already have one. This number is crucial for filing payroll taxes. Next, you’ll need to register with your state’s unemployment insurance agency and workers’ compensation insurance program. Then, you must establish a payroll system, either through a payroll service provider or by handling it in-house. This system will facilitate the accurate calculation and payment of wages, and the withholding and remittance of payroll taxes. Finally, you’ll need to provide your nanny with a W-2 form at the end of the year, summarizing their earnings and taxes withheld.

Costs and Benefits: Business vs. Personal Employment

| Cost Factor | Employing Nanny Through Business | Employing Nanny Personally |

|---|---|---|

| Wages | Deductible business expense | Not deductible |

| Payroll Taxes (Employer & Employee) | Business expense; Employer pays a portion | Nanny pays self-employment tax |

| Unemployment Insurance | Business expense | Not applicable |

| Workers’ Compensation Insurance | Business expense | Not applicable |

| Legal Compliance | Higher; adhering to federal and state labor laws | Lower; fewer legal requirements |

| Administrative Burden | Higher; payroll processing, tax filings | Lower; simpler payment process |

| Tax Implications | Potential tax deductions; complex tax filings | Simpler tax filings; no deductions for nanny expenses |

Insurance and Liability: Can I Pay My Nanny Through My Business

Employing a nanny through your business introduces significant insurance and liability considerations. Failing to adequately address these can lead to substantial financial and legal repercussions. This section details the necessary insurance coverage, employer liability, and potential risks associated with insufficient protection.

Types of Insurance Needed

Several insurance policies are crucial when employing a nanny through a business. These policies protect both the business owner and the nanny from various risks. The specific needs will depend on the nanny’s responsibilities and the nature of your business.

Employer’s Liability for Injuries or Accidents

As an employer, you are legally responsible for the safety and well-being of your nanny. This extends to injuries or accidents that occur during the course of their employment, whether involving the nanny herself or the children under her care. Liability can arise from a variety of situations, including slips and falls on your property, injuries sustained while performing nanny duties, or accidents involving the children in your care. Failure to maintain a safe work environment or provide proper training can significantly increase your liability.

Potential Risks of Inadequate Insurance Coverage

Insufficient insurance coverage exposes your business to significant financial risk. A lawsuit resulting from a workplace injury or accident involving the nanny or the children could lead to substantial legal fees and potentially massive payouts. Without adequate coverage, you could face bankruptcy. Furthermore, inadequate insurance can damage your business reputation and make it difficult to attract and retain qualified employees. The costs of uninsured incidents could far exceed the premiums for appropriate coverage. For example, a serious injury sustained by a child under the nanny’s care could result in a multi-million dollar lawsuit.

Nanny Insurance Coverage Verification Checklist

Before employing a nanny, verify their insurance coverage. This checklist ensures compliance and mitigates potential risks.

- Obtain proof of the nanny’s personal liability insurance, demonstrating coverage for incidents occurring while performing their duties.

- Verify the policy’s coverage limits are sufficient to cover potential liabilities.

- Confirm the policy is active and in good standing.

- Check whether the policy covers incidents both on and off your property, depending on the nanny’s responsibilities.

- Review the policy’s exclusions to understand any limitations in coverage.

- Document all insurance information for your records.

Examples of Relevant Insurance Policies

Several common insurance policies are relevant in this scenario.

- Employer’s Liability Insurance: Protects your business from claims arising from injuries or illnesses sustained by your employees (the nanny) during the course of their employment.

- General Liability Insurance: Covers claims related to bodily injury or property damage caused by your business operations, which could include incidents involving the nanny or the children under her care.

- Workers’ Compensation Insurance: (Depending on location and legal requirements) Provides medical benefits and wage replacement for your nanny if they are injured on the job. This is often mandatory in many jurisdictions.

- Professional Indemnity Insurance (Errors and Omissions Insurance): May be advisable if the nanny handles sensitive information or performs tasks that could lead to professional negligence claims. This would protect against claims of mistakes or omissions in the course of their work.

Payroll and Compensation

Paying a nanny through your business introduces complexities beyond a simple cash transaction. Proper payroll processing ensures legal compliance, protects both you and your nanny, and fosters a professional working relationship. This section details the key elements of setting up and managing your nanny’s payroll.

Setting Up Payroll for a Nanny Employed Through a Business

Establishing a payroll system for your nanny requires several steps. First, you’ll need to obtain an Employer Identification Number (EIN) from the IRS if your business doesn’t already have one. This number is crucial for tax reporting and withholding purposes. Next, you’ll need to choose a payroll provider, either a dedicated payroll service or accounting software with payroll capabilities. These services handle tax calculations, withholdings, and direct deposit, significantly simplifying the process. Finally, you’ll need to establish clear employment agreements outlining compensation, working hours, benefits (if any), and other relevant terms.

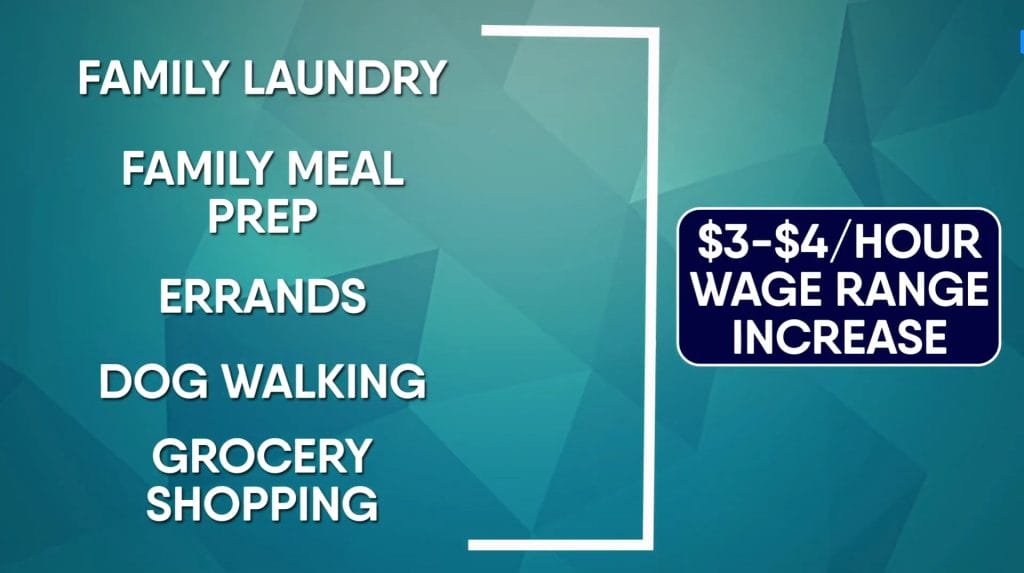

Nanny Wage Requirements: Minimum Wage and Overtime

Compliance with federal and state minimum wage laws is paramount. The federal minimum wage is $7.25 per hour, but many states have higher minimums. You must pay your nanny at least the applicable minimum wage for their location. Overtime pay is also crucial. Federal law mandates overtime pay (typically 1.5 times the regular rate) for hours worked exceeding 40 per week, although some states may have different rules. For example, California requires overtime pay for hours worked beyond 8 hours in a single workday, regardless of the total weekly hours. Always consult your state’s labor laws to ensure compliance.

Common Payroll Deductions, Can i pay my nanny through my business

Several deductions are typically made from a nanny’s gross pay. These include federal and state income taxes (if required based on income level and state laws), Social Security and Medicare taxes (FICA), and potentially state unemployment insurance taxes. Depending on your agreement, you might also deduct contributions for health insurance premiums, retirement plans (like a 401(k) or SEP IRA), or other benefits.

Calculating the Total Cost of Employing a Nanny

The total cost of employing a nanny surpasses the gross wages paid. Consider the following:

| Cost Component | Example |

|---|---|

| Gross Wages | $50,000 per year |

| Employer’s Share of FICA | 7.65% of gross wages ($3,825) |

| Federal and State Unemployment Taxes (varies by state) | $500 (estimated) |

| Payroll Provider Fees | $50 per month ($600 per year) |

| Health Insurance (if provided) | $500 per month ($6,000 per year) |

| Total Cost | $61,000 (approximately) |

The total cost can vary significantly depending on location, benefits offered, and payroll provider.

Sample Payroll Schedule and Payment Record-Keeping

A consistent payroll schedule is essential. Many employers opt for bi-weekly or semi-monthly payments. Maintaining accurate records is critical for tax purposes and to ensure transparency. This involves keeping detailed records of hours worked, wages paid, deductions made, and any other relevant financial information. A simple spreadsheet or dedicated payroll software can be used to track this information. Consider a system that includes: employee name, pay period dates, hours worked, gross pay, deductions, net pay, payment method, and payment date. This detailed record-keeping simplifies tax preparation and helps avoid potential disputes.

Contract and Employment Agreement

A well-defined employment contract is crucial when employing a nanny through your business. It protects both the employer and the employee by clearly outlining the terms of the agreement, minimizing the potential for misunderstandings and disputes. This contract should be legally sound and comprehensive, addressing all aspects of the employment relationship.

Sample Employment Contract for a Nanny

The following is a sample employment contract; however, it’s essential to consult with legal counsel to ensure it complies with all applicable laws and regulations in your jurisdiction. This sample should be adapted to reflect the specific circumstances of each employment.

This is a sample contract and should be reviewed and adapted by legal counsel to meet specific legal requirements.

Employment Agreement

This agreement, made this [Date], is between [Business Name], a [State] [Business Type] with its principal place of business at [Business Address] (“Employer”), and [Nanny’s Full Name], residing at [Nanny’s Address] (“Employee”).

1. Position: The Employee will serve as a nanny for [Child’s Name(s)], providing childcare services as Artikeld below.

2. Responsibilities: The Employee’s responsibilities include, but are not limited to: [List specific responsibilities, e.g., preparing meals, providing transportation to activities, assisting with homework, maintaining a clean and safe environment].

3. Compensation: The Employee will receive a salary of $[Amount] per [Pay Period], paid [Payment Frequency]. This compensation includes [Specify what is included, e.g., overtime pay, holiday pay].

4. Working Hours: The Employee’s regular working hours are [Start Time] to [End Time], [Days of the Week]. Overtime will be compensated at a rate of [Overtime Rate].

5. Benefits: The Employer will provide [List benefits, e.g., paid time off, health insurance].

6. Termination: This agreement may be terminated by either party with [Number] days’ written notice. Exceptions to this clause may include serious breaches of contract by either party.

7. Confidentiality: The Employee agrees to maintain the confidentiality of all information obtained during the course of employment.

8. Governing Law: This agreement shall be governed by and construed in accordance with the laws of the State of [State].

Essential Clauses in a Nanny Employment Contract

Several essential clauses are necessary to create a legally sound and comprehensive contract. These clauses help prevent disputes and ensure both parties understand their rights and responsibilities. Omitting these clauses can lead to costly legal battles later.

- Detailed Job Description: Clearly define the nanny’s responsibilities, including specific tasks and expectations.

- Compensation and Payment Schedule: Specify the salary, payment frequency, method of payment, and any additional compensation (e.g., overtime, bonuses).

- Working Hours and Schedule: Clearly Artikel the regular working hours, including days of the week and any flexibility.

- Vacation and Sick Leave: Detail the amount of paid time off the nanny is entitled to.

- Termination Clause: Artikel the procedures for terminating the employment agreement, including notice periods and reasons for termination.

- Confidentiality Clause: Protect sensitive information about the family and the child(ren).

- Governing Law and Dispute Resolution: Specify which state’s laws govern the contract and the process for resolving disputes.

Types of Employment Contracts for Nannies

Several types of employment contracts can be used, each with its own advantages and disadvantages. The choice depends on the specific needs and circumstances of the employer and nanny. Consulting legal counsel is crucial to ensure the chosen contract is appropriate.

- At-Will Employment Contract: This allows either party to terminate the employment relationship at any time, with or without cause (subject to limitations imposed by law).

- Fixed-Term Contract: This specifies a defined period of employment, after which the contract automatically expires.

- Part-Time Contract: This is suitable for situations where the nanny works fewer than full-time hours.

Essential Elements to Mitigate Legal Disputes

A well-drafted contract is the first line of defense against legal disputes. Including specific details minimizes ambiguity and reduces the potential for disagreements.

- Clear and Unambiguous Language: Avoid jargon and legal terms that the nanny may not understand.

- Detailed Responsibilities: Clearly Artikel all duties and expectations.

- Specific Compensation Terms: Leave no room for interpretation regarding salary, benefits, and payment schedules.

- Defined Termination Procedures: Establish a clear process for ending the employment relationship.

- Signatures of Both Parties: Ensure both the employer and the nanny sign and date the agreement.

Workplace Safety and Regulations

Ensuring a safe environment for both the nanny and the child(ren) is paramount when employing childcare services through a business. Neglecting safety protocols can lead to serious injuries, legal repercussions, and reputational damage. This section Artikels essential safety measures, relevant regulations, and preventative strategies to create a secure and healthy workplace.

Safety Measures for Nanny and Child(ren)

Implementing comprehensive safety measures requires a proactive approach encompassing the physical environment, equipment, and procedures. This involves regular inspections, preventative maintenance, and emergency preparedness. A safe environment minimizes risks and promotes a positive childcare experience.

- Childproofing: Thorough childproofing of the home or designated childcare area is crucial. This includes covering electrical outlets, securing cabinets containing hazardous materials, and removing any potential choking hazards. Regular checks should be conducted to ensure ongoing safety.

- Safe Play Areas: Designated play areas should be free of sharp objects, trip hazards, and potential choking hazards. Age-appropriate toys and equipment should be provided. Outdoor play areas should be fenced and regularly inspected for safety.

- Emergency Procedures: A clear emergency plan, including contact information for emergency services, parents, and other relevant individuals, should be readily accessible. The nanny should be trained in basic first aid and CPR.

- Transportation Safety: If transportation is part of the nanny’s responsibilities, the vehicle must be properly maintained and equipped with appropriate car seats or booster seats for the child(ren). The nanny should adhere to all traffic laws and safe driving practices.

Relevant Workplace Safety Regulations and Compliance

Compliance with relevant workplace safety regulations is non-negotiable. Failure to comply can result in significant fines and legal action. These regulations often vary by location, so it’s essential to research and understand the specific requirements in your area.

For example, in many jurisdictions, employers are required to provide a safe working environment, which includes adherence to occupational safety and health standards. These standards may address aspects like emergency exits, fire safety, and the handling of hazardous materials. Additionally, specific regulations may exist concerning the supervision of children in childcare settings, including staff-to-child ratios and background checks.

Potential Workplace Hazards and Preventative Measures

Identifying and mitigating potential hazards is crucial for preventing accidents. Hazards can range from physical dangers like tripping hazards to chemical hazards such as cleaning products.

- Slips, Trips, and Falls: Regular cleaning and maintenance of floors, removal of clutter, and adequate lighting can significantly reduce the risk of slips, trips, and falls.

- Choking Hazards: Small objects, loose buttons, and food items should be kept out of reach of children. Proper food preparation and supervision during mealtimes are also important.

- Burns: Hot liquids, stoves, and other heat sources should be kept out of children’s reach. Potentially hazardous kitchen appliances should be used with extreme caution.

- Poisoning: Household cleaning products, medications, and other potentially poisonous substances should be stored securely and out of reach of children. Proper labeling and storage are crucial.

Safety Protocols and Training Programs for Nannies

Comprehensive training programs are essential for ensuring the nanny’s competence in handling safety-related situations. These programs should cover various aspects, including first aid, CPR, child development, and emergency procedures.

For instance, a training program might include practical sessions on administering first aid, using fire extinguishers, and responding to various emergency scenarios. Regular refresher courses should be provided to maintain the nanny’s knowledge and skills.

Workplace Safety Procedures Checklist

A comprehensive checklist ensures adherence to safety protocols. Regular reviews and updates are crucial to adapt to changing circumstances.

- Childproofing completed and regularly inspected.

- Emergency plan in place and reviewed regularly.

- First aid kit readily accessible and well-stocked.

- Transportation safety measures in place (if applicable).

- Nanny has completed appropriate first aid and CPR training.

- Regular safety inspections conducted and documented.

- Hazardous materials stored securely and out of reach of children.

- Appropriate supervision levels maintained.

- All safety equipment (e.g., car seats) properly installed and maintained.

- Emergency contacts readily available.