Can I sell on Amazon without a business license? This question plagues many aspiring entrepreneurs eager to tap into Amazon’s vast marketplace. The answer, however, isn’t a simple yes or no. Selling on Amazon involves navigating a complex web of federal and state regulations, Amazon’s Seller Agreement, and various tax implications. Understanding these legal and financial nuances is crucial for avoiding potential penalties, account suspension, and long-term business complications. This guide delves into the legal requirements, Amazon’s policies, tax obligations, and insurance considerations for selling on Amazon, whether you operate as an individual or a registered business.

We’ll explore the differences between selling as an individual versus a business entity, highlighting the potential risks and benefits of each approach. We’ll examine Amazon’s specific policies regarding business registration and compliance, providing clear examples of situations where a business license is essential. Furthermore, we’ll dissect the tax implications for both individual and business sellers, comparing and contrasting the reporting procedures and potential liabilities. Finally, we’ll address the importance of insurance and liability protection, offering practical advice on securing the right coverage for your specific circumstances and business growth.

Legal Requirements for Selling on Amazon

Selling on Amazon, whether as an individual or a business, involves navigating a complex legal landscape. Understanding the federal and state regulations is crucial to avoid penalties and ensure compliance. This section details the legal requirements for selling on Amazon in the US, highlighting key differences between individual sellers and businesses.

Federal and State Regulations for Amazon Sellers

Federal regulations impacting Amazon sellers primarily focus on tax obligations, product safety, and intellectual property rights. The Internal Revenue Service (IRS) requires sellers to report income earned through Amazon sales and pay applicable taxes. The Consumer Product Safety Commission (CPSC) enforces regulations ensuring the safety of products sold online, including those on Amazon. Similarly, trademark and copyright laws protect intellectual property rights, requiring sellers to avoid infringement. State regulations vary significantly. Many states require sellers to obtain a business license or seller’s permit, particularly if they operate as a business entity or exceed a certain sales threshold. These state-level requirements often involve sales tax collection and remittance, as well as compliance with specific industry regulations.

Legal Differences Between Individual Sellers and Businesses

The legal requirements differ considerably depending on whether you sell as an individual or a business. Individuals selling personal items occasionally typically face less stringent regulations compared to businesses selling goods regularly. However, even individual sellers must still comply with federal tax laws and product safety regulations. Businesses, on the other hand, face more comprehensive requirements, including state-level business licensing, tax registration (e.g., obtaining a sales tax permit), and potentially adhering to specific industry regulations based on the products they sell. Operating as a business entity (LLC, corporation, etc.) often involves additional legal and administrative obligations.

Situations Requiring a Business License for Amazon Sellers

A business license is typically mandatory for Amazon sellers who operate as a business entity (sole proprietorship, LLC, corporation, etc.). Additionally, exceeding a specific sales threshold within a state often triggers the requirement for a business license and sales tax permit. Selling products requiring specific licenses or permits (e.g., alcohol, firearms, certain food products) also necessitates obtaining those licenses in addition to a general business license. Finally, consistent and substantial sales activity, regardless of the legal structure, may lead state authorities to investigate and require a license.

Implications of Selling With and Without a License

Selling on Amazon without the necessary licenses and permits carries significant risks. These include hefty fines, legal action from state and federal authorities, and potential suspension or termination of your Amazon selling privileges. Conversely, operating with the proper licenses and permits demonstrates legal compliance, protects your business from legal challenges, and fosters trust with customers. It also ensures you’re correctly collecting and remitting sales taxes, avoiding further legal complications.

Potential Legal Consequences of Selling Without a License by State

| State | License Requirement | Penalties for Non-Compliance | Resources for Obtaining a License |

|---|---|---|---|

| California | Generally required for businesses, thresholds vary | Fines, back taxes, legal action | California Secretary of State, California Department of Tax and Fee Administration |

| Texas | Generally required for businesses, thresholds vary | Fines, back taxes, legal action | Texas Comptroller of Public Accounts |

| New York | Generally required for businesses, thresholds vary | Fines, back taxes, legal action | New York Department of State, New York State Department of Taxation and Finance |

| Florida | Generally required for businesses, thresholds vary | Fines, back taxes, legal action | Florida Department of State, Florida Department of Revenue |

Amazon’s Seller Policies and Terms of Service

Amazon’s Seller Agreement dictates the terms and conditions governing all sales activity on its platform. Understanding these policies, particularly concerning legal compliance, is crucial for maintaining a successful and sustainable selling presence. Failure to comply can lead to significant consequences, including account suspension or termination. This section details Amazon’s stance on business licensing and the potential ramifications of non-compliance.

Amazon’s official stance on selling without a business license is not explicitly stated as a blanket prohibition. However, the platform implicitly requires sellers to adhere to all applicable laws and regulations in their respective jurisdictions. This includes obtaining the necessary business licenses and permits required by local, state, and federal authorities. The Seller Agreement emphasizes the seller’s responsibility for legal compliance.

Amazon Seller Agreement and Business Registration

The Amazon Services Business Solutions Agreement (the “Seller Agreement”) places the onus of legal compliance squarely on the seller. While not explicitly listing “business license” as a requirement, several clauses implicitly mandate it. Sections pertaining to tax collection, product safety regulations, and general legal compliance all necessitate the proper business registration and adherence to relevant laws. Failure to comply with these implied requirements exposes sellers to significant risk. For instance, sections dealing with tax collection require sellers to comply with all applicable tax laws, a task significantly simplified and legitimized by having a properly registered business. Similarly, sections related to product safety require sellers to ensure their products comply with all relevant safety standards, a responsibility that is easier to demonstrate with a formal business structure.

Risks and Challenges for Unlicensed Sellers

Operating without the necessary business licenses on Amazon exposes sellers to a multitude of risks. These include legal repercussions from relevant authorities, potential financial penalties, and reputational damage. Amazon itself may take action against unlicensed sellers, ranging from warnings and account restrictions to full account suspension and termination. This is because operating without the proper licenses often indicates a lack of adherence to other Seller Agreement stipulations, leading to a higher risk of violating Amazon’s policies in other areas. A lack of proper business registration can also hinder a seller’s ability to resolve disputes effectively and access certain seller support services.

Impact of Violating Amazon’s Terms of Service

Violation of Amazon’s Seller Agreement regarding business licensing and legal compliance can have severe consequences. Amazon reserves the right to suspend or terminate seller accounts that are found to be non-compliant. The severity of the consequences will depend on the nature and extent of the violation. Repeated or egregious violations are likely to result in permanent account closure. This can lead to the loss of sales, revenue, customer base, and the significant investment of time and resources in building a seller presence on Amazon. Furthermore, a history of non-compliance can make it difficult, if not impossible, to re-open an account in the future.

Steps to Ensure Compliance with Amazon’s Seller Agreement

Ensuring compliance with Amazon’s Seller Agreement requires proactive steps. This is not merely about avoiding penalties; it’s about building a sustainable and legitimate business.

- Determine the necessary business licenses and permits required in your location. This may involve researching federal, state, and local regulations.

- Register your business with the appropriate authorities. This typically involves filing the necessary paperwork and paying any applicable fees.

- Obtain an Employer Identification Number (EIN) from the IRS if you are a sole proprietor or plan to hire employees.

- Familiarize yourself with all relevant tax laws and regulations. This includes understanding sales tax requirements and properly filing tax returns.

- Maintain accurate and up-to-date records of all financial transactions and business activities.

- Regularly review and update your understanding of Amazon’s Seller Agreement and all applicable laws and regulations.

- Proactively address any compliance concerns or questions you may have with the relevant authorities and Amazon.

Tax Implications of Selling on Amazon Without a Business License: Can I Sell On Amazon Without A Business License

Selling on Amazon without a business license can significantly impact your tax obligations. Understanding these implications is crucial to avoid penalties and ensure compliance with tax laws. The key difference lies in how the IRS treats income generated from self-employment versus business income. This impacts reporting requirements, deductions, and overall tax liability.

Tax Reporting Differences: Individuals vs. Businesses

Individuals selling on Amazon without a business license report their Amazon sales income as self-employment income on Schedule C of Form 1040. This form is used to report profit or loss from a business (even if it’s a sole proprietorship). Businesses, on the other hand, file different tax forms depending on their legal structure (e.g., sole proprietorship, LLC, corporation). The choice of business structure directly influences how profits are taxed and reported. For instance, an LLC might file a separate tax return, while a sole proprietorship’s income is reported on the owner’s personal tax return. The key distinction is the separation of personal and business liabilities; a business structure offers this separation, which a sole proprietorship lacks.

Potential Tax Liabilities for Unlicensed Sellers

Unlicensed sellers face several potential tax liabilities. The most prominent is income tax on profits from Amazon sales. This is calculated after deducting allowable business expenses (though the range of deductible expenses is more limited for individuals than for businesses). Additionally, they may owe self-employment tax, which covers Social Security and Medicare taxes. This tax applies to net earnings from self-employment, impacting individuals but not necessarily business entities in the same way. Furthermore, depending on the state and the types of goods sold, unlicensed sellers might also be liable for sales tax. Sales tax is collected from buyers and remitted to the relevant state taxing authority. Failure to collect and remit sales tax can result in significant penalties. For example, if an individual sells $50,000 worth of goods on Amazon, netting $20,000 in profit, they will owe income tax on that $20,000, plus self-employment tax, and possibly sales tax depending on location and sales.

Tax Filing Procedures: Individuals vs. Businesses

Individuals selling on Amazon without a business license file their taxes using Form 1040, including Schedule C to report their self-employment income. They need to track all income and expenses meticulously throughout the year to accurately calculate their profit or loss. Businesses, depending on their structure, will file different forms. Sole proprietors, similar to individuals, use Schedule C, while LLCs might file Form 1065 (for partnerships) or even Form 1120 (for corporations), depending on their designation with the IRS. The complexity and procedures for filing vary significantly based on the chosen business structure and its accounting methods. Maintaining detailed records is crucial regardless of the chosen structure.

Tax Implications: Sole Proprietorship vs. LLC

| Tax Type | Sole Proprietorship | LLC |

|---|---|---|

| Income Tax | Reported on owner’s personal income tax return (Form 1040, Schedule C) | Depends on the LLC’s tax classification (e.g., disregarded entity, partnership, S corporation, C corporation). Taxed at the owner’s individual rate or at the business level. |

| Self-Employment Tax | Owed on net earnings from self-employment | May or may not be owed depending on the LLC’s tax classification and the owner’s role. |

| Sales Tax | Collected and remitted to the state (if applicable) | Collected and remitted to the state (if applicable) |

| Liability Protection | No legal separation between personal and business assets. Personal assets are at risk. | Offers varying degrees of liability protection, depending on the state and how the LLC is structured. |

Insurance and Liability Considerations

Selling on Amazon, whether with or without a business license, carries inherent risks. Protecting yourself from potential financial losses is crucial, and insurance plays a vital role in mitigating these risks. Understanding the various types of insurance available and their relevance to your Amazon selling operation is essential for long-term success and peace of mind.

Types of Relevant Insurance for Amazon Sellers

Several types of insurance can significantly benefit Amazon sellers. Product liability insurance is paramount, covering claims of bodily injury or property damage caused by your products. General liability insurance protects against claims of property damage or bodily injury caused by your business operations, excluding your products. Professional liability insurance (also known as Errors & Omissions insurance) protects against claims of negligence or mistakes in your professional services, if applicable (e.g., if you offer design services related to your products). Commercial property insurance can cover damage or loss to your inventory or business property. Finally, depending on your business structure and operations, you might consider cyber liability insurance to protect against data breaches or other cyber-related incidents.

Insurance Protection Against Financial Loss

Consider this scenario: a customer claims injury from a faulty product you sold on Amazon. Without product liability insurance, you could face substantial legal fees and compensation payments. Similarly, if a customer trips and falls in your warehouse (if you have one), general liability insurance would cover medical expenses and potential legal costs. If you make a mistake in a product description leading to a customer dispute, professional liability insurance could protect you. These examples highlight how insurance safeguards your financial well-being against unforeseen circumstances.

Liability Risks: Licensed vs. Unlicensed Sellers

While the core risks are similar for both licensed and unlicensed sellers, the legal and financial consequences of incidents can differ significantly. Licensed sellers typically have more robust legal protections and potentially lower insurance premiums due to established business structures. However, both licensed and unlicensed sellers are responsible for the safety and quality of their products. An unlicensed seller facing a lawsuit might face greater personal liability, potentially jeopardizing personal assets. This underscores the importance of insurance for all Amazon sellers, regardless of licensing status.

Recommended Insurance Coverage for Amazon Sellers

Choosing the right insurance coverage depends on your specific business model and risk profile. Below is a categorized list of recommendations:

It’s crucial to tailor your insurance coverage to your specific business needs. Consult with an insurance professional to determine the appropriate level of coverage for your unique circumstances.

- High Risk (High-volume sellers, products with inherent risks): Product Liability Insurance, General Liability Insurance, Professional Liability Insurance (if applicable), Commercial Property Insurance, Cyber Liability Insurance.

- Medium Risk (Moderate sales volume, relatively low-risk products): Product Liability Insurance, General Liability Insurance.

- Low Risk (Low sales volume, very low-risk products): Product Liability Insurance (minimum coverage).

Scaling Your Amazon Business and Legal Requirements

Successfully scaling an Amazon business requires careful consideration of evolving legal obligations. While initially, operating without a formal business structure might seem simpler, significant growth necessitates a more robust legal framework to protect your interests and ensure compliance. Ignoring these requirements can lead to substantial financial and legal penalties.

The Point at Which a Business License Becomes Crucial

The need for a business license isn’t tied to a specific revenue threshold or employee count, but rather a combination of factors. While selling a few handmade items from home might not require formal registration, exceeding certain sales volumes, employing staff, or transitioning to more complex business operations significantly increases the legal risks of operating without a license. For example, a sole proprietor selling under $50,000 annually might not face immediate legal repercussions, but reaching $100,000 in revenue, particularly with employees, substantially increases the likelihood of encountering legal issues and significantly increases the potential penalties for non-compliance. The complexity of your product also plays a role; selling regulated goods, like certain food items or medical devices, will require additional permits and licenses regardless of revenue.

Key Factors Influencing Business Formalization

Several key factors influence the decision to formalize a business structure. These include:

- Revenue: As revenue increases, so do the tax implications and the potential for audits. A formal business structure provides better tools for managing finances and complying with tax regulations.

- Employee Count: Hiring employees introduces employment laws, payroll taxes, and worker’s compensation requirements. A formal business structure provides a legal framework for managing these obligations.

- Product Complexity: Selling regulated products necessitates specific licenses and permits, regardless of revenue or employee count. This applies to items requiring FDA approval, specific manufacturing permits, or adherence to particular safety standards.

- Business Expansion: Plans to expand into new markets or product lines often necessitate a more structured legal entity to handle increased complexities and potential liabilities.

- Liability Protection: A formal business structure, such as an LLC or corporation, offers liability protection, shielding personal assets from business debts or lawsuits.

Transitioning from Unlicensed to Legally Registered

Transitioning from an unlicensed seller to a legally registered business requires a systematic approach. The process involves several steps, each crucial for successful and compliant operation.

Step-by-Step Guide for Obtaining Necessary Licenses and Permits, Can i sell on amazon without a business license

The specific licenses and permits required vary by location and business type. However, a general process includes:

- Choose a Business Structure: Determine the appropriate legal structure for your business (sole proprietorship, partnership, LLC, corporation). This choice impacts liability, taxation, and administrative requirements.

- Register Your Business Name: Check for name availability and register your business name with the relevant state or local authorities. This may involve obtaining a fictitious business name (DBA) certificate.

- Obtain an Employer Identification Number (EIN): If you have employees or operate as a corporation or partnership, you’ll need an EIN from the IRS. This is crucial for tax purposes and opening a business bank account.

- Obtain Necessary Licenses and Permits: Research and obtain all required licenses and permits at the federal, state, and local levels. This might include business licenses, sales tax permits, professional licenses (if applicable), and permits related to your specific industry or product category.

- Open a Business Bank Account: Separate your business finances from your personal finances to maintain clear accounting and comply with tax regulations.

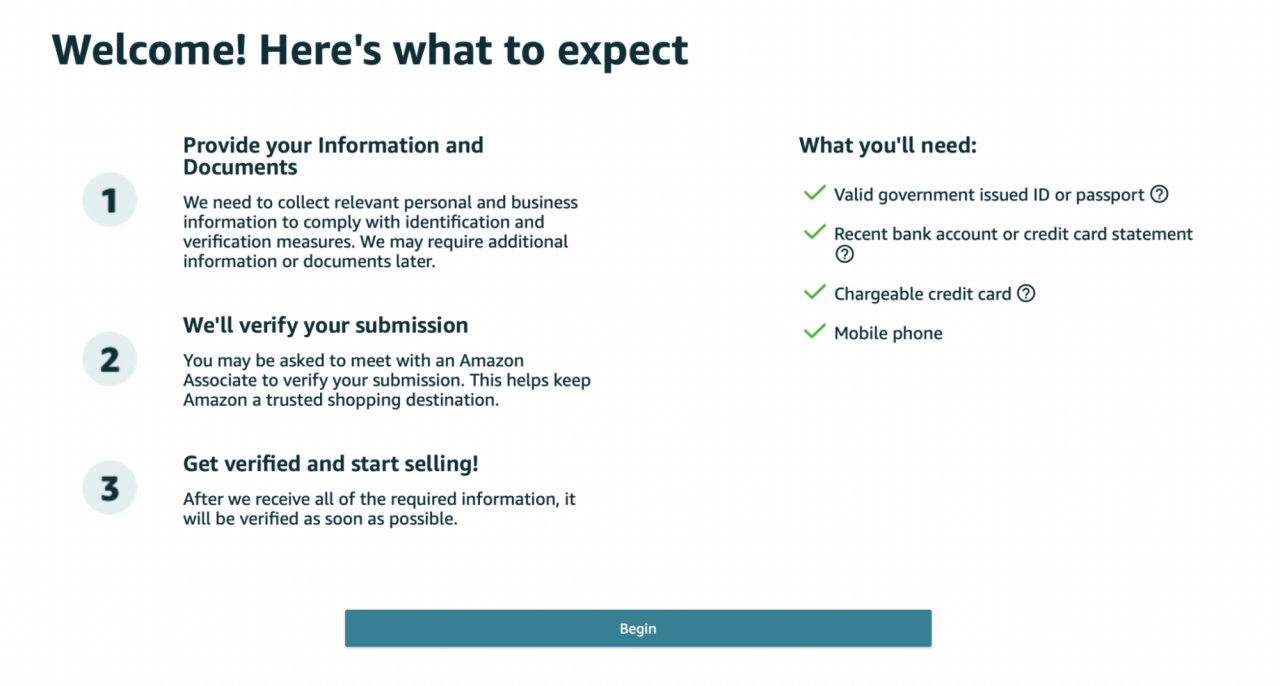

- Update Amazon Seller Account: Update your Amazon seller account with your new business information, including your business name, address, and tax identification number.