Can you start an LLC without a business? Absolutely. While many associate LLC formation with an already-running enterprise, establishing an LLC before launching a business offers significant strategic advantages. This proactive approach allows you to secure liability protection, establish a solid legal framework, and streamline future business development. Understanding the legal requirements, financial implications, and operational aspects is key to successfully navigating this path.

This guide delves into the intricacies of forming an LLC before starting a business, covering everything from the initial registration process and ongoing financial obligations to the importance of a well-structured operating agreement. We’ll explore the various reasons why someone might choose this route, highlighting the benefits and potential drawbacks. We’ll also provide practical advice and examples to help you make informed decisions.

Legal Requirements for LLC Formation

Forming a Limited Liability Company (LLC) involves navigating a series of legal requirements that vary by state. These requirements, however, generally center around registration, adherence to state-specific operating agreements, and ongoing compliance. Crucially, the process doesn’t inherently require a pre-existing business; you can establish an LLC as a framework for future ventures.

LLC Registration Process

Registering an LLC typically involves submitting the Articles of Organization (or a similar document) to the relevant state agency. This document Artikels fundamental information about the LLC, including its name, registered agent, and purpose. While the specific requirements for the Articles of Organization differ across states, they all require basic information about the LLC’s structure and principals. The process usually involves an online submission, although some states may allow for mail-in applications. After submission and payment of the associated fees, the state will issue a Certificate of Organization, signifying the official registration of the LLC. This entire process can be completed even before launching any business operations.

State-Specific Paperwork and Fees

The paperwork and fees associated with LLC formation vary considerably among states. For instance, Delaware, known for its LLC-friendly laws, typically requires a relatively straightforward Articles of Organization filing with a moderate fee. However, states like California may have more extensive paperwork requirements and higher filing fees. Some states also impose annual franchise taxes or other recurring fees for maintaining LLC status. It’s crucial to research the specific requirements and fees for the chosen state before initiating the formation process. Failing to understand these variations can lead to delays and unexpected costs. For example, while Delaware’s filing fees are relatively low, California’s are significantly higher, reflecting differences in state regulations and administrative costs.

LLC Formation Checklist (Without Pre-Existing Business)

Before commencing the LLC formation process, a comprehensive checklist ensures a smoother and more efficient experience. This checklist, tailored for those without a pre-existing business, should include:

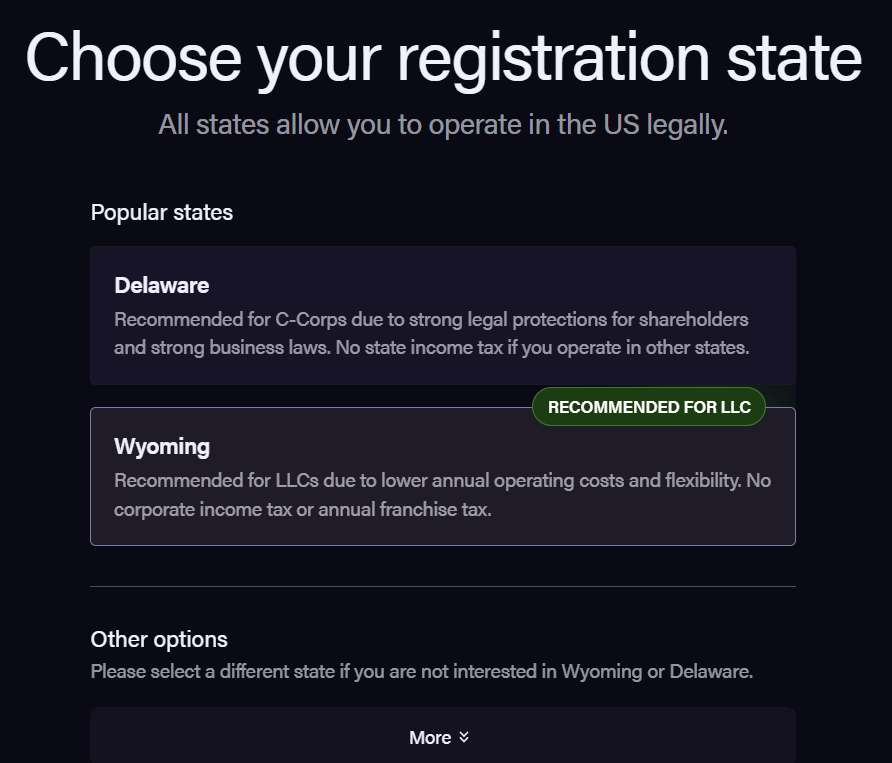

- Choose a State: Research and select a state for LLC registration, considering factors like tax implications and business-friendliness.

- Choose a Name: Select a unique LLC name that complies with state naming conventions, often requiring a designation like “LLC” or “L.L.C.”

- Appoint a Registered Agent: Designate a registered agent, an individual or entity responsible for receiving legal and official documents on behalf of the LLC. This is a mandatory requirement in all states.

- Prepare Articles of Organization: Complete and file the Articles of Organization, accurately providing all required information about the LLC’s structure and members.

- Pay Filing Fees: Submit the required filing fees to the designated state agency.

- Create an Operating Agreement: Though not always legally mandated, an operating agreement Artikels the internal management structure and member responsibilities of the LLC. This is highly recommended, even without immediate business operations, to establish clear guidelines for future activities.

- Obtain an EIN (Employer Identification Number): If the LLC plans to hire employees or operate as a corporation for tax purposes, an EIN is required from the IRS.

Following this checklist systematically minimizes the risk of omissions and ensures compliance with legal requirements, even in the absence of current business activities. This proactive approach lays a solid foundation for future business growth and operational efficiency.

Purpose and Activities of an LLC without a Pre-existing Business

Forming a Limited Liability Company (LLC) before launching a specific business is a strategic move undertaken for various legitimate reasons. While many associate LLC formation with an already-operating enterprise, proactively establishing an LLC offers significant advantages in terms of asset protection, business structuring, and future expansion. This proactive approach allows for careful planning and lays a solid foundation for future business endeavors.

Many entrepreneurs choose to form an LLC before starting a business to establish a legal entity that separates their personal assets from business liabilities. This proactive approach minimizes personal financial risk, even before any business activities commence. This structure is particularly beneficial for individuals exploring high-risk ventures or those anticipating potential lawsuits, regardless of the business’s operational status.

Legitimate Reasons for Forming an LLC Before Starting a Business

Establishing an LLC before commencing business activities provides a framework for future operations and offers several key advantages. One significant benefit is asset protection. Even without active business operations, the LLC’s separate legal identity shields personal assets from potential business-related lawsuits or debts. This protection extends to future ventures conducted under the LLC umbrella. Another key benefit lies in simplifying the process of securing funding or attracting investors. A pre-established LLC provides a more professional and organized structure, making it easier to secure loans or attract investment capital compared to an informal business structure.

Benefits of Establishing an LLC for Future Business Ventures

The strategic formation of an LLC prior to initiating business operations offers several long-term advantages. Firstly, it streamlines the transition from planning to execution. Once the business idea is ready for launch, the LLC is already in place, reducing the administrative burden and delays associated with setting up a new legal entity. Secondly, an LLC facilitates easier expansion and diversification. As the business grows and diversifies into new products or services, the existing LLC structure can easily accommodate these changes without requiring complex legal restructuring. Finally, it offers enhanced credibility and professionalism. Having a formally established LLC projects a more professional image to clients, partners, and potential investors, enhancing trust and fostering stronger business relationships.

Implications of Operating an LLC without Immediate Business Activity

Operating an LLC without immediate business activity doesn’t automatically render it inactive or invalid. However, it does necessitate compliance with certain legal and administrative requirements. Annual filings and reporting obligations, including the payment of any applicable fees, must still be adhered to, even in the absence of active business operations. Failure to meet these requirements can result in penalties or even the dissolution of the LLC. Furthermore, maintaining an LLC without active business activities might incur ongoing costs, such as registered agent fees or other administrative expenses. It’s crucial to weigh these costs against the potential long-term benefits of having a pre-established LLC.

Hypothetical Scenario: Anticipating a Future Business

Imagine Sarah, a software engineer, develops a novel algorithm for AI-powered image recognition. While she hasn’t yet built a fully functional product, she anticipates significant market potential. To protect her intellectual property and prepare for future business ventures, Sarah forms an LLC, “Visionary AI Solutions,” even before launching a product or actively seeking customers. This allows her to secure legal protection for her algorithm, attract investors for product development, and establish a solid foundation for her future business, minimizing risk and maximizing potential. This proactive approach enables her to focus on refining her technology and building a strong business plan, without the immediate pressure of establishing a legal entity concurrently.

Financial Aspects of an LLC without Business Operations: Can You Start An Llc Without A Business

Maintaining an LLC, even without active business operations, incurs ongoing financial obligations. Understanding these costs and their tax implications is crucial for responsible LLC management. Failure to account for these expenses can lead to unexpected financial burdens and potential legal issues.

Operating an LLC, regardless of activity level, necessitates consistent financial management. Several recurring expenses are unavoidable, and ignoring them can result in penalties or the involuntary dissolution of your LLC. Furthermore, the tax implications of an inactive LLC differ significantly from those of an active one, requiring careful consideration and potentially specialized tax advice.

Ongoing Financial Obligations of an Inactive LLC

An inactive LLC still requires adherence to state-mandated filing fees and the maintenance of a registered agent. Annual fees vary widely by state, ranging from a few dozen dollars to several hundred. Registered agent services, which handle official state correspondence, typically cost between $50 and $250 annually. These are fundamental expenses and neglecting them can lead to penalties, including fines and potential legal action. Additional costs might include bank account maintenance fees if you choose to maintain a business account, even if it is rarely used. It’s vital to budget for these costs to avoid unexpected financial strains.

Tax Implications of an Inactive LLC

The tax implications for an inactive LLC depend largely on the LLC’s structure (single-member or multi-member) and the tax election made (sole proprietorship, partnership, S-corp, or C-corp). Even without income, the LLC may still be required to file annual tax returns. Failure to file, even with no income, can result in penalties. For example, a single-member LLC might be considered a disregarded entity by the IRS, meaning its income and expenses are reported on the owner’s personal tax return. However, the LLC itself might still need to file an informational return (Form 1065 or Form 1120) depending on state regulations, even if no income is generated. This is especially true if the LLC was previously active or is intended for future use. Seeking professional tax advice is strongly recommended to ensure compliance.

Tax Implications Comparison: Active vs. Inactive LLC

| Aspect | Active LLC | Inactive LLC | Notes |

|---|---|---|---|

| Income Tax | Taxed on business income (depending on tax election) | Generally no income tax, but filing requirements may still exist | Tax liability depends on the chosen tax structure (e.g., pass-through taxation for single-member LLCs, or corporate taxation for C-corps) |

| Filing Requirements | Annual tax returns (e.g., Form 1065, Form 1120, Form 1040 Schedule C) and potentially state filings. | Annual informational returns may be required depending on state and election, even without income. | Failure to file can result in penalties. |

| Self-Employment Tax | Applicable to owners of active LLCs structured as sole proprietorships or partnerships. | Generally not applicable, unless income is generated. | This tax applies to profits from self-employment. |

| Franchise Tax/Annual Fees | Applicable, usually based on income or revenue. | Applicable; a fixed fee regardless of income. | These fees are typically required by states for LLC maintenance. |

Budgeting for Ongoing Costs of an Inactive LLC

Creating a realistic budget for an inactive LLC involves estimating and allocating funds for the recurring expenses. This includes annual state filing fees (research your state’s specific fees), registered agent service fees (consider various providers and their pricing), and potential bank account maintenance fees. A contingency fund should also be included to cover unexpected expenses or potential penalties. For example, if annual fees total $200 and registered agent services cost $150, a yearly budget of $350 is a reasonable starting point. Adding a 20% contingency (or $70) would result in a total annual budget of $420. This proactive approach ensures the LLC remains compliant and avoids financial surprises.

Operating Agreements and Governance

Even without immediate business operations, a comprehensive operating agreement is crucial for any LLC. It serves as the foundational document governing the internal affairs of the company, defining member roles, responsibilities, and decision-making processes. This proactive approach minimizes potential disputes and ensures a clear framework for future business activities. Failing to establish a clear operating agreement can lead to misunderstandings and conflicts down the line, potentially impacting the LLC’s overall efficiency and success.

An operating agreement, even for a dormant LLC, provides a legal framework to address various aspects of the company’s structure and operation. This prevents future disputes and ensures the LLC is properly managed. It’s a proactive measure to avoid problems rather than a reactive solution to existing ones.

Key Elements of an Operating Agreement for a Newly Formed LLC

The operating agreement should clearly define the LLC’s purpose, even if that purpose is currently undefined. It should also Artikel the management structure, member contributions, profit and loss allocation, and procedures for admitting or removing members. Crucially, it should address the process for amending the agreement itself, ensuring flexibility as the LLC evolves. Specific clauses should be included to address scenarios such as the death or withdrawal of a member, ensuring a smooth transition of ownership and management.

Management Structures for LLCs Without Active Business

Several approaches exist for managing an LLC with no active business. One common approach is to designate a managing member who holds primary responsibility for overseeing the LLC’s affairs. Alternatively, the LLC members can opt for a member-managed structure where all members participate in decision-making. The choice depends on the members’ preferences, the complexity of the LLC’s affairs, and the anticipated future business activities. A third approach involves appointing an independent manager, particularly if the members have limited time or expertise in business management. This option is less common for LLCs without active operations but can offer a structured approach to handling administrative tasks.

Sample Operating Agreement Excerpt

This Operating Agreement is made effective [Date], by and among [Member Names], collectively referred to as the “Members,” to form [LLC Name], a limited liability company organized under the laws of [State]. While the LLC currently has no active business operations, this agreement establishes the framework for its future governance and management. The LLC will be managed by [Managing Member Name] as the designated managing member. The managing member shall be responsible for maintaining the LLC’s good standing with the state, ensuring compliance with all applicable laws, and generally overseeing the LLC’s administrative affairs. All significant decisions regarding the future business operations of the LLC will require the unanimous consent of the Members. This agreement may be amended by the unanimous written consent of all Members.

Future Business Planning and the LLC

Forming an LLC before launching your business offers significant advantages in long-term planning and growth. The structure provides a flexible framework that adapts to evolving business needs, while offering crucial legal protection and enhanced credibility. This proactive approach can save time, resources, and potential legal headaches down the line.

Establishing an LLC before actively conducting business provides a solid foundation for future expansion and strategic maneuvering. The legal separation between personal and business assets protects your personal wealth from potential business liabilities, even before generating revenue. This is particularly beneficial when seeking funding or attracting investors.

Facilitating Future Business Planning and Expansion

An LLC’s flexible structure allows for easy adaptation to changing market conditions and business strategies. For example, an LLC initially established for a single product line can easily expand to incorporate new products or services without requiring complex legal restructuring. This scalability is a key advantage over sole proprietorships or partnerships, which may face significant hurdles when expanding their operations. The ability to issue membership interests also provides options for future growth through equity financing or strategic partnerships.

Advantages of an Established Legal Entity When Seeking Funding or Partnerships

Investors and potential partners view established LLCs more favorably than unincorporated businesses. The LLC’s legal structure demonstrates a commitment to professionalism and provides a clear legal framework for investment and collaboration. This established entity provides transparency and reassurance to investors regarding liability and ownership. For example, securing a bank loan or attracting angel investors is significantly easier with a pre-existing LLC due to the reduced risk associated with the business’s legal separation from the owner’s personal assets. Furthermore, a well-defined operating agreement provides a clear understanding of ownership and operational procedures, which is crucial for attracting strategic partners.

Protecting Personal Assets Before Commencing Business Operations

Even before commencing operations, an LLC protects personal assets from business-related liabilities. This protection extends to lawsuits, debts, and other financial obligations incurred by the business. For instance, if the LLC is sued, the plaintiff cannot seize the owner’s personal assets to satisfy a judgment unless the owner has personally guaranteed the LLC’s debts. This preemptive protection is a significant benefit, mitigating potential financial risks before any business activities begin. This is particularly important in industries with higher liability risks.

Transitioning an Inactive LLC into an Active Business Entity, Can you start an llc without a business

Transitioning an inactive LLC to an active state involves several key steps:

- Review the Operating Agreement: Ensure the operating agreement aligns with the business’s current goals and operational plans. Amendments may be necessary to reflect changes in ownership, responsibilities, or profit-sharing arrangements.

- Obtain Necessary Licenses and Permits: Depending on the nature of the business and location, various licenses and permits may be required. This step ensures compliance with local, state, and federal regulations.

- Open a Business Bank Account: Separating business finances from personal finances is crucial for maintaining clear accounting records and protecting personal assets. This also enhances the professional image of the business.

- Establish an Accounting System: Implement a robust accounting system to track income, expenses, and other financial transactions. This is essential for tax compliance and effective financial management.

- File the Annual Report (if required): Many states require LLCs to file an annual report, even if inactive. Failure to comply can result in penalties or the dissolution of the LLC. Updating the annual report to reflect the transition to active status is essential.

- Update the Registered Agent Information: Ensure the registered agent information is current and accurate. The registered agent receives official legal and tax documents on behalf of the LLC.