CEFCU car loans offer a potential pathway to affordable vehicle financing. This guide delves into the intricacies of obtaining a CEFCU car loan, from understanding interest rates and application processes to navigating repayment options and eligibility requirements. We’ll explore customer experiences, compare CEFCU loans with other financing choices, and clarify associated fees. Ultimately, this comprehensive resource aims to empower you with the knowledge needed to make informed decisions about your next vehicle purchase.

Whether you’re a first-time car buyer or looking to refinance, understanding the specifics of CEFCU’s offerings is crucial. We’ll dissect the factors influencing interest rates, detail the application process step-by-step, and analyze various repayment plans. We’ll also compare CEFCU’s terms to those offered by dealerships and other lenders, helping you determine the best financial strategy for your unique situation.

CEFCU Car Loan Interest Rates

Securing a car loan involves careful consideration of interest rates, as they significantly impact the overall cost. Understanding the factors that influence these rates and comparing them across different lenders is crucial for making an informed financial decision. This section details CEFCU’s car loan interest rates, compares them to competitors, and explains the key determinants.

CEFCU’s car loan interest rates are competitive within the market, though the precise rate offered will vary based on several individual factors. It’s important to note that interest rates are subject to change and are dependent on prevailing market conditions. Always contact CEFCU directly for the most up-to-date information.

Comparison of CEFCU Car Loan Interest Rates with Competitors

The following table provides a comparison of approximate interest rates, loan term options, and minimum credit score requirements for CEFCU and some major competitors. Please remember that these are estimates and may not reflect current offers. Contact the respective lenders for the most accurate and current information. Actual rates will vary based on individual creditworthiness and other factors.

| Lender | Interest Rate (%) | Loan Term Options (Years) | Minimum Credit Score Requirement |

|---|---|---|---|

| CEFCU | 3.99% – 14.99% (estimated) | 24-72 months | 660 (estimated) |

| Credit Union A | 4.49% – 15.99% (estimated) | 24-84 months | 680 (estimated) |

| Bank B | 5.25% – 17.99% (estimated) | 36-72 months | 700 (estimated) |

| Credit Union C | 4.99% – 16.49% (estimated) | 24-60 months | 650 (estimated) |

Factors Influencing CEFCU Car Loan Interest Rates

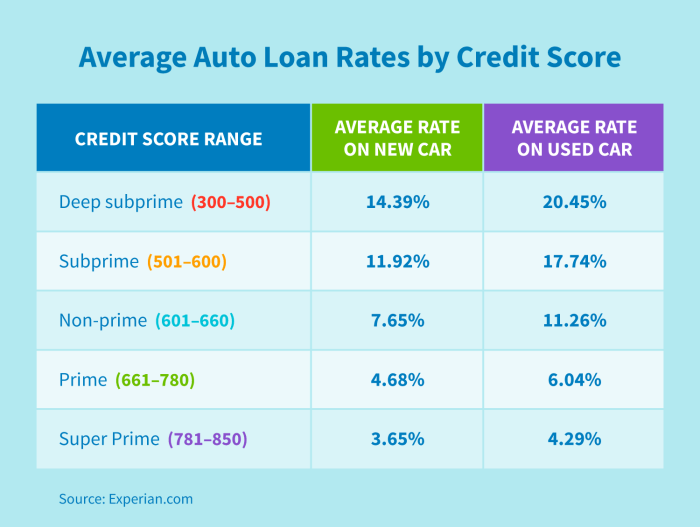

Several factors contribute to the interest rate CEFCU offers on car loans. A higher credit score generally results in a lower interest rate, reflecting a lower perceived risk to the lender. The length of the loan term also plays a significant role; longer terms often come with higher interest rates due to increased risk for the lender. The type of vehicle being financed can influence the rate; new cars might command lower rates than used cars, reflecting differences in depreciation and resale value. Finally, the loan amount itself can impact the interest rate offered.

Special Offers and Promotions

CEFCU occasionally offers special promotions on car loans, such as reduced interest rates for a limited time or incentives for members who meet specific criteria. These offers can vary and are usually advertised on CEFCU’s website and through their branches. It is advisable to check CEFCU’s official website or contact them directly to inquire about any current promotions. For example, a past promotion might have included a reduced interest rate for members who financed a new, fuel-efficient vehicle. Another example might be a lower interest rate for members who use CEFCU’s auto-buying service.

CEFCU Car Loan Application Process

Applying for a CEFCU car loan is a straightforward process designed for efficiency and convenience. The application can be completed online, by phone, or in person at a branch, offering flexibility to suit individual preferences. The entire process, from initial application to final approval, is designed to be transparent and easily understood.

The application process involves several key steps, each designed to ensure a smooth and efficient loan approval. Careful preparation of the required documentation will expedite the process significantly.

Steps in the CEFCU Car Loan Application Process

The following steps Artikel the typical application procedure. While specific steps may vary slightly depending on individual circumstances, this provides a general overview of what to expect.

- Pre-qualification: Before formally applying, consider using CEFCU’s pre-qualification tool (if available) to get an estimate of your potential loan terms and interest rate. This helps you understand your borrowing power and plan accordingly.

- Complete the Application: Submit a complete and accurate application form. This typically involves providing personal information, employment details, and vehicle information. The application can be completed online, via phone, or in person at a branch.

- Provide Required Documentation: Submit all necessary supporting documents as requested. This might include pay stubs, tax returns, and proof of insurance. Ensuring accuracy and completeness at this stage is crucial for timely processing.

- Credit Check: CEFCU will perform a credit check to assess your creditworthiness. This is a standard procedure for loan applications and helps determine your eligibility and interest rate.

- Loan Approval or Denial: Once the application and supporting documentation are reviewed, CEFCU will notify you of their decision. If approved, you’ll receive details about the loan terms, interest rate, and repayment schedule.

- Loan Closing: If approved, you’ll need to finalize the loan agreement and complete any remaining paperwork. This typically involves signing the loan documents and providing any final documentation required.

- Disbursement of Funds: After loan closing, the funds will be disbursed according to the agreed-upon terms, often directly to the car dealership.

Required Documentation for a CEFCU Car Loan

Having the necessary documentation readily available will streamline the application process. The specific documents required may vary slightly, so it’s best to confirm directly with CEFCU. However, the following list represents common requirements.

- Valid government-issued photo identification (driver’s license or passport)

- Proof of income (pay stubs, W-2 forms, tax returns)

- Proof of residency (utility bill, lease agreement)

- Vehicle information (VIN number, make, model, year)

- Proof of insurance (auto insurance policy)

Flowchart Illustrating the CEFCU Car Loan Application Process

The following description depicts a flowchart illustrating the CEFCU car loan application process. The flowchart would visually represent the sequential steps, using boxes and arrows to show the flow of the process. Each box would represent a step (e.g., “Complete Application,” “Provide Documentation,” “Credit Check,” “Loan Approval/Denial,” “Loan Closing,” “Funds Disbursement”). Arrows would connect the boxes, indicating the progression from one step to the next. Decision points, such as loan approval, would be represented using diamond shapes.

The flowchart would begin with the applicant initiating the application process and would conclude with the disbursement of funds to the applicant or the dealership.

CEFCU Car Loan Repayment Options

Choosing the right repayment plan is crucial for managing your CEFCU car loan effectively. Understanding the available options and their implications will help you make informed financial decisions and avoid potential penalties. This section details the various repayment structures offered by CEFCU and the consequences of late or missed payments.

CEFCU offers a range of repayment options to accommodate diverse financial situations. Borrowers can typically choose from various loan terms, impacting both the monthly payment amount and the total interest paid over the loan’s life. Shorter loan terms result in higher monthly payments but lower overall interest costs, while longer terms mean lower monthly payments but higher total interest paid. The specific terms available will depend on factors such as the loan amount, the borrower’s creditworthiness, and the type of vehicle being financed.

Consequences of Late or Missed Payments

Late or missed payments on a CEFCU car loan can have significant financial consequences. These consequences typically include late payment fees, increased interest charges, and potential damage to your credit score. Repeated late payments could even lead to loan default, resulting in repossession of the vehicle. It’s essential to contact CEFCU immediately if you anticipate difficulty making a payment to explore possible solutions, such as loan modification or hardship programs. Proactive communication can often mitigate the negative effects of financial setbacks.

Sample Loan Repayment Schedules

The following table illustrates the monthly payment amounts for a $20,000 car loan with varying loan terms and interest rates. These are examples only, and actual rates and terms may vary depending on individual circumstances and prevailing market conditions. It is crucial to contact CEFCU directly to obtain a personalized loan quote.

| Loan Term (Years) | Annual Interest Rate (Example) | Approximate Monthly Payment |

|---|---|---|

| 3 | 6% | $608.46 |

| 4 | 6% | $466.03 |

| 5 | 6% | $376.60 |

| 6 | 6% | $316.05 |

CEFCU Car Loan Eligibility Requirements

Securing a CEFCU car loan hinges on meeting specific eligibility criteria. These requirements are designed to assess the applicant’s ability to repay the loan, minimizing risk for both the borrower and the credit union. Factors such as credit history, income stability, and the type of vehicle being financed all play a significant role in the approval process.

CEFCU, like most financial institutions, evaluates applicants based on a combination of factors. A strong credit history and a good credit score are generally essential for loan approval. However, other factors, such as income and debt-to-income ratio, are also carefully considered. The specific requirements may vary depending on the loan amount and the type of vehicle being purchased.

Credit History and Credit Score Impact, Cefcu car loan

A positive credit history, demonstrated by consistent on-time payments on previous loans and credit accounts, significantly improves the chances of loan approval. A higher credit score, typically ranging from 300 to 850, reflects a lower risk to the lender. Applicants with excellent credit scores often qualify for lower interest rates and more favorable loan terms. Conversely, a poor credit history or a low credit score may result in loan denial or less favorable terms, such as a higher interest rate or a larger down payment requirement. For example, an applicant with a FICO score above 750 might receive a significantly lower interest rate compared to an applicant with a score below 600. The difference in monthly payments could be substantial over the loan term.

Situations Affecting Borrower Eligibility

Several situations can affect a borrower’s eligibility for a CEFCU car loan. These include:

A history of missed or late payments on previous loans or credit accounts can negatively impact creditworthiness. Similarly, high levels of existing debt, resulting in a high debt-to-income ratio, can make it difficult to qualify for a new loan. Income instability, such as frequent job changes or periods of unemployment, can also raise concerns about the borrower’s ability to repay the loan. Furthermore, the type of vehicle being financed and its value can influence the loan approval process. For instance, financing a used vehicle might require a larger down payment or a shorter loan term compared to financing a new vehicle. Finally, incomplete or inaccurate information provided in the loan application can delay or prevent approval.

CEFCU Car Loan Customer Reviews and Experiences

Understanding customer feedback is crucial for assessing the overall quality of CEFCU’s car loan services. Online reviews provide valuable insights into both the positive and negative aspects of the loan process, from application to repayment. Analyzing these reviews allows for a comprehensive understanding of customer satisfaction and areas where improvements might be needed.

Numerous online platforms host reviews of CEFCU’s car loan services. These reviews offer a diverse range of perspectives, highlighting both the strengths and weaknesses of the institution’s lending practices. While a detailed quantitative analysis is beyond the scope of this overview, a summary of common themes found in customer feedback is presented below.

Positive Customer Feedback

Positive reviews frequently praise several key aspects of the CEFCU car loan experience. These positive comments often highlight the efficiency and ease of the application process, the competitive interest rates offered, and the helpfulness of CEFCU staff.

- Many reviewers cite the straightforward application process as a major positive, noting its simplicity and speed.

- Competitive interest rates are frequently mentioned as a significant draw, making CEFCU a desirable lender compared to other financial institutions.

- Reviewers consistently praise the helpfulness and responsiveness of CEFCU staff members, both in person and over the phone.

Negative Customer Feedback

Conversely, negative reviews often focus on specific pain points within the CEFCU car loan process. While less frequent than positive reviews, these negative experiences highlight areas where CEFCU could improve customer satisfaction.

- Some reviewers express frustration with the loan approval process, citing lengthy wait times or unclear communication regarding their application status.

- A recurring theme involves difficulties in contacting customer service representatives, with some reviewers reporting long wait times or unhelpful interactions.

- Occasionally, complaints arise concerning the clarity of loan terms and conditions, suggesting a need for more transparent communication.

Common Themes and Recurring Issues

Analyzing the aggregate of customer reviews reveals several recurring themes and issues. These common threads help to pinpoint areas for potential improvement within CEFCU’s car loan services.

- Communication: A lack of clear and timely communication is a prevalent concern, affecting both the application and customer service aspects of the loan process.

- Transparency: Some reviewers express a desire for greater transparency regarding loan terms and conditions, particularly concerning fees and interest calculations.

- Customer Service Responsiveness: While many praise the helpfulness of staff, some reviewers report difficulty contacting representatives or experiencing unhelpful interactions.

CEFCU’s Response to Customer Concerns

While a direct, publicly available response from CEFCU to every individual review is not always apparent, the institution’s overall commitment to customer service is reflected in its operational procedures. For instance, CEFCU’s website and in-branch materials emphasize customer satisfaction and provide contact information for addressing concerns. The existence of a dedicated customer service department suggests a proactive approach to resolving issues raised by borrowers.

Comparing CEFCU Car Loans with Other Financing Options

Securing a car loan involves careful consideration of various financing options. While CEFCU offers competitive rates and terms, it’s crucial to compare its offerings with those available directly from dealerships to make an informed decision. Understanding the advantages and disadvantages of each approach will help you choose the best financing solution for your specific needs and financial situation.

CEFCU Car Loans versus Dealership Financing

Dealership financing and credit unions like CEFCU present distinct approaches to car financing. Dealership financing often involves higher interest rates and potentially less favorable terms compared to credit union loans. This is because dealerships are incentivized to maximize their profit margins, and their financing offers may not always reflect the best rates available in the market. Conversely, credit unions, like CEFCU, are not-for-profit organizations that prioritize member benefits, frequently offering lower interest rates and more flexible repayment options.

Advantages and Disadvantages of CEFCU Car Loans

CEFCU car loans generally offer several advantages. Lower interest rates compared to dealership financing can lead to significant savings over the loan’s lifespan. Additionally, CEFCU often provides more transparent and straightforward terms, avoiding hidden fees or complex loan structures. However, a potential disadvantage is that the loan approval process might be slightly more rigorous than at some dealerships. This is because credit unions typically have stricter lending criteria, aiming to minimize risk for their members.

Advantages and Disadvantages of Dealership Financing

Dealership financing offers the convenience of completing the entire car purchase process in one location. This can streamline the buying experience, making it attractive to those seeking a quick and efficient transaction. However, as previously mentioned, interest rates tend to be higher, potentially resulting in greater overall costs. Dealerships may also offer incentives, such as discounted pricing or added features, that are tied to their financing options. It’s essential to carefully compare these incentives against the potential higher cost of the financing itself.

Comparison Table: Key Features of CEFCU and Dealership Financing

The following table summarizes key features, noting that specific rates and terms are subject to change and individual creditworthiness.

| Feature | CEFCU Car Loan | Dealership Financing |

|---|---|---|

| Interest Rates | Generally lower, competitive with market rates. Specific rates depend on credit score and loan terms. Example: A potential rate could be 4-7% APR. | Generally higher, often designed to maximize dealership profit. Example: A potential rate could be 8-12% APR. |

| Fees | Typically lower or non-existent origination fees. May include standard loan processing fees. | May include higher origination fees, prepayment penalties, or other undisclosed charges. |

| Loan Terms | Offers a range of loan terms to suit various budgets and financial situations. | Loan terms may be less flexible, potentially restricting choices for borrowers. |

| Application Process | May involve a more thorough credit check and documentation review. | Often a quicker and less stringent application process. |

Understanding CEFCU Car Loan Fees and Charges

Securing a car loan involves more than just the interest rate; various fees and charges can significantly impact the overall cost. Understanding these fees upfront is crucial for budgeting and making informed financial decisions. This section details the potential fees associated with a CEFCU car loan, explaining when they apply and how they might affect your total loan expense.

Origination Fees

CEFCU may charge an origination fee, a one-time fee for processing your loan application. This fee covers the administrative costs associated with reviewing your application, verifying your information, and preparing the loan documents. The amount of the origination fee can vary depending on the loan amount and your creditworthiness. For example, a larger loan might incur a higher origination fee than a smaller one. A borrower with excellent credit might qualify for a lower origination fee compared to someone with a less-than-perfect credit history. It’s important to inquire about the specific origination fee associated with your loan offer before accepting it.

Prepayment Penalties

Prepayment penalties are fees charged if you pay off your loan early. While CEFCU’s specific policy on prepayment penalties should be confirmed directly with them, many lenders include these penalties to compensate for lost interest income. The penalty might be a percentage of the remaining loan balance or a fixed dollar amount. For instance, a 2% prepayment penalty on a $20,000 remaining balance would result in a $400 penalty. Borrowers should carefully weigh the potential benefits of early repayment against any associated penalties before making a decision.

Late Payment Fees

Missing a loan payment will likely result in a late payment fee. The exact amount of this fee is typically specified in your loan agreement. These fees can range from a small fixed amount to a percentage of the missed payment. Consistent late payments can negatively impact your credit score and could lead to further penalties or even loan default. Careful budgeting and setting up automatic payments can help avoid late payment fees.

Other Potential Fees

Depending on the specifics of your loan, there may be other fees, such as a document preparation fee or a title and registration fee. It’s essential to thoroughly review all loan documents and ask clarifying questions about any fees you don’t understand before signing the agreement. Transparency about all associated costs is crucial for making an informed decision. Comparing the total cost of the loan, including all fees, is recommended before finalizing your decision.

Securing a Pre-Approval for a CEFCU Car Loan

Pre-approval for a CEFCU car loan offers significant advantages before you start shopping for a vehicle. It provides you with a clear understanding of your borrowing power, allowing for more confident and efficient car shopping. Knowing your budget beforehand prevents you from falling in love with a car you can’t afford and streamlines the final loan process.

Obtaining pre-approval simplifies the overall car buying experience. With a pre-approved loan amount in hand, you can negotiate the price of the vehicle more effectively, knowing your maximum budget. Dealers are more likely to work with you when you demonstrate financial readiness. The final loan process will also be faster and smoother, as much of the paperwork and credit checks will already be completed.

CEFCU Pre-Approval Process

The CEFCU pre-approval process is designed to be straightforward. Generally, it involves completing an online application or visiting a branch. You will need to provide personal information, employment details, and financial information, including income, debts, and credit history. CEFCU will then review your application and determine your eligibility for a loan, and the amount they are willing to lend. This pre-approval is typically contingent upon a final credit check and vehicle appraisal upon selection of a vehicle. It’s important to note that the pre-approved amount may differ slightly from the final loan amount, depending on the vehicle’s value and other factors.

Improving Chances of Pre-Approval

Several factors can significantly influence your chances of receiving pre-approval for a CEFCU car loan. Maintaining a good credit score is paramount. A higher credit score demonstrates financial responsibility and reduces the lender’s risk. This directly impacts the interest rate offered. Furthermore, providing accurate and complete information on your application is crucial. Any inconsistencies or omissions can delay the process or lead to rejection. Having a stable income and employment history also increases your chances of approval. Demonstrating a consistent income stream reassures the lender of your ability to repay the loan. Finally, keeping your debt-to-income ratio low is advisable. A lower ratio suggests that you have more financial flexibility, making you a less risky borrower.

Closing Notes: Cefcu Car Loan

Securing a car loan is a significant financial undertaking. By carefully considering interest rates, application procedures, repayment options, and eligibility criteria, you can navigate the process with confidence. This guide provides a comprehensive overview of CEFCU car loans, empowering you to make informed choices that align with your financial goals. Remember to compare CEFCU’s offerings with other lenders and explore pre-approval options to optimize your borrowing experience. Making informed decisions will ensure you find the best financing solution for your needs.

Expert Answers

What credit score is needed for a CEFCU car loan?

While CEFCU doesn’t publicly state a minimum credit score, a higher score generally leads to better interest rates. It’s advisable to check your credit report before applying.

Can I refinance my existing car loan with CEFCU?

Yes, CEFCU likely offers refinancing options. Contact them directly to inquire about eligibility and current rates.

What types of vehicles are eligible for CEFCU car loans?

CEFCU typically finances new and used vehicles. Specific eligibility criteria may vary; contact them for details.

What happens if I miss a payment on my CEFCU car loan?

Late payments can result in late fees and negatively impact your credit score. Contact CEFCU immediately if you anticipate difficulty making a payment.