Comerica Bank auto loan rates are a crucial factor for anyone considering financing a vehicle. Understanding these rates, along with the influencing factors and available options, is key to securing the best possible deal. This guide dives deep into Comerica’s auto loan offerings, comparing them to competitors and exploring the entire process from application to repayment.

We’ll cover eligibility requirements, application procedures, different loan types (new, used, refinancing), associated fees, and even delve into real customer experiences. By the end, you’ll be well-equipped to navigate the world of Comerica auto loans and make an informed decision.

Comerica Bank Auto Loan Rate Overview

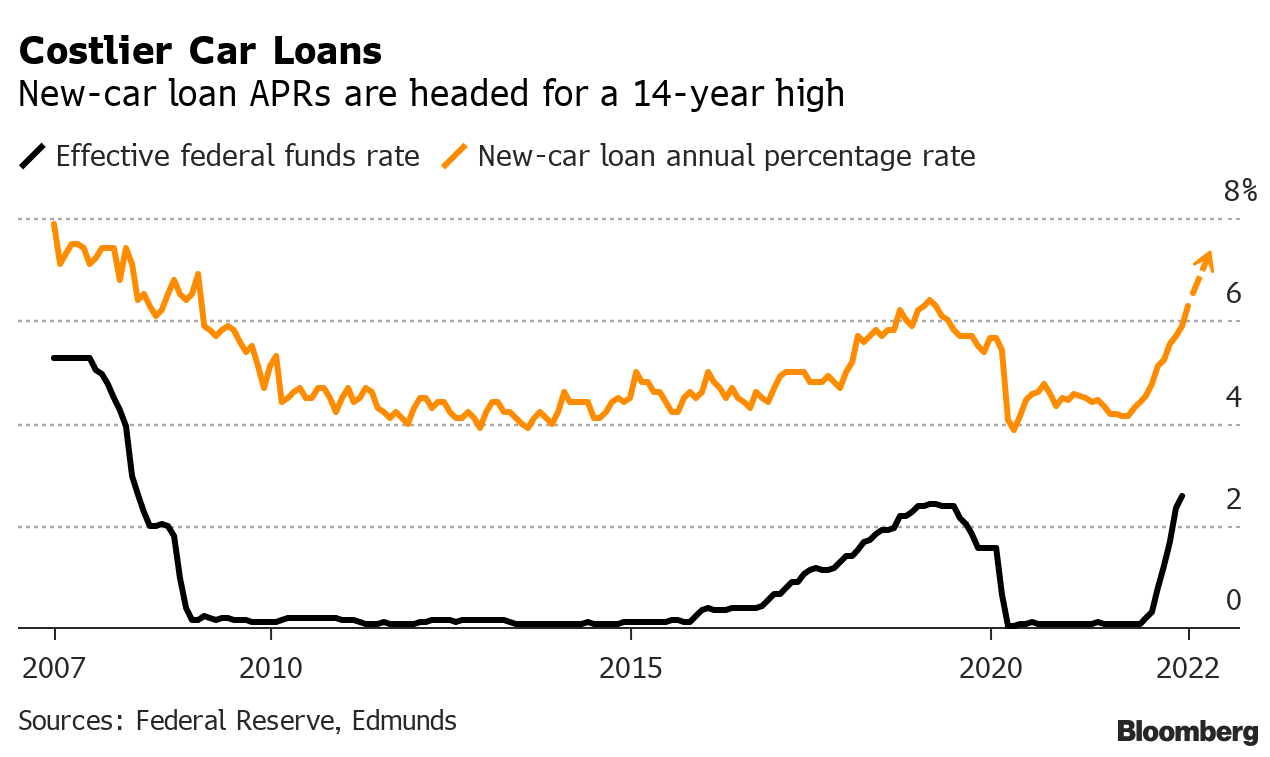

Comerica Bank offers auto loans to individuals seeking to finance new or used vehicles. Their interest rates are competitive, though the exact APR will vary depending on several key factors. Understanding these factors is crucial for securing the best possible rate. This overview will detail the components influencing Comerica’s auto loan rates and provide a comparison to other major lenders.

Comerica’s auto loan interest rates are not publicly listed as a fixed range. Instead, they are determined on a case-by-case basis, considering the applicant’s creditworthiness, the loan term selected, and the type of vehicle being financed. Generally, borrowers with higher credit scores and shorter loan terms will qualify for lower interest rates. The condition and age of the vehicle also play a significant role; financing a newer vehicle often results in a lower rate compared to a used car. While Comerica may offer occasional promotions or special financing incentives, these are typically time-limited and subject to change. It is always advisable to check directly with Comerica for the most up-to-date information on any current offers.

Factors Influencing Comerica Auto Loan Rates

Several key factors significantly impact the interest rate a borrower receives from Comerica Bank. These factors work in conjunction to determine the overall risk assessment for the lender, thus influencing the final APR.

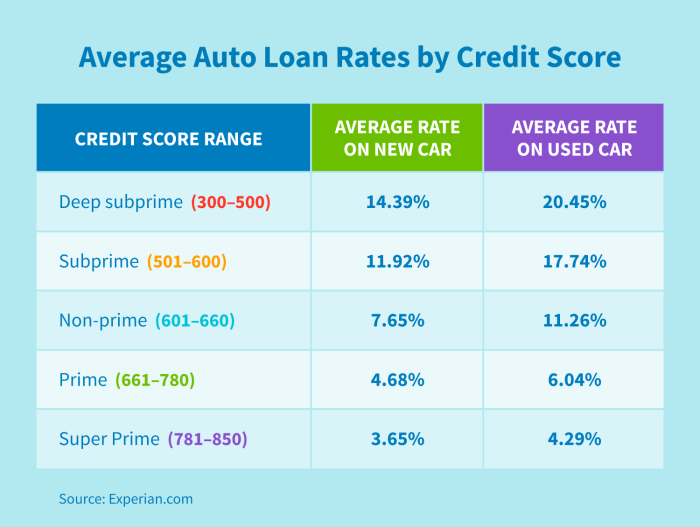

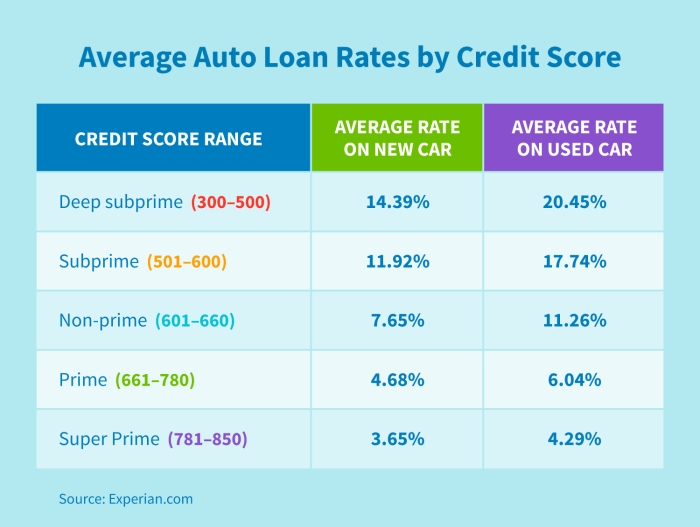

A borrower’s credit score is the most influential factor. A higher credit score (generally above 700) typically indicates lower risk to the lender, resulting in a lower interest rate. Conversely, a lower credit score often leads to a higher rate, reflecting the increased risk of default. The length of the loan term also plays a role; longer loan terms (e.g., 72 or 84 months) usually come with higher interest rates due to the increased risk associated with a longer repayment period. The type of vehicle being financed also matters. New cars tend to command lower interest rates than used cars, as they generally depreciate at a slower rate. Finally, the loan amount itself can indirectly influence the rate, as larger loan amounts may carry a slightly higher rate due to increased risk for the lender.

Comparison of Auto Loan Rates

The following table compares Comerica Bank’s estimated auto loan rates with those of three major competitors. Note that these rates are estimates and can vary based on individual circumstances. It is crucial to contact each lender directly for the most accurate and current information. Associated fees may also vary.

| Lender | APR (Estimate) | Loan Term (Example) | Fees (Example) |

|---|---|---|---|

| Comerica Bank | 4.5% – 18% | 36 – 72 months | Origination fee (varies) |

| Bank of America | 4% – 17% | 24 – 84 months | Origination fee (varies) |

| Capital One | 5% – 19% | 36 – 60 months | Application fee (may apply) |

| Chase | 4.25% – 16% | 48 – 72 months | Origination fee (varies) |

Eligibility Requirements for Comerica Auto Loans

Securing a Comerica Bank auto loan hinges on meeting specific eligibility criteria. These requirements ensure that borrowers are capable of managing the financial obligations associated with an auto loan. Understanding these requirements upfront will streamline the application process and increase the likelihood of approval.

Comerica Bank, like other financial institutions, assesses applicants based on a combination of creditworthiness, income stability, and the type of vehicle being financed. The specific requirements may vary depending on the loan program and the prevailing economic conditions. However, a general understanding of the typical requirements is crucial for prospective borrowers.

Minimum Credit Score and Income Requirements

While Comerica Bank doesn’t publicly state a minimum credit score, a good to excellent credit score significantly improves the chances of loan approval and securing a favorable interest rate. Applicants with lower credit scores may still be considered, but they might face higher interest rates or stricter loan terms. Similarly, a stable and sufficient income is essential to demonstrate the ability to repay the loan. This typically involves providing proof of income through pay stubs, tax returns, or bank statements. The required income level will depend on factors like the loan amount, loan term, and the applicant’s overall financial situation. For example, an applicant seeking a larger loan amount will likely need a higher income to demonstrate repayment capacity.

Eligible Vehicle Types

Comerica Bank generally finances a wide range of vehicles, including new and used cars, trucks, SUVs, and vans. However, there might be restrictions on the age and condition of used vehicles. Very old or significantly damaged vehicles may not qualify for financing. The bank’s assessment will consider the vehicle’s value as a crucial factor in determining the loan amount. For instance, a newer, high-value vehicle will likely secure a larger loan amount compared to an older, less valuable vehicle. Specific restrictions on vehicle types or age might be Artikeld in the loan application details.

Required Documentation

To apply for a Comerica Bank auto loan, applicants need to provide several documents to verify their identity, income, and creditworthiness. This typically includes a valid driver’s license or state-issued ID, proof of income (pay stubs, tax returns, W-2 forms), and proof of residence (utility bills, bank statements). Applicants will also need to provide information about the vehicle being financed, such as the vehicle identification number (VIN), make, model, and year. In some cases, the bank may request additional documentation, such as a completed loan application form and a copy of the vehicle’s title. Providing all necessary documentation promptly can expedite the loan approval process.

The Application and Approval Process

Securing a Comerica Bank auto loan involves a straightforward application process, available both online and in person. The method you choose will influence the specific steps, but the core information required remains consistent. Understanding the process and what to expect can significantly streamline your experience.

Applying for a Comerica auto loan requires providing detailed personal and financial information to allow the bank to assess your creditworthiness and determine your eligibility for a loan. This information is used to calculate your interest rate and determine the loan amount you qualify for. The entire process, from application to funding, typically takes several business days, though the exact timeframe can vary based on individual circumstances and the completeness of your application.

Applying for a Comerica Auto Loan Online

The online application process is designed for convenience and efficiency. It allows you to submit your application at any time, from the comfort of your home or office. The steps involved are relatively simple and user-friendly.

- Visit the Comerica Bank Website: Begin by navigating to the Comerica Bank website and locating their auto loan application page. This is typically found under a section dedicated to personal or consumer banking.

- Complete the Application Form: The online application will require you to provide personal information, including your name, address, contact details, employment history, and income. You will also need to provide details about the vehicle you intend to purchase, such as the make, model, year, and VIN.

- Provide Financial Information: Be prepared to provide information about your current financial situation, including your credit score, existing debts, and monthly expenses. This helps Comerica assess your ability to repay the loan.

- Upload Supporting Documents: You may be required to upload supporting documents, such as proof of income, pay stubs, and tax returns. This helps verify the information provided in your application.

- Submit Your Application: Once you have completed the application and uploaded all necessary documents, review your information carefully before submitting it for review.

Applying for a Comerica Auto Loan In Person

Alternatively, you can apply for a Comerica auto loan in person at a local branch. This method allows for direct interaction with a loan officer who can answer any questions you may have and guide you through the process.

- Visit a Comerica Bank Branch: Locate your nearest Comerica Bank branch and schedule an appointment or visit during their business hours.

- Speak with a Loan Officer: Discuss your auto loan needs with a loan officer. They will provide you with the necessary application forms and assist you in completing them accurately.

- Provide Required Documentation: You will need to provide the same documentation as with the online application, including personal identification, proof of income, and vehicle information.

- Review and Submit Your Application: Once the application is complete, review it thoroughly with the loan officer before submitting it for processing.

Loan Approval and Funding Timeframe

The approval process for a Comerica auto loan typically takes a few business days. However, this timeframe can be influenced by several factors, including the completeness of your application, your credit score, and the availability of the requested loan amount. Once approved, the funding process usually takes a few additional business days, after which the funds will be disbursed to the dealership or directly to you, depending on the loan terms. In some cases, a faster approval process may be available. For example, if you have a pre-approved loan offer or if you have a strong credit history, the process might be expedited. Conversely, if your application requires additional verification or if your credit score is lower, the process might take longer.

Types of Comerica Auto Loans

Comerica Bank offers a range of auto loan options to suit various needs and financial situations. Understanding the differences between these loan types is crucial for securing the best financing for your vehicle purchase. Factors like interest rates and loan terms vary significantly depending on the type of loan and the borrower’s creditworthiness.

Comerica’s auto loan offerings generally fall into three main categories: new car loans, used car loans, and refinancing options. Each type comes with its own set of benefits and drawbacks that potential borrowers should carefully consider before making a decision. While specific interest rates and terms are subject to change and depend on individual credit profiles and market conditions, a general comparison can be made to illustrate the key differences.

New Car Loans

New car loans from Comerica are designed for the purchase of brand-new vehicles directly from dealerships. These loans typically offer competitive interest rates, reflecting the lower risk associated with financing a new car. The terms are usually structured to align with the vehicle’s warranty period, often ranging from 36 to 72 months.

- Pros: Potentially lower interest rates compared to used car loans; access to longer loan terms; often bundled with dealer financing options for convenience.

- Cons: Higher initial purchase price compared to used cars; faster depreciation of the vehicle’s value; potential for higher monthly payments.

Used Car Loans

Used car loans are provided by Comerica for the purchase of pre-owned vehicles. Interest rates are generally higher than those for new car loans due to the increased risk associated with used vehicles. Loan terms might be shorter, and the lender may require a larger down payment.

- Pros: Lower initial purchase price compared to new cars; slower depreciation of the vehicle’s value; potentially lower monthly payments.

- Cons: Higher interest rates compared to new car loans; shorter loan terms; potential for higher maintenance costs.

Auto Loan Refinancing

Comerica also offers auto loan refinancing, allowing borrowers to replace their existing auto loan with a new one from Comerica. This can be beneficial if borrowers can secure a lower interest rate, reducing their overall financing costs. Refinancing can also help consolidate debt or adjust loan terms for better affordability.

- Pros: Potential for lower interest rates; opportunity to lower monthly payments; possibility of extending or shortening the loan term.

- Cons: Fees may apply; requires a credit check; might not always result in significant savings.

Repayment Options and Fees

Understanding your repayment options and associated fees is crucial when securing a Comerica Bank auto loan. This section details the various repayment methods available and Artikels the potential costs involved. Knowing this information upfront allows you to budget effectively and avoid unexpected charges.

Comerica Bank offers flexible repayment options designed to accommodate various financial situations. Borrowers typically choose a repayment schedule based on their loan term and budget. Shorter loan terms generally lead to higher monthly payments but result in less overall interest paid. Longer terms offer lower monthly payments but increase the total interest paid over the life of the loan. The specific repayment options available may vary depending on the type of loan and individual circumstances. It’s recommended to discuss these options with a Comerica loan representative to find the best fit for your needs.

Repayment Schedule Options

Borrowers can typically choose from a range of loan terms, influencing their monthly payment amount. For example, a 36-month loan will have higher monthly payments than a 60-month loan for the same principal amount. Comerica may offer terms ranging from 24 to 72 months, but this is subject to change and depends on the borrower’s creditworthiness and the vehicle being financed. The specific terms available should be confirmed directly with the bank.

Associated Fees

Several fees may be associated with a Comerica Bank auto loan. These fees can impact the overall cost of borrowing, so understanding them is essential for informed decision-making. While specific fees and amounts can change, understanding the general categories helps prepare borrowers for potential costs.

| Fee Type | Description |

|---|---|

| Origination Fee | This fee covers the administrative costs associated with processing your loan application. The amount can vary depending on the loan amount and terms. It’s usually a percentage of the loan amount or a fixed dollar amount. |

| Late Payment Fee | A penalty charged if your monthly payment is not received by the due date. The exact amount of the late fee is usually specified in the loan agreement and can vary. Consistent on-time payments are crucial to avoid incurring these fees. |

| Prepayment Penalty | In some cases, Comerica may charge a prepayment penalty if you pay off your loan early. This fee compensates the bank for lost interest income. However, it’s advisable to check the loan agreement to see if a prepayment penalty applies. |

| Returned Check Fee | If a payment is returned due to insufficient funds, a fee will be charged to cover the bank’s processing costs. This fee can be significant and should be avoided by ensuring sufficient funds are available in your account. |

Customer Reviews and Experiences: Comerica Bank Auto Loan Rates

Customer feedback offers valuable insights into Comerica Bank’s auto loan services. Analyzing reviews from various platforms provides a comprehensive understanding of customer satisfaction levels and pinpoints areas for potential improvement. This analysis considers both positive and negative experiences, offering a balanced perspective.

Customer reviews regarding Comerica Bank auto loans are mixed, reflecting a range of experiences. While many customers praise the bank’s competitive interest rates and straightforward application process, others express frustration with customer service responsiveness and the complexity of certain loan terms. These varied experiences highlight the importance of thorough research and careful consideration before applying for a Comerica auto loan.

Distribution of Positive and Negative Reviews

A bar chart effectively visualizes the distribution of positive and negative customer reviews. The horizontal axis represents the rating categories, ranging from “Very Dissatisfied” to “Very Satisfied,” potentially using a five-point scale. The vertical axis represents the number of reviews falling into each category. Data points would be represented by bars, with the height of each bar corresponding to the frequency of reviews in that rating category. For example, if 60% of reviews are positive (“Satisfied” and “Very Satisfied”), the bars representing these categories would be significantly taller than those representing negative feedback. A legend would clearly label each bar representing a specific rating category. This visual representation provides a clear and concise summary of overall customer sentiment towards Comerica Bank auto loans.

Common Positive Feedback

Positive feedback frequently centers around Comerica’s competitive interest rates and the generally smooth application process. Many customers report a relatively quick and easy online application experience, with approvals often occurring within a reasonable timeframe. Some reviewers also highlight the helpfulness of certain loan officers in guiding them through the process. These positive experiences contribute to a positive overall perception for some borrowers.

Common Complaints, Comerica bank auto loan rates

Recurring negative comments focus primarily on customer service responsiveness. Several reviews cite difficulties reaching representatives via phone or email, leading to delays in addressing loan-related inquiries or resolving issues. Other complaints involve perceived complexity in loan terms and conditions, leading to confusion and dissatisfaction among some borrowers. These negative experiences highlight areas where Comerica Bank could improve its customer service and loan transparency.

Final Thoughts

Securing a car loan can feel overwhelming, but with a clear understanding of Comerica Bank’s auto loan rates and the process involved, you can confidently navigate the process. Remember to compare rates across lenders, carefully review the terms and conditions, and choose the option that best suits your financial situation. This guide provides a solid foundation; however, always consult directly with Comerica Bank for the most up-to-date information and personalized guidance.

Commonly Asked Questions

What credit score is needed for a Comerica auto loan?

While Comerica doesn’t publicly state a minimum credit score, a higher score generally leads to better rates. Aim for a good to excellent credit score for the most favorable terms.

Can I pre-qualify for a Comerica auto loan online?

Yes, Comerica typically offers online pre-qualification tools allowing you to check your eligibility without impacting your credit score.

What documents are needed for application?

Expect to provide proof of income, identification, and vehicle information. Specific requirements may vary.

How long does the approval process take?

Approval times can vary, but generally range from a few days to a couple of weeks depending on the complexity of your application.