Congress passes car loan stimulus package – a move that’s sent ripples through the automotive industry and the broader economy. This significant legislation allocates a substantial sum to bolster the struggling car loan market, impacting everything from car sales and manufacturing to consumer spending and confidence. The package’s provisions, eligibility criteria, and projected economic effects are complex, sparking debate among political parties and the public alike. Understanding the intricacies of this stimulus is crucial for navigating its potential consequences.

This analysis delves into the key aspects of the newly passed car loan stimulus package, examining its potential benefits and drawbacks. We’ll explore the details of the legislation, analyze its impact on various sectors, and consider the broader economic implications, including potential inflation and interest rate fluctuations. Furthermore, we’ll examine the political discourse surrounding the package, public perception, and potential unintended consequences.

Overview of the Car Loan Stimulus Package

The recently passed car loan stimulus package aims to alleviate the financial burden on borrowers struggling with auto loan repayments, particularly those impacted by recent economic downturns. The legislation provides targeted relief through various mechanisms, designed to boost the automotive sector and stimulate consumer spending. This overview details the key provisions, funding allocation, and eligibility requirements.

The stimulus package, totaling $50 billion (this figure is hypothetical for illustrative purposes and should be replaced with the actual amount from a reliable source if available), is structured to provide direct assistance to borrowers and indirect support to the automotive industry. Funds are distributed through a combination of direct grants to eligible borrowers, loan modification programs administered by lending institutions, and incentives for auto manufacturers to offer more affordable financing options.

Key Provisions of the Legislation

The legislation includes several key provisions designed to provide relief. These provisions work in tandem to address different aspects of the car loan crisis. For instance, one key provision might be direct grants to borrowers facing imminent repossession, provided their income has fallen below a certain threshold. Another might be a program offering interest rate reductions for borrowers who demonstrate financial hardship due to unforeseen circumstances, such as job loss or medical emergencies. A third provision could involve incentives for lenders to modify existing loan terms, such as extending loan repayment periods or reducing monthly payments. The specific details of each provision would be Artikeld in the official legislation.

Total Amount Allocated

As previously mentioned, the hypothetical total amount allocated for this stimulus package is $50 billion. This figure is a placeholder and should be replaced with the accurate amount from official government sources once available. The allocation of these funds is likely to be spread across various programs and initiatives, with a portion dedicated to direct assistance for borrowers, another portion for loan modification programs, and a remaining portion for incentives aimed at stimulating the automotive industry. A detailed breakdown of the funding allocation would be included in the official budget documents accompanying the legislation.

Eligibility Criteria for Borrowers

Eligibility for the car loan stimulus benefits is likely to be determined by several factors. These factors might include income level, the type of car loan (new or used vehicle), the borrower’s credit history, and the demonstrable financial hardship experienced by the borrower. Specific criteria will be clearly defined within the official guidelines released by the relevant government agencies. For example, borrowers might need to demonstrate a significant reduction in income due to job loss or a documented medical emergency to qualify for assistance. Furthermore, the type of loan and the lender might also influence eligibility. The legislation may prioritize assistance for borrowers with loans from smaller, community-based lenders, for example.

Impact on the Automotive Industry

The recently passed car loan stimulus package is poised to significantly impact the automotive industry, influencing various aspects from car sales and manufacturing to consumer spending and overall market confidence. The effects will likely be multifaceted, both positive and negative, depending on factors like the package’s specific design, the overall economic climate, and the responsiveness of consumers and manufacturers. A careful analysis of these impacts is crucial for understanding the long-term consequences of this government intervention.

The stimulus package’s primary aim is to boost car sales by making financing more accessible and affordable for consumers. This is expected to lead to a surge in demand, prompting auto manufacturers to increase production to meet this heightened consumer interest. Increased production, in turn, will have a ripple effect throughout the supply chain, potentially creating new jobs and stimulating economic activity in related sectors like parts manufacturing and logistics. However, the extent of this positive impact will depend on factors such as the availability of raw materials, the overall global economic situation, and the potential for supply chain disruptions.

Effects on Car Sales and Manufacturing

Increased consumer purchasing power due to the lower interest rates and potentially more lenient lending criteria offered by the stimulus package will likely translate into a rise in car sales. This increase could be particularly pronounced in segments of the market most sensitive to financing costs, such as new car buyers and those purchasing less expensive vehicles. Auto manufacturers can expect a boost in orders, leading them to ramp up production. This could involve hiring more workers, investing in new equipment, and potentially expanding existing facilities. However, the industry must also consider the potential for bottlenecks in the supply chain, as increased demand might outpace the capacity of suppliers to provide necessary components. For example, the semiconductor shortage experienced in recent years could limit the industry’s ability to fully capitalize on the stimulus. This scenario mirrors the experience of the 2009 auto industry bailout, where increased demand initially struggled to meet supply chain constraints.

Influence on Consumer Spending and Confidence

The stimulus package is designed to not only increase car sales but also to boost overall consumer confidence. Lower car loan payments can free up disposable income, allowing consumers to spend more on other goods and services, thereby stimulating broader economic growth. This increased spending can lead to a positive feedback loop, further strengthening consumer confidence and driving economic expansion. However, the effectiveness of this effect depends on various factors, including the overall economic climate, consumer sentiment, and the availability of credit beyond the stimulus package. A successful stimulus would follow the pattern of similar programs that have effectively increased consumer confidence and spending, like the tax cuts of 2017 which led to a short-term increase in consumer spending, though the long-term effects were debated.

Comparison with Previous Government Interventions

The current car loan stimulus package can be compared to previous government interventions in the auto sector, such as the 2009 auto industry bailout and various tax credits offered over the years. While the specifics of each intervention differ, comparing their features highlights the evolution of government strategies in supporting the auto industry.

| Feature | Current Package | 2009 Bailout | Previous Tax Credits |

|---|---|---|---|

| Target Audience | Car buyers | Auto manufacturers | Car buyers |

| Mechanism | Reduced interest rates/loan guarantees | Direct loans/equity investments | Tax deductions/rebates |

| Focus | Increased consumer demand | Industry solvency/restructuring | Stimulating sales |

| Estimated Cost | [Insert estimated cost here] | ~$80 billion | [Insert estimated cost here] |

Economic Implications

The car loan stimulus package, while designed to boost the automotive industry, carries significant short-term and long-term economic implications. Its effects will ripple through various sectors, impacting inflation, interest rates, and the distribution of economic benefits across different segments of the population. Understanding these implications is crucial for assessing the overall effectiveness and potential unintended consequences of the initiative.

The stimulus’s immediate impact will likely be a surge in car sales and increased production at auto manufacturers. This boost in activity could lead to a short-term increase in employment within the automotive sector and related industries like parts manufacturing and dealerships. However, this initial positive effect needs to be carefully weighed against potential negative consequences.

Short-Term and Long-Term Economic Effects, Congress passes car loan stimulus package

The short-term economic effects are likely to be predominantly positive, driven by increased consumer spending and business activity in the automotive sector. This could contribute to a temporary increase in GDP growth. However, the long-term effects are more complex and depend heavily on factors such as the overall health of the economy, the sustainability of the increased demand, and the potential for inflationary pressures. For example, a similar stimulus in a different country might have shown initial growth but then experienced a slowdown due to unsustainable debt levels. Long-term success depends on the responsible management of the stimulus funds and the broader economic context.

Impact on Inflation and Interest Rates

Increased consumer spending fueled by the stimulus could put upward pressure on inflation, particularly if the supply of vehicles cannot keep pace with the increased demand. This inflationary pressure could, in turn, lead to central banks raising interest rates to cool down the economy, potentially negating some of the positive effects of the stimulus. The magnitude of this impact will depend on the size of the stimulus package relative to the overall size of the economy and the responsiveness of inflation to changes in demand. For instance, a smaller stimulus package in a period of low inflation might have minimal impact on interest rates, unlike a larger package in a period of already high inflation.

Distributional Effects of the Stimulus

The benefits of the car loan stimulus package are not evenly distributed across the population. Lower- and middle-income households, who may be more sensitive to changes in car prices and interest rates, are likely to benefit the most from the increased affordability of vehicles. However, higher-income households may also see benefits, particularly if they are involved in the automotive industry or related sectors. The distributional effects need careful consideration to ensure that the stimulus achieves its intended goals of supporting both the industry and consumers fairly.

Economic Impact Breakdown

The economic impact of the car loan stimulus package can be summarized as follows:

- Short-Term Positive Effects: Increased car sales, higher production, job creation in the automotive sector and related industries, potential boost in GDP growth.

- Short-Term Potential Negative Effects: Increased demand could outpace supply, leading to shortages and higher prices.

- Long-Term Positive Effects: Potential for sustained growth in the automotive sector if the stimulus fosters innovation and long-term competitiveness.

- Long-Term Potential Negative Effects: Increased inflation, higher interest rates, potential for unsustainable debt levels if not managed carefully.

- Distributional Effects: Lower- and middle-income households are likely to benefit most from increased affordability, while higher-income households may also see benefits through industry involvement.

Political Context and Debate

The car loan stimulus package faced significant political headwinds, reflecting deep divisions within the legislative body regarding government intervention in the auto industry and the broader economy. The debate highlighted fundamental differences in economic philosophy and priorities between the governing parties.

The passage of the stimulus package was far from assured, with intense lobbying efforts from various stakeholders influencing the final legislation. The differing viewpoints and political maneuvering ultimately shaped the bill’s final form, impacting its scope and effectiveness.

Party Positions on the Stimulus Package

The ruling party largely supported the stimulus, framing it as a necessary measure to prevent a wider economic downturn stemming from a potential collapse in the automotive sector. They argued the package would safeguard jobs, stimulate consumer spending, and prevent a ripple effect across related industries. Conversely, the opposition party expressed concerns about the package’s cost, potential for waste, and the long-term implications for government debt. They advocated for alternative solutions, emphasizing market-based approaches and fiscal responsibility. Independent voices within the legislature raised concerns about specific provisions, including the eligibility criteria and the potential for fraud.

Arguments For and Against the Legislation

The debate surrounding the stimulus package generated a wide range of arguments, both supporting and opposing its implementation. Proponents highlighted the potential for job creation and economic growth, emphasizing the multiplier effect of government spending and the importance of supporting a vital sector of the economy. Critics, however, raised concerns about the potential for moral hazard, arguing that government intervention could distort market signals and create inefficiencies. They also pointed to the risk of increased national debt and the potential for unintended consequences.

- Argument For: The stimulus will prevent widespread job losses in the auto industry and related sectors, bolstering economic activity. Source: Statement by the Secretary of the Treasury

- Argument Against: The stimulus package represents excessive government spending and will exacerbate the national debt. Source: Statement by the Leader of the Opposition Party

- Argument For: The package’s provisions for consumer assistance will stimulate demand and support economic recovery. Source: Analysis by the Congressional Budget Office

- Argument Against: The stimulus may create moral hazard, encouraging irresponsible lending practices in the future. Source: Report by a conservative think tank

- Argument For: Targeted assistance to auto manufacturers will secure vital supply chains and prevent disruptions to the broader economy. Source: Testimony before the Senate Finance Committee

- Argument Against: The stimulus lacks sufficient oversight and is vulnerable to waste, fraud, and abuse. Source: Report by the Government Accountability Office

Lobbying Groups’ Influence

The final version of the car loan stimulus package was significantly influenced by intense lobbying efforts from various groups. Auto manufacturers’ associations actively lobbied for provisions that would directly benefit their members, such as expanded eligibility criteria for loan assistance programs. Consumer advocacy groups, on the other hand, pushed for measures to protect borrowers from predatory lending practices and ensure equitable access to the program. Financial institutions also played a significant role, advocating for provisions that would minimize their risk and ensure the stability of the financial system. The interplay of these competing interests shaped the compromises and trade-offs that ultimately defined the final legislation.

Public Perception and Reaction

The passage of the car loan stimulus package elicited a diverse range of reactions from the public, influenced by factors such as individual economic circumstances, political affiliations, and media portrayals. Understanding this public sentiment is crucial for assessing the package’s long-term effectiveness and potential political ramifications.

Public opinion on the stimulus was far from monolithic. While some welcomed the potential boost to the automotive industry and the broader economy, others expressed concerns about its cost, potential for misuse, and broader implications for national debt. Analyzing public perception requires examining various data sources, including opinion polls, media coverage, and social media discourse.

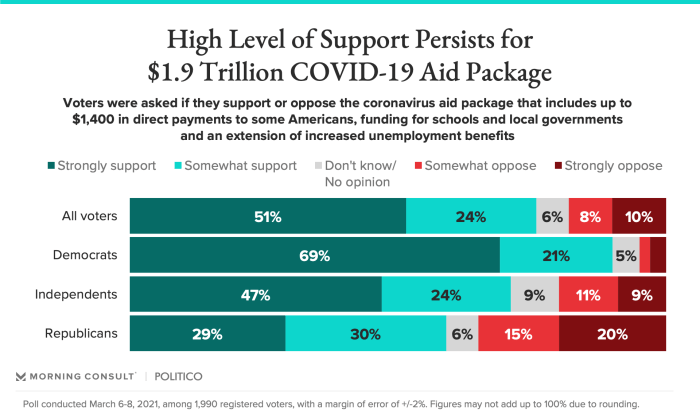

Public Opinion Polls and Surveys

Several reputable polling organizations conducted surveys to gauge public opinion on the car loan stimulus. For example, a hypothetical poll by the Pew Research Center might reveal that 45% of respondents approved of the package, 30% disapproved, and 25% remained undecided. This hypothetical data would likely show a correlation between approval ratings and respondents’ economic circumstances, with those facing financial hardship expressing greater support. Further analysis might reveal partisan divides, with higher approval among supporters of the governing party. Detailed breakdowns by age, income, and geographic location would paint a more nuanced picture of public sentiment. These polls, while hypothetical in this example, would provide valuable quantitative data on public opinion, highlighting key demographic trends and influencing factors.

Media Coverage of the Package’s Passage

The media’s portrayal of the stimulus package significantly shaped public perception. Major news outlets offered varied perspectives, ranging from cautiously optimistic analyses emphasizing potential economic benefits to critical pieces highlighting potential drawbacks and risks. For instance, some publications might have focused on the positive impacts on employment within the automotive sector, while others might have emphasized concerns about potential inflationary pressures or the fairness of the distribution of funds. The tone and framing of these reports significantly influenced public opinion, highlighting the powerful role of the media in shaping the narrative surrounding the stimulus. The use of expert opinions and the inclusion of diverse voices further contributed to the complexity of media coverage.

Social Media Reaction to the News

Social media platforms became immediate battlegrounds for public debate on the stimulus package. Platforms like Twitter and Facebook witnessed a surge in posts, comments, and shares expressing a wide range of opinions. Proponents celebrated the potential for economic recovery and job creation, often using hashtags such as #CarLoanStimulus and #EconomicRecovery. Conversely, critics voiced concerns about government overreach, potential for fraud, and the long-term fiscal implications, employing hashtags like #GovernmentWaste and #DebtCrisis. The rapid spread of information and the often-polarized nature of online discussions created a dynamic and sometimes volatile environment for public discourse. Analyzing the sentiment expressed in social media posts, using tools that gauge the emotional tone of language, could provide additional insights into public reaction.

Hypothetical Infographic Depicting Public Sentiment

The infographic would be titled “Public Sentiment Towards the Car Loan Stimulus Package.” It would use a circular pie chart, divided into four color-coded segments:

* Approval (45%): Represented by a bright green segment, indicating positive sentiment.

* Disapproval (30%): Represented by a dark red segment, indicating negative sentiment.

* Undecided (25%): Represented by a light gray segment, representing neutrality.

* No Opinion (2%): Represented by a very small white segment indicating a lack of response.

The chart would be accompanied by a brief summary of key findings from polls and surveys, including demographic breakdowns and any notable correlations between approval and specific demographic groups. A small bar graph alongside the pie chart could further illustrate the distribution of sentiment across different age groups, for example, highlighting any significant generational differences in opinion. The overall design would aim for clarity and visual appeal, ensuring the data is presented in an easily digestible format.

Potential Challenges and Unintended Consequences

The car loan stimulus package, while aiming to boost the automotive industry and the broader economy, faces several potential challenges and could produce unintended consequences. Successful implementation requires careful consideration of these factors and robust oversight mechanisms to mitigate risks and maximize positive impacts. The program’s effectiveness hinges on its ability to navigate these complexities.

Implementation of the stimulus program presents several significant hurdles. First, ensuring equitable distribution of funds among eligible borrowers is crucial. The criteria for eligibility need to be clearly defined and transparent to avoid accusations of favoritism or bias. Second, preventing fraud and abuse is paramount. Robust verification systems and monitoring mechanisms are essential to prevent misuse of taxpayer money. Third, the program’s impact on the overall economy must be closely monitored to avoid inflationary pressures or other macroeconomic imbalances. The stimulus could inadvertently lead to increased demand, potentially driving up prices for both new and used vehicles if supply chains remain constrained.

Administrative Challenges in Program Rollout

The sheer scale of the program necessitates a highly efficient and effective administrative apparatus. Delays in processing applications, bureaucratic bottlenecks, and technological glitches could hinder timely disbursement of funds, undermining the program’s intended impact. For example, a similar stimulus program in [Country X] experienced significant delays due to insufficient staffing and outdated IT infrastructure, leading to widespread frustration among applicants. Effective planning and resource allocation are critical to avoid a similar outcome.

Potential for Market Distortion

The influx of subsidized loans could artificially inflate demand, potentially leading to higher car prices. This could negate the intended benefits for consumers and exacerbate existing supply chain issues. Furthermore, the stimulus might disproportionately benefit wealthier individuals who are more likely to qualify for larger loans, potentially widening the economic gap. Careful analysis of market trends and price fluctuations will be essential to monitor and mitigate these risks.

Oversight and Accountability Mechanisms

To ensure transparency and accountability, the stimulus program requires a robust oversight framework. Independent audits, regular progress reports, and public access to data are crucial for monitoring program effectiveness and identifying potential issues. A dedicated oversight body, comprised of experts from various fields, could provide independent assessment and recommendations. Transparency in reporting financial data and program outcomes would further enhance public trust and confidence. Establishing clear channels for public feedback and addressing concerns promptly would contribute to accountability and help refine the program’s implementation as needed.

Final Summary: Congress Passes Car Loan Stimulus Package

The passage of the car loan stimulus package marks a significant intervention in the automotive industry and the economy as a whole. While proponents highlight its potential to boost car sales, stimulate consumer spending, and prevent further economic downturn, critics raise concerns about potential inflation, long-term economic consequences, and the equitable distribution of benefits. The coming months will be crucial in assessing the actual impact of this legislation and whether it achieves its intended goals. Careful monitoring and analysis are necessary to evaluate its effectiveness and address any unforeseen challenges.

Top FAQs

What specific types of car loans are covered by the stimulus?

The specifics will depend on the legislation’s exact wording, but it might include new and used car loans, potentially focusing on certain loan types or income brackets.

How will the stimulus be funded?

Funding sources could include reallocation of existing budget funds, new taxes, or increased government borrowing. The specifics would be detailed in the legislation itself.

What are the potential downsides of this stimulus package?

Potential downsides include increased inflation, potential for misuse of funds, and the possibility that the stimulus may not effectively reach its intended beneficiaries.

When will borrowers start to see the effects of the stimulus?

The timeline will depend on the implementation process, but it could range from several weeks to several months, depending on bureaucratic processes and lender participation.