Covantage loan calculator simplifies the often-daunting process of understanding loan terms and repayment schedules. This comprehensive guide explores its functionality, comparing it to other popular online calculators and highlighting its strengths and weaknesses. We’ll delve into user experience, potential applications, and crucial factors affecting calculation accuracy, ensuring you’re equipped to make informed financial decisions.

We’ll cover everything from input parameters like loan amount and interest rate to the various calculations performed, such as monthly payments and total interest paid. We’ll also analyze the user interface, offering suggestions for improvement and exploring how this tool can be integrated into broader financial planning strategies. By the end, you’ll have a clear understanding of how a Covantage loan calculator can benefit you.

Understanding “Covantage Loan Calculator” Functionality

A Covantage loan calculator is a digital tool designed to quickly estimate the financial implications of various loan options. It simplifies the complex process of loan calculations, allowing borrowers and lenders to explore different scenarios and make informed decisions. This functionality is crucial for understanding the true cost of borrowing and for comparing different loan offers effectively.

Covantage loan calculators typically require several key input parameters to generate accurate results. These inputs allow the calculator to model a specific loan scenario.

Input Parameters for Loan Calculations

The most common input parameters include the loan amount (the principal sum borrowed), the annual interest rate (the cost of borrowing expressed as a percentage), the loan term (the length of the loan repayment period, usually in months or years), and the loan type (e.g., fixed-rate mortgage, auto loan). Some calculators may also request additional information such as down payment amount (if applicable) and any associated fees or charges. Accurate input is crucial for generating reliable estimates.

Types of Loan Calculations Performed, Covantage loan calculator

Covantage loan calculators typically perform several key calculations. These calculations provide a comprehensive overview of the loan’s financial aspects. The most common calculations include determining the monthly payment amount (the fixed payment due each month), calculating the total interest paid over the loan’s life, and generating an amortization schedule. An amortization schedule details the breakdown of each payment, showing how much goes towards principal repayment and how much goes towards interest.

Impact of Input Parameters on Calculated Results

Altering the input parameters significantly affects the calculated results. For example, increasing the loan amount will naturally lead to higher monthly payments and total interest paid. Similarly, a higher interest rate will also increase both monthly payments and total interest paid, while a longer loan term will decrease monthly payments but increase the total interest paid over the loan’s lifetime. Conversely, a shorter loan term will increase monthly payments but decrease the total interest paid.

Sample Loan Calculations

The following table illustrates how different loan amounts and interest rates affect the calculated monthly payment and total interest paid, assuming a fixed-rate loan with a 360-month (30-year) term. These are illustrative examples and should not be taken as financial advice.

| Loan Amount | Annual Interest Rate | Monthly Payment | Total Interest Paid |

|---|---|---|---|

| $150,000 | 4.5% | $760.03 | $121,610.80 |

| $200,000 | 4.5% | $1013.37 | $164,812.80 |

| $150,000 | 6.0% | $899.33 | $181,558.80 |

| $200,000 | 6.0% | $1199.11 | $243,679.60 |

Comparison with Other Loan Calculators: Covantage Loan Calculator

Covantage’s loan calculator, while robust, occupies a specific niche within the broader landscape of online loan calculation tools. Comparing it to other popular options reveals both its strengths and areas where it could improve, ultimately impacting the user experience. This comparison focuses on key features, functionality, and user interface design to provide a comprehensive overview.

This section analyzes Covantage’s loan calculator against two widely used alternatives: Bankrate and NerdWallet. These platforms offer diverse features and cater to different user needs, providing a valuable benchmark for assessing Covantage’s capabilities and identifying potential areas for enhancement.

Feature Comparison of Loan Calculators

The following table directly compares Covantage, Bankrate, and NerdWallet loan calculators, highlighting their key features, advantages, and disadvantages. The comparison considers factors such as ease of use, data input options, loan type coverage, and additional features offered beyond basic calculations.

| Feature | Covantage | Bankrate | NerdWallet |

|---|---|---|---|

| Loan Types Supported | Primarily focuses on mortgages and home equity loans; potentially limited support for other loan types. | Offers a wider range, including mortgages, auto loans, personal loans, and student loans. | Provides comprehensive coverage across various loan types, similar to Bankrate. |

| Data Input Options | May offer limited customization in data input fields, potentially restricting user flexibility. | Allows for detailed input customization, enabling users to accurately reflect their financial circumstances. | Offers a balance between customization and simplicity, ensuring a user-friendly experience. |

| User Interface | May require some technical understanding to navigate effectively; the design may not be fully intuitive. | Generally user-friendly with a clean and intuitive design, making it accessible to a wide range of users. | Similar to Bankrate in terms of user-friendliness and intuitive design. |

| Additional Features | May lack additional features such as amortization schedules or loan comparison tools. | Often includes detailed amortization schedules and loan comparison tools. | Provides similar advanced features as Bankrate, enhancing user understanding. |

| Strengths | Potentially offers specialized features for its target loan types (mortgages and home equity loans). | Wide range of loan types, user-friendly interface, and advanced features. | Comprehensive loan type coverage, intuitive design, and helpful supplementary resources. |

| Weaknesses | Limited loan type support, potentially less intuitive interface, and fewer advanced features. | May be overwhelmed with information for users seeking simple calculations. | May not offer highly specialized features for niche loan types. |

Impact on User Experience

The differences highlighted above significantly impact the user experience. Bankrate and NerdWallet, with their intuitive interfaces and comprehensive features, offer a smoother and more informative experience for a broader audience. Covantage, however, may cater better to users specifically seeking detailed calculations within its niche area of expertise, potentially at the cost of accessibility for those unfamiliar with the technical aspects of its design.

For example, a first-time homebuyer might find Bankrate or NerdWallet easier to use for comparing mortgage options, while a seasoned investor refinancing a home equity loan might find Covantage’s specialized features more beneficial, despite a potentially steeper learning curve.

User Experience and Interface Design

A well-designed loan calculator is crucial for a positive user experience. Covantage, like other financial technology companies, needs to prioritize an intuitive and efficient interface to help users easily understand and utilize its loan calculation features. A poorly designed interface can lead to user frustration and potentially inaccurate calculations, impacting the overall user satisfaction and trust in the platform.

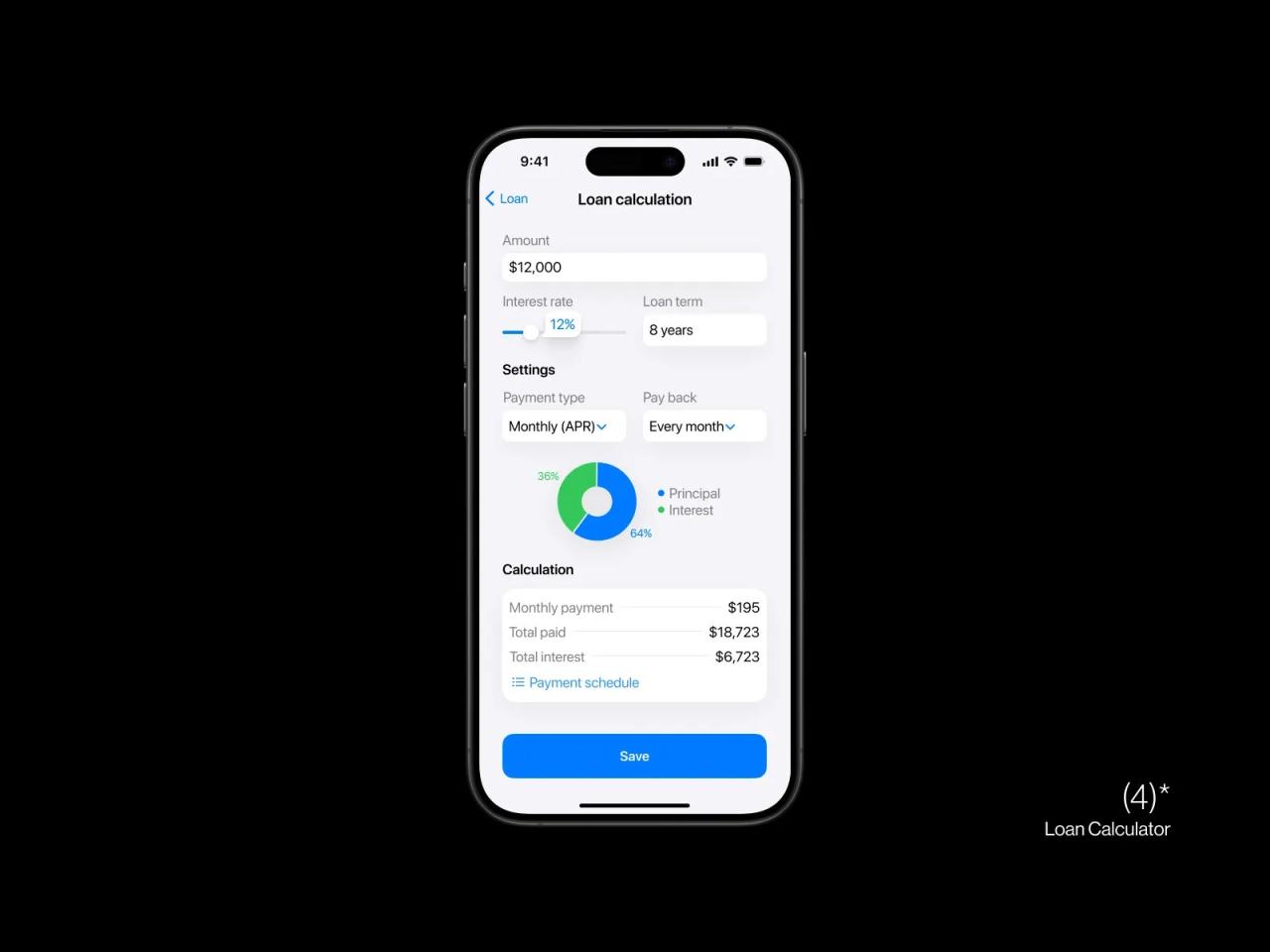

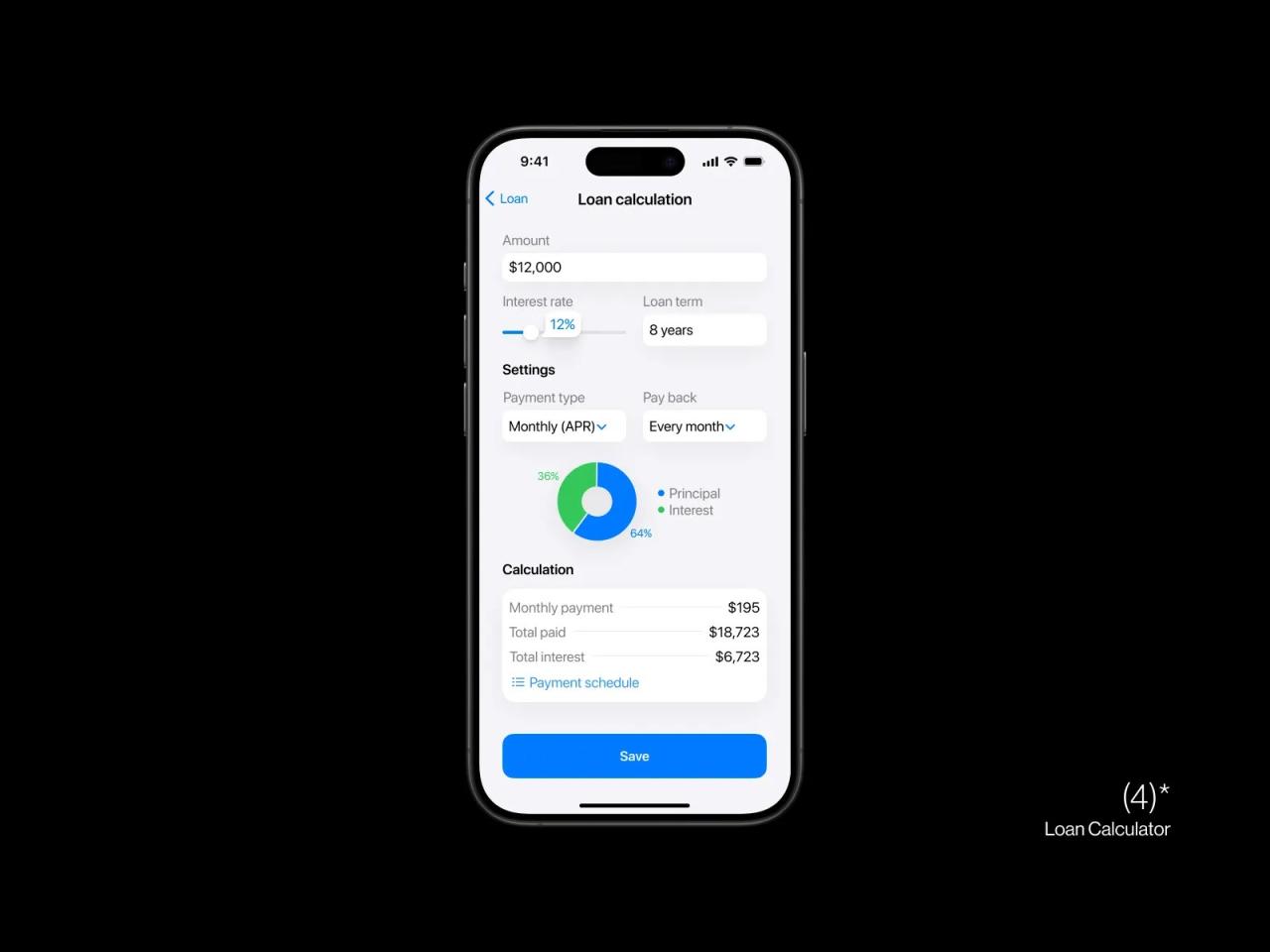

The user interface of a typical Covantage loan calculator likely presents a form-based structure, requiring users to input various parameters such as loan amount, interest rate, loan term, and down payment. These fields are typically clearly labeled, allowing users to understand what information is required. However, the specific design elements, such as the layout, color scheme, and visual hierarchy, vary depending on the specific implementation.

Usability and Intuitiveness of the Covantage Loan Calculator Interface

The usability of a loan calculator hinges on its clarity and ease of navigation. A well-designed interface should be immediately understandable, even for users with limited financial literacy. Ideally, the input fields should be logically grouped and clearly labeled. The calculator should provide immediate feedback, showing the results of the calculations in real-time as the user adjusts the input parameters. Features such as clear error messages and helpful tooltips can further enhance usability. A clean and uncluttered design, free of distracting elements, contributes to a more intuitive experience. However, the degree to which these elements are successfully implemented varies across different loan calculators, and a thorough user testing process is needed to determine the actual usability of a specific Covantage implementation. For example, a poorly designed interface might bury important information within nested menus or present calculations in a confusing format.

Potential Areas for Improvement in User Experience

Several aspects of the Covantage loan calculator interface could be improved to enhance the user experience. One common issue is the lack of clear visual cues guiding users through the process. Another area for improvement is providing more context-sensitive help and explanations, particularly for complex financial terms. Furthermore, the visual presentation of the results could be improved. For example, using charts or graphs to visualize the amortization schedule could make it easier for users to understand the loan repayment plan. Finally, ensuring the calculator is accessible to users with disabilities is crucial. This includes features such as keyboard navigation, screen reader compatibility, and sufficient color contrast.

Suggestions for Enhancing the Design to Improve Clarity and Ease of Use

To enhance the clarity and ease of use, several design improvements can be implemented. First, the input fields should be grouped logically, perhaps using visual separators or distinct sections to categorize related parameters. Second, adding tooltips or brief explanations next to each input field would help users understand the meaning and purpose of each parameter. Third, the results should be presented in a clear and concise manner, possibly using a combination of text and visual aids like charts or graphs. Fourth, implementing a progress indicator would help users track their progress through the calculation process. Finally, providing options for users to save or print their results would be beneficial.

Mock-up of an Improved Interface

Imagine an improved Covantage loan calculator interface. The top section displays a clear heading: “Loan Calculator.” Below this, three distinct sections are presented using visually separated boxes. The first section, “Loan Details,” contains input fields for loan amount, interest rate (with a clear indication of whether it’s annual or monthly), loan term (with options for years and months), and down payment. Each field has a brief tooltip explaining its purpose when the user hovers over it. The second section, “Additional Options,” includes checkboxes for options like property taxes and insurance, allowing users to factor these additional costs into their calculations. The third section, “Results,” displays the calculated monthly payment, total interest paid, and total amount paid. A clear, interactive amortization schedule is shown as a graph below these figures, allowing users to easily visualize the repayment schedule over time. A button at the bottom allows users to download the results as a PDF. The overall color scheme is clean and professional, using a calming color palette. The font size is appropriately large for easy readability, and sufficient color contrast is used to ensure accessibility for users with visual impairments. This revised design emphasizes clarity, ease of navigation, and visual appeal, resulting in a significantly improved user experience.

Potential Applications and Use Cases

A Covantage loan calculator, offering precise and adaptable calculations, proves invaluable across diverse financial scenarios for both individuals and businesses. Its ability to quickly assess loan affordability and potential costs empowers users to make informed decisions, minimizing financial risks and optimizing borrowing strategies. The calculator’s versatility extends to various loan types, allowing users to compare options effectively and select the most suitable financial product.

The following examples illustrate the practical applications of a Covantage loan calculator in various financial planning situations.

Personal Loan Planning

Individuals can leverage the Covantage loan calculator to plan for significant personal expenses like home renovations, debt consolidation, or purchasing a vehicle. By inputting loan amounts, interest rates, and repayment terms, users can instantly generate personalized amortization schedules, visualizing the total cost and monthly payments. This allows for realistic budgeting and prevents financial overextension. For instance, a user planning a $20,000 home renovation could explore different loan options (e.g., 36 months vs. 60 months) to determine the most manageable monthly payment and overall interest paid.

Business Loan Assessment

Entrepreneurs and small business owners can use the calculator to assess the feasibility of business loans for expansion, equipment purchases, or working capital needs. The tool facilitates a comparison of different loan products, enabling businesses to choose the most cost-effective option based on their specific financial circumstances and projections. A business considering a $50,000 loan for new equipment can compare options from various lenders, factoring in interest rates and repayment periods to optimize their cash flow and minimize borrowing costs.

Mortgage Pre-qualification

Before committing to a mortgage application, prospective homebuyers can use the calculator to estimate their potential mortgage payments and determine a comfortable borrowing range. By inputting their desired home price, down payment, and interest rate, users can obtain a preliminary understanding of their monthly mortgage obligations, helping them refine their home search criteria and avoid financial strain. For example, a user aiming to purchase a $300,000 home can explore various loan terms and interest rates to determine a suitable monthly payment and total loan cost.

Debt Consolidation Strategy

Individuals burdened with multiple high-interest debts can use the calculator to explore debt consolidation options. By inputting the balances and interest rates of their existing debts, the calculator can estimate the potential savings from consolidating these debts into a single, lower-interest loan. This helps users assess the feasibility and potential benefits of debt consolidation and make an informed decision about their financial strategy. For example, a user with several credit card debts totaling $15,000 can input these details to see how a consolidated loan with a lower interest rate would impact their monthly payments and overall interest paid.

Integration into Broader Financial Planning Applications

The Covantage loan calculator can be seamlessly integrated into comprehensive financial planning applications or personal finance management software. This integration would provide users with a holistic view of their financial situation, allowing them to model the impact of loan decisions on their overall financial health. For instance, the calculator could be incorporated into a budgeting tool to automatically factor loan payments into monthly expense projections, offering a more realistic and accurate financial forecast.

Accuracy and Reliability of Calculations

The accuracy and reliability of any loan calculator, including the Covantage Loan Calculator, are paramount. Inaccurate calculations can lead to poor financial decisions, potentially resulting in significant financial losses for users. Several factors contribute to the accuracy of the results, and understanding these factors is crucial for building trust and ensuring the calculator’s usefulness.

Factors Affecting Calculation Accuracy and Potential Sources of Error

Input Data Validation and Error Handling

The accuracy of the loan calculation hinges entirely on the accuracy of the input data provided by the user. Errors in input, such as incorrect interest rates, loan amounts, or loan terms, will directly impact the calculated results. The Covantage Loan Calculator employs robust input validation techniques to detect and flag potential errors. For example, the system checks for non-numeric values in numerical fields, and it verifies that interest rates are within a realistic range. Error messages are displayed to guide the user in correcting any identified issues. Despite these safeguards, unexpected or intentionally incorrect input can still lead to inaccurate outputs. For instance, entering a negative loan amount would result in nonsensical calculations.

Algorithmic Accuracy and Implementation

The underlying algorithms used to calculate loan payments, total interest paid, and amortization schedules must be mathematically sound and correctly implemented in the calculator’s code. Errors in the formula implementation, such as incorrect order of operations or flawed logic, can lead to inaccurate results. The Covantage Loan Calculator uses well-established financial formulas, thoroughly tested and reviewed to ensure accuracy. Regular code reviews and unit testing are performed to identify and correct any bugs or inconsistencies.

Methods for Ensuring Reliability

To ensure the reliability of the calculated results, the Covantage Loan Calculator employs several strategies. These include rigorous testing using a wide range of input values, including edge cases and boundary conditions. Cross-validation against other reputable loan calculators and financial tools is also conducted to verify the consistency of the results. Furthermore, the calculator’s code is regularly reviewed by experienced developers to identify and correct any potential flaws.

Recommendations for Improving Accuracy and Robustness

Continuous improvement is key to maintaining the accuracy and robustness of the Covantage Loan Calculator. This includes regularly updating the calculator’s algorithms to reflect changes in financial regulations and best practices. Implementing more sophisticated error handling mechanisms, such as fuzzy matching for input data and more robust data type validation, can further enhance accuracy. Additionally, incorporating user feedback and conducting user acceptance testing can help identify and address any unforeseen issues or areas for improvement.

Scenario Illustrating the Impact of Input Errors

Let’s consider a scenario where a user is calculating the monthly payment for a $200,000 mortgage at a 5% annual interest rate over 30 years. If the user mistakenly enters the interest rate as 50% instead of 5%, the calculated monthly payment will be significantly higher, potentially by several thousand dollars. This erroneous input could lead the user to believe they cannot afford the mortgage, even though they might be able to afford it at the correct interest rate. The impact of this error is a distorted view of affordability and the potential for missed opportunities.

Illustrative Examples

Understanding loan amortization is crucial for effective financial planning. This section provides detailed examples to illustrate how loan payments are structured and how extra payments can impact the loan’s repayment schedule. We will explore both standard and accelerated repayment scenarios.

Loan Amortization Explained

Loan amortization is the process of paying off a debt over time through regular installments. Each payment consists of two components: principal and interest. The principal is the original amount borrowed, while the interest is the cost of borrowing the money. In the early stages of repayment, a larger portion of the payment goes towards interest, while a smaller portion goes towards principal. As the loan progresses, the proportion shifts, with a greater percentage of each payment applied to the principal. This is because the interest is calculated on the remaining balance, which decreases with each payment.

Sample Loan Amortization Schedule

Let’s consider a $10,000 loan with a 5% annual interest rate and a 36-month term. The monthly payment would be approximately $304.22. Below is a textual representation of a portion of the amortization schedule:

Month | Beginning Balance | Payment | Interest | Principal | Ending Balance

——- | ——– | ——– | ——– | ——– | ——–

1 | $10,000.00 | $304.22 | $41.67 | $262.55 | $9,737.45

2 | $9,737.45 | $304.22 | $40.61 | $263.61 | $9,473.84

3 | $9,473.84 | $304.22 | $39.56 | $264.66 | $9,209.18

4 | $9,209.18 | $304.22 | $38.45 | $265.77 | $9,000.00 (approximately)

… | … | … | … | … | …

This schedule demonstrates how the principal payment increases while the interest payment decreases over time.

Amortization Schedule with Extra Payments

Now, let’s examine the impact of making extra payments. Assume the same loan as above, but with an additional $100 payment each month.

Month | Beginning Balance | Payment | Interest | Principal | Ending Balance

——- | ——– | ——– | ——– | ——– | ——–

1 | $10,000.00 | $404.22 | $41.67 | $362.55 | $9,637.45

2 | $9,637.45 | $404.22 | $40.16 | $364.06 | $9,273.39

3 | $9,273.39 | $404.22 | $38.64 | $365.58 | $8,907.81

… | … | … | … | … | …

By making extra payments, the loan term is significantly shortened, and the total interest paid is reduced.

Visual Representation of Amortization

Imagine a bar chart. The horizontal axis represents the loan’s lifespan (months). The vertical axis represents the dollar amount of each payment. Two stacked bars represent each month’s payment: one bar showing the principal portion and the other showing the interest portion. Initially, the interest bar will be much larger than the principal bar. As the loan progresses, the principal bar will gradually increase in size, while the interest bar decreases until, at the end of the loan, the interest bar is minimal and the principal bar represents the final payment. This visual clearly shows the shift in the proportion of principal and interest over time.

Ending Remarks

Mastering the art of loan calculations is crucial for sound financial planning. The Covantage loan calculator, while offering valuable functionality, benefits from a critical evaluation of its user interface and accuracy. By understanding its strengths and limitations, and by comparing it to alternatives, you can confidently navigate the complexities of borrowing and make informed decisions that align with your financial goals. Remember to always double-check your inputs for accuracy to ensure reliable results.

Questions and Answers

Is the Covantage loan calculator free to use?

Most online loan calculators, including those from Covantage, are typically free to use. However, some advanced features or integrations might require a subscription or fee.

What happens if I input incorrect data into the calculator?

Incorrect data will result in inaccurate calculations. Always double-check your input values (loan amount, interest rate, loan term) before relying on the results. A small error in the interest rate, for instance, can significantly impact the total interest paid over the life of the loan.

Can the calculator handle different types of loans (e.g., mortgages, auto loans)?

The specific types of loans a Covantage calculator handles depend on its design. Some may focus on a single loan type, while others offer options for various loan scenarios. Check the calculator’s documentation for supported loan types.

Where can I find the Covantage loan calculator?

The location of the Covantage loan calculator depends on whether it’s a standalone tool or integrated into a larger platform. You may find it on the Covantage website or through a partner’s financial planning application.