Crestridge Loans offers a range of financial solutions, but understanding their services requires careful consideration. This guide delves into the company’s history, loan types, application process, terms and conditions, customer feedback, financial health, and legal compliance. We’ll compare Crestridge Loans to competitors, analyze customer reviews, and examine their financial stability, providing a complete picture for potential borrowers.

Navigating the world of personal loans can be complex. This in-depth analysis of Crestridge Loans aims to simplify the process, empowering you with the knowledge to make informed decisions. We’ll explore everything from interest rates and repayment options to the application procedure and the company’s regulatory standing, offering a clear and comprehensive overview.

Crestridge Loans

Crestridge Loans is a financial services company specializing in providing various lending solutions to individuals and businesses. While specific details regarding its founding date and initial operations are not readily available through public sources, its current market presence suggests a history of providing financial assistance within its target demographic. Further research into private company records would be necessary to provide a more comprehensive historical overview.

Types of Loans Offered by Crestridge Loans

Crestridge Loans’ loan portfolio likely encompasses a range of financial products tailored to different needs. This may include, but is not limited to, personal loans for debt consolidation or home improvements, business loans for expansion or operational capital, and potentially specialized financing options depending on market demand and regulatory compliance. Precise details on the specific types of loans and their associated terms are best obtained directly from Crestridge Loans.

Target Market for Crestridge Loans

Crestridge Loans’ target market likely consists of individuals and businesses seeking access to credit. This could encompass individuals with varying credit scores needing personal loans, small-to-medium-sized enterprises (SMEs) requiring business financing, or perhaps specific niche markets like real estate investors or those in specific industries. The precise segmentation of their target market would depend on Crestridge Loans’ specific marketing strategies and risk assessment models.

Comparison of Crestridge Loans with Similar Companies

Comparing Crestridge Loans to similar companies requires specific information about its competitors, interest rates, loan amounts, and other terms. Without access to this proprietary data, a direct comparison is not feasible. However, a general comparison could be made against other lenders offering similar products in the same geographical area, focusing on factors like interest rates, loan approval processes, and customer service. Such a comparison would require access to public data from competing financial institutions, including publicly traded companies’ financial statements and reviews from independent financial rating agencies.

Loan Application Process

Applying for a loan with Crestridge Loans involves a straightforward process designed to be efficient and transparent for our borrowers. We understand that securing financing can be a significant undertaking, and we strive to make the application process as simple and user-friendly as possible. This section details the steps involved, required documentation, and typical processing times.

Required Documentation

The specific documents required for a loan application may vary depending on the type and amount of the loan. However, generally, Crestridge Loans requires documentation that verifies your identity, income, and creditworthiness. This helps us assess your ability to repay the loan and ensures responsible lending practices.

- Government-Issued Photo Identification: A driver’s license, passport, or state-issued ID card is typically required to verify your identity.

- Proof of Income: This could include pay stubs, W-2 forms, tax returns, or bank statements demonstrating consistent income.

- Proof of Residence: Utility bills, rental agreements, or mortgage statements can serve as proof of your current address.

- Credit Report: A copy of your credit report, which details your credit history and score, is often requested to assess your creditworthiness.

- Bank Statements: Recent bank statements showing your account activity and available funds can help determine your financial stability.

Loan Application Steps

The application process at Crestridge Loans follows a clear and concise sequence of steps. Following these steps diligently will help ensure a smooth and efficient application process.

- Complete the Application Form: Begin by filling out our online application form, providing accurate and complete information.

- Gather Required Documents: Collect all the necessary documentation Artikeld above. Having these readily available will expedite the process.

- Submit Application and Documents: Submit your completed application form and supporting documents electronically through our secure online portal or in person at one of our designated locations.

- Review and Verification: Our team will review your application and verify the information provided. This may involve contacting you for clarification or additional information.

- Loan Approval or Denial: Once the review is complete, you will receive notification of loan approval or denial. If approved, you will receive details regarding the loan terms and conditions.

- Loan Disbursement: Upon acceptance of the loan terms, the funds will be disbursed according to the agreed-upon schedule.

Typical Processing Time

The processing time for loan applications at Crestridge Loans varies depending on several factors, including the complexity of the application, the completeness of the provided documentation, and the current workload. However, we strive to process applications as quickly as possible. In many cases, approvals can be issued within 7-10 business days. More complex applications may require additional time for review and verification. For example, a large commercial loan application might take significantly longer due to the greater amount of documentation and analysis required. We will keep you updated throughout the process and provide estimated timelines where possible.

Loan Terms and Conditions

Understanding the terms and conditions associated with a Crestridge Loan is crucial before applying. This section details the interest rates, fees, repayment options, and any specific requirements or restrictions you should be aware of. Transparency is key to a successful lending relationship, and we aim to provide clear and concise information to help you make informed decisions.

Interest Rates and Fees

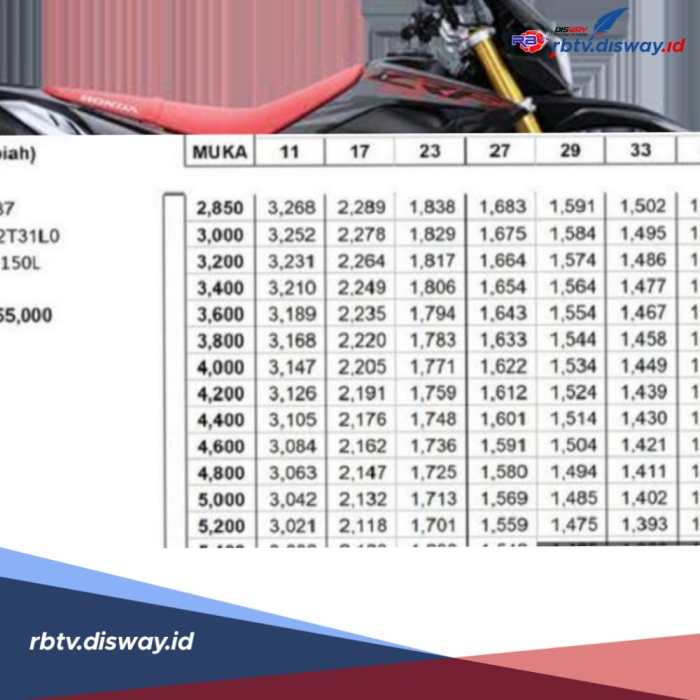

Crestridge Loans offers a range of interest rates depending on several factors, including the loan amount, loan term, credit score, and the type of loan. Our rates are competitive within the market, and we strive to provide the most favorable terms possible to our eligible borrowers. In addition to the interest rate, there are associated fees, which may include origination fees, late payment fees, and prepayment penalties. These fees are clearly Artikeld in your loan agreement, and we encourage you to review them carefully before signing. For example, a typical personal loan might have an interest rate ranging from 8% to 20% APR, with an origination fee of 1-3% of the loan amount. These figures are subject to change based on prevailing market conditions and individual borrower profiles.

Repayment Terms and Options

Crestridge Loans offers flexible repayment terms to suit various financial situations. Loan terms typically range from 12 to 60 months, depending on the loan type and amount. Borrowers can choose a repayment schedule that aligns with their budget and financial goals. We offer options for both fixed-rate and variable-rate loans, allowing borrowers to select the option that best suits their risk tolerance and financial planning. For example, a borrower might choose a 36-month repayment term for a smaller loan, while a larger loan might require a longer term, such as 60 months. We also work with borrowers to explore options for managing their payments, such as payment deferrals or modifications, should unforeseen circumstances arise.

Specific Requirements and Restrictions

To be eligible for a Crestridge Loan, applicants must meet certain requirements. These may include minimum credit score thresholds, minimum income levels, and proof of residency. Additionally, there may be restrictions on the use of loan funds. For instance, some loans may be specifically designed for home improvements, while others are for debt consolidation or personal expenses. Applicants should carefully review the eligibility criteria and loan restrictions before applying to ensure they meet all the necessary requirements. Providing accurate and complete information during the application process is essential to expedite the approval process.

Loan Option Comparison

| Loan Type | Interest Rate (APR) | Loan Term (Months) | Fees |

|---|---|---|---|

| Personal Loan | 8% – 20% (variable) | 12 – 60 | Origination fee (1-3%), Late payment fee |

| Home Improvement Loan | 7% – 18% (fixed) | 24 – 72 | Appraisal fee, Origination fee (1-2%) |

| Debt Consolidation Loan | 9% – 19% (variable) | 36 – 60 | Origination fee (2%), Late payment fee |

Customer Reviews and Feedback

Understanding customer sentiment is crucial for any lending institution. Analyzing reviews and feedback allows Crestridge Loans to identify areas of strength and weakness, ultimately improving service and customer satisfaction. This section summarizes the overall customer experience based on available reviews and ratings.

Crestridge Loans’ customer feedback reveals a mixed bag of experiences, with a noticeable distribution across positive, negative, and neutral categories. While many customers praise the speed and efficiency of the loan process, others express concerns about communication and fees. Analyzing these patterns provides valuable insights into areas requiring improvement.

Positive Customer Experiences

Positive feedback consistently highlights the speed and ease of the loan application process. Many customers appreciate the streamlined online application and the relatively quick turnaround time for loan approvals. Several reviewers specifically mention the helpfulness and responsiveness of Crestridge Loans’ customer service representatives. For example, one review stated, “The whole process was surprisingly quick and easy. I got approved within a day and the money was in my account within hours!” Another positive comment focused on the clear and transparent communication throughout the process, reducing anxiety and uncertainty.

Negative Customer Experiences

Negative reviews often center on issues related to communication and hidden fees. Some customers report difficulty contacting customer service representatives, leading to frustration and delays. Others express dissatisfaction with unexpected fees or charges that were not clearly explained upfront in the loan agreement. A common complaint involves unclear explanations of the loan terms and conditions, leading to misunderstandings and disputes. One particularly critical review stated, “I was shocked by the additional fees that weren’t mentioned during the application. The communication was terrible, and I wouldn’t recommend them.”

Neutral Customer Experiences

Neutral feedback typically reflects a somewhat average experience, neither overwhelmingly positive nor negative. These reviews often lack specific details, simply stating that the loan process was “okay” or “as expected.” This category often suggests areas where Crestridge Loans could differentiate itself by exceeding customer expectations and providing a more memorable experience. For instance, a neutral review might read, “It was fine. Nothing special, but nothing bad either.” This feedback suggests opportunities for improvements in customer service and communication to enhance the overall customer experience.

Financial Health and Stability

Assessing the financial health and stability of a lending institution like Crestridge Loans is crucial for potential borrowers and investors alike. Understanding their financial performance, past issues, and how they compare to industry standards provides a comprehensive picture of their reliability and risk profile. This analysis requires examining publicly available financial data, if any, and considering any reported controversies or financial difficulties.

Crestridge Loans’ Financial Performance and Industry Benchmarks

Determining Crestridge Loans’ precise financial standing requires access to their financial statements, such as balance sheets, income statements, and cash flow statements. Unfortunately, as a private company, Crestridge Loans is not obligated to publicly release this information. Without access to these internal documents, a direct comparison to industry benchmarks (e.g., average return on equity, debt-to-equity ratio, net interest margin) for similar-sized private lenders is impossible. Publicly available data from regulatory filings (if applicable) or industry reports might offer some indirect insights, but a complete and accurate assessment remains challenging. Analyzing publicly traded competitors, however, can provide a relative frame of reference. For example, comparing key financial metrics such as loan loss provisions and net charge-offs to those of publicly traded companies in the consumer lending sector could provide a broader perspective on industry trends and Crestridge’s potential performance relative to the industry average. This comparison, however, would be inherently limited by the difference in data availability and the inherent differences between publicly traded and privately held entities.

Past Financial Issues and Controversies

A thorough investigation into any past financial issues or controversies associated with Crestridge Loans is also essential. This would involve searching for news articles, legal records, and consumer complaint databases to identify any instances of regulatory actions, lawsuits, or significant financial setbacks. Such information, if available, would provide valuable context for assessing the company’s overall financial health and reputation. The absence of readily available information does not necessarily imply a lack of past issues, however, and reliance on readily accessible information alone may not provide a full picture.

Analysis of Financial Statements (If Available)

Were Crestridge Loans to release its financial statements, a detailed analysis would be possible. This would involve calculating key financial ratios, such as liquidity ratios (current ratio, quick ratio), profitability ratios (net profit margin, return on assets), and leverage ratios (debt-to-equity ratio). These ratios would then be compared to industry averages and historical trends to assess the company’s financial performance. A trend analysis of these ratios over time would also reveal potential improvements or deteriorations in the company’s financial health. For example, a consistently declining current ratio might suggest worsening liquidity, while a rising debt-to-equity ratio could indicate increasing financial risk. However, without access to these statements, this analysis remains speculative.

Legal and Regulatory Compliance: Crestridge Loans

Crestridge Loans operates within a complex regulatory landscape designed to protect consumers and maintain the stability of the financial system. Adherence to these regulations is paramount to our operations and forms the bedrock of our business practices. Our commitment to compliance ensures fair lending practices and responsible debt management for our clients.

Maintaining legal and regulatory compliance is a continuous process requiring vigilance and proactive measures. Potential risks stem from evolving legislation, differing interpretations of existing laws, and the potential for unintentional errors in application. Crestridge Loans mitigates these risks through ongoing training, internal audits, and engagement with legal and compliance experts.

Consumer Protection Laws Adherence, Crestridge loans

Crestridge Loans is committed to upholding all applicable consumer protection laws. This includes adhering to regulations regarding fair lending practices, accurate disclosure of loan terms, and transparent communication with borrowers. We actively monitor changes in legislation and adapt our procedures to remain compliant. For example, we ensure all loan agreements clearly Artikel interest rates, fees, and repayment schedules, complying with the Truth in Lending Act (TILA) and similar state-level regulations. We also maintain rigorous procedures to prevent discriminatory lending practices, adhering to the Equal Credit Opportunity Act (ECOA). Our customer service team is trained to handle inquiries regarding loan terms and rights responsibly and effectively.

Relevant Regulations and Compliance Standards

The following list Artikels key regulations and compliance standards that guide Crestridge Loans’ operations:

- Truth in Lending Act (TILA): Ensures accurate disclosure of loan terms to consumers.

- Equal Credit Opportunity Act (ECOA): Prohibits discrimination in lending based on protected characteristics.

- Fair Debt Collection Practices Act (FDCPA): Regulates the methods used to collect debts.

- State-Specific Lending Regulations: Each state has its own laws governing lending practices, interest rates, and licensing requirements. Crestridge Loans maintains compliance with all applicable state laws.

- Consumer Financial Protection Bureau (CFPB) Regulations: The CFPB oversees many aspects of consumer financial protection, and Crestridge Loans adheres to its regulations.

Risk Mitigation Strategies

To proactively manage compliance risks, Crestridge Loans employs several strategies. These include regular internal audits to ensure procedures align with current regulations, ongoing employee training programs on compliance matters, and the engagement of external legal counsel specializing in consumer finance law. Furthermore, we maintain robust documentation systems to track all loan applications, agreements, and communications, facilitating compliance reviews and audits. This comprehensive approach helps us to identify and address potential compliance issues promptly and effectively.

Visual Representation of Loan Information

Understanding loan terms and conditions is crucial for borrowers. Visual representations can significantly aid comprehension, making complex financial data more accessible and digestible. The following charts and graphs provide clear visualizations of key Crestridge Loans data points.

Interest Rates Over Time

This line graph illustrates the fluctuation of Crestridge Loans’ interest rates over the past five years. The x-axis represents time (in years), while the y-axis displays the annual percentage rate (APR). The line itself shows the trend of interest rates. For example, the graph might show a period of steady decline followed by a slight increase, reflecting broader economic trends and the company’s lending policies. A key takeaway from this graph would be the overall stability or volatility of interest rates, providing borrowers with a clear picture of potential rate changes over time. This allows for better financial planning and informed decision-making.

Loan Amounts Disbursed

A bar chart effectively visualizes the distribution of loan amounts disbursed by Crestridge Loans. The x-axis represents loan amount ranges (e.g., $0-$10,000, $10,001-$25,000, etc.), and the y-axis shows the number of loans disbursed within each range. The height of each bar directly corresponds to the frequency of loans within that particular amount range. For instance, a taller bar for the $10,001-$25,000 range would indicate a higher number of loans disbursed within that bracket compared to others. This provides insights into the typical loan size Crestridge Loans provides, helping potential borrowers gauge the feasibility of their loan requests within the company’s typical lending parameters.

Loan Repayment Process

A flowchart provides a clear visual representation of the loan repayment process at Crestridge Loans. The flowchart would begin with the disbursement of the loan, followed by a series of boxes illustrating each step in the repayment process, such as monthly payment due dates, methods of payment (online, mail, etc.), and potential consequences of late payments. Arrows would connect these boxes, illustrating the sequential nature of the process. A final box would indicate the completion of loan repayment. This clear visual representation would help borrowers understand the repayment schedule and expectations, reducing confusion and potential issues arising from unclear repayment terms. The flowchart might also include a box detailing the options available for borrowers facing financial difficulties, such as loan modification or hardship programs.

Concluding Remarks

Ultimately, choosing a lender is a significant financial decision. This exploration of Crestridge Loans provides a detailed overview, highlighting key aspects to help you assess their suitability for your needs. By understanding their loan offerings, application process, customer experiences, and financial stability, you can make a well-informed choice that aligns with your financial goals. Remember to thoroughly research and compare options before committing to any loan.

FAQ

What credit score is required for a Crestridge Loan?

Crestridge Loans’ credit score requirements vary depending on the loan type and amount. Check their website or contact them directly for specific requirements.

What types of collateral are accepted?

The types of collateral accepted by Crestridge Loans depend on the specific loan product. Some loans may be secured, requiring collateral, while others may be unsecured.

What happens if I miss a loan payment?

Missing a payment can result in late fees and negatively impact your credit score. Contact Crestridge Loans immediately if you anticipate difficulty making a payment to discuss potential solutions.

Are there prepayment penalties?

Whether prepayment penalties apply depends on the specific loan agreement. Review your loan contract carefully for details on prepayment terms.