Delta Community Credit Union auto loan rates are a key factor for anyone considering financing a vehicle. Understanding these rates requires examining various influences, including your credit score, the loan term, the type of vehicle, and the size of your down payment. This comprehensive guide delves into the specifics of Delta Community Credit Union’s auto loan offerings, comparing them to industry competitors and outlining the application process from start to finish. We’ll also explore repayment options, fees, and customer experiences to provide a complete picture of what to expect.

This detailed analysis will equip you with the knowledge necessary to make informed decisions about your auto loan, helping you navigate the process with confidence and secure the best possible financing terms. We’ll cover everything from understanding the factors that influence your interest rate to exploring available repayment options and special promotions.

Delta Community Credit Union Overview: Delta Community Credit Union Auto Loan Rates

Delta Community Credit Union is a significant financial institution serving the Atlanta metropolitan area and beyond. Established with a focus on serving educators, its reach has expanded considerably over its history, offering a wide range of financial products and services to a diverse membership base. This overview will detail the credit union’s history, services, mission, and target audience.

Delta Community Credit Union’s history traces back to its origins as a small credit union catering primarily to teachers in the Atlanta area. Over the decades, it has experienced substantial growth, expanding its membership eligibility and service offerings to encompass a much broader demographic. This growth reflects a successful adaptation to changing market conditions and a commitment to providing accessible and competitive financial solutions. The credit union’s evolution showcases its ability to remain relevant and responsive to the evolving needs of its members.

Services Offered

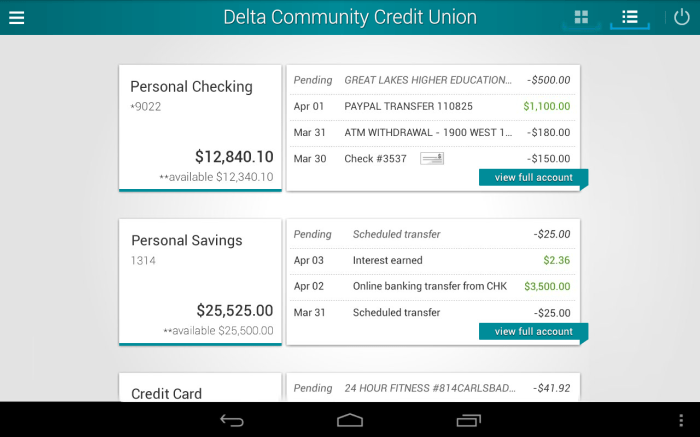

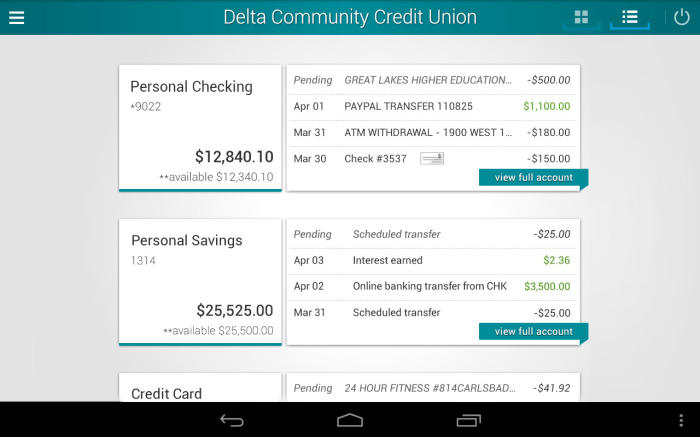

Beyond auto loans, Delta Community Credit Union provides a comprehensive suite of financial services designed to meet the diverse needs of its members. These include checking and savings accounts, mortgages, personal loans, credit cards, investment services, and insurance products. The credit union’s commitment to providing a one-stop shop for financial needs fosters member loyalty and strengthens its position within the community. The breadth of its offerings ensures members can manage various aspects of their financial lives under one roof, simplifying their financial administration.

Mission Statement and Core Values

Delta Community Credit Union’s mission statement emphasizes its commitment to serving its members and the community. While the exact wording may vary slightly depending on the source, the core tenets consistently highlight member satisfaction, financial empowerment, and community engagement. Core values often include integrity, transparency, and a dedication to providing exceptional customer service. These values guide the credit union’s decision-making processes and shape its interactions with both members and the broader community. They are integral to the credit union’s identity and its long-term success.

Target Audience

Delta Community Credit Union’s target audience has broadened significantly from its initial focus on educators. While it maintains strong ties to the education community, its membership now includes individuals and families across various professions and income levels within the Atlanta metropolitan area and surrounding regions. The credit union actively seeks to serve those seeking reliable, affordable, and accessible financial services, emphasizing community involvement and personalized member experiences. This broad appeal contributes to the credit union’s overall growth and stability.

Auto Loan Rate Factors

Delta Community Credit Union’s auto loan interest rates are determined by a variety of factors, all working together to assess the risk associated with lending you money. Understanding these factors can help you secure the most favorable rate possible. This section will detail the key elements influencing your final interest rate.

Credit Score’s Impact on Loan Approval and Interest Rates

Your credit score is arguably the most significant factor influencing your auto loan approval and interest rate. A higher credit score demonstrates a history of responsible financial management, signaling lower risk to the lender. Lenders typically use a credit scoring model, such as FICO, to assess your creditworthiness. A score above 700 generally qualifies you for the best rates, while scores below 600 may result in higher rates or even loan denial. The impact is substantial; a difference of even a few points can translate to a noticeable difference in your monthly payment over the life of the loan. For example, a borrower with a 750 credit score might receive a rate significantly lower than a borrower with a 650 credit score, resulting in thousands of dollars saved in interest over the loan term.

Other Factors Affecting Auto Loan Rates

Beyond your credit score, several other factors play a crucial role in determining your final auto loan rate. These include the loan term, the type of vehicle, and the size of your down payment.

A longer loan term (e.g., 72 months versus 60 months) typically results in a lower monthly payment, but it also means you’ll pay more interest over the life of the loan, hence a potentially higher interest rate. Conversely, a shorter loan term usually comes with a higher monthly payment but a lower overall interest cost and potentially a better interest rate.

The type of vehicle you’re financing also affects the rate. New cars often command lower interest rates than used cars due to their perceived lower risk of depreciation. The vehicle’s value and its resale potential are considered by the lender.

A larger down payment reduces the loan amount, thereby lowering the lender’s risk and potentially resulting in a lower interest rate. A substantial down payment shows your commitment to the loan and improves your chances of securing a better rate.

Comparison of Auto Loan Rates Across Financial Institutions

While Delta Community Credit Union offers competitive rates, it’s beneficial to compare them to other financial institutions. The following table provides a hypothetical comparison – actual rates vary based on individual circumstances and may change over time. It is crucial to check current rates with each institution directly.

| Institution | Rate (APR) | Term (Months) | Requirements |

|---|---|---|---|

| Delta Community Credit Union | 4.5% – 8.0% | 24-72 | Credit score, income verification, vehicle information |

| Example Bank A | 5.0% – 9.0% | 36-60 | Credit score, income verification, vehicle information |

| Example Credit Union B | 4.0% – 7.5% | 24-48 | Credit score, income verification, vehicle information |

| Example Online Lender C | 6.0% – 10.0% | 36-72 | Credit score, income verification, vehicle information |

Loan Application Process

Applying for an auto loan at Delta Community Credit Union involves a straightforward process designed for efficiency and convenience. The application can be completed online, by phone, or in person at a branch, offering flexibility to suit individual preferences. Careful preparation of the necessary documentation will streamline the application process and expedite approval.

The steps involved in applying for an auto loan at Delta Community Credit Union are Artikeld below. Accurate and complete information is crucial for a smooth and timely approval. Providing all required documents upfront will minimize delays.

Required Documentation

To successfully complete your auto loan application, Delta Community Credit Union requires specific documentation to verify your identity, income, and creditworthiness. This documentation helps assess your loan eligibility and determine the appropriate interest rate and loan terms. Failure to provide complete documentation may delay the processing of your application.

- Valid government-issued photo identification (driver’s license or passport).

- Proof of income (pay stubs, tax returns, or bank statements).

- Proof of residence (utility bill or lease agreement).

- Information about the vehicle you intend to purchase (year, make, model, VIN).

- Details of your down payment (if applicable).

Steps in the Auto Loan Application Process

The application process is designed to be user-friendly and efficient. Each step is crucial in ensuring a successful loan application. Applicants should carefully review each step and ensure they provide accurate and complete information.

- Pre-qualification: Before formally applying, you may choose to pre-qualify to get an estimate of your potential loan terms and interest rate. This step doesn’t require a hard credit inquiry.

- Complete the Application: Complete the auto loan application form either online, by phone, or in person at a branch location. Be sure to accurately and completely fill out all required fields.

- Submit Required Documentation: Gather and submit all the necessary documentation as Artikeld above. Organize your documents for easy review.

- Credit Check and Approval: Delta Community Credit Union will review your application and conduct a credit check. The approval process may take a few business days.

- Loan Closing: Upon approval, you’ll receive details of your loan terms, including the interest rate, monthly payment, and loan duration. You will then sign the loan agreement.

- Disbursement of Funds: Once the loan agreement is signed, the funds will be disbursed according to the agreed-upon terms. This typically involves transferring the funds to the seller of the vehicle.

Auto Loan Application Process Flowchart

A visual representation of the application process would show a flow beginning with the pre-qualification (optional) step, branching to application completion, followed by document submission, credit check and approval, loan closing, and finally, disbursement of funds. A “No” decision at the credit check and approval stage would lead to application rejection, while a “Yes” decision leads to the next stage. The entire process would be represented as a linear sequence with decision points, illustrating the steps clearly and concisely. Each step would be clearly labeled, showing the flow from one stage to the next.

Loan Repayment Options and Fees

Delta Community Credit Union offers flexible repayment options tailored to individual financial situations. Understanding your repayment plan and associated fees is crucial for responsible loan management. This section details the available options and potential costs.

Delta Community Credit Union typically offers various loan terms, ranging from 24 to 84 months, depending on the loan amount and vehicle type. Monthly payment amounts are calculated based on the loan’s principal amount, interest rate, and loan term. Shorter loan terms result in higher monthly payments but lower overall interest paid, while longer terms lead to lower monthly payments but higher total interest. Borrowers should carefully consider their budget and financial goals when selecting a loan term.

Loan Term Options and Monthly Payment Calculations

The monthly payment amount is determined using a standard amortization formula. This formula considers the loan principal, interest rate, and loan term. For example, a $20,000 auto loan at a 5% interest rate over 60 months would result in an approximate monthly payment of $377. However, the exact amount may vary slightly depending on the specific terms and conditions of the loan.

Fees Associated with Auto Loans

Delta Community Credit Union may charge certain fees associated with auto loans. These fees can include origination fees, which are typically a percentage of the loan amount, and late payment fees, which are assessed if a payment is not received by the due date. It’s essential to review the loan agreement carefully to understand all applicable fees.

Consequences of Missed or Late Payments

Missed or late payments can have several negative consequences. These include the accrual of late payment fees, a negative impact on the borrower’s credit score, and potential loan default. In cases of persistent late payments, Delta Community Credit Union may pursue collection actions, which could include referring the debt to a collection agency.

Sample Amortization Schedule

The following table illustrates a sample amortization schedule for a $20,000 auto loan at a 5% annual interest rate over 60 months. Note that this is a simplified example, and actual payments may vary slightly.

| Month | Starting Balance | Payment | Ending Balance |

|---|---|---|---|

| 1 | $20,000.00 | $377.42 | $19,622.58 |

| 2 | $19,622.58 | $377.42 | $19,242.16 |

| 3 | $19,242.16 | $377.42 | $18,858.74 |

| 4 | $18,858.74 | $377.42 | $18,472.32 |

| 5 | $18,472.32 | $377.42 | $18,082.90 |

| … | … | … | … |

| 60 | $379.54 | $379.54 | $0.00 |

Customer Testimonials and Reviews

Delta Community Credit Union’s commitment to customer satisfaction is a cornerstone of its success. Understanding customer experiences, both positive and negative, is crucial for continuous improvement and maintaining a strong reputation within the auto loan market. The following details illustrate how Delta Community Credit Union actively solicits and addresses customer feedback to enhance its services.

Positive customer experiences are vital in building trust and encouraging repeat business. Delta Community Credit Union actively seeks and shares these experiences to demonstrate the value of its services.

Positive Customer Experiences

Delta Community Credit Union actively collects positive feedback through various channels. Examples of positive customer experiences shared include:

- “The entire process was incredibly smooth and efficient. The loan officer, Sarah, was incredibly helpful and answered all my questions patiently. I received my loan approval quickly and the interest rate was very competitive.” – John D., Atlanta, GA

- “I was pre-approved for my auto loan in minutes online. The application was easy to complete and I felt informed every step of the way. I highly recommend Delta Community Credit Union for auto loans.” – Maria R., Decatur, GA

- “I appreciated the personalized service I received. My loan officer took the time to understand my financial situation and helped me find the best loan option for my needs. The communication was excellent throughout the entire process.” – David L., Stone Mountain, GA

Methods for Gathering Customer Feedback

Delta Community Credit Union employs a multi-faceted approach to gather customer feedback, ensuring a comprehensive understanding of customer satisfaction levels regarding their auto loan services. This commitment to feedback collection allows for continuous improvement and adaptation to evolving customer needs.

- Post-loan surveys: Customers receive email surveys following loan completion, allowing them to rate their experience and provide detailed feedback on specific aspects of the process.

- Online reviews: Delta Community Credit Union monitors and responds to reviews on platforms like Google, Yelp, and other relevant financial review sites.

- Customer service interactions: Feedback is gathered during phone calls, in-person visits, and online chat sessions with customer service representatives. These interactions provide valuable real-time insights into customer satisfaction.

- Focus groups and interviews: Periodically, Delta Community Credit Union conducts focus groups and individual interviews to gather in-depth feedback and understand the underlying reasons behind customer satisfaction or dissatisfaction.

Addressing Negative Customer Feedback

Delta Community Credit Union takes negative feedback seriously and uses it as an opportunity to improve its services. A structured process is in place to address concerns and resolve issues promptly and effectively.

- Prompt response: All negative feedback is acknowledged and responded to promptly, demonstrating a commitment to resolving customer concerns.

- Investigation and resolution: The credit union investigates the issue thoroughly, identifies the root cause, and works towards a fair and equitable resolution. This may involve adjustments to loan terms, fee waivers, or other appropriate actions.

- Process improvement: Negative feedback is analyzed to identify systemic issues and areas for improvement within the auto loan process. This data informs changes to policies, procedures, and training to prevent similar issues from recurring.

- Transparency and communication: Customers are kept informed throughout the process of addressing their concerns, fostering trust and building stronger relationships.

Hypothetical Scenario Illustrating Positive Customer Service

Imagine Sarah is applying for an auto loan. She initially feels overwhelmed by the process. However, her loan officer, Mark, proactively contacts her to explain the requirements and options clearly. He patiently answers all her questions, clarifies any confusion, and helps her choose the best loan product to fit her budget. Throughout the process, Mark maintains open and consistent communication, providing updates and addressing any concerns promptly. Sarah’s experience is positive because of Mark’s professionalism, attentiveness, and commitment to providing excellent customer service. This results in a satisfied customer who is likely to recommend Delta Community Credit Union to others.

Special Offers and Promotions

Delta Community Credit Union frequently offers special promotions on its auto loans, though these offers are subject to change. It’s crucial to check their official website or contact a representative directly for the most up-to-date information on current promotions. These promotions often aim to incentivize borrowers and may include reduced interest rates, waived fees, or other attractive benefits.

Delta Community Credit Union’s special offers typically have specific terms and conditions. These conditions might include a minimum loan amount, a required loan term length, or specific vehicle types that qualify. Some promotions may also have limited-time availability, meaning they expire after a set period. For example, a past promotion might have offered a 0.25% reduction on the interest rate for members who refinanced their auto loan within a specific timeframe. These terms and conditions are designed to manage risk and ensure the promotion’s success for the credit union.

Current Special Offer Details, Delta community credit union auto loan rates

To find details on any currently active special offers, visit the Delta Community Credit Union website’s auto loan section. Look for banners, pop-ups, or dedicated promotional pages highlighting current deals. The website usually provides clear explanations of the offer’s terms, conditions, and eligibility requirements. Alternatively, contacting a loan officer via phone or in person is another effective way to obtain the latest information on available promotions.

Eligibility Requirements for Promotions

Eligibility for Delta Community Credit Union’s auto loan promotions varies depending on the specific offer. Common eligibility criteria might include membership in the credit union, a satisfactory credit score, a stable income, and the purchase of a vehicle that meets the credit union’s requirements. Some promotions might also target specific demographic groups or prioritize certain types of vehicles. For instance, a promotion might be designed to encourage members to purchase fuel-efficient vehicles. The specific eligibility criteria are always clearly Artikeld in the promotional materials.

Calculating Potential Savings from a Special Offer

Calculating potential savings from a special offer involves comparing the loan’s cost with and without the promotion. Let’s assume a hypothetical scenario: A member is considering a $20,000 auto loan with a 5% interest rate over 60 months. The monthly payment would be approximately $377. If a promotion reduces the interest rate to 4.75%, the monthly payment would decrease to approximately $371. The total savings over the loan term would be approximately $360 ($6 difference per month x 60 months). This is a simplified example, and the actual savings will depend on the loan amount, interest rate reduction, and loan term. It is recommended to use a loan calculator available on the Delta Community Credit Union website or a similar online tool to determine the precise amount of savings.

Last Word

Securing an auto loan can feel overwhelming, but understanding the intricacies of Delta Community Credit Union’s offerings empowers you to make informed choices. By carefully considering the factors influencing interest rates, thoroughly reviewing the application process, and understanding repayment options, you can confidently navigate the path to securing your next vehicle. Remember to compare rates with other institutions and leverage any available promotions to optimize your financing.

Helpful Answers

What credit score is needed for approval?

While Delta Community Credit Union doesn’t publicly state a minimum credit score, a higher score generally leads to better interest rates and a higher chance of approval. It’s best to check your credit report and score before applying.

What types of vehicles are eligible for financing?

Delta Community Credit Union likely finances a wide range of vehicles, including new and used cars, trucks, SUVs, and motorcycles. Specific eligibility criteria might vary; contact them directly for details.

What happens if I miss a payment?

Missing payments will result in late fees and negatively impact your credit score. It could also lead to further penalties and potentially default on the loan. Contact Delta Community Credit Union immediately if you anticipate difficulty making a payment.

Can I pre-qualify for a loan online?

Check Delta Community Credit Union’s website. Many credit unions offer online pre-qualification tools to get an estimate of your potential interest rate and loan amount without impacting your credit score.