Do I need a business bank account for rental income? This crucial question impacts your financial well-being, tax obligations, and liability protection as a landlord. Managing rental properties involves complex financial transactions, and understanding the implications of separating personal and business finances is key to long-term success and minimizing potential risks. This guide clarifies the benefits and drawbacks, helping you make an informed decision about whether a dedicated business account is right for your rental property portfolio.

From simplifying tax preparation and improving record-keeping to building business credit and protecting personal assets, the advantages of a separate business bank account for rental income are numerous. We’ll delve into the legal and financial aspects, providing practical advice and real-world examples to illustrate the importance of sound financial management in the rental property business.

Legal and Tax Implications of Rental Income

Managing rental properties involves significant legal and tax responsibilities. Understanding these implications is crucial for maximizing profits and avoiding potential penalties. Failure to comply with reporting requirements can lead to significant financial repercussions. This section details the legal requirements for reporting rental income and explores the tax advantages and disadvantages associated with different accounting methods.

Reporting Rental Income

The Internal Revenue Service (IRS) requires all rental income to be reported accurately and timely. This typically involves filing Schedule E (Supplemental Income and Loss) with Form 1040, your annual individual income tax return. Rental income includes all payments received from tenants, including rent, late fees, and security deposits (less any returned portion). Accurate record-keeping is paramount, encompassing all income and expenses related to the property. This includes receipts for repairs, maintenance, insurance, property taxes, and mortgage interest. Failing to accurately report rental income can result in penalties and interest charges from the IRS. Accurate record keeping, therefore, is crucial for minimizing tax liability and avoiding legal issues.

Tax Benefits and Drawbacks of Using a Business Bank Account

A dedicated business bank account for rental income offers several tax advantages. Separating personal and business finances simplifies bookkeeping, making it easier to track income and expenses relevant to the rental property. This clear separation simplifies tax preparation and reduces the risk of commingling personal and business funds, which can complicate tax calculations and audits. A drawback might be the slight added administrative burden of managing a separate account. However, this is generally outweighed by the benefits of improved organization and clarity for tax purposes.

Tax Implications of Commingling Personal and Rental Income

Commingling personal and rental income—mixing them in a single bank account—can create significant tax complications. It makes it difficult to accurately track rental-related expenses, potentially leading to underreporting of deductions and increased tax liability. The IRS may scrutinize accounts where personal and business finances are intermingled, leading to audits and potential penalties. This can significantly increase the complexity and cost of tax preparation. Keeping accurate records becomes exponentially more challenging, potentially resulting in errors and increased liability.

Examples of How a Separate Account Simplifies Tax Preparation

Imagine preparing your taxes with all your rental income and expenses clearly documented in a separate bank account. You can easily generate reports showing all income received and all expenses paid, directly from your bank statements. This streamlines the process of completing Schedule E, reducing the time and effort required. Contrast this with the scenario of combing through personal bank statements to identify rental-related transactions, a much more time-consuming and error-prone process. A dedicated account provides a clear audit trail, simplifying the process for both you and your tax professional (if you use one).

Tax Advantages of a Dedicated Account

| Personal Account | Business Account |

|---|---|

| Difficult to track rental income and expenses. Increased risk of errors and omissions in tax reporting. Higher likelihood of IRS scrutiny. | Easy tracking of rental income and expenses. Simplified tax preparation. Reduced risk of errors and IRS scrutiny. Clear separation of personal and business finances. |

Financial Management and Record Keeping

Effective financial management is crucial for successful rental property ownership. Separating your personal and business finances provides clarity, simplifies tax preparation, and protects your personal assets from potential liabilities associated with your rental properties. Proper record-keeping ensures you can accurately track income, expenses, and ultimately, your profitability.

Benefits of Separating Personal and Business Finances

Maintaining separate accounts for personal and rental income offers significant advantages. It streamlines accounting, making it easier to identify profitable and unprofitable properties. This separation also simplifies tax preparation by clearly delineating business expenses from personal ones, minimizing the risk of errors and potential audits. Furthermore, a separate business account protects your personal assets from potential lawsuits or financial difficulties related to your rental properties. In the event of a legal claim against your rental business, your personal funds remain shielded. This separation is vital for liability protection and financial security.

Best Practices for Organizing Financial Records Related to Rental Properties

Organizing financial records effectively is essential for efficient tax preparation and informed business decisions. A well-organized system allows for quick access to crucial information, facilitating timely responses to tax authorities or potential financial inquiries. A robust system typically involves maintaining a dedicated folder or digital system for each rental property. Within this system, you should organize documents chronologically, including lease agreements, rental income statements, expense receipts, maintenance records, and tax documents. Consider using cloud-based storage for easy access and backup protection. Regularly reviewing and updating your records ensures accuracy and helps prevent discrepancies.

How a Business Account Improves Tracking of Income and Expenses

A dedicated business bank account significantly simplifies the process of tracking rental income and expenses. All rental income is deposited into this account, providing a clear and concise record of all funds received. Similarly, all rental-related expenses, such as mortgage payments, property taxes, insurance, repairs, and maintenance, are paid from this account, creating a comprehensive financial picture. This detailed record simplifies the preparation of financial statements and tax returns, reducing the likelihood of errors and omissions. The clear separation also makes it easier to monitor the profitability of each rental property individually.

Potential Challenges of Managing Rental Income Without a Separate Account

Managing rental income without a separate business account can lead to several complications. Mingling personal and business finances can create confusion when tracking income and expenses, making it difficult to accurately determine profitability. This lack of clarity can also complicate tax preparation, potentially leading to errors and increased risk of audits. Moreover, it exposes your personal assets to greater risk in the event of legal issues related to your rental properties. Without clear financial separation, it becomes challenging to demonstrate the distinct financial status of your rental business to lenders or investors.

Setting Up a System for Tracking Rental Income and Expenses

Establishing a reliable system for tracking rental income and expenses is crucial for successful rental property management. A well-defined system ensures accurate financial records, facilitating informed decision-making and efficient tax preparation. Follow these steps to implement a robust system:

- Open a dedicated business bank account: This is the cornerstone of effective financial management for rental properties.

- Establish a filing system: Choose a method (physical or digital) to organize all rental-related documents for each property.

- Use accounting software: Software like QuickBooks or Xero can automate many aspects of financial tracking and reporting.

- Regularly reconcile bank statements: Compare your bank statements to your records to identify any discrepancies.

- Maintain detailed expense records: Keep receipts for all expenses and categorize them appropriately.

- Track rental income meticulously: Record all rental payments received, noting the date and tenant.

- Perform regular financial reviews: Conduct periodic reviews (monthly or quarterly) to monitor profitability and identify areas for improvement.

Building Business Credit and Reputation

A dedicated business bank account is crucial for establishing and maintaining a strong business credit profile, separate from your personal finances. This separation protects your personal assets and allows lenders to assess your business’s financial health independently, leading to improved creditworthiness and access to more favorable financial products. By consistently demonstrating responsible financial management through your business account, you build a positive credit history that benefits your rental business and future ventures.

Opening a business bank account specifically designed for rental income streamlines financial management and simplifies tax preparation. This separation of funds clarifies your income sources and provides a clear audit trail for tax purposes. Furthermore, it enhances the professionalism of your rental business, fostering trust with tenants and potential investors.

Business Account Options for Landlords

Several types of business accounts cater to the needs of landlords. Sole proprietorships might opt for a simple business checking account, while those operating as LLCs or partnerships may require more sophisticated accounts offering features like multiple signatory access. The choice depends on the legal structure of your rental business and its specific financial needs. For example, a single-property landlord might find a basic business checking account sufficient, whereas a landlord managing a portfolio of properties might benefit from an account offering online banking tools for efficient tracking of multiple income streams and expenses. Accounts with robust reporting features can significantly simplify tax preparation and financial analysis.

Benefits of a Strong Financial History

A strong financial history, meticulously documented through your business bank account, translates into numerous advantages. Lenders will view your rental business as less risky, resulting in access to more favorable loan terms—potentially lower interest rates and higher loan amounts. This improved credit standing also enhances your negotiating power when securing contracts, such as with vendors or insurance providers. Moreover, a solid credit history makes attracting investors easier, providing opportunities for expansion and growth of your rental portfolio. For instance, a landlord with a consistently positive financial track record might secure a loan to purchase additional properties at a lower interest rate compared to a landlord with a less established credit history.

Documents Needed to Open a Business Bank Account

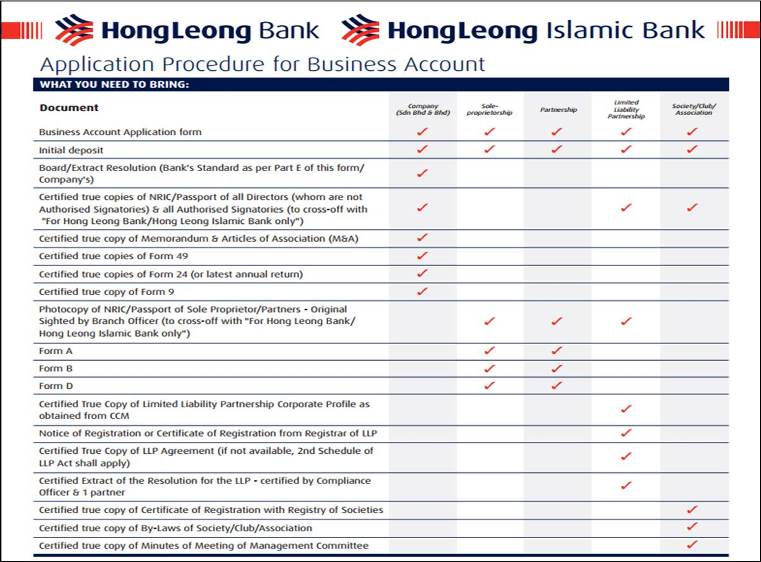

Before opening a business bank account for rental income, gather the necessary documentation. Having these documents readily available will streamline the application process.

- Business Registration Documents: Articles of Incorporation (if applicable), LLC operating agreement (if applicable), or sole proprietorship documentation.

- Employer Identification Number (EIN): Obtain this from the IRS if you are operating as anything other than a sole proprietorship.

- Personal Identification: Driver’s license or passport for all business owners.

- Business Address Verification: Utility bill or lease agreement showing the business address.

- Initial Deposit: Funds to open the account; requirements vary by bank.

Protecting Personal Assets

Operating a rental property business carries inherent risks. Separating your personal and business finances through a dedicated business bank account is a crucial strategy for mitigating these risks and protecting your personal assets from potential liabilities. This separation provides a critical layer of protection, limiting your personal exposure to lawsuits, debts, and other financial challenges associated with your rental business.

Liability protection offered by separating personal and business finances is significant. A business bank account acts as a clear boundary, preventing the commingling of personal and business funds. This separation is vital for shielding your personal assets—such as your home, savings, and other investments—from claims made against your rental business. In the event of a lawsuit, creditors typically only have recourse to the assets held within the business account, leaving your personal finances largely untouched.

Real-World Scenarios Illustrating Asset Protection

Consider a scenario where a tenant suffers a serious injury on your rental property due to negligence. A lawsuit could ensue, resulting in significant financial penalties. If your personal and business finances are intertwined, the plaintiff could potentially seize your personal assets to satisfy the judgment. However, with separate accounts, the lawsuit would primarily target the business account, preserving your personal wealth. Similarly, if your rental business incurs substantial debt, creditors are more likely to pursue the business assets first. A separate account significantly reduces the risk of them targeting your personal accounts and assets.

How a Business Bank Account Shields Personal Assets from Lawsuits

A business bank account provides a legal firewall between your personal and business liabilities. Courts recognize the distinction between personal and business entities when separate accounts are maintained. This legal separation significantly reduces the likelihood of creditors pursuing your personal assets to satisfy business debts or judgments. This is particularly crucial in cases involving property damage, tenant disputes, or other legal challenges related to the rental business. The separation clearly delineates business transactions and liabilities, making it more difficult for plaintiffs to claim your personal assets.

Potential Legal Risks Associated with Commingling Funds

Commingling personal and business funds significantly increases your legal risk. It blurs the lines between your personal and business liabilities, making it difficult to distinguish between personal and business expenses. This can lead to difficulties in accurately tracking income and expenses for tax purposes, potentially resulting in penalties from tax authorities. Furthermore, in the event of a lawsuit, commingling funds can make it easier for plaintiffs to argue that your personal assets are intertwined with your business, increasing the likelihood of them being pursued. This lack of clear separation can significantly weaken your defense and expose your personal assets to significant risk.

Hypothetical Case Study: Consequences of Not Having a Separate Account

Imagine Sarah, a landlord who manages several rental properties but uses her personal checking account for all rental income and expenses. One tenant suffers a severe injury due to a faulty appliance on the property, resulting in a substantial lawsuit. Because Sarah commingled funds, the plaintiff’s lawyers easily demonstrate a direct link between Sarah’s personal assets and the rental business. The court rules in favor of the plaintiff, and due to the lack of separation, the court is able to seize Sarah’s personal savings and even place a lien on her home to cover the judgment. Sarah’s failure to maintain a separate business bank account cost her dearly, demonstrating the critical importance of protecting personal assets through proper financial segregation.

Streamlining Banking and Payment Processing: Do I Need A Business Bank Account For Rental Income

A dedicated business bank account significantly simplifies the management of rental income, offering enhanced organization, security, and efficiency compared to commingling personal and business finances. This separation improves financial tracking, facilitates tax preparation, and protects personal assets from potential liabilities associated with the rental property.

Using a business account streamlines the process of receiving rent payments, providing clear separation from personal funds and offering various tools for efficient management. Online banking features further enhance this process, allowing for automated transactions, improved record-keeping, and better overall financial oversight.

Rent Payment Receipt Simplification, Do i need a business bank account for rental income

A business account provides a centralized location for all rental income. This eliminates the confusion of tracking payments across multiple personal accounts or using less secure methods. Landlords can easily monitor incoming payments, identify late payments, and generate reports for tax purposes. The clear separation between business and personal finances also simplifies bookkeeping and reduces the risk of errors.

Online Banking Features for Rental Property Management

Online banking platforms offer numerous tools specifically designed to simplify rental property management. Features such as automatic bill pay can schedule rent payments to mortgage lenders or property management companies. Online account statements provide a detailed audit trail of all transactions, facilitating reconciliation and tax preparation. Many platforms also offer mobile apps, allowing landlords to monitor accounts and process payments from anywhere. Real-time balance tracking provides a constant overview of cash flow, allowing for proactive financial management.

Comparison of Payment Processing Methods

Several methods exist for processing rental payments, each with its own advantages and disadvantages. ACH transfers offer a secure and efficient method for electronic payments directly from tenant bank accounts. Online payment platforms like PayPal or Venmo provide convenience but may incur transaction fees. Checks, while still used, are slower to process and carry a higher risk of loss or delay. The choice of payment method should consider factors such as transaction fees, security, and tenant preferences. For example, a landlord might offer multiple payment options to cater to diverse tenant needs, ensuring convenience while maintaining financial security.

Improving Cash Flow Management with a Business Account

A business account allows for better cash flow management through features like automated recurring transfers, which can be scheduled to move funds from the rental account to a personal account or to a savings account for property maintenance or repairs. This ensures consistent income allocation, avoiding the risk of overspending or neglecting essential expenses. Regular reconciliation of the business account ensures accurate tracking of income and expenses, enabling informed financial decisions. For instance, analyzing monthly cash flow statements allows landlords to predict future expenses and adjust rental rates accordingly, maintaining a healthy financial position.

Reconciling a Business Bank Account for Rental Income

Reconciling a business bank account is crucial for accurate financial reporting. This process ensures that the bank’s records match the landlord’s records. Following these steps ensures accuracy:

- Gather necessary documents: bank statement, check register, and all other records of transactions.

- Compare bank statement transactions to your records: Identify any discrepancies.

- Investigate and resolve discrepancies: Contact the bank or tenant to resolve any issues.

- Calculate the adjusted balance: Add any outstanding deposits and subtract any outstanding checks.

- Compare the adjusted balance to the bank statement balance: The two balances should match.

- Document the reconciliation: Keep a record of the reconciliation process for tax purposes.

Regular reconciliation minimizes the risk of errors and helps in identifying potential issues early on. For example, discrepancies could highlight a potential accounting error or even fraudulent activity.