Do I need a CPA for my small business? This crucial question faces countless entrepreneurs navigating the complex world of finance. Understanding your business’s unique needs, from basic bookkeeping to intricate tax strategies, is paramount. This guide explores the various factors influencing this decision, weighing the benefits of professional accounting services against the potential cost savings of DIY solutions. We’ll delve into the legal and tax implications of different business structures, examining the potential pitfalls of neglecting professional guidance. Ultimately, we’ll empower you to make an informed choice that aligns with your business goals and financial resources.

We’ll examine the core services offered by CPAs, including tax planning, financial forecasting, and budgeting, comparing these services to the challenges of managing finances independently. We’ll also discuss alternative solutions, such as affordable accounting software and online bookkeeping services, helping you determine the best fit for your specific situation. By the end, you’ll have a clear understanding of whether a CPA is a necessary investment or a luxury you can afford to forego.

Understanding Your Business Needs

The decision of whether or not you need a CPA for your small business hinges heavily on understanding your specific business needs. The complexity of your accounting requirements isn’t solely determined by your business’s size, but rather by its structure, industry, and volume of transactions. Ignoring these factors can lead to costly mistakes and hinder your business’s growth.

Types of Small Businesses and Accounting Complexities

Different business structures present varying levels of accounting complexity. A sole proprietorship, for instance, blends the owner’s personal finances with the business’s, simplifying bookkeeping but increasing the personal liability of the owner. In contrast, a Limited Liability Company (LLC) offers a separation between personal and business assets, demanding more intricate accounting procedures to maintain this distinction. Partnerships involve multiple owners, necessitating meticulous record-keeping to track each partner’s contributions and share of profits and losses. Corporations, even small ones (S-Corps or C-Corps), have the most complex accounting requirements due to stringent regulatory compliance needs and shareholder reporting obligations. The industry also plays a role; businesses in highly regulated sectors like healthcare or finance will generally have more complex accounting needs than those in less regulated areas.

Financial Tasks Involved in Running a Small Business

Managing the finances of a small business involves a multifaceted array of tasks. These include accurate and timely recording of all income and expenses, managing accounts receivable and payable, preparing financial statements (income statements, balance sheets, cash flow statements), reconciling bank accounts, managing payroll, and preparing tax returns. Furthermore, businesses must adhere to various tax regulations, including sales tax, payroll tax, and income tax, which can be especially complex depending on the business structure and location. Budgeting and forecasting are crucial for planning and making informed business decisions, requiring accurate financial data. Finally, many businesses also need to manage inventory, track assets, and handle other financial aspects specific to their industry.

Common Bookkeeping Mistakes Small Business Owners Make, Do i need a cpa for my small business

Many small business owners make common bookkeeping errors that can have significant consequences. One prevalent mistake is inconsistent record-keeping. Failing to record transactions promptly and accurately can lead to inaccurate financial statements and tax filings. Another frequent error is neglecting to separate business and personal finances, especially common in sole proprietorships. This can complicate tax preparation and make it difficult to track the business’s true profitability. Improperly classifying expenses can result in tax penalties, as can failing to account for depreciation of assets. Finally, neglecting to reconcile bank accounts regularly can mask errors and discrepancies, hindering the ability to identify potential fraud or other financial issues.

Accounting Needs by Business Structure

| Business Structure | Bookkeeping Complexity | Tax Filing Complexity | Need for CPA |

|---|---|---|---|

| Sole Proprietorship | Low (often integrated with personal finances) | Relatively Low (filed with personal taxes) | Often not required, but beneficial for tax planning |

| Partnership | Moderate (requires tracking individual partner contributions) | Moderate (partnership tax return required) | Recommended, especially for complex partnerships |

| LLC | Moderate to High (depends on how it’s taxed and managed) | Moderate to High (can be taxed as a pass-through entity or corporation) | Recommended for complex LLC structures or significant transactions |

| S-Corporation | High (complex tax requirements and shareholder reporting) | High (separate corporate tax return required) | Highly Recommended due to intricate tax and regulatory compliance |

| C-Corporation | High (most complex structure with stringent regulatory compliance) | High (separate corporate tax return required, double taxation potential) | Essential for compliance and effective financial management |

CPA Services and Their Value

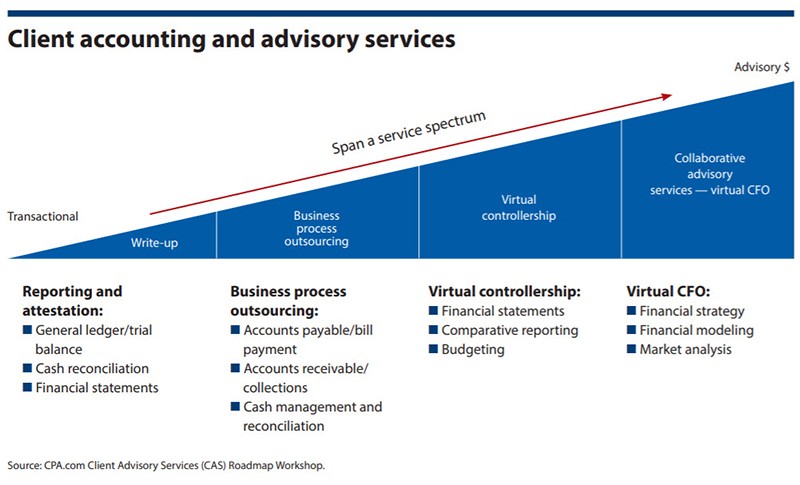

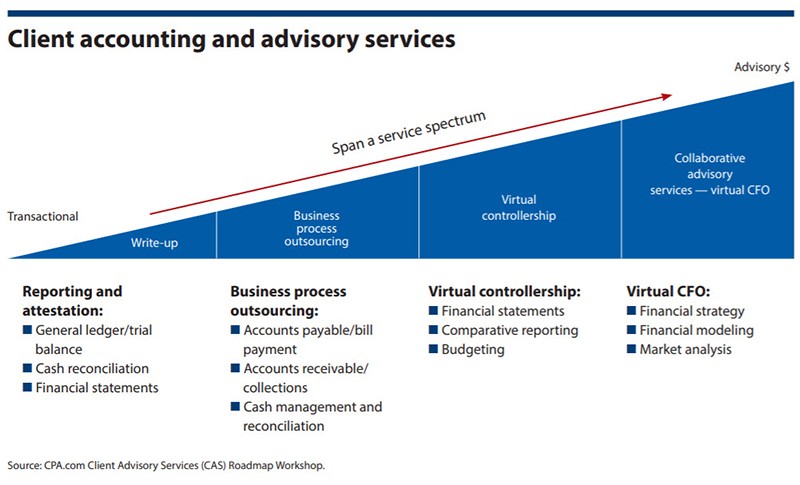

CPAs (Certified Public Accountants) offer a wide range of services invaluable to small businesses, extending far beyond simple tax preparation. Their expertise can significantly contribute to a company’s financial health and long-term success, providing insights and guidance that can save time, money, and alleviate stress. Understanding the core services and their benefits is crucial for any small business owner considering professional financial management.

CPAs provide a comprehensive suite of services tailored to the specific needs of small businesses. These services are designed to streamline financial processes, optimize tax strategies, and improve overall financial decision-making.

Core CPA Services for Small Businesses

A CPA’s core services for small businesses typically include tax preparation and planning, financial statement preparation and review, bookkeeping assistance, and business consulting. Tax preparation involves accurately filing all necessary tax returns, ensuring compliance with all relevant regulations and minimizing tax liability. Financial statement preparation helps business owners understand their financial position and performance. Bookkeeping assistance provides support with day-to-day record-keeping, and business consulting offers strategic guidance on various financial matters. For example, a CPA can advise on business structure, financing options, and growth strategies.

Benefits of CPA Services for Tax Planning and Preparation

Utilizing a CPA for tax planning and preparation offers substantial advantages. A CPA’s in-depth knowledge of tax laws allows them to identify and utilize all available deductions and credits, minimizing tax burdens and maximizing profitability. They can also proactively plan for future tax liabilities, ensuring compliance and avoiding potential penalties. For instance, a CPA can help structure business expenses to optimize deductions, or advise on the best strategies for handling capital gains. This proactive approach ensures businesses stay compliant while maximizing their after-tax income.

CPA Assistance with Financial Forecasting and Budgeting

Financial forecasting and budgeting are critical for a small business’s success. A CPA can assist with developing accurate financial forecasts by analyzing historical data, market trends, and projected sales. This allows for more informed decision-making regarding investments, resource allocation, and expansion strategies. In budgeting, a CPA can help create a realistic and comprehensive budget, aligning expenses with revenue projections to ensure financial stability. For example, a CPA can help a small business owner project cash flow needs for the next year, enabling them to secure necessary financing or adjust spending plans accordingly. This proactive approach reduces the risk of financial shortfalls and improves overall financial health.

Cost Comparison: CPA vs. Independent Financial Management

The decision of whether to hire a CPA or manage finances independently involves a careful consideration of costs and benefits. While managing finances independently might seem cost-effective initially, the potential for errors, missed opportunities, and increased stress can ultimately prove more expensive in the long run.

The following table compares the cost factors for each option:

| Cost Factor | Hiring a CPA | Independent Management |

|---|---|---|

| Professional Fees | Varies depending on services and CPA’s rates. Expect to pay an hourly rate or a fixed fee per service. | $0 (but may include the cost of software, training, and time spent managing finances). |

| Software & Tools | CPA usually covers the cost of necessary software. | Costs of accounting software, potentially expensive if advanced features are required. |

| Time Commitment | Minimal time commitment from the business owner. | Significant time commitment from the business owner. |

| Risk of Errors | Low risk due to CPA’s expertise. | High risk of errors, leading to potential penalties and financial losses. |

| Tax Optimization | High potential for tax savings due to strategic planning. | Limited tax optimization opportunities without specialized knowledge. |

Legal and Tax Implications: Do I Need A Cpa For My Small Business

Operating a small business involves navigating a complex web of legal and tax obligations. Understanding these requirements is crucial for maintaining compliance, avoiding penalties, and ensuring the long-term success and profitability of your venture. Failure to comply can result in significant financial and legal repercussions.

Record-Keeping and Financial Reporting Requirements

Maintaining accurate and organized financial records is a fundamental legal requirement for all small businesses, regardless of structure. These records serve as evidence of income, expenses, and overall financial health, and are essential for filing accurate tax returns, securing loans, and attracting investors. The specific requirements vary depending on the business structure and industry, but generally include maintaining detailed records of all transactions, including invoices, receipts, bank statements, and payroll records. These records must be kept for a minimum period, typically three to seven years, depending on the jurisdiction and specific tax regulations. Failure to maintain adequate records can lead to difficulties during tax audits and potential legal challenges.

Tax Implications of Different Business Structures

The choice of business structure significantly impacts tax obligations. Sole proprietorships and partnerships generally have simpler tax structures, with profits and losses reported on the owner’s personal income tax return. However, corporations and LLCs are considered separate legal entities, resulting in separate tax filings and potentially different tax rates. For example, an S corporation allows pass-through taxation, avoiding double taxation on profits, while a C corporation faces double taxation—on corporate profits and again on dividends distributed to shareholders. Choosing the optimal structure requires careful consideration of tax implications, liability protection, and administrative burdens. A CPA can provide invaluable guidance in this decision-making process.

Penalties for Non-Compliance with Tax Regulations

Non-compliance with tax regulations can lead to a range of penalties, including late filing penalties, accuracy-related penalties, and interest charges. Late filing penalties are typically calculated as a percentage of the unpaid tax, increasing over time. Accuracy-related penalties are imposed for errors or omissions on tax returns, even if unintentional. Interest is charged on unpaid taxes from the due date until the taxes are paid in full. In severe cases, non-compliance can result in criminal charges, leading to significant fines and even imprisonment. Proactive tax planning and adherence to filing deadlines are essential to avoid these penalties.

Key Tax Forms for Various Business Types

The following table Artikels some of the key tax forms required for different business types. Note that specific requirements may vary based on location and individual circumstances. Consulting with a tax professional is crucial for ensuring accurate and timely filing.

| Business Type | Tax Form(s) | Filing Deadline | Penalties for Late Filing |

|---|---|---|---|

| Sole Proprietorship | Schedule C (Form 1040) | April 15th (or extension date) | Percentage of unpaid tax, plus interest |

| Partnership | Form 1065 | March 15th (or extension date) | Percentage of unpaid tax, plus interest |

| S Corporation | Form 1120-S | March 15th (or extension date) | Percentage of unpaid tax, plus interest |

| C Corporation | Form 1120 | April 15th (or extension date) | Percentage of unpaid tax, plus interest |

Alternatives to Hiring a CPA

For many small businesses, the cost of hiring a CPA can be a significant barrier. Fortunately, several alternatives exist, allowing entrepreneurs to manage their finances effectively without sacrificing accuracy or compliance. These options range from user-friendly accounting software to online bookkeeping services and, for those with the necessary expertise, self-management. The best choice depends on your business’s size, complexity, and your own accounting proficiency.

Affordable Accounting Software Solutions

Numerous software solutions cater specifically to the needs of small businesses, offering a range of features at varying price points. These tools often automate many accounting tasks, simplifying processes like invoicing, expense tracking, and financial reporting. Choosing the right software depends on your specific requirements, but some popular and affordable options include Xero, QuickBooks Online, and FreshBooks. Xero, for example, offers robust features like bank reconciliation and inventory management, while QuickBooks Online is known for its intuitive interface and extensive integrations with other business tools. FreshBooks focuses on streamlining invoicing and payment processing, making it ideal for service-based businesses. The selection of the right software often depends on the specific needs of the business and its preferred features.

Online Bookkeeping Services

Online bookkeeping services provide a middle ground between DIY accounting and hiring a full-service CPA. These services typically offer a team of experienced bookkeepers who handle your day-to-day accounting tasks, such as recording transactions, reconciling bank statements, and generating financial reports. The pros include reduced administrative burden and access to professional expertise without the higher cost of a CPA. However, a potential con is the relinquishing of some control over your financial data. Furthermore, the cost of these services can vary significantly depending on the scope of work required and the size of your business. Consider the level of support needed when deciding whether this is the right choice for your small business.

Self-Managing Finances with Strong Accounting Skills

For business owners with a strong understanding of accounting principles and practices, managing their own finances can be a viable option. This approach offers significant cost savings and allows for complete control over financial data. However, it requires a substantial time commitment and carries the risk of errors if accounting skills are not impeccable. It’s crucial to stay updated on tax laws and regulations, and to maintain meticulous records to ensure compliance. This option is only feasible for business owners with the necessary expertise and dedication. Consider the time investment needed versus the cost of professional services.

Comparison of Cash Basis vs. Accrual Basis Accounting

Choosing the right accounting method is vital for accurate financial reporting. Small businesses typically choose between the cash basis and accrual basis.

- Cash Basis Accounting: Revenue is recognized when cash is received, and expenses are recorded when paid.

- Advantages: Simple to understand and implement; less complex record-keeping.

- Disadvantages: May not accurately reflect the business’s financial position; can lead to inconsistencies in reporting.

- Accrual Basis Accounting: Revenue is recognized when earned, regardless of when cash is received, and expenses are recorded when incurred, regardless of when they are paid.

- Advantages: Provides a more accurate picture of the business’s financial health; better for tax planning.

- Disadvantages: More complex to manage; requires more detailed record-keeping.

The choice between these methods often depends on the business’s size and complexity, with smaller businesses often opting for the simpler cash basis, while larger businesses may find accrual basis more suitable.

Assessing Your Individual Situation

Determining whether you need a CPA for your small business requires a thorough self-assessment of your financial literacy and accounting needs. This process involves evaluating your comfort level with financial management, the complexity of your business operations, and your understanding of relevant tax laws and regulations. A systematic approach will help you make an informed decision that best suits your business’s unique circumstances.

A crucial first step is honestly evaluating your own financial literacy. Do you understand basic accounting principles like debits and credits? Can you confidently prepare a profit and loss statement or balance sheet? Are you comfortable navigating tax regulations and filing your business taxes accurately? If you answered “no” to many of these questions, engaging a CPA might be beneficial to ensure your financial records are accurate and compliant.

Evaluating Financial Literacy and Accounting Needs

To effectively assess your needs, consider the following steps:

- Self-Assessment Questionnaire: Create a simple questionnaire addressing your understanding of key financial concepts, your comfort level with accounting software, and your experience managing business finances. Rate your confidence level on a scale of 1 to 5 for each area. A lower score suggests a greater need for professional assistance.

- Review Existing Financial Records: Examine your current financial records. Are they organized, accurate, and readily accessible? Identifying gaps or inconsistencies can highlight areas where professional help would be valuable. For example, difficulty reconciling bank statements or understanding your cash flow might signal a need for CPA assistance.

- Assess Business Complexity: Consider the complexity of your business structure, the number of transactions you handle, and the variety of income streams you have. A simpler business with fewer transactions might require less accounting support than a complex business with multiple income streams and international transactions.

Checklist for Hiring a CPA

Before making a decision, consider these factors:

- Business Complexity: High volume of transactions, multiple entities, international operations, or complex financial instruments.

- Tax Implications: Significant tax liability, complex tax structures, or potential for audits.

- Financial Literacy: Limited understanding of accounting principles, tax laws, or financial management.

- Time Constraints: Lack of time to dedicate to accounting and tax tasks.

- Growth Potential: Planning for future growth and expansion, requiring more sophisticated financial planning.

- Regulatory Compliance: Need for compliance with industry-specific regulations.

Scenarios Requiring a CPA vs. Those That May Not

Several scenarios strongly suggest the need for a CPA. For instance, a rapidly growing business with multiple investors might require a CPA to manage complex financial reporting and ensure compliance with regulatory requirements. Similarly, businesses operating in highly regulated industries, such as healthcare or finance, typically benefit from the expertise of a CPA to navigate complex compliance issues.

Conversely, a very small, simple business with straightforward transactions and a business owner with strong financial literacy might manage its accounting needs effectively without a CPA. A sole proprietor with limited transactions and a basic understanding of tax preparation might be able to handle their accounting independently using readily available software.

Finding and Vetting a Qualified CPA

Finding a qualified CPA involves careful research and vetting. Start by seeking recommendations from other business owners, your network, or professional organizations. Online directories can also help identify CPAs in your area. Once you have a list of potential candidates, thoroughly investigate their qualifications, experience, and specialization. Check their credentials with professional organizations, review client testimonials, and schedule consultations to discuss your specific needs and expectations. Ensure they have the relevant experience and expertise to handle your business’s specific financial needs.