Do I need an LLC for a cleaning business? This crucial question impacts everything from your personal liability to your business’s growth potential. Understanding the legal structures available – sole proprietorship versus LLC – is paramount for navigating the complexities of running a cleaning business. This guide explores the key differences, outlining the advantages and disadvantages of each structure, and helping you make an informed decision that protects your assets and sets your business up for success.

We’ll delve into the critical aspects of liability protection, tax implications, business expansion strategies, insurance considerations, and client perception. By examining real-world scenarios and providing practical advice, this guide empowers you to choose the best legal structure for your cleaning business, ensuring both its longevity and your peace of mind.

Legal Liability and Personal Assets

Operating a cleaning business, like any other enterprise, carries inherent risks. Understanding the legal structure of your business is crucial for protecting your personal assets from potential liabilities. The choice between a sole proprietorship and a Limited Liability Company (LLC) significantly impacts your personal liability in case of lawsuits or business debt.

The primary difference lies in the separation of personal and business liabilities. A sole proprietorship offers no legal distinction between the owner and the business. This means personal assets, such as your home, savings, and vehicles, are directly exposed to business debts and legal judgments. In contrast, an LLC provides a “corporate veil” separating the owner’s personal assets from the business’s liabilities. This separation limits the liability of the LLC owner to the extent of their investment in the business.

Personal Liability in Sole Proprietorships and LLCs

In a sole proprietorship, you are personally liable for all business debts and obligations. If your cleaning business incurs debt or is sued successfully, creditors or plaintiffs can pursue your personal assets to satisfy the judgment. This could lead to the loss of your personal savings, home, or other property. An LLC, however, shields your personal assets. While the LLC itself can be sued, your personal assets are generally protected unless you have personally guaranteed business loans or acted fraudulently.

Risks of Operating Without an LLC

Operating a cleaning business without an LLC exposes you to significant financial risks. Accidents on the job, property damage, customer injury, or employee lawsuits could result in substantial legal costs and judgments against you personally. Even seemingly minor incidents can escalate into costly legal battles. The accumulation of business debt without the protection of an LLC could lead to personal bankruptcy. Furthermore, the lack of liability protection can make it challenging to secure loans or attract investors, as lenders and investors will be wary of the personal risk involved.

Examples of LLC Asset Protection

Consider a scenario where a cleaning employee is injured on the job due to negligence. In a sole proprietorship, the injured employee could sue the business owner personally, potentially leading to the seizure of personal assets to cover medical bills and damages. However, if the business were an LLC, the lawsuit would be against the LLC, and the owner’s personal assets would generally be protected. Similarly, if the business incurs significant debt, an LLC would prevent creditors from seizing the owner’s personal assets to recover the debt. Another example: a customer’s valuable item is damaged during a cleaning. An LLC provides a layer of protection against such claims.

Hypothetical Case Study: Lawsuit Financial Consequences, Do i need an llc for a cleaning business

Let’s compare two cleaning business owners: Sarah, a sole proprietor, and John, who owns an LLC. Both are sued for $100,000 due to a customer injury. Sarah, as a sole proprietor, faces the full $100,000 liability personally. If she doesn’t have sufficient insurance or assets to cover the judgment, her personal assets could be seized. John, however, as the owner of an LLC, is only liable for the assets within the LLC. If the LLC’s assets are insufficient, John’s personal assets remain protected, barring any personal guarantees or fraudulent actions. This hypothetical example illustrates the significant financial advantage of operating under an LLC structure.

Taxes and Business Structure

Choosing the right business structure for your cleaning business significantly impacts your tax obligations. Understanding the differences between operating as a sole proprietorship and a Limited Liability Company (LLC) is crucial for minimizing your tax burden and ensuring compliance. This section will compare the tax implications of each structure, outlining the filing process and highlighting the advantages and disadvantages related to taxes.

Sole Proprietorship Tax Implications

A sole proprietorship is the simplest business structure, where the business and the owner are considered one and the same for tax purposes. This means that all business income and expenses are reported on your personal income tax return, using Schedule C (Form 1040). The profits are taxed at your individual income tax rate, which can range from 10% to 37% depending on your taxable income. This structure offers simplicity in terms of setup and filing, but it also exposes your personal assets to business liabilities.

LLC Tax Implications

An LLC offers more flexibility in terms of taxation. By default, an LLC is treated as a disregarded entity for tax purposes, meaning its income and expenses are reported on the owner’s personal income tax return, similar to a sole proprietorship. However, an LLC can elect to be taxed as a partnership, S corporation, or even a C corporation, each with its own tax implications. Choosing the right tax classification for your LLC depends on various factors, including your income level, anticipated profits, and future business plans. The IRS provides detailed information on choosing the appropriate tax classification for an LLC.

Tax Filing Process: Sole Proprietorship vs. LLC (Disregarded Entity)

For both a sole proprietorship and an LLC taxed as a disregarded entity, the tax filing process is relatively straightforward. Business income and expenses are tracked throughout the year, typically using accounting software or spreadsheets. At the end of the tax year, this information is used to complete Schedule C (Form 1040), which is then filed along with Form 1040, your personal income tax return. Estimated taxes may be required to be paid quarterly to avoid penalties for underpayment.

Tax Advantages and Disadvantages

| Feature | Sole Proprietorship | LLC (Disregarded Entity) |

|---|---|---|

| Tax Filing | Simple; reported on personal return (Schedule C) | Simple; reported on personal return (Schedule C) |

| Tax Rates | Individual income tax rates (10%-37%) | Individual income tax rates (10%-37%) |

| Liability Protection | No separate legal entity; personal assets at risk | Limited liability protection, separating personal and business assets |

| Administrative Burden | Low | Slightly higher due to LLC formation and maintenance requirements |

Tax Form Comparison

| Business Structure | Primary Tax Form | Estimated Tax Payments | Potential Tax Savings |

|---|---|---|---|

| Sole Proprietorship | Schedule C (Form 1040) | Required if estimated tax liability exceeds $1,000 | Limited; deductions for business expenses |

| LLC (Disregarded Entity) | Schedule C (Form 1040) | Required if estimated tax liability exceeds $1,000 | Limited; deductions for business expenses; potential for future tax advantages with different tax elections (not applicable as disregarded entity) |

Business Growth and Expansion

Scaling a cleaning business requires careful planning and consideration of the legal structure. While starting small as a sole proprietorship might seem simpler, the limitations it imposes can significantly hinder long-term growth and expansion. Forming an LLC offers several key advantages that can propel your business forward, attracting investment and facilitating smoother transitions as your operations expand.

The legal structure you choose significantly impacts your ability to attract investment and secure financing. This section will explore the benefits of an LLC in this context, as well as the potential pitfalls of remaining a sole proprietorship or partnership during a period of growth. We will also examine how an LLC can simplify expansion and acquisitions.

LLC Benefits for Investment and Financing

An LLC provides a crucial layer of liability protection that makes it more attractive to investors and lenders. Investors are less likely to risk their capital in a business where their personal assets are at risk. Similarly, banks and other financial institutions are more willing to extend loans to LLCs due to the reduced risk. The limited liability feature of an LLC separates the business’s debts and liabilities from the owner’s personal assets, thus reducing the risk for both investors and lenders. This increased credibility and reduced risk often translate into better loan terms and more favorable investment opportunities. For example, a cleaning business owner seeking a loan to expand into commercial cleaning might find it easier to secure financing as an LLC than as a sole proprietor. The LLC’s structure provides a stronger financial foundation, making the business a more attractive investment.

Challenges of Scaling Without an LLC

Scaling a cleaning business without the legal structure of an LLC can present numerous challenges. As the business grows, so do its liabilities. Without the protection of an LLC, the owner faces unlimited personal liability for business debts and lawsuits. This can expose personal assets, such as a home or savings, to significant financial risk. Furthermore, attracting investors or securing significant loans becomes more difficult without the limited liability protection offered by an LLC. The lack of a distinct legal entity can also complicate expansion efforts, making it harder to manage multiple locations or acquire other cleaning businesses. Consider a scenario where a rapidly growing cleaning business faces a lawsuit due to an employee’s negligence. If the business is not an LLC, the owner could be held personally liable, potentially leading to the loss of personal assets.

Facilitating Business Expansion and Acquisitions with an LLC

An LLC’s structure simplifies future business expansion and acquisitions. It provides a clear legal framework for managing multiple locations, expanding service offerings, or acquiring competing businesses. The separate legal entity allows for easier management of finances, contracts, and employee relations across different locations or business units. For example, an LLC can easily open new branches in different cities or states, manage separate bank accounts for each location, and streamline the process of acquiring another cleaning business. The clear legal separation allows for a smoother transition and avoids the complexities of merging personal and business assets. This streamlined process allows for more efficient growth and reduces the administrative burden associated with scaling operations.

Factors to Consider When Choosing Between a Sole Proprietorship and an LLC for Long-Term Growth

Choosing the right legal structure is crucial for long-term business growth. Several factors should be considered when deciding between a sole proprietorship and an LLC.

The following table summarizes key considerations:

| Factor | Sole Proprietorship | LLC |

|---|---|---|

| Liability Protection | Unlimited personal liability | Limited liability |

| Taxation | Pass-through taxation (business income taxed on owner’s personal income tax return) | Pass-through taxation (typically) |

| Administrative Requirements | Minimal paperwork and administrative burden | More complex formation and compliance requirements |

| Fundraising | More difficult to attract investors or secure loans | Easier to attract investors and secure loans |

| Business Continuity | Business dissolves upon owner’s death or incapacity | Business can continue operating even after owner’s death or incapacity |

Insurance and Risk Management: Do I Need An Llc For A Cleaning Business

Operating a cleaning business, regardless of its legal structure, exposes you to various risks. Understanding insurance options and implementing effective risk management strategies are crucial for protecting your assets and ensuring the long-term viability of your business. The choice between operating as a sole proprietor or an LLC significantly impacts your insurance needs and the level of protection afforded.

Insurance options and coverage requirements differ substantially between sole proprietorships and LLCs. While both need insurance to mitigate risk, the extent of personal liability differs drastically, affecting both the type and cost of insurance. Understanding these differences is key to making informed decisions that protect both your business and personal assets.

Insurance Options for Sole Proprietors vs. LLC Owners

Sole proprietors typically face unlimited personal liability. This means that if your cleaning business is sued and loses, your personal assets (home, car, savings) are at risk. Therefore, sole proprietors need comprehensive liability insurance to protect themselves. Conversely, LLCs offer limited liability protection, meaning your personal assets are generally shielded from business debts and lawsuits. While an LLC reduces personal liability, it doesn’t eliminate the need for insurance; it simply alters the scope and potential impact. An LLC owner may still require insurance to cover specific incidents, such as property damage or employee injuries. The level of coverage needed will depend on the size and nature of the business. For example, a larger cleaning business with multiple employees would require more extensive coverage than a solo operator.

Necessary Insurance Coverage for Cleaning Businesses

Several types of insurance are essential for cleaning businesses, irrespective of their legal structure. General liability insurance is paramount, covering bodily injury or property damage caused by your business operations. Workers’ compensation insurance is necessary if you employ others, protecting them from work-related injuries or illnesses. Commercial auto insurance is vital if you use a vehicle for business purposes, covering accidents or damages. In addition, depending on the nature of your cleaning services, you might need professional liability insurance (errors and omissions insurance) to protect against claims of negligence or mistakes. For example, if you’re cleaning sensitive medical equipment, this type of insurance would be particularly critical. Consider also commercial property insurance if you store cleaning supplies or equipment in a rented or owned space.

Influence of LLCs on Insurance Premiums and Coverage

Forming an LLC can positively influence insurance premiums and coverage options. Insurers often view LLCs as less risky than sole proprietorships due to the limited liability protection they offer. This perception can translate into lower premiums, as the insurer’s exposure to financial loss is reduced. Moreover, LLCs might have access to broader coverage options, as insurers may be more willing to provide specialized policies tailored to the specific needs of a business entity. However, the exact impact on premiums will vary based on factors such as the insurer, the business’s risk profile, and the specific coverage sought. For instance, a cleaning business with a history of accidents or claims might still face higher premiums even as an LLC.

Potential Risks and LLC Mitigation

Understanding potential risks is vital for effective risk management. An LLC can mitigate many of these, though not all.

- Property Damage: Accidental damage to a client’s property during cleaning. An LLC protects personal assets from lawsuits arising from such damage.

- Bodily Injury: Injuries sustained by clients or employees on the job. General liability and workers’ compensation insurance, often more readily available and potentially cheaper with an LLC, cover these.

- Employee-related Issues: Lawsuits from employees for wrongful termination or discrimination. An LLC provides a layer of protection, though proper employment practices remain crucial.

- Theft or Loss of Equipment: Insurance coverage protects against financial loss. An LLC might improve access to better coverage.

- Legal Disputes: Contractual disagreements or disputes with clients. An LLC limits the potential impact on personal assets.

Credibility and Client Perception

The legal structure of your cleaning business significantly impacts how clients perceive your professionalism and trustworthiness. Choosing the right structure can be a powerful tool in building a strong reputation and attracting high-value clients. A well-defined legal entity conveys a sense of stability and seriousness, reassuring potential clients that you are a legitimate and reliable business.

An LLC, or Limited Liability Company, offers several advantages in this regard. It provides a clear separation between your personal assets and business liabilities, which projects an image of responsibility and financial stability. This separation reassures clients that they are dealing with a business that is properly structured and prepared to handle potential risks. Furthermore, the formal structure of an LLC inherently communicates professionalism and commitment to clients.

LLC’s Impact on Professionalism and Credibility

An LLC’s formal structure immediately enhances the perceived professionalism of a cleaning business. Simply using “LLC” after your business name on marketing materials, contracts, and invoices subtly communicates a level of seriousness and organization that a sole proprietorship may lack. This is because an LLC is a legally recognized business entity, subject to various regulations and requirements, which implies a higher degree of accountability and legitimacy. For example, an LLC can open a dedicated business bank account, separating personal and business finances, further bolstering the impression of professionalism and financial stability. This clear distinction fosters client trust, as it demonstrates a commitment to transparent and organized business practices. A dedicated business phone line and email address also enhance this professional image.

Securing Larger Contracts and Attracting High-Value Clients with an LLC

Larger commercial cleaning contracts or high-net-worth residential clients often prefer to work with established and legally sound businesses. The perceived stability and liability protection offered by an LLC make it a more attractive option for these clients. They are more likely to trust a business with a clear legal structure and a demonstrated commitment to managing risk. The formal structure of an LLC provides reassurance that the business is well-managed and capable of handling the complexities of larger contracts, including insurance requirements and contractual obligations. This translates to increased opportunities for growth and higher-value contracts. For example, a large apartment complex or a luxury hotel chain would likely prefer to contract with an LLC rather than a sole proprietor due to the added legal and financial protection.

Comparative Presentation of Business Structures

Consider the difference in how a business card or website might present a sole proprietorship versus an LLC. A sole proprietorship might simply list the owner’s name and contact information, perhaps with a brief description of services. In contrast, an LLC’s business card or website would prominently display the business name (including “LLC”), a professional logo, a clear description of services, and potentially contact information for multiple individuals within the business structure. The website might also include a detailed “About Us” section outlining the company’s mission, values, and experience. This difference in presentation conveys a significant difference in professionalism and organizational capacity, directly impacting client perception and trust. For instance, a website with a professional design, clear terms of service, and a visible LLC designation will project a more trustworthy image compared to a website with minimal information and a personal email address.

Administrative and Operational Aspects

Choosing between a sole proprietorship and an LLC for your cleaning business involves considering the administrative burden each structure entails. While a sole proprietorship offers simplicity, an LLC provides a layer of protection and potentially streamlines certain administrative tasks in the long run, despite initial setup complexities. This section details the administrative differences and provides a practical guide to forming and maintaining an LLC in California.

The administrative burden of maintaining an LLC is significantly higher than that of a sole proprietorship. Sole proprietorships require minimal paperwork; essentially, you need to obtain the necessary licenses and permits to operate legally. In contrast, LLCs require more extensive documentation, including articles of organization, operating agreements, and ongoing compliance filings. This increased complexity translates to higher administrative costs, potentially necessitating professional assistance such as legal or accounting services.

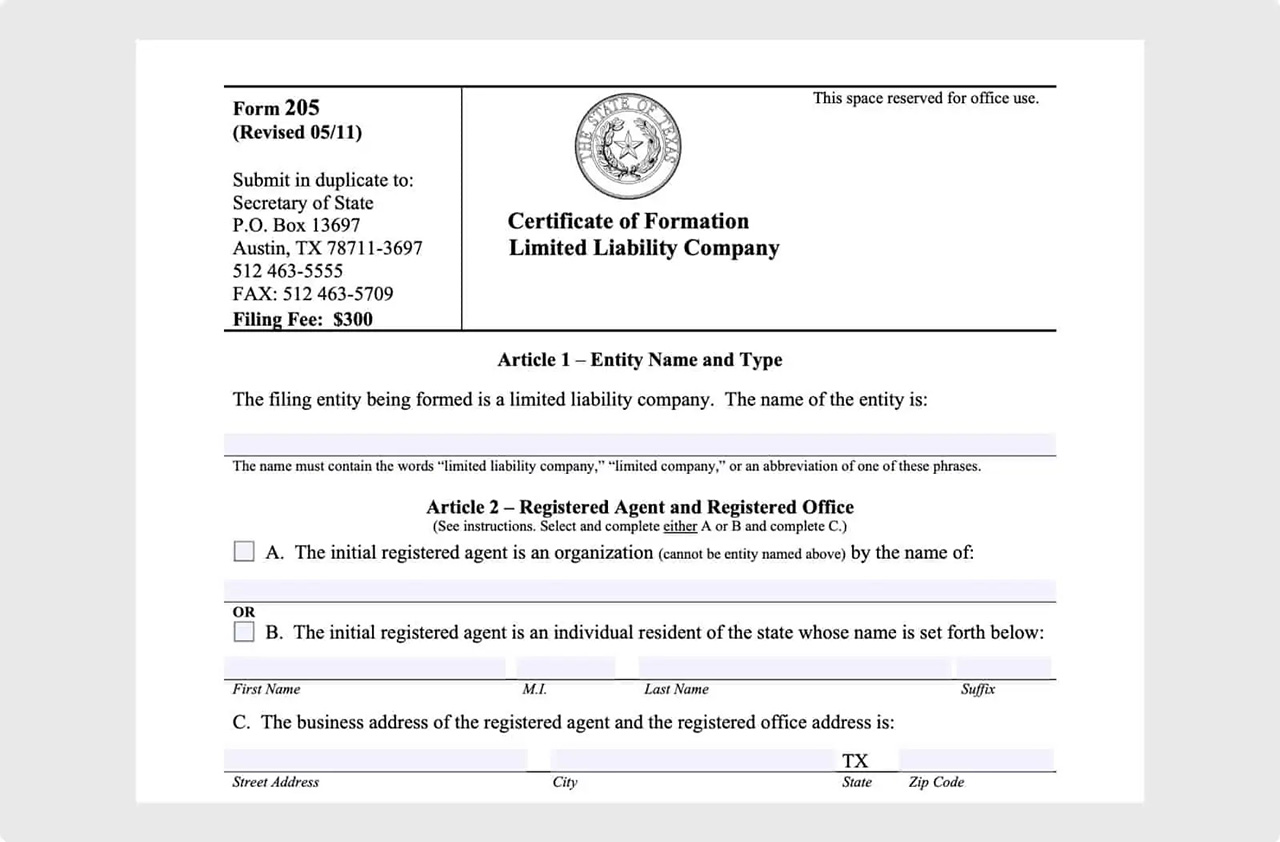

Forming an LLC in California

Forming an LLC in California involves several key steps. First, choose a name that complies with California’s naming requirements, including the LLC designation. Next, appoint a registered agent, a person or entity responsible for receiving legal and official documents on behalf of the LLC. Then, file the Articles of Organization with the California Secretary of State, paying the required filing fee. This document Artikels basic information about your LLC, including its name, address, and registered agent. Finally, create an operating agreement, an internal document outlining the LLC’s management structure, member responsibilities, and profit-sharing arrangements. While not legally required in California, an operating agreement is highly recommended to avoid future disputes among members.

Ongoing Compliance Requirements for an LLC in California

Maintaining an LLC in California involves ongoing compliance obligations. This includes filing an annual report with the California Secretary of State, typically including information about the LLC’s current status and registered agent. Failure to file this report may result in penalties or the LLC’s administrative dissolution. Additionally, LLCs are subject to state and federal tax requirements, including the timely payment of taxes and the filing of necessary tax returns. California also requires compliance with other regulations depending on the specific nature of the cleaning business, such as obtaining specific licenses or permits for handling hazardous materials.

Setting Up and Maintaining a Cleaning Business: A Checklist

Effective business management hinges on meticulous organization. The following checklists Artikel essential tasks for setting up and maintaining both sole proprietorships and LLCs. Note that the LLC checklist includes additional steps due to its increased administrative complexity.

Sole Proprietorship Checklist:

- Obtain necessary business licenses and permits.

- Open a business bank account (recommended).

- Establish a simple accounting system.

- Obtain liability insurance.

- File required tax returns (Schedule C).

LLC Checklist:

- Choose an LLC name and register it with the California Secretary of State.

- Appoint a registered agent.

- File the Articles of Organization.

- Create an operating agreement.

- Obtain an Employer Identification Number (EIN) from the IRS if you plan to hire employees.

- Open a business bank account.

- Establish a comprehensive accounting system.

- Obtain necessary liability insurance and workers’ compensation insurance (if applicable).

- File annual reports with the California Secretary of State.

- File required tax returns (typically Form 1065 or Form 1120).