Do I need to register my business as a freelancer? This crucial question faces every independent worker, impacting taxes, liability, and professional standing. Navigating the complexities of sole proprietorships, LLCs, partnerships, and S-corps can feel overwhelming, especially when considering varying income thresholds and jurisdictional regulations. Understanding the implications of registration—or the lack thereof—is paramount to building a sustainable and successful freelance career. This guide will demystify the process, providing clarity on legal structures, registration requirements, and the long-term benefits of formalizing your freelance business.

From determining the optimal legal structure for your specific circumstances to understanding the registration process and ongoing compliance, we’ll explore the practical steps and considerations involved. We’ll also delve into the potential penalties for non-compliance and highlight the numerous advantages of registering your business, including improved credibility, access to funding, and stronger client relationships. Whether you’re a seasoned freelancer or just starting out, this comprehensive overview will equip you with the knowledge to make informed decisions about your business’s legal structure and future growth.

Legal Structures for Freelancers

Choosing the right legal structure for your freelance business is crucial for managing taxes, liability, and long-term growth. The structure you select will significantly impact your financial and legal responsibilities. Understanding the differences between the common options – sole proprietorship, partnership, LLC, and S-corp – is vital for making an informed decision.

Sole Proprietorship

A sole proprietorship is the simplest structure, where the business is not legally separate from the owner. This means the owner directly receives all profits but is also personally liable for all business debts and obligations. From a tax perspective, profits and losses are reported on the owner’s personal income tax return (Schedule C). Liability protection is minimal; personal assets are at risk if the business incurs debt or faces lawsuits.

Partnership, Do i need to register my business as a freelancer

A partnership involves two or more individuals who agree to share in the profits or losses of a business. Like sole proprietorships, partners typically face personal liability for business debts. Tax implications mirror the sole proprietorship model, with profits and losses reported on each partner’s individual tax return. The type of partnership (general or limited) influences the level of liability each partner bears. General partners have unlimited liability, while limited partners’ liability is restricted to their investment.

Limited Liability Company (LLC)

An LLC offers a blend of partnership and corporate structures. It provides limited liability protection, meaning personal assets are generally shielded from business debts and lawsuits. The IRS treats most single-member LLCs as disregarded entities, meaning profits and losses are reported on the owner’s personal income tax return. Multi-member LLCs can elect to be taxed as partnerships or corporations. This flexibility in taxation and liability protection makes LLCs a popular choice for freelancers.

S-Corporation

An S-corp is a more complex structure that offers potential tax advantages. It allows profits to be passed through to the owners without being subject to corporate tax rates. However, owners must pay self-employment taxes on their distributions. The significant administrative burden and compliance requirements associated with S-corps often outweigh the tax benefits for many freelancers, particularly those with lower incomes. Liability protection is similar to that of an LLC, offering protection for personal assets.

Comparison of Legal Structures for Freelancers

| Structure | Tax Implications | Liability | Pros & Cons |

|---|---|---|---|

| Sole Proprietorship | Profits/losses reported on personal income tax return (Schedule C) | Unlimited personal liability | Simple to set up; easy tax reporting; high personal liability risk; limited fundraising options. |

| Partnership | Profits/losses reported on individual partners’ tax returns | Generally unlimited personal liability (varies by partnership type) | Shared resources and expertise; relatively easy setup; high personal liability risk (for general partners); potential for disagreements. |

| LLC | Usually pass-through taxation; flexibility in tax elections | Limited liability; protects personal assets | Limited liability protection; flexible taxation; more complex setup than sole proprietorship; may require annual filings. |

| S-Corporation | Pass-through taxation; potential tax savings (depending on income and deductions) | Limited liability; protects personal assets | Potential tax advantages; limited liability protection; complex setup and compliance requirements; higher administrative costs. |

Income Thresholds and Registration Requirements

Navigating the complexities of freelance income and registration requirements can be challenging. Understanding the thresholds that trigger mandatory registration in your jurisdiction is crucial for compliance and avoiding potential penalties. This section clarifies income thresholds, mandatory versus optional registration scenarios, and the consequences of non-compliance.

Income thresholds for mandatory business registration vary significantly across jurisdictions. These thresholds are often tied to annual revenue, profit, or a combination of factors. Some jurisdictions may have no specific income threshold for freelancers, requiring registration regardless of earnings. Others might exempt freelancers earning below a certain amount, while those exceeding the threshold must register their business as a sole proprietorship, limited liability company (LLC), or another suitable legal structure.

Income Thresholds by Jurisdiction

The following examples illustrate the diversity of income thresholds and registration requirements. Note that these are for illustrative purposes only and should not be considered exhaustive or legal advice. Always consult the relevant authorities in your specific jurisdiction for accurate and up-to-date information.

| Jurisdiction | Income Threshold (Example) | Registration Requirement | Notes |

|---|---|---|---|

| United States (Example – varies by state) | No Federal threshold; State-specific thresholds may exist. Some states may require registration upon exceeding a certain income level or if employing others. | Varies by state and local regulations; often requires registration if exceeding a certain income level or employing others. | Regulations differ significantly between states. Consult your state’s tax and business registration authorities. |

| Canada (Example – varies by province/territory) | Varies by province/territory; some may not have specific income thresholds for freelancers. | Registration may be required for tax purposes, regardless of income level, or upon exceeding a specific threshold for certain business activities. | Provincial and territorial regulations determine registration requirements. Consult your province/territory’s relevant authorities. |

| United Kingdom | No specific income threshold for registering as self-employed for tax purposes. However, exceeding certain thresholds may trigger VAT registration. | Registration with HMRC (Her Majesty’s Revenue and Customs) is necessary for tax purposes, regardless of income level. VAT registration is triggered above a specific turnover. | HMRC provides detailed guidance on self-assessment and VAT registration. |

Mandatory vs. Optional Registration

Understanding when registration is mandatory versus optional is critical. While some jurisdictions may not mandate registration based solely on income, other factors can trigger the requirement. For example, employing others, operating under a business name different from your personal name, or engaging in specific business activities (e.g., contracting with government agencies) can necessitate registration regardless of income level.

A freelancer earning below a specified income threshold in a jurisdiction with such a threshold might choose *optional* registration for benefits such as enhanced credibility, easier access to business services, and potential tax advantages. However, if they exceed the threshold or meet other criteria, registration becomes *mandatory*.

Penalties for Non-Registration

Operating without proper registration as a freelancer can lead to significant penalties. These penalties vary by jurisdiction but commonly include:

- Back taxes and interest charges.

- Fines.

- Legal action.

- Difficulty accessing certain business opportunities.

The severity of penalties can increase with the duration of non-compliance and the amount of unreported income.

Freelancer Registration Decision Flowchart

The following flowchart visually represents the decision-making process for freelancers regarding business registration:

[Imagine a flowchart here. The flowchart would begin with a decision point: “Are you operating as a freelancer?” Yes leads to another decision point: “What is your annual income?” If below a certain threshold (specific to the jurisdiction), the path leads to “Registration is optional.” If above the threshold, it leads to “Registration is mandatory.” A separate path from “What is your annual income?” should consider if the freelancer employs others, operates under a business name, or engages in specific business activities, regardless of income, leading to “Registration is mandatory.” All “Registration is mandatory” paths converge to a final box: “Register your business according to your jurisdiction’s requirements.”]

Benefits of Business Registration for Freelancers: Do I Need To Register My Business As A Freelancer

Registering your freelance business offers significant advantages beyond simply complying with legal requirements. It’s a strategic move that can significantly enhance your professional standing, access to resources, and overall success. The benefits extend across financial, legal, and professional spheres, ultimately contributing to a more stable and prosperous freelance career.

Enhanced Professional Credibility

Business registration lends immediate credibility to your freelance operation. A registered business name and structure project professionalism and seriousness, reassuring potential clients of your commitment and stability. This is particularly important when competing against other freelancers or seeking contracts with larger organizations that often prioritize working with established entities. For instance, a registered business can present a more polished image on proposals and invoices, significantly improving your chances of securing high-value contracts. The official registration acts as a form of validation, demonstrating your dedication to your work and your business. Clients are more likely to trust and invest in a registered business, perceiving it as less risky and more reliable than an unregistered one.

Improved Access to Funding and Resources

Formal business registration opens doors to various funding opportunities and resources often unavailable to unregistered freelancers. Banks and financial institutions are more likely to approve loan applications from registered businesses, offering access to capital for expansion or investment in equipment and technology. Furthermore, registered businesses become eligible for government grants, tax incentives, and other support programs designed to boost small businesses and entrepreneurship. For example, a registered business might qualify for Small Business Administration (SBA) loans in the US, providing access to favorable interest rates and flexible repayment terms. Similarly, many countries offer tax breaks and subsidies for registered small businesses.

Positive Impact on Client Relationships and Contract Negotiations

Registering your business strengthens your position during client interactions and contract negotiations. The formal structure provides a clear framework for legal agreements, protecting both you and your clients. This reduces ambiguity and potential disputes, fostering stronger, more trusting relationships. A registered business can negotiate contracts with greater confidence, setting clear terms and conditions that reflect your professional standing. The legal protection afforded by registration also ensures smoother resolution of any potential conflicts, providing a more robust framework for dispute resolution compared to informal arrangements. For example, a registered business can utilize legally binding contracts that clearly define payment terms, intellectual property rights, and other crucial aspects of the agreement.

- Financial Benefits: Access to loans and lines of credit, eligibility for government grants and tax benefits, improved invoicing and payment processing, better expense management and tracking.

- Legal Benefits: Protection of intellectual property, stronger legal standing in contract disputes, clearer liability limitations, enhanced business insurance options.

- Professional Benefits: Increased credibility and trust with clients, better marketing and branding opportunities, professional networking opportunities, enhanced ability to attract higher-paying clients.

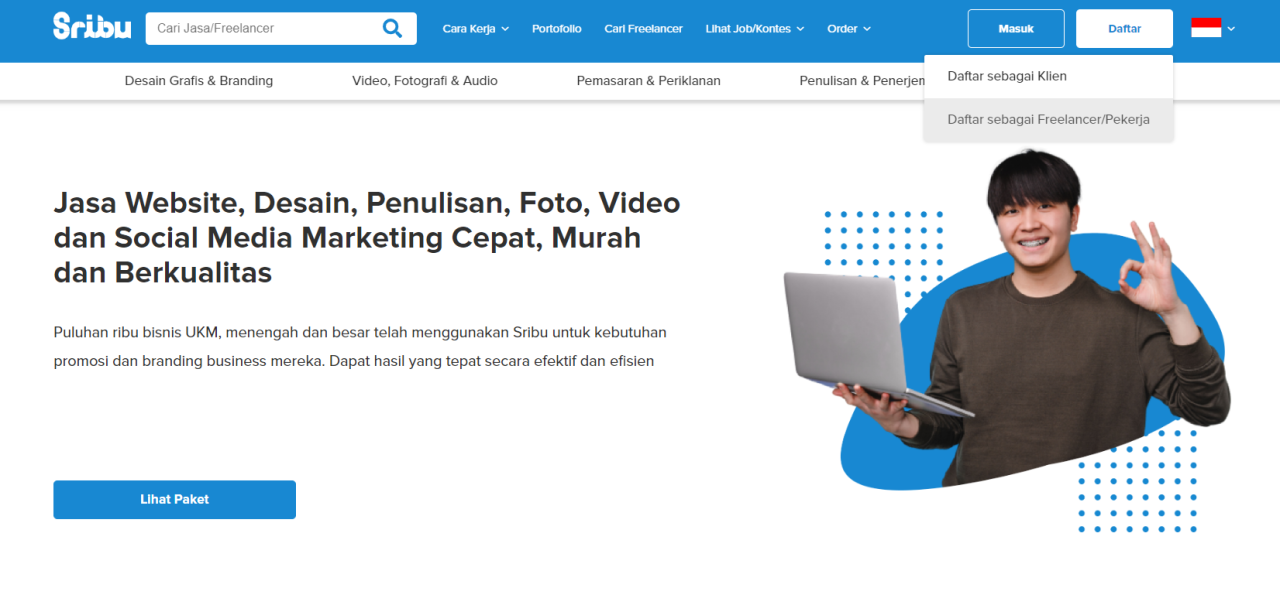

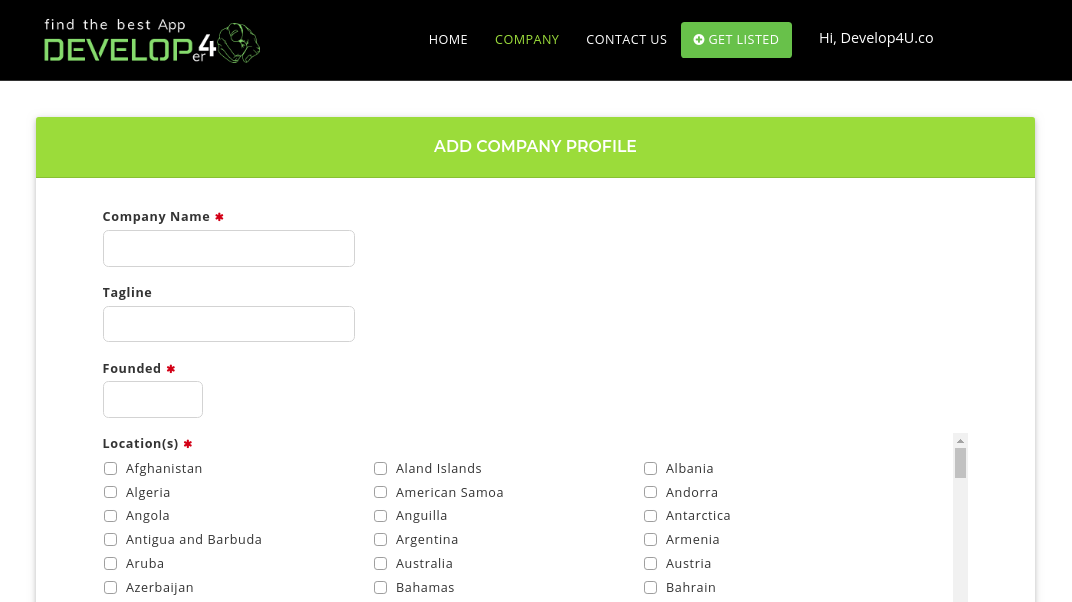

The Registration Process

Registering your freelance business involves several steps, the specifics of which vary depending on your location and the type of business structure you choose (sole proprietorship, LLC, etc.). Understanding this process is crucial to ensuring you operate legally and efficiently. This section Artikels a general process, but always consult your local government’s resources for precise requirements.

The registration process typically involves several key stages. Completing each stage accurately and efficiently is vital to avoiding delays and potential penalties.

Steps Involved in Business Registration

The following steps provide a general overview. Specific requirements will vary by jurisdiction. Always verify the exact steps with your local authorities or a qualified business advisor.

- Choose a Business Structure: Decide whether to operate as a sole proprietorship, LLC, partnership, or other legal structure. Each has different legal and tax implications. For example, an LLC offers liability protection that a sole proprietorship lacks, but involves more complex setup and ongoing compliance.

- Choose a Business Name: Select a name that is available and reflects your brand. Check for name availability with your local government and ensure it doesn’t infringe on existing trademarks. For instance, “Acme Freelance Writing” might be available, but “Google Freelance Writing” would likely be problematic.

- Obtain Necessary Licenses and Permits: Depending on your location and industry, you may need various licenses and permits to operate legally. This might include a general business license, professional licenses (if applicable, like a contractor’s license), and sales tax permits. Failure to obtain necessary permits can lead to fines.

- Register Your Business Name (if applicable): If you’re operating under a name different from your own, you’ll need to register it with your state or local government. This often involves filing a “Doing Business As” (DBA) or fictitious business name statement.

- Obtain an Employer Identification Number (EIN) (if applicable): If you plan to hire employees, open a business bank account, or operate as an LLC or corporation, you’ll need an EIN from the IRS. This is a unique tax identification number for your business.

- Open a Business Bank Account: Separating your business and personal finances is crucial for tax purposes and liability protection. This allows for easier tracking of income and expenses.

Fees and Timelines

The fees and timelines associated with business registration vary widely depending on your location and the type of registration. Some jurisdictions offer online registration, speeding up the process. Others may require in-person visits and longer processing times.

Fees can range from a few dollars for online filings to hundreds for more complex registrations. Processing times can range from a few days to several weeks. Always check your local government’s website for specific fees and estimated processing times.

For example, registering a DBA in one state might cost $50 and take a week, while forming an LLC in another state could cost $500 and take several weeks.

Common Mistakes and How to Avoid Them

Many freelancers make avoidable mistakes during the registration process. Understanding these common pitfalls can save you time, money, and frustration.

- Not researching requirements: Failing to thoroughly research the specific requirements for your location and business type is a major mistake. Always check your state and local government websites for precise guidelines.

- Choosing the wrong business structure: Selecting an inappropriate business structure can lead to tax complications and liability issues. Consult with a legal or financial professional to determine the best structure for your needs.

- Ignoring deadlines: Missing deadlines for filing paperwork can result in penalties and delays. Keep track of all deadlines and submit your paperwork well in advance.

- Failing to obtain necessary licenses and permits: Operating without the required licenses and permits can lead to significant fines. Ensure you have all necessary permits before starting operations.

- Mixing personal and business finances: Commingling personal and business funds makes it difficult to track expenses and can create tax problems. Always maintain separate accounts.

Ongoing Compliance and Maintenance

Registering your freelance business is only the first step. Maintaining compliance involves ongoing responsibilities to ensure you remain in good standing with relevant authorities and avoid potential penalties. This includes consistent record-keeping, timely tax filings, and staying updated on evolving regulations. Failure to meet these obligations can lead to significant financial and legal repercussions.

Ongoing compliance for registered freelancers centers around meticulous financial record-keeping and accurate tax reporting. This is crucial not only for fulfilling legal obligations but also for effectively managing your business finances, making informed decisions, and claiming legitimate deductions. Understanding and adhering to these requirements is vital for the long-term success and stability of your freelance venture.

Tax Filings and Reporting

Accurate and timely tax filings are paramount for registered freelancers. This typically involves filing quarterly estimated tax payments to avoid penalties at the end of the tax year. The specific requirements vary depending on your location and the legal structure of your business (sole proprietorship, LLC, etc.). Freelancers are responsible for paying self-employment taxes, including Social Security and Medicare taxes, in addition to income tax. Failing to file or underpaying taxes can result in significant penalties and interest charges. Consulting with a tax professional can provide invaluable guidance on navigating these complexities. For example, a freelancer might need to file Form 1040-ES (Estimated Tax for Individuals) to pay estimated taxes quarterly and Schedule C (Profit or Loss from Business) to report their business income and expenses.

Financial Record-Keeping Best Practices

Maintaining accurate financial records is the cornerstone of successful freelance business management and compliance. This involves meticulously tracking all income and expenses related to your freelance work. Effective record-keeping simplifies tax preparation, helps you monitor your profitability, and provides valuable data for informed business decisions. Consider using accounting software or spreadsheets to organize invoices, receipts, bank statements, and other financial documents. A well-organized system will allow for easy retrieval of information when needed for tax purposes or audits. For instance, a freelancer could use a dedicated spreadsheet to categorize expenses by type (e.g., office supplies, travel, software subscriptions) and maintain a separate log of all invoices issued and payments received.

Resources for Staying Informed

Staying updated on changes in regulations and compliance requirements is essential for maintaining compliance. Several resources can assist freelancers in this endeavor. Government websites (such as the IRS website in the US) provide comprehensive information on tax laws and regulations. Professional organizations for freelancers often offer updates and resources on compliance matters. Consulting with a tax advisor or accountant provides personalized guidance and ensures you’re meeting all legal obligations. Industry-specific publications and newsletters can also offer valuable insights into relevant compliance changes. For example, a freelancer in the US could consult the IRS website (irs.gov) for the latest tax forms and publications, while a UK-based freelancer might refer to HMRC’s website (gov.uk/government/organisations/hm-revenue-customs).

Visual Representation of Ongoing Compliance

Imagine a flowchart. The starting point is “Business Registration.” From there, two main branches emerge: “Financial Record-Keeping” and “Tax Filings.” Under “Financial Record-Keeping,” there are sub-branches representing different aspects such as “Income Tracking,” “Expense Tracking,” and “Invoice Management.” Similarly, “Tax Filings” branches into “Quarterly Estimated Taxes,” “Annual Tax Returns,” and “State/Local Taxes (if applicable).” Connecting all these branches are feedback loops representing regular review and updates, highlighting the iterative nature of compliance. Finally, a separate branch labeled “Staying Informed” connects to all other branches, indicating the importance of continuously updating knowledge on regulations and best practices. This visual representation illustrates the interconnectedness of different compliance aspects and the importance of continuous monitoring and adaptation.