Do you need calculus for business? The short answer is: it depends. While some business fields, like financial modeling and operations research, heavily utilize calculus, many others don’t require it at all. This article explores the specific areas where calculus proves invaluable, contrasting them with roles where other quantitative skills are more beneficial. We’ll examine the role of mathematical software in simplifying complex calculations and highlight alternative methods for solving business problems without advanced calculus.

We’ll delve into specific business areas, detailing the types of calculus (if any) used, and comparing the need for calculus across various specializations. We’ll also cover alternative quantitative methods such as linear algebra and statistical analysis, showing how these can effectively replace the need for calculus in many business contexts. Finally, we’ll discuss the importance of developing a strong quantitative skillset, regardless of your calculus proficiency, emphasizing the crucial role of data interpretation, analysis, and financial literacy.

Business Fields Requiring Calculus

Calculus, while often perceived as a purely mathematical discipline, plays a significant role in several key business areas. Its application allows for sophisticated modeling, optimization, and prediction, leading to more informed decision-making and improved business outcomes. Understanding the core concepts of calculus provides a competitive advantage in these fields.

Business Fields Utilizing Calculus

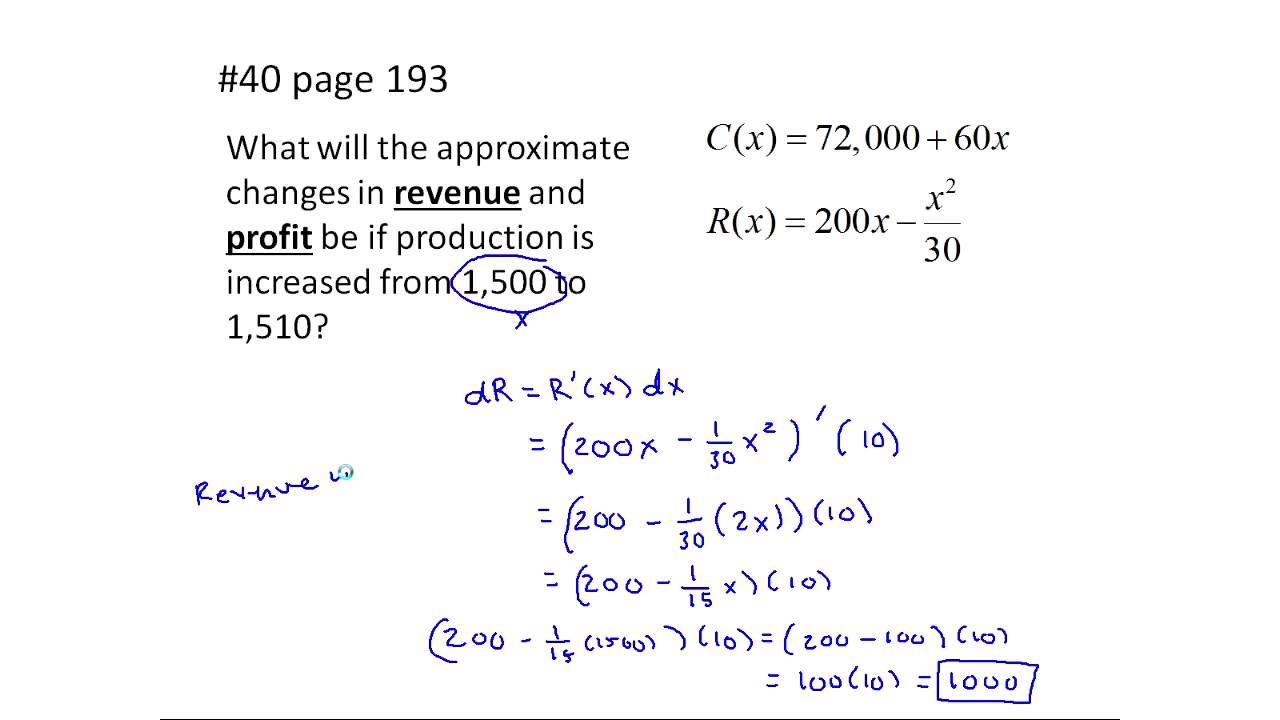

Several business fields rely heavily on calculus for modeling and analysis. These include finance, operations research, supply chain management, and economics, among others. The specific applications vary depending on the field and the complexity of the problems being addressed. For instance, financial modeling often employs calculus for derivative pricing, while operations research utilizes it for optimization problems.

Calculus Concepts in Financial Modeling

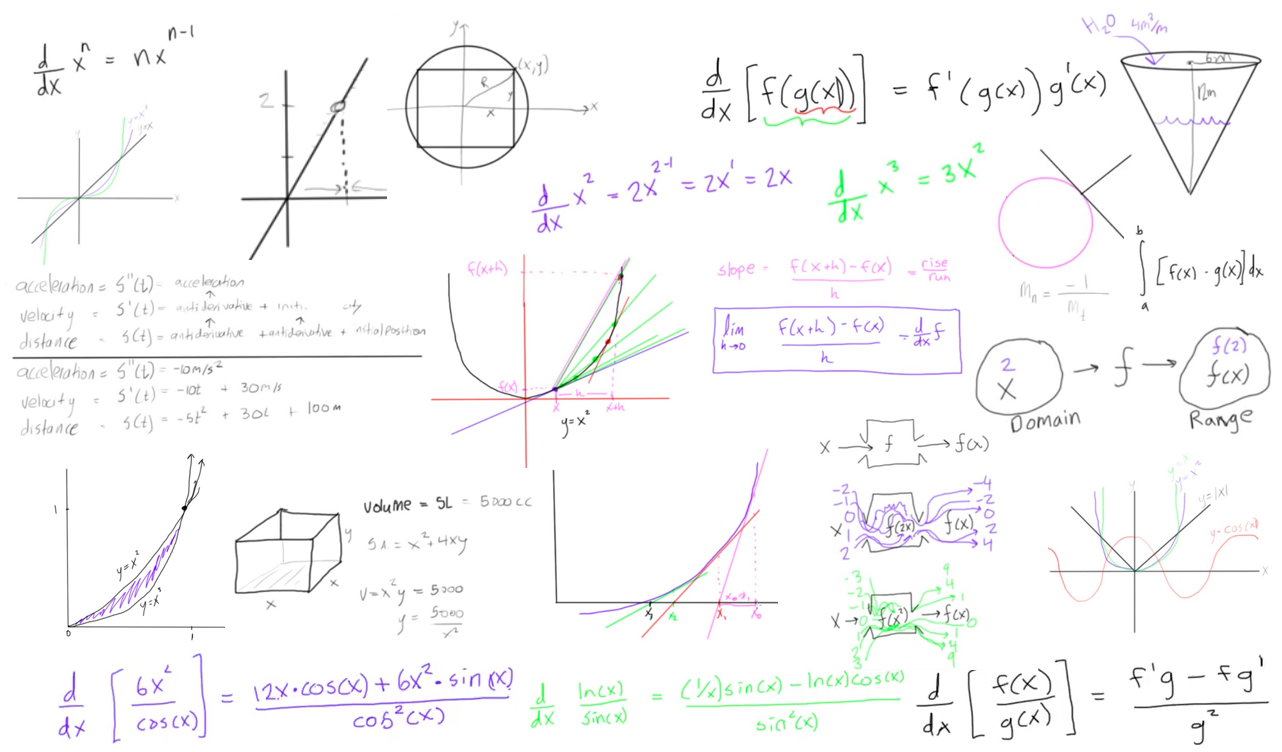

Financial modeling extensively uses calculus, particularly differential and integral calculus. Differential calculus is crucial for determining the sensitivity of financial variables, such as portfolio value or option prices, to changes in underlying factors. For example, calculating the delta of an option (the rate of change of the option price with respect to the underlying asset price) directly utilizes the concept of derivatives. Integral calculus is essential for calculating present values of future cash flows, a cornerstone of financial valuation. For instance, calculating the present value of a continuous income stream requires integrating a function over time. Furthermore, stochastic calculus, a more advanced branch, plays a crucial role in modeling asset prices with randomness, a cornerstone of modern financial theory.

Calculus in Operations Research vs. Supply Chain Management

Both operations research and supply chain management benefit from calculus applications, though their focus differs. Operations research frequently uses calculus for optimization problems, aiming to find the best solution among many possibilities. This involves techniques like linear programming, which, while not directly using calculus notation, relies on its underlying principles. Supply chain management uses calculus for inventory optimization, determining optimal order quantities to minimize costs while meeting demand. While both fields use optimization techniques, operations research tends to focus on broader strategic problems, while supply chain management is more focused on tactical and operational aspects of managing the flow of goods. The complexity of calculus used might vary; operations research often involves more complex optimization models compared to the simpler inventory models in supply chain management.

Differential Equations in Economic Forecasting

Differential equations are powerful tools in economic forecasting, allowing for the modeling of dynamic systems. These equations describe how economic variables change over time, capturing the interdependencies between different factors. For example, the Solow-Swan model, a neoclassical growth model, uses differential equations to describe capital accumulation and economic growth. Analyzing these equations helps economists understand the long-run behavior of the economy and the impact of policy changes. The complexity of these models can vary greatly, ranging from relatively simple models to highly complex systems requiring sophisticated numerical methods for solution. Predicting future economic trends based on these models, however, requires careful consideration of various factors and limitations inherent in any forecasting methodology. For example, accurately predicting the impact of a sudden global pandemic on economic growth is extremely challenging even with sophisticated models.

Calculus Requirements Across Business Specializations

| Business Field | Calculus Level | Specific Applications | Example |

|---|---|---|---|

| Finance (Quantitative Analyst) | Advanced | Derivative pricing, risk management, portfolio optimization | Black-Scholes model for option pricing |

| Operations Research | Intermediate | Optimization problems, linear programming, simulation modeling | Finding the optimal production schedule to minimize costs |

| Supply Chain Management | Basic | Inventory management, logistics optimization | Determining optimal order quantities using the economic order quantity (EOQ) model |

| Economics (Econometrics) | Intermediate | Econometric modeling, forecasting | Estimating the elasticity of demand using regression analysis |

Business Fields Where Calculus is NOT Essential: Do You Need Calculus For Business

While calculus plays a crucial role in certain specialized business areas, many successful careers thrive without requiring advanced mathematical knowledge beyond basic arithmetic and statistics. Many business roles focus on practical application, communication, and strategic thinking rather than complex mathematical modeling.

Many business functions rely heavily on interpreting data, but this interpretation doesn’t necessitate the advanced mathematical tools calculus provides. Instead, a strong understanding of business principles, effective communication, and the ability to use data analysis software are far more important.

Business Roles Rarely Requiring Calculus

Numerous business roles function effectively without calculus. These roles often emphasize interpersonal skills, strategic thinking, and a deep understanding of business operations. Examples include marketing, sales, human resources, and many management positions. The core skills needed for success in these fields are vastly different from the analytical skills required for roles that use calculus.

Skillsets Required in Non-Calculus-Intensive Business Areas

The typical skillset for roles where calculus isn’t essential centers around communication, interpersonal skills, and business acumen. Strong written and verbal communication skills are paramount for effective collaboration and presentation. Critical thinking and problem-solving abilities are crucial for navigating business challenges and making informed decisions. Furthermore, proficiency in business software and applications is often essential for efficient task completion.

- Strong Communication Skills: Effectively conveying information, both verbally and in writing, is essential for collaboration and influencing others.

- Interpersonal Skills: Building and maintaining strong relationships with colleagues, clients, and stakeholders is vital for success in most business roles.

- Business Acumen: A deep understanding of business principles, including finance, marketing, and operations, is crucial for making sound strategic decisions.

- Proficiency in Business Software: Mastering software like Microsoft Office Suite, CRM systems, and project management tools is often a prerequisite for many roles.

- Strategic Thinking: The ability to analyze situations, identify opportunities, and develop effective strategies is highly valued across numerous business fields.

Alternative Mathematical Skills

While calculus isn’t necessary, a solid foundation in other mathematical skills is beneficial. These skills are more directly applicable to the day-to-day tasks and decision-making processes in these business areas.

- Basic Arithmetic and Algebra: Essential for basic financial calculations, budgeting, and data interpretation.

- Descriptive Statistics: Understanding measures of central tendency (mean, median, mode), variance, and standard deviation is vital for data analysis.

- Financial Accounting: Knowledge of accounting principles and financial statements is crucial for financial analysis and decision-making.

- Data Visualization: The ability to present data effectively using charts and graphs is essential for communicating insights to stakeholders.

Data Analysis Tools Replacing Advanced Calculus

Modern data analysis tools and software significantly reduce or eliminate the need for manual calculations using advanced calculus. These tools automate complex calculations and provide readily interpretable results.

- Spreadsheet Software (Excel, Google Sheets): These programs offer built-in functions for statistical analysis, data visualization, and financial modeling, eliminating the need for manual calculus calculations.

- Statistical Software Packages (SPSS, R, SAS): These powerful tools automate complex statistical analyses, including regression analysis and hypothesis testing, making advanced mathematical knowledge less crucial.

- Business Intelligence (BI) Tools (Tableau, Power BI): BI tools provide intuitive dashboards and visualizations, allowing users to analyze large datasets and extract meaningful insights without needing to perform complex calculations.

Alternatives to Calculus for Business Problem Solving

While calculus offers powerful tools for optimization and modeling, many crucial business problems can be effectively addressed using alternative quantitative methods. These methods often require less mathematical sophistication, making them accessible to a broader range of business professionals. This section explores several such alternatives, highlighting their strengths and applications within a business context.

Linear Algebra Compared to Calculus in Business Problem Solving

Linear algebra and calculus, while both branches of mathematics, offer different approaches to problem-solving in business. Calculus excels in analyzing continuous change and optimization problems involving smooth functions, such as maximizing profit given a continuous production function. Linear algebra, on the other hand, focuses on linear relationships and systems of equations. This makes it particularly useful for analyzing scenarios involving multiple variables and constraints, such as portfolio optimization, resource allocation, and input-output analysis in economics. For example, linear programming, a technique heavily reliant on linear algebra, is widely used to optimize resource allocation in supply chain management, finding the most cost-effective way to distribute goods given various constraints like production capacity and transportation costs. Unlike calculus, which often requires iterative numerical methods for complex problems, linear algebra problems can sometimes be solved directly using matrix algebra, offering a more straightforward approach.

Statistical Methods for Business Data Analysis Without Calculus

Statistical methods provide a robust toolkit for analyzing business data without requiring advanced calculus knowledge. Descriptive statistics, such as mean, median, mode, and standard deviation, are fundamental for summarizing and understanding data trends. Inferential statistics, encompassing hypothesis testing and regression analysis, allow for drawing conclusions about populations based on sample data. For instance, A/B testing, a common marketing technique, relies on statistical hypothesis testing to determine whether a change in a website’s design significantly impacts conversion rates. Regression analysis, another powerful statistical tool, helps businesses model the relationship between variables, such as predicting sales based on advertising expenditure. These methods are widely implemented in spreadsheet software and statistical packages, requiring minimal calculus understanding.

Spreadsheet Software for Business Calculations

Spreadsheet software like Microsoft Excel or Google Sheets provides a user-friendly interface for handling various business calculations without the need for advanced mathematical knowledge. Built-in functions handle complex calculations, including financial modeling, statistical analysis, and data visualization. For example, Excel’s built-in functions for calculating net present value (NPV) and internal rate of return (IRR) are crucial for evaluating investment opportunities. Similarly, data analysis tools within spreadsheets allow for easy creation of charts and graphs, facilitating data interpretation and presentation to stakeholders. The ease of use and accessibility of spreadsheet software makes it a powerful tool for business professionals regardless of their calculus proficiency.

Flowchart for Selecting Appropriate Quantitative Methods

The selection of appropriate quantitative methods depends heavily on the specific business problem. The following flowchart illustrates a decision-making process:

[Diagram description: A flowchart starting with a “Business Problem” box. This branches into two boxes: “Continuous Data/Optimization?” (Yes/No). A “Yes” leads to “Calculus-based methods (e.g., optimization, differential equations)” and a “No” leads to “Discrete Data/Relationships?”. A “Yes” here leads to “Linear Algebra/Linear Programming (e.g., resource allocation, portfolio optimization)” and a “No” leads to “Statistical Methods (e.g., descriptive statistics, hypothesis testing, regression)”. All paths ultimately converge to a final box: “Analysis and Decision Making”.]

This flowchart provides a simplified framework. In reality, many business problems may require a combination of different methods for a comprehensive analysis.

The Role of Mathematical Software in Business

Mathematical software packages have become indispensable tools for businesses across various sectors, streamlining complex calculations and enabling data-driven decision-making. These tools significantly reduce the time and effort required for intricate analyses, freeing up valuable resources for strategic planning and other crucial business activities. The capabilities offered range from basic statistical analysis to sophisticated forecasting models, allowing businesses of all sizes to leverage data effectively.

Capabilities of Specific Software Packages, Do you need calculus for business

Several software packages cater specifically to the needs of business analysis and forecasting. Microsoft Excel, a ubiquitous spreadsheet program, offers a wide array of built-in functions for statistical analysis, data visualization, and basic financial modeling. More specialized software, such as SAS, SPSS, and R, provide advanced statistical modeling capabilities, including regression analysis, time series forecasting, and hypothesis testing. Furthermore, dedicated business intelligence (BI) tools like Tableau and Power BI excel at data visualization and interactive dashboards, allowing for easy interpretation of complex data sets. Finally, programming languages like Python, coupled with libraries like NumPy and Pandas, offer highly customizable and powerful solutions for data manipulation and statistical analysis, enabling users to build bespoke analytical tools.

Comparison of Software Packages

The choice of software depends on the specific needs and technical expertise within a business. Excel’s ease of use makes it ideal for basic analyses and for users with limited programming experience. However, its capabilities are limited compared to dedicated statistical packages like SAS or SPSS, which offer far more sophisticated modeling techniques but often require specialized training. R, while highly powerful and flexible, has a steeper learning curve and demands strong programming skills. Tableau and Power BI focus on data visualization and dashboard creation, making complex data easily understandable for non-technical users. The cost varies significantly, with Excel being relatively inexpensive as part of the Microsoft Office suite, while SAS and SPSS can be quite expensive, especially for enterprise licenses.

Advantages and Disadvantages of Software Reliance

Relying on mathematical software for business calculations offers several advantages. It significantly increases efficiency, reduces the risk of human error, and allows for more complex analyses than manual calculations. Software also facilitates data visualization, enabling clearer communication of findings to stakeholders. However, over-reliance on software can lead to a lack of understanding of the underlying mathematical principles. It’s crucial to have a basic understanding of the methods employed to ensure the appropriate application of software and the correct interpretation of results. Furthermore, the accuracy of the results depends heavily on the quality of the input data. Garbage in, garbage out remains a pertinent concern.

Features of Mathematical Software Packages

| Software Name | Key Features | Cost | Ease of Use |

|---|---|---|---|

| Microsoft Excel | Basic statistical functions, data visualization, financial modeling | Included in Microsoft Office Suite | High |

| SAS | Advanced statistical modeling, data mining, forecasting | High (enterprise licenses) | Medium |

| SPSS | Statistical analysis, data management, survey analysis | High (enterprise licenses) | Medium |

| R | Highly customizable statistical computing and graphics | Free and open-source | Low (steep learning curve) |

| Tableau | Data visualization, interactive dashboards, business intelligence | Subscription-based | High |

| Power BI | Data visualization, interactive dashboards, business intelligence | Subscription-based | High |

Developing a Strong Quantitative Skillset for Business

Success in the modern business world hinges on the ability to understand, interpret, and apply quantitative data. While calculus might be beneficial in certain specialized roles, a broader range of quantitative skills are essential for virtually all business professionals. This section Artikels key quantitative skills crucial for business success, regardless of a background in calculus. These skills equip individuals to make informed decisions, analyze market trends, and contribute meaningfully to organizational goals.

Key Quantitative Skills for Business Success

Several core quantitative skills are vital for navigating the complexities of the business world. Proficiency in these areas empowers individuals to contribute effectively to various business functions, from strategic planning to operational efficiency. These skills are increasingly valuable in data-driven decision-making environments.

- Data Interpretation and Analysis: The ability to extract meaningful insights from raw data is paramount. This involves understanding data visualization techniques, identifying trends and patterns, and drawing accurate conclusions. For example, a marketing manager needs to interpret website analytics to understand customer behavior and optimize marketing campaigns.

- Statistical Modeling: Statistical models are crucial for forecasting, risk assessment, and understanding customer behavior. Regression analysis, for instance, can help predict sales based on various factors like advertising spend and seasonality. A financial analyst might use time series analysis to predict future stock prices.

- Financial Literacy and Accounting Skills: A strong grasp of financial statements (balance sheets, income statements, cash flow statements), budgeting, and financial ratios is essential for sound financial decision-making. This understanding allows business professionals to assess profitability, liquidity, and the overall financial health of an organization.

- Spreadsheet Software Proficiency: Mastering spreadsheet software like Microsoft Excel or Google Sheets is a fundamental skill. This allows for data manipulation, analysis, and the creation of insightful reports and presentations. For example, an operations manager might use spreadsheets to track inventory levels and optimize supply chain processes.

- Probability and Statistics: Understanding basic probability and statistical concepts is crucial for risk management, decision-making under uncertainty, and analyzing market research data. For instance, understanding confidence intervals is vital when interpreting survey results.

Data Interpretation and Analysis in Business

Data interpretation and analysis are foundational skills that enable businesses to understand their performance, identify opportunities, and mitigate risks. This involves not only collecting and organizing data but also critically evaluating its reliability, validity, and relevance. The ability to translate complex data into actionable insights is a highly sought-after skill across various business functions. For instance, analyzing customer feedback data can help a company improve its products or services, while market research data can inform strategic decision-making. The use of data visualization tools like charts and graphs significantly enhances the clarity and impact of data analysis.

Practical Applications of Statistical Modeling in Business

Statistical modeling offers powerful tools for addressing various business challenges. These models provide a framework for understanding relationships between variables, making predictions, and assessing risk. For example, regression analysis can be used to predict customer churn based on factors like usage patterns and customer satisfaction scores. In finance, statistical models are used for risk management, portfolio optimization, and fraud detection. Furthermore, A/B testing, a statistical method, is frequently used in marketing to compare the effectiveness of different marketing campaigns.

Benefits of Strong Financial Literacy and Accounting Skills

Financial literacy and accounting skills are essential for making informed financial decisions at all levels of a business. A solid understanding of financial statements enables effective resource allocation, cost control, and performance evaluation. Strong accounting skills ensure accurate financial reporting, compliance with regulations, and the prevention of financial fraud. This understanding is critical for securing funding, negotiating contracts, and making strategic investment decisions. For example, a strong understanding of cash flow allows businesses to manage their liquidity and avoid financial distress.

Resources for Developing Quantitative Skills

Developing strong quantitative skills requires dedicated effort and the utilization of various resources. Numerous options exist to enhance these critical skills.

- Online Courses: Platforms like Coursera, edX, and Udemy offer a wide range of courses in statistics, data analysis, financial accounting, and other relevant areas.

- University Programs: Many universities offer business analytics, finance, and accounting programs that provide a comprehensive education in quantitative skills.

- Books and Tutorials: Numerous books and online tutorials are available on topics such as data analysis, statistical modeling, and financial accounting.

- Professional Certifications: Certifications like the Certified Management Accountant (CMA) or the Chartered Financial Analyst (CFA) demonstrate proficiency in financial management and analysis.

- Software Training: Dedicated training programs for spreadsheet software like Excel and data analysis software like R or Python can significantly enhance practical skills.