Does business bankruptcy affect personal credit? The answer, unfortunately, isn’t a simple yes or no. The impact hinges on several crucial factors, including the type of bankruptcy filed (Chapter 7, 11, or 13), the existence of personal guarantees on business loans, and the specific legal structure of your business. Understanding these nuances is critical for business owners, as a business’s financial downfall can significantly impact personal finances and creditworthiness for years to come. This guide navigates the complexities, offering clarity and actionable strategies to mitigate potential damage.

We’ll delve into the specifics of each bankruptcy chapter, exploring how personal liability varies depending on the chosen path. The often-overlooked role of personal guarantees will be examined, highlighting how seemingly innocuous signatures can have devastating consequences. We’ll also differentiate between business and personal credit, outlining how each is affected separately and offering strategies to protect your personal credit score during and after a business bankruptcy. Finally, we’ll explore long-term effects and provide a roadmap for rebuilding your credit after the storm.

Types of Business Bankruptcy and Their Impact

Business bankruptcy can significantly impact both the business and its owner’s personal finances. Understanding the different types of bankruptcy and their implications is crucial for business owners facing financial distress. The primary types of bankruptcy relevant to businesses are Chapter 7, Chapter 11, and Chapter 13, each with distinct procedures and consequences for personal liability.

Chapter 7 Bankruptcy

Chapter 7 bankruptcy, also known as liquidation bankruptcy, involves the sale of a business’s assets to repay creditors. In the context of a sole proprietorship or a single-member LLC, personal assets are often at risk because there’s typically no legal separation between the business and the owner. For partnerships and corporations, the impact on personal assets depends on the extent of personal guarantees provided by the owners. If the business debt is personally guaranteed, creditors can pursue personal assets to satisfy outstanding debts even after business assets have been liquidated.

For example, a sole proprietor who personally guaranteed a business loan might see their personal savings account and home seized to pay off the remaining debt after the business assets are sold in a Chapter 7 proceeding.

Chapter 11 Bankruptcy

Chapter 11 bankruptcy is a reorganization bankruptcy, allowing businesses to continue operations while restructuring their debts. This process involves creating a reorganization plan that Artikels how the business will repay its creditors over a specific period. While Chapter 11 offers a chance to salvage the business, personal liability still depends on the structure of the business and any personal guarantees. Limited liability companies (LLCs) and corporations generally provide some protection, but personal guarantees on loans or other obligations can expose personal assets to creditors if the reorganization plan fails.

For instance, if a small business owner personally guaranteed a lease agreement, and the Chapter 11 reorganization plan fails, the landlord could still pursue the owner’s personal assets to recover unpaid rent.

Chapter 13 Bankruptcy

Chapter 13 bankruptcy is a reorganization plan specifically for individuals with regular income, including sole proprietors and business owners. It allows them to create a repayment plan over three to five years to pay off debts. While it primarily focuses on individual debt, business debts may be included in the plan if the business is closely tied to the individual’s finances. Personal liability for business debts remains, and failure to adhere to the repayment plan can result in the loss of personal assets.

Imagine a sole proprietor with significant personal and business debt filing for Chapter 13. If the repayment plan fails, creditors could still pursue the proprietor’s personal assets to recover outstanding debts.

Comparison of Bankruptcy Types and Their Impact

The following table summarizes the impact of each bankruptcy type on personal credit scores and personal liability:

| Bankruptcy Type | Personal Liability | Asset Protection | Credit Score Impact |

|---|---|---|---|

| Chapter 7 | High (especially for sole proprietorships and personal guarantees) | Low (personal assets may be seized) | Significant negative impact (can remain on credit report for 10 years) |

| Chapter 11 | Varies (depends on personal guarantees and success of reorganization) | Moderate (some protection offered by corporate structures, but personal guarantees negate this) | Significant negative impact (length of impact depends on factors including successful reorganization) |

| Chapter 13 | High (business debts may be included in the plan) | Low to Moderate (depends on plan success and adherence) | Negative impact (but potentially less severe than Chapter 7 or 11 if plan is successfully completed) |

Personal Guarantees and Their Implications

A personal guarantee is a legally binding commitment where an individual pledges their personal assets to secure a business loan. This means that if the business fails to repay the loan, the lender can pursue the guarantor for the outstanding debt, potentially seizing personal assets like homes, savings accounts, and other property. Understanding the implications of signing a personal guarantee is crucial for business owners seeking financing.

Personal guarantees significantly impact personal credit if the business defaults. The lender will report the defaulted loan to credit bureaus, resulting in a severely damaged credit score. This can make it difficult to obtain future loans, credit cards, or even rent an apartment. The negative impact on personal credit can persist for several years, hindering financial opportunities and potentially leading to further financial hardship.

Consequences of a Personal Guarantee on Personal Credit

When a business defaults on a loan secured by a personal guarantee, the lender has recourse against the guarantor’s personal assets. This means the guarantor becomes personally liable for the debt. The lender will typically attempt to collect the debt through various means, including wage garnishment, bank levies, and ultimately, the sale of personal assets. The resulting negative impact on the guarantor’s credit report can be devastating, making it extremely difficult to secure future credit. Furthermore, the legal costs associated with debt collection can add to the financial burden.

Examples of Personal Guarantees Leading to Personal Bankruptcy

Consider a scenario where a small business owner, John, secures a loan for his bakery using a personal guarantee. His bakery fails due to unforeseen circumstances, leaving him unable to repay the loan. The lender pursues John, and despite attempts to sell some personal assets, the debt remains unpaid. Faced with overwhelming debt and legal action, John may file for personal bankruptcy as a last resort to protect himself from further financial ruin. Another example involves a couple who co-signed a loan for their daughter’s struggling restaurant. When the restaurant closes, they become liable for the debt, ultimately leading them to personal bankruptcy due to their inability to manage the debt alongside their existing financial obligations.

Process of a Personal Guarantee and its Impact on Personal Credit

The following flowchart illustrates the process:

[Flowchart Description: The flowchart begins with “Signing a Personal Guarantee for a Business Loan.” This leads to two branches: “Business Successfully Repays Loan” (resulting in “No Impact on Personal Credit”) and “Business Defaults on Loan.” The “Business Defaults on Loan” branch leads to “Lender Seeks Repayment from Guarantor.” This further branches into “Guarantor Repays Debt” (resulting in “Negative Impact on Personal Credit, but potentially manageable”) and “Guarantor Fails to Repay Debt.” “Guarantor Fails to Repay Debt” leads to “Legal Action, Asset Seizure, and Potential Bankruptcy,” ultimately resulting in “Severely Damaged Personal Credit.” ]

Business Credit vs. Personal Credit: Does Business Bankruptcy Affect Personal Credit

Understanding the distinction between business and personal credit is crucial for entrepreneurs. While both impact your overall financial health, they operate independently, with different scoring systems, influencing factors, and consequences in the event of bankruptcy. Failure to grasp these differences can lead to significant financial setbacks.

Business credit and personal credit are distinct systems used to assess the creditworthiness of businesses and individuals, respectively. They are evaluated using different scoring models, influenced by various factors, and have separate consequences in the event of bankruptcy.

Factors Influencing Business and Personal Credit Scores

Business credit scores rely heavily on factors related to the business’s financial performance and payment history. These include payment history on business loans and credit cards, business revenue and profitability, length of time in business, and the number of open business credit accounts. In contrast, personal credit scores are influenced by factors like payment history on personal loans and credit cards, amounts owed, length of credit history, new credit accounts opened, and the mix of credit used. A consistent record of on-time payments is a cornerstone of a strong score in both cases. However, a missed payment on a business loan will impact the business credit score, while a missed personal loan payment will affect the personal credit score.

Impact of Business Bankruptcy on Business and Personal Credit Scores, Does business bankruptcy affect personal credit

A business bankruptcy filing, specifically Chapter 7 or Chapter 11, will severely damage the business credit score. This is because bankruptcy is a clear indication of the business’s inability to meet its financial obligations. The negative impact can persist for several years, making it difficult to secure future financing. However, the effect on a personal credit score depends on several factors, most significantly the presence of a personal guarantee. Without a personal guarantee, the bankruptcy of the business typically does not directly affect the personal credit score. However, if a personal guarantee was signed, the business debts become personal debts, resulting in a significant negative impact on the personal credit score.

Impact of Business Bankruptcy: A Comparison

The following points summarize the differences in the impact of business bankruptcy on business and personal credit scores, along with potential recovery strategies.

- Business Credit Impact: Severe negative impact, potentially lasting for several years. Difficulty securing future financing. Public record of bankruptcy.

- Personal Credit Impact: Dependent on personal guarantees. No impact without a personal guarantee; significant negative impact with a personal guarantee.

- Recovery Strategies for Business Credit: Focus on rebuilding business credit through responsible financial management, timely payments on new accounts, and obtaining trade credit. Consider seeking advice from a business credit repair specialist.

- Recovery Strategies for Personal Credit: If impacted due to a personal guarantee, focus on responsible credit management, timely payments on existing accounts, and potentially exploring credit counseling or debt management plans. Building new credit responsibly over time is key.

Strategies to Mitigate the Impact

Business bankruptcy can significantly impact personal credit, but proactive strategies can lessen the blow. Understanding the potential consequences and taking preventative measures is crucial for minimizing the long-term effects on your personal financial health. This section Artikels key steps to protect your personal assets and credit score during and after a business bankruptcy.

Protecting Personal Assets from Business Debts

Separating personal and business assets is paramount. This involves meticulous record-keeping, utilizing separate bank accounts and credit cards, and structuring business ownership appropriately (e.g., forming an LLC to limit personal liability). Failing to maintain this separation can lead to creditors pursuing personal assets to satisfy business debts. For example, if a sole proprietor fails to maintain separate accounts, personal savings could be at risk. Conversely, forming an LLC with proper legal documentation provides a crucial layer of protection, shielding personal assets from business liabilities. Regularly reviewing your financial structure with a legal professional is vital to ensure continued protection.

The Importance of Consulting Legal and Financial Professionals

Seeking expert advice is not optional; it’s essential. A bankruptcy attorney can guide you through the complexities of the bankruptcy process, helping you choose the most appropriate chapter and navigate legal requirements. A financial advisor can help you analyze your financial situation, develop a recovery plan, and manage your personal finances post-bankruptcy. These professionals provide invaluable support, ensuring you make informed decisions and avoid costly mistakes. For instance, an attorney can help negotiate with creditors to potentially reduce debt obligations, while a financial advisor can create a budget to manage expenses effectively after the bankruptcy.

Step-by-Step Guide to Improving Personal Credit After Bankruptcy

After a business bankruptcy filing, rebuilding your credit requires a strategic and disciplined approach. The following steps Artikel a roadmap to recovery:

- Obtain a copy of your credit report: Review your credit report for inaccuracies and understand the impact of the bankruptcy on your score.

- Create a budget: Develop a realistic budget to manage your expenses and prioritize debt repayment.

- Pay all debts on time: Consistent on-time payments on all remaining accounts are crucial for demonstrating creditworthiness.

- Consider secured credit cards: Secured credit cards can help rebuild credit by requiring a security deposit, which reduces lender risk.

- Monitor your credit score regularly: Track your progress and identify areas for improvement.

- Explore credit counseling: A credit counselor can offer personalized advice and guidance.

Following these steps diligently demonstrates responsible financial management, gradually improving your creditworthiness over time. For example, consistently paying off a secured credit card on time will demonstrate responsible credit behavior to lenders, positively impacting your credit score. The time it takes to fully recover varies, but consistent effort is key.

Long-Term Effects on Personal Credit

Business bankruptcy, even if solely related to a business entity, can cast a long shadow on your personal creditworthiness. The severity and duration of this impact depend on several factors, including the type of bankruptcy filed, the presence of personal guarantees, and your proactive steps to mitigate the damage. Understanding these long-term effects is crucial for planning your financial recovery.

The most significant long-term effect is a substantial drop in your personal credit score. This decline can make it significantly harder to obtain loans, credit cards, or even rent an apartment for several years. The negative information from the bankruptcy filing remains on your credit report for a considerable period, impacting your ability to secure favorable interest rates and credit limits. Furthermore, the bankruptcy can create a negative perception among lenders, making them hesitant to extend credit, even if your financial situation has improved.

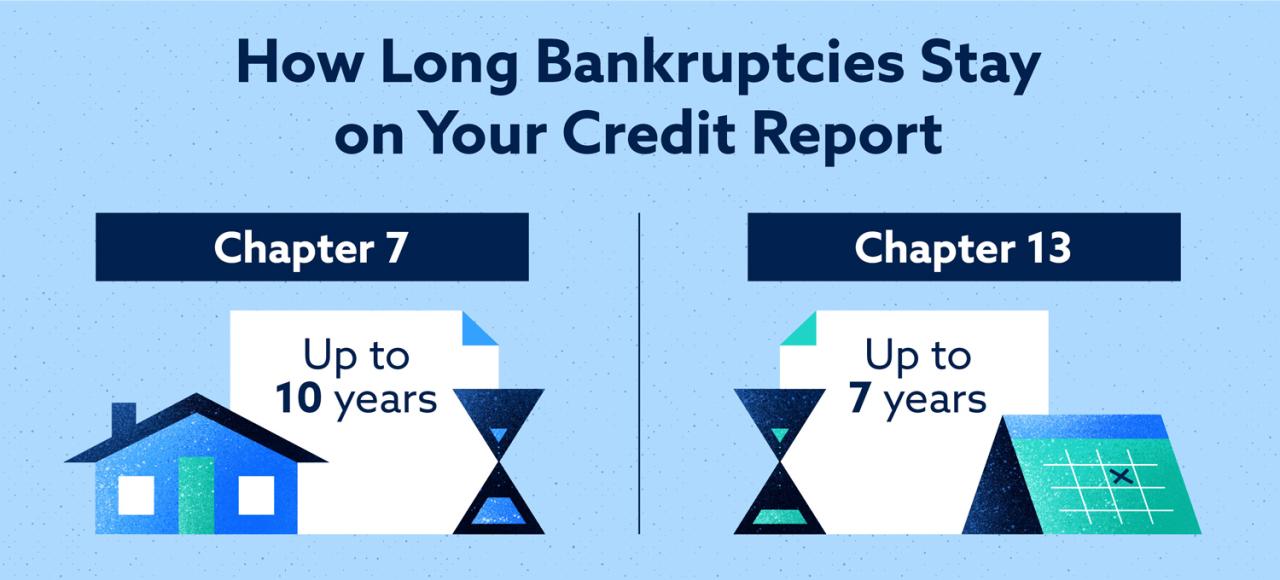

Duration of Bankruptcy on Credit Reports

A Chapter 7 bankruptcy typically remains on your credit report for 10 years from the filing date. A Chapter 13 bankruptcy, which involves a repayment plan, stays on your report for seven years from the date of discharge. This extended presence significantly impacts your credit score and lending opportunities during this time. Even after the bankruptcy is removed, its negative impact can linger for some time, influencing lenders’ decisions. For example, a potential lender might still review the information from your credit report, even if the bankruptcy is no longer present, and might be hesitant to approve a loan based on past performance.

Challenges in Obtaining Credit After Business Bankruptcy

Securing credit after a business bankruptcy presents considerable challenges. Lenders view bankruptcy as a high-risk factor, significantly reducing your chances of approval for loans or credit cards. Even if approved, you will likely face higher interest rates and stricter lending terms compared to individuals with clean credit histories. This makes it more difficult to rebuild your financial life and can significantly impact your ability to invest in future opportunities. Furthermore, obtaining a mortgage or auto loan can be extremely difficult, as lenders are very cautious about extending large sums of money to individuals with a history of bankruptcy.

Rebuilding Personal Credit After Business Bankruptcy: A Case Study

Consider Sarah, a small business owner who filed for Chapter 7 bankruptcy after her bakery experienced unforeseen financial difficulties. Her personal credit score plummeted, and she struggled to obtain credit for several years. However, Sarah took proactive steps to rebuild her credit. She began by paying all her bills on time, meticulously tracking her spending, and paying down existing debt. She also obtained a secured credit card, which requires a security deposit to open an account and helps build credit responsibly. Over the next three years, Sarah consistently demonstrated responsible financial behavior. She diligently monitored her credit reports, noting the gradual improvement in her score. After five years, she was able to secure a personal loan with a reasonable interest rate, representing a significant step towards fully recovering her financial standing. This case illustrates the potential for recovery, but it highlights the importance of patience, discipline, and a strategic approach to credit rebuilding.

Specific Examples of Business Structures and Impact

Understanding the specific business structure significantly impacts how a bankruptcy filing affects personal credit. The level of personal liability directly correlates with the extent of the potential damage to one’s personal credit score. This section will detail the differences in liability and credit impact for various business structures.

The degree to which a business bankruptcy affects personal credit hinges largely on the legal structure of the business. Sole proprietorships, partnerships, and LLCs all offer different levels of liability protection, leading to varied outcomes in bankruptcy proceedings.

Sole Proprietorships and Personal Liability

In a sole proprietorship, the business and the owner are legally indistinguishable. This means the owner is personally liable for all business debts. If the business declares bankruptcy, creditors can pursue the owner’s personal assets to satisfy outstanding debts. This can severely damage the owner’s personal credit score, potentially leading to significant financial hardship. For example, if a sole proprietor’s business incurs $100,000 in debt and files for bankruptcy, creditors can seize personal assets like a house or car to recover the debt, drastically impacting the owner’s personal credit report.

Partnerships and Shared Liability

Partnerships, whether general or limited, share a similar risk profile. In a general partnership, all partners are jointly and severally liable for business debts. This means each partner is fully responsible for the entire debt, even if one partner incurred it solely. In a limited partnership, general partners bear unlimited liability, while limited partners’ liability is limited to their investment. Bankruptcy proceedings can severely impact the personal credit of general partners, while limited partners’ impact is less severe, though still possible. A scenario where one partner’s mismanagement leads to bankruptcy could severely impact the credit of all general partners, highlighting the interconnected nature of liability.

Limited Liability Companies (LLCs) and Liability Protection

LLCs offer a degree of liability protection, separating the business’s liabilities from the owner’s personal assets. However, this protection is not absolute. If the LLC is structured as a disregarded entity by the IRS, it is treated as a sole proprietorship for tax purposes, meaning the owner’s personal liability remains. Even with a properly structured LLC, personal guarantees on loans or other business debts can pierce the corporate veil, exposing the owner to personal liability. Therefore, while an LLC generally offers better protection than a sole proprietorship or general partnership, the owner’s personal credit is not entirely insulated from business bankruptcy. A situation where an LLC owner personally guaranteed a business loan, and the business subsequently filed for bankruptcy, could lead to significant negative impacts on their personal credit score.

Impact of Bankruptcy on Personal Credit Across Different Business Structures

| Business Structure | Level of Personal Liability | Impact on Personal Credit | Strategies for Mitigation |

|---|---|---|---|

| Sole Proprietorship | Unlimited | Significant negative impact; creditors can pursue personal assets. | Maintain strong personal credit before starting the business; explore business insurance options; carefully manage business finances. |

| General Partnership | Unlimited, joint and several | Significant negative impact for all general partners; creditors can pursue personal assets of any partner. | Same as sole proprietorship, with added importance of partner agreement and careful selection of partners. |

| Limited Partnership | Unlimited for general partners, limited for limited partners | Significant negative impact for general partners; limited impact for limited partners (potentially only up to investment). | General partners should follow the same strategies as sole proprietors; limited partners should carefully assess the risk profile of the general partners. |

| LLC (Disregarded Entity) | Unlimited | Significant negative impact; treated like a sole proprietorship. | Same as sole proprietorship. |

| LLC (Properly Structured) | Limited (generally) | Limited impact (unless personal guarantees are in place). | Maintain strong personal credit; avoid personal guarantees whenever possible; ensure proper LLC formation and compliance. |