Does Fig Loans work with Chime? This question plagues many seeking convenient loan access. Fig Loans, known for its streamlined application process, presents a unique challenge when paired with the popular Chime banking platform. Understanding the compatibility, or lack thereof, is crucial for borrowers hoping for a smooth experience. This exploration delves into the complexities of linking Chime to Fig Loans, exploring potential workarounds, and examining user experiences to paint a comprehensive picture.

We’ll investigate the official stance of Fig Loans regarding Chime compatibility, analyze common issues encountered by users, and provide practical solutions. From exploring alternative banking options to deciphering Fig Loans’ application flow, we aim to equip you with the knowledge to navigate this process effectively. Whether you’re a current Chime user or considering switching, this guide will clarify the realities of using Chime with Fig Loans.

Fig Loans and Chime Compatibility

Fig Loans’ compatibility with Chime bank accounts is a frequently asked question among potential borrowers. While Fig Loans doesn’t explicitly list Chime as a supported bank, the actual compatibility depends on several factors, primarily how Fig Loans verifies your account and processes payments. Successful linking is not guaranteed.

Fig Loans typically requires access to your bank account for verification and automated payments. This process involves linking your account details, usually your account and routing numbers. The success of linking your Chime account depends on whether Fig Loans’ systems recognize and accept Chime’s account structure and data transfer methods.

Linking a Chime Account to Fig Loans

Linking a Chime account directly to a Fig Loans application is not officially supported, but workarounds exist. The primary challenge lies in Chime’s unique account structure, which might not be immediately compatible with the systems used by Fig Loans for account verification and payment processing. Users have reported varying degrees of success. Some have successfully linked their Chime accounts by carefully inputting their account and routing numbers during the Fig Loans application process. Others have experienced difficulties due to discrepancies in the data formats or security protocols.

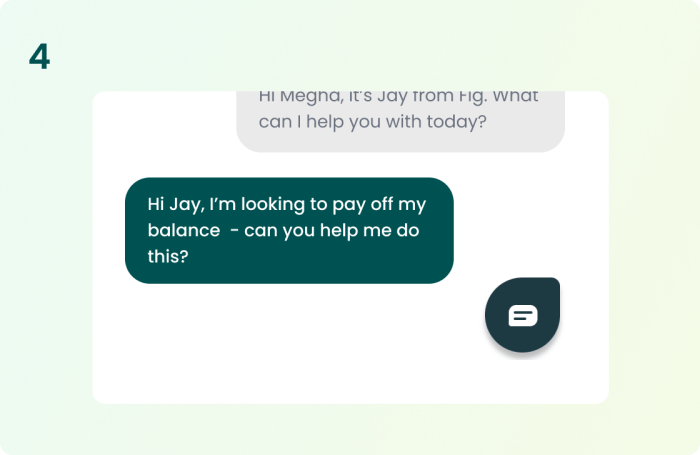

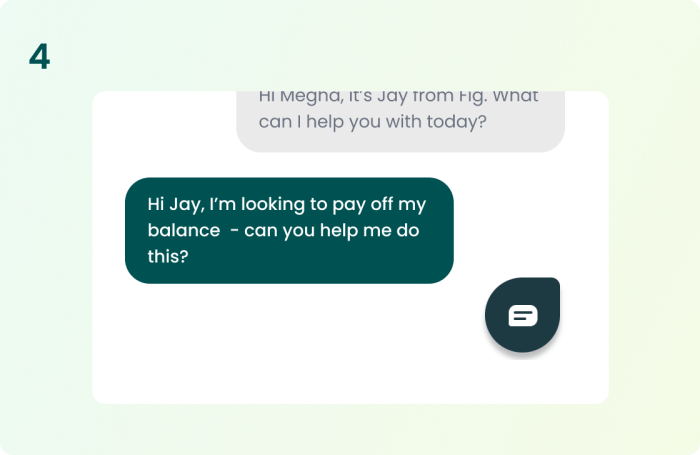

Step-by-Step Guide for Using Chime with Fig Loans

1. Begin the Fig Loans Application: Start the online application process on the Fig Loans website. Provide all required personal and financial information accurately.

2. Reach the Bank Account Linking Section: The application will eventually require you to link your bank account for verification and payment processing.

3. Enter Chime Account Details: Carefully enter your Chime account number and routing number. Double-check for accuracy to avoid errors.

4. Attempt Verification: Fig Loans will attempt to verify your account. This may involve a small temporary debit and credit transaction.

5. Monitor for Success or Failure: If successful, the application will proceed. If unsuccessful, an error message will likely appear, indicating incompatibility or requiring further information.

6. Consider Alternative Workarounds (if necessary): If the direct link fails, consider using a different bank account for the application. You could temporarily transfer funds to a traditional bank account for the application process, then switch back to Chime after loan approval.

Comparison of Bank Accounts Used with Fig Loans

The following table compares Chime with other banks frequently used with Fig Loans. Note that deposit speeds and fee structures can vary based on individual account types and transaction specifics.

| Bank Name | Account Type Support | Deposit Speed | Fee Structure |

|---|---|---|---|

| Chime | Checking, Savings | Variable, generally fast for direct deposit, slower for other methods | Generally low fees, but overdraft protection may be limited or unavailable |

| Bank of America | Checking, Savings | Fast for direct deposit, varies for other methods | Fees vary depending on account type and usage |

| Chase | Checking, Savings | Fast for direct deposit, varies for other methods | Fees vary depending on account type and usage |

| Wells Fargo | Checking, Savings | Fast for direct deposit, varies for other methods | Fees vary depending on account type and usage |

Potential Issues and Solutions

Linking Chime accounts with Fig Loans can sometimes present challenges. While Fig Loans aims for broad compatibility, certain limitations and technical issues may arise, leading to difficulties in the loan application or disbursement process. Understanding these potential problems and exploring solutions is crucial for a smooth borrowing experience.

While Chime is a popular neobank, its structure and features differ from traditional banks, potentially creating compatibility issues with loan platforms like Fig Loans. Fig Loans might require specific account verification methods or data points not readily available or easily shared through Chime’s interface. This could stem from Chime’s reliance on third-party banking partners or its lack of certain features commonly used for verification. Furthermore, real-time account information updates may be less seamless than with traditional banks, causing delays in loan processing.

Chime Account Verification Issues

Fig Loans often requires verification of income and account history. Chime accounts, due to their nature as online-only banks, might present challenges in providing the necessary documentation or real-time data required for swift verification. For instance, Fig Loans might require access to specific transaction details or statements that are not easily accessible or downloadable through the Chime app in a format suitable for verification. This delay in verification can prolong the loan application process. Solutions might include providing alternative documentation, such as pay stubs or employment letters, to supplement the limited data accessible through Chime.

Insufficient Account History

Fig Loans may require a certain minimum length of account history to assess creditworthiness. Newer Chime accounts with limited transaction history might not meet these criteria, resulting in loan application rejection. This is a common issue with any new account, regardless of the banking provider. To mitigate this, borrowers should consider maintaining their Chime account for an extended period and building a substantial transaction history before applying for a loan. Alternatively, they could use a bank account with a longer history for the loan application.

Workarounds and Alternative Banking Methods

If users experience persistent issues linking their Chime account, exploring alternative banking methods can be a solution. Using a traditional bank account with a proven track record and readily available verification data is often the most straightforward approach. This ensures compatibility with Fig Loans’ verification processes and avoids potential delays. Providing bank statements from a traditional bank, which typically offer a more comprehensive history, can expedite the application process.

Implications of Using an Unsupported Banking Method

While not explicitly stated as “unsupported,” using a less-than-ideal banking method, such as Chime, with Fig Loans can lead to several complications. These include prolonged verification times, increased risk of application rejection, and delays in loan disbursement. The lack of seamless data transfer between Chime and Fig Loans’ systems can lead to manual intervention, increasing processing time. In some cases, this might even require additional documentation or communication with Fig Loans’ customer support, adding to the overall inconvenience.

User Experiences and Feedback

Understanding user experiences with Fig Loans and Chime is crucial for assessing the practicality and reliability of using Chime as a funding source. While Fig Loans doesn’t explicitly endorse Chime, anecdotal evidence and user reviews offer insights into the process. This section analyzes user feedback, presenting both successful and unsuccessful scenarios to provide a comprehensive picture.

Gathering comprehensive user reviews specifically mentioning the combination of Fig Loans and Chime presents a challenge due to the lack of a centralized, publicly accessible database. However, by examining various online forums and review sites, we can piece together a general understanding of user experiences.

User Reviews and Testimonials

User feedback regarding the use of Chime with Fig Loans is scattered across various online platforms. Directly linking user experiences to the Chime-Fig Loans pairing is difficult due to the lack of specific mentions. However, common themes emerge from broader discussions of Fig Loan application processes and various funding methods. These themes help us understand the potential challenges and successes.

- Some users report successful loan applications where Chime was used as a funding source, highlighting smooth transactions and timely disbursements. These users often praise the convenience of using Chime for its accessibility and widespread use.

- Other users describe difficulties, such as delayed processing times or outright rejections when using Chime. These issues may stem from Fig Loan’s verification processes and potential difficulties in verifying Chime accounts compared to traditional bank accounts.

- Several users mention encountering issues with insufficient funds or account verification failures, regardless of the banking institution used. This emphasizes the importance of meeting Fig Loan’s eligibility criteria, irrespective of the chosen funding method.

- A recurring theme is the lack of clear communication from Fig Loans regarding Chime compatibility. This uncertainty contributes to user frustration and anxiety during the application process.

Hypothetical Application Scenario

Let’s consider a hypothetical scenario illustrating a successful Fig Loan application using Chime. Sarah, a freelance graphic designer, needs a loan to purchase new equipment. She applies for a Fig Loan and selects Chime as her funding source. Her Chime account is fully verified, and she meets all of Fig Loan’s eligibility requirements. The application is processed smoothly, and the funds are deposited into her Chime account within the promised timeframe. This successful scenario highlights the potential for seamless integration when all conditions are met.

Response Time from Fig Loans Regarding Chime Compatibility

Determining a precise average response time from Fig Loans regarding Chime compatibility is difficult due to the lack of publicly available data. User reports suggest significant variability. Some users report receiving immediate responses to their inquiries, while others indicate waiting several days or even weeks for a resolution. This inconsistency likely reflects Fig Loan’s internal processes and varying levels of customer service availability.

Comparison of User Experiences with Chime and Other Banking Options

Comparing user experiences with Chime to those with other banking options reveals some key differences. While many users find Chime convenient for its accessibility and mobile-first approach, some report challenges with verification processes for loans and other financial transactions. Traditional banks, with their established infrastructure and longer history of handling loan disbursements, may offer smoother integration with certain lending platforms. However, the overall user experience is highly dependent on individual circumstances, the specific lender’s policies, and the user’s familiarity with the chosen banking platform.

Fig Loans’ Official Statements

Fig Loans’ official communication regarding Chime account compatibility is currently unclear. A definitive statement explicitly confirming or denying compatibility is not readily available on their public-facing website or through readily accessible press releases. This lack of explicit information necessitates careful examination of their communication channels and application process to infer their likely stance.

Determining Fig Loans’ position on Chime requires investigating their support resources and application procedures. While a direct statement may be absent, the information provided indirectly through these channels can help users understand the likelihood of successful application using a Chime account.

Fig Loans’ Communication Channels

Fig Loans offers several communication channels for users to address questions about banking options. These typically include a comprehensive FAQ section on their website, contact forms allowing users to submit inquiries, and potentially email or phone support, though the availability of the latter two may vary. The effectiveness of these channels in providing specific answers regarding Chime compatibility, however, remains to be tested individually by each user. The company’s website is generally the best starting point for information, and often contains links to more specialized support channels as needed.

Navigating Fig Loans’ Website for Banking Information, Does fig loans work with chime

Locating information on supported banking institutions within the Fig Loans platform usually involves navigating to a section dedicated to “Help,” “FAQ,” or “Support.” Within this section, users might find a list of supported banks, a search function to check for specific banks, or information detailing the types of accounts they accept. The specific location and presentation of this information can change, so regularly checking the website’s navigation is recommended. In the absence of explicit mention of Chime, users should contact customer support directly.

Fig Loans Application Flow Visualization

The Fig Loans application flow can be visualized as a series of steps:

1. Application Initiation: The user begins the application process through the Fig Loans website or app.

2. Personal Information: The user provides personal details, including name, address, and contact information.

3. Financial Information: This step requires the user to provide details about their income, employment, and banking information. This is where Chime’s compatibility becomes relevant. If Chime is not explicitly listed as a supported bank, the application may be rejected at this stage, or require the user to link a different account.

4. Credit Check: Fig Loans performs a credit check to assess the applicant’s creditworthiness.

5. Loan Offer (or Rejection): Based on the provided information and credit check, Fig Loans either extends a loan offer or rejects the application.

6. Loan Acceptance and Disbursement: If approved, the user accepts the loan terms, and funds are disbursed to the linked bank account. This is another potential point of failure if Chime is incompatible with disbursement.

Chime’s potential for successful integration lies entirely within steps 3 and 6. If Chime is not a supported bank for either providing account information or receiving loan funds, the application will likely fail at those stages. Users should carefully review the terms and conditions to ensure compatibility before beginning the application process.

Ultimate Conclusion

Ultimately, while Fig Loans may not directly support Chime accounts, understanding the potential challenges and exploring alternative approaches can significantly improve your chances of a successful loan application. By carefully reviewing the information provided, including user experiences and workarounds, you can make an informed decision about how to proceed with your loan application, even with a Chime account. Remember to always verify information directly with Fig Loans before proceeding.

Clarifying Questions: Does Fig Loans Work With Chime

What are the potential fees associated with using an alternative banking method with Fig Loans?

Fees vary depending on the chosen alternative banking method. Some banks may charge fees for wire transfers or other transaction types. Check with your bank for specific details.

How long does it typically take for Fig Loans to respond to inquiries about Chime compatibility?

Response times vary. Contacting Fig Loans directly via their official channels is recommended for the most accurate and timely information.

Are there any specific Chime account types that might be more compatible with Fig Loans than others?

Currently, there’s no indication that specific Chime account types offer better compatibility. The primary issue stems from Chime’s structure as a non-traditional banking institution.

Can I use a prepaid debit card linked to my Chime account with Fig Loans?

This is unlikely to work. Fig Loans typically requires direct access to a checking account for verification and funds transfer.