Does JG Wentworth give loans? This question delves into the core of JG Wentworth’s business model, a company known for its unique approach to financial solutions. While not a traditional lender in the sense of offering conventional loans, JG Wentworth provides a distinct service catering to individuals seeking immediate cash. This guide explores JG Wentworth’s operations, advertising practices, customer experiences, and legal considerations, ultimately helping you understand if their services align with your financial needs and whether they offer loans in any form.

We’ll dissect their advertised services, examining the fine print and potential pitfalls. We’ll also compare JG Wentworth to other options available, exploring the advantages and disadvantages of each. This comprehensive analysis will equip you with the knowledge to make informed decisions about your financial future, regardless of whether you’re considering JG Wentworth or exploring alternative solutions.

Understanding JG Wentworth’s Business Model

JG Wentworth is a financial services company specializing in the purchase of structured settlements and lottery winnings. Unlike traditional lenders, it doesn’t offer loans in the conventional sense; instead, its business model centers around acquiring these future income streams at a discounted rate. This allows individuals to receive immediate lump-sum payments in exchange for their future payments. This approach caters to a specific niche market with unique financial needs.

JG Wentworth generates revenue through the difference between the discounted price it pays for structured settlements and lottery winnings and the present value of the future payments it acquires. Essentially, they profit from the time value of money—the principle that money available at the present time is worth more than the same amount in the future due to its potential earning capacity. The company also benefits from its efficient operational processes and its expertise in evaluating and managing these complex financial instruments.

JG Wentworth’s Financial Products

JG Wentworth primarily offers structured settlement purchasing and lottery winnings purchasing services. In structured settlement purchasing, the company buys the rights to future payments from individuals who have received a structured settlement award, typically from a personal injury or wrongful death lawsuit. For lottery winners, JG Wentworth provides a similar service, purchasing the right to receive future payments from lottery winnings. These transactions provide immediate liquidity to the recipients, allowing them to address immediate financial needs. The terms of each purchase are negotiated individually, taking into account factors such as the present value of the future payments, the risk involved, and the individual’s financial circumstances.

Comparison with Traditional Lenders

Traditional lenders, such as banks and credit unions, provide loans based on an individual’s creditworthiness and ability to repay. They assess risk through credit scores, income verification, and collateral. In contrast, JG Wentworth’s business model doesn’t rely on traditional credit assessments. Instead, its risk assessment focuses on the present value and future predictability of the structured settlement or lottery winnings payments. This means individuals with poor credit scores or limited borrowing power might find JG Wentworth’s services more accessible than traditional loans. However, it’s crucial to understand that the lump sum received will be significantly less than the total value of the future payments. Traditional lenders offer a wider range of financial products, including mortgages, auto loans, and credit cards, while JG Wentworth focuses solely on purchasing structured settlements and lottery winnings.

Examining JG Wentworth’s Advertised Services

JG Wentworth’s advertising heavily relies on emotional appeals and promises of quick financial solutions. Their commercials often feature individuals facing immediate financial hardship, suggesting that a structured settlement or annuity payout can be easily and rapidly converted into immediate cash. This messaging aims to resonate with viewers facing urgent financial needs, potentially overshadowing the complexities and potential drawbacks of their services. A critical examination of their advertising language reveals key aspects of their marketing strategy and its potential impact on consumers.

JG Wentworth’s advertisements frequently utilize positive and persuasive language, emphasizing the ease and speed of their process. Phrases like “get your cash now,” “fast and easy,” and “we make it simple” are commonly used to create a sense of urgency and alleviate concerns about potential complications. However, this simplification might downplay the significant financial implications of selling a structured settlement or annuity. The focus on immediate gratification could lead viewers to overlook the long-term financial consequences, such as the loss of future payments and potential tax implications. The commercials often showcase happy individuals receiving large sums of cash, creating a visually appealing narrative that might not accurately reflect the experiences of all customers.

Analysis of JG Wentworth’s Advertising Language

JG Wentworth’s advertising strategically employs emotionally charged language to target individuals facing financial distress. The ads often portray scenarios of urgent need, implying that JG Wentworth offers a quick and easy solution to immediate problems. This creates a sense of urgency and encourages viewers to act without fully considering the long-term consequences. The language used is deliberately simple and avoids complex financial terminology, making the offer seem accessible and straightforward. However, this simplification can mask the inherent complexities of structured settlements and annuities, potentially misleading consumers about the true nature of the transaction. For example, while the ads highlight the speed of the cash payout, they often downplay the significant discount applied to the settlement’s future value.

Potential Misleading Statements in JG Wentworth’s Marketing

While JG Wentworth’s advertisements don’t explicitly make false claims, their simplified messaging and emphasis on speed and ease could be interpreted as misleading. The ads may create an unrealistic expectation of the process’s simplicity and the amount of cash received. The significant discount applied to the future value of the structured settlement or annuity is often not prominently displayed or explained in detail. Furthermore, the potential tax implications of the transaction are rarely explicitly addressed, leaving consumers to potentially face unexpected tax liabilities. This omission of crucial financial details could be considered misleading, as it presents an incomplete picture of the overall financial implications of using JG Wentworth’s services.

Comparison of Advertised Benefits and Potential Drawbacks

| Advertised Benefit | Potential Drawback |

|---|---|

| Fast and easy cash payout | Significant discount on the future value of the settlement/annuity |

| Simplified process | Potential for complex tax implications |

| Immediate financial relief | Loss of future income stream |

| Convenient solution | Higher overall cost compared to other financing options |

Exploring Alternatives to JG Wentworth

JG Wentworth offers a specific service: the immediate purchase of structured settlements and annuity payments. While convenient for some, its high fees and potentially lower overall payout compared to other options make exploring alternatives crucial. Understanding the various financial solutions available allows individuals to make informed decisions that best suit their individual needs and circumstances. This section Artikels several alternatives, comparing their advantages and disadvantages against JG Wentworth’s approach.

Alternative Financial Solutions for Immediate Cash

Several options exist for individuals needing immediate cash, each with its own set of benefits and drawbacks. Carefully considering the pros and cons is essential before committing to any particular solution. The best choice will depend heavily on the individual’s financial situation, the amount of money needed, and their long-term financial goals.

- Personal Loans: Banks and credit unions offer personal loans with varying interest rates and repayment terms. Advantages include potentially lower interest rates than JG Wentworth and greater control over repayment schedules. Disadvantages include a credit check and potential rejection if creditworthiness is low. The approval process may also take longer than receiving a quick payout from JG Wentworth.

- Home Equity Loans or Lines of Credit (HELOCs): Using home equity as collateral allows for larger loan amounts at potentially lower interest rates than personal loans. However, it carries significant risk; defaulting on the loan could lead to foreclosure. The process can also be time-consuming, unlike the rapid transactions offered by JG Wentworth.

- Payday Loans: These short-term, high-interest loans provide quick access to cash but come with extremely high fees and potentially crippling interest rates. While they offer immediate funds, much like JG Wentworth, the long-term financial consequences can be severe and should be avoided unless absolutely necessary and as a last resort.

- Selling Assets: Selling valuable possessions like cars, jewelry, or collectibles can provide immediate cash. This avoids debt entirely but results in a permanent loss of the asset. The value received may also be less than the asset’s true worth, depending on the market conditions. This differs from JG Wentworth, which involves selling a future income stream rather than a tangible asset.

- Borrowing from Family or Friends: This can be a more favorable option than other high-interest loans, often with more flexible repayment terms. However, it can strain personal relationships if repayment isn’t handled carefully. This option offers a level of personal flexibility not available with JG Wentworth’s structured process.

Decision-Making Flowchart for Choosing a Financial Solution

A clear decision-making process helps navigate the various options effectively. The flowchart below Artikels a simplified approach, prioritizing factors like urgency, creditworthiness, and risk tolerance.

[The following describes a flowchart. It cannot be visually represented here but can be easily created using flowchart software or drawn manually.]

The flowchart would begin with a central question: “What is your immediate cash need and urgency?” Branching from this would be options: “High Urgency (need cash immediately)” and “Lower Urgency (can wait).”

The “High Urgency” branch would lead to a secondary question: “Good credit score?” This would branch to “Yes” (consider personal loans, home equity options if applicable) and “No” (consider selling assets, payday loans – with a strong warning about the high interest rates and potential consequences).

The “Lower Urgency” branch would lead to a question: “Willing to take on debt?” This would branch to “Yes” (consider personal loans, home equity options) and “No” (consider selling assets, borrowing from family/friends).

All branches ultimately lead to a final decision point representing the chosen financial solution. Each decision point should include considerations of interest rates, fees, repayment terms, and the long-term financial implications of each choice.

Analyzing Customer Reviews and Experiences

Understanding customer sentiment towards JG Wentworth is crucial for a comprehensive assessment of the company. Online reviews offer a valuable, albeit sometimes biased, perspective on the company’s services, revealing both positive and negative aspects of the customer journey. Analyzing these reviews provides insights into areas where JG Wentworth excels and areas needing improvement.

Common themes emerging from online customer reviews of JG Wentworth frequently revolve around the speed of payment, the clarity of the terms and conditions, and the overall helpfulness of customer service representatives. While some customers praise the efficiency and ease of receiving their lump-sum payment, others express frustration with perceived high fees, complex paperwork, and difficulties in reaching customer support. The overall experience is often highly subjective and depends heavily on individual circumstances and expectations.

Positive Customer Experiences with JG Wentworth

Positive reviews often highlight the speed and convenience of the process. Customers frequently appreciate the quick turnaround time from application to receiving funds, which can be particularly beneficial for those facing immediate financial needs. For example, many testimonials describe receiving their settlement payment within a matter of days or weeks, providing much-needed financial relief. Other positive feedback focuses on the straightforward nature of the application process and the helpfulness of some customer service representatives who provided clear explanations and guidance.

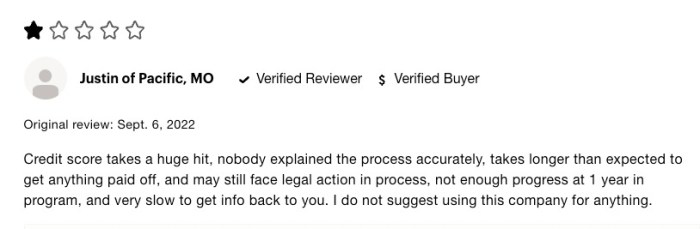

Negative Customer Experiences with JG Wentworth

Conversely, negative reviews often center on the high fees associated with JG Wentworth’s services. Customers frequently express concern that the fees significantly reduce the overall amount received, leaving them with less than initially anticipated. Complaints also highlight difficulties in understanding the fine print of the contracts and navigating the complexities of the application process. For instance, several reviews detail experiences where customers felt pressured into accepting less favorable terms or were misled regarding the total fees involved. Difficulties contacting customer support and receiving timely responses are also recurrent themes in negative reviews.

Categorization of Customer Feedback

Customer feedback can be broadly categorized based on specific aspects of the JG Wentworth service.

| Category | Positive Feedback | Negative Feedback |

|---|---|---|

| Application Process | Simple, straightforward, easy to complete online. | Complex, confusing paperwork; unclear instructions; difficult to navigate the website. |

| Payment Terms | Fast payment processing; received funds quickly. | High fees; unclear fee structure; felt pressured into accepting unfavorable terms. |

| Customer Support | Helpful and responsive customer service representatives; easy to contact. | Difficult to reach customer service; slow response times; unhelpful representatives. |

Legal and Regulatory Considerations

JG Wentworth’s operations are subject to a complex web of federal and state laws and regulations designed to protect consumers from predatory lending practices and ensure fair business dealings. Understanding these legal frameworks is crucial for assessing the risks and benefits associated with utilizing their services. Non-compliance can lead to significant penalties and reputational damage for the company.

The primary regulatory bodies overseeing JG Wentworth’s activities include state-level agencies responsible for licensing and consumer protection, and federal agencies like the Consumer Financial Protection Bureau (CFPB). These agencies monitor compliance with laws prohibiting deceptive advertising, unfair lending practices, and violations of consumer protection statutes. Specific regulations vary by state and can include usury laws, licensing requirements for financial services providers, and rules governing the advertising of financial products.

State Licensing and Regulations

JG Wentworth, as a structured settlement purchasing company, must obtain licenses and adhere to specific regulations in each state where it operates. These licenses ensure the company meets minimum standards of financial stability and ethical conduct. Failure to obtain or maintain these licenses can result in significant fines and legal repercussions, potentially impacting the company’s ability to operate within a given state. The specific requirements for licensing vary considerably between states, influencing the operational complexities and compliance burdens faced by JG Wentworth. For example, some states may have stricter regulations concerning the disclosure of fees and interest rates than others.

Federal Regulations and Consumer Protection

At the federal level, the CFPB plays a significant role in overseeing JG Wentworth’s activities, particularly concerning consumer protection. The CFPB’s authority extends to ensuring fair lending practices, preventing deceptive advertising, and enforcing regulations designed to protect consumers from predatory lending. The Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA) are relevant federal laws that dictate disclosure requirements and prohibit certain deceptive practices in the financial industry. Non-compliance with these federal regulations can lead to substantial fines and legal actions, impacting JG Wentworth’s reputation and financial stability. The CFPB actively monitors complaints and investigates potential violations, reinforcing the importance of strict adherence to these regulations.

Risks Associated with Using JG Wentworth’s Services

Using JG Wentworth’s services carries inherent risks, primarily centered around the potential for receiving less money than the present value of the structured settlement. The company’s business model involves purchasing structured settlements at a discount, which means the upfront cash payment received by the client is typically less than the total future payments of the settlement. This discount reflects the inherent risk and uncertainty associated with future payments. Additional risks include the possibility of unforeseen circumstances affecting the client’s financial situation, making the upfront payment less advantageous than the original structured settlement agreement. Finally, the complexity of the legal and financial aspects involved underscores the importance of seeking independent financial and legal advice before making a decision.

Alignment with Industry Best Practices

JG Wentworth’s practices, while legally compliant in most cases, may not always align perfectly with broader industry best practices concerning transparency and consumer protection. While the company provides disclosures, some argue that the complexity of these disclosures and the inherent financial incentives of the business model can lead to potential misunderstandings or disadvantageous outcomes for consumers. A comparison with industry leaders in responsible financial services might reveal areas where JG Wentworth could enhance its practices to better serve its clients and build greater trust. This includes simplifying the disclosure process, providing more comprehensive financial education to clients, and actively promoting the exploration of alternative financial solutions.

Financial Implications of Using JG Wentworth: Does Jg Wentworth Give Loans

JG Wentworth’s structured settlement purchasing business model offers a quick influx of cash in exchange for future payments. However, this seemingly straightforward transaction carries significant long-term financial implications that require careful consideration. Understanding these implications is crucial before engaging with their services. The decision to sell a structured settlement should be based on a thorough assessment of both short-term needs and long-term financial goals.

The long-term financial consequences of utilizing JG Wentworth’s services primarily revolve around the loss of future income streams. By accepting a lump-sum payment, individuals forfeit the guaranteed future payments they were originally entitled to. This can have a substantial impact on their financial security, especially in the long run, as inflation erodes the purchasing power of the upfront payment and the missed future payments represent a significant opportunity cost. Furthermore, the discounted amount offered by JG Wentworth is typically considerably less than the present value of the future payments, reflecting the inherent risk and profit margin built into their business model. This discount can represent a substantial financial loss over the life of the settlement.

Long-Term Financial Consequences of Settlement Sales

Selling a structured settlement to JG Wentworth results in the immediate receipt of a lump sum, but this comes at the cost of losing future payments. This loss of future income can significantly impact long-term financial planning, particularly for retirement or other long-term goals. The lump sum received may seem attractive in the short term, but it’s crucial to consider the potential for financial hardship later in life due to the absence of these future payments. The decision should be carefully weighed against the potential long-term financial consequences. A thorough financial plan should be developed to account for the lack of future income.

Scenarios Where JG Wentworth Services Might Be Beneficial or Detrimental

Using JG Wentworth’s services might be beneficial in situations where immediate financial needs outweigh the long-term value of the structured settlement. For instance, an individual facing immediate medical expenses or debt consolidation might find the immediate liquidity offered by JG Wentworth helpful. However, if the individual has a solid financial plan and doesn’t face pressing financial needs, selling the settlement is likely detrimental. The loss of future income could significantly hinder long-term financial stability, especially considering the substantial discount applied by JG Wentworth.

Hypothetical Case Study: The Impact of a JG Wentworth Transaction

Let’s consider a hypothetical case: Sarah received a $100,000 structured settlement payable in $10,000 annual installments over ten years. JG Wentworth offers her a lump-sum payment of $60,000. While this seems appealing, the present value of her structured settlement, considering a reasonable discount rate (say, 5%), is significantly higher than $60,000. By accepting JG Wentworth’s offer, Sarah receives $60,000 immediately but loses the potential for an additional $40,000 in future payments. Furthermore, the $60,000, if not carefully managed, could be depleted within a few years, leaving Sarah with no income stream in the future. This highlights the potential for a detrimental outcome if the individual lacks a robust financial plan to manage the lump-sum payment responsibly and account for the loss of future income. This scenario emphasizes the importance of consulting with a financial advisor before making such a significant financial decision.

Illustrating Potential Scenarios

Understanding whether a JG Wentworth transaction is financially sound depends heavily on individual circumstances and the specific terms offered. While JG Wentworth can provide immediate liquidity, it’s crucial to weigh this against the long-term financial implications. The following scenarios illustrate situations where using their services might be beneficial or detrimental.

Financially Sound Scenario: Immediate Medical Emergency, Does jg wentworth give loans

Imagine a scenario where an individual unexpectedly faces a significant medical emergency requiring immediate payment of $50,000. They possess a structured settlement annuity paying out $10,000 annually for the next ten years. Accessing the full value of the settlement through traditional means would be lengthy and potentially impossible given the urgency. In this case, receiving a lump sum from JG Wentworth, even at a discounted rate, might be the most financially sound option, allowing them to address the immediate crisis.

The key here is the immediate need outweighing the long-term cost of the discount. The individual’s life and health are prioritized, making the cost of the discounted payment a secondary concern.

This scenario assumes the individual has explored all other options, such as borrowing from family or friends, and found them inadequate. The immediate need for funds is the critical factor making the high cost of the transaction acceptable. Let’s assume JG Wentworth offers $35,000 for the annuity, resulting in a loss of $15,000. While significant, this loss is offset by the immediate resolution of a life-threatening situation.

Financially Unwise Scenario: Unnecessary Early Access to Funds

Consider an individual receiving a structured settlement annuity of $20,000 annually for 20 years. They are financially stable and have no immediate pressing financial needs. However, they are tempted by the prospect of immediate access to a lump sum and choose to work with JG Wentworth, receiving a discounted lump sum of $250,000. This seems attractive, but they sacrifice the potential for significant long-term growth.

The opportunity cost of foregoing future payments significantly outweighs the convenience of immediate access to funds.

In this scenario, the individual forfeits receiving a total of $400,000 over the life of the annuity. The difference of $150,000 represents a substantial loss in potential returns. This loss could have been invested, generating potentially much higher returns over 20 years. This highlights the importance of carefully considering the long-term implications before making such a decision. Even accounting for potential investment losses, the difference remains substantial.

Cost Comparison: A Detailed Breakdown

The difference in overall cost between the two scenarios is dramatic. In the first scenario (medical emergency), the individual loses $15,000 ($50,000 total value – $35,000 received). This represents a 30% discount. However, this is viewed as a necessary expense to address a critical health issue.

In the second scenario (unnecessary early access), the individual loses $150,000 ($400,000 total value – $250,000 received). This represents a 60% discount. This represents a substantial loss that could have been avoided by simply waiting to receive the annuity payments. The cost of convenience becomes exceedingly high. The interest rate equivalent would be incredibly high, far exceeding standard loan interest rates. The lack of interest rate transparency from JG Wentworth makes it difficult to directly compare to other lending options, but the massive discount is indicative of a very high effective interest rate.

Conclusive Thoughts

Understanding whether JG Wentworth offers loans, or rather, what financial products they *do* offer, requires careful consideration of their business model and the potential financial implications. While their services might provide a quick solution for some, it’s crucial to weigh the potential long-term costs against the immediate benefits. By carefully evaluating your financial situation and exploring alternatives, you can make a responsible choice that aligns with your long-term financial well-being. Remember, thorough research and a clear understanding of the terms are paramount before engaging with any financial service provider.

FAQ Section

What types of settlements does JG Wentworth typically work with?

JG Wentworth primarily works with structured settlements and annuities.

Are there any hidden fees associated with JG Wentworth’s services?

Yes, it’s crucial to carefully review all fees and charges before proceeding. These can vary depending on the specific transaction.

How long does the JG Wentworth process typically take?

The processing time can vary, but it’s generally faster than traditional lending options.

Can I get a loan from JG Wentworth if I have bad credit?

JG Wentworth’s services are not based on traditional credit scoring, but they do assess the viability of the settlement or annuity being offered.