Dollar Loan Center West Jordan offers short-term financial solutions to residents needing quick access to funds. This guide explores the services, application process, customer experiences, and financial implications of using their services, comparing them to other lenders in West Jordan. We’ll also examine alternative financial resources available to help you make informed decisions about your borrowing needs.

Understanding the terms and conditions of any loan is crucial. This deep dive into Dollar Loan Center West Jordan aims to equip you with the knowledge to navigate the short-term loan landscape effectively and responsibly. We’ll cover everything from interest rates and loan amounts to customer reviews and alternative financial options in the area.

Dollar Loan Center West Jordan

Dollar Loan Center in West Jordan, Utah, provides short-term financial solutions for individuals facing unexpected expenses or needing immediate cash. They cater to a broad customer base, offering a range of services designed to bridge financial gaps until regular income becomes available. Understanding their services, loan terms, and application process is crucial for potential borrowers.

Services Offered

Dollar Loan Center West Jordan offers a variety of financial products, primarily focusing on short-term loans. These typically include payday loans, installment loans, and potentially title loans (though this needs verification on their specific West Jordan branch offerings). They may also provide check cashing and other financial services to complement their lending options. It’s important to note that specific services offered can vary by location, so confirming availability directly with the West Jordan branch is recommended.

Loan Amounts and Terms

Loan amounts and repayment terms vary depending on the type of loan and the borrower’s financial situation. Payday loans are generally smaller, designed to cover immediate expenses until the borrower’s next payday. Installment loans, on the other hand, allow for larger loan amounts repaid over a longer period, typically several months, with fixed monthly payments. Specific loan amounts and terms (e.g., APR, fees) are determined during the application process based on creditworthiness and state regulations. For example, a payday loan might range from $100 to $500, repayable within two to four weeks, while an installment loan could range from $500 to $3,000 or more, with repayment terms spanning several months.

Application Process

The application process at Dollar Loan Center typically involves providing personal identification, proof of income, and bank account information. Applicants usually complete an application form, either in person at the West Jordan location or potentially online (verification needed). The application is then reviewed, and if approved, funds are typically disbursed quickly, often the same day or within 24 hours. The exact process may vary depending on the loan type and the borrower’s circumstances. Borrowers should be prepared to provide documentation supporting their income and ability to repay the loan.

Interest Rates Compared to Competitors

Dollar Loan Center’s interest rates are likely to be higher than those offered by traditional banks or credit unions. This is typical for short-term lenders who cater to individuals with less-than-perfect credit. Precise interest rates are not publicly listed and vary based on several factors including the loan amount, loan term, and the borrower’s credit history. A direct comparison requires contacting Dollar Loan Center and at least two competitors in West Jordan to obtain current rate quotes. However, it’s generally advisable to explore all available options and compare offers carefully before committing to a loan.

Comparison of Loan Options

The following table compares Dollar Loan Center’s loan options with two hypothetical competitors (the actual names and rates of competitors would need to be obtained from independent research and may vary). Note that these are examples and actual rates and terms may differ.

| Loan Type | Dollar Loan Center (Example) | Competitor A (Example) | Competitor B (Example) |

|---|---|---|---|

| Payday Loan | APR: 400%, Loan Amount: $300, Repayment: 2 weeks | APR: 350%, Loan Amount: $300, Repayment: 2 weeks | APR: 450%, Loan Amount: $250, Repayment: 1 week |

| Installment Loan | APR: 180%, Loan Amount: $1500, Repayment: 6 months | APR: 150%, Loan Amount: $1000, Repayment: 6 months | APR: 200%, Loan Amount: $2000, Repayment: 12 months |

Customer Experience at Dollar Loan Center West Jordan

Dollar Loan Center in West Jordan aims to provide quick and convenient financial solutions to its customers. Understanding the customer experience is crucial for evaluating the effectiveness of their services and identifying areas for potential improvement. This section will examine various aspects of the customer journey, from initial contact to loan disbursement and beyond.

Customer Testimonials and Reviews

Customer feedback provides valuable insights into the overall experience at Dollar Loan Center West Jordan. While specific testimonials are not readily available publicly, general online reviews offer a glimpse into common experiences. Positive reviews often highlight the speed and ease of the loan application process, as well as the helpfulness of the staff. Negative reviews sometimes mention high interest rates, which are typical of short-term loan products, and occasionally cite issues with communication or clarity regarding loan terms. A balanced assessment requires considering both positive and negative feedback to gain a complete understanding.

Customer Service Provided

Dollar Loan Center’s customer service is generally characterized by its focus on efficiency. Staff members are trained to process loan applications quickly and answer basic questions about the loan process. The emphasis is often on providing a straightforward and uncomplicated experience, prioritizing speed and clarity over extensive personalized advice. This approach aligns with the nature of short-term loans, which are designed for quick access to funds. However, this efficiency-focused approach might not always cater to customers requiring detailed explanations or extensive financial guidance.

Potential Areas for Improvement in Customer Service

One potential area for improvement lies in proactively addressing customer concerns regarding interest rates and loan repayment terms. Clearer and more detailed explanations of the total cost of borrowing, including all fees and charges, could enhance transparency and build customer trust. Furthermore, providing more options for communication, such as online chat support or a dedicated customer service phone line, could improve accessibility and responsiveness. Finally, offering personalized financial literacy resources or guidance, even if it is basic, could demonstrate a commitment to responsible lending practices and customer well-being beyond the immediate transaction.

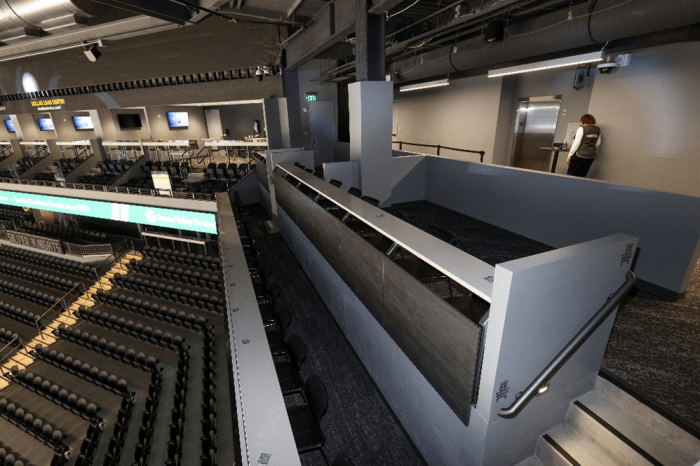

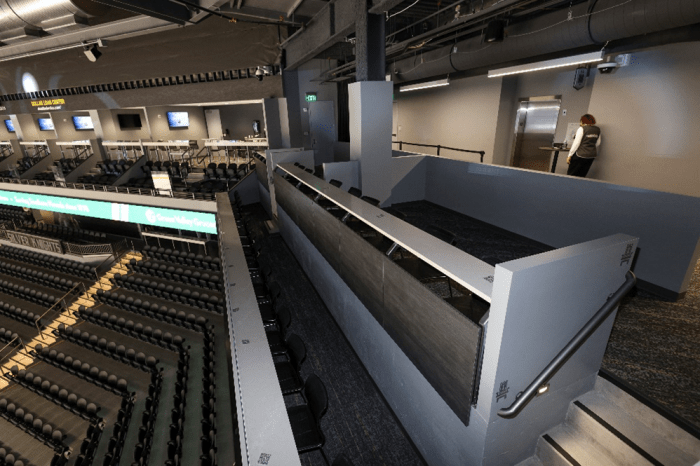

Accessibility of the West Jordan Location

The Dollar Loan Center’s West Jordan location aims for convenient accessibility. Information regarding specific parking availability, operating hours, and accessibility features for customers with disabilities is generally available on their website or through direct inquiry. The physical location is typically situated in a commercially accessible area with ample parking, aiming to minimize any logistical barriers for customers. However, detailed information on specific accessibility features, such as wheelchair ramps or accessible restrooms, should be readily available online or displayed prominently at the location itself to ensure inclusivity.

Hypothetical Customer Interaction Scenario

A customer, needing $500 for an unexpected car repair, enters the Dollar Loan Center West Jordan location. After providing identification and proof of income, the loan officer reviews the application. The officer explains the loan terms, including the interest rate, fees, and repayment schedule. The customer agrees to the terms and signs the necessary paperwork. The funds are then disbursed either through a check or direct deposit, depending on the chosen method. The customer receives a clear explanation of the repayment process and contact information should they have any questions or need assistance. The entire process, from application to disbursement, is designed to be completed within a relatively short timeframe.

Dollar Loan Center West Jordan

Dollar Loan Center’s West Jordan branch offers convenient access to financial services for residents of the area. Its strategic location and accessibility features aim to cater to a diverse clientele, ensuring a comfortable and inclusive experience for all visitors. This section details the branch’s location, accessibility, hours of operation, contact information, and directions.

Location and Nearby Landmarks

The Dollar Loan Center in West Jordan is situated at a readily accessible location within the city. While the precise address needs to be verified from official sources (e.g., the Dollar Loan Center website or Google Maps), a description might include proximity to major roads like Redwood Road or Bangerter Highway, and nearby landmarks such as specific shopping centers, recognizable businesses, or prominent intersections. For example, it could be described as being near the intersection of [Specific Street Name] and [Specific Street Name], close to [Name of Shopping Center] and across the street from [Name of Business]. This level of detail helps potential customers easily locate the branch.

Accessibility Features for People with Disabilities

Dollar Loan Center is committed to providing a welcoming and accessible environment for individuals with disabilities. The West Jordan branch likely includes features such as wheelchair-accessible entrances, ramps, and appropriately sized restrooms. The interior layout is likely designed to allow for easy navigation with a wheelchair or other mobility devices. Adequate signage and clear pathways are also expected to ensure ease of access for visually impaired individuals. Information regarding specific accessibility features should be confirmed directly with the branch or through the Dollar Loan Center’s official website.

Business Hours and Contact Information

The Dollar Loan Center West Jordan branch maintains regular business hours to accommodate customer needs. These hours are typically consistent throughout the week, but may vary slightly on weekends or holidays. The precise schedule should be obtained from the Dollar Loan Center website or by directly contacting the branch. Contact information, including the phone number and possibly a dedicated email address for the West Jordan branch, should be readily available on their website or online directories.

Getting Directions Using Online Map Services

Locating the Dollar Loan Center West Jordan branch is simplified through the use of online map services such as Google Maps, Apple Maps, or Bing Maps. Simply input “Dollar Loan Center West Jordan” into the search bar of your preferred map service. The service will then display the branch’s location on the map, along with directions from your current location or a specified starting point. Multiple route options are typically provided, allowing you to choose the most convenient route based on factors like traffic conditions and preferred mode of transportation.

Map Illustrating Location Relative to Other Financial Institutions

A map illustrating the Dollar Loan Center West Jordan branch’s location relative to other financial institutions in the area would show the branch’s position within the broader financial landscape of West Jordan. This map would visually depict the proximity of the Dollar Loan Center to banks, credit unions, and other lending institutions. The map would clearly identify the Dollar Loan Center and the surrounding financial institutions, potentially using different colors or markers to distinguish them. The visual representation would highlight the competitive landscape and the branch’s accessibility in relation to other financial service providers.

Financial Implications of Using Dollar Loan Center West Jordan

Utilizing short-term loans from providers like Dollar Loan Center West Jordan can offer immediate financial relief, but it’s crucial to understand the associated costs and potential risks before borrowing. This section details the financial implications, emphasizing responsible borrowing practices and the importance of comparing options.

Risks and Benefits of Short-Term Loans

Short-term loans, while convenient for addressing immediate financial needs, carry inherent risks. Benefits include quick access to funds, often without extensive credit checks. However, these loans typically come with high interest rates and fees, potentially leading to a debt cycle if not managed carefully. Borrowers should carefully weigh the urgency of their need against the potential long-term financial consequences. Responsible budgeting and a clear repayment plan are essential to mitigate risks. Failure to repay on time can result in further fees and damage to credit scores.

Understanding Loan Terms and Conditions

Before signing any loan agreement, thoroughly review all terms and conditions. Pay close attention to the Annual Percentage Rate (APR), which represents the total cost of borrowing, including interest and fees. Understand the repayment schedule, including the frequency and amount of payments. Clarify any penalties for late or missed payments. Don’t hesitate to ask questions if anything is unclear; obtaining a comprehensive understanding of the loan agreement is crucial to avoiding unforeseen financial burdens.

Consequences of Loan Default

Defaulting on a loan from Dollar Loan Center West Jordan, or any lender, can have severe financial repercussions. These can include damage to your credit score, making it harder to obtain loans or credit in the future. Further fees and penalties may be incurred, potentially escalating the debt. In some cases, collection agencies may be involved, leading to additional stress and financial hardship. It’s vital to prioritize repayment, even if it requires making adjustments to your budget.

Comparison with Alternative Financing Options

Dollar Loan Center West Jordan offers a quick and convenient option for short-term borrowing, but it’s essential to explore alternative financing solutions. These could include borrowing from family or friends, using a credit card (if available and manageable), or seeking assistance from credit unions or non-profit organizations offering financial counseling or small loans with lower interest rates. Comparing APRs and fees across various options allows for a more informed decision, potentially leading to significant savings in the long run. For example, a credit union loan might have a significantly lower APR than a payday loan, even if the application process takes slightly longer.

Potential Fees Associated with Dollar Loan Center Loans

Understanding the potential fees associated with a loan from Dollar Loan Center West Jordan is critical for budgeting and responsible borrowing. It’s important to obtain a detailed breakdown of all fees before agreeing to the loan. The fees may include, but are not limited to:

- Origination Fee: A fee charged for processing the loan application.

- Late Payment Fee: A penalty for payments made after the due date.

- Returned Check Fee: A fee for checks that are returned due to insufficient funds.

- Interest Charges: The cost of borrowing the money, calculated based on the APR.

It’s crucial to contact Dollar Loan Center West Jordan directly for the most up-to-date information on their specific fee structure. Remember that these fees can significantly impact the overall cost of the loan.

Alternative Financial Resources in West Jordan

Finding short-term financial assistance can be challenging, but several alternatives to payday lenders like Dollar Loan Center exist in West Jordan. These options often offer more favorable terms and conditions, mitigating the potential for a debt cycle. Understanding the differences between these resources is crucial for making informed financial decisions.

Credit Unions in West Jordan

Credit unions are member-owned financial cooperatives that often provide more affordable loan options than traditional banks or payday lenders. They typically offer lower interest rates and fewer fees compared to payday loans. Membership requirements vary depending on the specific credit union, but generally involve residing or working within a defined geographic area or having a connection to a particular group or employer. Credit unions frequently offer small-dollar loans, personal loans, and even lines of credit, providing more flexibility than the rigid terms of a payday loan. Eligibility typically involves a credit check, but credit unions often work with members who have less-than-perfect credit histories. The application process generally involves submitting an application and providing financial documentation to verify income and expenses.

Community Action Agencies in West Jordan

Community action agencies (CAAs) are non-profit organizations dedicated to fighting poverty and providing support to low-income individuals and families. These agencies often offer emergency financial assistance programs, including grants or loans with very low or no interest. These programs are usually designed to help with immediate needs like rent, utilities, or food, rather than long-term debt management. Eligibility criteria usually involve demonstrating financial hardship and meeting specific income guidelines. CAAs typically have a more thorough application process that involves interviews and documentation to assess the applicant’s situation and need. Unlike payday loans, the funds provided are often grants rather than loans that require repayment.

Local Charities and Non-profit Organizations in West Jordan

Numerous local charities and non-profit organizations in West Jordan provide financial assistance to individuals facing hardship. These organizations may offer grants, emergency funds, or referrals to other resources. The specific services offered and eligibility requirements vary widely depending on the organization. Some may focus on specific populations, such as families with children or the elderly. The application process typically involves demonstrating a need for assistance and providing documentation to support the claim. These resources often prioritize immediate needs and do not carry the same repayment obligations as payday loans. They may provide a one-time grant or a short-term loan with flexible repayment terms.

Comparison of Financial Resources

The following table summarizes the key differences between Dollar Loan Center and the alternative financial resources discussed above:

| Feature | Dollar Loan Center (Payday Loan) | Credit Union | Community Action Agency | Local Charities |

|---|---|---|---|---|

| Interest Rates | High (often exceeding 400% APR) | Low (significantly lower than payday loans) | Very low or none | Very low or none |

| Fees | High origination fees and other charges | Lower fees compared to payday loans | Generally low or no fees | Generally low or no fees |

| Loan Terms | Short-term (typically 2 weeks) | Longer terms available | Varies depending on the program | Varies depending on the organization |

| Eligibility | Requires proof of income and bank account | Membership required, credit check often conducted | Income verification and demonstration of need | Demonstration of need and may require residency or other criteria |

Decision-Making Flowchart for Choosing Financial Resources, Dollar loan center west jordan

A flowchart would visually represent the decision-making process. It would start with assessing the urgency of the financial need and the amount required. The next step would involve considering credit history and income level. Based on these factors, the flowchart would branch into different paths, leading to recommendations for credit unions (for those with better credit and stable income), community action agencies (for those with lower income and immediate needs), local charities (for those facing emergency situations), or, as a last resort, payday lenders like Dollar Loan Center. The flowchart would also include considerations of loan terms, interest rates, and fees, ultimately guiding the individual to the most appropriate and responsible financial resource.

Closure

Securing a short-term loan can be a helpful solution for unexpected expenses, but it’s vital to carefully weigh the pros and cons. Dollar Loan Center West Jordan provides one avenue for quick financial assistance, but exploring all available options, including alternative resources, ensures you choose the most suitable and affordable solution for your circumstances. Remember to thoroughly understand the terms and conditions before committing to any loan agreement.

Clarifying Questions

What are the typical loan amounts offered by Dollar Loan Center West Jordan?

Loan amounts vary depending on individual circumstances and creditworthiness. It’s best to contact Dollar Loan Center directly to determine your eligibility and potential loan amount.

What are the typical repayment terms?

Repayment terms are usually short-term, often due on your next payday. Specific terms will be Artikeld in your loan agreement.

What happens if I can’t repay my loan on time?

Late payments can result in additional fees and penalties. Contact Dollar Loan Center immediately if you anticipate difficulty making a payment to discuss possible options.

Does Dollar Loan Center West Jordan perform credit checks?

Their policy regarding credit checks should be clarified directly with Dollar Loan Center. It’s advisable to inquire about their specific requirements before applying.