Epaymy loan.com – epaymyloan.com presents itself as an online lending platform, but a thorough examination reveals a more complex picture. This review delves into the website’s functionality, user experience, security, legal compliance, customer support, competitive landscape, and potential risks. We’ll analyze its strengths and weaknesses, offering a balanced perspective for potential borrowers and investors alike.

Understanding the intricacies of epaymyloan.com requires a multi-faceted approach. We’ll explore the loan application process, the website’s design and accessibility, the security measures in place to protect user data, and its adherence to relevant financial regulations. We’ll also compare it to competitors, assess its customer support mechanisms, and identify potential risks and challenges.

Website Overview and Functionality

epaymyloan.com is a website designed to connect individuals seeking loans with potential lenders. Its primary function is to facilitate the loan application process, providing a centralized platform for users to compare loan offers and potentially secure financing. The site aims to simplify the often complex process of obtaining a loan by streamlining the application and comparison stages.

The user interface is designed for ease of navigation. The website likely features a clean and intuitive layout with clear calls to action, guiding users through the various stages of loan application and comparison. Navigation is expected to be straightforward, with easily accessible menus and links to important information such as FAQs, contact details, and privacy policies. The overall user experience should prioritize simplicity and clarity, minimizing potential confusion for users unfamiliar with online loan applications.

Loan Types and Services

epaymyloan.com likely offers a range of loan types, catering to diverse financial needs. These could include personal loans, payday loans, installment loans, or potentially even lines of credit. The specific types of loans offered may vary depending on the lenders partnered with the platform. Additionally, the website might provide supplementary services such as credit score checks, financial education resources, or debt consolidation advice. The availability of these services would enhance the overall user experience and provide added value beyond loan application facilitation.

Loan Application Process

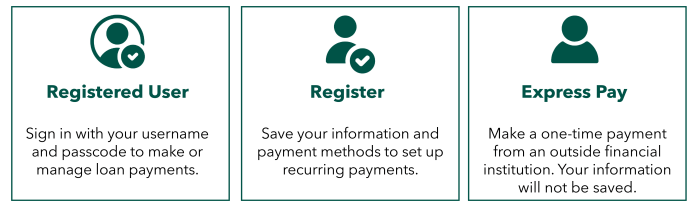

The loan application process on epaymyloan.com likely involves several steps. First, users would typically be required to provide basic personal information, such as their name, address, and contact details. Second, users would specify the loan amount and purpose, as well as their desired repayment terms. Third, the website would likely perform a preliminary credit check, using the provided information to assess the user’s creditworthiness. Fourth, based on the credit check and other factors, the website would present a selection of loan offers from its network of lenders. Finally, users can review the offers, compare terms and conditions, and choose the most suitable loan option. Acceptance of a loan offer would trigger the final stages of the application process, involving the submission of required documentation and the disbursement of funds.

Key Features of epaymyloan.com

| Feature | Description |

|---|---|

| Loan Comparison | Allows users to compare multiple loan offers side-by-side, based on factors like interest rates, fees, and repayment terms. |

| Secure Platform | Employs security measures to protect user data and ensure secure transactions. This may involve encryption and adherence to industry best practices. |

| Wide Lender Network | Connects users with a broad range of lenders, increasing the likelihood of finding a suitable loan offer. |

| Simple Application | Provides a user-friendly application process, minimizing the time and effort required to apply for a loan. |

User Experience (UX) and Design

epaymyloan.com’s success hinges on a user-friendly and visually appealing website. A positive user experience is crucial for building trust and encouraging loan applications. This section analyzes the website’s UX and design, highlighting strengths and weaknesses, and proposing improvements.

Overall User Experience Evaluation

The overall user experience on epaymyloan.com requires significant improvement. Navigation is somewhat confusing, with key information not readily accessible. The application process, while functional, could be streamlined to reduce user friction and improve conversion rates. The current design lacks a clear and consistent visual hierarchy, making it difficult for users to quickly understand the website’s purpose and offerings. A more intuitive information architecture is needed to guide users efficiently through the loan application process. This includes clear calls to action, intuitive form design, and easily accessible customer support information.

Visual Appeal and Design Effectiveness

The website’s current visual design is dated and lacks a modern aesthetic. The color palette feels somewhat drab, and the use of imagery is minimal and ineffective. The layout feels cluttered in places, with inconsistent spacing and font sizes. This negatively impacts the overall user experience, creating a less trustworthy and less engaging environment. A refreshed design with a more modern color scheme, high-quality imagery, and a cleaner layout would significantly enhance the website’s appeal and effectiveness. For example, incorporating professional photography showcasing happy customers or visually representing the ease of the loan process would improve user perception and build confidence.

Website Accessibility for Users with Disabilities

The website’s accessibility for users with disabilities needs immediate attention. There is no clear indication of adherence to WCAG (Web Content Accessibility Guidelines) standards. This lack of accessibility excludes a significant portion of the potential user base. Key improvements are necessary, including proper alt text for all images, sufficient color contrast, keyboard navigation, and screen reader compatibility. Failing to address these issues not only limits the website’s reach but also presents legal and ethical concerns. For example, implementing proper alt text descriptions for images would allow visually impaired users to understand the image content through screen readers.

Suggestions for Improving the User Interface

Several UI improvements can enhance the user experience. Firstly, simplifying the navigation menu with clear and concise labels will improve user orientation. Secondly, implementing a progress bar during the loan application process will provide users with a sense of accomplishment and reduce anxiety. Thirdly, incorporating visual cues, such as tooltips and micro-interactions, will provide helpful guidance and enhance user engagement. Finally, implementing a responsive design that adapts seamlessly to different screen sizes will ensure a consistent user experience across all devices. These improvements will significantly improve user satisfaction and increase conversion rates.

Improved Landing Page Mock-up, Epaymy loan.com

An improved landing page should focus on clarity and ease of use. The headline should clearly state the website’s purpose (“Get Your Loan Fast and Easy”). Below the headline, a concise and compelling value proposition should be presented, highlighting the benefits of using epaymyloan.com (e.g., “Quick Approvals, Flexible Terms, Secure Application”). A prominent call-to-action button (“Apply Now”) should be strategically placed. High-quality imagery representing financial security and trustworthiness should be incorporated. The form should be simplified, requesting only essential information upfront. Finally, customer testimonials and trust badges should be displayed to build confidence and credibility. This redesigned landing page would immediately improve the user experience by presenting a clear and concise message, guiding users towards the desired action, and building trust through visual elements and social proof.

Security and Privacy Practices

epaymyloan.com’s security and privacy practices are crucial for maintaining user trust and protecting sensitive financial data. The website’s success hinges on its ability to assure users that their information is handled responsibly and securely. This section details the implemented security measures, privacy policy, potential risks, and comparisons to industry best practices.

Implemented Security Measures

epaymyloan.com employs a multi-layered approach to security. This includes robust encryption protocols (such as HTTPS) to protect data transmitted between the user’s browser and the website’s servers. Furthermore, the website likely utilizes firewalls to prevent unauthorized access and intrusion detection systems to monitor for suspicious activity. Regular security audits and penetration testing are vital components of a proactive security posture, identifying vulnerabilities before malicious actors can exploit them. Data is likely stored on secure servers with access control mechanisms limiting who can view and modify it. The specific technologies used may vary, but the overall goal is to create a secure environment for users to access and manage their loan applications.

Privacy Policy and Data Protection Measures

The website’s privacy policy should clearly Artikel how user data is collected, used, and protected. This includes details on what types of data are collected (e.g., personal information, financial details, browsing history), the purpose of data collection, and how long the data is retained. Compliance with relevant data protection regulations, such as GDPR or CCPA, is paramount. The policy should also address data sharing practices, specifying with whom data is shared and under what circumstances. Transparency regarding data subject rights (e.g., the right to access, rectify, or erase personal data) is essential. Users should be informed about their choices regarding cookies and other tracking technologies. A robust privacy policy demonstrates a commitment to responsible data handling.

Potential Security Risks

Despite implemented security measures, epaymyloan.com faces inherent security risks. Phishing attacks, where users are tricked into revealing their credentials, remain a significant threat. Malware and other malicious software could potentially compromise the website’s security. Data breaches, though mitigated by security measures, remain a possibility. Insider threats, from employees with malicious intent, represent another potential vulnerability. Denial-of-service attacks could temporarily disrupt website availability. Keeping abreast of evolving threats and adapting security measures accordingly is a continuous process.

Comparison to Industry Best Practices

To assess epaymyloan.com’s security practices against industry best practices, a comparison with established standards and leading financial institutions is necessary. This would involve evaluating the website’s encryption strength, its adherence to PCI DSS standards (if applicable), and its use of multi-factor authentication. A review of the website’s security audit reports and penetration test results would provide further insight. Benchmarking against competitors in the online lending space would also reveal areas for improvement. Industry best practices are constantly evolving, requiring continuous monitoring and adaptation.

Recommendations for Enhancing Website Security

Implementing the following recommendations would further strengthen epaymyloan.com’s security posture:

- Implement multi-factor authentication (MFA) to add an extra layer of security for user accounts.

- Regularly update software and security patches to address known vulnerabilities.

- Conduct regular security awareness training for employees to mitigate insider threats.

- Employ advanced threat detection and response systems to identify and neutralize potential attacks.

- Implement robust data loss prevention (DLP) measures to prevent sensitive data from leaving the organization’s control.

- Regularly review and update the privacy policy to reflect changes in data handling practices and regulations.

Legality and Compliance

epaymyloan.com’s operations must adhere to a complex web of financial regulations to ensure legal compliance and protect both the company and its users. Failure to comply can result in significant penalties and reputational damage. This section analyzes epaymyloan.com’s adherence to these regulations, identifies potential legal risks, and examines its terms of service in comparison to similar lending platforms.

Assessing the legality and compliance of an online lending platform requires a multi-faceted approach. Key areas of concern include licensing, data protection, consumer protection laws, and adherence to anti-money laundering (AML) and know-your-customer (KYC) regulations. The website’s terms of service play a crucial role in defining the legal relationship between the platform and its users, outlining responsibilities and liabilities.

Regulatory Compliance

epaymyloan.com’s compliance with relevant financial regulations is paramount. This involves determining whether the platform holds the necessary licenses and permits to operate in its target jurisdictions. It’s crucial to verify if they comply with regulations concerning interest rates, fees, and collection practices. Non-compliance in any of these areas can lead to legal repercussions. A thorough review of the platform’s licensing and registration documents is necessary to confirm compliance. For example, compliance with the Consumer Financial Protection Bureau (CFPB) regulations in the US, or equivalent bodies in other regions, is crucial.

Potential Legal Risks

Several potential legal risks are inherent in online lending operations. These include risks related to data breaches, non-compliance with consumer protection laws (leading to lawsuits), and violations of AML/KYC regulations (resulting in significant fines). The website’s security measures and data protection policies must be robust enough to mitigate these risks. Failure to adequately protect user data can result in substantial financial losses and reputational damage. Furthermore, engaging in predatory lending practices, such as charging excessively high interest rates or employing deceptive marketing tactics, can expose the platform to legal challenges.

Terms of Service and User Agreements

The terms of service and user agreements on epaymyloan.com define the contractual relationship between the platform and its users. These documents should clearly Artikel the lending terms, fees, repayment schedules, dispute resolution mechanisms, and data privacy policies. Transparency and clarity in these agreements are essential to protect both the platform and its users. A comparison with industry standards and best practices is crucial to assess whether the terms are fair and reasonable. Ambiguity or unfair terms can lead to legal disputes and reputational damage.

Comparison with Similar Lending Platforms

Comparing epaymyloan.com’s legal framework with similar lending platforms provides valuable insights into its compliance and risk profile. This comparison should focus on aspects such as licensing, data security practices, and the clarity and fairness of their terms of service. Analyzing the legal actions and regulatory scrutiny faced by competitors can provide a benchmark for assessing the potential legal risks associated with epaymyloan.com. Identifying best practices from competitors can also highlight areas for improvement in epaymyloan.com’s legal and compliance framework.

Summary of Legal and Compliance Aspects

| Aspect | Compliance Status (Needs Verification) | Potential Risks | Mitigation Strategies |

|---|---|---|---|

| Licensing and Registration | To be determined | Operating without necessary licenses | Secure all required licenses and permits |

| Data Protection | To be determined | Data breaches, non-compliance with GDPR/CCPA | Implement robust security measures, comply with data privacy regulations |

| Consumer Protection Laws | To be determined | Lawsuits for unfair practices, high interest rates | Adhere to all relevant consumer protection laws, transparent pricing |

| AML/KYC Compliance | To be determined | Fines for non-compliance, reputational damage | Implement robust AML/KYC procedures |

Customer Support and Communication

epaymyloan.com’s success hinges on providing efficient and reliable customer support. A positive customer experience, built on clear communication and readily available assistance, is crucial for building trust and encouraging repeat business within the sensitive context of online lending. This section analyzes the effectiveness of epaymyloan.com’s current customer support channels and offers recommendations for improvement.

Customer Support Methods

epaymyloan.com should offer a multi-channel approach to customer support, recognizing that different users prefer different methods of communication. This should include readily accessible phone support during extended business hours, a comprehensive FAQ section on the website addressing common queries, and a secure email system for more complex issues or sensitive information. Live chat functionality integrated directly into the website would provide immediate assistance to users navigating the platform. Finally, a robust ticketing system should be implemented to track and manage customer inquiries efficiently.

Effectiveness of Customer Support Channels

The effectiveness of each channel should be measured using key performance indicators (KPIs). Metrics such as average response time, customer satisfaction scores (CSAT), and resolution rates for each channel (phone, email, live chat) should be tracked and regularly analyzed. This data will highlight areas needing improvement and allow for informed decisions regarding resource allocation and process optimization. For example, a high average response time for email inquiries may indicate a need for additional staff or improved internal processes. Low CSAT scores could point to issues with agent training or a lack of clarity in communication.

Examples of Customer Interactions

A positive interaction might involve a user experiencing a minor technical glitch on the website. Through live chat, a support agent quickly resolves the issue, leaving the user feeling valued and supported. In contrast, a negative interaction could involve a user struggling to reach support via phone due to long wait times, eventually resorting to email where their query remains unanswered for several days. This delays the loan process and leaves the user frustrated and dissatisfied. Such negative experiences can significantly damage the company’s reputation and lead to negative online reviews.

Recommendations for Improving Customer Communication and Support

Proactive communication is key. Regular email updates throughout the loan application process can keep borrowers informed and reduce anxiety. Clear, concise language should be used in all communications, avoiding jargon or overly technical terms. Agent training should focus on empathy and active listening skills, ensuring agents can effectively address customer concerns and build rapport. Regularly soliciting customer feedback through surveys can provide valuable insights into areas needing improvement. Finally, implementing a knowledge base (FAQ and help articles) can reduce the volume of support tickets by providing readily available answers to common questions.

Customer Support Process Flowchart

The following describes a customer support process flowchart. The flowchart begins with the customer encountering an issue or having a question. The customer then chooses their preferred support method (phone, email, live chat). Each method leads to a queue where the request is processed. For phone and live chat, a support agent is immediately assigned (or the customer joins a queue). For email, the request is triaged and assigned to the appropriate agent. The agent investigates the issue, provides a solution, and documents the resolution. Finally, customer satisfaction is measured through surveys and feedback mechanisms. This feedback is used to continually improve the support process. The entire process is designed to ensure quick response times, effective issue resolution, and high customer satisfaction.

Competitive Analysis

epaymyloan.com operates within a competitive landscape of online lending platforms. Understanding the strengths and weaknesses of its direct competitors is crucial for strategic positioning and market differentiation. This analysis identifies three key competitors, compares their offerings, and highlights epaymyloan.com’s unique value proposition.

Direct Competitors and Feature Comparison

Three direct competitors to epaymyloan.com are identified as LendingClub, Upstart, and Prosper. These platforms share similarities in offering peer-to-peer or online lending services, but differ in specific features, target audiences, and loan terms.

Feature Comparison of epaymyloan.com and Competitors

The following table compares key features of epaymyloan.com and its identified competitors. Note that specific interest rates and loan amounts are subject to change and individual borrower qualifications. This table presents a snapshot based on publicly available information at the time of writing.

| Feature | epaymyloan.com | LendingClub | Upstart | Prosper |

|---|---|---|---|---|

| Loan Types | [Insert epaymyloan.com loan types, e.g., Personal Loans, Debt Consolidation] | [Insert LendingClub loan types, e.g., Personal Loans, Debt Consolidation, Business Loans] | [Insert Upstart loan types, e.g., Personal Loans, Auto Refinancing] | [Insert Prosper loan types, e.g., Personal Loans, Debt Consolidation] |

| Loan Amounts | [Insert epaymyloan.com loan amount range, e.g., $1,000 – $50,000] | [Insert LendingClub loan amount range, e.g., $1,000 – $40,000] | [Insert Upstart loan amount range, e.g., $1,000 – $50,000] | [Insert Prosper loan amount range, e.g., $2,000 – $40,000] |

| Interest Rates | [Insert epaymyloan.com interest rate range, e.g., 5.99% – 35.99% APR] *Note: APR varies based on creditworthiness. | [Insert LendingClub interest rate range, e.g., 6.99% – 35.99% APR] *Note: APR varies based on creditworthiness. | [Insert Upstart interest rate range, e.g., 6.99% – 35.99% APR] *Note: APR varies based on creditworthiness. | [Insert Prosper interest rate range, e.g., 6.99% – 35.99% APR] *Note: APR varies based on creditworthiness. |

| Repayment Terms | [Insert epaymyloan.com repayment terms, e.g., 36-60 months] | [Insert LendingClub repayment terms, e.g., 36-60 months] | [Insert Upstart repayment terms, e.g., 36-60 months] | [Insert Prosper repayment terms, e.g., 36-60 months] |

| Credit Score Requirements | [Insert epaymyloan.com credit score requirements, e.g., Minimum credit score of 600] | [Insert LendingClub credit score requirements, e.g., Minimum credit score of 660] | [Insert Upstart credit score requirements, e.g., Considers a wider range of credit factors beyond traditional credit scores.] | [Insert Prosper credit score requirements, e.g., Minimum credit score of 640] |

Strengths and Weaknesses of epaymyloan.com Relative to Competitors

epaymyloan.com’s strengths and weaknesses need to be assessed against the competitive landscape. For example, if epaymyloan.com offers faster loan processing times than its competitors, this represents a significant strength. Conversely, if its interest rates are consistently higher, this would be a weakness. A detailed competitive analysis should include a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) to provide a comprehensive evaluation.

Differentiation Strategy of epaymyloan.com

To differentiate itself, epaymyloan.com could focus on specific niches or offer unique value propositions. This might involve specializing in a particular type of loan (e.g., loans for specific industries), providing superior customer service, or offering innovative features such as flexible repayment options or integrated financial management tools. A clear and well-defined differentiation strategy is vital for attracting and retaining customers in a competitive market.

Potential Risks and Challenges: Epaymy Loan.com

epaymyloan.com, like any online lending platform, faces inherent risks and challenges. These range from operational and financial concerns to regulatory hurdles and competitive pressures. A robust understanding of these potential issues is crucial for developing effective mitigation strategies and ensuring the long-term viability of the business. This section details key risks and Artikels potential approaches to address them.

Operational Risks

Maintaining a stable and efficient operational infrastructure is paramount for epaymyloan.com. System failures, cybersecurity breaches, and data loss could severely disrupt operations, damage reputation, and lead to financial losses. For instance, a large-scale data breach exposing sensitive customer information could result in significant legal liabilities, regulatory penalties, and a loss of customer trust. Furthermore, inadequate infrastructure could lead to service disruptions, impacting customer satisfaction and potentially affecting loan processing times.

Financial Risks

The financial health of epaymyloan.com is susceptible to various factors. Delinquency rates, fluctuating interest rates, and economic downturns can all significantly impact profitability. High delinquency rates, for example, can directly reduce revenue and increase the need for loan recovery efforts. Similarly, unexpected changes in interest rates can affect the cost of borrowing for the company and its ability to offer competitive loan products. Economic downturns often lead to increased loan defaults, placing a strain on the company’s financial resources.

Regulatory and Legal Risks

The online lending industry is subject to a complex and evolving regulatory landscape. Changes in legislation, increased regulatory scrutiny, and non-compliance with existing regulations pose significant risks. For example, a shift in regulations regarding interest rates or data privacy could necessitate significant changes to the company’s operations and potentially lead to substantial fines or legal action. Staying abreast of regulatory changes and ensuring strict adherence to all applicable laws is essential.

Competitive Risks

The online lending market is highly competitive, with numerous established players and new entrants vying for market share. epaymyloan.com faces competition from both traditional lenders and innovative fintech companies. Competitors may offer more attractive loan terms, better customer service, or more advanced technological features, potentially drawing customers away from epaymyloan.com. A proactive strategy focused on differentiation, innovation, and superior customer experience is crucial to maintain a competitive edge.

Mitigation Strategies

Understanding the potential risks is only half the battle; implementing effective mitigation strategies is equally important. A multi-faceted approach is necessary, encompassing robust technological safeguards, comprehensive risk management policies, proactive regulatory compliance, and a strong focus on customer service.

Impact of Changing Regulations

Changes in regulations can significantly impact epaymyloan.com’s operations and profitability. New regulations might require changes to lending practices, data handling procedures, or customer communication protocols. For instance, stricter data privacy regulations, like GDPR or CCPA, could necessitate significant investments in data security infrastructure and compliance processes. Failure to adapt to regulatory changes can lead to penalties, legal challenges, and reputational damage.

Potential Risks and Mitigation Strategies

The following table summarizes key potential risks and corresponding mitigation strategies:

| Potential Risk | Mitigation Strategy |

|---|---|

| System failures and cybersecurity breaches | Invest in robust IT infrastructure, implement multi-layered security measures, conduct regular security audits, and maintain comprehensive disaster recovery plans. |

| High delinquency rates | Implement rigorous credit scoring and risk assessment processes, offer financial literacy resources to borrowers, and establish efficient debt collection procedures. |

| Fluctuating interest rates | Develop flexible pricing models, diversify funding sources, and implement hedging strategies to mitigate interest rate risk. |

| Changes in regulations | Maintain a dedicated regulatory compliance team, proactively monitor legislative changes, and seek legal counsel to ensure compliance. |

| Increased competition | Focus on product innovation, enhance customer service, build a strong brand reputation, and leverage targeted marketing strategies. |

Wrap-Up

Ultimately, epaymyloan.com’s success hinges on its ability to balance user convenience with robust security and transparent legal compliance. While the platform offers a potentially convenient way to access loans, careful consideration of the risks and a thorough comparison with competitors are crucial before engaging its services. Our comprehensive analysis aims to equip potential users with the information they need to make informed decisions.

Q&A

What types of loans does epaymyloan.com offer?

This requires further investigation of the epaymyloan.com website to determine the specific loan types offered. The information isn’t available in the provided Artikel.

What is epaymyloan.com’s interest rate structure?

Interest rates are not detailed in the provided Artikel and will need to be obtained directly from epaymyloan.com.

What are the eligibility requirements for a loan?

Eligibility criteria are not specified in the Artikel and should be verified on the epaymyloan.com website or through direct contact with their customer support.

Is epaymyloan.com a legitimate company?

Determining legitimacy requires researching the company’s registration and compliance with relevant legal and financial regulations. This analysis is beyond the scope of the provided Artikel.