FedChoice auto loan rates offer a compelling option for federal employees seeking financing for their next vehicle. Understanding the factors that influence these rates, from credit score to the type of vehicle, is crucial for securing the best possible terms. This guide delves into the intricacies of FedChoice auto loans, comparing them to competitors and providing a comprehensive overview of the application process, loan terms, and financial implications.

We’ll explore the various loan options available, including those for new and used vehicles, and detail the eligibility requirements to help you determine if you qualify. We’ll also analyze the financial impact of different loan terms and interest rates, offering strategies to improve your chances of securing a favorable rate. By the end, you’ll have a clear understanding of whether a FedChoice auto loan is the right choice for you.

Understanding FedChoice Auto Loan Rates

Securing an auto loan through FedChoice Federal Credit Union offers a potentially cost-effective way to finance your vehicle purchase. However, understanding the factors that influence your interest rate is crucial to securing the best possible terms. This section will explore the key elements determining FedChoice’s auto loan rates, the types of loans they offer, and how their rates compare to those of other major lenders.

Factors Influencing FedChoice Auto Loan Interest Rates

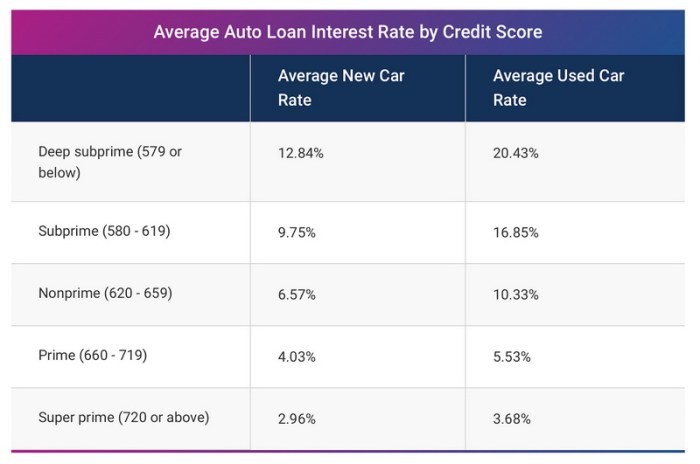

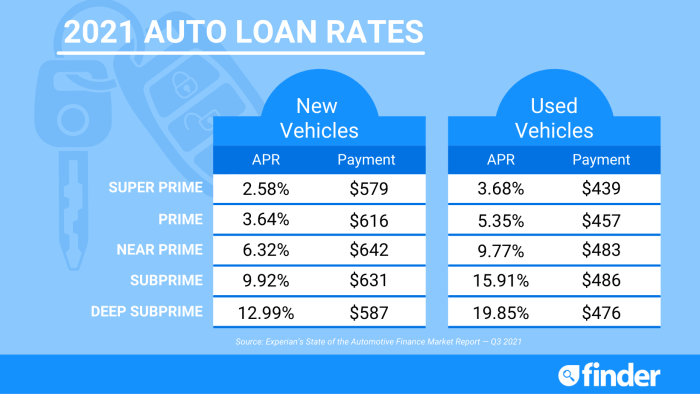

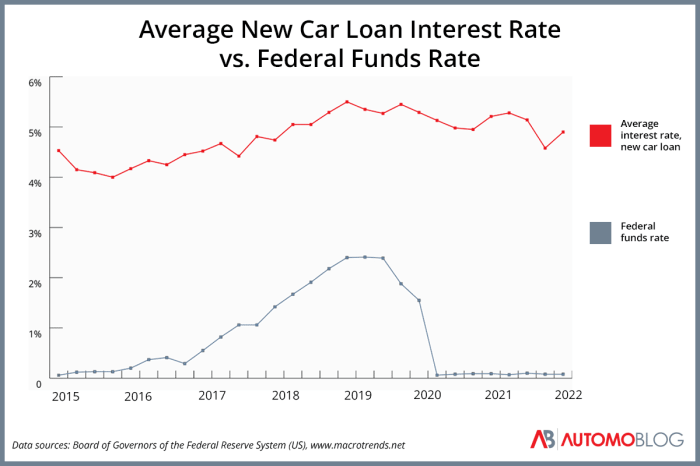

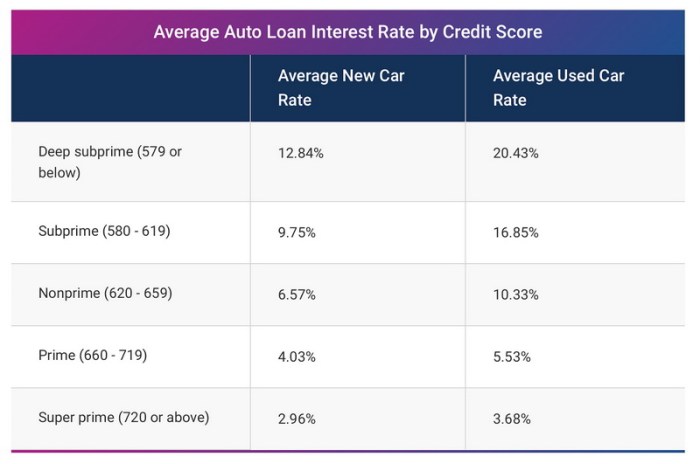

Several factors contribute to the interest rate you’ll receive from FedChoice. These include your credit score, the loan term (length of the loan), the type of vehicle (new or used), the loan-to-value ratio (LTV), and the prevailing market interest rates. A higher credit score generally results in a lower interest rate, reflecting lower perceived risk to the lender. Similarly, shorter loan terms often lead to lower rates, although higher monthly payments are involved. New vehicles typically command lower rates than used vehicles due to their perceived lower depreciation risk. A higher LTV (loan amount as a percentage of the vehicle’s value) can also lead to a higher interest rate. Finally, overall market conditions and the Federal Reserve’s actions influence base interest rates, impacting the rates offered by lenders like FedChoice.

Types of Auto Loans Offered by FedChoice

FedChoice likely offers various auto loan options tailored to different needs and financial situations. These may include loans for new and used vehicles, potentially with options for varying loan terms and repayment schedules. They may also provide refinancing options for existing auto loans, allowing borrowers to potentially lower their interest rate or consolidate debt. Specific details regarding loan types and eligibility criteria should be confirmed directly with FedChoice.

Comparison of FedChoice Rates with Other Major Lenders

Direct comparison of FedChoice’s auto loan rates with other major lenders requires accessing current rate information from each institution. These rates fluctuate constantly based on market conditions and individual borrower profiles. However, general observations can be made: credit unions, like FedChoice, often offer competitive rates compared to banks and other financial institutions due to their not-for-profit structure and focus on member benefits. However, individual rate comparisons must be made at the time of application, considering specific loan terms and borrower qualifications.

Comparison of Interest Rates: New vs. Used Vehicles

The following table provides a hypothetical comparison of interest rates for new versus used vehicles, assuming a similar credit profile and loan term. These are illustrative examples only and should not be taken as a guaranteed representation of FedChoice’s current rates. Actual rates will vary.

| Loan Type | Loan Term (Months) | Approximate Interest Rate Range (%) | Credit Score Impact |

|---|---|---|---|

| New Vehicle | 60 | 3.0 – 6.0 | Higher credit scores generally result in lower rates within this range. |

| Used Vehicle | 60 | 4.0 – 7.0 | Higher credit scores generally result in lower rates within this range. |

| New Vehicle | 72 | 3.5 – 6.5 | Higher credit scores generally result in lower rates within this range. |

| Used Vehicle | 72 | 4.5 – 7.5 | Higher credit scores generally result in lower rates within this range. |

Eligibility and Application Process

Securing a FedChoice auto loan hinges on meeting specific eligibility criteria and navigating a straightforward application process. Understanding these aspects is crucial for a smooth and successful loan application. This section details the requirements and steps involved.

Eligibility Requirements for a FedChoice Auto Loan

Eligibility for a FedChoice auto loan is primarily determined by your employment status and creditworthiness. Applicants must be current Federal employees, retirees, or eligible family members. Specific credit score minimums are typically established, although these may vary depending on the loan type and prevailing market conditions. Furthermore, income verification and proof of employment are standard requirements. The lender assesses your debt-to-income ratio to ensure responsible lending practices. A stable employment history and a positive credit report significantly enhance your chances of approval. Meeting these criteria demonstrates your capacity to manage and repay the loan responsibly.

FedChoice Auto Loan Application Procedure

The FedChoice auto loan application process is designed to be efficient and user-friendly. It generally involves several key steps. First, you’ll need to pre-qualify online or contact a loan officer to discuss your options and determine your eligibility. Next, you will complete the formal application, providing detailed personal and financial information. Once submitted, your application will undergo a credit and income verification process. Upon approval, you will receive a loan offer outlining the terms and conditions. Finally, you will need to sign the loan documents and complete the final steps to receive your funds. This process is typically completed electronically, streamlining the overall experience.

Required Documentation for a FedChoice Auto Loan Application

To successfully complete the application, you will need to provide supporting documentation. This typically includes proof of identity (such as a driver’s license or passport), proof of income (pay stubs or tax returns), and proof of employment (employment verification letter). Additionally, you may be asked to provide information regarding your current debts and assets. Providing complete and accurate documentation expedites the approval process. In some cases, additional documentation, such as a vehicle identification number (VIN) and details about the vehicle being purchased, may also be required. Failure to provide necessary documentation can lead to delays or rejection of your application.

Application Process Flowchart

The following description illustrates the FedChoice auto loan application process as a flowchart.

The flowchart begins with the “Start” node. An arrow leads to the “Pre-qualification” box, representing the initial assessment of eligibility. From there, an arrow branches to either “Eligible” or “Ineligible.” The “Ineligible” path leads to the “End” node. The “Eligible” path continues to the “Complete Application” box, which involves filling out the application form and providing necessary documentation. An arrow leads from this box to the “Credit & Income Verification” box, where the lender reviews the applicant’s financial information. An arrow branches from this box to either “Approved” or “Denied.” The “Denied” path leads to the “End” node. The “Approved” path proceeds to the “Loan Offer” box, presenting the loan terms. The final arrow from this box leads to the “Loan Funding” box, after which the process concludes at the “End” node. The entire flowchart is structured linearly, with each step leading logically to the next, until the loan is either approved or denied.

Loan Terms and Conditions

Understanding the terms and conditions of your FedChoice auto loan is crucial for responsible borrowing and financial planning. This section details the loan options, associated fees, and provides illustrative examples to help you make informed decisions. Remember to always verify the current rates and terms directly with FedChoice before making any financial commitments.

Loan Length and Repayment Options

FedChoice likely offers a range of loan terms, allowing borrowers to choose a repayment schedule that aligns with their budget and financial goals. Typical loan lengths might vary from 24 to 72 months, or even longer depending on the loan amount and vehicle type. Shorter loan terms generally result in higher monthly payments but lower overall interest paid, while longer terms mean lower monthly payments but higher total interest. Repayment options typically involve fixed monthly installments, automatically deducted from a designated bank account. Some lenders might offer options for additional payments to reduce the principal and shorten the loan term. It is vital to understand the implications of each loan length on your total interest cost.

Fees Associated with FedChoice Auto Loans

While FedChoice strives for transparency, it’s important to inquire about all potential fees upfront. These might include an application fee, though this is not always standard practice. Crucially, determine whether prepayment penalties exist. A prepayment penalty is a fee charged if you pay off the loan before its scheduled maturity date. This can significantly impact your financial planning if you anticipate early repayment, perhaps due to receiving an inheritance or bonus. Other potential fees could include late payment fees, which are usually clearly Artikeld in the loan agreement. Carefully review all associated costs to gain a complete understanding of the loan’s true cost.

Loan Amortization Schedule Examples

An amortization schedule details the breakdown of each payment, showing how much goes toward principal and how much toward interest over the life of the loan. Let’s illustrate with hypothetical examples:

| Loan Amount | Interest Rate | Loan Term (Months) | Monthly Payment (Example) |

|---|---|---|---|

| $20,000 | 5% | 36 | $591.50 (Approximate) |

| $20,000 | 5% | 60 | $377.42 (Approximate) |

| $30,000 | 6% | 48 | $705.75 (Approximate) |

*Note: These are simplified examples and do not reflect any potential fees. Actual monthly payments will vary based on the specific loan terms and conditions offered by FedChoice.* A detailed amortization schedule will be provided in your loan documents. Review this schedule carefully to understand the payment breakdown and total interest paid over the loan term.

Benefits and Drawbacks of a FedChoice Auto Loan

Understanding the potential advantages and disadvantages of a FedChoice auto loan is vital for making an informed decision.

- Potential Benefits: Competitive interest rates (potentially lower than those offered by other lenders), convenient application process, potentially favorable terms for federal employees.

- Potential Drawbacks: Limited loan amounts or vehicle types compared to other lenders, potentially stricter eligibility requirements, fees (application, prepayment, late payment) may apply.

Comparison with Competitor Rates

Choosing the right auto loan can significantly impact your overall cost. Understanding how FedChoice’s rates and terms stack up against major competitors is crucial for making an informed decision. This section compares FedChoice’s offerings with those of three other prominent lenders, highlighting key differences to aid in your selection process.

FedChoice Auto Loan Rates Compared to Competitors

To provide a comprehensive comparison, we’ll analyze interest rates, fees, and loan terms offered by FedChoice alongside those of Navy Federal Credit Union, USAA, and Capital One Auto Navigator. These lenders represent a range of financial institutions, offering a diverse perspective on auto loan options. It’s important to note that rates are subject to change based on credit score, loan amount, and the prevailing economic conditions. The following data represents a snapshot in time and should be verified with the respective lenders for the most up-to-date information.

| Lender | APR Range (Example) | Origination Fee | Loan Term Options |

|---|---|---|---|

| FedChoice | 3.99% – 14.99% | $0 – $100 (depending on loan amount) | 24-72 months |

| Navy Federal Credit Union | 3.49% – 17.99% | $0 | 24-84 months |

| USAA | 4.24% – 18.99% | $0 – $250 (depending on loan amount) | 12-84 months |

| Capital One Auto Navigator | 4.99% – 20.99% | $0 – $595 (depending on loan amount and credit score) | 24-72 months |

Key Differences in Loan Terms and Conditions

While all four lenders offer auto loans, significant differences exist in their terms and conditions. For example, Navy Federal Credit Union often boasts longer loan terms (up to 84 months) compared to FedChoice (maximum 72 months). This longer term can result in lower monthly payments but ultimately increases the total interest paid over the life of the loan. Conversely, Capital One might offer a wider range of loan amounts but may also have higher origination fees. USAA, known for its military-focused services, may offer specific benefits and programs for eligible members. Careful review of each lender’s terms is crucial to identify which best suits individual needs and financial circumstances.

Advantages and Disadvantages of Choosing FedChoice

Choosing FedChoice offers several potential advantages. As a credit union, they may prioritize member satisfaction and offer competitive rates, particularly for members with good credit. Their potential disadvantage lies in the possible limitations on loan amounts or eligibility criteria compared to larger national lenders like Capital One. FedChoice’s accessibility may also vary depending on geographic location and membership requirements. Conversely, lenders like Capital One may offer broader reach and a wider range of loan options, but potentially at the cost of higher fees or less personalized service. USAA’s specialization in serving military members and their families provides a unique advantage to that demographic, while Navy Federal provides similar benefits to its members. The best choice depends on individual priorities and circumstances.

Financial Impact and Considerations

Choosing an auto loan involves significant financial commitments. Understanding the long-term implications of different loan terms and interest rates is crucial for making informed decisions and avoiding potential financial strain. This section explores the financial impact of various loan options and offers strategies for mitigating risks.

The total cost of an auto loan is heavily influenced by the interest rate and loan term. A higher interest rate translates to significantly higher overall payments. Similarly, longer loan terms, while resulting in lower monthly payments, lead to substantially increased interest paid over the life of the loan. For example, a $25,000 loan at 5% APR over 60 months will cost approximately $28,400 in total, while the same loan at 7% APR will cost around $29,800. Extending the loan to 72 months at 5% APR will increase the total cost to approximately $29,300. These differences, though seemingly small on a monthly basis, can accumulate to thousands of dollars over the loan’s duration.

The Importance of APR and Interest Rate

The Annual Percentage Rate (APR) represents the total cost of borrowing, encompassing the interest rate and other fees. It provides a more comprehensive picture than the interest rate alone. While the interest rate is the core component, the APR includes additional charges such as origination fees, processing fees, and other lender charges. Comparing loans solely on the interest rate can be misleading, as a lower interest rate might be offset by higher fees, resulting in a higher APR and a more expensive loan overall. Always compare the APRs of different loan offers to make an accurate comparison.

Strategies for Improving Credit Score

A higher credit score typically qualifies borrowers for lower interest rates, reducing the overall cost of the loan. Several strategies can help improve creditworthiness:

- Pay bills on time and in full: Consistent on-time payments are the most significant factor in credit score calculation.

- Maintain low credit utilization: Keep credit card balances well below the credit limit (ideally under 30%).

- Keep older accounts open: A longer credit history demonstrates responsible credit management.

- Monitor your credit report regularly: Check for errors and address them promptly with the credit bureaus.

- Consider a secured credit card: This can help build credit if you have limited or poor credit history.

Improving your credit score takes time and consistent effort, but the potential savings on interest rates can be substantial. Even a small improvement in your credit score can translate into significant long-term savings.

Potential Risks Associated with Auto Loans and Mitigation Strategies

Auto loans, like any form of debt, carry inherent risks. Failure to make timely payments can result in negative impacts on credit scores, repossession of the vehicle, and potential legal action. Furthermore, unforeseen circumstances, such as job loss or unexpected medical expenses, can make loan repayments challenging.

- Budgeting and financial planning: Create a realistic budget that accounts for all expenses, including the auto loan payment. Establish an emergency fund to handle unforeseen financial difficulties.

- Choosing a manageable loan term: Opt for a loan term that aligns with your financial capabilities, balancing affordability with the total interest paid.

- Gap insurance: Consider purchasing gap insurance to cover the difference between the vehicle’s value and the outstanding loan balance in case of a total loss.

- Understanding loan terms and conditions: Carefully review the loan agreement before signing to understand all fees, penalties, and repayment terms.

Proactive planning and risk mitigation strategies can significantly reduce the potential negative consequences associated with auto loans. By carefully considering these factors, borrowers can make informed decisions and minimize financial risks.

Customer Reviews and Experiences: Fedchoice Auto Loan Rates

Customer feedback regarding FedChoice auto loans reveals a mixed bag of experiences, highlighting both positive and negative aspects of the service. While many borrowers express satisfaction with certain elements, others voice concerns about specific areas of the loan process. Analyzing these reviews provides valuable insights into the overall customer satisfaction with FedChoice’s auto loan offerings.

Interest Rate Experiences

Reviews concerning interest rates offered by FedChoice are varied. Some customers report receiving competitive rates, aligning with or even bettering those offered by other financial institutions. These borrowers often emphasize the affordability of their loans and the positive impact on their monthly budgets. Conversely, other reviews indicate that interest rates received were less favorable, leading to higher monthly payments and overall loan costs. The discrepancy may be attributed to factors such as individual credit scores, loan terms, and the prevailing market conditions at the time of application.

Customer Service Quality

Customer service experiences with FedChoice show a similar range of feedback. Many customers praise the responsiveness and helpfulness of FedChoice representatives, noting clear communication and efficient problem-solving. These positive experiences often cite the ease of contact and the readily available support throughout the loan process. However, other reviews describe difficulties in reaching representatives, slow response times, and instances of unhelpful or unclear communication, creating frustration and impacting the overall loan experience.

Loan Application Process, Fedchoice auto loan rates

The loan application process itself is another area where customer feedback varies. Some borrowers describe a straightforward and user-friendly application, praising the ease of online submission and the clear instructions provided. The quick processing time is also frequently mentioned as a positive aspect. Conversely, other reviews highlight challenges encountered during the application, such as lengthy processing times, confusing instructions, and difficulties navigating the online portal. These negative experiences often cite bureaucratic hurdles and a lack of transparency throughout the application process.

Overall Customer Satisfaction

Based on the available data, overall customer satisfaction with FedChoice auto loans appears to be moderate. While many customers express satisfaction with specific aspects, such as competitive interest rates or helpful customer service, others report negative experiences that negatively affect their overall perception. The variability in experiences suggests that individual results may differ considerably depending on several factors, including creditworthiness, the specific loan terms, and the individual interaction with FedChoice representatives. A comprehensive analysis of customer feedback across various platforms is crucial to accurately gauge overall satisfaction and identify areas for improvement.

Conclusion

Securing an auto loan can be a significant financial decision. By carefully considering the factors influencing FedChoice auto loan rates, comparing them to competitor offerings, and understanding the application process, you can make an informed choice that aligns with your financial goals. Remember to meticulously review loan terms and conditions, and don’t hesitate to seek professional financial advice if needed. Choosing the right auto loan can significantly impact your overall financial well-being, so thorough research is key.

Essential Questionnaire

What credit score is needed for a FedChoice auto loan?

While FedChoice doesn’t publicly state a minimum credit score, a higher score generally leads to better interest rates. Aim for a score above 670 for optimal results.

Can I refinance my existing auto loan with FedChoice?

Yes, FedChoice may offer refinancing options. Check their website or contact them directly for details on eligibility and current rates.

What happens if I miss a payment on my FedChoice auto loan?

Missing payments will negatively impact your credit score and may incur late fees. Contact FedChoice immediately if you anticipate difficulty making a payment to explore potential solutions.

Does FedChoice offer pre-approval for auto loans?

It’s best to check FedChoice’s website or contact them directly to confirm if they offer pre-approval for auto loans. This allows you to shop for vehicles knowing your borrowing power.