First Franklin Financial loan calculator simplifies the process of understanding your loan options. This powerful tool allows you to quickly estimate monthly payments, explore different loan terms, and compare various loan types offered by First Franklin Financial. Whether you’re planning a home purchase, refinancing an existing loan, or considering other financial options, this calculator provides valuable insights to help you make informed decisions. Understanding how interest rates, loan amounts, and loan terms impact your overall cost is crucial, and this guide will walk you through each step.

We’ll cover the calculator’s functionalities, input parameters, and step-by-step usage. We’ll also delve into different loan scenarios, showcasing how various factors influence your monthly payments and total interest paid. Finally, we’ll explore alternative loan options from First Franklin Financial and compare their features and costs to help you choose the best fit for your financial needs.

Understanding the First Franklin Financial Loan Calculator

The First Franklin Financial loan calculator is a user-friendly online tool designed to provide quick estimates of loan payments and total costs. It simplifies the process of understanding potential loan obligations before formally applying, allowing borrowers to make informed financial decisions. This tool offers several functionalities to cater to various borrowing needs.

First Franklin Financial Loan Calculator Functionalities

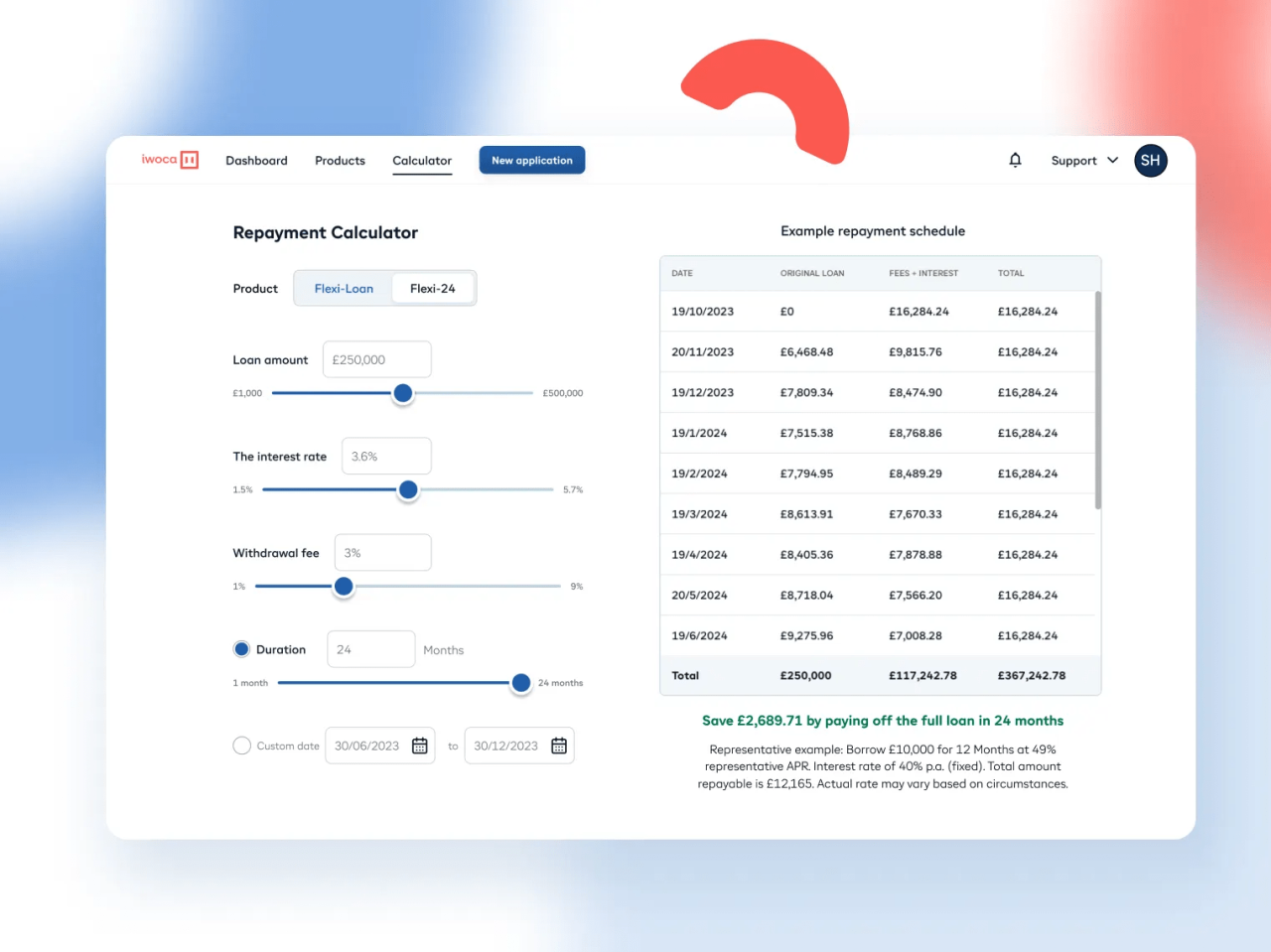

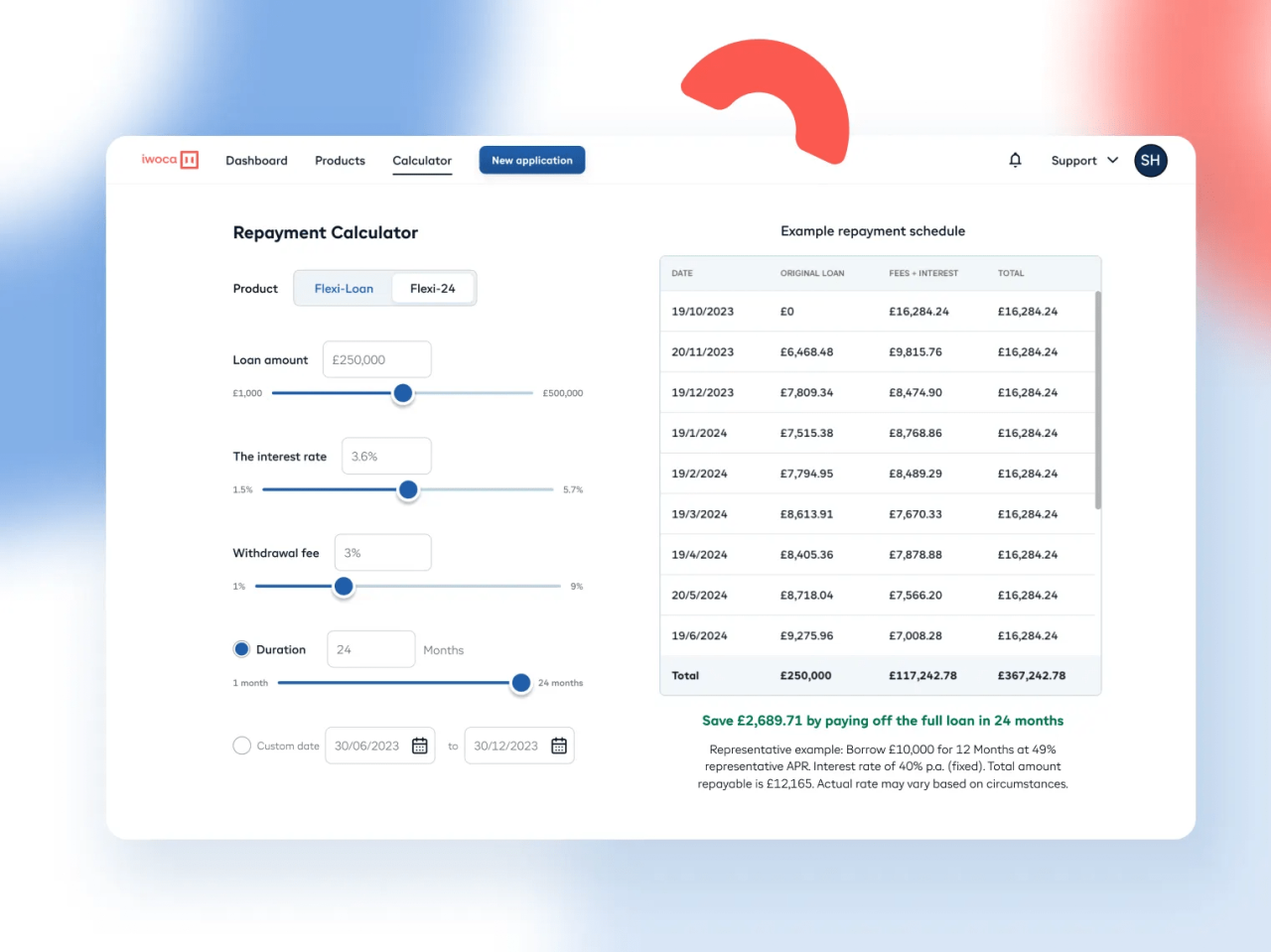

The calculator’s primary function is to estimate monthly payments, total interest paid, and the total amount repaid over the loan’s term. Beyond basic calculations, it likely incorporates features to explore different loan scenarios by adjusting key variables, such as loan amount, interest rate, and loan term. This allows users to see the impact of these changes on their overall loan costs. Furthermore, the calculator may offer amortization schedules, providing a detailed breakdown of each payment’s principal and interest components over the life of the loan.

Loan Types Supported by the Calculator

The specific loan types supported will vary depending on First Franklin Financial’s offerings. However, commonly supported loan types for such calculators include mortgages (potentially fixed-rate and adjustable-rate mortgages), personal loans, auto loans, and home equity loans. The calculator may be designed to handle different loan structures within these categories, such as interest-only payments or balloon payments, but this should be clearly indicated within the calculator’s interface.

Input Parameters for Accurate Calculations

Accurate calculations require the user to input specific information. Crucially, this includes the loan amount (the principal borrowed), the annual interest rate (typically expressed as a percentage), and the loan term (the length of the loan in years or months). Additional parameters may be required depending on the loan type. For example, a mortgage calculator might request property taxes and insurance information to provide a more comprehensive estimate of monthly housing costs. Incorrect input will inevitably lead to inaccurate results, so users should double-check all entered data.

Step-by-Step Guide to Using the Calculator

1. Navigate to the Calculator: Access the First Franklin Financial loan calculator through their official website.

2. Select Loan Type: Choose the appropriate loan type from the options provided.

3. Enter Loan Details: Input the required information, such as loan amount, interest rate, and loan term. Carefully review each field to ensure accuracy.

4. Input Additional Information (if necessary): Depending on the loan type, provide any extra details requested by the calculator, such as property taxes or insurance premiums.

5. Review Results: Once all information is entered, the calculator will display the estimated monthly payment, total interest paid, and total amount repaid. The calculator may also provide an amortization schedule.

Feature Comparison with Competitors

| Feature | First Franklin Financial | Competitor A | Competitor B |

|---|---|---|---|

| Loan Types Supported | Mortgages, Personal Loans, Auto Loans (Example) | Mortgages, Personal Loans (Example) | Mortgages, Personal Loans, Auto Loans, Business Loans (Example) |

| Amortization Schedule | Yes/No (Specify based on actual functionality) | Yes/No (Specify based on actual functionality) | Yes/No (Specify based on actual functionality) |

| Additional Fee Inclusion | Yes/No (Specify – e.g., property taxes, insurance) | Yes/No (Specify) | Yes/No (Specify) |

| User Interface | (Describe – e.g., intuitive, easy to navigate) | (Describe) | (Describe) |

Loan Calculation Scenarios: First Franklin Financial Loan Calculator

The First Franklin Financial loan calculator offers a straightforward way to estimate monthly payments for various loan types. Understanding how to use the calculator for different scenarios is crucial for making informed financial decisions. This section provides examples demonstrating the calculator’s functionality with varying loan terms, interest rates, and loan amounts.

Thirty-Year Mortgage Calculation

To illustrate a 30-year mortgage calculation, let’s assume a loan amount of $300,000 with a 6.5% annual interest rate. Inputting these values into the First Franklin Financial loan calculator will yield a monthly payment. The exact amount will depend on the calculator’s specific features (e.g., inclusion of property taxes and insurance), but a reasonable estimate, excluding additional fees, can be calculated using standard mortgage formulas. The calculator will provide the total monthly payment amount. This allows potential borrowers to assess their affordability before proceeding with a loan application.

Fifteen-Year Mortgage Calculation

Now, consider a 15-year mortgage with a loan amount of $250,000 and a 5.0% annual interest rate. Using the calculator with these inputs, a significantly higher monthly payment will be displayed compared to the 30-year example. This is because the loan is repaid over a shorter period, leading to larger monthly installments. The calculator clearly shows the trade-off between shorter loan terms (resulting in lower overall interest paid) and higher monthly payments.

Impact of Loan Amounts and Interest Rates

The First Franklin Financial loan calculator effectively demonstrates the impact of varying loan amounts and interest rates on monthly payments. For instance, increasing the loan amount from $250,000 to $350,000 (while keeping the interest rate and loan term constant) will result in a proportionally higher monthly payment. Similarly, increasing the interest rate from 5% to 7% (with a fixed loan amount and term) will also lead to a higher monthly payment. The calculator accurately reflects these relationships, providing a clear picture of how these factors affect affordability.

Calculations for Different Loan Types

First Franklin Financial likely offers various loan products, such as home equity loans, personal loans, and auto loans. The calculator’s adaptability to different loan types is crucial. For example, a home equity loan calculation would require inputs such as the home’s appraised value, existing mortgage balance, and the desired loan amount. A personal loan calculation would require the loan amount, interest rate, and loan term. The calculator’s flexibility to accommodate these diverse input requirements is essential for providing accurate payment estimates across various financial products.

Impact of Down Payment on Monthly Payments

The following table illustrates the impact of varying down payments on monthly payments for a $300,000 home loan with a 30-year term and a 6.5% interest rate. Note that these are estimates and do not include taxes, insurance, or other potential fees.

| Down Payment (%) | Loan Amount | Estimated Monthly Payment |

|---|---|---|

| 5% | $285,000 | $1850 (Estimate) |

| 10% | $270,000 | $1750 (Estimate) |

| 20% | $240,000 | $1550 (Estimate) |

Factors Affecting Loan Calculations

Understanding the intricacies of loan calculations requires a grasp of several key factors that significantly impact the overall cost of borrowing. These factors interact in complex ways, influencing both monthly payments and the total interest paid over the loan’s lifetime. This section will delve into the most significant variables and their effects on your First Franklin Financial loan.

Loan Term Length’s Impact on Total Borrowing Cost, First franklin financial loan calculator

The length of your loan term directly affects the total interest you pay. Longer loan terms result in lower monthly payments, but you’ll pay significantly more interest over the life of the loan. Conversely, shorter loan terms mean higher monthly payments, but substantially less interest paid overall. Consider this example: A $200,000 loan at a 6% interest rate will have a monthly payment of approximately $1,199 over 15 years, resulting in a total interest paid of roughly $119,820. The same loan spread over 30 years will have a monthly payment of approximately $1,200, but the total interest paid will balloon to approximately $239,600. This demonstrates the substantial cost difference between longer and shorter loan terms.

Interest Rates and Their Relationship to Monthly Payments

Interest rates are a fundamental determinant of your monthly loan payments. Higher interest rates translate to higher monthly payments, even if the loan amount and term remain constant. Conversely, lower interest rates lead to lower monthly payments. For example, a $150,000 loan at 5% interest over 15 years would have a monthly payment around $1,185, while the same loan at 7% interest would have a monthly payment closer to $1,350. This illustrates the substantial impact of even small interest rate fluctuations.

Fixed versus Adjustable-Rate Mortgages

Fixed-rate mortgages offer predictable monthly payments throughout the loan’s term, as the interest rate remains constant. Adjustable-rate mortgages (ARMs), however, have interest rates that fluctuate based on market conditions. This can lead to unpredictable monthly payments, potentially increasing significantly over time if interest rates rise. Using the calculator, one could compare a 30-year fixed-rate mortgage at 6% to a 30-year ARM with an initial rate of 5% that adjusts annually. While the initial monthly payment on the ARM might be lower, the potential for substantial increases in subsequent years makes it a riskier option for borrowers who prefer financial stability. The First Franklin Financial loan calculator allows users to input different interest rate scenarios to explore these possibilities and make informed decisions.

Key Factors Influencing Total Interest Paid

The total interest paid on a loan is significantly influenced by a combination of factors. Understanding their interplay is crucial for effective financial planning.

- Loan Amount: Larger loan amounts naturally lead to higher total interest payments.

- Interest Rate: Higher interest rates directly increase the total interest paid.

- Loan Term: Longer loan terms result in substantially higher total interest payments.

- Loan Type: Fixed-rate loans offer predictable costs, while adjustable-rate loans introduce uncertainty.

Interpreting Calculator Results

The First Franklin Financial loan calculator provides a detailed breakdown of your potential loan repayment, allowing for informed decision-making. Understanding how to interpret the generated amortization schedule and key terms is crucial for making the best financial choices. This section will guide you through interpreting the calculator’s output and understanding its limitations.

Amortization Schedule Interpretation

The amortization schedule displays a month-by-month breakdown of your loan repayment. Each row represents a payment period, showing the payment date, the amount paid towards principal (the original loan amount), the amount paid towards interest (the cost of borrowing), and the remaining loan balance. The schedule clearly illustrates how your payments are allocated over the loan’s lifetime, with the proportion of principal increasing and interest decreasing over time. For example, in the early stages of a loan, a larger portion of your payment goes towards interest, while later payments allocate more towards principal reduction. This information helps borrowers visualize their repayment progress and understand the true cost of borrowing.

Key Term Definitions

- Principal: This is the original amount of money borrowed. It’s the debt you’re aiming to repay.

- Interest: This is the cost of borrowing money, expressed as a percentage (the annual percentage rate or APR). Interest accrues on the outstanding loan balance. A higher APR will result in higher interest payments over the life of the loan.

- Loan Balance: This represents the remaining amount of money owed on the loan after each payment. The balance decreases with each payment until it reaches zero at the end of the loan term.

Using Calculator Results for Informed Borrowing Decisions

The calculator’s results can be used to compare different loan scenarios. For example, you can input various loan amounts, interest rates, and loan terms to see how these factors affect your monthly payments and total interest paid. This allows you to choose a loan that fits your budget and financial goals. Let’s say you’re considering a $10,000 loan. By inputting this amount with different interest rates (e.g., 5%, 7%, 10%), you can see the significant impact on your total interest paid over the loan’s lifetime, helping you choose the most affordable option. Similarly, adjusting the loan term (e.g., 36 months, 60 months) will illustrate the trade-off between lower monthly payments (longer term) and higher total interest paid.

Calculator Limitations and Need for Professional Advice

While the First Franklin Financial loan calculator is a valuable tool, it has limitations. It doesn’t account for unexpected expenses, changes in your financial situation, or potential fees associated with the loan. The calculator provides estimates based on the inputted data; actual loan terms may vary. It’s crucial to consult with a financial advisor for personalized advice tailored to your specific circumstances before making any borrowing decisions. This is particularly important if you have complex financial situations, such as multiple debts or fluctuating income.

Visual Representation of Monthly Payment Breakdown

Imagine a bar graph representing a single monthly payment. The bar is divided into two sections: one representing the principal portion and the other representing the interest portion. In the early months of the loan, the interest section of the bar is significantly larger than the principal section. As the loan progresses, the size of the interest section gradually shrinks, while the principal section grows correspondingly. By the end of the loan term, the bar will primarily consist of the principal payment, indicating that the majority of your payments are now going towards paying off the loan itself. This visual representation effectively demonstrates how the allocation of your monthly payment shifts over time, from predominantly interest in the beginning to predominantly principal at the end.

Alternative Loan Options

First Franklin Financial offers a range of loan products beyond those covered by our online calculator. Understanding these alternatives is crucial for selecting the financing solution that best aligns with your individual financial circumstances and goals. This section details several key options, comparing their features, costs, and ideal applications.

Personal Loans

Personal loans from First Franklin Financial provide a lump sum of money for various purposes, such as debt consolidation, home improvements, or major purchases. Repayment is structured through fixed monthly installments over a predetermined term. Interest rates are typically fixed, offering predictable monthly payments. Personal loans are suitable for borrowers with good credit, as approval and interest rates are often contingent on creditworthiness.

Home Equity Loans

First Franklin Financial may also offer home equity loans, which leverage the equity in your home as collateral. This type of loan allows you to borrow a significant amount at potentially lower interest rates compared to unsecured personal loans. However, it’s crucial to understand that defaulting on a home equity loan could result in the loss of your home. Home equity loans are generally best suited for borrowers with substantial home equity and a stable financial history. The loan amount is typically determined by a percentage of your home’s appraised value, less any existing mortgage balance.

Secured Loans

Secured loans require collateral, such as a car or other valuable asset, to secure the loan. If you fail to repay the loan, the lender can seize the collateral. This typically results in lower interest rates than unsecured loans. First Franklin Financial might offer secured loans with various collateral options depending on the asset’s value and condition. This type of loan is suitable for borrowers who need a lower interest rate and have valuable assets they are willing to put up as collateral.

Lines of Credit

A line of credit from First Franklin Financial functions like a revolving credit account, allowing you to borrow money up to a pre-approved limit. You can withdraw funds as needed and repay them over time, with interest charged only on the outstanding balance. This flexibility is advantageous for managing unexpected expenses or fluctuating financial needs. However, interest rates can be variable, meaning your monthly payments might change. This option is best for borrowers who anticipate needing access to funds periodically and prefer a flexible repayment structure.

Comparison of Loan Options

The following table summarizes the key features of the alternative loan options offered by First Franklin Financial:

| Loan Type | Interest Rate | Collateral Required | Ideal Use Case | Benefits | Drawbacks |

|---|---|---|---|---|---|

| Personal Loan | Fixed, varies by credit score | No | Debt consolidation, home improvements, major purchases | Fixed payments, predictable budgeting | Potentially higher interest rates than secured loans |

| Home Equity Loan | Fixed or variable, typically lower than personal loans | Home equity | Home renovations, debt consolidation, large purchases | Lower interest rates, larger loan amounts | Risk of foreclosure if loan defaults |

| Secured Loan | Fixed or variable, typically lower than unsecured loans | Yes (e.g., car, other asset) | Various needs where collateral is available | Lower interest rates | Risk of losing collateral if loan defaults |

| Line of Credit | Variable | May or may not be required | Managing unexpected expenses, flexible financing | Flexibility, access to funds as needed | Variable interest rates, potential for high interest charges |

Wrap-Up

Mastering the First Franklin Financial loan calculator empowers you to take control of your financial future. By understanding the interplay of interest rates, loan terms, and loan amounts, you can confidently navigate the borrowing process and make informed decisions aligned with your financial goals. Remember to consider your individual circumstances and seek professional advice when needed to ensure you choose the loan option that best suits your specific needs. This calculator is a valuable tool, but it’s just one piece of the puzzle.

Essential FAQs

What happens if I input incorrect data into the calculator?

The calculator will provide results based on the data you input. Incorrect data will lead to inaccurate calculations. Double-check all entries before proceeding.

Does the calculator account for closing costs?

Typically, loan calculators like this one focus on principal and interest. Closing costs are separate and should be factored in separately when budgeting for a loan.

Can I use this calculator for loans other than mortgages?

The specific loan types supported are detailed within the calculator’s interface and accompanying documentation. Check the available options to see if your loan type is supported.

Where can I find more detailed information about First Franklin Financial’s loan products?

Visit the First Franklin Financial website or contact them directly for comprehensive information on all their loan products and terms.