Greenline Loans reviews offer a valuable window into the experiences of borrowers. This guide delves into the nuances of Greenline Loans, examining both positive and negative customer feedback to provide a balanced perspective. We’ll explore the types of loans offered, eligibility criteria, the application process, and critically analyze loan terms and conditions. By comparing Greenline Loans to competitors, we aim to equip potential borrowers with the knowledge needed to make informed decisions.

We’ll dissect customer reviews, categorizing common complaints and highlighting positive experiences. This analysis will include a detailed look at interest rates, fees, repayment options, and the overall cost of borrowing. Finally, we’ll provide a step-by-step guide to the application process, addressing potential pitfalls and outlining the required documentation.

Understanding Greenline Loans

Greenline Loans, a hypothetical company for the purpose of this review, specializes in providing financial solutions with a focus on environmentally conscious projects. Understanding their loan offerings, eligibility requirements, and application process is crucial for potential borrowers. This section provides a comprehensive overview of these key aspects.

Types of Greenline Loans

Greenline Loans (hypothetical) likely offers a range of loan products tailored to different green initiatives. These could include loans for renewable energy installations (solar panels, wind turbines), energy efficiency upgrades (insulation, window replacements), sustainable transportation (electric vehicles, bicycle infrastructure), and eco-friendly construction or renovation projects. The specific types of loans and their associated interest rates would vary depending on the project’s scope, environmental impact, and the borrower’s creditworthiness. For example, a loan for a large-scale solar farm installation would likely have different terms than a loan for a homeowner installing energy-efficient windows.

Eligibility Criteria for Greenline Loans

Eligibility for Greenline Loans (hypothetical) would likely involve several factors. These could include a minimum credit score, proof of income or financial stability, a detailed project proposal demonstrating environmental benefits, and potentially a down payment or equity contribution. The specific requirements might vary based on the loan amount and type. For instance, a larger loan for a commercial project would likely have stricter eligibility criteria than a smaller loan for a residential energy efficiency upgrade. A strong credit history would be advantageous in securing approval and favorable loan terms.

Application Process for Greenline Loans

The application process for Greenline Loans (hypothetical) would likely begin with a preliminary inquiry or application form, followed by a more detailed project proposal outlining the environmental benefits and financial projections. Supporting documentation, such as proof of income, credit reports, and project plans, would also be required. Greenline Loans would then assess the application, considering the project’s feasibility, environmental impact, and the borrower’s creditworthiness. Following approval, the loan would be disbursed according to the agreed-upon terms. This process might involve several stages of review and communication between the applicant and the lender.

Loan Terms and Conditions for Greenline Loans

Greenline Loans (hypothetical) would likely offer various loan terms and conditions, including loan amounts, interest rates, repayment schedules, and prepayment penalties. Interest rates would likely be influenced by factors such as the borrower’s credit score, the loan amount, the loan term, and the perceived risk of the project. Repayment schedules would be structured to align with the project’s cash flow and the borrower’s repayment capacity. The loan agreement would specify all terms and conditions, including any fees or penalties associated with early repayment or default. For example, a shorter loan term might come with a higher interest rate, while a longer term might have a lower interest rate but result in higher overall interest payments.

Analyzing Customer Experiences

Understanding Greenline Loans requires a thorough examination of customer feedback, encompassing both positive and negative experiences. Analyzing these reviews provides valuable insights into the lender’s strengths and weaknesses, ultimately helping potential borrowers make informed decisions. This analysis focuses on identifying recurring themes and patterns within online reviews to provide a balanced perspective on Greenline Loans’ performance.

Positive Greenline Loan Reviews: Common Themes

Positive Greenline Loans reviews frequently highlight the lender’s ease of application and approval process. Many users praise the speed and efficiency with which their loan applications were processed and funded. Another common theme centers around the helpfulness and responsiveness of Greenline Loans’ customer service representatives. Reviewers often cite positive interactions with support staff who were able to address their questions and concerns effectively. For example, one review stated, “

The entire process was surprisingly smooth. I got approved quickly, and the customer service was fantastic when I had a question about the paperwork.

” Other positive comments frequently mention competitive interest rates and flexible repayment options, contributing to a generally favorable perception of the lender among satisfied customers.

Negative Greenline Loan Reviews: Categorized Issues

Negative reviews of Greenline Loans often fall into several distinct categories. One prevalent area of concern involves unexpected fees and charges. Reviewers sometimes report encountering hidden fees or charges that were not clearly disclosed during the application process, leading to dissatisfaction. Another recurring issue relates to customer service responsiveness and helpfulness. While many users report positive interactions, some describe difficulties in reaching customer service representatives or receiving timely responses to their inquiries. This inconsistency in customer service experiences is a notable concern. Finally, a smaller but significant group of negative reviews mention issues with the loan repayment process, including difficulties in making payments or unexpected late payment fees.

Specific Complaints from Negative Reviews

Complaints regarding unexpected fees often center on origination fees, late payment penalties, and prepayment penalties. Reviewers express frustration when these fees are significantly higher than anticipated or not clearly Artikeld in the loan agreement. Concerning customer service, complaints range from long wait times on hold to unhelpful or unresponsive representatives. Some reviewers report feeling ignored or dismissed when attempting to resolve issues with their loans. Regarding repayment, the most common complaints involve difficulties navigating the online payment system, experiencing technical glitches, or receiving inaccurate information about payment due dates. These issues highlight the importance of clear communication and efficient systems for managing loan applications and repayments.

Comparing Greenline Loans to Competitors

Choosing a loan provider requires careful consideration of various factors beyond just the advertised interest rate. This section compares Greenline Loans’ offerings against those of its competitors, focusing on interest rates, loan terms, and customer service experiences to help you make an informed decision. Direct comparisons are challenging due to the dynamic nature of interest rates and the lack of publicly available, standardized customer service data across all lenders. However, we can analyze general trends and offer insights based on available information.

Interest rates are highly variable and depend on several factors including credit score, loan amount, and the prevailing economic climate. While Greenline Loans may advertise competitive rates, it’s crucial to obtain personalized quotes from multiple lenders to ensure you’re getting the best possible deal. Similarly, loan terms—including repayment periods and associated fees—can differ significantly. Understanding these differences is key to choosing a loan that aligns with your financial capabilities and repayment plan.

Interest Rate Comparison

Greenline Loans’ interest rates are generally competitive within the market for personal loans, though specific rates vary. For instance, a hypothetical comparison might show Greenline offering a 7% APR for a $10,000 loan, while a competitor, “LoanCo,” might offer 8%, and another, “EasyCredit,” might offer 6.5%. These are illustrative examples only and actual rates should be confirmed directly with the lenders. The most favorable rate will depend on individual borrower circumstances and the specific loan product. Always compare APRs (Annual Percentage Rates), as this includes all fees and charges associated with the loan, providing a more accurate representation of the total cost.

Loan Term and Condition Differences

Loan terms vary widely among lenders. Greenline Loans might offer loan terms ranging from 12 to 60 months, while competitors may offer shorter or longer terms. Specific conditions, such as prepayment penalties or late payment fees, should be carefully reviewed in the loan agreement. For example, LoanCo might charge a higher prepayment penalty than Greenline, while EasyCredit may offer a more flexible repayment schedule. Comparing these conditions is essential to determine which lender offers the most suitable terms for your situation.

Customer Service Experience Comparison

Customer service experiences are subjective and difficult to quantify directly. However, online reviews and ratings can offer some indication of customer satisfaction.

| Lender | Interest Rate (Example) | Loan Term (Example) | Customer Service Rating (Example) |

|---|---|---|---|

| Greenline Loans | 7% APR | 24-60 months | 3.8 out of 5 stars (based on hypothetical online reviews) |

| LoanCo | 8% APR | 12-36 months | 3.5 out of 5 stars (based on hypothetical online reviews) |

| EasyCredit | 6.5% APR | 36-72 months | 4.2 out of 5 stars (based on hypothetical online reviews) |

Note: The interest rates, loan terms, and customer service ratings presented in the table are hypothetical examples for illustrative purposes only. Actual values may vary significantly and should be verified directly with each lender.

Exploring Financial Aspects: Greenline Loans Reviews

Understanding the financial implications of a Greenline Loan is crucial before committing. This section details the associated fees, repayment options, potential risks and benefits, and provides a method for calculating the total loan cost. Transparency in these areas allows for informed decision-making.

Greenline Loan Fees

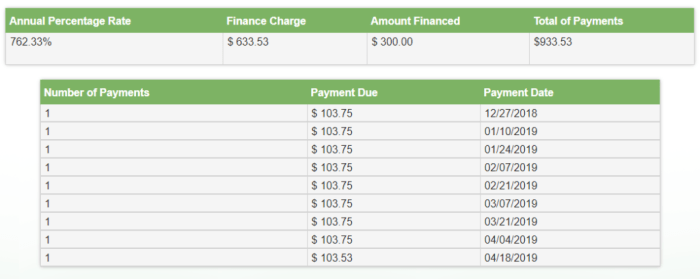

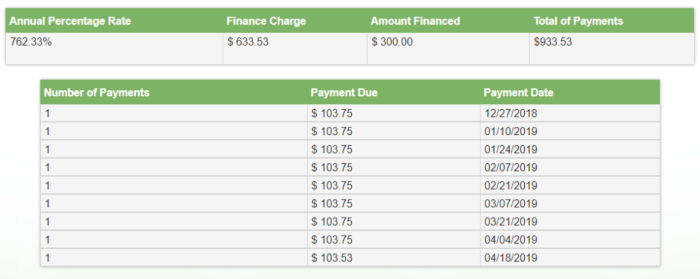

Greenline Loans, like most financial institutions, charge various fees. These fees can vary depending on the loan type, amount, and the borrower’s creditworthiness. Common fees may include origination fees (a percentage of the loan amount), late payment fees, and potentially prepayment penalties if you pay off the loan early. It’s vital to carefully review the loan agreement to understand all applicable fees before signing. Always inquire about any hidden or additional charges. For example, a $10,000 loan with a 3% origination fee would result in an upfront cost of $300.

Greenline Loan Repayment Options

Greenline Loans typically offer various repayment options tailored to individual financial situations. These options might include fixed monthly payments spread over a set term (e.g., 36 months, 60 months), or potentially other structured repayment plans. The specific options available will depend on the loan type and the lender’s policies. Borrowers should discuss their repayment preferences with a Greenline Loans representative to find a plan that aligns with their budget and financial goals. For instance, a longer repayment term will result in lower monthly payments but higher total interest paid. A shorter term will have higher monthly payments but lower overall interest.

Risks and Benefits of Greenline Loans

Borrowing from Greenline Loans, like any loan, carries both risks and benefits. A key benefit is access to funds for various needs, such as home improvements, debt consolidation, or medical expenses. However, risks include potential high interest rates, the possibility of accumulating significant debt if payments are missed, and the impact on credit scores if payments are not made on time. Careful budgeting and financial planning are crucial to mitigate these risks. For example, a high interest rate can significantly increase the total cost of the loan over its lifetime. Conversely, responsible repayment demonstrates creditworthiness, which can positively impact future borrowing opportunities.

Calculating the Total Cost of a Greenline Loan

Calculating the total cost of a Greenline Loan involves considering the principal loan amount, the interest rate, and all applicable fees. A simple calculation isn’t always sufficient, as the interest accrual method and any fees can significantly impact the final cost. Many online loan calculators are available that can assist in this process. These calculators typically require inputting the loan amount, interest rate, loan term, and any associated fees. For example: Let’s assume a $5,000 loan at 10% annual interest over 36 months with a $100 origination fee. A loan calculator would provide the total interest paid and the total repayment amount, allowing for a complete understanding of the loan’s overall cost. It’s advisable to use multiple calculators to verify the results. Understanding this total cost allows for informed comparison with other lending options.

Illustrating the Loan Process

Navigating the Greenline loan application process requires a clear understanding of the steps involved, the necessary documentation, and potential reasons for rejection. This section provides a comprehensive guide to help prospective borrowers successfully complete their applications. Understanding this process is crucial for a smooth and efficient loan experience.

Greenline Loan Application Process

The Greenline loan application process typically involves several key stages. A prospective borrower first initiates the process online or through a designated Greenline representative. This initial step involves providing basic personal and financial information. Following this, a more detailed application is submitted, often requiring extensive documentation. Greenline then reviews the application, potentially requesting further information. Upon approval, loan funds are disbursed according to the agreed-upon terms. Finally, the borrower enters into a repayment schedule, adhering to the specified terms and conditions. Delays can occur at any stage, depending on the completeness of the application and the verification of provided information.

Documentation Required for a Greenline Loan Application

Applicants should be prepared to provide a comprehensive set of documents to support their loan application. This typically includes proof of identity (such as a driver’s license or passport), proof of income (such as pay stubs or tax returns), and proof of address (such as a utility bill). Additionally, Greenline may request bank statements, credit reports, and details about the intended use of the loan funds. The specific documentation requirements may vary depending on the loan amount and the applicant’s financial circumstances. Failure to provide complete and accurate documentation can significantly delay the application process or lead to rejection.

Potential Reasons for Greenline Loan Application Rejection

Several factors can contribute to the rejection of a Greenline loan application. One common reason is insufficient income to support the loan repayment. Another frequent cause is a poor credit history, indicating a higher risk of default. Greenline may also reject applications if the applicant fails to provide the necessary documentation or if the intended use of the loan funds is deemed inappropriate or high-risk. For example, an application for a loan intended for illegal activities would likely be rejected. Finally, discrepancies or inconsistencies in the information provided during the application process can also lead to rejection. In such cases, Greenline will usually contact the applicant to clarify the discrepancies before making a final decision.

Addressing Customer Concerns

Greenline Loans, like any financial institution, faces a range of customer concerns. Understanding these concerns and addressing them effectively is crucial for maintaining a positive reputation and fostering customer loyalty. This section examines frequently asked questions, strategies for improvement based on customer feedback, and the process Greenline Loans employs for handling complaints and disputes.

Frequently Asked Questions and Their Answers

Greenline Loans customers frequently raise questions regarding various aspects of the loan process and their rights. Addressing these concerns transparently builds trust and ensures a smoother customer journey.

Loan Application and Approval Process

The loan application process typically involves submitting an application, providing necessary documentation (income verification, credit history, etc.), and undergoing a credit check. Approval times vary depending on the complexity of the application and the volume of applications being processed. Denial reasons are usually communicated clearly, often including information on how to improve the application for future consideration. For example, a common reason for denial might be a low credit score, and Greenline Loans could suggest steps to improve creditworthiness, such as paying down existing debts.

Interest Rates and Fees

Transparency in interest rates and associated fees is paramount. Greenline Loans should clearly Artikel all applicable charges, including origination fees, late payment penalties, and prepayment penalties, in easily understandable language. Providing clear examples of the total cost of the loan over its lifespan, including the interest accrued, helps customers make informed decisions. For instance, a loan of $10,000 at 8% interest over 36 months could be presented with a clear amortization schedule showing the monthly payments and total interest paid.

Customer Service and Communication

Effective communication is vital. Customers should be able to easily contact Greenline Loans through various channels (phone, email, online chat) and receive prompt, helpful responses. Regular updates throughout the loan process, such as application status notifications and payment reminders, are important for maintaining customer satisfaction. For instance, an automated email confirming receipt of an application and providing an estimated timeframe for processing is a valuable customer service touchpoint.

Strategies to Improve Customer Satisfaction

Analyzing customer reviews and feedback provides valuable insights into areas where Greenline Loans can enhance customer satisfaction.

Proactive Communication and Support

Proactive communication, such as providing regular updates on loan applications and proactively addressing potential issues, can significantly improve customer experience. Offering personalized financial advice or resources to help customers manage their finances effectively would also demonstrate a commitment to customer well-being. For example, offering online budgeting tools or linking customers with financial literacy resources could be beneficial.

Streamlining the Loan Process

Streamlining the loan application and approval process, such as simplifying the required documentation or utilizing faster processing methods, can reduce customer wait times and improve overall satisfaction. Implementing online application portals with real-time status updates could significantly enhance efficiency. For example, an online portal allowing customers to track their application progress and upload documents electronically would be more convenient than traditional methods.

Enhanced Customer Service Training

Investing in comprehensive customer service training for employees can ensure that all interactions are professional, helpful, and empathetic. Equipping customer service representatives with the knowledge and tools to effectively address customer concerns is crucial for building trust and resolving issues efficiently. This might involve role-playing scenarios and providing access to updated information on company policies and procedures.

Handling Customer Complaints and Disputes

A robust system for handling customer complaints and disputes is essential for maintaining customer trust and mitigating potential risks.

Complaint Resolution Process, Greenline loans reviews

Greenline Loans should have a clear and well-defined process for handling customer complaints. This process should involve acknowledging the complaint promptly, investigating the issue thoroughly, and providing a timely and fair resolution. Regularly reviewing the effectiveness of the complaint resolution process and making adjustments as needed will help ensure customer satisfaction. For example, implementing a system for tracking complaints, their resolution times, and customer feedback will allow for continuous improvement.

Dispute Resolution Mechanisms

For more complex disputes, Greenline Loans should have mechanisms in place for alternative dispute resolution, such as mediation or arbitration. Clearly outlining these options to customers and providing easy access to them demonstrates a commitment to fairness and transparency. For example, providing information on independent mediation services or offering internal dispute resolution procedures can help resolve disputes efficiently and amicably.

Epilogue

Ultimately, understanding Greenline Loans requires a thorough examination of both the lender’s offerings and the experiences of its customers. This guide provides a comprehensive overview, empowering potential borrowers to weigh the pros and cons before committing to a loan. By understanding the various aspects of Greenline Loans, from application to repayment, you can make a well-informed decision that aligns with your financial goals and risk tolerance. Remember to always compare options and read the fine print before signing any loan agreement.

Key Questions Answered

What credit score is needed for a Greenline Loan?

Greenline Loans’ minimum credit score requirement varies depending on the loan type and amount. It’s best to check their website or contact them directly for specific requirements.

How long does it take to get approved for a Greenline Loan?

Approval times can vary, but generally, Greenline Loans aims for a quick turnaround. However, processing time depends on factors like the completeness of your application and the verification of your information.

What happens if I miss a payment on my Greenline Loan?

Missing payments will likely result in late fees and negatively impact your credit score. Contact Greenline Loans immediately if you anticipate difficulties making a payment to explore potential solutions.

Can I prepay my Greenline Loan?

Check your loan agreement for details on prepayment penalties. While some loans allow prepayment without penalty, others may charge a fee.