How do I change my business address in Georgia? This seemingly simple question can trigger a complex process involving multiple state agencies and legal considerations. Relocating your business requires meticulous attention to detail, ensuring compliance with Georgia’s regulations to avoid penalties and maintain operational continuity. From updating your registration with the Secretary of State to notifying tax agencies and informing clients, we’ll guide you through each crucial step.

This comprehensive guide breaks down the process of changing your business address in Georgia, covering everything from the initial registration implications to the legal and tax ramifications. We’ll explore the specific requirements for different business structures, providing clear instructions and practical examples to ensure a smooth transition. By following these steps, you can confidently update your business address while maintaining compliance and minimizing disruptions.

Registering a Business in Georgia: How Do I Change My Business Address In Georgia

Registering a business in Georgia involves several steps and requires providing accurate information, including your business address. This address will be used for official communications, tax filings, and legal purposes. Choosing and correctly registering your business address is crucial for avoiding future complications and penalties.

Business Address Declaration During Registration

The initial declaration of your business address during the registration process depends on the type of business entity you are forming. For all business structures, the address you provide will be considered your registered agent’s address unless you appoint a registered agent separately. This registered agent is the designated individual or entity who receives legal and official documents on behalf of your business. The address you provide will be prominently featured on the registration documents. For example, when forming an LLC, the address is required on the Articles of Organization form filed with the Georgia Secretary of State. Similarly, corporations must provide their business address on their Certificate of Incorporation. Sole proprietorships, while not requiring formal registration with the state, often use their home address as the business address for tax and other purposes. Failure to accurately provide this information can lead to delays in processing your registration or even rejection of your application.

Updating the Registered Business Address During Initial Registration

While updating the business address *during* the initial registration process isn’t typically a separate step, it’s crucial to ensure the address you provide is accurate from the outset. If you discover an error before submitting your registration documents, you should correct it immediately. Most online registration portals allow for edits before final submission. However, once submitted, correcting an address requires filing an amendment with the Secretary of State, a process that involves additional paperwork and fees. Therefore, double-checking the accuracy of your address before submitting your application is essential.

Address Requirements for Different Business Structures in Georgia

The following table summarizes address requirements for various business structures in Georgia. Note that these requirements can change, so always refer to the most up-to-date information from the Georgia Secretary of State’s website.

| Business Structure | Address Requirements | Update Process | Penalties for Incorrect Address |

|---|---|---|---|

| Sole Proprietorship | No formal state registration; typically uses owner’s address for tax purposes. | Update with the IRS and other relevant agencies. | Potential delays in processing tax returns or other filings; may impact legal proceedings. |

| Limited Liability Company (LLC) | Registered agent address required on Articles of Organization; can be a physical street address or a commercial mail receiving agency address. | File a Certificate of Amendment with the Secretary of State. | Delays in processing legal documents; potential legal issues; fines. |

| Corporation | Registered agent address required on Certificate of Incorporation; similar to LLC requirements. | File a Certificate of Amendment with the Secretary of State. | Delays in processing legal documents; potential legal issues; fines. |

| Partnership | While not always required for state registration, a business address is usually needed for tax purposes and general business operations. | Update with the IRS and other relevant agencies. | Potential delays in processing tax returns or other filings; may impact legal proceedings. |

Updating the Address with the Georgia Secretary of State

Changing your business’s registered address in Georgia requires filing an amendment with the Georgia Secretary of State. This process ensures your business remains compliant with state regulations and allows for accurate communication and record-keeping. Failure to update your address can result in penalties or delays in receiving important state correspondence.

Amendment Process

The process for amending a business’s registered address with the Georgia Secretary of State involves completing the appropriate amendment form, paying the filing fee, and submitting the completed form and payment to the Secretary of State’s office. The specific form depends on your business entity type. For example, corporations use a different form than limited liability companies (LLCs). The entire process can typically be completed online, streamlining the procedure.

Required Forms and Their Acquisition

The Georgia Secretary of State’s website provides access to all necessary forms for amending business information, including the address. These forms are generally available as downloadable PDF documents. You can locate these forms by navigating to the Secretary of State’s business services section, typically under a heading like “Business Filings” or a similar designation. Searching the website for terms such as “amendment,” “address change,” and your specific business entity type (e.g., “LLC amendment,” “corporation amendment”) will also yield the appropriate forms. It is crucial to download the correct form for your business type to ensure accurate processing.

Filing Fees for Address Changes

The filing fee for changing a business address in Georgia varies depending on the business entity type. These fees are typically clearly stated on the relevant amendment forms and the Secretary of State’s website. It is advisable to check the website for the most current fee schedule before submitting your amendment. Fees are usually paid online during the electronic filing process, using credit cards or other accepted payment methods.

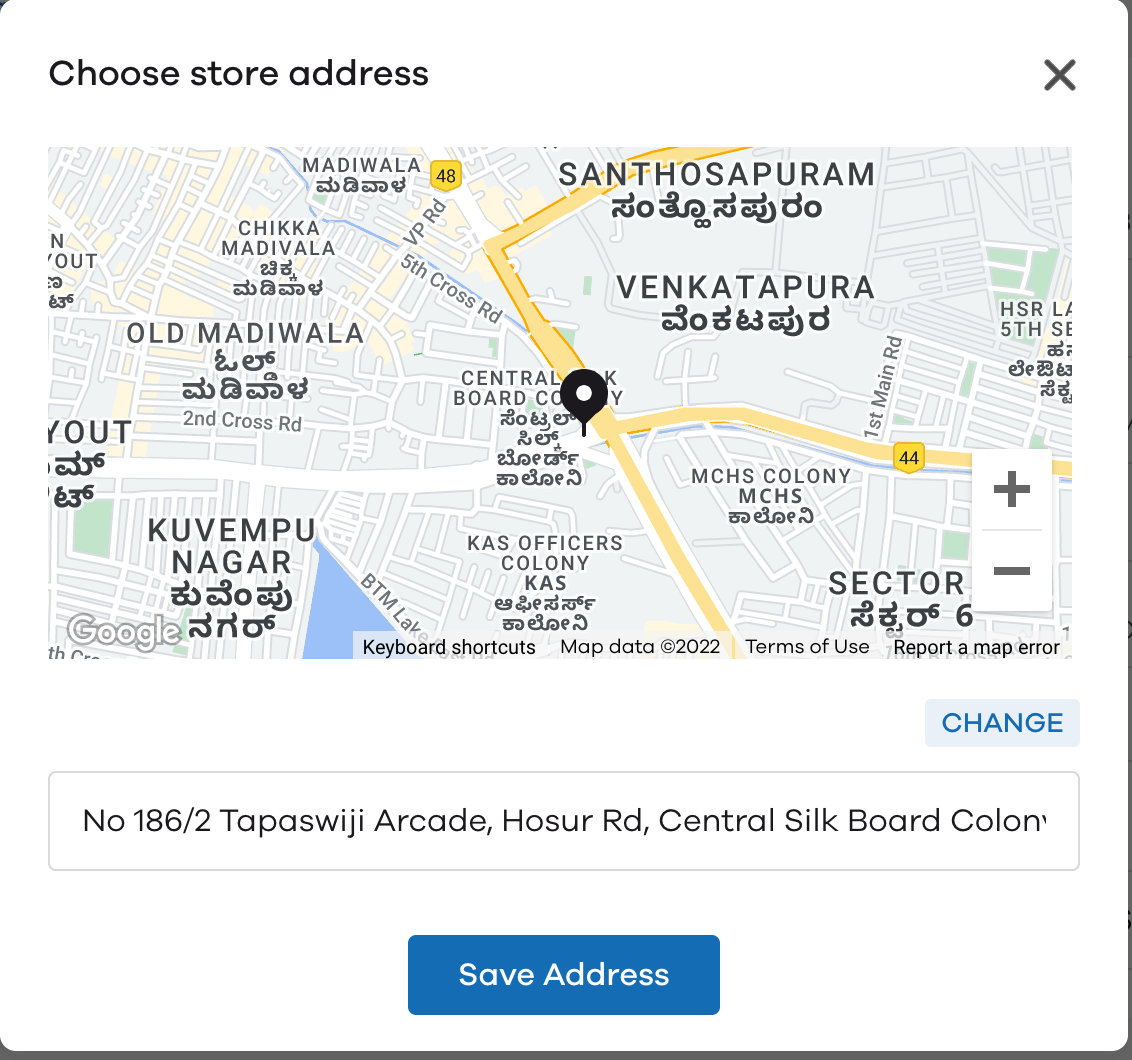

Completing the Address Change Form

Accurate completion of the amendment form is critical. The form will require information such as your business’s name, existing registered address, and the new registered address. It’s important to provide the new address in a consistent format. For example, a correctly formatted address might look like this:

123 Main Street, Suite 400

Atlanta, GA 30303

Avoid abbreviations or informal address styles. Double-check all information before submitting the form to prevent delays or rejection. Many forms allow for electronic signature, but check the specific form requirements.

Tax Implications of Changing a Business Address in Georgia

Changing your business address in Georgia necessitates notifying several state tax agencies to maintain compliance and avoid potential penalties. Failure to do so can lead to significant complications, including delayed tax filings, inaccurate tax assessments, and potential legal repercussions. This section Artikels the key tax agencies involved, the notification process, required documentation, and potential consequences of neglecting this crucial administrative task.

Relevant Georgia Tax Agencies

The primary Georgia tax agency affected by a business address change is the Georgia Department of Revenue (DOR). The DOR oversees various taxes, including sales tax, use tax, income tax (for businesses structured as corporations or partnerships), and withholding taxes. Depending on your business structure and activities, you may also need to notify other agencies, such as the Georgia Department of Labor if you have employees. It is crucial to verify which agencies apply to your specific business type and tax obligations.

Notifying Georgia Tax Agencies of an Address Change

The process of notifying Georgia tax agencies generally involves submitting a formal address change request. This usually entails completing a designated form, either online or via mail, providing your previous and new business addresses, your tax identification number (TIN), and other relevant business information. The specific forms and procedures vary depending on the agency and the type of tax. The DOR website provides comprehensive instructions and downloadable forms for various tax types. Directly contacting the relevant agencies for clarification is always advisable.

Documentation Required for Address Change Notification

The documentation required varies depending on the tax agency and the type of tax. However, generally, you will need to provide:

- Official business address change notification form: This form is usually obtained from the relevant agency’s website.

- Proof of new address: This could be a copy of your lease agreement, utility bill, or other official documentation showing your business’s new address.

- Business tax identification number (TIN): This is essential for the agency to identify your business accurately.

- Business legal name and structure: Accurate business information ensures proper record-keeping.

For example, when updating your address with the Georgia Department of Revenue for sales tax purposes, you might need Form DR-1, which requires the aforementioned details, including the new physical location of your business and any relevant changes to your business operations.

Potential Tax Implications of Failing to Update Address

Failing to update your business address with the relevant Georgia tax agencies can result in several negative consequences:

- Delays in tax processing: Tax returns sent to an outdated address might be delayed, potentially leading to late filing penalties.

- Inaccurate tax assessments: An incorrect address can lead to errors in tax calculations and assessments, resulting in underpayment or overpayment of taxes.

- Failure to receive important tax notices: Tax notices, including audits or payment reminders, might not reach you, leading to further complications.

- Legal penalties and interest: Late filings and non-compliance can result in significant penalties and interest charges.

- Difficulty in resolving tax disputes: An incorrect address can hinder communication with tax agencies, making it difficult to resolve any tax-related issues.

For instance, a business failing to update its address with the DOR for sales tax purposes might receive penalties for late filing if the tax return sent to the old address is not received on time. Similarly, a failure to receive important notices about an audit could lead to more severe penalties and potentially legal action.

Impact on Business Licenses and Permits

Changing your business address in Georgia necessitates updating your various business licenses and permits. Failure to do so can result in penalties, including fines or even license revocation. The specific procedures for updating your address vary depending on the licensing authority and the type of license or permit. This section details the process and necessary steps for updating your business address information across different licensing bodies.

Updating Business Licenses and Permits in Georgia

The process of updating your business address on licenses and permits generally involves submitting a formal notification to the issuing agency. This notification typically requires specific documentation, such as proof of your new address (e.g., a utility bill, lease agreement) and the appropriate application form. The timelines for processing these updates also vary depending on the agency’s workload and the completeness of your application. Some agencies may offer online portals for address changes, while others may require physical submission of paperwork. It’s crucial to check the specific requirements of each agency involved.

Procedures for Different License and Permit Types

The procedures for updating your address differ depending on the type of license or permit. For instance, a change of address for a retail business license issued by the county might involve a simpler process compared to updating a professional license governed by a state board. Some agencies may allow for online updates, while others may require mailed applications. Always confirm the specific procedures with the relevant agency. Failure to follow the correct procedures can lead to delays in processing your address change.

Address Update Steps for Various Business Licenses and Permits

The following table summarizes the steps involved in updating your business address for various licenses and permits in Georgia. Note that this information is for general guidance only, and it is crucial to verify the most up-to-date information with the relevant agency before submitting any updates.

| License/Permit Type | Update Method | Required Documentation | Contact Information |

|---|---|---|---|

| Retail Business License (County) | Online portal or mail | Application form, proof of new address (utility bill, lease agreement) | Contact your county’s business licensing department (Contact information varies by county – search online for “[County Name] Business License”) |

| Professional License (State Board) | Online portal or mail | Application form, proof of new address, license number | Contact the relevant state licensing board (e.g., Georgia Real Estate Commission, Georgia Department of Professional and Occupational Licensing) – specific contact information varies by profession. |

| Alcohol Beverage License (Georgia Department of Revenue) | Mail or in-person | Application form, proof of new address, license number, potentially additional documentation depending on the type of license | Georgia Department of Revenue, Alcohol and Tobacco Division (Specific contact information can be found on the Georgia Department of Revenue website) |

| Building Permits (Local Government) | In-person or mail | Application form, proof of new address, project details | Contact your local building permits office (Contact information varies by city/county – search online for “[City/County Name] Building Permits”) |

Legal and Compliance Considerations

Maintaining an accurate business address in Georgia is not merely a matter of administrative convenience; it’s a critical legal and compliance requirement with significant implications for your business. Failure to keep your registered address current can lead to serious legal repercussions, including penalties, lawsuits, and even business dissolution. This section details the legal requirements and potential liabilities associated with ensuring your business address is always up-to-date.

Legal Requirements and Potential Liabilities Associated with Maintaining an Accurate Business Address

Georgia law mandates that businesses maintain a current registered address with various state agencies, including the Georgia Secretary of State and the Department of Revenue. This address serves as the official point of contact for legal notices, tax documents, and other official communications. Providing an inaccurate or outdated address can lead to missed deadlines, penalties for non-compliance, and difficulty in resolving legal disputes. Furthermore, it can damage your business’s credibility and reputation. The liability extends beyond fines; failure to receive crucial legal documents due to an incorrect address could expose your business to significant legal and financial risks.

Consequences of Failing to Update the Business Address

Failing to update your business address with the relevant authorities in Georgia can result in a cascade of negative consequences. The most immediate consequence is often the non-receipt of important legal and tax documents. This can lead to missed deadlines for filing taxes, paying fees, or responding to legal actions, resulting in penalties and fines. More seriously, failure to receive a summons or other legal notice due to an outdated address could result in default judgments against your business, significantly impacting its financial stability and potentially leading to legal action. Furthermore, an outdated address can hinder communication with state agencies, delaying the processing of permits, licenses, and other essential business functions. In extreme cases, failure to maintain a current registered address can lead to the revocation of your business license or even the involuntary dissolution of your company.

Examples of Legal Issues Arising from an Outdated Business Address

Several scenarios illustrate the potential legal pitfalls of an outdated business address. Imagine a business that fails to update its address with the Georgia Department of Revenue. They subsequently miss a tax deadline due to non-receipt of the tax notice, incurring penalties and interest. Or consider a business that fails to update its address with the Secretary of State, resulting in their failure to receive a summons for a lawsuit. A default judgment could then be entered against them, leading to significant financial losses. Another example could involve a contractor who fails to update their address with their licensing board. If they miss a renewal notice due to an outdated address, their license could be revoked, halting their operations and potentially leading to legal disputes with clients.

Checklist for Legal Compliance When Changing a Business Address in Georgia, How do i change my business address in georgia

To ensure legal compliance when changing your business address in Georgia, follow this checklist:

- Notify the Georgia Secretary of State of your address change.

- Update your address with the Georgia Department of Revenue.

- Inform all relevant licensing and permitting agencies of the change.

- Update your address with the United States Postal Service (USPS).

- Notify your bank and other financial institutions.

- Update your business’s website and marketing materials.

- Inform your customers and suppliers of the new address.

- Review and update all business contracts and agreements to reflect the new address.

- Keep records of all address change notifications.

- Regularly review your business registration information to ensure accuracy.

Notification to Customers and Stakeholders

Changing your business address in Georgia requires more than just updating your registration; it necessitates informing your clientele and other stakeholders. Failing to do so can lead to lost business, frustrated customers, and damaged reputation. Proactive communication minimizes disruption and ensures a smooth transition.

Effective communication strategies are crucial for minimizing the impact of an address change on your business operations. A multi-pronged approach, leveraging various channels, guarantees that your message reaches a broad audience. This includes considering the preferences and communication habits of different stakeholder groups.

Methods for Announcing an Address Change

Several methods exist for effectively communicating your business address change. Each method offers unique advantages and should be selected based on your target audience and communication goals. A combination of approaches often proves most successful.

- Website Update: Prominently display the new address on your website’s contact page and other relevant sections. Consider adding a banner or announcement near the top of the page to draw immediate attention to the change. Include both the old and new addresses for a brief transition period to avoid confusion.

- Email Notification: Send a targeted email to your customer database, informing them of the address change and providing the new contact information. Include a clear and concise explanation of the reason for the move (if appropriate).

- Letter Notification: For clients who prefer traditional communication, a formal letter can reinforce the message. This is particularly relevant for high-value clients or those with whom you maintain a more formal relationship.

- Social Media Announcements: Utilize your social media platforms to announce the address change. This is a cost-effective method to reach a wide audience and maintain engagement.

Minimizing Disruption During Address Change

Planning and execution are key to minimizing disruption. Consider these strategies:

- Forwarding Mail: Arrange for mail forwarding with the United States Postal Service to ensure you receive all correspondence intended for your old address. This allows for a seamless transition without missing critical documents or communications.

- Update All Contact Information: Thoroughly update your address across all platforms – from your bank accounts and insurance providers to your online business listings and professional directories.

- Inform Employees and Suppliers: Ensure all internal and external stakeholders are aware of the address change to avoid any delays or confusion in operations and supply chain management.

- Phased Transition: If possible, consider a phased approach to the move, allowing time to adjust and address any unforeseen issues before fully transitioning to the new location.

Sample Email Notification

Subject: Important Update: Our New Business Address

Dear [Customer Name],

We’re excited to announce that we’ve moved to a new location! Effective [Date], our new address is:

[New Address]

[City, State, Zip Code]

Our phone number and email address remain the same.

We look forward to continuing to serve you at our new location. If you have any questions, please don’t hesitate to contact us.

Sincerely,

The [Your Company Name] Team