How do I file my business taxes separate from personal? This crucial question faces every business owner, regardless of size or structure. Successfully navigating the complexities of separating business and personal finances is essential for accurate tax filing, avoiding penalties, and ensuring the long-term health of your enterprise. Understanding the nuances of different business structures, proper record-keeping, and choosing the right accounting method are key steps in this process. This guide will walk you through the essential steps to ensure you’re compliant and confident in your tax filings.

From sole proprietorships to corporations, each business structure carries unique tax implications. We’ll explore these differences, outlining the specific forms and deadlines for each. Properly tracking income and expenses is paramount, and we’ll provide practical strategies for maintaining clear financial records. Additionally, we’ll delve into the differences between cash and accrual accounting methods, helping you select the best approach for your business. Finally, we’ll cover common mistakes to avoid and resources to help you along the way.

Understanding Business Structures and Tax Implications

Choosing the right business structure is crucial for both legal and financial reasons, significantly impacting your tax obligations. The structure you select determines how your business income is taxed, the level of personal liability you face, and the administrative burden involved in tax filing. Understanding these implications before launching your business can save significant time and money in the long run.

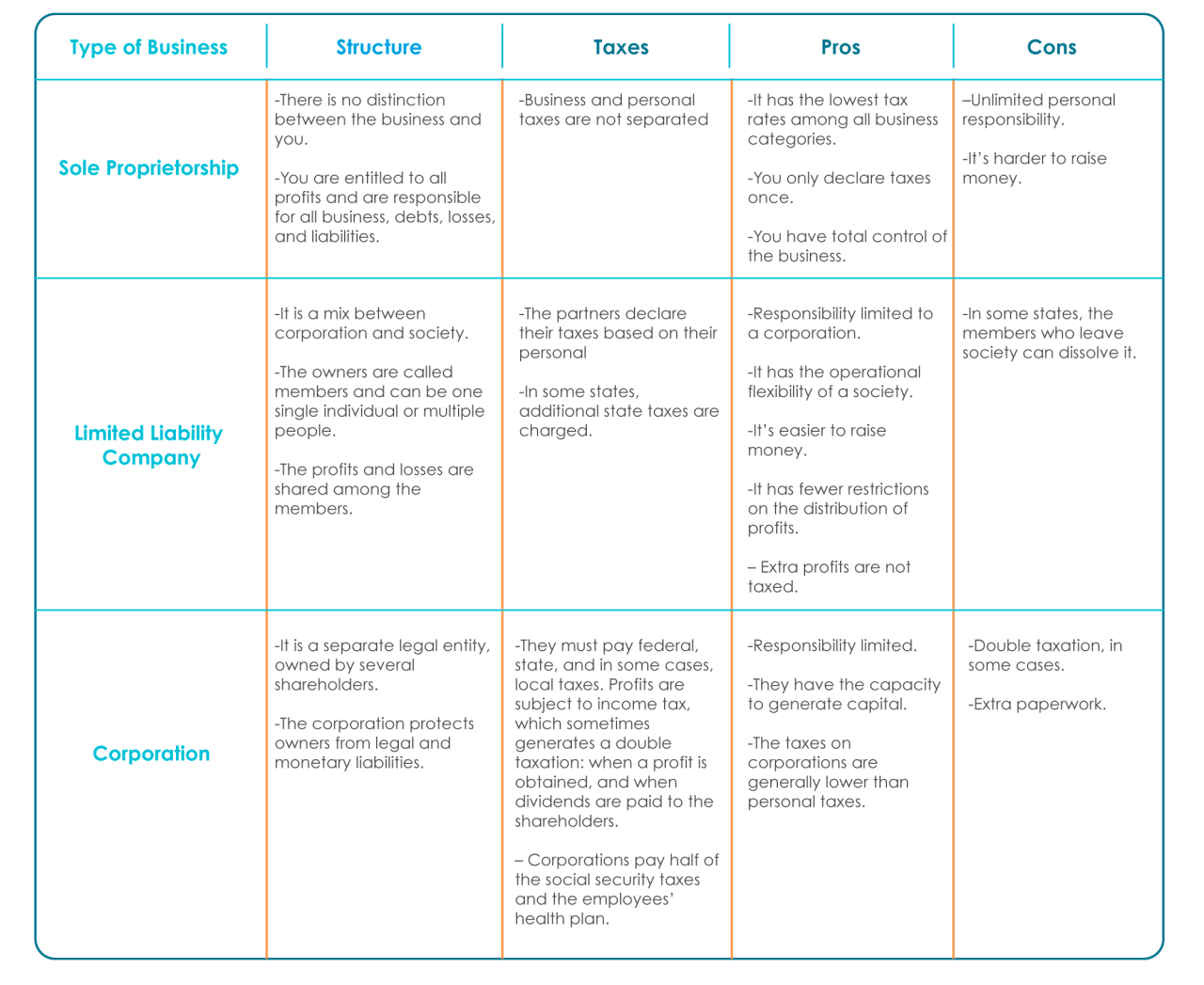

Business Structure Differences and Tax Implications

The four most common business structures—sole proprietorships, partnerships, LLCs, and corporations—each have distinct tax implications. Sole proprietorships and partnerships are considered pass-through entities, meaning their profits and losses are reported on the owners’ personal income tax returns. LLCs and corporations, on the other hand, can be taxed as pass-through entities or as separate legal entities, depending on their election and structure. This choice affects how profits are taxed and whether the business itself pays taxes separately from its owners.

Sole Proprietorship Tax Implications

A sole proprietorship is the simplest business structure, blending the business and owner legally and financially. Profits and losses are reported on the owner’s personal income tax return using Schedule C (Form 1040), “Profit or Loss from Business (Sole Proprietorship).” The owner is personally liable for all business debts and obligations. This structure offers ease of setup and minimal paperwork, but the owner faces unlimited personal liability.

Partnership Tax Implications

A partnership, involving two or more individuals, also operates as a pass-through entity. Income and losses are reported on each partner’s personal tax return using Form 1065, “U.S. Return of Partnership Income,” which is then allocated to individual partners via Schedule K-1. Like sole proprietorships, partners typically face personal liability for business debts. Partnerships offer the benefit of shared resources and responsibilities but require a well-defined partnership agreement to Artikel responsibilities and profit/loss sharing.

LLC Tax Implications

A Limited Liability Company (LLC) offers the flexibility to choose its tax classification. It can be taxed as a sole proprietorship, partnership, S corporation, or C corporation, depending on the election made with the IRS. This flexibility allows owners to optimize their tax situation based on their specific circumstances. However, LLCs offer limited liability protection, shielding personal assets from business debts.

Corporation Tax Implications

Corporations are separate legal entities from their owners, offering the strongest liability protection. They can be structured as either C corporations or S corporations. C corporations pay corporate income tax on their profits, and shareholders pay taxes on dividends received, leading to potential double taxation. S corporations, conversely, avoid double taxation by passing profits and losses through to shareholders’ personal income tax returns, similar to partnerships and LLCs taxed as pass-through entities. The choice between C and S corporation status depends heavily on factors like the expected level of profits and the shareholders’ individual tax brackets.

Tax Form Comparison

| Business Structure | Tax Form(s) | Filing Deadline | Key Considerations |

|---|---|---|---|

| Sole Proprietorship | Schedule C (Form 1040) | April 15th (or extension) | Unlimited personal liability; simple filing; income taxed at individual rates. |

| Partnership | Form 1065, Schedule K-1 | March 15th (or extension) | Unlimited personal liability for partners; income taxed at individual rates; requires partnership agreement. |

| LLC (varies by election) | Schedule C, Form 1065, Form 1120-S, Form 1120 (depending on election) | Varies by election (April 15th, March 15th, or September 15th) | Limited liability; flexible tax options; requires careful consideration of tax implications based on the chosen election. |

| C Corporation | Form 1120 | March 15th (or extension) | Limited liability; corporate income tax; potential for double taxation (corporate and shareholder level). |

| S Corporation | Form 1120-S, Schedule K-1 | March 15th (or extension) | Limited liability; income taxed at individual rates; avoids double taxation; stricter operational requirements. |

Separating Business and Personal Income

Successfully separating business and personal income is crucial for accurate tax filing and financial health. Blurring the lines can lead to significant penalties and complicate your financial planning. This section details effective methods for tracking business finances and avoiding common pitfalls.

Accurate tracking of business income and expenses is paramount. This ensures compliance with tax regulations and provides a clear picture of your business’s financial performance. Failing to meticulously separate business and personal finances can lead to significant tax liabilities and potentially even legal issues.

Methods for Tracking Business Income and Expenses

Maintaining detailed financial records is essential for accurate tax reporting and informed business decisions. Several methods can be employed to effectively track business income and expenses, ensuring a clear separation from personal finances. These methods include dedicated business bank accounts, accounting software, and meticulous record-keeping of all transactions.

A dedicated business bank account is the cornerstone of separating business and personal finances. All business income should be deposited into this account, and all business expenses should be paid from it. This provides a clear audit trail and simplifies the process of identifying business-related transactions. Using accounting software, such as QuickBooks or Xero, streamlines the process of tracking income and expenses. These programs automate many accounting tasks, including generating reports and creating financial statements. For smaller businesses, a simple spreadsheet can be sufficient, provided it is meticulously maintained. Every transaction, no matter how small, should be recorded with a description, date, and amount. This detailed record-keeping is essential for accurate tax preparation.

Common Mistakes in Separating Business and Personal Finances

Many small business owners make common mistakes when attempting to separate their business and personal finances. These mistakes can lead to inaccurate tax filings, increased tax liability, and potential audits. One frequent error is commingling funds—using the same bank account for both personal and business transactions. This makes it difficult to track expenses and income accurately, increasing the risk of misreporting to tax authorities. Another common mistake is neglecting to track all business expenses. This can range from overlooking small purchases to failing to account for home office deductions. Finally, inadequate record-keeping, such as using informal methods or failing to maintain receipts, can result in inaccurate tax reporting and difficulties during an audit.

Importance of Detailed Financial Records for Tax Purposes

Maintaining detailed financial records is not merely a good practice; it’s a legal requirement. The IRS requires businesses to maintain accurate records to support their tax returns. These records serve as evidence of income and expenses, allowing for accurate calculation of tax liability. Comprehensive records facilitate efficient tax preparation, minimizing the risk of errors and penalties. Furthermore, well-maintained records provide valuable insights into the financial health of the business, aiding in informed decision-making and strategic planning. In the event of an audit, detailed records offer crucial evidence to support the accuracy of the tax return, minimizing the likelihood of penalties or legal action. The absence of meticulous records can lead to significant complications and financial repercussions.

Sample Record-Keeping System for a Small Business, How do i file my business taxes separate from personal

A simple yet effective record-keeping system for a small business can significantly improve financial organization and tax compliance. This system should incorporate a dedicated business bank account, a detailed expense tracking log, and a system for storing receipts and invoices. The expense tracking log should include columns for date, description of expense, category (e.g., office supplies, marketing, travel), payment method, and amount. All receipts and invoices should be stored in a well-organized manner, either physically or digitally, with a clear labeling system. Regular reconciliation of bank statements with the expense log is essential to identify any discrepancies and ensure accuracy. This system allows for easy access to financial information needed for tax preparation and business analysis. Consider using cloud-based storage for easy access and backup.

Choosing the Right Accounting Method

Selecting the appropriate accounting method is crucial for accurately reflecting your business’s financial performance and determining your tax liability. The choice between cash and accrual accounting significantly impacts when income and expenses are recognized, ultimately affecting your tax burden in a given year. Understanding the nuances of each method is essential for optimal tax planning.

Cash Basis Accounting

Cash basis accounting recognizes income when cash is received and expenses when cash is paid. This method is simpler to implement and requires less record-keeping than accrual accounting. It provides a clear and straightforward picture of current cash flow. However, it can lead to a misrepresentation of a business’s true financial position if there are significant outstanding receivables or payables.

Accrual Basis Accounting

Accrual accounting recognizes income when it is earned, regardless of when cash is received, and expenses when they are incurred, regardless of when cash is paid. This method provides a more accurate reflection of a business’s financial performance over time, aligning revenue and expenses with the periods they relate to. It requires more detailed record-keeping and can be more complex to manage.

Comparison of Cash and Accrual Accounting Methods

The following table summarizes the key differences between cash and accrual accounting:

| Feature | Cash Basis | Accrual Basis |

|---|---|---|

| Income Recognition | When cash is received | When earned |

| Expense Recognition | When cash is paid | When incurred |

| Complexity | Simpler | More complex |

| Record-Keeping | Less extensive | More extensive |

| Financial Picture | Reflects cash flow | Reflects financial performance |

Appropriate Accounting Methods for Different Business Types

Small businesses with simple transactions and limited outstanding receivables or payables often find cash basis accounting suitable. Larger businesses with complex transactions, significant inventories, and credit sales typically use accrual accounting to provide a more accurate picture of their financial position. The IRS generally requires businesses with $25 million or more in average annual gross receipts to use accrual accounting. However, smaller businesses may choose to use accrual accounting for better financial management even if not required.

Advantages and Disadvantages of Each Method for Tax Purposes

Cash basis accounting simplifies tax preparation and can potentially defer tax liability by delaying income recognition. However, it may result in higher tax liability in years with high cash inflows. Accrual accounting provides a more accurate representation of income and expenses, potentially leading to a more stable tax liability over time. However, it increases the complexity of tax preparation and may require more sophisticated accounting software.

Examples of Tax Liability Impacts

Consider a small freelance writer using cash basis accounting. They invoice a client in December but receive payment in January. The income is recognized in January for tax purposes, delaying the tax liability. Conversely, a larger company using accrual accounting recognizes the revenue in December, when the service was performed, regardless of when payment is received. This can lead to a higher tax liability in the current year. A similar scenario applies to expenses. Under cash basis, an expense paid in December is deductible in that year. Under accrual, an expense incurred in December but paid in January is still deductible in December.

Completing the Necessary Tax Forms

Filing business taxes separately from personal taxes requires completing specific tax forms depending on your business structure. The accuracy and completeness of these forms are crucial for avoiding penalties and ensuring a smooth tax filing process. Understanding the requirements for each form is paramount.

Schedule C (Profit or Loss from Business) for Sole Proprietorships

Sole proprietors report their business income and expenses on Schedule C, which is then attached to their Form 1040, U.S. Individual Income Tax Return. This form details the profit or loss generated by the business during the tax year. Completing Schedule C involves meticulously recording all business revenue and deducting allowable business expenses. Accurate record-keeping throughout the year is essential for efficient completion of this form.

The process involves identifying all sources of business income, such as sales, fees, and other revenue streams. Then, you meticulously list all allowable business expenses, including costs of goods sold, rent, utilities, salaries, and marketing expenses. The difference between total revenue and total expenses determines the net profit or loss reported on Schedule C. Supporting documentation, such as invoices, receipts, and bank statements, is essential for substantiating the figures reported. For example, a freelancer might list their total client payments as income and deduct expenses such as their home office space, internet, and professional development courses.

Form 1065 (U.S. Return of Partnership Income) for Partnerships

Partnerships utilize Form 1065 to report their income and expenses. Unlike sole proprietorships, partnerships don’t pay taxes directly. Instead, the partnership files Form 1065, reporting the income and losses to each partner, who then reports their share on their individual tax returns (Form 1040). This form requires a detailed accounting of the partnership’s financial activities, including revenue, expenses, and the allocation of income and losses to each partner.

The process begins with compiling all financial records for the partnership throughout the tax year. This includes income statements, balance sheets, and other relevant financial documents. The partnership then determines the net income or loss, which is then allocated to each partner based on their ownership percentage or as defined in the partnership agreement. Each partner receives a Schedule K-1, which details their share of the partnership’s income, deductions, and credits. The partner then reports this information on their individual tax return. For example, a partnership of two equal partners would divide the net income equally, each receiving a Schedule K-1 reflecting 50% of the profits or losses.

Form 1120 (U.S. Corporation Income Tax Return) for Corporations

Corporations, as separate legal entities, file Form 1120 to report their income and expenses and calculate their corporate income tax liability. This form is significantly more complex than Schedule C or Form 1065, requiring detailed financial statements and adherence to corporate tax regulations. The corporation’s tax liability is determined based on its taxable income, which is calculated after deducting allowable business expenses from its gross income.

The process necessitates a thorough understanding of corporate tax laws and accounting principles. The corporation must maintain accurate financial records throughout the year, including income statements, balance sheets, and tax schedules. Form 1120 requires detailed information on various aspects of the corporation’s financial performance, including revenue, cost of goods sold, operating expenses, interest expense, and other deductions. The corporation’s tax liability is then calculated based on the applicable tax rates and any applicable credits or deductions. For instance, a corporation might deduct depreciation on its assets, research and development expenses, and charitable contributions to reduce its taxable income.

E-Filing Business Taxes

E-filing offers a convenient and efficient way to submit business tax returns. Several reputable tax preparation software programs and online services allow for electronic filing. Before e-filing, it’s crucial to ensure all information is accurate and complete, as errors can lead to delays or penalties. Many e-filing services offer error checking features to help identify potential problems before submission.

The e-filing process typically involves preparing the tax return using tax software, reviewing the return for accuracy, and then transmitting it electronically to the IRS. Most e-filing services provide confirmation of successful submission and often offer tracking tools to monitor the status of the return. E-filing significantly reduces processing time compared to paper filing, and it also minimizes the risk of errors associated with manual data entry. Choosing a reputable e-filing provider is crucial to ensure the security and confidentiality of your sensitive tax information.

Deductions and Credits for Businesses: How Do I File My Business Taxes Separate From Personal

Claiming deductions and credits is crucial for minimizing your business tax liability. Understanding which expenses are deductible and which credits you qualify for can significantly impact your bottom line. Properly documenting and reporting these items is essential for a successful tax filing.

Common Business Deductions

Numerous business expenses are deductible, reducing your taxable income. Accurate record-keeping is paramount for substantiating these deductions during an audit.

- Cost of Goods Sold (COGS): This includes the direct costs associated with producing goods sold by your business. For example, a bakery would include the cost of flour, sugar, and other ingredients in COGS. A software company would include the cost of programming labor directly related to a specific software product.

- Salaries and Wages: Payments made to employees, including wages, salaries, and benefits, are deductible. This also includes payroll taxes paid on behalf of employees.

- Rent and Utilities: Rent paid for office space or other business premises, along with utilities like electricity, gas, and water, are deductible business expenses. Properly allocate expenses if you use a portion of your home for business (see Home Office Deduction below).

- Office Supplies and Equipment: The cost of office supplies (paper, pens, ink) and equipment (computers, printers, furniture) can be deducted, often through depreciation over the asset’s useful life. Depreciation allows you to deduct a portion of the asset’s cost each year rather than all at once.

- Marketing and Advertising: Expenses related to promoting your business, such as advertising in newspapers or online, are deductible. This includes the costs associated with creating marketing materials and attending trade shows.

- Travel Expenses: Expenses incurred while traveling for business purposes, including transportation, lodging, and meals (subject to limitations), are deductible. You must maintain detailed records of your travel, including dates, destinations, and business purpose.

- Insurance: Premiums paid for business insurance, such as liability insurance or property insurance, are deductible.

Eligible Business Expenses

A comprehensive list of deductible business expenses is extensive. However, it’s important to note that some expenses may have limitations or require specific documentation. Always consult with a tax professional for guidance on specific situations.

- Professional fees (accountants, lawyers)

- Interest on business loans

- Vehicle expenses (for business use only, often requiring detailed mileage logs)

- Repairs and maintenance of business property

- Education and training expenses related to your business

- Bank charges

- Subscription fees for business software and services

Claiming Business Tax Credits

Business tax credits directly reduce the amount of tax owed, offering a more significant benefit than deductions. Several credits are available depending on your business type and activities.

- Research and Development (R&D) Tax Credit: This credit incentivizes businesses to invest in research and development activities. The credit is calculated based on qualified R&D expenses.

- Work Opportunity Tax Credit (WOTC): This credit encourages businesses to hire individuals from certain target groups, such as veterans or long-term unemployment recipients.

- Small Business Health Care Tax Credit: This credit helps small businesses offset the cost of providing health insurance to their employees.

The specific requirements and calculations for each credit can be complex, so seeking professional tax advice is recommended.

Home Office Deduction

If you use a portion of your home exclusively and regularly for business, you may be able to deduct expenses related to that space. This deduction can significantly reduce your tax liability. The deduction can be claimed either using the simplified method (a flat rate based on the square footage of your home office) or the regular method (which requires more detailed record-keeping and allows for the deduction of a larger percentage of expenses). The IRS provides detailed guidelines on calculating this deduction, and it is often advisable to seek professional assistance to ensure compliance. For example, if you use 100 square feet of a 1000 square foot home for business, you could deduct a percentage of your home-related expenses, such as mortgage interest, property taxes, utilities, and depreciation. The specific calculation depends on which method you choose and your individual circumstances.

Estimated Taxes and Quarterly Payments

Self-employment often means you’re responsible for paying estimated taxes throughout the year, unlike employees who have taxes withheld from their paychecks. Understanding this process is crucial for avoiding penalties and ensuring you meet your tax obligations. This section details the process, potential consequences, and calculation methods for estimated tax payments.

Estimated taxes are quarterly tax payments made by self-employed individuals and others who don’t have taxes withheld from their income. These payments cover income tax and self-employment tax. Accurate calculation and timely payment are essential to avoid penalties and interest charges.

Paying Estimated Taxes for Self-Employed Individuals

The process involves calculating your estimated tax liability, dividing it into four equal payments, and submitting them by the due dates. The IRS provides forms and instructions to guide taxpayers through this process. These payments are made through various methods, including online payment systems, mail, and authorized payment processors. Failure to pay on time can result in significant penalties.

Consequences of Not Paying Estimated Taxes on Time

Underpayment of estimated taxes can lead to penalties. The IRS assesses penalties based on the amount and duration of the underpayment. These penalties can significantly impact your overall tax burden, adding to the original tax owed. Interest may also accrue on unpaid taxes. Understanding the potential consequences encourages timely and accurate payment.

Calculating Estimated Tax Payments

Calculating estimated taxes requires careful consideration of various factors. A common method involves projecting your income and expenses for the year, determining your taxable income, and calculating the tax owed based on the applicable tax brackets. The self-employment tax, which covers Social Security and Medicare taxes, must also be included. A simplified calculation could involve using the previous year’s tax liability as a starting point, adjusting for any anticipated changes in income or deductions. For more accurate estimations, consulting a tax professional is advisable.

For example, let’s say a self-employed individual anticipates a net profit of $60,000 for the year. Using the current tax rates, they might calculate their income tax liability and add the self-employment tax (15.3% of net earnings). Dividing the total tax liability by four yields their estimated quarterly payment.

Scenarios Requiring Estimated Tax Payments

Various scenarios necessitate estimated tax payments. Self-employment is the most common, as mentioned earlier. However, others include situations where income is received from sources not subject to withholding, such as rental income, freelance work, or capital gains. Additionally, if an individual anticipates owing a substantial amount of taxes that exceeds the amount withheld from other income sources, they are generally required to make estimated tax payments. If you are unsure whether you need to pay estimated taxes, consulting a tax professional or using the IRS’s online resources is recommended.

Seeking Professional Tax Assistance

Navigating the complexities of business taxes can be challenging, even for experienced entrepreneurs. Seeking professional assistance is often the most effective way to ensure compliance, maximize deductions, and minimize potential tax liabilities. A qualified tax professional can provide valuable insights and guidance, saving you time, money, and potential headaches.

Benefits of Consulting a Tax Professional

Engaging a tax professional offers numerous advantages beyond simple tax form completion. They possess in-depth knowledge of tax laws and regulations, allowing them to identify deductions and credits you might otherwise miss. Their expertise can also help prevent costly errors and potential audits. Furthermore, they can provide strategic tax planning advice to minimize your overall tax burden in the long term, contributing to improved business financial health. This proactive approach can significantly impact your bottom line, far exceeding the cost of their services. For example, a CPA might identify a specific business expense deduction that saves a small business owner thousands of dollars, easily offsetting their professional fees.

Types of Tax Professionals

Several types of professionals specialize in tax preparation and planning. Certified Public Accountants (CPAs) are licensed professionals who have passed rigorous exams and meet stringent experience requirements. Enrolled Agents (EAs) are federally authorized tax practitioners who have passed a comprehensive IRS exam and have demonstrated expertise in tax law. Both CPAs and EAs can represent taxpayers before the IRS. Other professionals, such as tax attorneys, offer legal expertise related to tax matters, particularly beneficial in complex or contentious situations. The choice depends on your specific needs and the complexity of your tax situation.

Factors to Consider When Choosing a Tax Professional

Selecting the right tax professional is crucial. Consider their experience with businesses similar to yours, their understanding of your industry’s specific tax implications, and their fees. Check for professional certifications and any disciplinary actions or complaints filed against them. Look for someone who communicates clearly, answers your questions thoroughly, and provides personalized service tailored to your business’s unique circumstances. A strong track record of client satisfaction and testimonials are also valuable indicators of their competence and professionalism. For instance, a small business owner in the construction industry would benefit from selecting a tax professional with experience in that sector, as they would understand the specific deductions and challenges related to that industry.

Questions to Ask Potential Tax Professionals

Before engaging a tax professional, prepare a list of questions to ensure they are the right fit for your business. Inquire about their experience with businesses of your size and industry. Ask about their fees and payment methods. Clarify their process for tax preparation and communication frequency. Determine their availability for consultation throughout the year, not just during tax season. Finally, ask for references and testimonials from past clients to gauge their reputation and service quality. This proactive approach will help you find a professional who meets your needs and provides reliable and effective tax assistance.

Common Mistakes to Avoid

Filing business taxes separately from personal taxes requires meticulous attention to detail. Overlooking crucial aspects can lead to significant penalties and complications. Understanding common errors and implementing preventative strategies is crucial for smooth tax compliance. This section highlights frequent mistakes and offers solutions to avoid them.

Incorrect Classification of Expenses

Properly categorizing business expenses is fundamental. Misclassifying expenses as personal rather than business-related is a common error. This can significantly reduce your allowable deductions, leading to a higher tax liability. For example, claiming a personal vacation as a business trip or mixing personal and business use of a vehicle without accurate mileage tracking will result in an inaccurate tax return. To avoid this, maintain detailed records of all expenses, clearly indicating their business purpose. Use accounting software or spreadsheets to categorize transactions systematically. Always retain receipts and supporting documentation.

Failure to File Estimated Taxes

Many business owners are unaware of the requirement to pay estimated taxes quarterly. This applies to self-employed individuals and business owners who anticipate owing significant taxes. Failure to file and pay estimated taxes on time can result in penalties and interest charges. Accurate estimation requires careful forecasting of income and expenses throughout the year. Using last year’s tax return as a baseline and adjusting for anticipated changes is a good starting point. However, it is always advisable to consult a tax professional for personalized guidance on estimating tax liability.

Ignoring Self-Employment Taxes

Self-employed individuals are responsible for paying both the employer and employee portions of Social Security and Medicare taxes (self-employment tax). Forgetting to account for these taxes during tax preparation can lead to substantial underpayment. This tax is calculated on a portion of your net earnings from self-employment. Accurate calculation and timely payment are vital to avoid penalties. Understanding the self-employment tax rate and accurately calculating your taxable base is crucial.

Inaccurate Record Keeping

Maintaining accurate and organized financial records is paramount. Poor record-keeping can make it difficult to determine your income, expenses, and deductions accurately. This can lead to errors in your tax return and potential audits. Utilize accounting software, maintain detailed expense logs, and keep all receipts organized. Consider consulting a bookkeeper or accountant for assistance with record-keeping if needed. Remember, the IRS expects you to be able to substantiate any claim you make on your tax return.

Penalties for Incorrect Tax Filings

Incorrect tax filings can result in various penalties. These include penalties for underpayment, late filing, and inaccurate reporting. Penalties can range from a percentage of the underpaid tax to fixed amounts. In cases of intentional disregard of tax laws, the penalties can be significantly higher and may even involve legal repercussions. The severity of the penalties depends on factors such as the amount of underpayment, the reason for the error, and the taxpayer’s history. For instance, a simple oversight might result in a lower penalty than a deliberate attempt to evade taxes. Late filing penalties often accumulate daily, making prompt filing crucial.

- Underpayment Penalty: A penalty charged for not paying enough tax by the due date.

- Late Filing Penalty: A penalty for filing your tax return after the due date.

- Accuracy-Related Penalty: A penalty for substantial understatement of income or substantial overstatement of deductions.

- Failure to Pay Penalty: A penalty for not paying the tax owed by the due date.

Resources and Further Information

Navigating the complexities of business taxation can be challenging, even for experienced entrepreneurs. Fortunately, numerous resources are available to provide guidance and support throughout the process. This section Artikels key websites, publications, and assistance programs designed to help small business owners successfully manage their tax obligations. It also suggests helpful books and other resources to further enhance your understanding.

Understanding where to find reliable information is crucial for accurate tax filing. The following resources offer comprehensive guidance, practical tools, and support to assist you in every stage of the process, from understanding business structures to completing your tax returns.

IRS Publications and Websites

The Internal Revenue Service (IRS) is the primary source for information on US federal taxes. Their website offers a wealth of resources, including publications, forms, and instructions specifically tailored for small businesses. Key resources include the IRS website (www.irs.gov), which provides access to a vast library of publications covering various aspects of business taxation. Specifically, Publication 334, Tax Guide for Small Business, is an invaluable resource offering detailed information on various tax topics relevant to small businesses. Publication 463, Travel, Gift, and Car Expenses, provides guidance on deducting these common business expenses. Furthermore, the IRS offers interactive tax assistants and frequently asked questions (FAQs) sections to address common queries. Utilizing these tools can significantly streamline the tax preparation process and help avoid costly mistakes.

Small Business Tax Assistance Programs

Several programs offer assistance to small business owners with their tax obligations. The IRS itself offers various free services, including the Volunteer Income Tax Assistance (VITA) program and the Tax Counseling for the Elderly (TCE) program. These programs provide free tax help to qualifying taxpayers, particularly those with low-to-moderate income, persons with disabilities, and limited English-speaking taxpayers. Additionally, many states and local communities offer similar programs. These programs often provide in-person assistance or workshops, offering valuable guidance on tax preparation and related issues. Locating these programs can be done through a simple online search using s such as “small business tax assistance [your state/city]”. These programs can be especially beneficial for those new to business ownership or those lacking the resources to hire a professional tax preparer.

Helpful Books and Other Resources on Business Taxation

Supplementing online resources with dedicated books can provide a deeper understanding of business taxation. These resources offer comprehensive explanations, practical examples, and insights that can enhance your knowledge and confidence in managing your business finances.

- J.K. Lasser’s Small Business Taxes: This long-standing guide provides comprehensive coverage of various tax aspects relevant to small businesses.

- Tax Guide for Small Business (Publication 334): This IRS publication offers detailed guidance on various tax topics relevant to small businesses, including deductions, credits, and filing requirements.

- Business Owner’s Toolkit: Tax Planning and Compliance: This resource provides a practical approach to tax planning and compliance for business owners.