How do you put a lien on a business? This question, central to securing payment for goods or services rendered, unveils a complex legal landscape. Understanding the various types of business liens—mechanic’s liens, judgment liens, and tax liens—is crucial, as each carries specific filing requirements and legal ramifications. This guide navigates the intricacies of the lien filing process, outlining the necessary documentation, legal considerations, and potential pitfalls. We’ll also explore the impact of liens on business operations, financial standing, and creditworthiness, offering alternative debt recovery methods for comparison.

From navigating the steps involved in filing a lien to understanding the legal challenges and potential consequences, this comprehensive guide equips you with the knowledge to make informed decisions. We’ll delve into real-world examples to illustrate the process and provide clarity on the complexities involved in securing your payments. Whether you’re a contractor, supplier, or creditor, understanding how to pursue a lien effectively is vital for protecting your financial interests.

Types of Business Liens: How Do You Put A Lien On A Business

Placing a lien on a business is a serious legal action with significant consequences for both the creditor and the debtor. Understanding the different types of business liens is crucial for navigating these complex legal situations. This section Artikels the key characteristics of several common lien types, including their application, filing requirements, and implications.

Mechanic’s Liens

Mechanic’s liens, also known as construction liens, secure payment for labor, materials, or services provided to improve real property. In the context of a business, this could involve construction or renovation work done on a business building. For example, a contractor who performs renovations on a restaurant’s premises and is not paid can file a mechanic’s lien against the business’s property. Filing requirements vary by state, but generally involve providing a written notice to the property owner and filing a lien document with the relevant county or state agency within a specified timeframe (often within a few months of the completion of work). Failure to comply with these strict deadlines can invalidate the lien.

Judgment Liens

A judgment lien arises when a court enters a judgment against a business in a civil lawsuit. This judgment becomes a lien on the business’s assets, allowing the creditor to seize and sell those assets to satisfy the debt. For instance, if a supplier successfully sues a business for non-payment of goods, the court may issue a judgment against the business. The supplier can then record the judgment with the relevant county or state court, creating a judgment lien against the business’s assets. The process for recording a judgment lien also varies by jurisdiction.

Tax Liens

Tax liens are placed on a business’s assets by government entities (federal, state, or local) when the business fails to pay taxes owed. These can include income taxes, sales taxes, property taxes, or other business-related taxes. For example, if a business fails to remit sales taxes collected from customers, the state’s tax agency can file a tax lien against the business’s assets. The government generally follows a process of sending notices of delinquency before filing a lien. The priority of tax liens is often superior to other types of liens, meaning the government will be paid first from the sale of assets.

| Lien Type | Purpose | Secured by | Filing Requirements |

|---|---|---|---|

| Mechanic’s Lien | Secure payment for labor, materials, or services related to real property improvement. | Real property | Written notice to owner, filing with county/state agency within a specified timeframe. |

| Judgment Lien | Secure payment of a court judgment. | Business assets | Recording the judgment with the relevant county/state court. |

| Tax Lien | Secure payment of unpaid taxes. | Business assets | Government agency filing after notices of delinquency. |

The Lien Filing Process

Filing a lien against a business is a legal process that requires careful attention to detail and adherence to specific state regulations. The steps involved, necessary documentation, and legal deadlines vary significantly depending on the type of lien and the jurisdiction. Understanding these intricacies is crucial for ensuring the successful enforcement of your claim.

The process generally involves preparing the necessary documentation, filing the lien with the appropriate government agency, and properly serving notice to the business. Failure to comply with these steps can result in the invalidation of your lien, jeopardizing your ability to recover the debt.

Required Documentation for Lien Filing

The specific documents required will depend on the type of lien being filed (e.g., mechanics lien, tax lien, judgment lien). However, common documentation includes proof of the debt, a detailed description of the services rendered or goods provided, and a legal description of the business property subject to the lien. Accurate and complete documentation is essential; omissions or inaccuracies can lead to rejection of the lien filing. For instance, a mechanics lien requires detailed invoices showing the work performed, materials supplied, and dates of service. A tax lien would require official documentation from the relevant tax authority. A judgment lien necessitates a certified copy of the court judgment.

Legal Requirements and Deadlines for Lien Filing

Each state has its own statutes governing the filing of liens, including specific deadlines for filing. These deadlines are strictly enforced, and missing them can result in the loss of the lien’s validity. For example, a mechanics lien might require filing within a certain number of days after the completion of work, while a tax lien follows a different timeline determined by the tax authority’s procedures. It’s critical to consult state statutes and seek legal counsel to understand the specific requirements and deadlines applicable to your situation. Ignoring these deadlines can severely impact the effectiveness of your lien. Furthermore, the lien must be filed in the correct county or jurisdiction where the business operates.

Step-by-Step Guide to Filing a Lien

Filing a lien involves several distinct steps, each requiring careful execution. Failure at any stage can compromise the entire process.

- Gather Necessary Documentation: Compile all required documents, ensuring accuracy and completeness. This includes proof of debt, invoices, contracts, and any other relevant supporting evidence.

- Prepare the Lien Document: The lien document must accurately reflect the amount owed, the nature of the debt, and a precise description of the business property subject to the lien. Consult legal counsel to ensure compliance with all applicable state requirements.

- File the Lien with the Appropriate Agency: File the lien with the designated government agency, usually the county recorder’s office or a similar body. Retain a copy of the filed document for your records.

- Serve Notice to the Business: Proper service of notice to the business is crucial. The specific requirements for notice vary by state and lien type. Consult legal counsel to ensure compliance.

- Record the Lien: The lien is officially recorded upon acceptance by the filing agency. This establishes the lien’s priority and provides public notice.

Potential Pitfalls to Avoid During Lien Filing, How do you put a lien on a business

Several common pitfalls can derail the lien filing process. These include missing filing deadlines, providing inaccurate information, failing to properly serve notice, or filing in the wrong jurisdiction. Seeking legal counsel is strongly recommended to avoid these pitfalls and ensure the successful enforcement of your lien. For instance, a minor error in the description of the property could render the entire lien invalid. Similarly, neglecting to properly serve notice to the business could leave the lien unenforceable.

Legal Considerations

Placing a lien on a business carries significant legal ramifications that require careful consideration. Understanding the potential challenges and navigating the complexities of lien laws across different jurisdictions is crucial for a successful outcome. Failure to adhere to legal procedures can result in the invalidation of the lien, wasted resources, and potential legal repercussions for the lienholder.

Legal Ramifications of Placing a Lien on a Business involve a multitude of factors, including the validity of the underlying debt, proper adherence to procedural requirements, and potential defenses the business owner may raise. The process itself can be complex, and errors can lead to significant delays and increased costs. Furthermore, the lien may affect the business’s creditworthiness and ability to secure future financing.

Potential Legal Challenges During the Lien Process

Several legal challenges can arise during the lien process. The business owner may contest the validity of the debt, arguing that the amount owed is incorrect or that the debt is not legally enforceable. They might also challenge the proper notification procedures or the accuracy of the lien documentation. Additionally, the business owner may file a lawsuit to have the lien removed, claiming that the lien is improperly filed or that it violates their rights. The lienholder must be prepared to defend the validity of the lien and demonstrate compliance with all applicable laws and regulations.

Comparison of Lien Filing Processes Across Jurisdictions

Lien laws vary significantly across jurisdictions. For instance, the specific requirements for filing a lien, the types of liens available, and the procedures for enforcing a lien can differ substantially between states, and even between counties within a state. Some jurisdictions may require specific forms or notarization, while others may have more lenient requirements. The time limits for filing a lien also vary, and missing these deadlines can render the lien invalid. Understanding the specific legal requirements of the relevant jurisdiction is paramount before initiating the lien filing process. A thorough review of state and local statutes, along with consultation with legal counsel, is highly recommended. For example, a mechanic’s lien in California has different filing requirements than one in New York. The process in California may involve recording the lien with the county recorder’s office, while New York may have additional steps or requirements.

Common Legal Mistakes to Avoid When Filing a Lien

Failing to accurately follow the prescribed legal procedures is a common pitfall. This includes mistakes in the documentation, such as incorrect information about the debtor or the amount owed, or failure to properly serve the required notices. Another common mistake is missing the statutory deadline for filing the lien. Additionally, neglecting to conduct thorough research on the applicable laws and regulations in the relevant jurisdiction can lead to significant problems. Insufficient evidence to support the claim underlying the lien is another critical error. Failing to seek legal counsel before proceeding can also result in avoidable mistakes and delays. Finally, not properly recording or perfecting the lien according to the specific requirements of the jurisdiction can invalidate the lien. To avoid these pitfalls, careful planning, accurate documentation, and adherence to strict timelines are crucial.

Impact on Business Operations

A lien significantly impacts a business’s operational efficiency and financial health. It creates a cloud over the business’s assets, potentially hindering its ability to secure future funding and conduct normal operations. The severity of the impact depends on the type of lien, its amount, and the overall financial stability of the business.

A lien acts as a claim against a business’s assets. This means that the creditor holding the lien has a right to seize and sell those assets to recover the debt owed. This can disrupt daily operations, especially if essential equipment or property is subject to the lien. Furthermore, the mere existence of a lien can damage the business’s reputation and its ability to attract investors or secure favorable loan terms.

Financial Consequences of a Lien

The financial consequences of a lien can be substantial and far-reaching. For example, a business facing a significant lien might struggle to meet its payroll obligations, pay suppliers, or invest in necessary upgrades. The legal fees associated with fighting a lien or negotiating a settlement can also add to the financial burden. A business might be forced to sell assets at a loss to satisfy the lien, further depleting its capital. Consider a small construction company with a lien placed on its equipment due to unpaid invoices; the inability to use that equipment for new projects directly translates to lost revenue and potential contract breaches.

Impact on Credit Rating and Loan Securing

A lien is a serious blemish on a business’s credit report. Lenders view liens as a significant risk, indicating potential financial instability and difficulty in repaying debts. This can make it incredibly difficult for the business to secure future loans, even for essential operating expenses or expansion opportunities. The presence of a lien might lead to higher interest rates on any loans that are approved, increasing the overall cost of borrowing. For instance, a restaurant with a tax lien might find it impossible to obtain a loan to renovate its facilities, hindering its competitiveness and potential for growth.

Short-Term and Long-Term Effects of a Lien

| Effect | Short-Term (within 1 year) | Long-Term (beyond 1 year) |

|---|---|---|

| Financial Stability | Cash flow problems, difficulty meeting obligations, potential asset sales | Reduced profitability, potential bankruptcy, difficulty attracting investment |

| Operational Efficiency | Disruption of daily operations, delays in projects, loss of productivity | Reduced market share, loss of key personnel, potential business closure |

| Credit Rating | Negative impact on credit score, difficulty securing new credit | Persistent low credit score, limited access to financing, difficulty expanding business |

| Reputation | Damaged reputation among suppliers and customers | Loss of customer trust, difficulty attracting new clients, potential legal battles |

Alternatives to Liens

Recovering debt from a business can be challenging, and while a lien is a powerful legal tool, it’s not always the most appropriate or effective solution. Several alternatives exist, each with its own set of advantages, disadvantages, and procedural steps. Choosing the right approach depends heavily on the specifics of the debt, the debtor’s financial situation, and the creditor’s resources.

Negotiation and Settlement

Negotiation offers a less adversarial approach to debt recovery. It involves direct communication between the creditor and the debtor to reach a mutually agreeable payment plan. This method avoids the time and expense of legal proceedings. The advantages include preserving the business relationship and potentially achieving a faster resolution. However, negotiation relies heavily on the debtor’s willingness to cooperate and may not be effective if the debtor is insolvent or unwilling to negotiate. The steps involve initiating contact, presenting the debt claim, and proposing a payment plan. Successful negotiation often requires compromise from both parties. For example, a creditor might accept a reduced payment amount in exchange for immediate payment, while the debtor might agree to a structured repayment schedule.

Mediation

Mediation involves a neutral third party facilitating communication and negotiation between the creditor and the debtor. The mediator helps both sides identify common ground and work towards a resolution. Mediation is less formal than litigation and can be a more cost-effective way to resolve disputes. Advantages include a higher likelihood of reaching a mutually agreeable settlement and preserving the business relationship. However, mediation requires the cooperation of both parties, and it may not be successful if the parties have irreconcilable differences. The process typically begins with an agreement to mediate, followed by sessions with the mediator, and culminates in a written agreement if a settlement is reached.

Arbitration

Arbitration is a more formal dispute resolution process than mediation, where a neutral arbitrator hears evidence and makes a binding decision. While still less expensive than litigation, arbitration offers a more structured and legally binding outcome. The advantages include a quicker resolution than litigation and a less formal setting than court. However, arbitration can be costly, and the arbitrator’s decision is final and binding. The process involves selecting an arbitrator, presenting evidence and arguments, and accepting the arbitrator’s decision. A common example might be a dispute over a contract where both parties agree to arbitration clauses beforehand.

Lawsuit and Judgment

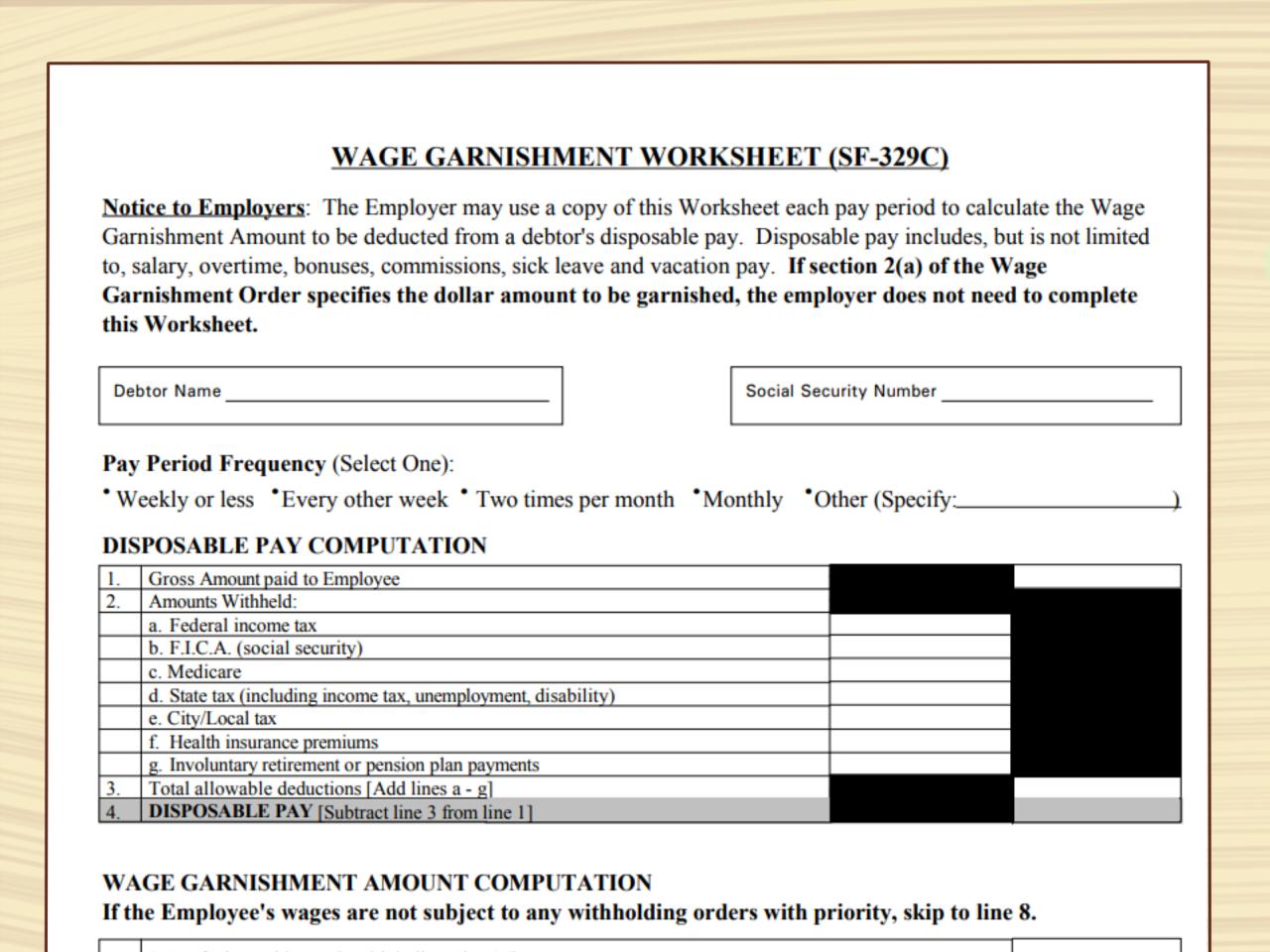

Filing a lawsuit is a more formal and aggressive approach to debt recovery. It involves initiating legal proceedings in court to obtain a judgment against the debtor. A judgment allows the creditor to pursue various enforcement methods, such as wage garnishment or bank levies, to collect the debt. The advantages are the possibility of recovering the full debt amount and the legal power to enforce the judgment. However, lawsuits are expensive, time-consuming, and can damage the business relationship. The process involves filing a complaint, participating in discovery, presenting evidence in court, and obtaining a judgment. If the debtor fails to comply with the judgment, the creditor can pursue further legal action to enforce it.

Collection Agencies

Collection agencies specialize in recovering outstanding debts. They handle the process of contacting the debtor, negotiating payment plans, and pursuing legal action if necessary. The advantage is that it removes the burden of debt collection from the creditor. However, it involves paying a commission to the agency, and it can damage the business relationship. The process involves assigning the debt to the agency, which then handles all aspects of collection. The agency typically works on a contingency basis, meaning they receive a percentage of the recovered debt.

Illustrative Examples

Understanding the practical application of liens requires examining real-world scenarios. The following examples illustrate how mechanic’s liens and judgment liens function, and how lien disputes can be resolved. These examples are hypothetical but based on common legal practices and financial realities.

Mechanic’s Lien on a Business

Imagine “Fix-It Fast,” an auto repair shop, performs extensive repairs on “Speedy Delivery,” a courier company’s delivery van. The repair work totals $10,000. Speedy Delivery, despite repeated requests, fails to pay. Fix-It Fast, following the proper legal procedures in their state, files a mechanic’s lien against Speedy Delivery’s van. The lien is properly recorded with the relevant county clerk’s office. The lien amount includes the $10,000 for repairs, plus $500 in statutory interest and $200 in court filing fees, totaling $10,700. Speedy Delivery’s failure to settle the debt within the legally stipulated timeframe allows Fix-It Fast to pursue foreclosure on the van to recover the debt. The van is sold at auction, and the proceeds, after auction fees, are used to satisfy the lien. If the proceeds exceed $10,700, the surplus is returned to Speedy Delivery. If the proceeds are insufficient, Fix-It Fast may pursue additional legal action to recover the remaining balance.

Judgment Lien Against a Business

“Acme Widgets,” a manufacturing company, loses a lawsuit to “Supplier Solutions” for breach of contract. The court awards Supplier Solutions $50,000 in damages, plus $5,000 in court costs. This judgment is formally recorded with the court. Supplier Solutions then files a judgment lien against Acme Widgets’ business assets. This lien becomes a public record, attaching to Acme Widgets’ real and personal property. This means that if Acme Widgets attempts to sell any of its assets, Supplier Solutions has a claim on the proceeds up to the $55,000 owed. Supplier Solutions could initiate legal proceedings to seize and sell Acme Widgets’ assets to satisfy the judgment if Acme Widgets fails to make payment. This could involve obtaining a writ of execution from the court, which authorizes a sheriff or marshal to seize and sell assets.

Resolving a Lien Dispute

“Green Thumb Landscaping” placed a lien on “Cozy Cottages,” a real estate development company, for unpaid landscaping services totaling $25,000. Cozy Cottages disputes the amount, claiming only $18,000 was owed. Both parties attempt negotiation, but they fail to reach an agreement. Green Thumb Landscaping files a lawsuit to enforce the lien. Cozy Cottages countersues, presenting evidence supporting their claim of $18,000. The court reviews the evidence presented by both parties, including contracts, invoices, and witness testimonies. After considering the evidence, the court rules in favor of Cozy Cottages, reducing the lien amount to $19,500, reflecting a compromise considering partial acceptance of Green Thumb Landscaping’s work and a deduction for some disputed charges. The lien is adjusted to reflect the court’s decision, and Cozy Cottages pays the revised amount, resolving the dispute. The court costs associated with the lawsuit are divided between the two parties based on the court’s assessment of each party’s liability.