How does seller financing work for a business? This question unlocks a world of strategic financial options for both buyers and sellers involved in business acquisitions. Seller financing, unlike traditional bank loans, allows the seller to directly finance the buyer’s purchase, often structuring payments over an extended period. This approach can be particularly attractive in situations where securing a bank loan proves challenging, offering a unique pathway to successful business transitions.

This guide delves into the intricacies of seller financing, exploring its benefits and risks for both parties. We’ll examine different financing arrangements, compare them to traditional bank loans, and provide practical examples to illustrate the process. Understanding the legal and financial implications, as well as the importance of a well-structured agreement, is crucial for a smooth and mutually beneficial transaction. We’ll also highlight potential pitfalls and offer strategies for mitigating risk.

What is Seller Financing?

Seller financing, in the context of business acquisitions, is a financing arrangement where the seller of a business provides all or part of the funding for the buyer to purchase the business. Instead of relying solely on traditional bank loans or investor capital, the buyer utilizes the seller’s existing equity as a significant portion of the financing. This allows the buyer to acquire the business with a lower upfront cash investment, while the seller receives a portion of the purchase price over a period of time, often structured as a series of payments. This approach carries both advantages and disadvantages for both parties involved.

Seller financing is a powerful tool in business transactions, offering flexibility not always available through traditional banking channels. It allows buyers to overcome potential hurdles like securing sufficient bank financing or attracting investors, particularly for smaller businesses or those in niche markets where traditional lending might be more challenging. For sellers, it can offer a strategic exit strategy, allowing them to receive payment over time rather than a single lump sum. The specific terms and conditions are negotiated between the buyer and seller, providing a customized financing solution tailored to the unique circumstances of the transaction.

Types of Seller Financing Arrangements

Several different structures can be used for seller financing. The most common include:

- Installment Sales Contract: The buyer makes regular payments to the seller over a predetermined period, often with interest. The seller retains legal title to the business until the final payment is made. This provides the seller with a level of security.

- Promissory Note: A promissory note is a legal document outlining the repayment terms, including the principal amount, interest rate, payment schedule, and any other relevant conditions. This is a more flexible arrangement than an installment sales contract, allowing for various repayment structures.

- Wrap-Around Mortgage: In cases where the business owns property, the seller might retain the existing mortgage and issue a new, larger mortgage to the buyer that “wraps around” the original loan. The buyer makes payments to the seller, who then makes payments on the underlying mortgage.

- Equity Participation: The seller might retain a portion of the ownership in the business after the sale, receiving a share of the future profits as payment for the financing provided. This approach aligns the seller’s interests with the buyer’s success.

Examples of Businesses Utilizing Seller Financing

Seller financing is frequently used across a range of industries, particularly in situations where traditional financing is difficult to obtain. This often includes:

- Small businesses: Startups and small businesses often lack the financial history or collateral to qualify for conventional bank loans, making seller financing a viable alternative.

- Franchises: Franchise businesses can utilize seller financing to facilitate the transfer of existing franchise units.

- Real estate businesses: Seller financing is common in real estate transactions, particularly for smaller properties or those in less desirable locations.

- Manufacturing businesses: Established manufacturing businesses with specialized equipment or intellectual property might utilize seller financing to ensure a smooth transition and ongoing support from the previous owner.

Seller Financing vs. Bank Loan

The table below compares seller financing and traditional bank loans, highlighting key differences and their respective advantages and disadvantages:

| Feature | Seller Financing | Bank Loan | Advantages/Disadvantages |

|---|---|---|---|

| Funding Source | Business Seller | Financial Institution | Seller financing offers flexibility but may lack the standardized terms and regulatory oversight of a bank loan. Bank loans offer established processes but can be more stringent in their requirements. |

| Interest Rates | Negotiated between buyer and seller; often higher than bank loans | Based on market rates and borrower’s creditworthiness; typically lower than seller financing | Seller financing interest rates can be higher due to the increased risk for the seller, but they can be negotiated. Bank loan interest rates are typically lower but subject to market fluctuations and credit score. |

| Approval Process | Simpler and faster; less stringent requirements | More complex and time-consuming; rigorous credit checks and collateral requirements | Seller financing is often quicker to secure but may involve less due diligence. Bank loans offer greater scrutiny but can be more difficult to obtain. |

| Collateral | Often requires less collateral or none at all | Usually requires significant collateral to secure the loan | Seller financing’s reduced collateral requirements make it accessible to buyers with limited assets. Bank loans typically demand substantial collateral to mitigate lender risk. |

Benefits of Seller Financing for the Buyer: How Does Seller Financing Work For A Business

Seller financing offers several compelling advantages for the buyer, primarily revolving around improved cash flow management and enhanced negotiating power. By structuring the acquisition with seller financing, buyers can significantly reduce the upfront capital required, allowing them to allocate resources more strategically and pursue other growth opportunities.

Seller financing allows buyers to conserve their working capital. Instead of depleting reserves for a large down payment, the buyer can maintain operational liquidity, ensuring smooth business continuity and enabling them to invest in essential areas such as marketing, inventory, or staff development. This preservation of cash flow is crucial, particularly for businesses operating on tight margins or experiencing periods of rapid expansion.

Improved Negotiation Position, How does seller financing work for a business

Utilizing seller financing strengthens a buyer’s negotiation position. The seller’s willingness to finance a portion of the sale indicates a strong belief in the business’s potential for success. This confidence can be leveraged to negotiate more favorable terms on the overall purchase price, potentially reducing the total acquisition cost. Furthermore, a buyer who demonstrates a commitment to the deal through seller financing might secure a better purchase price than a buyer solely relying on traditional financing methods, which can be time-consuming and subject to lender approvals. This dynamic shifts the power balance in favor of the buyer.

Benefits for Buyers with Limited Capital

Seller financing is particularly beneficial for buyers with limited access to traditional financing. Start-ups, small businesses, or those with less-than-perfect credit scores often face difficulties securing bank loans or other forms of external funding. Seller financing provides an alternative pathway to acquire a business, circumventing the stringent requirements and lengthy approval processes associated with traditional financing. In these cases, the seller’s willingness to extend credit becomes a critical factor enabling the transaction.

Securing Acquisitions When Traditional Financing is Unavailable

Numerous situations exist where seller financing proves indispensable. For example, imagine a buyer interested in acquiring a profitable but small, niche business. Traditional lenders might perceive the limited scale or specialized nature of the business as too high-risk, making it difficult to obtain a loan. However, the seller, having a deep understanding of the business and its potential, might be willing to provide seller financing, facilitating the acquisition. Another example could be a situation where the buyer’s credit history isn’t ideal due to unforeseen circumstances like a previous business setback. In such instances, seller financing offers a lifeline, allowing the buyer to demonstrate their commitment and potentially rebuild their creditworthiness through successful operation of the acquired business. This illustrates how seller financing can bridge the gap when traditional avenues are blocked.

Benefits of Seller Financing for the Seller

Seller financing offers compelling advantages for business owners looking to exit their ventures. Beyond simply receiving the sale price, it provides financial incentives, favorable tax implications, and strategic tools to achieve desired exit strategies. Understanding these benefits is crucial for sellers considering this financing option.

Seller financing presents several key financial incentives. The most obvious is the potential for a higher overall return than a traditional sale. By structuring the sale with payments spread over time, the seller receives a stream of income, often at a higher interest rate than they could achieve through other investments. This can significantly boost their overall return on investment compared to a lump-sum payment. Furthermore, the seller retains some control over the business’s future performance, potentially impacting the value of their future payments.

Financial Incentives for Sellers

The financial advantages of seller financing stem from the ability to structure the deal to maximize the seller’s return. This includes negotiating a higher purchase price than might be possible with a cash buyer, as the buyer often benefits from easier financing terms. The seller can also negotiate a higher interest rate on the financing, generating additional income. This income stream can be particularly attractive for sellers approaching retirement, providing a steady flow of funds during their post-business years. For example, a seller might receive a higher purchase price by offering a 10% interest rate over 10 years, rather than accepting a lower all-cash offer upfront. The total amount received over the 10 years could exceed the cash offer significantly.

Tax Implications of Seller Financing

The tax implications of seller financing can be complex and depend on several factors, including the structure of the financing agreement and the applicable tax laws. Generally, the seller will recognize income from the interest payments received. This income is typically taxed as ordinary income, not capital gains, potentially resulting in higher tax liabilities in some cases. However, the seller can also deduct expenses related to the financing, such as collection costs. It’s crucial for sellers to consult with a tax professional to understand the specific tax implications of their financing arrangement. Accurate financial planning and professional tax advice are essential for optimizing the tax efficiency of a seller financing transaction. A well-structured deal can minimize tax burdens and maximize after-tax returns.

Seller Financing and Exit Strategies

Seller financing can be a powerful tool for achieving a variety of exit strategies. For sellers who want a complete exit, the structured payments offer a phased withdrawal from the business. For those who want to retain some involvement or a stake in the business’s future success, seller financing allows for that. This can be particularly appealing for sellers who have built strong relationships with their employees or customers and want to ensure the business’s continued success. This also allows the seller to potentially benefit from the business’s future growth.

Scenario: Retaining Equity Through Seller Financing

Imagine Sarah, the owner of a thriving bakery, wants to sell her business but retain some equity and ongoing involvement. A potential buyer, Mark, is interested but lacks the full cash purchase price. Sarah offers seller financing: Mark purchases the bakery for $500,000, paying a down payment of $100,000 and financing the remaining $400,000 with a 7% interest rate over 10 years. Additionally, Sarah negotiates a small equity stake (e.g., 10%) in the bakery’s future profits. This structure allows Sarah to receive a substantial upfront payment, a steady stream of income from interest payments, and a share in the bakery’s continued growth. This multifaceted approach allows her to achieve a smooth exit while still benefiting from the bakery’s future success. This scenario demonstrates how seller financing can be customized to meet specific seller goals and objectives.

Risks of Seller Financing for Both Parties

Seller financing, while offering attractive benefits for both buyers and sellers, presents inherent risks that require careful consideration and mitigation. Understanding these risks is crucial for structuring a successful and legally sound transaction. Failure to adequately address these potential pitfalls can lead to significant financial losses and legal disputes for both parties involved.

Seller financing introduces a unique set of risks compared to traditional financing methods. These risks stem from the extended relationship between the buyer and seller, the inherent uncertainty of the buyer’s ability to repay, and the potential for unforeseen circumstances to impact the transaction. Both buyers and sellers need to conduct thorough due diligence and create a comprehensive agreement to protect their interests.

Risks for the Seller

The primary risk for the seller is the potential for non-payment by the buyer. This risk is amplified when the buyer lacks a strong credit history or sufficient collateral. Furthermore, the seller becomes reliant on the buyer’s success for repayment, tying their financial well-being to the buyer’s business performance. The seller also faces the risk of prolonged involvement in managing the buyer’s business, potentially beyond the initial sale agreement. Delays in payments or default can lead to significant financial losses and protracted legal battles to recover the outstanding debt. Additionally, the seller may face challenges in reselling the business if the buyer defaults, particularly if the market conditions have changed since the initial sale.

Risks for the Buyer

The buyer in a seller-financed transaction assumes the risk of potential financial strain. The buyer must manage the business operations while simultaneously making payments to the seller. This can create a challenging financial burden, especially during periods of low revenue or unexpected expenses. Further, the buyer’s negotiating power may be limited, potentially leading to less favorable terms compared to traditional financing options. The buyer also faces the risk of the seller interfering in the management of the business, which can hinder operational autonomy and strategic decision-making. The terms of the seller financing agreement can create financial obligations that could hinder the buyer’s ability to secure future funding or invest in business growth.

Legal and Financial Risks

Both buyers and sellers face significant legal and financial risks if the transaction is not properly documented and structured. Legal risks include disputes over the terms of the agreement, breaches of contract, and potential litigation. Financial risks include losses from default, interest rate fluctuations, and the costs associated with legal action. Improperly drafted agreements can leave both parties vulnerable to unforeseen circumstances and disputes. For example, a poorly defined default clause could lead to lengthy and costly legal battles. Similarly, ambiguous clauses regarding interest rates or payment schedules can create misunderstandings and conflict.

Importance of Due Diligence

Thorough due diligence is paramount in mitigating the risks associated with seller financing. This includes a comprehensive review of the buyer’s financial statements, business plan, and credit history. The seller should also conduct a thorough assessment of the business’s assets and liabilities. For the buyer, due diligence should involve a careful review of the seller’s legal standing, the terms of the financing agreement, and the potential risks involved. Independent legal and financial advice should be sought by both parties before entering into any agreement.

Mitigating Risks Through Contractual Clauses

A well-drafted seller financing agreement should include specific clauses to mitigate the risks for both parties. Examples of crucial clauses include:

* Detailed Payment Schedule: A clear and comprehensive payment schedule specifying the amount, frequency, and due dates of payments. This reduces ambiguity and potential disputes.

* Default Clause: A well-defined default clause outlining the consequences of missed payments, including late fees, acceleration of the debt, and potential repossession of assets.

* Prepayment Penalty Clause: A clause specifying any penalties for early repayment of the debt, protecting the seller’s interest in receiving the agreed-upon interest payments.

* Interest Rate Clause: A clear and unambiguous clause defining the interest rate, its calculation method, and whether it is fixed or variable.

* Events of Default: A detailed list of events that would constitute a default by the buyer, triggering the default clause. This could include missed payments, failure to meet certain financial covenants, or material breaches of the agreement.

* Dispute Resolution Clause: A clause specifying the method for resolving disputes, such as arbitration or litigation, to avoid costly and time-consuming legal battles.

Structuring a Seller Financing Agreement

A well-structured seller financing agreement is crucial for protecting both the buyer and the seller. It Artikels the terms of the transaction, mitigating potential disputes and ensuring a smooth process. A poorly drafted agreement, however, can lead to significant financial and legal problems down the line. This section details the key components of a comprehensive agreement and highlights common pitfalls to avoid.

A robust seller financing agreement goes beyond a simple promissory note. It needs to comprehensively address all aspects of the transaction, from payment schedules to default provisions. This ensures both parties are protected and understand their obligations.

Key Components of a Seller Financing Agreement

Several key components are essential for a comprehensive seller financing agreement. These elements work together to create a legally sound and financially secure arrangement for both parties involved.

- Purchase Price and Payment Schedule: This clearly states the total purchase price and Artikels the payment schedule, including the down payment, the amount and frequency of subsequent payments (e.g., monthly, quarterly), and the total repayment period. A detailed amortization schedule is often included.

- Interest Rate and Calculation Method: The agreement must specify the interest rate charged on the outstanding balance. The method of calculating interest (e.g., simple interest, compound interest) should also be clearly defined. It should also address how and when interest payments are due.

- Security Interest and Collateral: This section details the collateral securing the loan, which is typically the business being purchased. It Artikels the seller’s rights in case of default, including the potential for repossession.

- Default Provisions: This crucial section Artikels the consequences of the buyer’s failure to meet the payment terms. It might include late payment penalties, acceleration clauses (allowing the seller to demand immediate repayment of the entire balance), and procedures for repossession or foreclosure.

- Prepayment Penalties: The agreement should specify whether prepayment penalties apply if the buyer pays off the loan early. These penalties can compensate the seller for lost interest income.

- Governing Law and Dispute Resolution: This section specifies the jurisdiction’s laws governing the agreement and Artikels the method for resolving disputes (e.g., arbitration, litigation).

- Representations and Warranties: Both buyer and seller make representations and warranties about the accuracy of information provided in the agreement. For example, the seller might warrant the accuracy of financial statements provided to the buyer.

- Assignment and Transfer: This clause addresses whether the buyer can assign or transfer their rights and obligations under the agreement to a third party. The seller’s consent might be required.

The Importance of Legal Counsel

Negotiating and drafting a seller financing agreement is complex and carries significant legal and financial implications. Seeking independent legal counsel is essential for both the buyer and the seller to ensure their interests are protected. An attorney can review the agreement, identify potential risks, and advise on the best course of action. They can also help to ensure the agreement complies with all applicable laws and regulations.

Common Pitfalls to Avoid

Several common pitfalls can lead to disputes and financial losses in seller financing arrangements. Careful planning and professional legal advice can help mitigate these risks.

- Unrealistic Payment Schedules: Agreements with overly ambitious payment schedules can lead to buyer default. The payment schedule should be realistic and aligned with the buyer’s projected cash flow.

- Inadequate Due Diligence: Buyers should conduct thorough due diligence on the business before entering into a seller financing agreement. This helps to identify potential problems and accurately assess the business’s value and earning potential.

- Lack of Clear Definitions: Ambiguous language or undefined terms can lead to disputes. The agreement should use clear and precise language to avoid any misunderstandings.

- Ignoring Tax Implications: Both parties should consult with tax professionals to understand the tax implications of the seller financing arrangement. This can help to minimize tax liabilities and avoid future complications.

- Insufficient Documentation: The agreement should be comprehensive and well-documented. This includes detailed financial statements, appraisals, and other relevant documents.

Illustrative Example of Seller Financing in Action

Seller financing can be a powerful tool for both buyers and sellers, but understanding its intricacies is crucial for a successful transaction. This case study examines a real-world example of seller financing, highlighting the financial details, timeline, and key considerations.

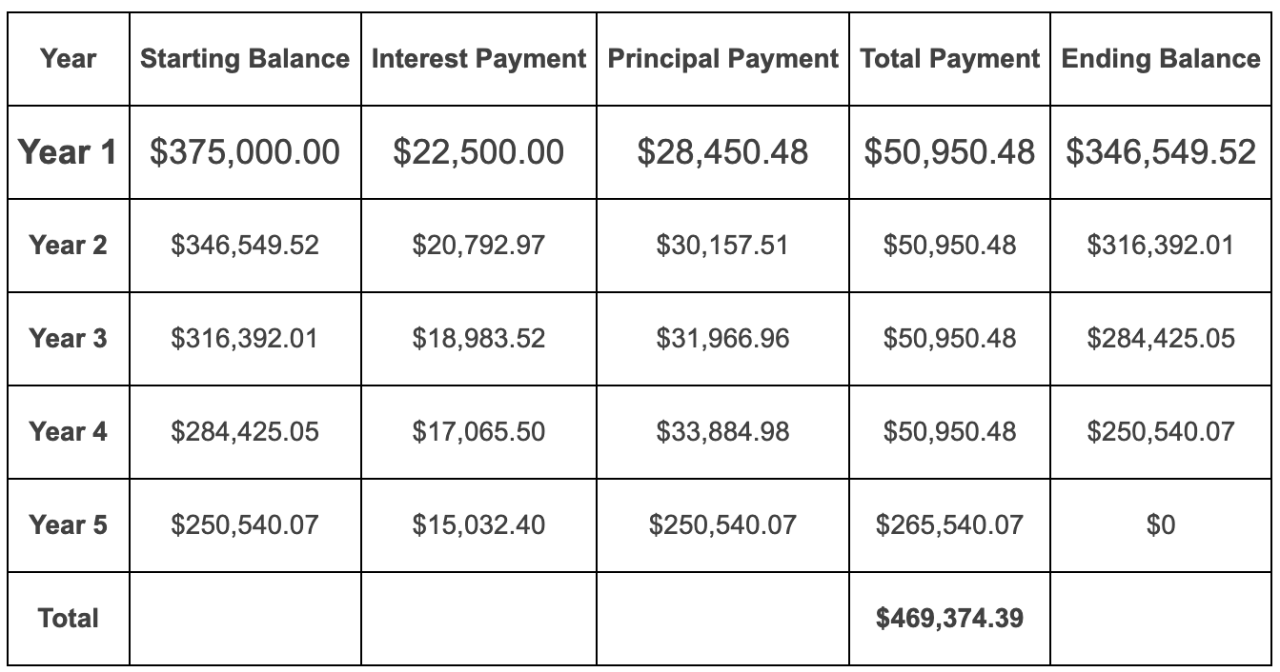

Let’s consider a scenario involving the sale of a small bakery, “Sweet Success,” valued at $250,000. The buyer, Sarah, lacks sufficient capital for a full cash purchase. The seller, John, is willing to offer seller financing to facilitate the sale and secure a potentially higher return than a traditional sale. They agree on a 10% down payment and a 5-year loan with a 7% interest rate.

Financial Details and Timeline of a Successful Seller Financing Transaction

The transaction unfolds as follows:

- Month 1-3: Negotiation and Due Diligence: Sarah and John negotiate the terms of the sale, including the purchase price, down payment, interest rate, loan term, and repayment schedule. Sarah conducts due diligence on the bakery’s financials and operations.

- Month 3-4: Legal Documentation: A comprehensive seller financing agreement is drafted and reviewed by legal counsel for both parties. This agreement Artikels all terms, including payment schedules, default provisions, and any prepayment penalties.

- Month 4: Closing: Sarah makes a $25,000 down payment (10% of $250,000). John transfers ownership of Sweet Success to Sarah. The loan agreement is officially signed and recorded.

- Month 5-60: Loan Repayment: Sarah makes monthly payments to John according to the agreed-upon schedule. These payments cover both principal and interest. The total monthly payment, calculated using a standard amortization schedule, would be approximately $4,700.

Visual Representation of Cash Flow and Payment Schedule

A simple chart would effectively illustrate the cash flow. The horizontal axis would represent the months (0-60), and the vertical axis would represent the dollar amount. A line graph would show the monthly payment made by Sarah (relatively constant). A second line would show the principal portion of the payment, gradually increasing over time. A third line would illustrate the interest portion of the payment, gradually decreasing over time. Finally, a separate bar chart would show the initial down payment made at month 0. The chart clearly shows the decreasing interest component and the increasing principal component over the life of the loan.

Example of a Failed Seller Financing Transaction

Let’s imagine a similar scenario, but with a different outcome. Suppose the buyer, Mark, lacked a solid business plan and underestimated the operational challenges of running Sweet Success. He secured seller financing under similar terms as Sarah, but failed to generate sufficient revenue to cover his monthly payments after the first year. This resulted in a default on the loan.

The reasons for failure include:

- Poor Business Planning: Mark’s lack of a robust business plan led to inaccurate revenue projections and inadequate cash flow management.

- Underestimation of Operational Costs: He underestimated the ongoing expenses of running the bakery, leading to insufficient funds for loan repayments.

- Inadequate Due Diligence: Perhaps Mark didn’t fully assess the bakery’s financial health or the competitive landscape before committing to the purchase.

In this case, John, the seller, faced significant financial losses. He might have to initiate legal action to recover his investment, potentially leading to lengthy and costly legal battles and potentially even repossession of the bakery.