How long does it take to sell a business? This question is far more complex than a simple number. The journey from listing to closing can vary wildly, influenced by factors ranging from market conditions and business valuation to the effectiveness of your marketing strategy and the skill of your negotiation team. This comprehensive guide explores the key variables affecting sale timelines, offering insights into preparation, marketing, negotiation, and potential delays, ultimately helping you navigate the process with greater clarity and confidence.

We’ll delve into the intricacies of business valuation, explore effective marketing strategies to attract the right buyers, and examine the crucial role of negotiation in securing a favorable deal. We’ll also address potential pitfalls and unexpected delays, providing actionable strategies to mitigate risks and streamline the process. Through detailed examples and insightful analysis, we aim to equip you with the knowledge necessary to make informed decisions and achieve a successful business sale.

Factors Influencing Business Sale Time

The time it takes to sell a business is rarely consistent, varying significantly depending on a multitude of interconnected factors. Understanding these influences is crucial for both business owners planning an exit strategy and potential buyers assessing risk and opportunity. This section details key elements impacting the duration of a business sale process.

Business Size and Sale Duration

The size of a business significantly impacts the time required for a sale. Smaller businesses, often simpler to evaluate and requiring less due diligence, typically sell faster. Larger, more complex businesses with intricate operations, extensive assets, and numerous employees necessitate a more thorough and time-consuming due diligence process, leading to extended sale timelines. For instance, a small, owner-operated bakery might sell within a few months, while a large manufacturing plant could take over a year, or even longer, to find a suitable buyer and complete the transaction. The sheer volume of data and contractual agreements involved in larger sales directly correlates with increased time commitment.

Industry Trends and Sale Timelines, How long does it take to sell a business

Prevailing industry trends exert a powerful influence on how quickly a business sells. Businesses operating in thriving sectors with high growth potential and strong investor interest tend to attract buyers more readily and thus sell faster. Conversely, businesses in declining or stagnant industries may face longer sale times due to reduced buyer interest and lower valuations. A tech startup in a rapidly expanding market segment, for example, might attract multiple offers within months, while a traditional brick-and-mortar retail store in a struggling mall could remain on the market for a significantly longer period.

Financial Performance and Sale Time

A business’s financial performance is paramount in determining its sale speed. Businesses with strong, consistent revenue growth, healthy profit margins, and robust cash flow are highly attractive to buyers and often sell quickly. Conversely, businesses experiencing financial difficulties, declining revenues, or significant losses will likely face extended sale periods and may even struggle to find a buyer at all. A profitable software company with a clear track record of success will likely attract bids quickly, while a struggling restaurant with inconsistent profits and high debt will likely take considerably longer to sell, if it sells at all.

Established Customer Base and Sale Time

The presence of a loyal and established customer base dramatically affects the sale timeline. Businesses with a strong customer base are viewed as less risky investments, making them more appealing to buyers and leading to faster sales. Conversely, businesses lacking a significant customer base may struggle to attract buyers, leading to prolonged sale periods. A well-established restaurant with a dedicated clientele will sell much faster than a new restaurant with an unproven customer base. The value and stability offered by a proven customer base significantly shorten the sale process.

Average Sale Times for Different Business Types

| Business Type | Average Sale Time (Months) | Factors Affecting Time | Examples |

|---|---|---|---|

| Small Retail Store | 3-6 | Ease of valuation, limited complexity | Independent bookstore, small clothing boutique |

| Restaurant | 6-12 | Location, lease terms, customer base | Local café, established fine-dining restaurant |

| Manufacturing Company | 12-24+ | Asset valuation, regulatory compliance, employee transition | Small factory, large industrial plant |

| Software Company | 6-18 | Intellectual property, recurring revenue, customer contracts | SaaS startup, established software provider |

Preparation and Valuation Stages

Preparing a business for sale and accurately valuing it are critical steps that significantly impact the speed and success of the transaction. A well-prepared business attracts more buyers and commands a higher price, leading to a faster sale. Conversely, inaccurate valuation can lead to protracted negotiations or even a failed sale. This section details the key aspects of these crucial stages.

Preparing a Business for Sale

Preparing a business for sale involves more than just tidying up the accounts. It’s about showcasing the business in the best possible light to potential buyers, highlighting its strengths and addressing any weaknesses proactively. This process often involves improving operational efficiency, strengthening financial performance, and compiling comprehensive documentation. A well-structured preparation process significantly enhances the business’s attractiveness and ultimately shortens the sale timeframe.

Business Valuation Methods

Several methods exist for valuing a business, each with its own strengths and weaknesses. The most common include asset-based valuation, which focuses on the net asset value of the business; income-based valuation, which considers the business’s profitability and future earnings; and market-based valuation, which compares the business to similar businesses that have recently sold. The chosen method often depends on the specific characteristics of the business and the industry. A combination of methods is often used to arrive at a comprehensive valuation.

Common Valuation Mistakes and Their Impact

Overvaluing or undervaluing a business are common mistakes that can significantly impact the sale timeline. Overvaluation can deter potential buyers, leading to prolonged negotiations or a failed sale. Undervaluation, on the other hand, can result in leaving money on the table. For example, failing to account for intangible assets like brand recognition or customer loyalty in an asset-based valuation can lead to a significantly lower valuation than the business is actually worth. Similarly, using outdated financial data or ignoring market trends can lead to inaccurate income-based valuations. These errors can delay the sale process as buyers challenge the valuation or walk away.

Key Documents for a Smooth Sale

Having the necessary documentation readily available is crucial for a quick and efficient sale. This includes audited financial statements for the past three to five years, tax returns, contracts with key suppliers and customers, intellectual property registrations, and detailed operational manuals. A complete and well-organized document package demonstrates transparency and professionalism, reassuring buyers and accelerating the due diligence process. Missing or incomplete documents can significantly delay the sale.

Pre-Sale Activities Checklist

A well-structured checklist can help ensure all necessary steps are completed before listing the business for sale. This checklist should include:

- Review and update financial statements.

- Assess and improve operational efficiency.

- Identify and address any legal or regulatory issues.

- Compile a comprehensive business profile and marketing materials.

- Secure necessary professional advice (legal, accounting, valuation).

- Develop a realistic asking price based on a thorough valuation.

- Prepare a detailed business plan outlining future growth strategies.

Completing these tasks proactively streamlines the sale process and increases the likelihood of a swift and successful transaction. A proactive approach minimizes surprises and uncertainties, encouraging buyer confidence and expediting the entire sales journey.

Marketing and Finding Buyers

Successfully selling a business hinges on effectively marketing it to the right potential buyers. A well-executed marketing strategy attracts qualified prospects, leading to a faster sale and a more favorable price. This involves understanding various marketing channels, crafting compelling materials, and potentially leveraging the expertise of a business broker.

Effective Strategies for Marketing a Business for Sale

Marketing a business for sale requires a multi-faceted approach. It’s not enough to simply list the business; you need to actively promote its strengths and appeal to potential investors. This includes creating a professional and detailed marketing package, targeting specific buyer demographics, and utilizing a variety of online and offline channels. A well-defined marketing plan should incorporate both active and passive strategies, ensuring broad reach and targeted engagement.

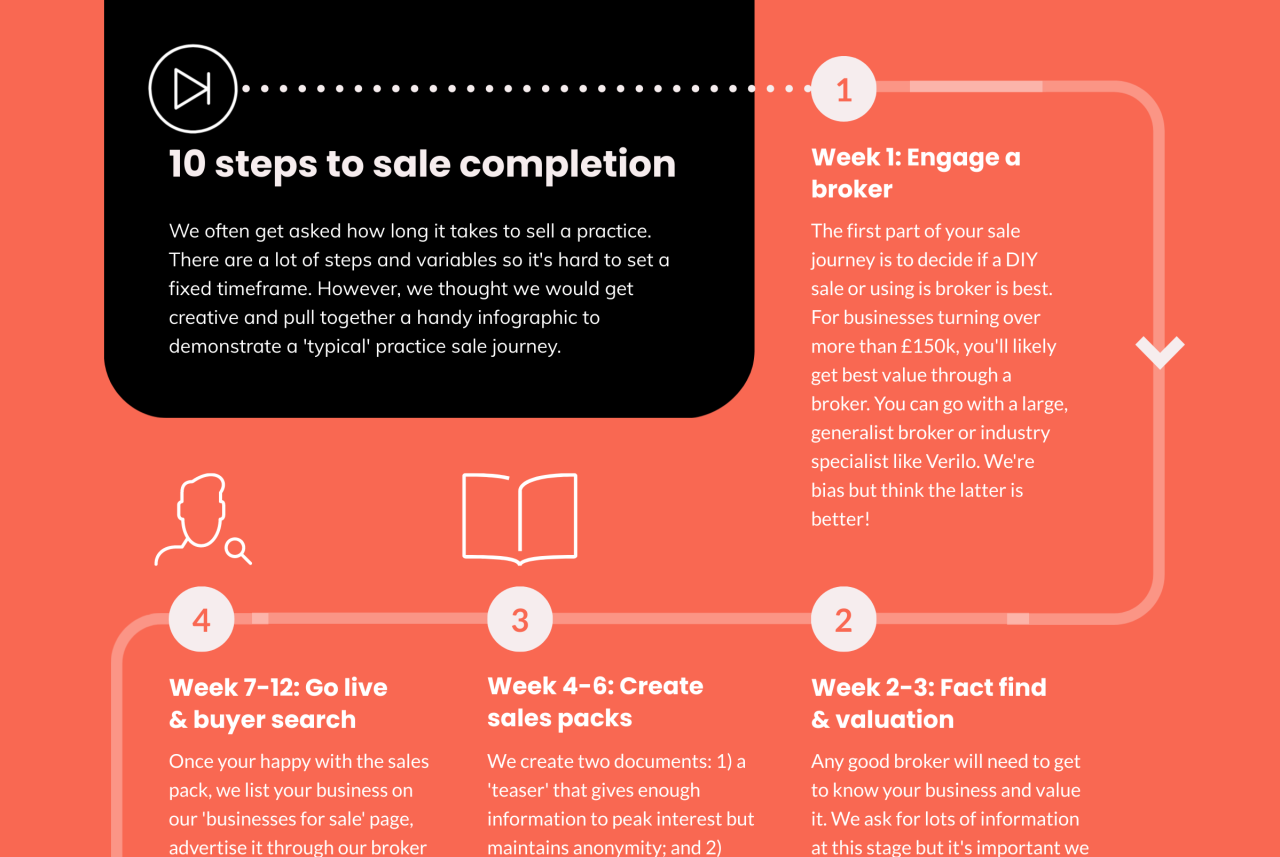

The Role of a Business Broker in Finding Buyers

Business brokers act as intermediaries, connecting sellers with potential buyers. Their expertise lies in marketing businesses effectively, evaluating valuations, negotiating deals, and managing the entire sale process. Brokers often have access to a wider network of potential buyers than individual sellers, including private investors, strategic acquirers, and larger corporations. They handle confidential negotiations, reducing the burden on the seller and increasing the likelihood of a successful transaction. Using a broker, particularly for complex or high-value businesses, often translates to a smoother, more efficient, and ultimately more profitable sale.

Comparison of Marketing Channels and Their Effectiveness

Several channels can be used to market a business for sale, each with its own advantages and disadvantages. The optimal approach depends on factors like the business type, target buyer profile, and budget. Some channels may prove more effective than others depending on the specific circumstances.

| Method | Pros | Cons | Cost |

|---|---|---|---|

| Online Business Brokerage Platforms (e.g., BizBuySell, FE International) | Wide reach, pre-qualified buyers, streamlined process | Commissions can be high, competition among listings | Variable, typically a percentage of the sale price |

| Targeted Online Advertising (e.g., Google Ads, LinkedIn Ads) | Highly targeted reach, measurable results | Requires expertise in digital marketing, can be expensive | Variable, depending on campaign complexity and bidding |

| Networking and Industry Events | Direct connection with potential buyers, relationship building | Time-consuming, limited reach | Variable, depending on event costs and travel expenses |

| Private Equity Firms and Investment Banks | Access to significant capital, potential for higher valuations | Highly competitive, rigorous due diligence process | Often involves fees for advisory services |

Examples of Compelling Marketing Materials for Attracting Potential Buyers

Compelling marketing materials are crucial for attracting potential buyers. A well-crafted Confidential Information Memorandum (CIM) is paramount, providing a detailed overview of the business, its financials, and market position. Supporting materials such as market research reports, financial statements, and operational summaries further enhance the presentation. High-quality photography or video showcasing the business location and operations can significantly increase buyer interest. A concise and persuasive executive summary should highlight key selling points and quickly capture the attention of potential investors. For example, a CIM for a successful restaurant might include details on its unique recipes, customer loyalty program, and prime location, accompanied by photos of the vibrant atmosphere and happy customers. A technology startup’s CIM would focus on its innovative product, intellectual property, and growth trajectory, perhaps including screenshots of the software interface and user engagement metrics.

Negotiation and Closing the Deal: How Long Does It Take To Sell A Business

Successfully navigating the negotiation phase and closing the deal are critical for a smooth business sale. This involves understanding common negotiation tactics, identifying potential deal-breakers, and ensuring all legal aspects are addressed correctly. A well-prepared seller will anticipate challenges and have strategies in place to overcome them, leading to a favorable outcome for all parties involved.

Common Negotiation Tactics in Business Sales

Negotiation in business sales is a strategic process. Both buyers and sellers employ various tactics to achieve their desired outcome. Sellers might employ anchoring (setting a high initial price), while buyers may use lowball offers or emphasize the business’s flaws to negotiate a lower price. Effective negotiation requires understanding these tactics and employing counter-strategies. For instance, a seller might counter a lowball offer by highlighting the business’s strengths and future potential, presenting a comprehensive valuation report, and emphasizing the unique opportunities it offers. A well-prepared seller will anticipate common tactics and prepare a range of responses.

Potential Deal-Breakers and Their Resolution

Several factors can derail a business sale. Financing issues, where the buyer struggles to secure funding, are a common obstacle. Discrepancies in due diligence findings, revealing unforeseen liabilities or inconsistencies in financial records, can also be deal-breakers. Disputes over intellectual property rights, especially if they are not clearly defined in the initial agreement, can cause significant delays or even termination of the deal. Addressing these potential problems proactively, through thorough due diligence, clear documentation, and open communication, is crucial. For example, a seller can mitigate financing risks by offering seller financing options or structuring the deal to allow for a phased payment schedule. Addressing discrepancies in due diligence findings may involve renegotiating the price or providing additional warranties and indemnities.

Legal Aspects of Closing a Business Sale

The legal aspects of closing a business sale are complex and require professional legal counsel. Key legal considerations include drafting a comprehensive purchase agreement that Artikels all terms and conditions, including the purchase price, payment terms, assets included in the sale, liabilities assumed by the buyer, and warranties and indemnities provided by the seller. Compliance with relevant regulations, such as tax laws and antitrust laws, is also crucial. Furthermore, ensuring proper transfer of licenses, permits, and other regulatory approvals is essential for a smooth transition. Ignoring these legal requirements can lead to significant financial and legal repercussions.

Key Documents Required for a Successful Closing

A successful closing requires a meticulous collection of documents. These include the purchase agreement, financial statements (audited if possible), tax returns, contracts with key employees and suppliers, intellectual property documentation, and any relevant permits or licenses. A detailed asset list, showing the value of all tangible and intangible assets being transferred, is also essential. All these documents must be accurately prepared and reviewed by legal counsel to ensure compliance with all applicable laws and regulations. The completeness and accuracy of these documents are crucial for a smooth and efficient closing process.

Sample Negotiation Scenario and Outcome

Imagine a small bakery owner, Sarah, is selling her business. She initially listed it for $200,000. A potential buyer, Mark, offers $150,000. Sarah counters with $180,000, highlighting the bakery’s consistent profitability and strong customer base. Mark, after reviewing the financials and conducting due diligence, agrees to $175,000, with a $25,000 down payment and the remaining balance paid over three years. Both parties engage legal counsel to finalize the purchase agreement, ensuring all terms are clearly defined and legally sound. The deal closes successfully with both parties satisfied with the outcome.

Unexpected Delays and Contingencies

Selling a business is a complex process, and despite meticulous planning, unexpected delays and contingencies are common. These unforeseen circumstances can significantly impact the timeline and ultimately the success of the transaction. Understanding potential delays and developing mitigation strategies is crucial for a smooth and efficient sale.

Common Reasons for Unexpected Delays in the Sale Process

Unexpected delays can stem from various sources, often related to due diligence, financing, or legal complexities. Buyers may require more time than anticipated to complete their financial and legal reviews of the business. This is especially true for larger transactions or those involving complex financial structures. Furthermore, securing financing can be a lengthy process, subject to market conditions and lender requirements. Unforeseen issues discovered during due diligence, such as undisclosed liabilities or compliance problems, can also lead to significant delays as these matters are investigated and resolved. Finally, legal negotiations can be protracted, particularly when dealing with multiple parties or complex legal agreements. Disagreements over contract terms, representations, and warranties can easily prolong the closing process.

Potential Contingencies Prolonging the Sale

Several contingencies can significantly extend the business sale timeline. For instance, a buyer’s financing might fall through due to unforeseen circumstances in the lending market, forcing a restart of the financing process. The discovery of previously unknown environmental liabilities during due diligence could trigger lengthy remediation discussions and negotiations. Similarly, a crucial employee’s unexpected resignation could impact the buyer’s assessment of the business’s value and operations, leading to renegotiations or even a termination of the deal. Legal challenges or disputes arising from prior contracts or intellectual property issues can also create significant delays, requiring legal intervention and potentially impacting the final sale price. Finally, changes in market conditions, such as an economic downturn, can affect buyer confidence and lead to renegotiations or a complete withdrawal from the sale.

Flowchart for Handling Unexpected Delays

A flowchart can visually represent the steps involved in addressing unexpected delays. The flowchart would begin with the identification of the delay (e.g., financing issues, due diligence findings, legal disputes). This would be followed by a step to assess the severity and potential impact of the delay. Next, the flowchart would Artikel options for addressing the delay, such as renegotiating terms, seeking alternative financing, or addressing legal challenges. The process would then involve implementing the chosen solution and monitoring its effectiveness. Finally, the flowchart would conclude with a decision point: either the sale proceeds, or the sale is terminated. The flowchart would clearly illustrate the decision points and the potential outcomes at each stage, allowing for a systematic approach to managing unexpected issues.

Strategies for Mitigating Potential Risks and Delays

Proactive risk management is essential in mitigating potential delays. This includes thorough due diligence on both sides, clear and concise contractual agreements, and securing multiple financing options. Maintaining open communication between all parties throughout the process is also crucial for early identification and resolution of potential issues. A well-structured purchase agreement that addresses potential contingencies and provides clear dispute resolution mechanisms can significantly reduce the likelihood of protracted negotiations. Engaging experienced legal and financial advisors is crucial to navigate complex issues and ensure the sale proceeds smoothly. Furthermore, preparing a comprehensive business valuation and due diligence package beforehand helps expedite the process and reduces the likelihood of unforeseen delays.

Potential Delays, Causes, and Mitigation Strategies

| Delay Type | Cause | Impact | Mitigation Strategy |

|---|---|---|---|

| Financing Delays | Unforeseen market changes, lender requirements, buyer’s financial difficulties | Extended closing timeline, potential deal collapse | Secure multiple financing options, thorough due diligence on buyer’s financial standing, contingency planning for financing failure |

| Due Diligence Delays | Unforeseen liabilities, compliance issues, incomplete documentation | Extended review period, renegotiation of terms, potential deal termination | Comprehensive pre-sale due diligence, transparent disclosure of all relevant information, efficient document management |

| Legal Delays | Contractual disputes, legal challenges, complex regulatory approvals | Extended negotiation period, increased legal costs, potential deal collapse | Clear and concise contractual agreements, experienced legal counsel, proactive addressing of potential legal issues |

| Market Condition Delays | Economic downturn, industry-specific challenges, changes in buyer sentiment | Reduced buyer interest, renegotiation of terms, potential deal termination | Flexible pricing strategy, understanding of market dynamics, contingency planning for market shifts |

Illustrative Examples of Sale Timelines

Understanding the timeframe for selling a business is crucial for effective planning and realistic expectations. The process can vary dramatically depending on numerous factors, including business type, market conditions, and the seller’s preparedness. Examining contrasting case studies illuminates the potential range of timelines and highlights key influencing elements.

Quick Business Sale: The Case of “Green Thumb Gardens”

Green Thumb Gardens, a small, profitable landscaping business, sold within three months. Several factors contributed to this swift transaction. The business had meticulously maintained detailed financial records, demonstrating consistent profitability and strong growth potential. Furthermore, the owner had proactively prepared a comprehensive business valuation and marketing package, including a well-written business plan and clear operational summaries. The streamlined business structure and readily available documentation significantly reduced due diligence time for potential buyers. Finally, the business operated in a robust market with high demand for landscaping services, leading to multiple offers within weeks of listing. The buyer, a larger landscaping company seeking expansion, was also highly motivated and experienced in navigating business acquisitions, further accelerating the process. The sale closed smoothly, largely due to the seller’s preparedness and the favorable market conditions.

Delayed Business Sale: The Case of “Tech Solutions Inc.”

Tech Solutions Inc., a software development firm, experienced a protracted sale process spanning over 18 months. This extended timeline stemmed from several interconnected challenges. Initially, the business valuation process proved complex due to the intangible nature of its intellectual property and the need for specialized valuation expertise. Securing a suitable valuation took several months. Secondly, the marketing process encountered difficulties. The initial marketing materials lacked clarity and failed to adequately highlight the company’s unique selling propositions. This resulted in a limited pool of qualified buyers. Subsequently, negotiations with potential buyers were protracted due to disagreements over the valuation and contractual terms. Several potential buyers withdrew from the process, further extending the timeline. Finally, unexpected legal complications arose during due diligence, delaying the closing significantly. The extended timeframe significantly impacted the seller’s emotional and financial well-being, highlighting the importance of thorough preparation and realistic expectations.

Comparison of Case Studies

The contrasting timelines of Green Thumb Gardens and Tech Solutions Inc. highlight the critical role of preparation and market conditions in influencing sale duration. Green Thumb Gardens’ swift sale resulted from meticulous planning, clear documentation, and a favorable market, whereas Tech Solutions Inc.’s prolonged sale was marked by valuation complexities, ineffective marketing, protracted negotiations, and unforeseen legal issues. The difference underscores the importance of professional guidance throughout the process, particularly in complex situations like that faced by Tech Solutions Inc.

Key Takeaways from Case Studies

- Thorough Preparation is Crucial: Meticulous record-keeping, a well-defined business valuation, and comprehensive marketing materials significantly reduce sale time and complexity.

- Market Conditions Matter: A strong market with high demand for the business type accelerates the sale process.

- Professional Guidance is Valuable: Seeking expert advice from business brokers, lawyers, and accountants can mitigate risks and streamline the process.

- Realistic Expectations are Necessary: Unforeseen delays are possible, and sellers should prepare for a longer timeline than initially anticipated.

- Clear Communication is Key: Effective communication with potential buyers throughout the negotiation process helps prevent misunderstandings and delays.