How much is a business license in New York? That seemingly simple question opens a door to a complex world of fees, regulations, and requirements. The cost of a New York business license isn’t a single number; it varies wildly depending on factors like your business type, location, and even the number of employees. This guide navigates the intricacies of New York business licensing, providing a clear understanding of the costs involved and the steps to secure your license.

From sole proprietorships to large corporations, navigating the New York business licensing landscape requires careful planning and understanding of the applicable regulations. This guide breaks down the process, providing insights into different license types, associated costs, and potential pitfalls to avoid. Whether you’re launching a small bakery in a rural town or a tech startup in bustling New York City, understanding the financial implications of licensing is crucial for success.

Types of New York Business Licenses

Obtaining the correct business license in New York is crucial for legal operation and avoiding penalties. The specific licenses required depend on several factors, including your business structure (sole proprietorship, partnership, LLC, corporation), industry, and location within the state. This section details the various license types and their associated requirements.

New York Business License Categories by Business Structure

The type of business entity you choose significantly impacts your licensing needs. Sole proprietorships, partnerships, LLCs, and corporations each have different registration and licensing requirements at the state level. While a general business license might be common across structures, additional permits or licenses may be industry-specific.

| License Type | Description | Required Documents | Relevant Fees (Range) |

|---|---|---|---|

| Sole Proprietorship License | A business owned and run by one person; often requires only a business registration or assumed name certificate. | Articles of Organization (if registering a DBA), proof of identity, and potentially local business permits. | Varies by county and municipality; generally low. |

| Partnership License | A business owned and operated by two or more individuals; requires registration as a partnership and potentially an assumed name certificate. | Partnership agreement, proof of identity for all partners, and potentially local business permits. | Varies by county and municipality; generally low. |

| LLC License | A limited liability company; requires filing articles of organization with the New York Department of State. | Articles of organization, operating agreement (recommended), proof of identity for members, and potentially local business permits. | Filing fees with the New York Department of State; varies by county and municipality for local permits. |

| Corporation License | A separate legal entity; requires filing articles of incorporation with the New York Department of State. | Articles of incorporation, bylaws, proof of identity for incorporators, and potentially local business permits. | Filing fees with the New York Department of State; varies by county and municipality for local permits. |

Licensing Requirements by Industry

Beyond the basic business structure registration, many industries require specific licenses and permits at the state and local levels. These often involve health inspections, safety certifications, or professional qualifications.

| Industry | License Type | Description | Required Documents | Relevant Fees (Range) |

|---|---|---|---|---|

| Restaurants | Food Service Establishment Permit | Allows the operation of a food service establishment; requires adherence to health and safety regulations. | Building plans, menu, health inspection reports, proof of ownership/lease. | Varies by county and municipality; includes application fees and potential inspection costs. |

| Retail Stores | Sales Tax Permit (if applicable) | Required to collect and remit sales tax to the state. | Business registration documents, proof of identity, and potentially local business permits. | Varies based on the type of business and sales volume. |

| Professional Services (Law, Medicine) | Professional License | Requires specific education, training, and examinations. This is regulated by professional licensing boards. | Education transcripts, proof of passing relevant examinations, professional references. | Licensing fees vary greatly depending on the profession and state board requirements. |

Cost Factors Affecting Business License Fees

The cost of obtaining a business license in New York is not uniform. Several factors significantly influence the final fee, making it crucial for prospective business owners to understand these variables before starting the application process. Failing to account for these cost drivers can lead to unexpected expenses and potential financial strain on a new venture.

Several key factors contribute to the overall cost of a New York business license. These factors interact in complex ways, resulting in a wide range of potential fees depending on the specific circumstances of the business. Understanding these factors allows for better budgeting and financial planning.

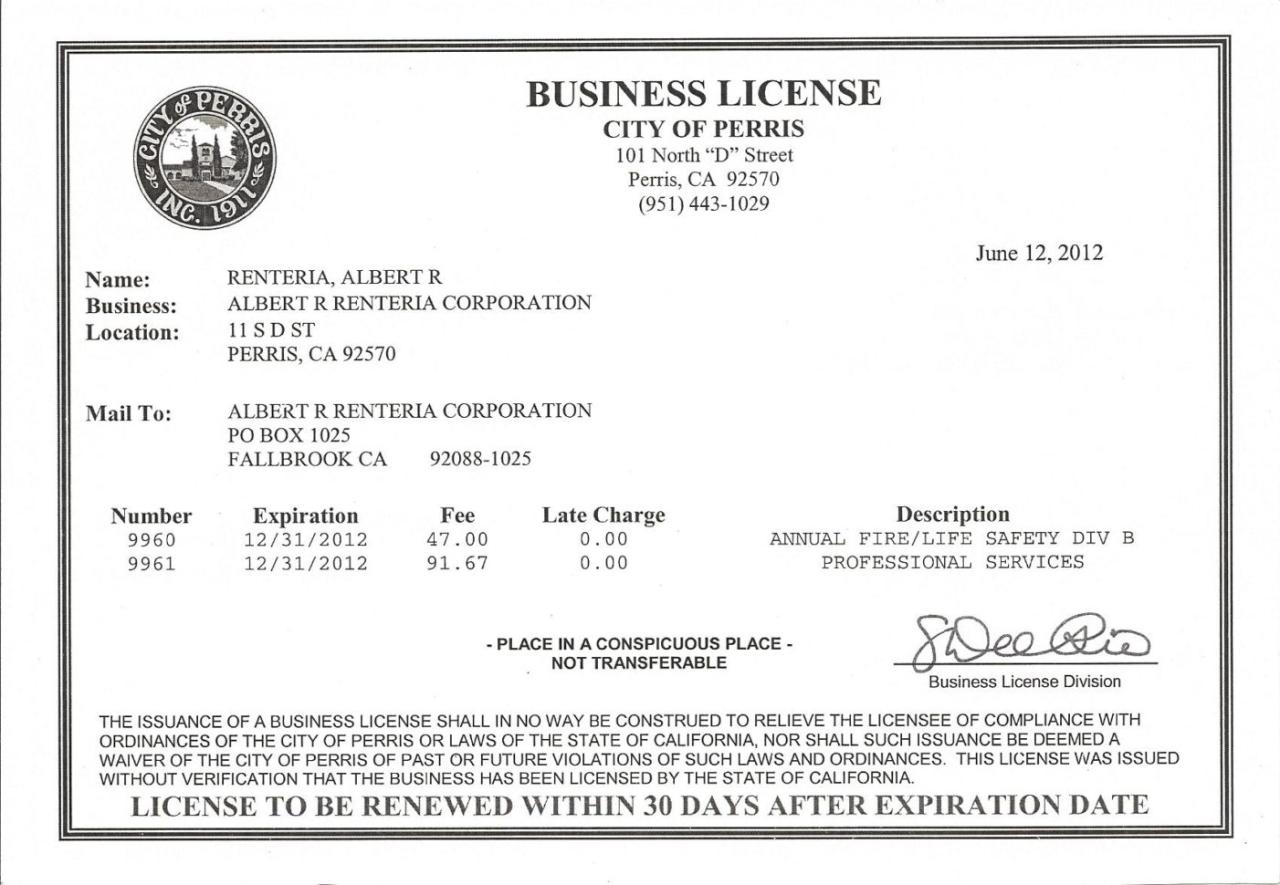

Business Location’s Impact on Licensing Fees

The location of your business within New York State heavily influences the cost of licensing. Different counties and cities have their own licensing procedures and fee structures. These variations reflect local regulations, administrative costs, and the specific services provided by each municipality. For instance, a business operating in New York City will likely face higher fees compared to one operating in a smaller, rural county due to the increased administrative overhead and regulatory complexity associated with a larger population and more extensive infrastructure. Additionally, some municipalities may levy additional fees based on factors such as square footage or the type of business operation.

Business Type and Licensing Fees, How much is a business license in new york

The type of business significantly impacts licensing costs. The complexity of the business operation, the potential environmental impact, and the level of regulation all play a role. For example, a simple sole proprietorship might have lower licensing fees than a complex corporation or a business operating in a heavily regulated industry such as healthcare or finance. Each business type necessitates different permits and licenses, leading to variations in the total cost. Furthermore, some business types may require additional licenses or permits beyond the basic business license, further increasing the overall expense.

Number of Employees and Licensing Costs

In some cases, the number of employees a business has can affect licensing fees. While not always a direct factor, certain licenses or permits might have tiered pricing structures based on the size of the workforce. This is often associated with employer responsibilities, such as worker’s compensation insurance requirements or the need for additional regulatory compliance measures for larger teams. Businesses with larger employee counts might also face higher fees due to increased administrative processing required by the licensing authorities.

Comparison of Licensing Fees Across New York Counties and Cities

The following provides a simplified comparison, recognizing that actual fees are subject to change and can vary based on specific business details:

- New York City: Generally higher fees due to the high volume of businesses and complex regulatory environment.

- Upstate New York (e.g., smaller counties): Often lower fees reflecting lower administrative costs and a less complex regulatory structure.

- Suburban Areas (e.g., Westchester County): Fees tend to fall between those of New York City and upstate counties, reflecting a balance between administrative costs and regulatory complexity.

It’s crucial to check directly with the specific county or city clerk’s office for the most up-to-date and precise fee information.

Additional Fees Beyond Initial Application

Beyond the initial application fee, businesses should anticipate additional costs. These include:

- Renewal Fees: Most business licenses require periodic renewal, incurring a renewal fee. These fees may be similar to or different from the initial application fee.

- Late Filing Penalties: Failure to file or renew licenses on time typically results in penalties, which can significantly increase the overall cost.

- Amendments and Updates: If a business needs to amend its license information (e.g., change of address, business structure), additional fees might apply.

Accurate record-keeping and timely submission of all required paperwork are crucial to minimizing these additional costs.

Obtaining a New York Business License

Securing the necessary business licenses in New York is a crucial first step for any entrepreneur. The process, while potentially complex, is manageable with careful planning and attention to detail. Understanding the steps involved, the required documentation, and potential pitfalls will significantly improve your chances of a smooth and efficient application.

Step-by-Step Guide to Obtaining a New York Business License

The application process for a New York business license varies depending on your business type, location, and specific activities. However, a general framework exists that covers most scenarios. The following ordered list Artikels a typical process:

- Determine the Necessary Licenses and Permits: Research which licenses and permits your business needs based on its type, location, and activities. New York State and local municipalities may require different licenses. The New York State Department of State website is a valuable resource for this initial step.

- Choose Your Business Structure: Decide on your business structure (sole proprietorship, partnership, LLC, corporation, etc.). This choice impacts your licensing requirements and tax obligations.

- Register Your Business Name (if applicable): If you’re operating under a name different from your own, you’ll need to register your business name with the New York Department of State. This often involves a “Doing Business As” (DBA) filing.

- Obtain an Employer Identification Number (EIN) (if applicable): If you plan to hire employees, you’ll need an EIN from the IRS. Sole proprietors and single-member LLCs may be able to use their Social Security Number (SSN) instead.

- Complete the Application: Gather all the required documentation and complete the application forms for the relevant licenses and permits. These forms are usually available online through the appropriate government agency websites.

- Submit Your Application: Submit your completed application and supporting documentation to the relevant agency. This may be done online, by mail, or in person.

- Pay the Fees: Pay the applicable fees for each license and permit. Fees vary depending on the type of license and location.

- Receive Your License(s): Once your application is processed and approved, you’ll receive your business license(s).

Flowchart Illustrating the New York Business License Application Process

A flowchart would visually represent the process as follows:

[Imagine a flowchart here. The flowchart would start with a box labeled “Determine Business Type and Location.” This would lead to a decision point: “Requires State License?” Yes would lead to “Apply for State License,” No would lead to “Apply for Local License Only.” Both “Apply for State License” and “Apply for Local License Only” would lead to “Gather Required Documents.” This would lead to “Complete Application,” followed by “Submit Application and Pay Fees,” and finally “Receive License.” There would be feedback loops for rejected applications, requiring corrections and resubmission.]

Common Mistakes and Solutions During the Application Process

Several common mistakes can delay or even prevent the successful acquisition of a New York business license. Understanding these pitfalls and their solutions is crucial.

- Incomplete Applications: Failing to provide all required information or documentation is a frequent error. Solution: Carefully review all application requirements and ensure all necessary forms and documents are included before submission.

- Incorrect Fees: Submitting an incorrect amount of payment can lead to delays. Solution: Verify the exact fee amounts on the relevant agency’s website before payment.

- Late Submissions: Missing deadlines can result in application rejection. Solution: Submit your application well in advance of any deadlines to allow for potential processing delays.

- Choosing the Wrong License Type: Applying for the wrong license due to a misunderstanding of your business activities. Solution: Thoroughly research the specific license requirements for your business type and activities, consulting with relevant agencies if needed.

Resources for Finding Business License Information: How Much Is A Business License In New York

Securing the necessary business licenses in New York can be a complex process. Navigating the various state and local agencies and understanding the specific requirements for your business type can be challenging. Fortunately, several resources are available to assist entrepreneurs in obtaining the information they need to comply with regulations. This section Artikels key official websites, contact information for relevant agencies, and alternative resources that can provide support throughout the licensing process.

Official New York State Government Websites and Agencies

Finding accurate and up-to-date information is crucial when obtaining a business license. The following table lists key New York State government websites and the relevant information they provide. It is important to consult these sites directly for the most current details, as regulations and procedures can change.

| Website Name | Relevant Information Provided |

|---|---|

| New York State Department of State (NYSDOS) | Information on business entity registration (corporations, LLCs, etc.), professional licenses, and general business resources. This is often the primary starting point for many business license inquiries. |

| New York State Department of Taxation and Finance | Details on sales tax permits, corporate taxes, and other tax-related requirements for businesses operating in New York. This is essential for understanding the tax obligations associated with your business. |

| New York City Department of Small Business Services (SBS) | Specific information regarding business licenses and permits within New York City, including assistance programs and resources for small businesses. This is crucial for businesses operating within the city limits. |

| NYS Department of Labor | Information on employment-related licenses and permits, such as those needed for specific industries or professions. This is vital for businesses hiring employees. |

Contact Information for Relevant Agencies

Direct contact with relevant agencies can be helpful for clarifying specific questions or addressing unique situations. The following bullet points provide contact information for the agencies listed above. Always verify this information on the official agency websites before contacting them.

* New York State Department of State (NYSDOS):

* Phone: (518) 474-4420 (General Inquiries) *Note: Specific division numbers may vary depending on the type of license.*

* Email: Check the NYSDOS website for specific contact email addresses for different divisions.

* Address: One Commerce Plaza, Albany, NY 12245

* New York State Department of Taxation and Finance:

* Phone: (518) 457-5000 (General Inquiries) *Note: Specific division numbers may vary depending on the type of tax.*

* Email: Check the NYSDOS website for specific contact email addresses for different divisions.

* Address: Tax Department, State of New York, PO Box 1027, Albany, NY 12201-1027

* New York City Department of Small Business Services (SBS):

* Phone: 311 (within NYC) or (212) 312-3660 (outside NYC)

* Email: Check the NYC SBS website for specific contact email addresses for different divisions.

* Address: 110 William Street, New York, NY 10038

Alternative Resources for Business Licensing Assistance

While official government websites are the primary source of information, other resources can offer valuable assistance. These resources can provide guidance, support, and potentially streamline the licensing process.

Several business associations, such as the New York State Chamber of Commerce and local chambers of commerce, offer guidance and resources to members on navigating the business licensing process. They often provide workshops, seminars, and networking opportunities that can be beneficial. Additionally, numerous consulting firms specialize in assisting businesses with licensing and regulatory compliance. These firms can offer expertise in navigating complex regulations and ensuring businesses meet all requirements. The cost of these services will vary depending on the firm and the scope of services required.

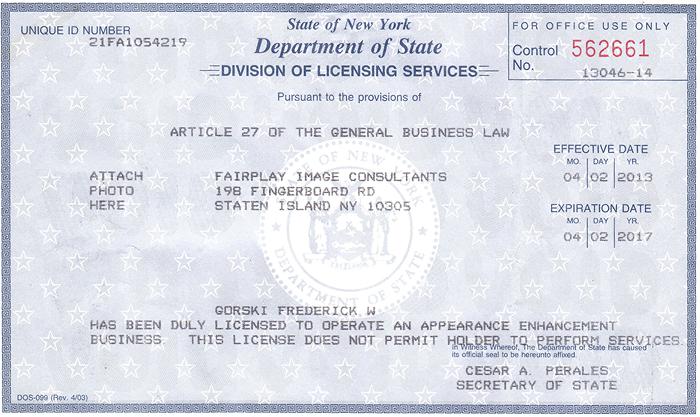

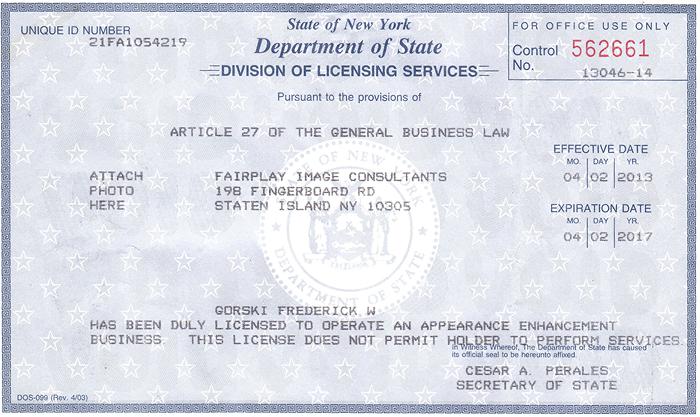

Illustrative Examples of Business License Costs

Determining the precise cost of a business license in New York can be complex, varying significantly based on business type, location, and specific requirements. This section provides illustrative examples to clarify the cost structure. It’s crucial to remember that these are estimates, and actual costs may differ. Always consult official sources for the most up-to-date information.

Business License Costs in New York City

The following table illustrates estimated costs for three different business types in New York City. These figures include the base license fee and other potentially associated costs, such as permits or registrations. Note that additional fees may apply depending on the specific business activity and location within the city.

| Business Type | License Fee | Other Associated Fees | Total Estimated Cost |

|---|---|---|---|

| Restaurant (Small, < 50 seats) | $1,000 – $3,000 (depending on borough and size) | Health Department permits ($500 – $1,500), Fire Department permits ($200 – $500), Liquor License (if applicable, $1,000 – $10,000+), other potential fees | $2,700 – $15,000+ |

| Retail Store (Small, < 1,000 sq ft) | $300 – $1,000 (depending on borough and type of goods sold) | Sales tax permit, general business tax, potential zoning permits ($200 – $500) | $500 – $1,700 |

| Consulting Firm (Sole Proprietorship) | $0 – $200 (Depending on Borough and specific business activities. May not require a separate license beyond the general business tax registration.) | General Business Tax registration fee, potential professional licenses (if applicable) | $0 – $500 |

Cost Differences: Rural vs. Urban Areas

Obtaining a business license in a rural area of New York is generally less expensive than in a major city like New York City. This is primarily due to lower administrative costs, fewer regulatory requirements, and potentially lower property taxes impacting certain license fees. For instance, a small retail store in a rural town might only face a license fee of $50-$150, compared to the much higher costs in NYC. However, even in rural areas, specific industry regulations (like those related to farming or construction) can lead to additional permits and fees.

Impact of Business Structure on License Costs

The legal structure of a business significantly impacts license costs. For example, consider two consulting firms: one structured as a sole proprietorship and the other as an LLC. The sole proprietorship may face minimal license fees, possibly only requiring general business tax registration. In contrast, the LLC, being a separate legal entity, might incur higher fees associated with registration and ongoing compliance requirements. This could include annual fees for maintaining the LLC’s status, potentially increasing the overall cost of licensing and operation compared to the sole proprietorship. This hypothetical scenario demonstrates how choosing the right business structure can influence the overall cost of licensing.