How to buy a business with seller financing? This question unlocks a powerful avenue for entrepreneurs seeking acquisition opportunities. Seller financing offers unique advantages, allowing buyers with limited capital to secure a business, while providing sellers with a flexible payment structure and potentially higher returns. This guide navigates the complexities of this approach, covering everything from finding suitable businesses and negotiating terms to structuring the deal and managing the post-acquisition phase. We’ll explore the pros and cons, dissect financial considerations, and provide actionable strategies for success.

We’ll delve into the specifics of various financing structures, including installment plans, balloon payments, and interest-only options, comparing them to traditional bank loans. You’ll learn how to identify businesses offering seller financing, negotiate favorable terms, and conduct thorough due diligence. Crucially, we’ll examine the legal and contractual aspects of seller financing agreements, highlighting the importance of legal counsel. Finally, we’ll Artikel strategies for successful post-acquisition integration and long-term management.

Understanding Seller Financing

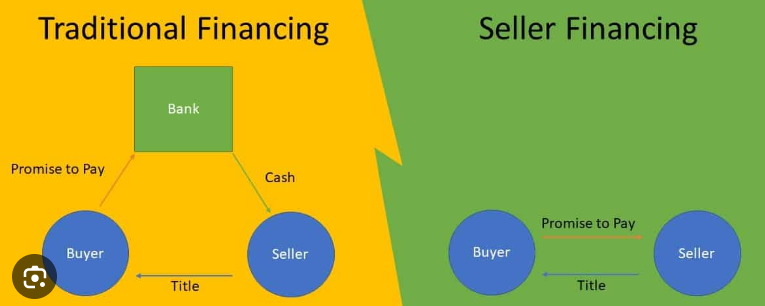

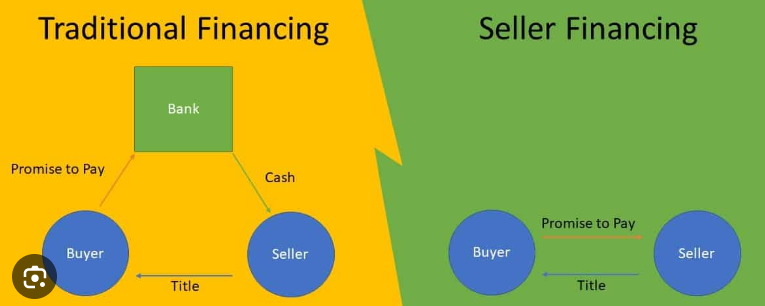

Seller financing, where the business seller provides the buyer with a loan to fund the acquisition, presents a unique alternative to traditional bank loans. This arrangement offers distinct advantages and disadvantages for both parties involved, shaping the overall feasibility and attractiveness of a business acquisition. Understanding these nuances is crucial for navigating the complexities of this financing option.

Advantages and Disadvantages of Seller Financing

Seller financing offers several benefits for both buyers and sellers. For buyers, it can ease access to capital, especially when securing a bank loan proves difficult. Lower down payments and potentially more flexible terms can be attractive. However, buyers assume higher risk, as they are personally liable for the loan repayment. Conversely, sellers benefit from a potentially higher sale price than they might achieve with a cash buyer, receiving payments over time. However, sellers face the risk of non-payment, extended collection processes, and potentially less liquid capital.

Typical Terms and Conditions in Seller Financing Agreements

Seller financing agreements typically include detailed terms outlining the repayment schedule, interest rate, loan amount, collateral, and default provisions. Repayment schedules can range from short-term to long-term arrangements, with monthly or quarterly installments being common. Interest rates are often negotiated based on market conditions and the perceived risk associated with the buyer. The agreement will also specify the collateral offered by the buyer to secure the loan, which might include the business assets themselves. Crucially, the agreement will detail the consequences of default, outlining the seller’s rights and remedies in case of non-payment. Prepayment penalties may also be included.

Seller Financing Compared to Traditional Bank Loans

Seller financing differs significantly from traditional bank loans. Banks typically require extensive financial documentation, credit checks, and collateral assessments before approving a loan. The approval process can be lengthy and stringent. Seller financing, on the other hand, often involves a less rigorous approval process, focusing more on the buyer’s business plan and potential for success. However, bank loans generally offer lower interest rates and potentially more favorable repayment terms due to the lower risk profile for the lender. The choice depends on the buyer’s financial standing and the seller’s willingness to take on risk.

Examples of Seller Financing Structures

Several seller financing structures exist, each with its own implications. Installment payments involve regular, fixed payments over a predetermined period, amortizing the loan principal and interest. Balloon payments require a substantial lump sum payment at the end of the loan term, with smaller payments made beforehand. Interest-only payments only cover the interest accrued during the loan term, with the principal repaid at the end or in a separate balloon payment. The choice of structure depends on the negotiation between the buyer and seller, reflecting their respective risk tolerances and financial capabilities. For example, a seller might prefer a balloon payment to receive a significant sum quickly, while a buyer might favor installment payments for better cash flow management.

Comparison of Financing Options

| Financing Option | Interest Rate | Down Payment | Repayment Period |

|---|---|---|---|

| Seller Financing (Installment) | Variable (Negotiated, e.g., 8-12%) | Variable (Negotiated, e.g., 20-30%) | Variable (Negotiated, e.g., 5-10 years) |

| Seller Financing (Balloon) | Variable (Negotiated, e.g., 7-11%) | Variable (Negotiated, e.g., 25-40%) | Variable (e.g., 3-5 years with balloon payment) |

| Traditional Bank Loan | Fixed or Variable (Market dependent, e.g., 6-10%) | Variable (Bank dependent, e.g., 20-40%) | Variable (Bank dependent, e.g., 5-20 years) |

Finding Businesses with Seller Financing

Securing seller financing can significantly enhance your chances of acquiring a business, offering flexibility and potentially more favorable terms than traditional bank loans. However, finding businesses actively seeking this type of arrangement requires a strategic approach encompassing both online and offline avenues. This section details effective methods for locating suitable businesses and navigating the negotiation and due diligence processes.

Online Resources for Finding Businesses with Seller Financing

Several online platforms specialize in listing businesses for sale, many of which allow for filtering based on financing options. Websites such as BizBuySell, BusinessesForSale.com, and FE International often include detailed business profiles, allowing potential buyers to identify those offering seller financing opportunities. It’s crucial to carefully review the listing descriptions and contact the brokers or sellers directly to confirm the availability and specifics of seller financing. Advanced search filters on these platforms allow you to refine your search based on criteria such as industry, location, and price range, focusing your efforts on businesses that align with your financial capabilities and investment goals.

Offline Resources for Finding Businesses with Seller Financing

While online resources are convenient, exploring offline avenues can yield promising results. Networking within your industry, attending industry events, and engaging with business brokers can provide access to off-market opportunities and businesses not actively advertised online. Building relationships with commercial real estate agents can also be beneficial, as they often have insights into businesses looking for buyers and may be aware of seller financing arrangements. Direct outreach to business owners in your area of interest, expressing your interest in acquiring a business and your preference for seller financing, can also lead to unexpected opportunities.

Negotiating Seller Financing Terms

Negotiating seller financing requires a clear understanding of your financial capabilities and the business’s valuation. A thorough due diligence process is paramount to ensure the business’s viability and to support your proposed financing terms. Key factors to negotiate include the down payment amount, the interest rate, the loan term, and the repayment schedule. It’s essential to present a well-structured offer that demonstrates your seriousness and financial capacity. Having a strong business plan that highlights your understanding of the business and your ability to manage and grow it strengthens your negotiating position. Consider seeking professional advice from a business broker or financial advisor to assist in structuring a favorable agreement.

Effective Communication Techniques When Approaching Sellers

When approaching sellers about seller financing, clear and concise communication is vital. Your initial contact should express your genuine interest in the business and your willingness to explore seller financing options. Highlight your experience and financial capacity, emphasizing your ability to manage and grow the business. Present a well-researched offer that demonstrates your understanding of the business’s valuation and the prevailing market conditions. Maintain a professional and respectful tone throughout the communication process, fostering a collaborative environment conducive to a mutually beneficial agreement. Be prepared to answer questions about your financial background and your business plan.

Due Diligence Process When Considering a Business with Seller Financing

Due diligence is critical when considering a business with seller financing. This involves a comprehensive review of the business’s financial records, including income statements, balance sheets, and cash flow statements, to verify the accuracy of the seller’s representations. Analyzing the business’s operational efficiency, customer base, and competitive landscape is also essential. Legal review of contracts, leases, and permits is crucial to ensure compliance and identify any potential liabilities. It is advisable to engage professionals, such as accountants and lawyers, to conduct thorough due diligence and provide expert guidance.

Essential Documents to Review Before Entering a Seller Financing Agreement

Before committing to a seller financing agreement, a comprehensive review of essential documents is crucial. This checklist includes the purchase agreement, the promissory note outlining the loan terms, the security agreement detailing the collateral, and any related financial statements and tax returns. Reviewing all relevant contracts, leases, and permits is also important. Legal counsel should be sought to ensure the agreement protects your interests and complies with all applicable laws and regulations. A clear understanding of the terms and conditions, including repayment schedules, interest rates, and potential penalties, is vital before signing any agreement.

Evaluating the Business and its Finances

Acquiring a business, especially with seller financing, requires a thorough evaluation of its financial health and future prospects. This due diligence process is crucial to determining the fair market value and mitigating potential risks. A robust framework, incorporating key financial ratios and valuation methods, is essential for making an informed investment decision.

Financial Health Assessment Framework

A comprehensive assessment of a business’s financial health involves analyzing historical financial statements (income statement, balance sheet, and cash flow statement) for at least the past three to five years. This analysis should identify trends, potential issues, and the overall financial strength of the business. Key areas to focus on include revenue growth, profitability margins, debt levels, and working capital management. Inconsistencies or significant fluctuations should be investigated further. External factors affecting the business, such as market conditions and economic trends, should also be considered.

Key Financial Ratios and Metrics, How to buy a business with seller financing

Several key financial ratios provide insights into a business’s profitability, liquidity, solvency, and efficiency. These ratios help to benchmark the business against industry averages and assess its financial health relative to its competitors.

| Ratio | Formula | Significance | Example |

|---|---|---|---|

| Gross Profit Margin | (Revenue – Cost of Goods Sold) / Revenue | Measures the profitability of sales after deducting direct costs. | A gross profit margin of 40% indicates that 40% of revenue remains after covering direct costs. |

| Net Profit Margin | Net Income / Revenue | Indicates the percentage of revenue remaining as profit after all expenses. | A net profit margin of 10% suggests that 10% of revenue is net profit. |

| Current Ratio | Current Assets / Current Liabilities | Measures the ability to pay short-term obligations with current assets. | A current ratio of 2:1 implies that the business has twice the current assets to cover current liabilities. |

| Debt-to-Equity Ratio | Total Debt / Total Equity | Indicates the proportion of financing from debt versus equity. | A debt-to-equity ratio of 0.5:1 suggests that the business uses half as much debt financing as equity financing. |

Business Valuation Methods

Several methods are used to value businesses, each with its own strengths and weaknesses. The most common methods include:

* Asset-Based Valuation: This method values the business based on the net asset value of its tangible and intangible assets. It’s suitable for asset-heavy businesses. For example, a manufacturing company with significant equipment would be well-suited for this method.

* Income-Based Valuation: This method values the business based on its future earnings potential. Discounted Cash Flow (DCF) analysis is a common income-based approach, which estimates the present value of future cash flows. A successful tech startup with strong projected growth would be a prime candidate for this valuation method.

* Market-Based Valuation: This method values the business by comparing it to similar businesses that have recently been sold. This approach relies on finding comparable transactions and adjusting for differences between the businesses. A small retail business could be valued using this method by comparing it to similar businesses sold in the same geographic area.

Projecting Future Cash Flows

Projecting future cash flows is crucial for determining the potential return on investment. This involves forecasting revenue, expenses, and capital expenditures for a specific period, typically five to ten years. The projections should be based on realistic assumptions, considering market trends, economic conditions, and the business’s historical performance. Sensitivity analysis, which examines the impact of different assumptions on the projected cash flows, is also important. For instance, a projection might consider different scenarios for economic growth or changes in customer demand. A well-structured financial model should be used to facilitate these projections and analyses.

Key Financial Indicators in Due Diligence

The following table Artikels key financial indicators and their significance in the due diligence process.

| Indicator | Significance | Source | Potential Red Flags |

|---|---|---|---|

| Revenue Growth | Indicates the business’s ability to generate sales and expand its market share. | Income Statement | Consistent decline in revenue, significant fluctuations. |

| Profitability Margins | Measures the efficiency and profitability of the business operations. | Income Statement | Low or declining profit margins, inconsistent profitability. |

| Working Capital | Shows the business’s ability to meet its short-term obligations. | Balance Sheet | Negative working capital, consistently low working capital. |

| Debt Levels | Indicates the business’s financial leverage and risk. | Balance Sheet | High debt levels, difficulty servicing debt. |

Structuring the Deal

Seller financing arrangements require meticulous structuring to protect both the buyer and the seller. A well-drafted agreement safeguards each party’s interests and ensures a smooth transition of ownership. This involves legal counsel, detailed contractual clauses, and adherence to relevant regulations.

Legal and Contractual Aspects of Seller Financing Agreements

Seller financing agreements are legally binding contracts outlining the terms of the sale, including the purchase price, payment schedule, interest rates, and other conditions. These agreements must be clear, unambiguous, and comprehensive to prevent future disputes. Key aspects include defining the purchase price, outlining the payment schedule (e.g., monthly installments, balloon payments), specifying the interest rate and calculation method, and detailing any collateral securing the loan. The agreement should also address default provisions, prepayment penalties, and the process for resolving disputes. Failure to address these elements thoroughly can lead to costly legal battles.

The Importance of Legal Counsel

Engaging legal counsel is crucial throughout the negotiation and closing process. An attorney specializing in business transactions can review the agreement, identify potential risks, and ensure the agreement protects your interests. They can also advise on tax implications, regulatory compliance, and other legal complexities involved in acquiring a business through seller financing. The cost of legal counsel is a small price to pay compared to the potential financial and legal repercussions of an inadequately structured agreement.

Common Clauses in Seller Financing Agreements

Several standard clauses commonly appear in seller financing agreements. Default provisions typically Artikel the consequences of missed payments, such as late fees, acceleration of the debt, or repossession of assets. Prepayment penalties might be included to compensate the seller for lost interest income if the buyer pays off the loan early. Other common clauses address insurance requirements, representations and warranties by the seller (regarding the business’s financial health and legal compliance), and provisions for dispute resolution (e.g., arbitration). These clauses should be carefully reviewed and negotiated to ensure they are fair and reasonable.

Securing Necessary Permits and Licenses

Acquiring a business often involves obtaining the necessary permits and licenses to operate legally. This process varies depending on the industry, location, and specific business activities. The buyer should thoroughly research and understand all relevant regulations before closing the deal. Failure to obtain the required permits and licenses can result in significant penalties, operational disruptions, and even legal action. It is advisable to work with relevant authorities and potentially consult with a business consultant to ensure all necessary approvals are secured before commencing operations.

Sample Seller Financing Agreement Key Sections

A sample seller financing agreement would include the following key sections:

Parties: Clearly identifies the buyer and seller.

Purchase Price and Payment Terms: Specifies the total purchase price, the down payment, and the payment schedule (including interest rate, payment amounts, and due dates).

Security Interest: Describes any assets serving as collateral for the loan (e.g., business equipment, inventory, accounts receivable).

Default and Remedies: Artikels the consequences of default (missed payments), including late fees, acceleration of the debt, and potential repossession of collateral.

Prepayment Penalty: Specifies any penalty for early repayment of the loan.

Representations and Warranties: Statements made by the seller about the business’s financial condition and legal compliance.

Covenants: Obligations of the buyer during the loan term (e.g., maintaining insurance, providing financial statements).

Governing Law and Dispute Resolution: Specifies the applicable law and the method for resolving disputes (e.g., arbitration, litigation).

Signatures: Signatures of both the buyer and the seller, indicating their agreement to the terms.

Post-Acquisition Management

Successfully acquiring a business through seller financing is only half the battle. The post-acquisition phase is crucial for realizing the full potential of your investment and ensuring a smooth transition. Effective management during this period is key to integrating the acquired business, managing debt, and building profitability. This section Artikels the critical steps involved in navigating this phase successfully.

Integrating the Acquired Business

Integrating the acquired business into your existing operations requires a well-defined plan and careful execution. A rushed or poorly planned integration can lead to disruptions, loss of productivity, and ultimately, failure. The process should be phased, allowing for adjustments based on initial observations and feedback. This phased approach allows for a more controlled and less disruptive integration.

Managing Debt and Maintaining Positive Cash Flow

Seller financing introduces a significant debt obligation. Effective debt management is paramount to long-term success. This involves creating a detailed repayment schedule, diligently tracking cash flow, and proactively addressing any potential shortfalls. Maintaining a positive cash flow is essential to meet debt obligations, reinvest in the business, and ensure its continued growth. Strategies for achieving this may include optimizing pricing, streamlining operations, and exploring opportunities for cost reduction. For example, a successful integration of a bakery into a larger food distribution network might involve negotiating better rates on ingredients through bulk purchasing, resulting in a significant cost saving and improved cash flow.

Successful Post-Acquisition Integration Strategies

Successful post-acquisition integration often involves a combination of strategies tailored to the specific circumstances. One common approach is to retain key personnel from the acquired business, particularly those with valuable expertise and customer relationships. This helps maintain operational continuity and minimizes disruption to existing clients. Another effective strategy is to clearly communicate the integration plan to employees of both businesses, addressing concerns and fostering a sense of collaboration. For instance, a company acquiring a smaller competitor might create a joint team for sales and marketing, leveraging the strengths of both organizations to increase market share. A gradual integration process, where systems and processes are merged incrementally, can also minimize disruptions and allow for adjustments along the way.

Ongoing Financial Monitoring and Reporting

Regular financial monitoring and reporting are essential for identifying potential problems early and making timely adjustments. This involves tracking key performance indicators (KPIs), comparing actual performance against projections, and regularly reviewing financial statements. This allows for proactive problem-solving and helps ensure the business remains on track to meet its financial goals. A lack of rigorous monitoring can lead to unforeseen issues that may be difficult or costly to address later.

Key Performance Indicators (KPIs) to Track Post-Acquisition Performance

Tracking the right KPIs is crucial for assessing the success of the integration and the overall financial health of the combined business. These KPIs should be monitored regularly and compared against benchmarks to identify areas needing improvement.

- Revenue Growth: Tracks the increase in overall revenue post-acquisition.

- Customer Retention Rate: Measures the percentage of customers retained from the acquired business.

- Debt-to-Equity Ratio: Indicates the level of financial leverage.

- Net Profit Margin: Shows the profitability of the combined business.

- Return on Investment (ROI): Measures the profitability of the acquisition.

- Customer Acquisition Cost (CAC): Tracks the cost of acquiring new customers.

- Employee Turnover Rate: Measures the rate of employee departures.

Illustrative Examples: How To Buy A Business With Seller Financing

To solidify understanding of seller financing in business acquisitions, let’s examine both successful and unsuccessful scenarios. These examples highlight key decision points and financial projections, illustrating the critical factors contributing to positive or negative outcomes. Analyzing these contrasting cases provides valuable insights for prospective buyers.

Successful Business Acquisition with Seller Financing

This example details the acquisition of a profitable bakery, “Sweet Success,” by a new owner, John. Sweet Success generated consistent revenue and profit for the past five years, with a strong customer base and established brand recognition. John, possessing relevant experience in the food industry, identified Sweet Success as a promising investment opportunity. He negotiated a deal with the seller, Mary, involving a significant portion of the purchase price financed by Mary herself.

Key Deal Terms: The bakery was valued at $500,000. John secured a $200,000 bank loan and negotiated seller financing for the remaining $300,000. Mary agreed to a five-year repayment plan with a 6% annual interest rate. The agreement included specific performance milestones and provisions for default. John meticulously reviewed Sweet Success’s financial records, ensuring accuracy and projecting future revenue streams.

Financial Projections (Annual):

| Year | Revenue | Expenses | Profit | Debt Payment | Net Income |

|---|---|---|---|---|---|

| 1 | $150,000 | $90,000 | $60,000 | $66,000 | -$6,000 |

| 2 | $170,000 | $95,000 | $75,000 | $66,000 | $9,000 |

| 3 | $190,000 | $100,000 | $90,000 | $66,000 | $24,000 |

| 4 | $210,000 | $105,000 | $105,000 | $66,000 | $39,000 |

| 5 | $230,000 | $110,000 | $120,000 | $66,000 | $54,000 |

Key Decision Points and Outcomes: John’s thorough due diligence, realistic financial projections, and strong business plan were crucial to success. The initial years showed a slight loss, but consistent revenue growth allowed for timely debt repayment. Mary’s willingness to provide seller financing, based on confidence in John and the business, was instrumental in facilitating the acquisition.

Failed Business Acquisition with Seller Financing

This example involves the acquisition of a struggling restaurant, “Flavors of the Past,” by Sarah. Flavors of the Past had declining revenue and inconsistent profitability for several years, with a high employee turnover rate and outdated marketing strategies. Sarah, lacking relevant experience in the restaurant industry, underestimated the challenges involved in revitalizing the business. She secured seller financing from the owner, Tom, without adequately assessing the risks.

Key Deal Terms: The restaurant was valued at $400,000. Sarah secured a small bank loan and negotiated seller financing for the majority of the purchase price. Tom agreed to a four-year repayment plan with a high 10% annual interest rate. The agreement lacked clear performance milestones and adequate provisions for default.

Financial Projections (Annual):

| Year | Revenue | Expenses | Profit | Debt Payment | Net Income |

|---|---|---|---|---|---|

| 1 | $100,000 | $120,000 | -$20,000 | $100,000 | -$120,000 |

| 2 | $90,000 | $110,000 | -$20,000 | $100,000 | -$120,000 |

| 3 | $80,000 | $100,000 | -$20,000 | $100,000 | -$120,000 |

| 4 | $70,000 | $90,000 | -$20,000 | $100,000 | -$120,000 |

Key Decision Points and Outcomes: Sarah’s lack of due diligence, unrealistic financial projections, and insufficient understanding of the restaurant industry contributed to the failure. The high interest rate on the seller financing, coupled with consistent losses, made debt repayment impossible. The absence of clear performance milestones and default provisions further exacerbated the situation, resulting in the eventual foreclosure of the restaurant.