How to file a lien against a business? It’s a question many contractors and vendors face when unpaid for services rendered. This process, while potentially complex, can be navigated successfully with the right understanding of legal requirements and procedures. Understanding the nuances of mechanic’s liens, from initial documentation to post-filing procedures, is crucial for securing payment and protecting your business interests. This guide will equip you with the knowledge to effectively pursue your claim and navigate potential disputes.

Successfully navigating the process of filing a lien against a business requires a clear understanding of the legal framework governing such actions, meticulous documentation, and a strategic approach to potential disputes. This involves not only correctly completing the lien document but also understanding the implications of your actions and potential alternative dispute resolution methods. The following sections will break down each step, providing practical advice and illustrative examples to guide you through the process.

Understanding Mechanic’s Liens Against Businesses

Mechanic’s liens, a powerful legal tool, allow individuals or businesses who provide labor or materials for a construction or improvement project to secure payment if the property owner fails to pay. This right stems from the principle of unjust enrichment – the property owner benefits from the improvements, and therefore should compensate those who made them possible. This article explores the specifics of filing a mechanic’s lien against a business.

Legal Basis for Mechanic’s Liens Against Businesses

The legal basis for mechanic’s liens varies by state, but generally rests on state statutes that provide specific procedures and requirements for filing. These statutes are designed to protect those who contribute to the improvement of real property. The underlying principle is that those who furnish labor or materials for a project have a claim against the property itself for payment, even if the property owner defaults on their contractual obligations. Failure to comply with the specific statutory requirements, such as timely filing and proper notice, can invalidate the lien. Therefore, thorough understanding of your state’s specific laws is crucial before pursuing this legal recourse.

Types of Businesses Subject to Mechanic’s Liens

A wide range of businesses can be subject to mechanic’s liens. This includes general contractors, subcontractors, material suppliers, and even specialized tradespeople such as electricians, plumbers, and HVAC installers. The key is that the business provided labor or materials that directly contributed to the improvement of the property. For instance, a landscaping company that installed new plants and irrigation systems could file a mechanic’s lien if the business owner failed to pay for the services. Similarly, a construction company that built an addition to a commercial building would have grounds to file a lien if the business owner did not fulfill their payment obligations. The type of business is less important than the nature of the work performed and the contractual agreement.

Determining Appropriateness of a Mechanic’s Lien

Before pursuing a mechanic’s lien, several factors must be carefully considered. First, a valid contract for services or materials must exist between the claimant and the property owner. Secondly, the claimant must have substantially completed the work Artikeld in the contract. Thirdly, the property owner must have failed to make payments as agreed upon in the contract. Finally, all other avenues of dispute resolution, such as negotiation and arbitration, should be explored before resorting to a mechanic’s lien. Filing a lien is a serious legal action that can negatively impact the business owner’s credit and property rights, and should only be pursued as a last resort after all other avenues have been exhausted.

Examples of Justified Mechanic’s Liens Against Businesses

Consider a scenario where a roofing company contracts with a restaurant to replace its damaged roof. The roofing company completes the work, but the restaurant owner refuses to pay the agreed-upon price. In this case, the roofing company is justified in filing a mechanic’s lien against the restaurant’s property to secure payment for its services. Another example could involve a construction company that built a new retail space for a clothing store. If the clothing store owner fails to pay for the construction work after completion, the construction company could file a mechanic’s lien against the newly constructed retail space. These scenarios illustrate situations where a mechanic’s lien provides a legitimate means for businesses to protect their financial interests when property owners fail to honor their contractual obligations.

Prerequisites for Filing a Lien

Successfully filing a mechanic’s lien against a business requires meticulous preparation and a thorough understanding of the legal requirements. Failing to meet these prerequisites can jeopardize your claim and result in the dismissal of your lien. This section Artikels the crucial steps and documentation needed before initiating the process.

Necessary Documentation, How to file a lien against a business

Compiling the necessary documentation is the cornerstone of a successful lien filing. Missing even a single crucial document can delay or prevent the process entirely. The specific requirements vary by state, so consulting your local laws is essential. However, common documents generally include the original contract or agreement with the business, detailed invoices reflecting all materials and labor provided, payment records demonstrating non-payment or partial payment, and proof of the business’s ownership or legal entity status. Additionally, you may need sworn affidavits attesting to the accuracy of your claims. These documents serve as irrefutable evidence supporting your claim.

Proving a Valid Contract or Agreement

Establishing the existence of a legally binding contract or agreement is paramount. This contract should clearly define the scope of work, payment terms, and the parties involved. This could be a written contract, a series of emails confirming the agreement, or other documented evidence of a mutual understanding. If the agreement is implied, rather than explicitly written, proving its existence requires substantial supporting evidence, such as consistent communication, invoices sent and received, and records of work completed. Ambiguity in the agreement can weaken your case, so clear and concise documentation is crucial. For instance, a simple email stating “We agree to your terms for the renovation of the office space for $50,000” could suffice if followed by subsequent actions reflecting the agreement.

Calculating the Amount Owed

Accurately calculating the amount owed is crucial to avoid under- or overstating the claim. The calculation should encompass all legitimate expenses incurred, including the cost of materials, labor, equipment rental, transportation, and any other directly related costs. Detailed invoices and receipts for each expense should be readily available. It is advisable to itemize each expense clearly to support the total amount claimed. For example, a calculation might include: $10,000 (materials), $15,000 (labor), $2,000 (equipment rental), $1,000 (transportation) = $28,000 (total amount owed). This detailed breakdown enhances the credibility of your claim.

Pre-Filing Checklist

Before initiating the lien filing process, a comprehensive checklist ensures that all necessary steps are taken and potential issues are addressed. This checklist should include:

- Verify the business’s legal name and address.

- Confirm the validity and enforceability of the contract.

- Gather all supporting documentation (contracts, invoices, payment records).

- Accurately calculate the amount owed, including all applicable costs.

- Review state-specific lien laws and filing procedures.

- Ensure all deadlines for filing are met.

- Consider consulting with a legal professional to ensure compliance and maximize the chances of a successful outcome.

This checklist helps streamline the process, minimizing the risk of errors or omissions that could compromise your claim. A thorough review of this checklist before filing significantly increases the probability of a successful lien.

The Lien Filing Process

Filing a mechanic’s lien against a business involves a series of precise steps, and the specifics vary significantly depending on your state. Failure to adhere to these procedures can invalidate your lien, so careful attention to detail is crucial. This section Artikels the general process and highlights key state-specific variations where applicable. Remember to consult your state’s statutes and relevant case law for the most accurate and up-to-date information.

The process generally begins with preparing the lien document, which must accurately reflect the work performed, the amount owed, and the relevant parties involved. Following preparation, the lien must be properly filed with the designated government agency and then served on the property owner. Finally, verification of successful filing is necessary to ensure the lien is legally valid and enforceable.

Steps in the Lien Filing Process

The steps involved in filing a mechanic’s lien generally follow a consistent pattern across jurisdictions, although specific requirements and timelines may vary. The process typically includes preparing the lien document, filing it with the appropriate court or government agency, and serving notice to the property owner. The following provides a general overview; consult your state’s specific regulations for precise instructions.

- Prepare the Lien Document: This involves accurately detailing the project, the amount owed, and all parties involved. The level of detail required varies by state.

- File the Lien: The lien document must be filed with the designated county or state agency, usually the county recorder’s office or a similar entity. There are often specific formatting and filing fee requirements.

- Serve Notice: The property owner must be properly served with a copy of the filed lien. Methods of service vary by state and may include personal service, certified mail, or other legally recognized methods.

- Verify Filing: After filing, it’s crucial to verify that the lien was properly recorded. This usually involves checking the relevant agency’s records or requesting confirmation.

Required Information for the Lien Document

The lien document requires specific information to be valid and enforceable. The exact requirements vary by state, but the following table provides a general overview of common fields. Always refer to your state’s specific statutes for complete accuracy.

| Field Name | Data Type | Required? | Example |

|---|---|---|---|

| Contractor Name and Address | Text | Yes | Acme Construction, 123 Main St, Anytown, CA 91234 |

| Property Owner Name and Address | Text | Yes | John Doe, 456 Oak Ave, Anytown, CA 91234 |

| Property Legal Description | Text | Yes | Lot 12, Block 3, Tract 1234, Anytown, CA |

| Date of Commencement of Work | Date | Yes | 2023-10-26 |

| Date of Completion of Work | Date | Yes | 2024-04-15 |

| Description of Work Performed | Text | Yes | Construction of a new roof, including materials and labor. |

| Amount Owed | Currency | Yes | $10,000.00 |

| Detailed Breakdown of Costs (Optional, but recommended) | Text | No | Materials: $5,000.00, Labor: $5,000.00 |

Lien Notice Service

Proper service of the lien notice is critical. Failure to properly serve the notice can render the lien invalid. Methods of service vary by state but often include personal service, certified mail with return receipt requested, or other methods specified by state law. In some states, specific requirements exist regarding the timing of service relative to the filing of the lien. Always consult your state’s statutes to ensure compliance.

Verifying Lien Filing

After filing the lien, it’s essential to verify its successful recording. This typically involves checking the records of the relevant county or state agency. Many agencies offer online record-checking services. Requesting a certified copy of the filed lien provides further confirmation. Retain all documentation related to the filing and service of the lien for your records.

Post-Filing Procedures

Filing a mechanic’s lien initiates a legal process with potential consequences for both the lien claimant and the business owner. Understanding the post-filing procedures, potential legal ramifications, and strategies for dispute resolution is crucial for maximizing the chances of successful recovery.

Potential Legal Ramifications Following Lien Filing

The filing of a mechanic’s lien creates a cloud on the title of the property, potentially impacting the business’s ability to sell, refinance, or obtain further loans. The business owner may respond by challenging the lien’s validity in court, arguing issues such as the accuracy of the work performed, the amount claimed, or the proper adherence to legal filing procedures. Failure to comply with legal requirements during the filing process can lead to the lien being dismissed. For the claimant, a successful lien can lead to the forced sale of the property to recover the debt, but this process can be lengthy and expensive. Conversely, an unsuccessful legal challenge could result in legal fees and court costs for the claimant. The business owner may also pursue counterclaims against the claimant for damages caused by faulty workmanship or other breaches of contract.

Timeline of Events After Lien Filing

Following lien filing, the business will typically receive formal notification. Their response will vary depending on the validity of the claim and their financial situation. They might attempt to negotiate a settlement, challenge the lien in court, or ignore the notice altogether. If the business contests the lien, the claimant should expect a legal process that may include discovery, depositions, and potentially a trial. The timeline can range from several months to several years, depending on the complexity of the case and the court’s docket. For example, a simple, uncontested lien might be resolved within a few months through negotiation, while a complex case involving multiple parties and substantial legal disputes could take several years to resolve.

Strategies for Handling Disputes or Challenges to the Lien

A strong legal foundation is paramount. This involves meticulous record-keeping of all communications, contracts, invoices, and proof of work completed. Accurate and detailed documentation is crucial in defending the lien’s validity. Seeking legal counsel from a construction attorney specializing in mechanic’s liens is highly recommended. They can advise on the legal requirements, potential challenges, and strategies for negotiating a settlement or defending against a challenge. Early engagement with legal counsel can significantly improve the chances of a successful outcome. Consider exploring alternative dispute resolution (ADR) methods such as mediation or arbitration as a less costly and time-consuming alternative to litigation. ADR can provide a more efficient path to resolution while maintaining a degree of control over the outcome.

Sample Communication Plan After Lien Filing

A proactive communication plan is essential. This might include sending a formal letter to the business reiterating the lien’s validity and the amount owed, including a clear explanation of the basis for the claim. This letter should offer a reasonable opportunity for negotiation and settlement. Following up with phone calls to ensure the business received the letter and to gauge their response is important. Maintain detailed records of all communications, including dates, times, and the content of conversations. If the business challenges the lien, promptly respond to any legal correspondence and cooperate fully with the court’s procedures. Regular consultations with legal counsel throughout the process will help guide your responses and ensure adherence to legal requirements. Example: A claimant might send a certified letter to the business owner within a week of filing the lien, outlining the amount owed and proposing a settlement within 30 days. This letter would clearly state the consequences of non-payment and the claimant’s intent to pursue legal action if necessary.

Alternative Dispute Resolution: How To File A Lien Against A Business

Resolving disputes arising from mechanic’s liens doesn’t always necessitate costly and time-consuming litigation. Alternative Dispute Resolution (ADR) methods offer viable alternatives, often resulting in faster, less expensive, and more amicable settlements. The choice of ADR method depends on several factors, including the complexity of the case, the relationship between the parties, and the desired level of formality.

Negotiation

Negotiation is the most informal ADR method. It involves direct communication between the parties involved to reach a mutually agreeable solution. This approach is best suited for straightforward disputes where a collaborative relationship can be maintained or re-established. Successful negotiation hinges on open communication, a willingness to compromise, and a clear understanding of each party’s interests. A skilled negotiator can guide the process, ensuring both parties feel heard and valued. However, negotiation relies heavily on the goodwill of the parties and may not be effective if one party is unwilling to compromise or lacks the power to negotiate effectively. This method is often the first step before resorting to more formal ADR processes.

Mediation

Mediation involves a neutral third-party mediator who facilitates communication and helps the parties reach a settlement. Unlike negotiation, where parties directly interact, mediation provides a structured environment where a skilled mediator guides the conversation, clarifies misunderstandings, and explores potential solutions. Mediation is beneficial because it promotes communication and understanding, potentially preserving the relationship between the parties. However, mediation requires the willingness of all parties to participate actively and compromise. If one party is unwilling to engage constructively, mediation may prove unsuccessful. The mediator does not impose a solution; they facilitate the parties’ own agreement.

Arbitration

Arbitration is a more formal ADR method than negotiation or mediation. It involves a neutral third-party arbitrator who hears evidence and arguments from both sides and then renders a binding decision. Arbitration is often preferred when a formal decision is needed and the parties want to avoid the expense and time commitment of litigation. The arbitrator’s decision is legally binding, similar to a court judgment. However, the process can still be less expensive and faster than litigation. The selection of the arbitrator is crucial, and the process itself follows established rules of procedure, often Artikeld in a pre-agreed arbitration agreement.

Litigation

Litigation is the formal legal process of resolving disputes through the court system. It’s the most expensive and time-consuming method, requiring legal representation, court filings, and adherence to strict procedural rules. Litigation is generally pursued only when other ADR methods have failed or when the parties have irreconcilable differences. While litigation provides a definitive resolution through a court judgment, it can be costly, stressful, and potentially damage relationships beyond repair. This option is generally a last resort.

Decision Tree for Dispute Resolution Strategy Selection

The following decision tree illustrates a potential approach to choosing the appropriate dispute resolution strategy:

- Is the dispute relatively simple and is there a good working relationship with the other party? Yes: Proceed to Negotiation. No: Proceed to Step 2.

- Is there a willingness from all parties to engage in a collaborative process? Yes: Proceed to Mediation. No: Proceed to Step 3.

- Is a binding decision required and is cost and time efficiency important? Yes: Proceed to Arbitration. No: Proceed to Litigation.

Note: This decision tree serves as a general guideline. The specific circumstances of each case may warrant a different approach. Legal counsel should be consulted to determine the most appropriate strategy.

Illustrative Examples

Understanding the mechanics of filing a mechanic’s lien can be challenging. These examples illustrate successful and unsuccessful lien filings, highlighting key steps and potential pitfalls. They also provide a visual representation of a properly completed lien document.

Successful Mechanic’s Lien Filing

Ace Construction, a general contractor, was hired by “Best Burgers,” a thriving local restaurant, to build a new outdoor patio. The contract, valued at $50,000, stipulated payment milestones tied to project completion stages. Ace completed the foundation and framing, totaling $25,000 worth of work, but Best Burgers failed to make the agreed-upon payment. Ace Construction, after providing Best Burgers with proper notice of intent to file a lien (as required by state law – this notice period varies by jurisdiction), proceeded to file a mechanic’s lien. The lien was meticulously prepared, accurately detailing the project description, the amount owed, the property address, and other legally required information. The lien was filed with the appropriate county clerk’s office and recorded. Best Burgers, faced with the prospect of a lien on their property, which could hinder future financing and sales, promptly negotiated with Ace Construction, resulting in full payment of the outstanding balance. The lien was subsequently released upon payment. The successful filing of the lien was largely due to Ace Construction’s adherence to legal procedures, proper documentation, and timely action.

Unsuccessful Mechanic’s Lien Filing

Bob’s Renovations attempted to file a mechanic’s lien against “Coffee Corner,” a local café, for unpaid renovation work. However, their attempt failed.

- Improper Notice: Bob’s Renovations failed to provide Coffee Corner with the legally required notice of intent to file a lien before filing the lien itself. This crucial step is necessary to allow the property owner an opportunity to resolve the dispute before formal legal action is taken.

- Inaccurate Lien Information: The lien document contained several inaccuracies, including a misspelled property address and an incorrect amount owed. These errors rendered the lien invalid.

- Missed Filing Deadline: The lien was filed significantly past the statutory deadline specified in the state’s mechanic’s lien laws. Each state has a specific timeframe for filing, and missing this deadline automatically invalidates the lien.

- Lack of Proper Contract: Bob’s Renovations lacked a written contract with Coffee Corner, making it difficult to prove the scope of work and the agreed-upon payment terms. A written contract is crucial evidence in supporting a mechanic’s lien claim.

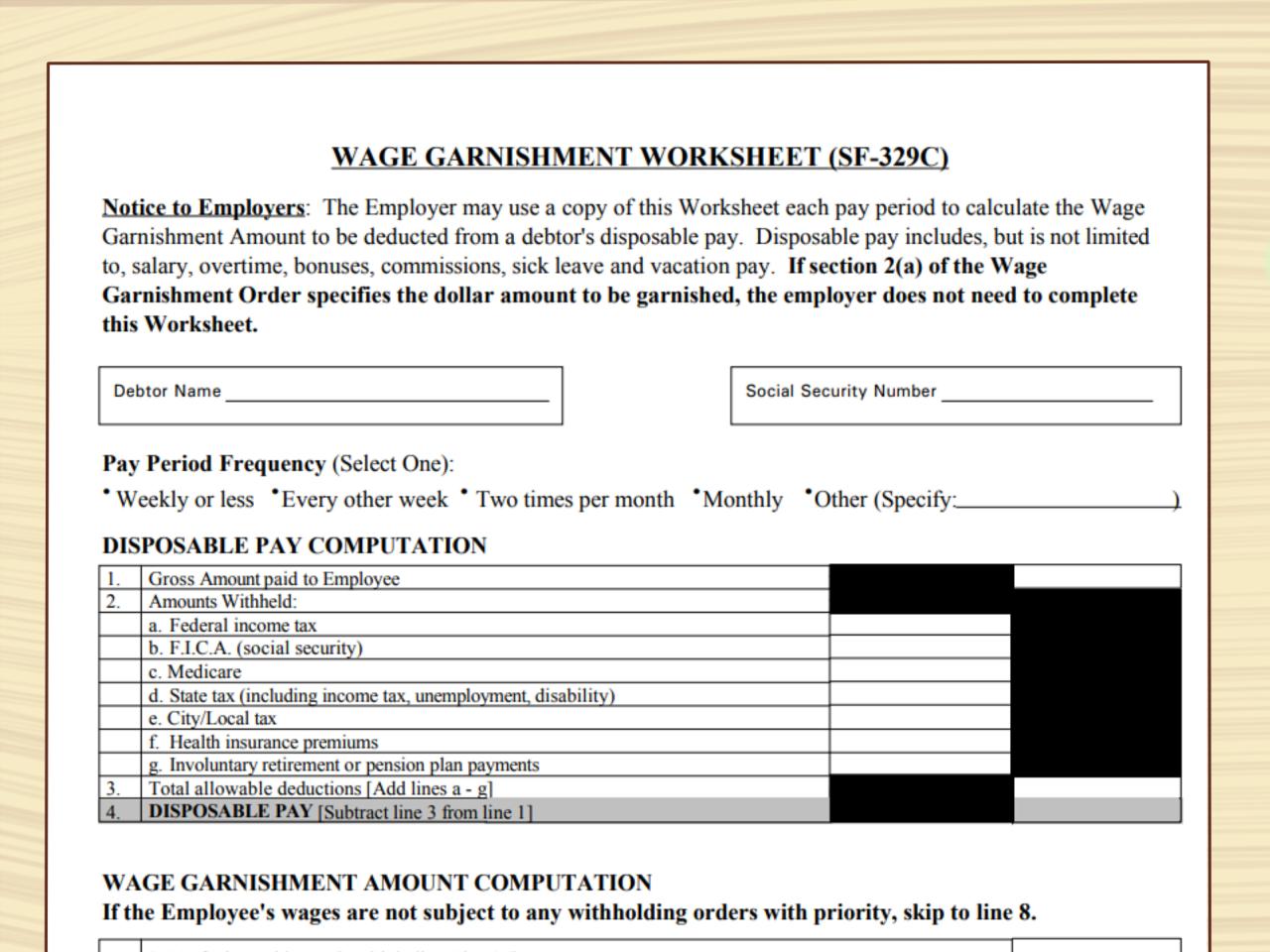

Visual Representation of a Completed Lien Document

A correctly completed lien document typically resembles a legal form, often structured in sections. Imagine a form with clearly defined fields. The top section would include identifying information such as the name and contact details of the claimant (the contractor), the property owner’s name and address, and the legal description of the property (lot and block number, etc.). A central section details the project, including a clear description of the work performed, the contract dates, and the amount owed. This section must be accurate and supported by documentation. Another section would state the date the work was completed and the date the lien was filed. Finally, a signature and notarization section ensures the authenticity and legality of the document. The entire document should be clear, concise, and free of errors, with all required fields completed accurately. It’s crucial to understand that specific requirements for the content and format of the lien document vary significantly by state and jurisdiction. Consulting with a legal professional is strongly recommended to ensure compliance with all local regulations.