How to file a lien on a business? It’s a question that arises when businesses fail to meet their financial obligations. Understanding the intricacies of lien filings—from mechanics liens securing unpaid construction work to tax liens levied by the government—is crucial for both creditors seeking recourse and businesses striving to protect their assets. This comprehensive guide unravels the complexities of lien law, providing a step-by-step process and highlighting the critical legal considerations involved.

This guide will walk you through the various types of business liens, eligibility requirements, the step-by-step filing process, and the potential legal ramifications. We’ll also explore lien priority, enforcement methods, and state-specific regulations, offering real-world examples to illustrate the process. By the end, you’ll have a clear understanding of how to navigate the often-complex world of business liens.

Types of Liens on a Business

Filing a lien against a business is a serious legal action taken when a business fails to pay a debt. Understanding the different types of liens available and their implications is crucial for both creditors and debtors. This section details several common types of business liens, outlining their characteristics and consequences.

Mechanics Liens

Mechanics liens secure payment for labor, services, or materials provided to improve real property. They are typically filed by contractors, subcontractors, material suppliers, and other individuals who contributed to a construction or renovation project. If a business owner fails to pay for these services, the lienholder can place a claim against the property itself.

| Type | Description | Requirements | Consequences of Non-Payment |

|---|---|---|---|

| Mechanics Lien | Secures payment for labor, services, or materials used to improve real property. | Proper notice to the owner, timely filing, and a valid contract for services. Specific requirements vary by state. | The lienholder can foreclose on the property to recover the debt. This can lead to the sale of the property to satisfy the lien. |

Tax Liens

Tax liens arise when a business fails to pay its federal, state, or local taxes. The government can file a tax lien against the business’s assets, including real estate, equipment, and bank accounts, to recover the unpaid taxes and penalties. These liens are a powerful tool for tax authorities to collect revenue.

| Type | Description | Requirements | Consequences of Non-Payment |

|---|---|---|---|

| Tax Lien | Secures payment of unpaid taxes owed to government entities. | Unpaid taxes, proper assessment of taxes, and compliance with statutory filing procedures. | The government can seize and sell the business’s assets to satisfy the tax debt. This can also severely impact the business’s credit rating. |

Judgment Liens

A judgment lien is placed on a business’s assets after a court has ruled in favor of a creditor in a lawsuit. This type of lien allows the creditor to seize and sell the business’s assets to satisfy the judgment amount. Judgment liens can arise from various types of lawsuits, including breach of contract, negligence, or fraud.

| Type | Description | Requirements | Consequences of Non-Payment |

|---|---|---|---|

| Judgment Lien | Secures payment of a debt awarded by a court judgment. | A successful lawsuit resulting in a monetary judgment against the business, and proper recording of the judgment with the relevant authorities. | The creditor can levy on the business’s assets, including bank accounts and real estate, to satisfy the judgment. This can lead to significant financial hardship for the business. |

Comparison of Lien Types, How to file a lien on a business

The filing processes and requirements for each type of lien differ significantly. Mechanics liens typically require providing notice to the property owner and filing the lien within a specific timeframe after the completion of work. Tax liens are filed by government agencies following a process Artikeld in tax codes. Judgment liens require obtaining a court judgment and then recording the judgment with the appropriate court or government office. The priority of liens, determining which lienholder gets paid first in the event of multiple liens, also varies depending on the type of lien and the date of filing. For example, tax liens often have priority over other types of liens.

Determining Eligibility to File a Lien

Filing a lien against a business is a serious legal action with significant consequences for both the creditor and the debtor. Before initiating this process, it’s crucial to understand the specific eligibility requirements to ensure the legality and effectiveness of your claim. Failure to meet these criteria can result in the dismissal of your lien and potential legal repercussions.

Eligibility to file a lien hinges on establishing a valid and enforceable debt owed to you by the business. This requires a clear understanding of the underlying contract or agreement that forms the basis of your claim. The specific requirements can vary depending on the type of lien and the jurisdiction, but several common elements are generally necessary.

Necessary Criteria for Lien Eligibility

To be eligible to file a lien, a creditor must demonstrate that a legitimate debt exists. This means proving that the business received goods or services and failed to pay for them according to the agreed-upon terms. This often involves presenting evidence of a formal contract, invoice, or other documentation detailing the debt. The creditor must also show that they have taken reasonable steps to collect the debt through other means before resorting to a lien. This might include sending demand letters or attempting to negotiate a payment plan. Finally, the creditor must ensure the lien is filed within the statutory timeframe defined by the relevant state or local laws. This timeframe is crucial and missing the deadline can invalidate the lien.

Required Documentation to Prove Eligibility

The specific documentation required can vary by jurisdiction and the type of lien, but some common examples include: a copy of the contract or agreement outlining the terms of the debt; invoices or other proof of goods or services provided; proof of payment demands sent to the business; records of any previous attempts to collect the debt (e.g., letters, phone calls, emails); and a copy of the filed lien itself. Thorough documentation is crucial to substantiate the claim and protect against potential challenges.

Legal Ramifications of Filing an Ineligible Lien

Filing a lien without meeting the necessary eligibility criteria carries several significant risks. The lien could be deemed invalid and dismissed, leaving the creditor without recourse to recover the debt. Furthermore, the business owner could sue the creditor for damages, including legal fees and compensation for any harm caused by the wrongful filing. In some cases, the creditor might face penalties or fines for violating relevant laws and regulations. Therefore, it’s imperative to consult with legal counsel to ensure full compliance with all applicable laws and regulations before filing a lien.

The Lien Filing Process

Filing a lien on a business is a legal process that requires careful attention to detail and adherence to specific state regulations. Failure to follow the correct procedures can result in the invalidation of your lien, leaving you without recourse for recovering your debt. This step-by-step guide Artikels the general process, but it’s crucial to consult your state’s specific laws and regulations, as they vary significantly. Always seek legal counsel if you are unsure about any aspect of the process.

Required Documentation

Before initiating the lien filing process, gather all necessary documentation. This typically includes proof of the debt owed, a detailed description of the services or goods provided, and any relevant contracts or agreements. You’ll also need accurate information about the business, including its legal name, address, and any registered agent information. Missing or incomplete documentation can delay the process or lead to rejection.

- Proof of Debt: This could be an invoice, contract, promissory note, or court judgment demonstrating the amount owed and the date of the debt’s origin.

- Detailed Description of Services or Goods: This should clearly Artikel the nature of the goods or services provided, the dates of service, and the agreed-upon price. Specificity is crucial for supporting your claim.

- Contracts and Agreements: Any signed contracts or agreements between you and the business should be included. These documents serve as legally binding evidence of the debt.

- Business Information: Accurate and complete information about the business, including its legal name, registered address, and the name and contact information of its owner or registered agent, is essential.

Completing and Submitting the Lien Form

Once you have gathered all necessary documents, you must complete the appropriate lien form. The specific form and requirements vary by state. The form typically requires detailed information about the debt, the parties involved, and the property subject to the lien. Incorrectly completed forms can lead to rejection, so careful completion is critical. Review the instructions provided with the form thoroughly.

- Obtain the Correct Lien Form: Contact your state’s relevant government agency or court to obtain the correct lien form for your situation. This is often available online.

- Complete the Form Accurately: Fill out all sections of the form completely and accurately. Double-check for any errors before submission.

- Attach Supporting Documentation: Attach copies of all supporting documents, such as invoices, contracts, and proof of service. Keep originals for your records.

- File the Lien: Submit the completed form and supporting documentation to the designated filing office, typically a county clerk’s office or a similar agency. Follow the instructions provided by the filing office regarding submission methods (e.g., mail, in-person, electronic filing).

Example of a Completed Lien Form

Imagine a scenario where “ABC Construction” owes “XYZ Supplies” $10,000 for building materials. The completed lien form would include details such as the name and address of both parties, the date of the transaction, a detailed description of the materials supplied, the total amount due ($10,000), and the legal description of the property (the construction site) where the materials were used. The form would also require the signature of the filer (XYZ Supplies) and possibly a notary’s seal. The attached supporting documentation would include the invoices for the materials supplied. This example highlights the need for comprehensive and accurate information on the form.

Understanding Lien Priority and Enforcement

Filing a lien doesn’t guarantee immediate payment. The order in which liens are paid depends on a crucial concept: priority. Understanding lien priority and the available enforcement methods is vital for maximizing the chances of recovering owed funds. This section details how lien priority works and the steps involved in pursuing payment through lien enforcement.

Lien priority determines the order in which creditors are paid when a business’s assets are liquidated. Generally, the first lien filed takes priority, meaning it’s paid first. However, exceptions exist, and certain types of liens, such as tax liens, often have superior priority regardless of filing date. This “first-in-time, first-in-right” rule is not absolute, and state laws dictate the specific rules governing lien priority. Conflicts often arise when multiple liens are filed against the same business, leading to complex legal battles over payment distribution. Careful consideration of potential conflicts and state-specific regulations is crucial before filing.

Lien Priority Rules

Several factors determine lien priority. These include the type of lien (e.g., mechanic’s lien, tax lien, judgment lien), the date the lien was filed, and any existing contractual agreements that may affect the order of payment. For example, a tax lien often takes precedence over a mechanic’s lien, even if the mechanic’s lien was filed earlier. State laws vary, and consulting with legal counsel is highly recommended to determine the precise priority of a specific lien within a given jurisdiction. Understanding the potential for conflicting claims and their impact on the recovery process is essential for effective lien management.

Methods of Lien Enforcement

After a lien has been properly filed and the debtor fails to satisfy the obligation, the lienholder can pursue several enforcement methods to recover the debt. These generally involve either foreclosure or legal action.

Foreclosure

Foreclosure is a legal process that allows the lienholder to sell the debtor’s property to satisfy the debt. The specific procedures vary by state and the type of property involved (real estate, personal property, etc.). The foreclosure process typically involves providing notice to the debtor, conducting a sale, and distributing the proceeds to satisfy the outstanding debt and associated costs. Any remaining funds after satisfying the lien are returned to the debtor. If the sale proceeds are insufficient to cover the debt, the lienholder may pursue further legal action to recover the deficiency.

Legal Action

If foreclosure is not feasible or insufficient, the lienholder can pursue legal action to recover the debt. This may involve filing a lawsuit against the debtor to obtain a judgment, which can then be enforced through various means, including wage garnishment or bank levy. Legal action can be complex and costly, requiring the expertise of legal professionals. The choice between foreclosure and legal action depends on various factors, including the type of property subject to the lien, the debtor’s assets, and the applicable state laws.

Lien Enforcement Flowchart

The following flowchart illustrates a simplified version of the lien enforcement process. The actual process can be significantly more complex and vary depending on specific circumstances and applicable laws.

[Descriptive Text of Flowchart]

The flowchart would begin with a box labeled “Lien Filed and Unpaid.” This would branch into two options: “Foreclosure Possible?” If yes, the process would proceed to a box detailing the foreclosure steps (notice, sale, distribution of proceeds). If no, the process would move to a box indicating “Legal Action Initiated,” leading to steps such as filing a lawsuit, obtaining a judgment, and enforcing the judgment. Each step would be represented by a box, with arrows indicating the flow of the process. The flowchart would conclude with a box indicating either “Debt Satisfied” or “Further Legal Action Required.” This visual representation provides a clear overview of the potential paths involved in lien enforcement.

Potential Legal Ramifications and Considerations

Filing a lien against a business, while a potentially effective method of recovering debt, carries significant legal risks and ramifications. Understanding these potential challenges is crucial to avoid costly mistakes and legal battles. Improperly filed liens can lead to financial penalties, damage to your reputation, and even legal action against you.

Filing a lien involves navigating complex legal procedures and state-specific regulations. A poorly executed lien filing can be easily challenged and dismissed, leaving you with no recourse and potentially liable for the business’s legal fees in defending against it. Conversely, a successful lien filing can significantly impact the business’s operations and creditworthiness, leading to potential disputes and even bankruptcy proceedings. Therefore, careful consideration and professional guidance are paramount.

Risks Associated with Lien Filing

The process of filing a lien is not without its inherent risks. Incorrectly completing the paperwork, failing to meet filing deadlines, or omitting crucial information can render the lien invalid. Furthermore, the business owner might contest the lien, arguing that the debt is not legitimate or that the lien filing process was not followed correctly. This can lead to protracted legal battles, incurring substantial legal fees and consuming considerable time and resources. In some cases, a judge might rule in favor of the business, resulting in the lien being dismissed and the creditor potentially facing counter-claims. For example, a contractor who mistakenly files a lien against the wrong property could face legal repercussions, including having to pay the property owner’s legal fees.

Importance of Legal Counsel

Seeking legal counsel before filing a lien is strongly recommended. An experienced attorney can review your case, ensure all necessary documentation is accurate and complete, and guide you through the complex legal procedures involved in filing a lien in your jurisdiction. They can advise on the best course of action, considering the specifics of your situation and the potential legal challenges you might encounter. This proactive approach can significantly reduce the risk of errors and minimize potential legal ramifications. The cost of legal counsel is often far outweighed by the potential costs associated with an improperly filed lien or a protracted legal battle.

Outcomes of Successful and Unsuccessful Lien Filings

A successful lien filing typically results in the creditor obtaining a legal claim against the business’s assets. This claim can be enforced through legal proceedings, potentially leading to the sale of the business’s assets to satisfy the debt. This can significantly impact the business’s financial stability and operations. However, an unsuccessful lien filing can lead to the dismissal of the claim, leaving the creditor with no legal recourse to recover the debt. Furthermore, the creditor might be liable for the business’s legal fees incurred in defending against the lien. For instance, a supplier who successfully files a lien against a struggling retailer might receive payment of their outstanding invoices through the sale of the retailer’s inventory. Conversely, a supplier who fails to provide sufficient evidence of their debt might see their lien dismissed and be left with unpaid invoices and legal costs.

State-Specific Lien Laws and Regulations

Filing a lien against a business is governed by complex state-specific laws. These laws dictate the eligibility requirements, filing procedures, and enforcement mechanisms, making it crucial to understand the nuances of the relevant jurisdiction before proceeding. Variations exist across states in the types of liens allowed, the documentation needed, and the timelines for filing and enforcement. Failure to comply with these state-specific regulations can lead to significant legal challenges and potentially invalidate the lien.

State-Specific Lien Law Variations

The following table offers a simplified comparison of lien laws across a few selected states. It’s important to note that this is not an exhaustive list and the information provided is for illustrative purposes only. Always consult the official statutes and regulations of the relevant state for accurate and up-to-date information.

| State | Key Differences in Requirements | Filing Fees | Enforcement Procedures |

|---|---|---|---|

| California | Strict requirements for notice and documentation; specific forms required; detailed description of the debt. | Varies by county; typically ranges from $100-$300. | Judicial foreclosure is common; involves court proceedings. |

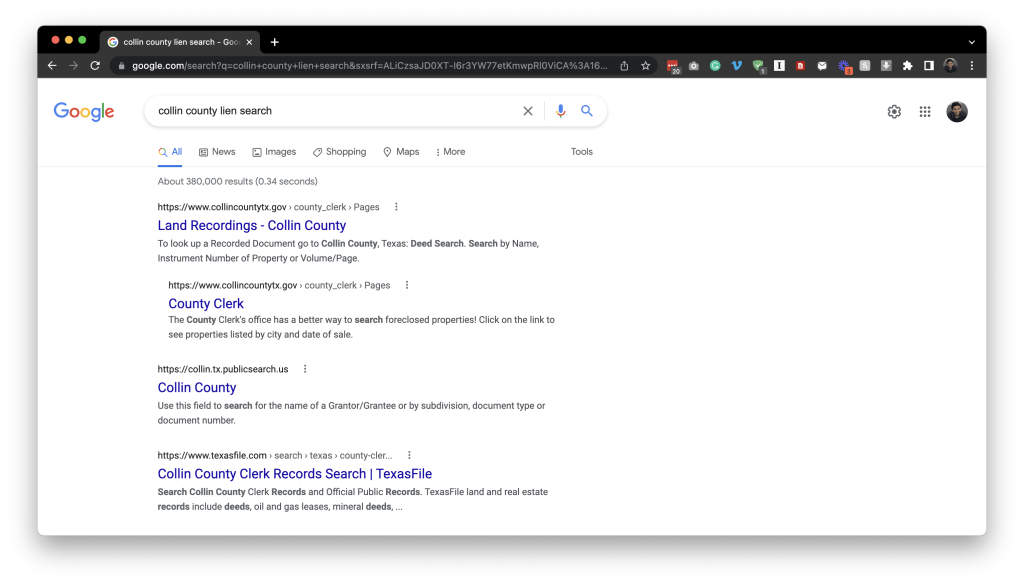

| Texas | Emphasis on proper affidavit preparation; specific statutory requirements for the content of the lien. | Varies by county; generally lower than California. | Non-judicial foreclosure is possible under certain circumstances; otherwise, court action is required. |

| Florida | Detailed statutory requirements regarding the type of work performed and the amount owed; strict adherence to notice requirements. | Varies by county; fees can include recording and processing charges. | Judicial foreclosure is the primary method of enforcement. |

| New York | Different lien types exist depending on the nature of the debt (e.g., mechanics liens, materialmen’s liens); strict adherence to notice periods. | Varies by county; generally higher than some other states. | Judicial foreclosure is the typical enforcement method; complex procedures. |

Impact of State-Specific Laws on the Lien Filing Process

State-specific laws significantly impact every stage of the lien filing process. For example, the required documentation might vary widely. Some states might mandate notarized affidavits, while others might accept simpler declarations. The timeframe for filing a lien also differs, with some states allowing a longer period than others after the completion of work or provision of services. The methods of service and notice to the property owner or business also differ significantly across jurisdictions, influencing the overall effectiveness of the lien. Finally, enforcement procedures, including the possibility of non-judicial foreclosure versus court-ordered foreclosure, significantly impact the time and cost associated with recovering the debt.

Importance of Jurisdictional Research

Thorough research and understanding of the specific laws in the relevant jurisdiction are paramount. Failure to comply with state-specific requirements can render the lien invalid, resulting in the loss of the right to recover the debt. This necessitates consulting state-specific statutes, legal precedents, and seeking professional legal advice to ensure compliance. This proactive approach mitigates risks and increases the likelihood of a successful lien filing and subsequent debt recovery.

Illustrative Examples of Lien Filings: How To File A Lien On A Business

Understanding the practical application of lien laws is crucial. The following examples illustrate how liens are filed in different scenarios, highlighting the necessary documentation and procedures.

Mechanics Lien: Business Owner vs. Contractor

Sarah, owner of “Sweet Surrender Cakes,” hired “Flour Power Construction” to renovate her bakery. The agreed-upon price was $50,000. After completing 80% of the work, Flour Power Construction abandoned the project, leaving unfinished renovations and demanding an immediate payment of $45,000, despite the incomplete work. Sarah, having paid $30,000 already, refused to pay the remaining amount due to the unfinished work. To recover the value of the unfinished work and protect her investment, Sarah decided to file a mechanics lien against Flour Power Construction. The lien amount claimed was $15,000, representing the difference between the value of the completed work ($30,000) and the amount already paid. To file the lien, Sarah needed to provide documentation including the contract with Flour Power Construction, proof of payments made, detailed descriptions of the work performed and the remaining work, and a sworn statement detailing the contractor’s breach of contract. She also needed to comply with her state’s specific requirements for mechanics lien filings, including the exact timeframe for filing. This typically involves serving notice to Flour Power Construction and filing the lien with the appropriate county or state office.

Tax Lien: Government vs. Business Owner

“Artisan Coffee Roasters,” owned by Mark, accumulated a significant tax debt of $75,000 due to unpaid federal and state taxes. The Internal Revenue Service (IRS) and the state tax authority issued notices of tax liability to Mark, demanding payment. Despite repeated attempts to collect the debt, Mark failed to pay. Consequently, the IRS and the state tax authority filed a tax lien against Artisan Coffee Roasters. This lien secured the tax debt, allowing the government to seize and sell Artisan Coffee Roasters’ assets to recover the owed taxes. The documentation involved in filing a tax lien includes the tax assessment notices, records of payment attempts, and details of the tax debt. The government also typically needs to follow a specific procedure Artikeld in federal and state tax laws, which includes a period of notice and opportunity for payment before the lien is filed. The lien is recorded with the relevant county or state office to provide public notice of the tax debt.