How to fix business credit? It’s a question many entrepreneurs grapple with. A strong business credit score is the key to unlocking favorable loan terms, attracting investors, and securing vital business resources. This guide provides a comprehensive roadmap to understanding, repairing, and maintaining excellent business credit, transforming your financial landscape and paving the way for sustainable growth. We’ll explore the intricacies of business credit reports, identify common pitfalls, and Artikel effective strategies for building a positive credit history.

From understanding the nuances of different credit bureaus like Experian, Equifax, and Dun & Bradstreet to mastering dispute resolution techniques and responsibly managing business credit cards and loans, this guide offers actionable advice. We’ll also delve into the critical role of business credit in securing funding and provide practical resources to help you navigate the complexities of business credit repair.

Understanding Business Credit Scores

Building and maintaining a strong business credit score is crucial for securing loans, attracting investors, and negotiating favorable terms with suppliers. A healthy score reflects your business’s financial responsibility and trustworthiness, opening doors to numerous opportunities. Understanding the factors that influence your score and how it differs from your personal credit is the first step toward improving your business’s financial standing.

Factors Contributing to a Business Credit Score

Several key factors contribute to a business credit score. These factors are weighted differently by each credit bureau, but generally include payment history (the most significant factor), amounts owed, length of credit history, new credit, and credit mix. Consistent on-time payments demonstrate financial responsibility and significantly boost your score. High levels of debt relative to your credit limit negatively impact your score, as does frequently applying for new credit. A longer credit history, showcasing consistent responsible behavior over time, generally leads to a higher score. Finally, a diverse mix of credit accounts (e.g., loans, credit cards, lines of credit) can also contribute positively.

Differences Between Personal and Business Credit

Personal and business credit are distinct entities. Your personal credit score reflects your individual financial history, while your business credit score reflects the financial history of your business. Lenders assess these separately. A poor personal credit score might not directly impact your business credit score, but it can indirectly affect your ability to obtain business financing if you use personal guarantees. Conversely, a strong business credit score can improve your access to credit and financing, even if your personal credit needs improvement. It’s essential to treat them as independent but interconnected elements of your overall financial health.

Obtaining a Business Credit Report

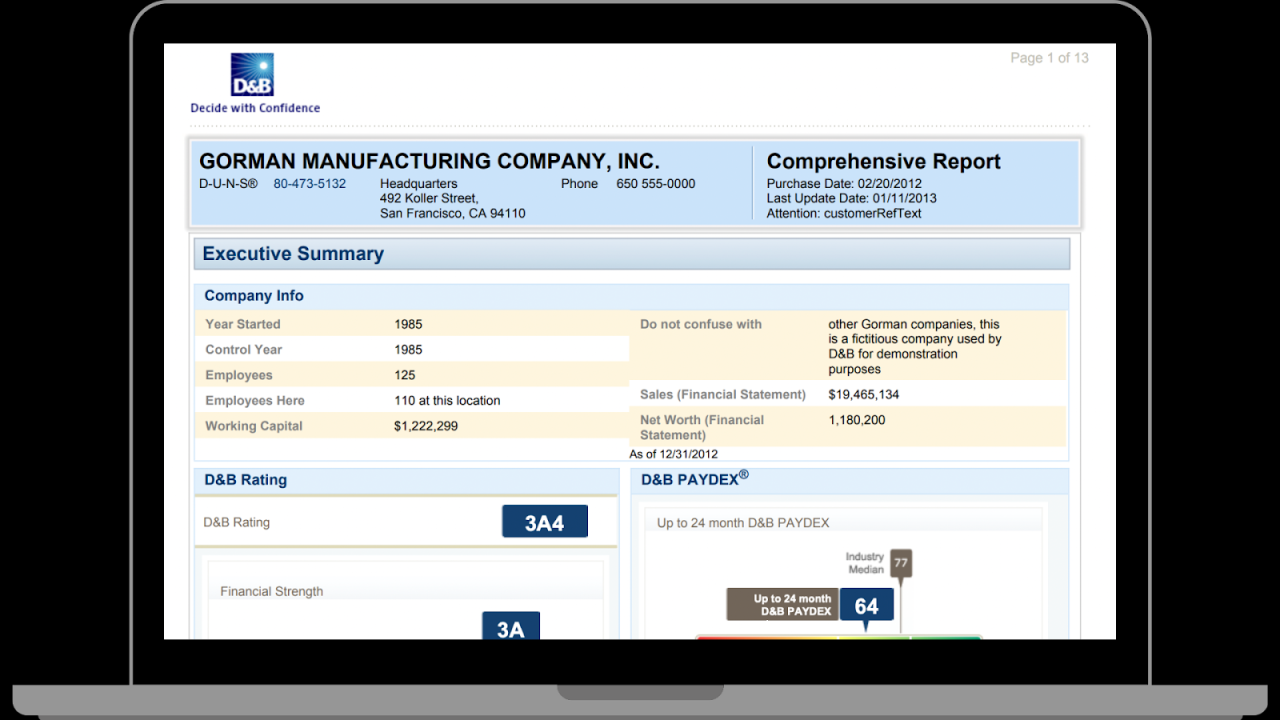

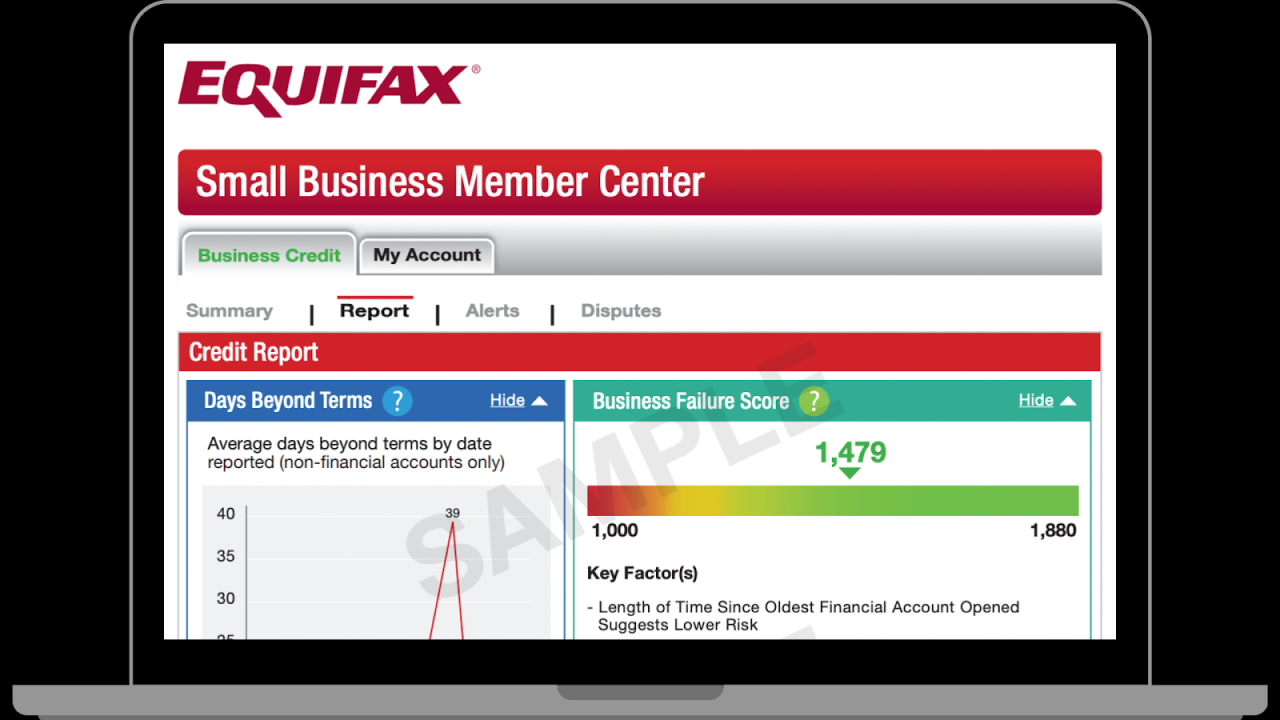

Securing your business credit report is a straightforward process. Each major credit bureau (Experian, Equifax, and Dun & Bradstreet) offers this service. You typically need to provide your business’s Tax Identification Number (TIN) or Employer Identification Number (EIN) and potentially other identifying information. The bureaus will then provide a report detailing your business’s credit history, including payment history, outstanding debts, and public records. Regularly reviewing these reports helps you identify and address any inaccuracies or negative marks promptly.

Comparison of Major Business Credit Bureaus

| Feature | Experian | Equifax | Dun & Bradstreet (D&B) |

|---|---|---|---|

| Focus | Broad range of business credit information | Strong emphasis on small business credit | Primarily focuses on larger businesses and commercial credit |

| Scoring Model | Intelliscore Plus | Business Credit Score | PAYDEX Score |

| Data Sources | Variety of sources, including financial institutions and public records | Similar to Experian, with a focus on small business data | Extensive network of business and financial data sources |

| Report Cost | Varies depending on the report type and access | Varies depending on the report type and access | Varies depending on the report type and access; often subscription-based |

Identifying and Addressing Credit Issues

A low business credit score can significantly hinder your company’s growth and access to funding. Understanding the reasons behind a poor score is the first step towards improving it. This involves reviewing your business credit report for inaccuracies and addressing any negative information impacting your score. By proactively tackling these issues, you can pave the way for a healthier financial future for your business.

Common Causes of Low Business Credit Scores

Several factors contribute to a low business credit score. These factors often intertwine, creating a complex situation that requires a multi-faceted approach to resolution. Ignoring these issues can lead to a downward spiral, making it increasingly difficult to secure loans or favorable credit terms.

- Late Payments: Consistent late payments are a major detriment to your credit score. Even a single late payment can negatively impact your score, and multiple late payments can severely damage it.

- High Credit Utilization: Using a large percentage of your available credit can signal financial instability to lenders. Keeping your credit utilization low demonstrates responsible credit management.

- Public Records: Bankruptcies, lawsuits, and liens are all reflected in your business credit report and significantly lower your score. These public records indicate financial distress and risk to lenders.

- Inaccurate Information: Errors or outdated information on your credit report can negatively affect your score. Regularly reviewing your report is crucial to identify and correct such inaccuracies.

- Lack of Credit History: New businesses often lack sufficient credit history, making it difficult to establish a strong credit profile. Building credit takes time and strategic use of credit accounts.

Impact of Late Payments on Business Credit

Late payments have a substantial and lasting impact on your business credit score. Lenders view late payments as a sign of poor financial management and increased risk. The severity of the impact depends on the frequency and duration of late payments. A single late payment can negatively affect your score, while repeated late payments can severely damage it, potentially leading to higher interest rates or denied credit applications. For example, a business consistently paying invoices 30 days late will likely see a significantly lower score than one that pays on time or only occasionally experiences minor delays. The negative impact of late payments can persist for several years, making prompt payment crucial for maintaining a healthy credit score.

Resolving Negative Items on a Business Credit Report

Addressing negative items on your business credit report requires a proactive and systematic approach. This may involve negotiating with creditors, paying outstanding debts, or disputing inaccurate information.

- Negotiating with Creditors: Contacting creditors directly to negotiate payment plans or settlements can help improve your credit standing. A documented agreement can demonstrate your commitment to resolving outstanding debts.

- Paying Outstanding Debts: The most effective way to address negative items is to pay off outstanding debts. This demonstrates financial responsibility and improves your creditworthiness. Paying off older debts can significantly improve your score over time.

- Disputing Inaccurate Information: If you identify inaccurate information on your business credit report, dispute it immediately with the relevant credit bureaus. Provide supporting documentation to prove the inaccuracies.

Effective Dispute Resolution Methods for Inaccurate Information

Disputing inaccurate information on your business credit report requires a methodical approach. This involves gathering supporting evidence and submitting a formal dispute to the credit bureaus.

- Review Your Credit Report Thoroughly: Carefully examine your report for any inaccuracies, outdated information, or items you don’t recognize. Make detailed notes of any discrepancies.

- Gather Supporting Documentation: Collect any evidence that supports your claim of inaccuracy. This might include canceled checks, payment receipts, or correspondence with creditors.

- Submit a Formal Dispute: Follow the credit bureau’s dispute process carefully. Clearly explain the inaccuracies and provide all supporting documentation. Keep copies of all correspondence.

- Monitor the Resolution: Track the progress of your dispute and follow up if necessary. The credit bureau should investigate and update your report accordingly.

Building Positive Business Credit

Establishing and maintaining strong business credit is crucial for accessing favorable financing options, securing better terms with vendors, and building a reputable business presence. A positive credit history demonstrates financial responsibility and trustworthiness, leading to significant long-term advantages. This section Artikels a strategic approach to building positive business credit from the ground up.

Designing a Business Credit-Building Plan, How to fix business credit

A well-defined plan is essential for effectively building business credit. This involves understanding your current financial standing, setting realistic goals, and implementing consistent strategies. Start by separating your personal and business finances completely. This includes opening a separate business bank account and obtaining an Employer Identification Number (EIN) from the IRS. Next, identify your short-term and long-term credit goals. For example, a short-term goal might be obtaining a business credit card, while a long-term goal might be securing a loan for expansion. Regularly monitor your credit reports to track your progress and identify any potential issues.

Legitimate Business Credit-Building Methods

Several legitimate methods contribute to building a positive business credit profile. These methods require diligence, responsible financial management, and consistent effort.

- Obtain a Business Credit Card: Applying for and responsibly managing a business credit card is a cornerstone of building business credit. Consistent on-time payments and maintaining a low credit utilization ratio are critical. Avoid maxing out your credit limit, as this negatively impacts your credit score.

- Establish Business Lines of Credit: Securing a business line of credit demonstrates financial responsibility and provides access to funds as needed. Similar to credit cards, responsible usage, including timely payments and maintaining a low utilization rate, is crucial for building positive credit.

- Pay Bills on Time: Prompt payment of all business-related bills, including utilities, suppliers, and loans, is paramount. Late payments significantly damage your credit score and hinder your ability to secure future financing.

- Build Trade Relationships: Establishing strong relationships with vendors and suppliers and consistently paying your invoices on time can positively impact your business credit report. Many reporting agencies consider payment history with vendors when assessing creditworthiness.

- Register Your Business with Dun & Bradstreet: Dun & Bradstreet (D&B) is a major business credit reporting agency. Registering your business with D&B allows you to establish a business credit file and track your creditworthiness. This provides a comprehensive view of your business’s financial health to lenders and vendors.

Responsible Use of Business Credit Cards

Utilizing a business credit card responsibly is instrumental in building a strong credit profile. This involves establishing a good payment history, maintaining a low credit utilization ratio, and understanding the terms and conditions of the card. Responsible use of a business credit card not only contributes to building positive credit but also provides convenient payment options and potential rewards programs. Always pay your balance in full and on time each month to avoid interest charges and maintain a high credit score. Avoid carrying a large balance, as a high credit utilization ratio can negatively impact your credit score.

Comparing Different Types of Business Loans and Their Credit Impact

Various types of business loans exist, each impacting your credit differently.

| Loan Type | Impact on Credit | Considerations |

|---|---|---|

| Term Loan | Positive impact with timely payments; negative impact with late or missed payments. | Fixed repayment schedule, typically used for large purchases or investments. |

| Line of Credit | Positive impact with responsible usage and timely payments; negative impact with high utilization or late payments. | Flexible access to funds; interest only paid on borrowed amount. |

| Small Business Administration (SBA) Loan | Significant positive impact with timely repayment; can significantly improve creditworthiness. | Government-backed loans, typically require strong credit and business plan. |

Responsible management of any business loan is crucial for maintaining a healthy credit profile. Consistent and timely payments demonstrate financial responsibility and improve your creditworthiness. Conversely, missed or late payments can severely damage your credit score and make it difficult to secure future financing. Understanding the terms and conditions of each loan type is essential for responsible borrowing and managing its impact on your business credit.

Maintaining Good Business Credit

Maintaining a strong business credit score is not a one-time achievement; it’s an ongoing process requiring consistent effort and diligent monitoring. Just as building a positive credit history takes time, preserving it demands vigilance and proactive management of your business finances. Neglecting your business credit can lead to higher interest rates, limited access to funding, and ultimately, hinder your business growth.

Business Credit Score Maintenance Checklist

A comprehensive checklist is crucial for maintaining a healthy business credit score. Regularly reviewing and acting upon these points ensures consistent progress and minimizes the risk of negative impacts. This checklist should be integrated into your business’s operational procedures.

- Pay all bills on time: Consistent on-time payments are the cornerstone of a good credit score. Set up automated payments to avoid late fees and negative reporting.

- Monitor credit reports frequently: Regularly reviewing your business credit reports from all three major bureaus (Equifax, Experian, and Dun & Bradstreet) allows for early detection of errors or suspicious activity.

- Maintain a low debt-to-credit ratio: Keep your business credit utilization low. High utilization suggests financial strain and can negatively impact your score.

- Keep business and personal credit separate: Avoid commingling personal and business finances. This protects your personal credit from business-related issues.

- Establish a strong payment history: A long history of on-time payments demonstrates financial responsibility and positively influences your score.

- Review credit limits regularly: Ensure your credit limits are appropriate for your business needs and avoid requesting excessive credit.

- Address negative items promptly: If you discover inaccuracies or negative items on your credit report, dispute them immediately with the respective credit bureau.

- Diversify your credit mix: A diverse range of credit accounts (e.g., business credit cards, loans) can positively influence your score, demonstrating responsible credit management.

Importance of Timely Payments on Business Obligations

Timely payments are paramount for maintaining a healthy business credit score. Late payments are reported to credit bureaus and significantly damage your creditworthiness. This can result in higher interest rates on future loans, difficulty securing financing, and a negative perception among potential business partners. Even a single late payment can have a lasting impact. For example, a small business owner who consistently paid their invoices late found it increasingly difficult to secure loans, even for smaller amounts, resulting in a significant setback to their expansion plans.

Monitoring Business Credit Reports Regularly

Regular monitoring of business credit reports is essential for identifying and resolving potential issues promptly. Each of the three major credit bureaus (Equifax, Experian, and Dun & Bradstreet) maintains separate business credit reports. Accessing and reviewing these reports regularly allows for the early detection of errors, fraudulent activity, or negative information that could impact your credit score. For instance, a business might discover an inaccurate late payment reported by a vendor, which, if left uncorrected, could negatively affect their creditworthiness. Addressing such issues immediately mitigates potential long-term damage.

Best Practices for Managing Business Finances to Improve Credit

Effective financial management is crucial for improving and maintaining good business credit. This involves establishing a robust budgeting system, accurately tracking income and expenses, and prioritizing debt repayment. Strategies such as creating a detailed financial plan, implementing efficient accounting practices, and utilizing financial software can significantly improve financial management. A small bakery that meticulously tracked its expenses and income found it easier to manage its cash flow, resulting in consistent on-time payments and a subsequent improvement in its business credit score. This demonstrates the direct link between responsible financial management and improved business credit.

Resources for Business Credit Repair: How To Fix Business Credit

Repairing damaged business credit can be a complex process, often requiring professional assistance. Understanding the available resources and their potential implications is crucial for making informed decisions. This section Artikels reputable resources, explores the benefits and risks of using credit repair services, details associated costs, and emphasizes the importance of verifying the legitimacy of any chosen company.

Reputable Resources for Business Credit Repair Services

Finding a trustworthy business credit repair service requires thorough research. While many companies offer assistance, not all operate ethically or effectively. It’s vital to check reviews, verify licensing, and understand the services offered before engaging any firm. Consider seeking recommendations from other business owners or industry professionals. The Better Business Bureau (BBB) can also provide valuable information on companies operating in your area. Remember that legitimate credit repair services focus on correcting errors and improving credit practices, not on making false promises of rapid or unrealistic improvements.

Benefits and Risks of Using Credit Repair Services

Utilizing a business credit repair service can offer several advantages. Professionals possess the expertise and resources to navigate complex credit reporting systems, identify inaccuracies, and dispute negative information effectively. They can also provide guidance on improving credit practices and strategies for building positive credit history. However, there are inherent risks. Some companies engage in deceptive practices, making unsubstantiated claims or charging excessive fees. Others may not deliver on their promises, leaving businesses financially burdened and with unresolved credit issues. Therefore, due diligence is paramount.

Costs Associated with Business Credit Repair Options

The cost of business credit repair services varies significantly depending on the service provider, the extent of the needed repairs, and the complexity of the issues involved. Some companies charge flat fees, while others operate on a per-item or hourly basis. Below is a table illustrating a range of potential costs. These figures are estimates and should not be considered definitive pricing. Always obtain a detailed cost breakdown from any potential service provider before engaging their services.

| Credit Repair Option | Cost Range (USD) | Payment Structure | Typical Services Included |

|---|---|---|---|

| DIY Credit Repair | $0 – $100 (for software or resources) | One-time purchase or subscription | Access to credit reports, dispute letter templates, educational materials |

| Basic Credit Repair Service | $500 – $1500 | Flat fee or per-item | Credit report review, dispute of inaccuracies, basic credit building advice |

| Comprehensive Credit Repair Service | $1500 – $5000+ | Monthly payments or flat fee | Extensive credit report analysis, aggressive dispute strategy, comprehensive credit building plan, ongoing support |

| Legal Consultation (for severe issues) | $200 – $500+/hour | Hourly rate | Legal advice, representation in credit disputes, litigation support (if necessary) |

Verifying the Legitimacy of Credit Repair Companies

Before entrusting your business credit to any repair service, rigorous verification is essential. Check the company’s Better Business Bureau (BBB) rating and look for any complaints or negative reviews. Verify their licensing and ensure they comply with all relevant state and federal regulations. Beware of companies making unrealistic promises of quick fixes or guaranteed results. A legitimate company will provide transparent pricing, detailed service agreements, and a clear explanation of their process. Request references from previous clients and speak with them to gauge their experience. Remember, protecting your business credit requires careful selection and diligent monitoring of any services engaged.

The Role of Business Credit in Securing Funding

A strong business credit score is paramount when seeking funding for your business. Lenders rely heavily on this score to assess your creditworthiness and the risk associated with lending you money. A good score significantly increases your chances of approval and can lead to more favorable loan terms.

Impact of Business Credit Score on Loan Approval Rates

Lenders use business credit scores to predict the likelihood of loan repayment. A higher score indicates a lower risk of default, making you a more attractive borrower. Businesses with excellent credit scores (typically above 750) often enjoy approval rates significantly higher than those with poor scores (below 600). Conversely, a low score can lead to outright rejection or necessitate significantly higher interest rates to compensate for the increased risk. For example, a business with a score above 780 might be approved for a loan with favorable terms at a prime rate plus a small margin, whereas a business with a score below 600 might face rejection or a rate several percentage points higher, reflecting the perceived risk. This disparity highlights the critical role of business credit in the loan approval process.

Advantages of Securing Funding with Strong Business Credit

Strong business credit offers several advantages beyond higher approval rates. These include access to a wider range of funding options, such as SBA loans, lines of credit, and equipment financing. Businesses with excellent credit can often negotiate better loan terms, including lower interest rates, longer repayment periods, and more favorable fees. This translates to significant cost savings over the life of the loan. Moreover, a strong credit history demonstrates financial responsibility and stability, enhancing the business’s reputation and attracting potential investors and partners. A positive credit profile acts as a powerful endorsement, showcasing the business’s financial health and trustworthiness.

Interest Rates and Business Credit Scores

The interest rate offered on business loans and lines of credit is directly correlated with the business’s credit score. Lenders typically offer lower interest rates to businesses with higher credit scores to reflect the lower risk of default. A business with an excellent credit score might qualify for a prime rate plus a small margin, while a business with a poor score might face significantly higher interest rates, potentially exceeding double digits. This difference can amount to thousands of dollars in interest payments over the loan’s lifetime. For instance, a $100,000 loan at 5% interest will accrue significantly less interest than the same loan at 15% interest. The cost savings associated with a good credit score can be substantial.

Applying for Business Loans and Lines of Credit

The process of applying for business loans and lines of credit generally involves several steps. First, you’ll need to gather all the necessary financial documents, including your business credit report, tax returns, and financial statements. Next, you’ll need to choose a lender and submit your application, which typically includes an explanation of how the loan funds will be used. The lender will then review your application and assess your creditworthiness, taking into account your business credit score and other financial factors. If approved, you’ll need to sign the loan agreement and receive the funds. This process can vary depending on the lender and the type of funding being sought, but maintaining a strong business credit score significantly simplifies and improves the likelihood of a successful application.

Visual Representation of Credit Improvement

Improving your business credit score is a multifaceted process that benefits from a clear visual representation to track progress and understand the interconnectedness of various actions. A well-designed flowchart and infographic can effectively communicate this complex process and its impact.

Business Credit Improvement Flowchart

A flowchart provides a step-by-step visual guide to improving business credit. It should begin with assessing the current credit situation and conclude with maintaining a strong credit profile. Each step should include specific actions and milestones to achieve. The flowchart could be structured chronologically, starting with the initial assessment and moving through each stage of improvement. Crucially, the flowchart should highlight the iterative nature of credit building, emphasizing the need for consistent monitoring and adjustment.

For instance, the flowchart could start with a box labeled “Assess Current Credit Situation,” branching into actions like obtaining a credit report and identifying negative items. The next step might be “Develop a Credit Improvement Plan,” followed by boxes detailing specific strategies such as paying down debt, establishing trade lines, and monitoring credit utilization. Subsequent boxes would depict milestones such as “Achieve X% reduction in debt,” “Establish Y number of trade lines,” and “Maintain Z% credit utilization.” Finally, the flowchart culminates in a box labeled “Maintain Good Business Credit,” which would branch into actions such as regularly monitoring credit reports and continuing to pay bills on time.

Infographic: Impact of Credit Score on Loan Interest Rates

An infographic can effectively demonstrate the correlation between a business credit score and loan interest rates. This visual representation should clearly show how a higher credit score translates to lower interest rates, resulting in significant cost savings over the loan term.

The infographic could utilize a bar graph or line graph to illustrate this relationship. The horizontal axis could represent different credit score ranges (e.g., 600-650, 650-700, 700-750, 750-800, 800+), while the vertical axis would show the corresponding average interest rates for a specific loan type (e.g., small business loan). The visual difference in interest rates between a low credit score and a high credit score would immediately highlight the financial benefits of improving business credit. For added impact, the infographic could include data points illustrating the actual dollar amount saved in interest over the life of a loan for different credit score ranges, assuming a specific loan amount and term. For example, it could show that a business with a 750+ score might save $10,000 in interest over a five-year loan compared to a business with a 600-650 score, taking the same loan amount. This quantifiable impact would strongly emphasize the importance of credit score improvement.